公司簡介

| RKFS 評論摘要 | |

| 成立日期 | 2020-06-08 |

| 註冊國家/地區 | 印度 |

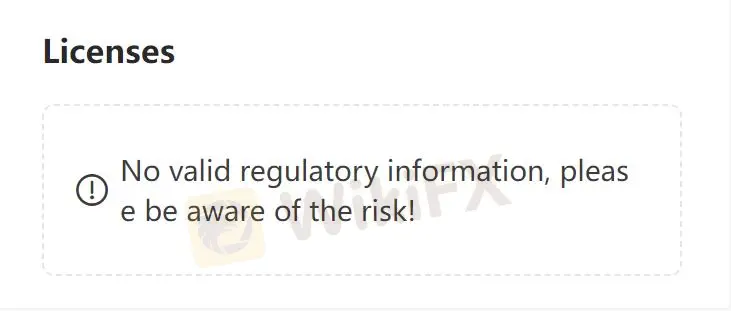

| 監管 | 未受監管 |

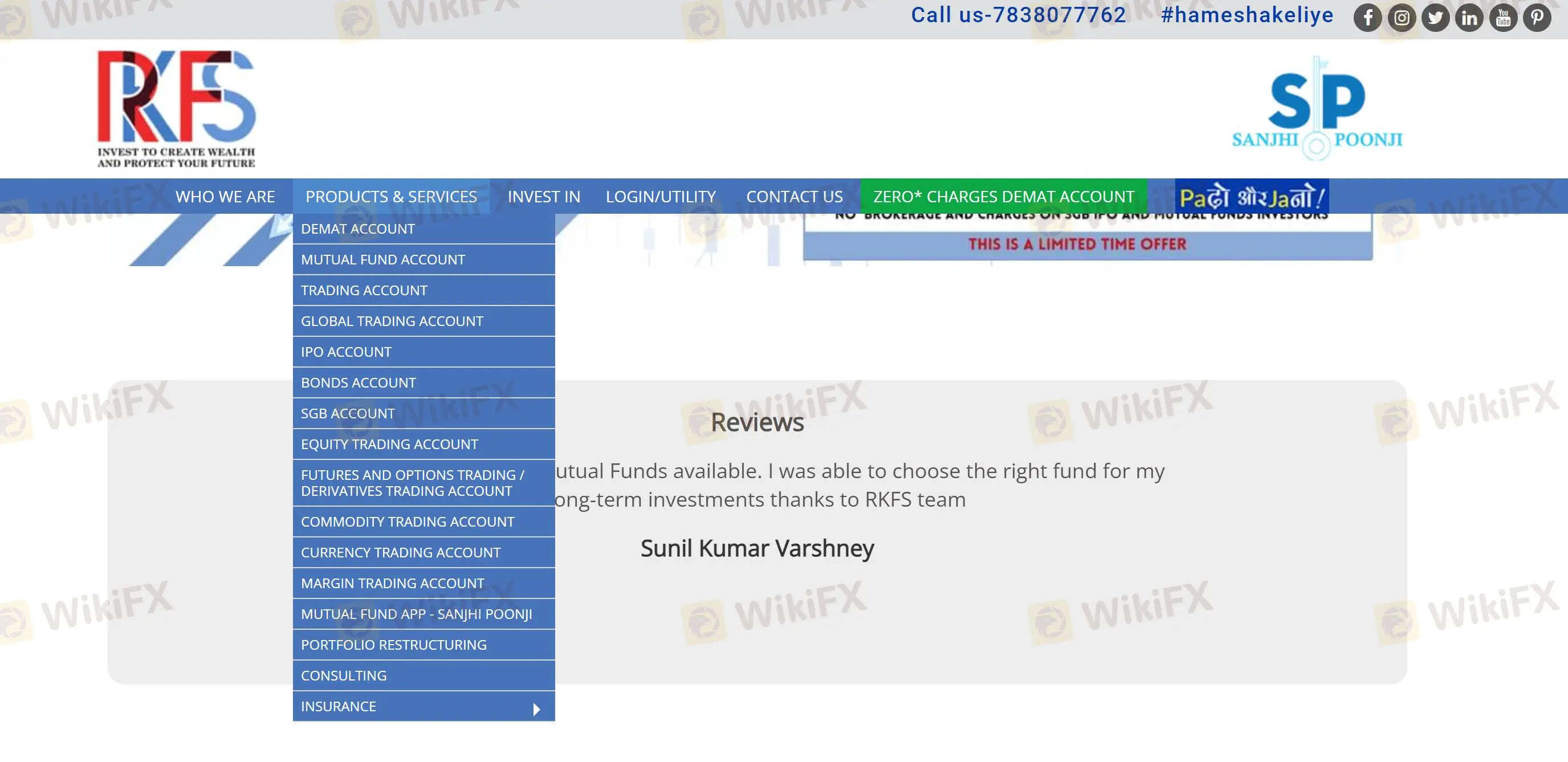

| 市場工具 | 證券、共同基金、股票、保險、諮詢服務等 |

| 模擬帳戶 | 未提及 |

| 交易平台 | Sanjhi Poonji(Web、Android 和 iOS)和後端 |

| 最低存款 | 無限制 |

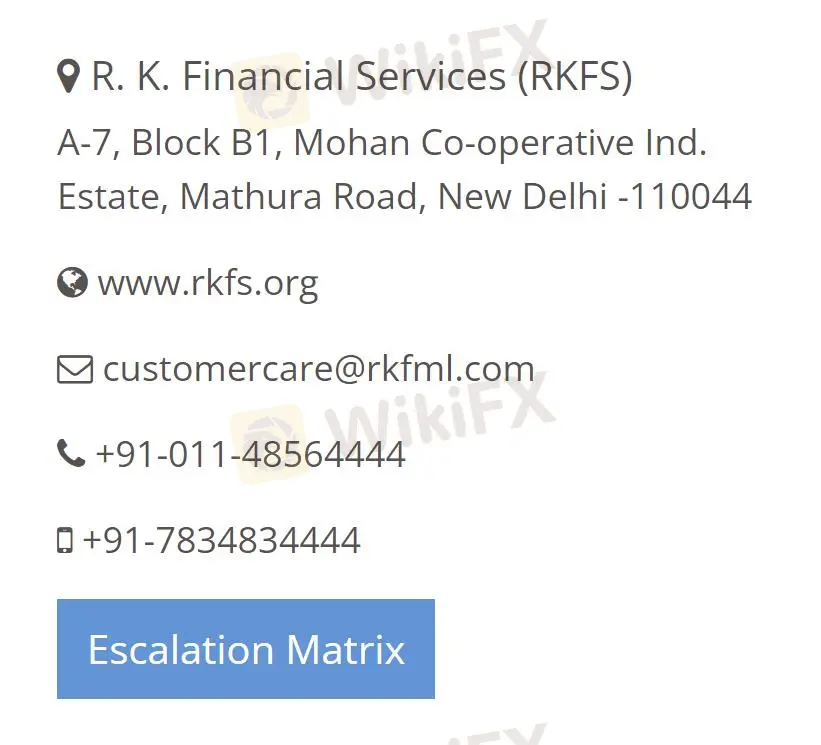

| 客戶支援 | 電話:+91-011-485644440+91-7834834444 |

| 電子郵件:Mcustomercare@rkfml.com | |

| 在線聊天 | |

| 社交媒體(Facebook、Instagram、LinkedIn、YouTube 等) | |

RKFS 資訊

RKFS 是一家金融諮詢公司,提供各種產品和服務,包括證券、共同基金、股票、保險、諮詢服務等。有免佣金的 demat 和 RKFS-INDIA INX 全球帳戶。

優點和缺點

| 優點 | 缺點 |

| 各種產品和服務 | 未受監管 |

| 24/7 在線支援 |

RKFS 是否合法?

RKFS 未受監管,相對於受監管的公司來說,安全性較低。

RKFS 有哪些產品和服務?

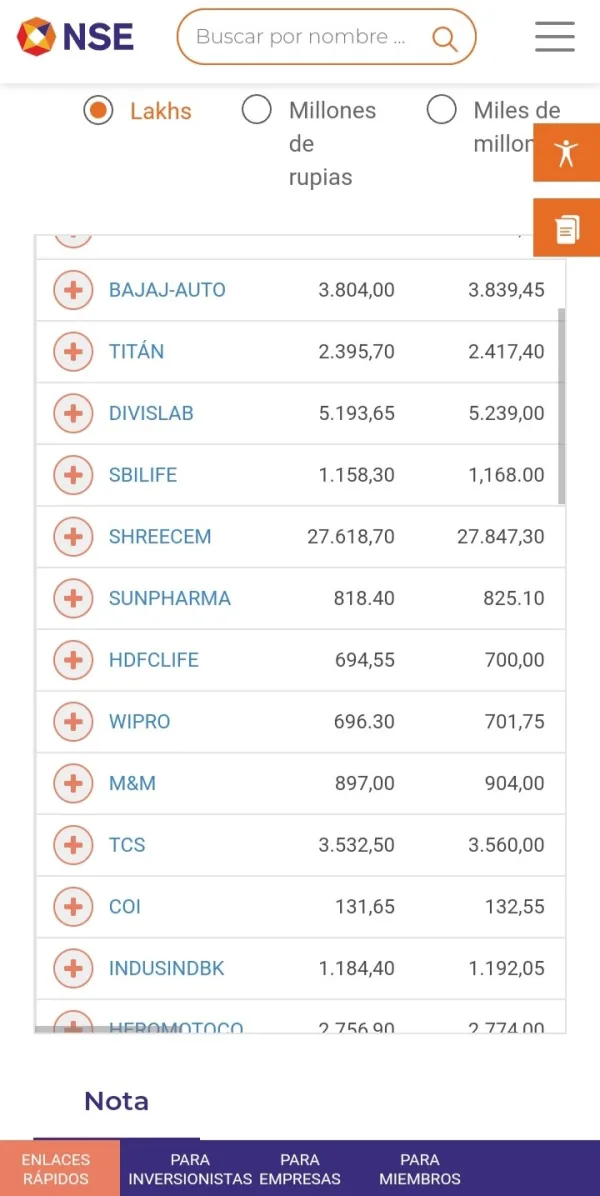

交易者可以開設帳戶投資多種交易資產,包括證券、共同基金、首次公開募股(IPO)、股票、期權、期貨和保證金交易,以及ETF、貨幣、債券等,還提供保險和諮詢服務。

| 可交易工具 | 支援 |

| 證券 | ✔ |

| 共同基金 | ✔ |

| 首次公開募股(IPO) | ✔ |

| 股票 | ✔ |

| 期權和期貨 | ✔ |

| 保證金交易 | ✔ |

| ETF | ✔ |

| 貨幣 | ✔ |

| 共同基金 | ✔ |

| 保險 | ✔ |

| 諮詢 | ✔ |

帳戶類型

RKFS 提供證券帳戶和 RKFS-INDIA INX 全球帳戶(GA)。GA 允許投資者透過單一整合帳戶全球投資於股票、ETF、期權、期貨、貨幣、債券、共同基金,除了提供上述資產服務外,證券帳戶還可以投資於首次公開募股(IPO)、商品等。

| 帳戶類型 | 支援 |

| 證券帳戶 | ✔ |

| RKFS-INDIA INX 全球帳戶(GA) | ✔ |

RKFS 費用

佣金為零。

交易平台

RKFS 可以通過Sanjhi Poonjis Android、iOS 或網頁版本投資公共基金。其他資產投資可以通過後台學習和下載。

| 交易平台/軟件 | 支援 | 可用設備 |

| Sanjhi Poonji | ✔ | 網頁、Android 和 iOS |

存款和提款

最低存款額度為無限制。RKFS支持網上資金轉帳,合作銀行包括HDFC和ICICI銀行。

客戶支援選項

交易者享受增值服務,例如全天候即時支援。RKFS支持通過電話和電子郵件以及社交媒體(包括Facebook、Instagram、LinkedIn、YouTube等)聯繫。

| 聯繫選項 | 詳情 |

| 電話 | +91-011-485644440+91-7834834444 |

| 電子郵件 | Mcustomercare@rkfml.com |

| 即時聊天 | ✔ |

| 社交媒體 | Facebook、Instagram、LinkedIn、YouTube等 |

| 支援語言 | 英文 |

| 網站語言 | 英文 |

| 實體地址 | R. K. Financial Services (RKFS)A-7, Block B1, Mohan Co-operative Ind.Estate, Mathura Road, New Delhi-110044 |