Buod ng kumpanya

| RKFS Buod ng Pagsusuri | |

| Itinatag | 2020-06-08 |

| Rehistradong Bansa/Rehiyon | India |

| Regulasyon | Hindi Regulado |

| Mga Instrumento sa Merkado | mga seguridad, mutual funds, mga stock, seguro, serbisyong pang-konsulta, at iba pa |

| Demo Account | Hindi nabanggit |

| Plataporma ng Pagkalakalan | Sanjhi Poonji (Web, Android, at iOS) at backend |

| Min Deposit | Walang limitasyon |

| Suporta sa Customer | Telepono: +91-011-485644440+91-7834834444 |

| Email: Mcustomercare@rkfml.com | |

| Live chat | |

| Social Media (Facebook, Instagram, LinkedIn, YouTube, at iba pa) | |

RKFS Impormasyon

RKFS ay isang kumpanya ng pangangasiwa sa pinansya, na nagbibigay ng iba't ibang mga produkto at serbisyo, kasama ang mga seguridad, mutual funds, mga stock, seguro, serbisyong pang-konsulta, at iba pa. May mga demat at RKFS-INDIA INX global accounts na may libreng komisyon.

Mga Benepisyo Kadahilanan Iba't ibang mga produkto at serbisyo Hindi Regulado 24/7 suporta sa live chat Totoo ba ang RKFS?

Ang RKFS ay hindi regulado, kaya't mas hindi ligtas kumpara sa mga reguladong kumpanya.

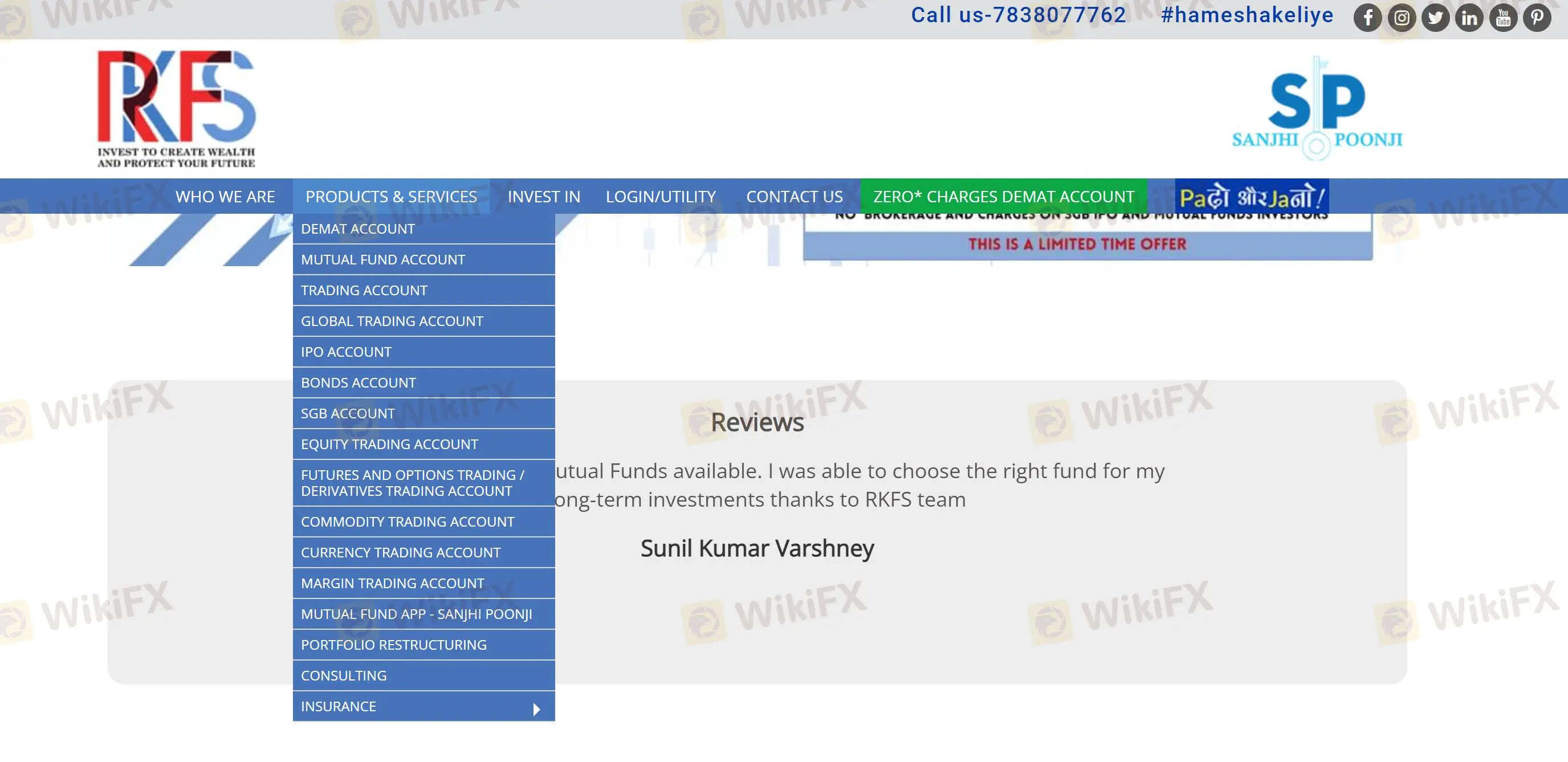

Ano ang mga produkto at serbisyo na meron ang RKFS?

Ang mga mangangalakal ay maaaring magbukas ng isang account upang mamuhunan sa iba't ibang mga asset sa kalakalan, kabilang ang securities, mutual funds, IPO, stocks, options, futures, at margin trading, kasama ang ETFs, currencies, bonds, at iba pa, pati na rin ang insurance at consulting services.

| Mga Tradable na Instrumento | Supported |

| Securities | ✔ |

| Mutual Funds | ✔ |

| IPO | ✔ |

| Stocks | ✔ |

| Options and Futures | ✔ |

| Margin Trading | ✔ |

| ETFs | ✔ |

| Currencies | ✔ |

| Mutual Funds | ✔ |

| Insurance | ✔ |

| Consulting | ✔ |

Uri ng Account

Ang RKFS ay nagbibigay ng mga account na demat at RKFS-INDIA INX global. Ang GA ay nagbibigay-daan sa mga mamumuhunan na mamuhunan sa buong mundo sa mga stocks, ETFs, options, futures, currencies, bonds, mutual funds mula sa isang solong integrated account at bukod sa pagbibigay ng mga nasabing serbisyo sa asset, ang demat ay maaari ring mamuhunan sa mga IPO, commodities, at iba pa.

| Uri ng Account | Supported |

| Demat Account | ✔ |

| RKFS-INDIA INX GLOBAL ACCOUNT(GA) | ✔ |

RKFS Fees

Ang komisyon ay walang.

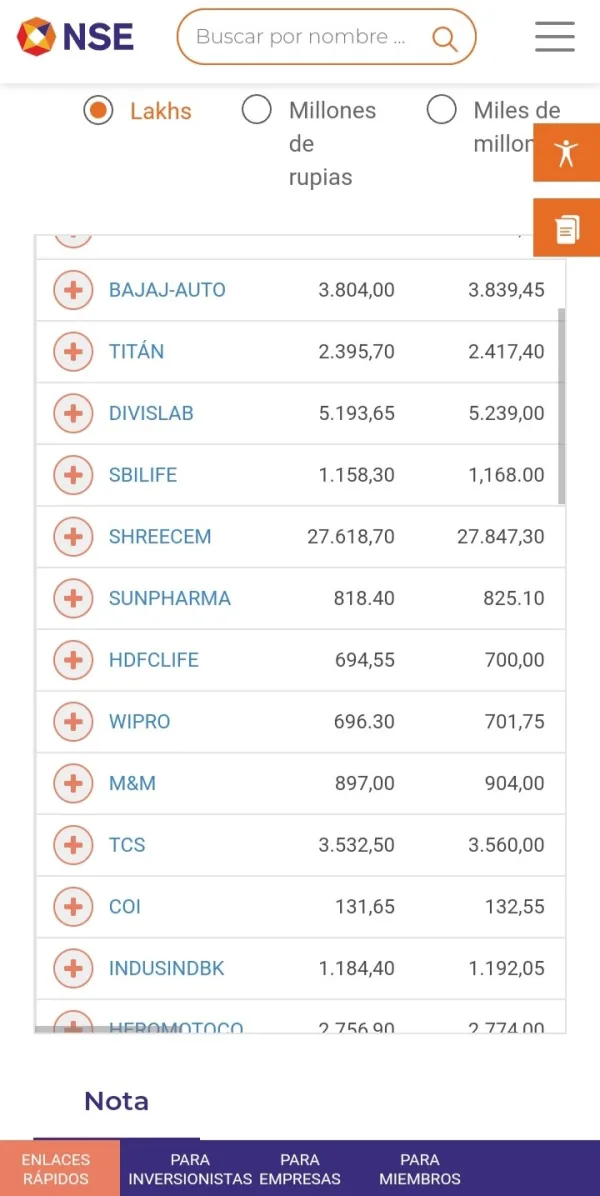

Platforma ng Kalakalan

Ang RKFS ay maaaring mamuhunan sa mga pampublikong pondo sa pamamagitan ng Sanjhi Poonjis Android, iOS, o bersyon ng web. Ang iba pang mga pamumuhunan sa asset ay maaaring matutuhan at mai-download sa pamamagitan ng back office.

| Platforma ng Kalakalan/Software | Supported | Available Devices |

| Sanjhi Poonji | ✔ | Web, Android, at iOS |

Pag-iimpok at Pagwi-withdraw

Ang minimum na deposito ay walang limitasyon. RKFS ay sumusuporta sa online fund transfers, at ang mga partner na bangko ay HDFC at ICICI banks.

Mga Pagpipilian sa Suporta sa Customer

Ang mga trader ay nag-eenjoy ng mga value-added na serbisyo, tulad ng 24/7 live support. Ang RKFS ay sumusuporta sa pakikipag-ugnayan sa pamamagitan ng telepono at email, pati na rin sa social media, kabilang ang Facebook, Instagram, LinkedIn, YouTube, atbp.

| Mga Pagpipilian sa Pakikipag-ugnayan | Mga Detalye |

| Telepono | +91-011-485644440+91-7834834444 |

| Mcustomercare@rkfml.com | |

| Live chat | ✔ |

| Social Media | Facebook, Instagram, LinkedIn, YouTube, atbp. |

| Supported Language | Ingles |

| Website Language | Ingles |

| Physical Address | R. K. Financial Services (RKFS)A-7, Block B1, Mohan Co-operative Ind.Estate, Mathura Road, New Delhi-110044 |