Unternehmensprofil

| RKFS Überprüfungszusammenfassung | |

| Gegründet | 2020-06-08 |

| Registriertes Land/Region | Indien |

| Regulierung | Unreguliert |

| Marktinstrumente | Wertpapiere, Investmentfonds, Aktien, Versicherungen, Beratungsdienstleistungen usw. |

| Demokonto | Nicht angegeben |

| Handelsplattform | Sanjhi Poonji (Web, Android und iOS) und Backend |

| Mindesteinzahlung | Keine Begrenzung |

| Kundensupport | Telefon: +91-011-485644440+91-7834834444 |

| E-Mail: Mcustomercare@rkfml.com | |

| Live-Chat | |

| Soziale Medien (Facebook, Instagram, LinkedIn, YouTube usw.) | |

RKFS Informationen

RKFS ist ein Finanzberatungsunternehmen, das verschiedene Produkte und Dienstleistungen anbietet, einschließlich Wertpapiere, Investmentfonds, Aktien, Versicherungen, Beratungsdienstleistungen usw. Es gibt Demat- und RKFS-INDIA INX Global-Konten mit kostenloser Provision.

Vor- und Nachteile

| Vorteile | Nachteile |

| Verschiedene Produkte und Dienstleistungen | Unreguliert |

| 24/7 Live-Support |

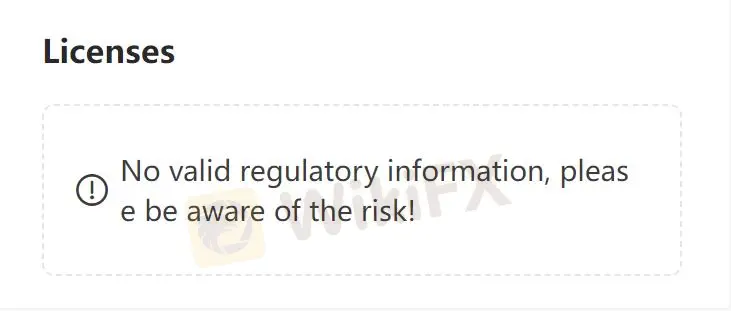

Ist RKFS legitim?

RKFS ist nicht reguliert, was es weniger sicher macht als regulierte Unternehmen.

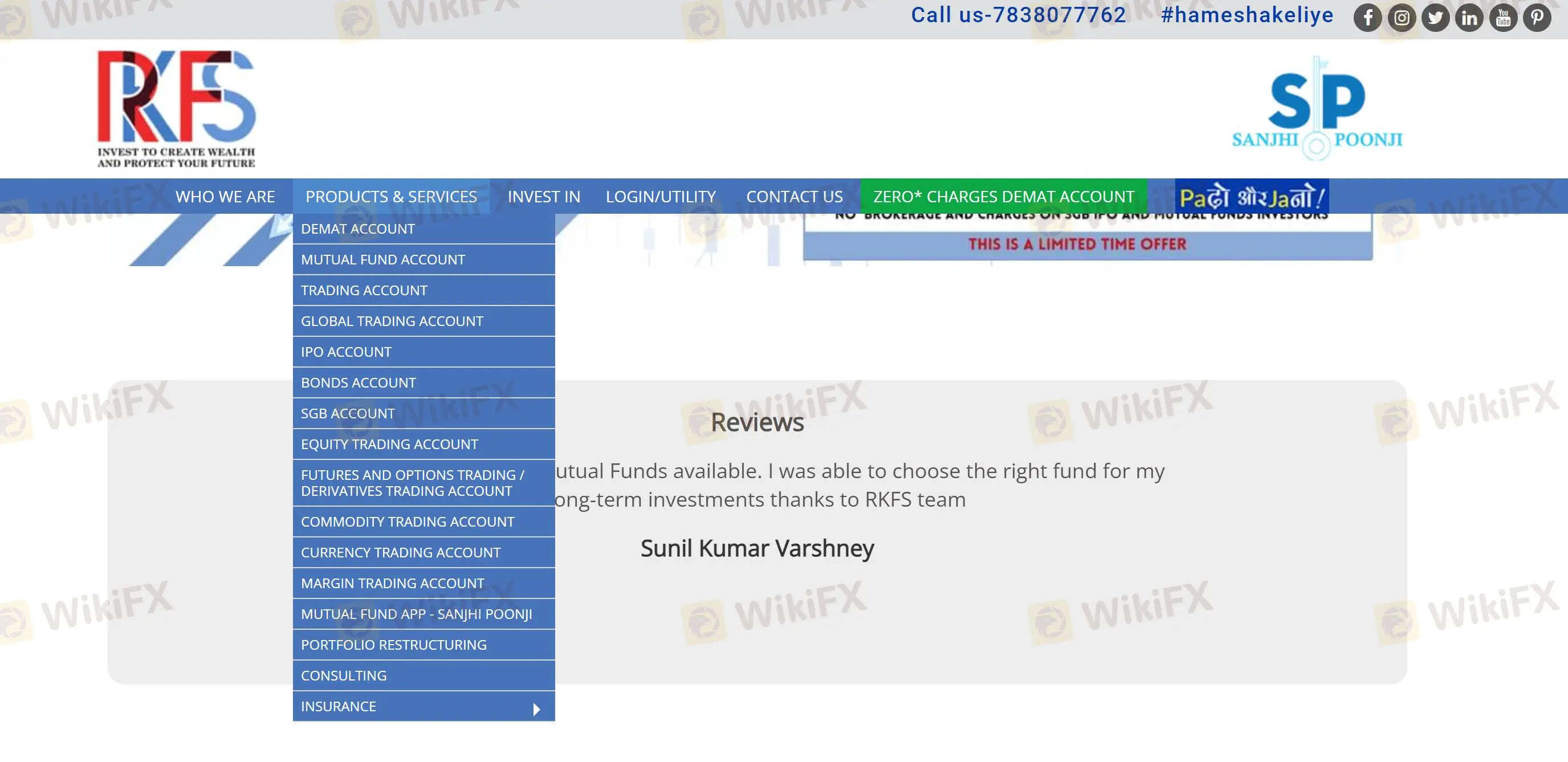

Welche Produkte und Dienstleistungen bietet RKFS an?

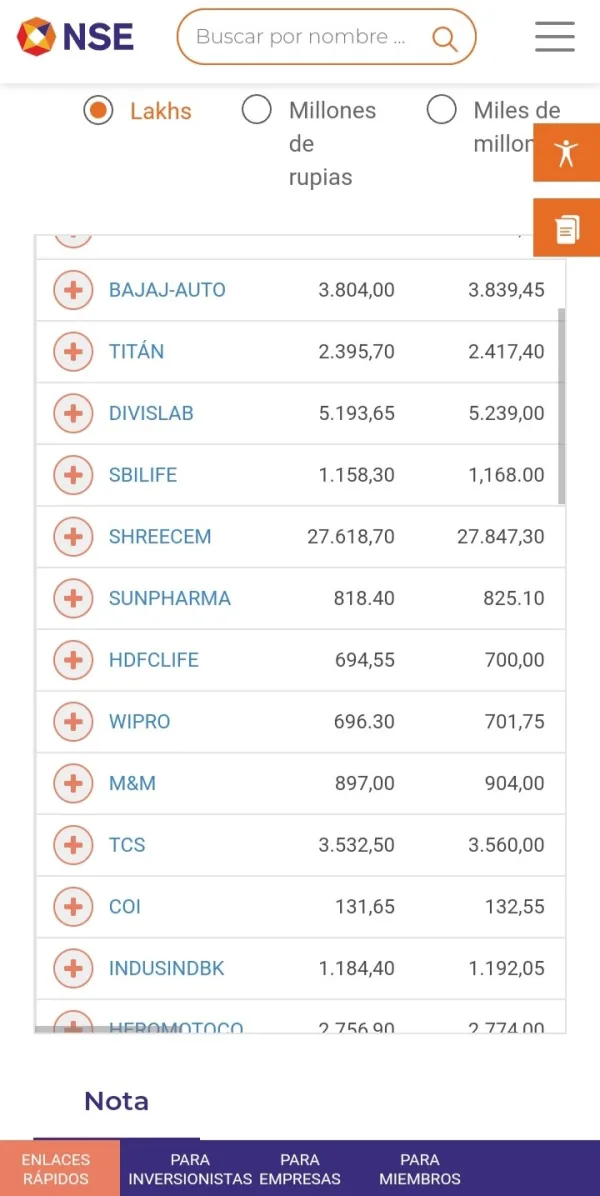

Händler können ein Konto eröffnen, um in mehrere Handelsanlagen zu investieren, einschließlich Wertpapiere, Investmentfonds, IPO, Aktien, Optionen, Futures und Margin-Handel, sowie ETFs, Währungen, Anleihen und so weiter, sowie Versicherungs- und Beratungsdienstleistungen.

| Handelbare Instrumente | Unterstützt |

| Wertpapiere | ✔ |

| Investmentfonds | ✔ |

| IPO | ✔ |

| Aktien | ✔ |

| Optionen und Futures | ✔ |

| Margin-Handel | ✔ |

| ETFs | ✔ |

| Währungen | ✔ |

| Investmentfonds | ✔ |

| Versicherung | ✔ |

| Beratung | ✔ |

Kontotyp

RKFS bietet Demat- und RKFS-INDIA INX Global Konten an. GA ermöglicht es Anlegern, global in Aktien, ETFs, Optionen, Futures, Währungen, Anleihen, Investmentfonds über ein einziges integriertes Konto zu investieren und zusätzlich zu den oben genannten Vermögensdienstleistungen kann Demat auch in IPOs, Rohstoffe und so weiter investieren.

| Kontotyp | Unterstützt |

| Demat-Konto | ✔ |

| RKFS-INDIA INX GLOBAL ACCOUNT(GA) | ✔ |

RKFS Gebühren

Die Provision beträgt Null.

Handelsplattform

RKFS kann über die Sanjhi Poonjis Android-, iOS- oder Web-Version in öffentliche Fonds investieren. Andere Vermögensinvestitionen können über das Backoffice erlernt und heruntergeladen werden.

| Handelsplattform/Software | Unterstützt | Verfügbare Geräte |

| Sanjhi Poonji | ✔ | Web, Android und iOS |

Einzahlung und Auszahlung

Die Mindesteinzahlung beträgt kein Limit. RKFS unterstützt Online-Fundüberweisungen und Partnerbanken wie HDFC und ICICI Bank.

Kundensupport-Optionen

Händler profitieren von Mehrwertdiensten wie 24/7 Live-Support. RKFS bietet Kontaktmöglichkeiten per Telefon und E-Mail sowie über soziale Medien wie Facebook, Instagram, LinkedIn, YouTube usw.

| Kontaktmöglichkeiten | Details |

| Telefon | +91-011-485644440+91-7834834444 |

| Mcustomercare@rkfml.com | |

| Live-Chat | ✔ |

| Soziale Medien | Facebook, Instagram, LinkedIn, YouTube usw. |

| Unterstützte Sprache | Englisch |

| Websprache | Englisch |

| Physische Adresse | R. K. Financial Services (RKFS)A-7, Block B1, Mohan Co-operative Ind.Estate, Mathura Road, New Delhi-110044 |