Perfil de la compañía

| RKFS Resumen de la revisión | |

| Fundado | 2020-06-08 |

| País/Región Registrado | India |

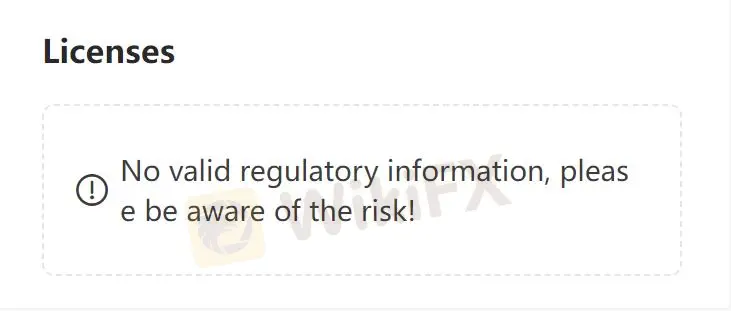

| Regulación | No regulado |

| Instrumentos de Mercado | valores, fondos mutuos, acciones, seguros, servicios de consultoría, etc. |

| Cuenta de Demostración | No mencionado |

| Plataforma de Trading | Sanjhi Poonji (Web, Android e iOS) y backend |

| Depósito Mínimo | Sin límite |

| Soporte al Cliente | Teléfono: +91-011-485644440+91-7834834444 |

| Correo electrónico: Mcustomercare@rkfml.com | |

| Chat en vivo | |

| Redes Sociales (Facebook, Instagram, LinkedIn, YouTube, etc.) | |

Información de RKFS

RKFS es una empresa de asesoramiento financiero, que ofrece diversos productos y servicios, incluyendo valores, fondos mutuos, acciones, seguros, servicios de consultoría, etc. Hay cuentas globales demat y RKFS-INDIA INX sin comisiones.

Ventajas y Desventajas

| Pros | Cons |

| Varios productos y servicios | No regulado |

| Soporte en vivo 24/7 |

¿Es RKFS Legítimo?

RKFS no está regulado, lo que lo hace menos seguro que los regulados.

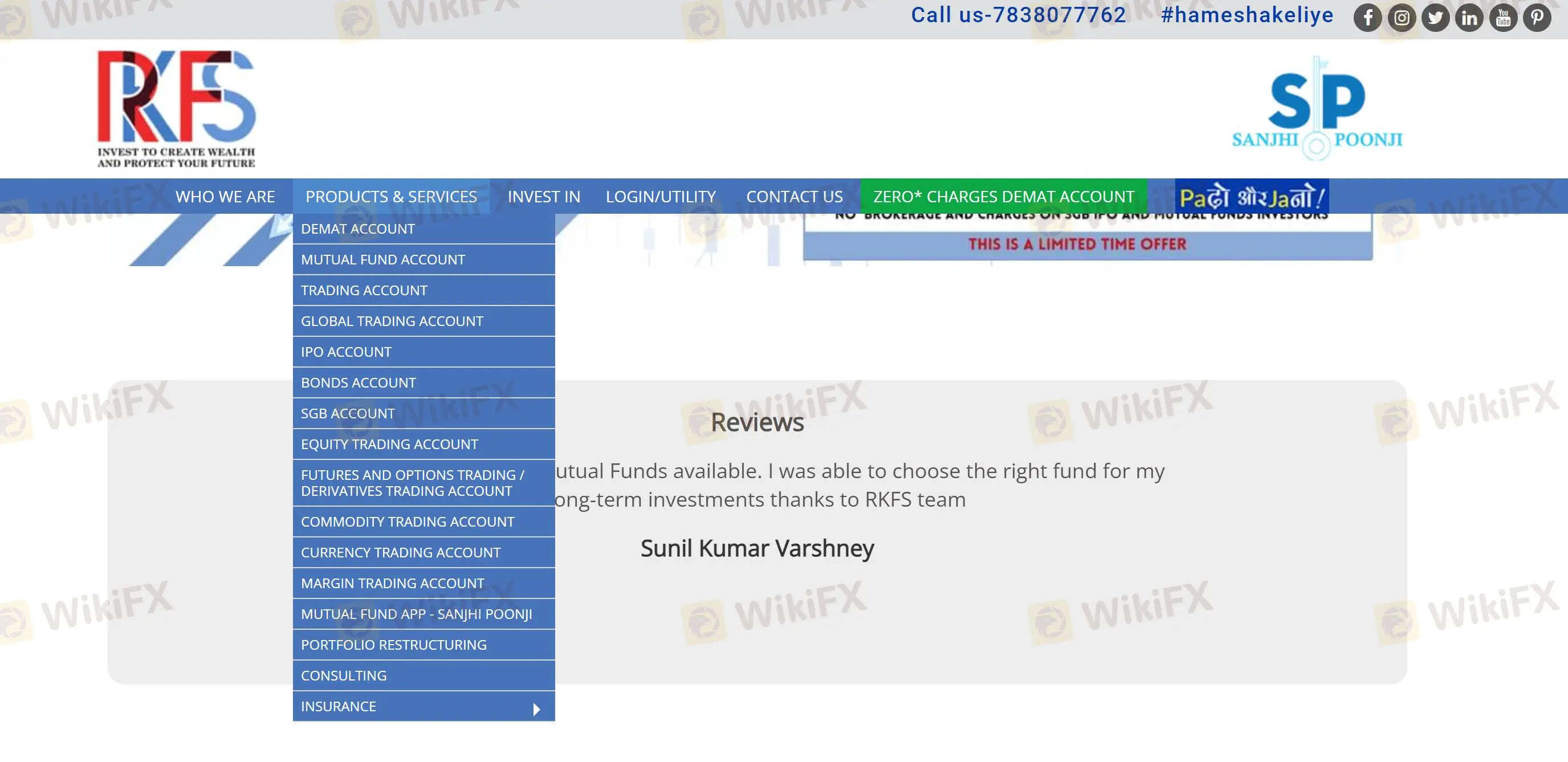

¿Qué productos y servicios ofrece RKFS?

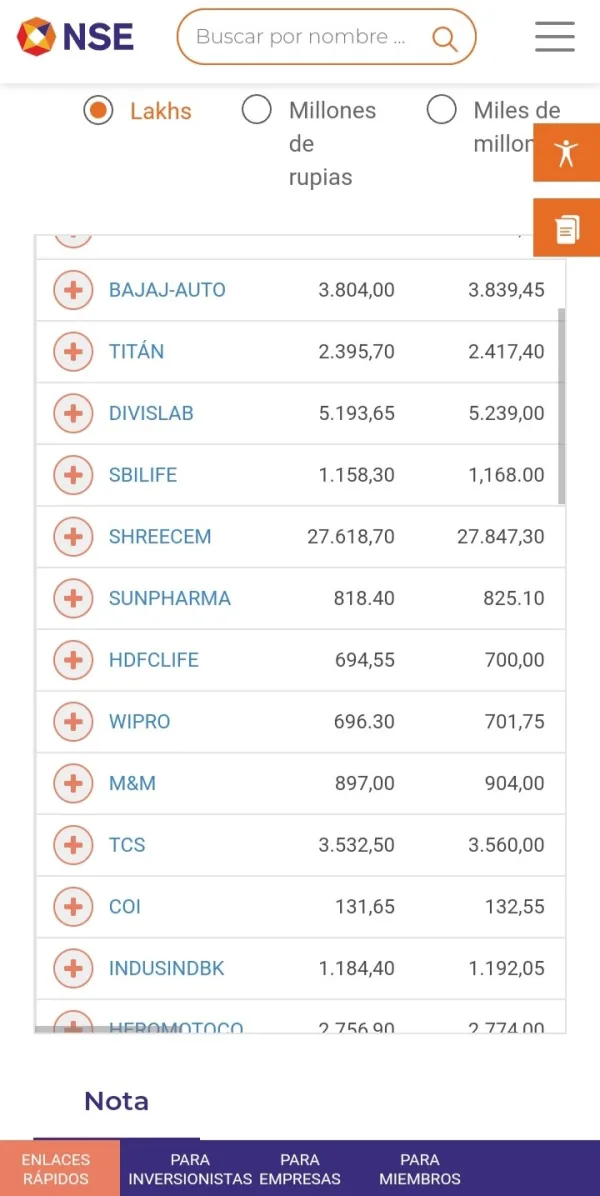

Los traders pueden abrir una cuenta para invertir en múltiples activos de trading, incluyendo valores, fondos mutuos, IPO, acciones, opciones, futuros y operaciones con margen, junto con ETFs, divisas, bonos, y así sucesivamente, además de servicios de seguros y consultoría.

| Instrumentos Negociables | Soportados |

| Valores | ✔ |

| Fondos Mutuos | ✔ |

| IPO | ✔ |

| Acciones | ✔ |

| Opciones y Futuros | ✔ |

| Operaciones con Margen | ✔ |

| ETFs | ✔ |

| Divisas | ✔ |

| Fondos Mutuos | ✔ |

| Seguros | ✔ |

| Consultoría | ✔ |

Tipo de Cuenta

RKFS ofrece cuentas demat y RKFS-INDIA INX global. GA permite a los inversores invertir globalmente en acciones, ETFs, opciones, futuros, divisas, bonos, fondos mutuos desde una sola cuenta integrada y además de proporcionar los servicios de activos mencionados anteriormente, demat también puede invertir en IPOs, materias primas, y así sucesivamente.

| Tipo de Cuenta | Soportado |

| Cuenta Demat | ✔ |

| RKFS-INDIA INX GLOBAL ACCOUNT(GA) | ✔ |

Tarifas de RKFS

La comisión es cero.

Plataforma de Trading

RKFS puede invertir en fondos públicos a través de Sanjhi Poonjis Android, iOS o versión web. Otras inversiones de activos se pueden aprender y descargar a través de la oficina de respaldo.

| Plataforma/Software de Trading | Soportado | Dispositivos Disponibles |

| Sanjhi Poonji | ✔ | Web, Android e iOS |

Depósito y Retiro

El depósito mínimo es sin límite. RKFS admite transferencias de fondos en línea, y los bancos asociados son HDFC y ICICI.

Opciones de Soporte al Cliente

Los traders disfrutan de servicios de valor añadido, como soporte en vivo las 24 horas, los 7 días de la semana. RKFS admite el contacto a través de teléfono y correo electrónico, así como redes sociales, incluyendo Facebook, Instagram, LinkedIn, YouTube, etc.

| Opciones de Contacto | Detalles |

| Teléfono | +91-011-485644440+91-7834834444 |

| Correo Electrónico | Mcustomercare@rkfml.com |

| Chat en Vivo | ✔ |

| Redes Sociales | Facebook, Instagram, LinkedIn, YouTube, etc. |

| Idioma Soportado | Inglés |

| Idioma del Sitio Web | Inglés |

| Dirección Física | R. K. Financial Services (RKFS)A-7, Block B1, Mohan Co-operative Ind.Estate, Mathura Road, New Delhi-110044 |