Présentation de l'entreprise

| RKFS Résumé de l'examen | |

| Fondé | 2020-06-08 |

| Pays/Région enregistré | Inde |

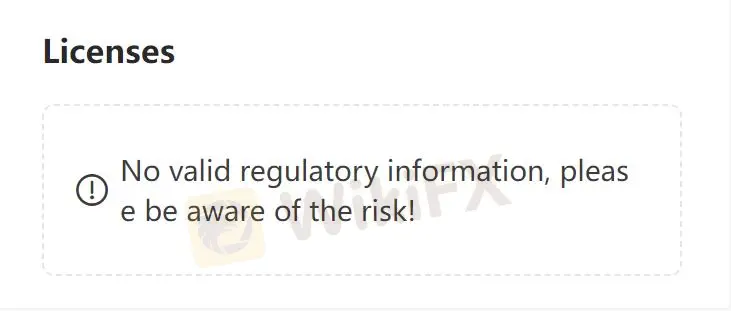

| Réglementation | Non réglementé |

| Instruments de marché | valeurs mobilières, fonds communs de placement, actions, assurance, services de conseil, etc. |

| Compte de démonstration | Non mentionné |

| Plateforme de trading | Sanjhi Poonji (Web, Android et iOS) et backend |

| Dépôt minimum | Pas de limite |

| Assistance clientèle | Téléphone : +91-011-485644440+91-7834834444 |

| Email : Mcustomercare@rkfml.com | |

| Chat en direct | |

| Réseaux sociaux (Facebook, Instagram, LinkedIn, YouTube, etc.) | |

RKFS Information

RKFS est une société de conseil financier, proposant divers produits et services, notamment des valeurs mobilières, des fonds communs de placement, des actions, une assurance, des services de conseil, etc. Il existe des comptes mondiaux demat et RKFS-INDIA INX sans commission.

Avantages et inconvénients

| Avantages | Inconvénients |

| Divers produits et services | Non réglementé |

| Assistance en direct 24/7 |

RKFS est-il légitime ?

RKFS n'est pas réglementé, ce qui le rend moins sûr que les entités réglementées.

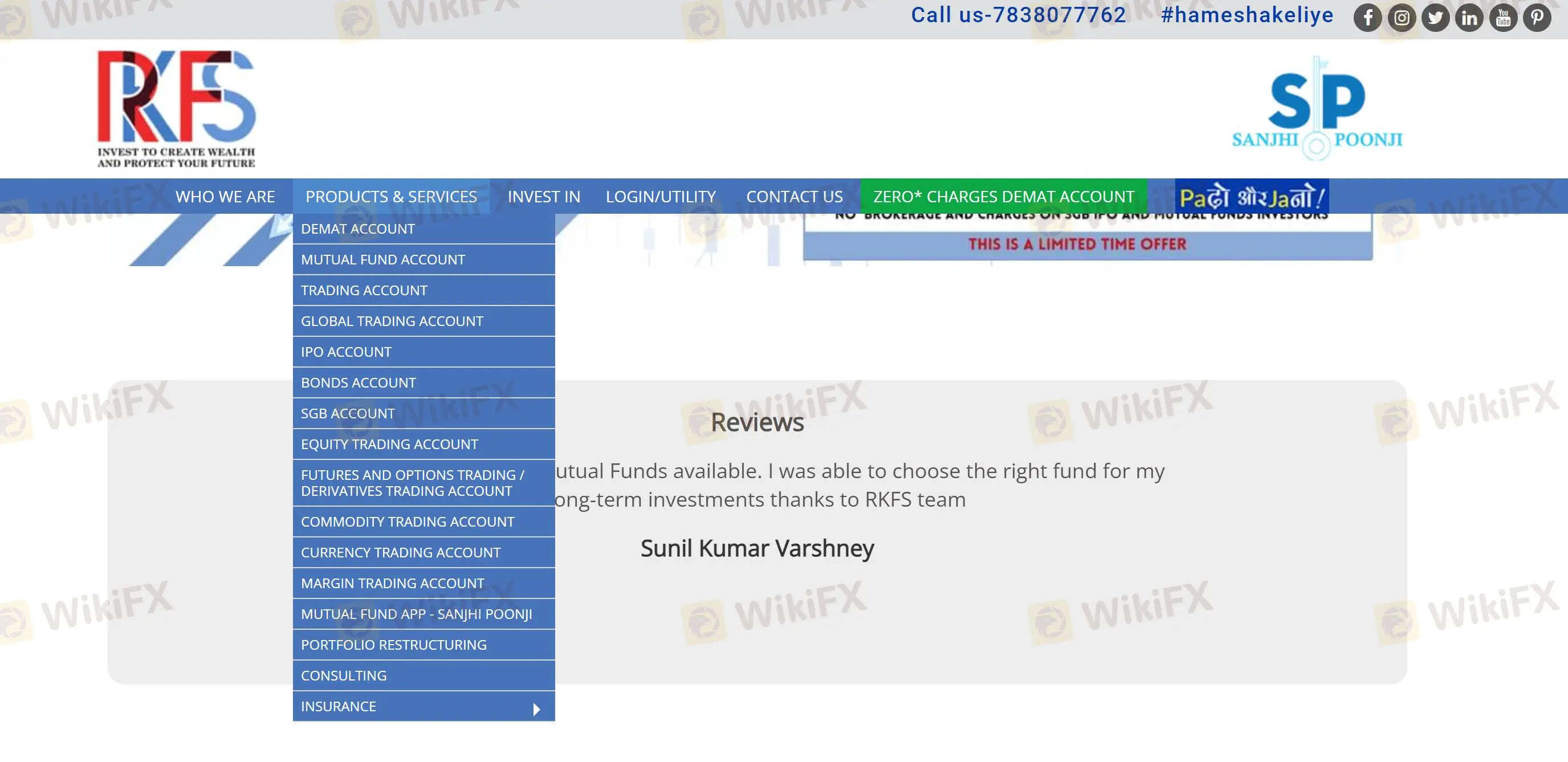

Quels produits et services propose RKFS ?

Les traders peuvent ouvrir un compte pour investir dans plusieurs actifs de trading, y compris les valeurs mobilières, les fonds communs de placement, les IPO, les actions, les options, les contrats à terme et le trading sur marge, ainsi que les ETF, les devises, les obligations, etc., ainsi que les services d'assurance et de conseil.

| Instruments négociables | Pris en charge |

| Valeurs mobilières | ✔ |

| Fonds communs de placement | ✔ |

| IPO | ✔ |

| Actions | ✔ |

| Options et contrats à terme | ✔ |

| Trading sur marge | ✔ |

| ETF | ✔ |

| Devises | ✔ |

| Fonds communs de placement | ✔ |

| Assurance | ✔ |

| Conseil | ✔ |

Type de compte

RKFS propose des comptes demat et RKFS-INDIA INX global. GA permet aux investisseurs d'investir mondialement dans des actions, des ETF, des options, des contrats à terme, des devises, des obligations, des fonds communs de placement à partir d'un compte intégré unique et en plus de fournir les services d'actifs mentionnés ci-dessus, demat peut également investir dans des IPO, des matières premières, etc.

| Type de compte | Pris en charge |

| Compte Demat | ✔ |

| RKFS-INDIA INX GLOBAL ACCOUNT(GA) | ✔ |

Frais RKFS

La commission est nulle.

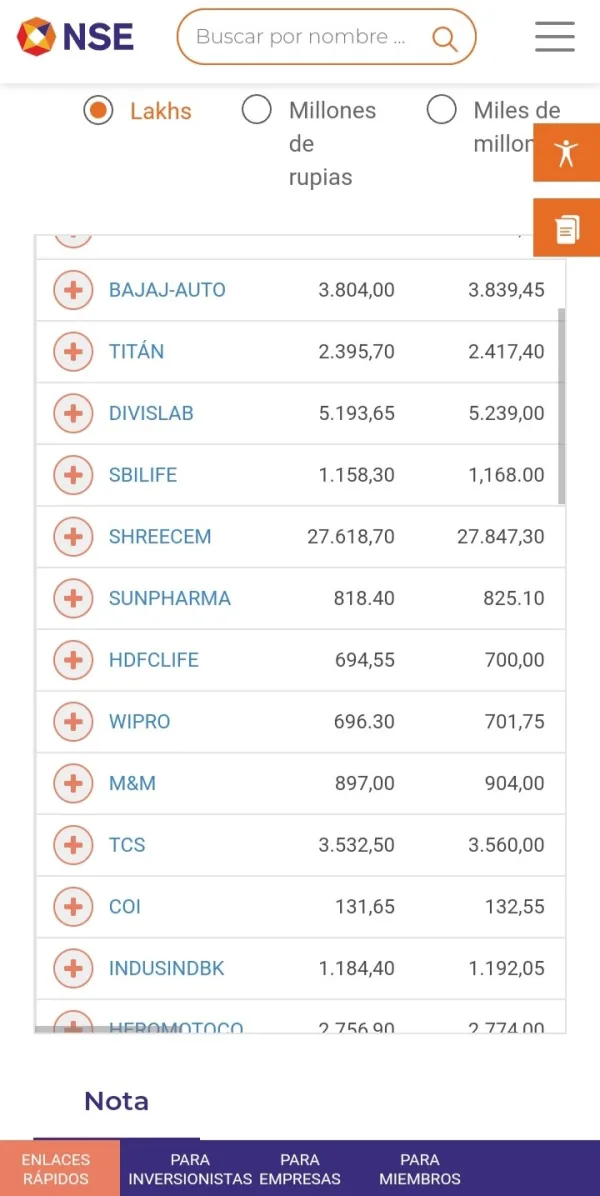

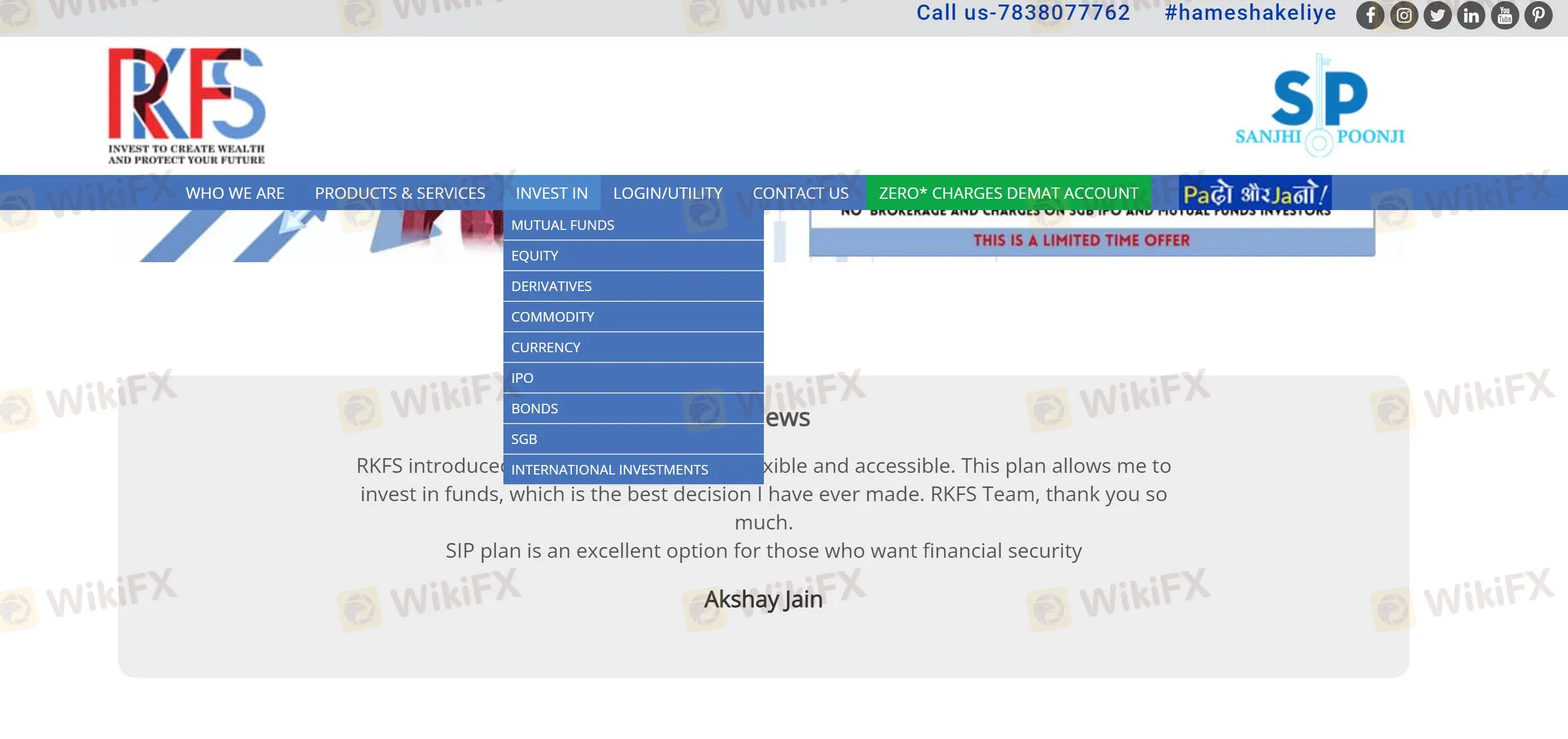

Plateforme de trading

RKFS peut investir dans des fonds publics via la version Android, iOS ou web de Sanjhi Poonjis. Les autres investissements d'actifs peuvent être appris et téléchargés via le back office.

| Plateforme/Logiciel de trading | Pris en charge | Appareils disponibles |

| Sanjhi Poonji | ✔ | Web, Android et iOS |

Dépôt et retrait

Le dépôt minimum est sans limite. RKFS prend en charge les transferts de fonds en ligne, et les banques partenaires sont HDFC et ICICI.

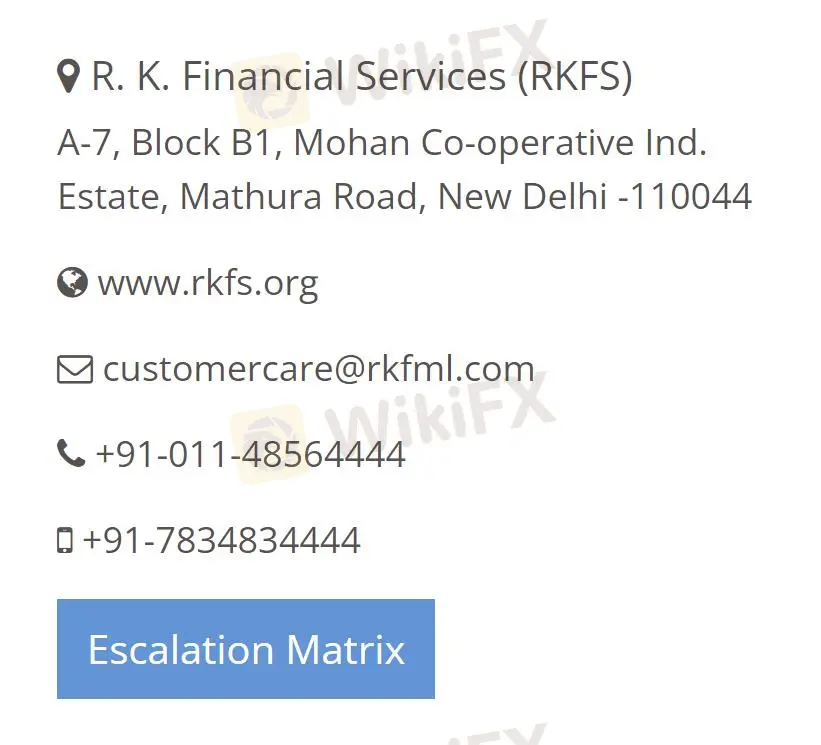

Options de support client

Les traders bénéficient de services à valeur ajoutée, tels que le support en direct 24/7. RKFS prend en charge le contact par téléphone et e-mail, ainsi que les médias sociaux, y compris Facebook, Instagram, LinkedIn, YouTube, etc.

| Options de contact | Détails |

| Téléphone | +91-011-485644440+91-7834834444 |

| Mcustomercare@rkfml.com | |

| Chat en direct | ✔ |

| Médias sociaux | Facebook, Instagram, LinkedIn, YouTube, etc. |

| Langue prise en charge | Anglais |

| Langue du site web | Anglais |

| Adresse physique | R. K. Financial Services (RKFS)A-7, Block B1, Mohan Co-operative Ind.Estate, Mathura Road, New Delhi-110044 |