公司簡介

| LIGHT FX 評論摘要 | |

| 成立年份 | 2002 |

| 註冊國家/地區 | 日本 |

| 監管 | 受日本金融廳監管 |

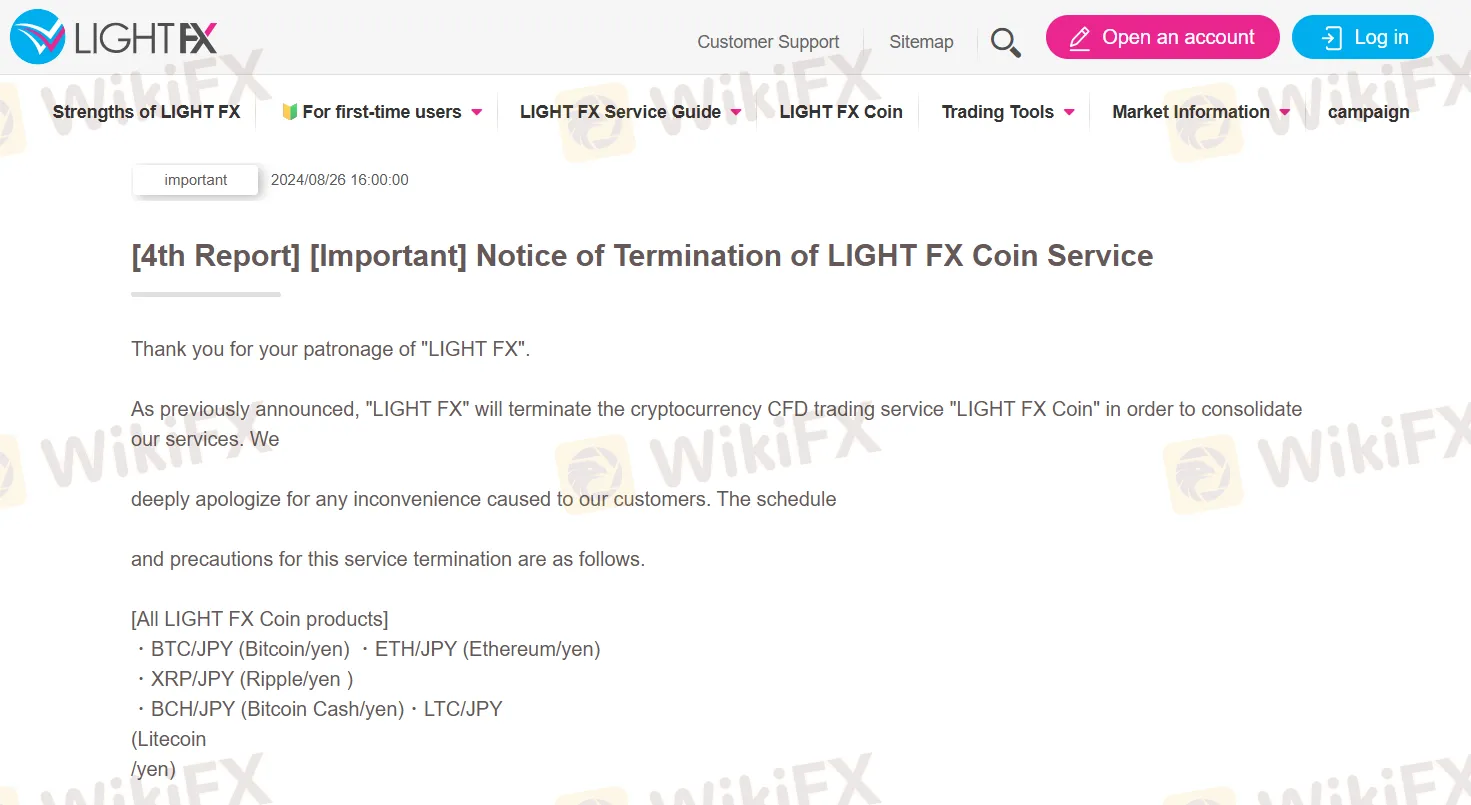

| 市場工具 | 外匯,加密貨幣 |

| 模擬帳戶 | / |

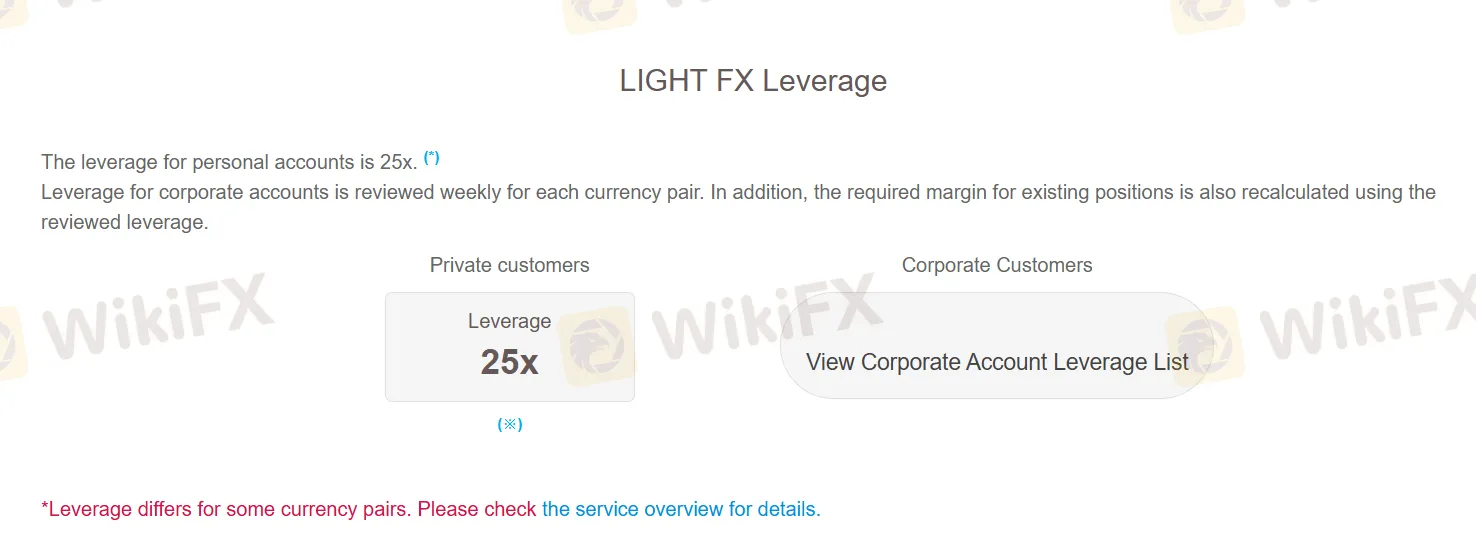

| 槓桿 | 最高1:25 |

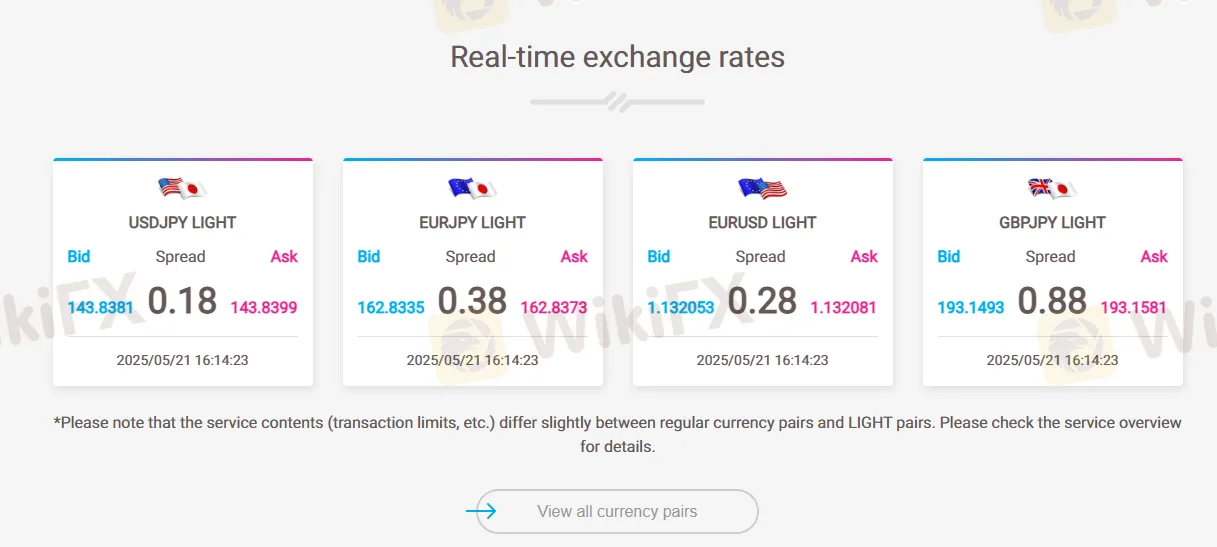

| EUR/USD 傳播 | 約0.28點左右 |

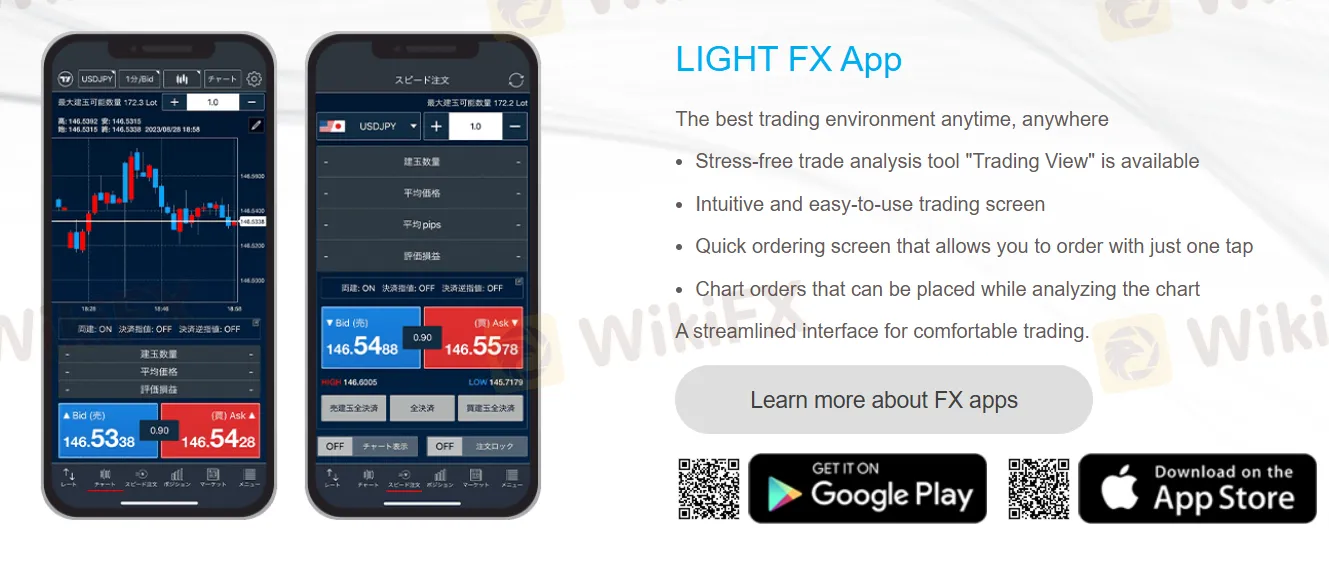

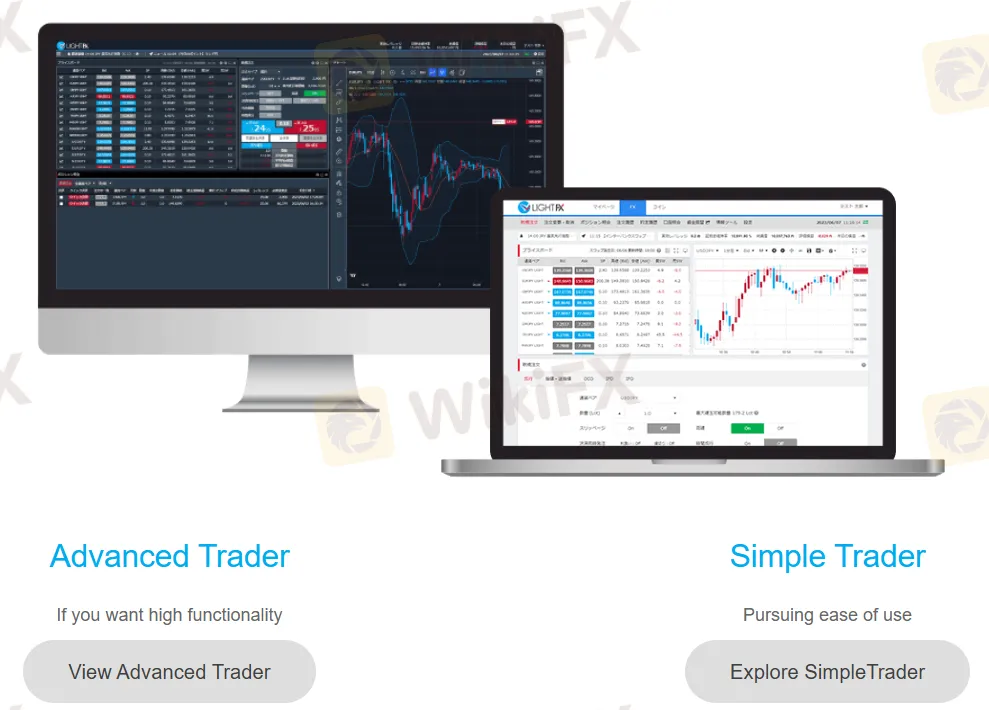

| 交易平台 | LIGHT FX App,Simple Trader,Advanced Trader |

| 最低存款 | 0 |

| 客戶支援 | 聯絡表格 |

| 電話:0120-637-105 | |

| 地址:Traders Securities Co., Ltd. “LIGHT FX” 東京都澀谷區恵比寿4-丁目20-3 恵比寿ガーデンプレイスタワー28樓 150-6028 | |

| 社交媒體:X | |

LIGHT FX 資訊

LIGHT FX 是一家成立於2002年的日本經紀商,受金融廳監管。提供外匯和加密貨幣交易。

優點和缺點

| 優點 | 缺點 |

| 受金融廳監管 | 交易資產有限 |

| 多個交易平台 | 不支援MT4和MT5 |

| 無佣金費 | 無模擬帳戶 |

| 允許小額交易 | |

| 實體辦公室證明 | |

| 營運時間長 |

LIGHT FX 是否合法?

LIGHT FX 受日本金融廳監管,屬於トレイダーズ証券株式会社,牌照號碼為関東財務局長(金商)第123号。

| 監管狀態 | 監管機構 | 牌照機構 | 牌照類型 | 牌照號碼 |

| 受監管 | 日本金融廳 | トレイダーズ証券株式会社 | 零售外匯牌照 | 関東財務局長(金商)第123号 |

WikiFX 實地調查

WikiFX 地勘團隊訪問了 LIGHT FX 的日本地址,我們在現場發現了該公司的辦公室,這意味著該公司設有實體辦公室。

我可以在 LIGHT FX 交易什麼?

| 交易工具 | 支援 |

| 外匯 | ✔ |

| 加密貨幣 | ✔ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 股票 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| ETF | ❌ |

槓桿

LIGHT FX 提供最高達 1:25 的槓桿,視乎工具和帳戶類型而定。槓桿讓交易者用較少的資金控制更大的頭寸,放大潛在利潤和損失。

交易平台

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| LIGHT FX 應用程式 | ✔ | iOS, Android | / |

| 簡易交易員 | ✔ | Web(基於瀏覽器) | / |

| 高級交易員 | ✔ | Web(基於瀏覽器) | / |

| MT4 | ❌ | / | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |

存款和提款

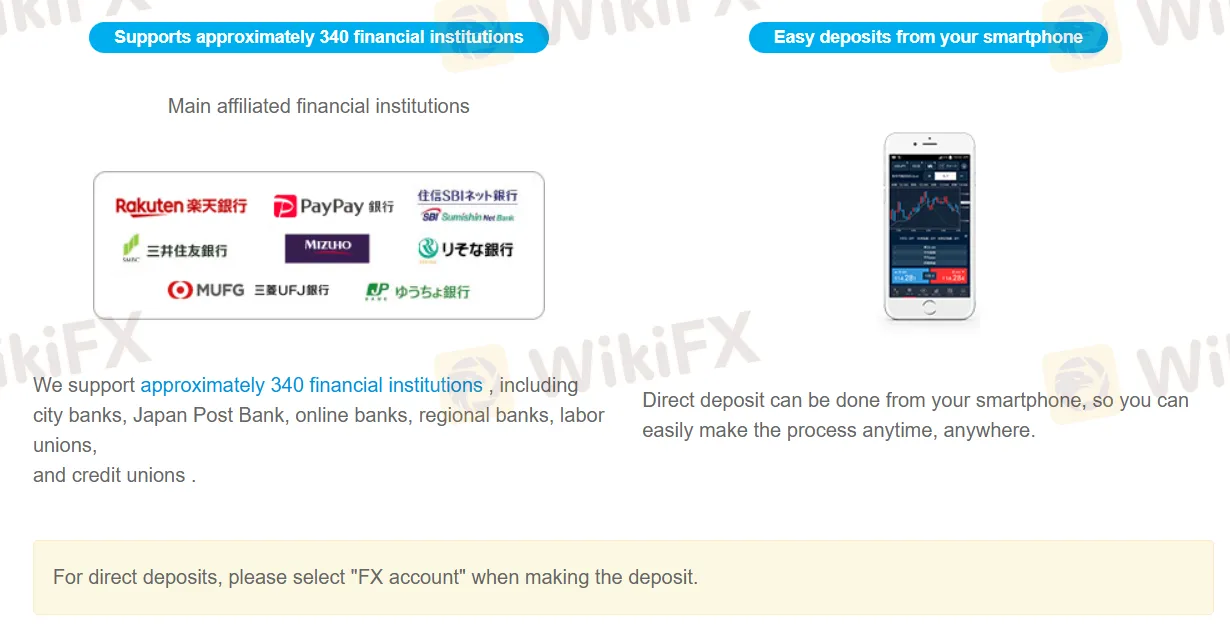

LIGHT FX 沒有最低存款要求,非常適合新投資者和沒有太多資本的人。

| 存款方式 | 最低存款 | 存款費用 | 存款時間 |

| 銀行轉帳 | 0 | 0 | 24小時內 |

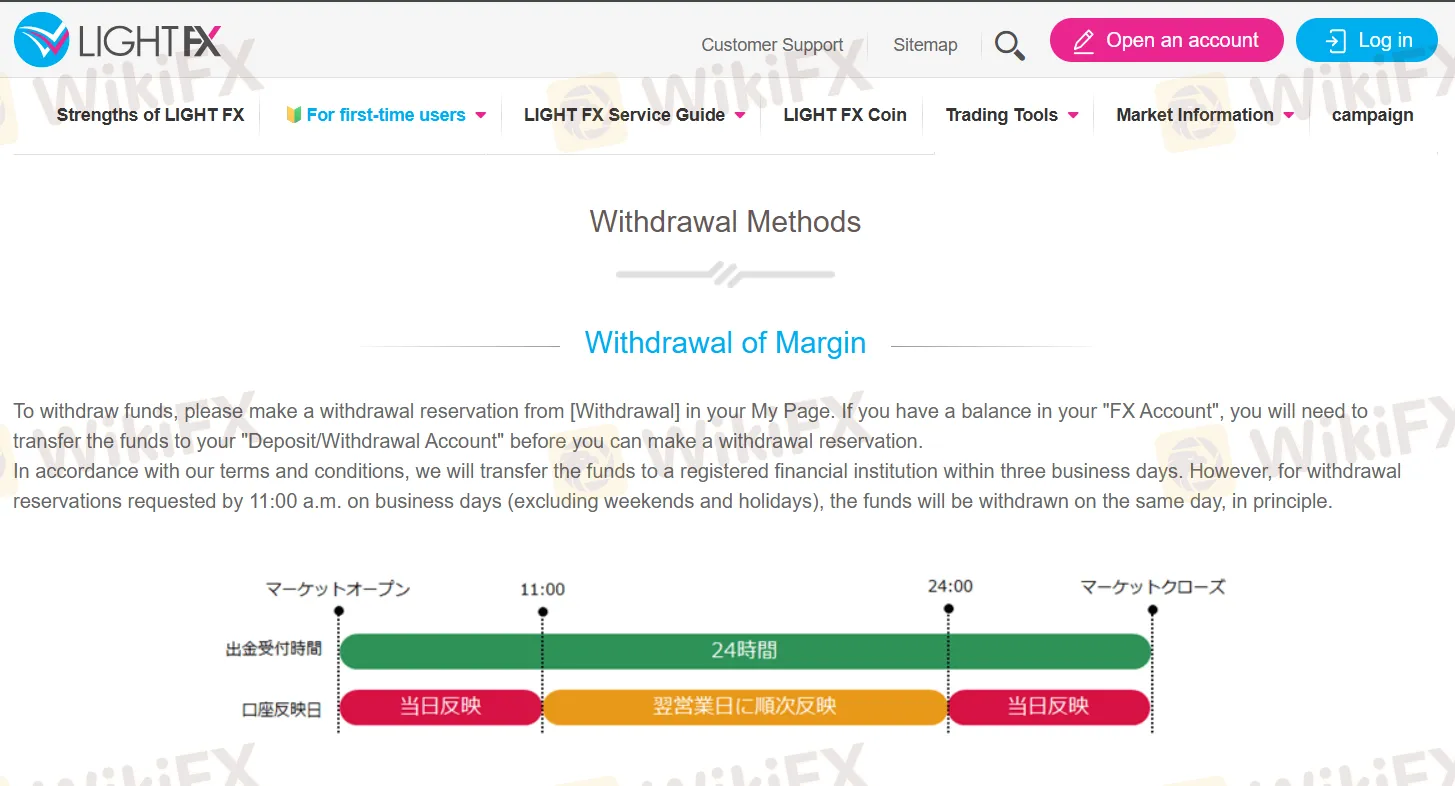

提款服務由LIGHT FX提供,最低提款金額為JPY 2000,提款時間為3個工作天。

| 提款方式 | 最低提款 | 提款費用 | 提款時間 |

| 銀行轉帳 | JPY 2000 | / | 3個工作天 |