회사 소개

| RKFS 리뷰 요약 | |

| 설립일 | 2020-06-08 |

| 등록 국가/지역 | 인도 |

| 규제 | 규제되지 않음 |

| 시장 기구 | 증권, 펀드, 주식, 보험, 컨설팅 서비스 등 |

| 데모 계정 | 언급되지 않음 |

| 거래 플랫폼 | Sanjhi Poonji(Web, Android, and iOS) 및 백엔드 |

| 최소 입금액 | 무제한 |

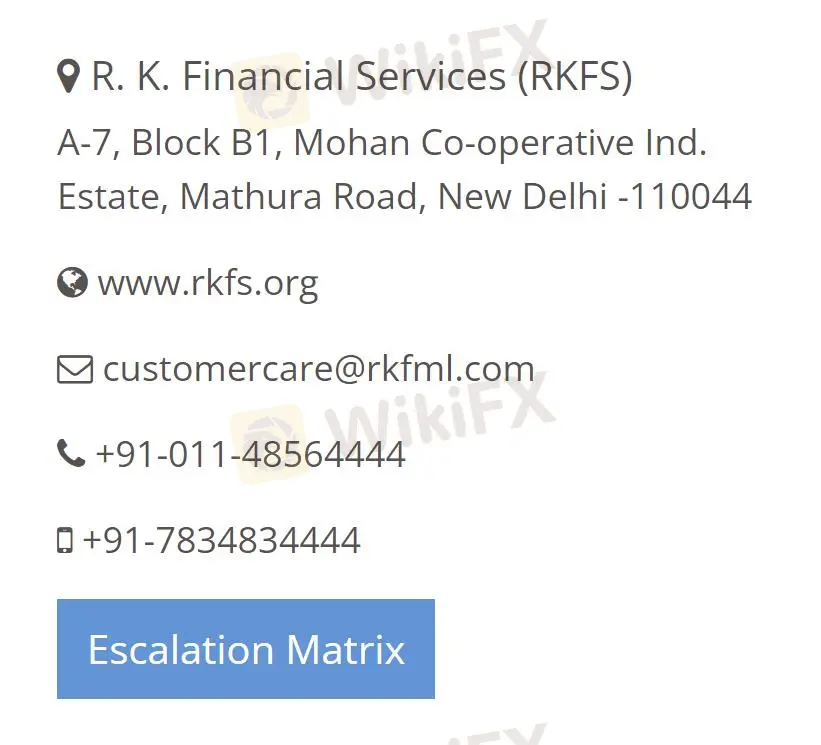

| 고객 지원 | 전화:+91-011-485644440+91-7834834444 |

| 이메일: Mcustomercare@rkfml.com | |

| 라이브 채팅 | |

| 소셜 미디어(Facebook, Instagram, LinkedIn, YouTube 등) | |

RKFS 정보

RKFS은 금융 컨설팅 회사로서, 증권, 펀드, 주식, 보험, 컨설팅 서비스 등 다양한 제품과 서비스를 제공합니다. 무수수한 수수료로 데마트 및 RKFS-INDIA INX 글로벌 계정이 있습니다.

장단점

| 장점 | 단점 |

| 다양한 제품과 서비스 | 규제되지 않음 |

| 24/7 라이브 지원 |

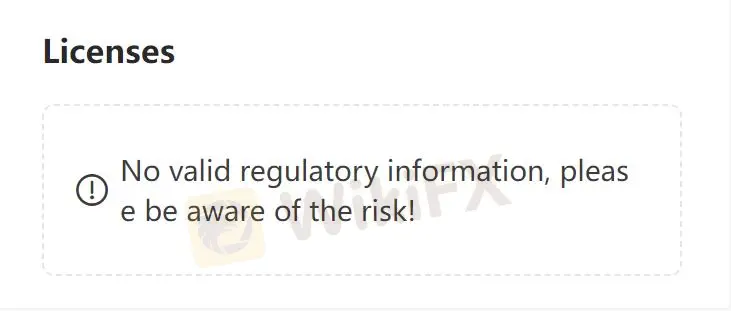

RKFS의 신뢰성

RKFS은 규제되지 않음으로, 규제된 업체보다 안전성이 낮습니다.

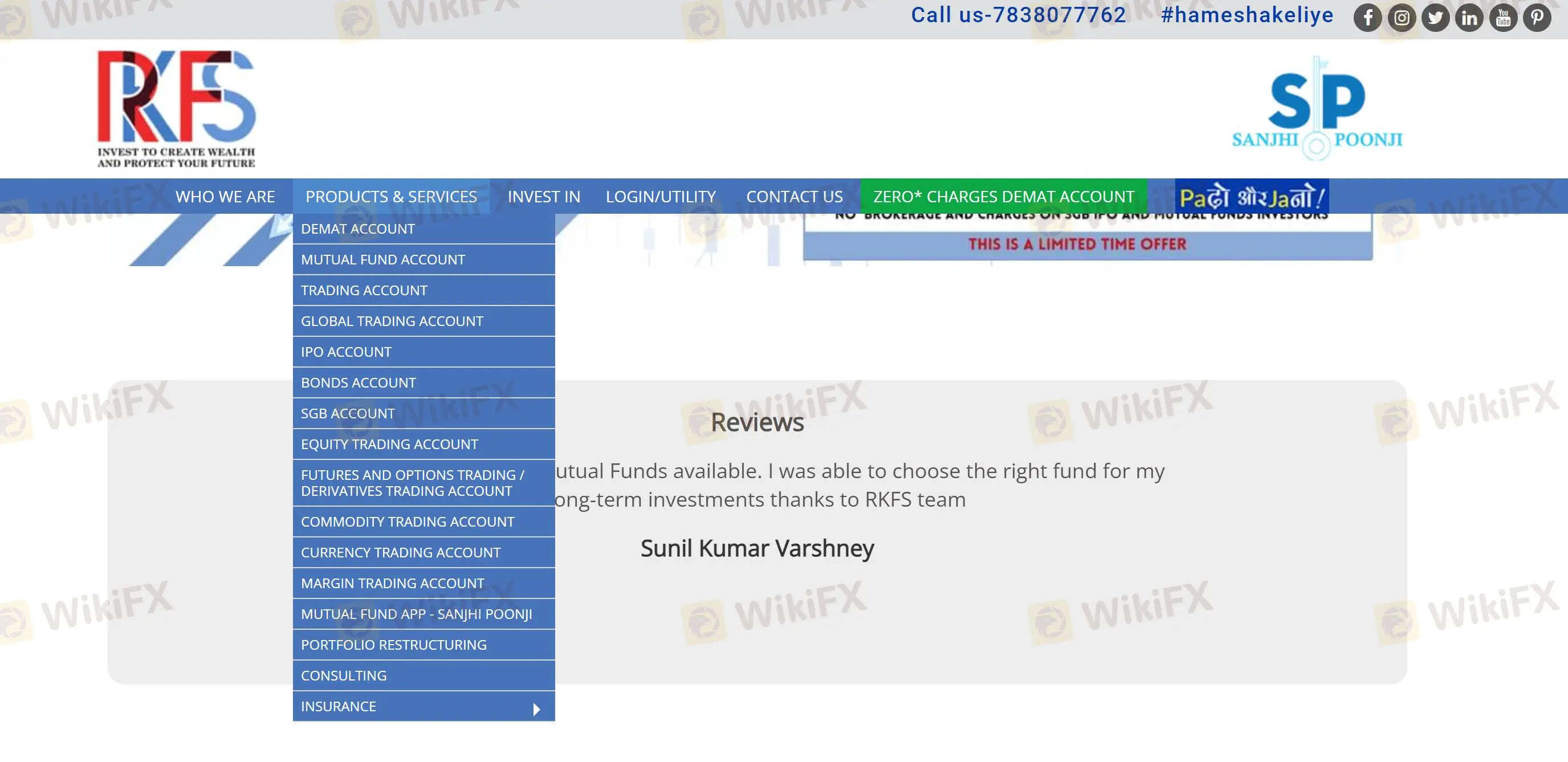

RKFS의 제품과 서비스

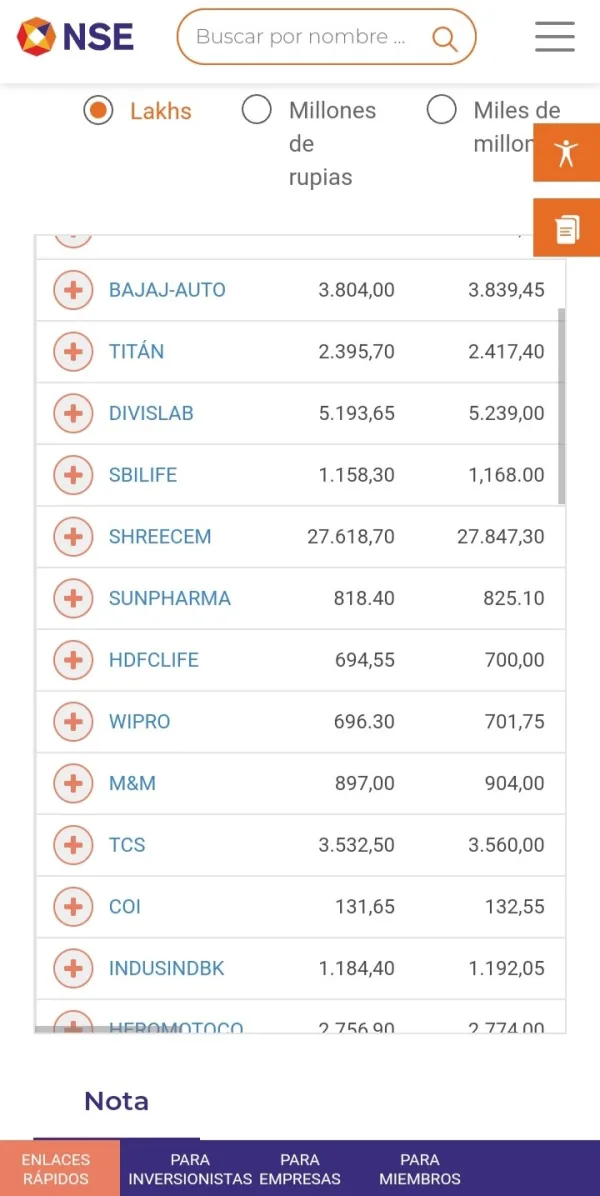

트레이더들은 증권, 펀드, IPO, 주식, 옵션, 선물, 마진 트레이딩을 포함한 다양한 거래 자산에 투자하기 위해 계좌를 개설할 수 있으며, ETF, 통화, 채권 등과 같은 자산뿐만 아니라 보험 및 컨설팅 서비스도 제공됩니다.

| 거래 가능한 자산 | 지원 여부 |

| 증권 | ✔ |

| 펀드 | ✔ |

| IPO | ✔ |

| 주식 | ✔ |

| 옵션 및 선물 | ✔ |

| 마진 트레이딩 | ✔ |

| ETF | ✔ |

| 통화 | ✔ |

| 펀드 | ✔ |

| 보험 | ✔ |

| 컨설팅 | ✔ |

계좌 유형

RKFS은 데마트 및 RKFS-인도 INX 글로벌 계좌를 제공합니다. GA는 단일 통합 계좌에서 주식, ETF, 옵션, 선물, 통화, 채권, 펀드 등에 글로벌하게 투자할 수 있도록 해주며, 위의 자산 서비스를 제공하는 것 외에도 데마트는 IPO, 상품 등에도 투자할 수 있습니다.

| 계좌 유형 | 지원 여부 |

| 데마트 계좌 | ✔ |

| RKFS-인도 INX 글로벌 계좌(GA) | ✔ |

RKFS 수수료

수수료는 0입니다.

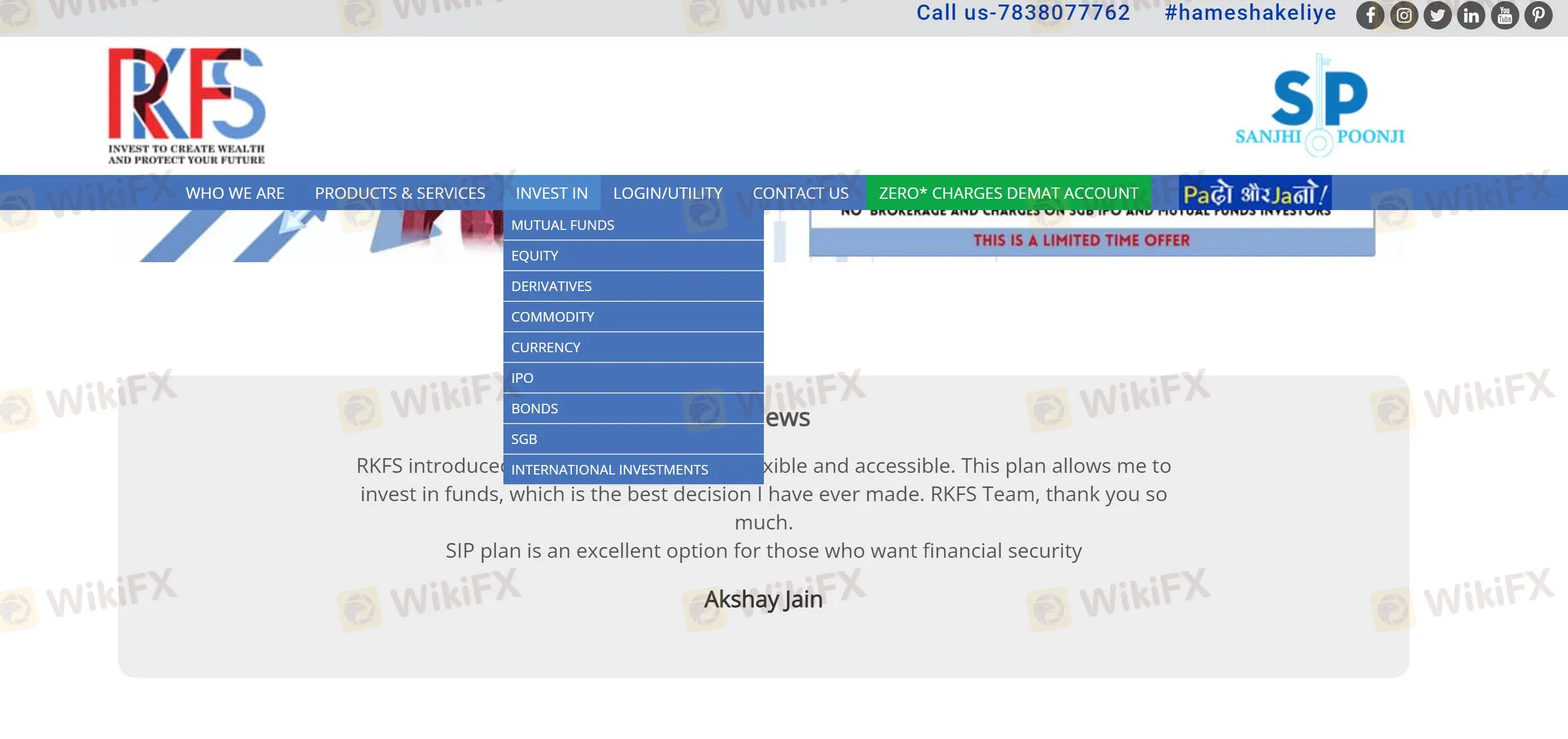

거래 플랫폼

RKFS은 Sanjhi Poonjis Android, iOS 또는 웹 버전을 통해 공개 펀드에 투자할 수 있습니다. 다른 자산 투자는 백오피스를 통해 학습하고 다운로드할 수 있습니다.

| 거래 플랫폼/소프트웨어 | 지원 여부 | 사용 가능한 장치 |

| Sanjhi Poonji | ✔ | 웹, 안드로이드 및 iOS |

입출금

최소 입금액은 무제한입니다. RKFS은(는) 온라인 자금 이체를 지원하며, 파트너 은행으로 HDFC 및 ICICI 은행을 보유하고 있습니다.

고객 지원 옵션

트레이더는 24/7 실시간 지원과 같은 부가 서비스를 즐길 수 있습니다. RKFS은(는) 전화 및 이메일을 통한 연락을 지원하며, 페이스북, 인스타그램, 링크드인, 유튜브 등의 소셜 미디어도 지원합니다.

| 연락 옵션 | 세부 정보 |

| 전화 | +91-011-485644440+91-7834834444 |

| 이메일 | Mcustomercare@rkfml.com |

| 라이브 채팅 | ✔ |

| 소셜 미디어 | 페이스북, 인스타그램, 링크드인, 유튜브 등 |

| 지원되는 언어 | 영어 |

| 웹사이트 언어 | 영어 |

| 실제 주소 | R. K. Financial Services (RKFS)A-7, Block B1, Mohan Co-operative Ind.Estate, Mathura Road, New Delhi-110044 |