公司簡介

| 大華継显 評論摘要 | |

| 成立年份 | 1996 |

| 註冊地區 | 香港 |

| 監管 | 由SFC(香港)監管 |

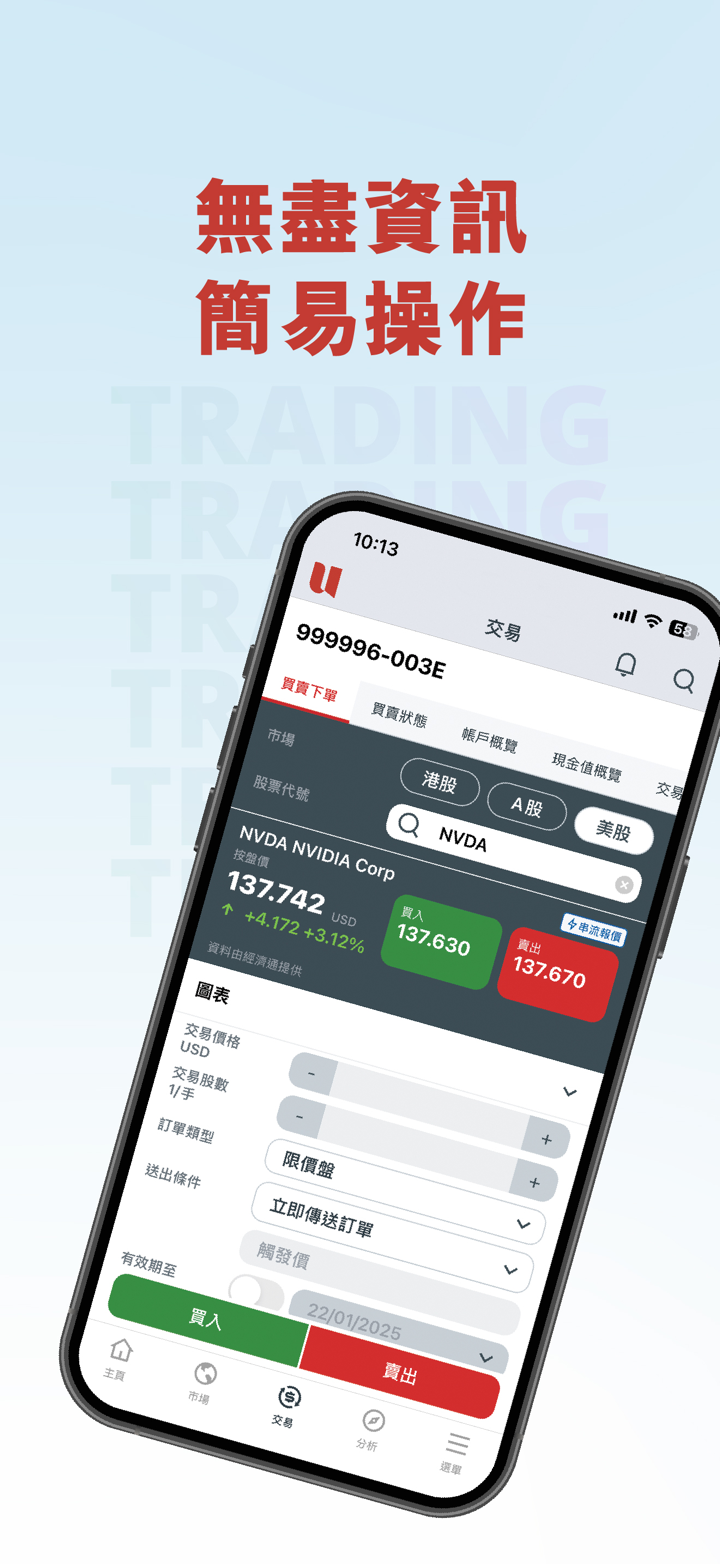

| 市場工具 | 股票、ETF、REITs、期權、期貨、牛熊證、債券、認股權證 |

| 模擬帳戶 | ❌ |

| 交易平台 | WebTrader、大華継显 手機應用程式 |

| 客戶支援 | 在線聊天、聯絡表格 |

| 電郵:clientservices@uobkayhian.com.hk | |

| 電話:+852 2136 1818 | |

| 地址:香港告士打道39號夏愨大廈6樓 | |

大華継显 資訊

大華継显 是一家成立於2014年的香港經紀商,受SFC監管。它提供多元化的市場工具,例如:股票、ETF、REITs、期權、期貨、牛熊證、債券和認股權證。

優缺點

| 優點 | 缺點 |

| 受SFC監管 | 有限的交易條件信息 |

| 多種聯絡渠道 | 無模擬帳戶 |

| 支援即時聊天 | |

| 多樣的交易工具 | |

| 長時間運作 |

大華継显 是否合法?

大華継显 部分合法。它受到SFC(香港)監管,由UOB Kay Hian Futures(香港)有限公司持有牌照號碼AHY424。

| 監管狀態 | 監管機構 | 持牌機構 | 牌照類型 | 牌照號碼 |

| 受監管 | SFC(香港) | UOB Kay Hian Futures(香港)有限公司 | 從事期貨合約交易 | AHY424 |

WikiFX 實地調查

WikiFX 地勘團隊訪問了 大華継显 的香港地址,我們發現了該公司的辦公室,這意味著該公司設有實體辦公室。

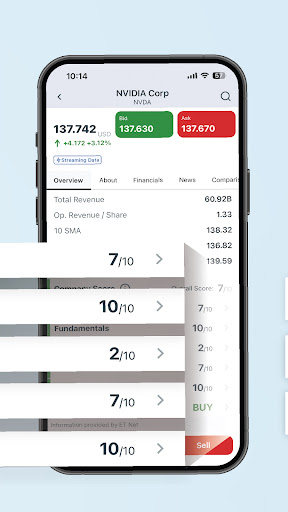

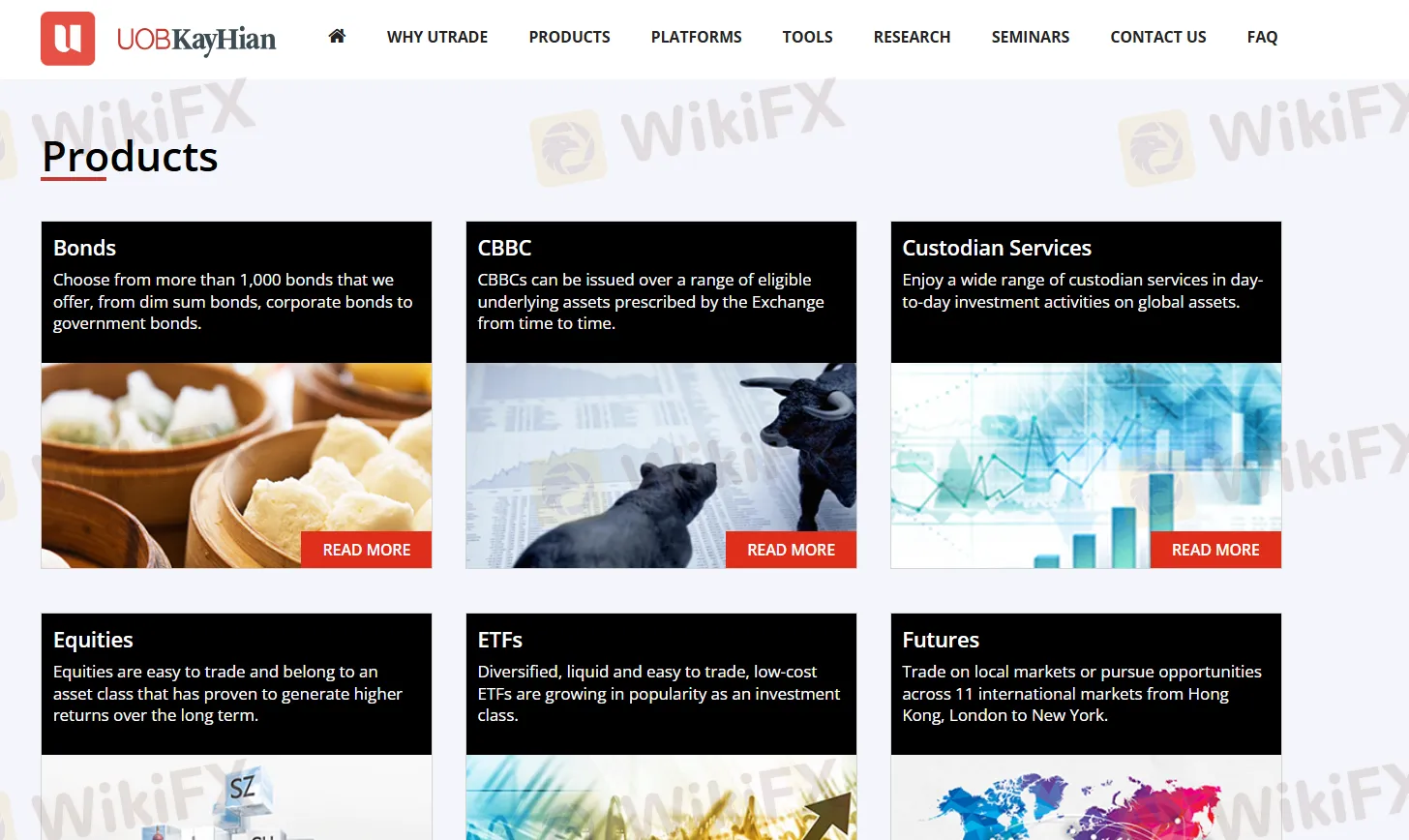

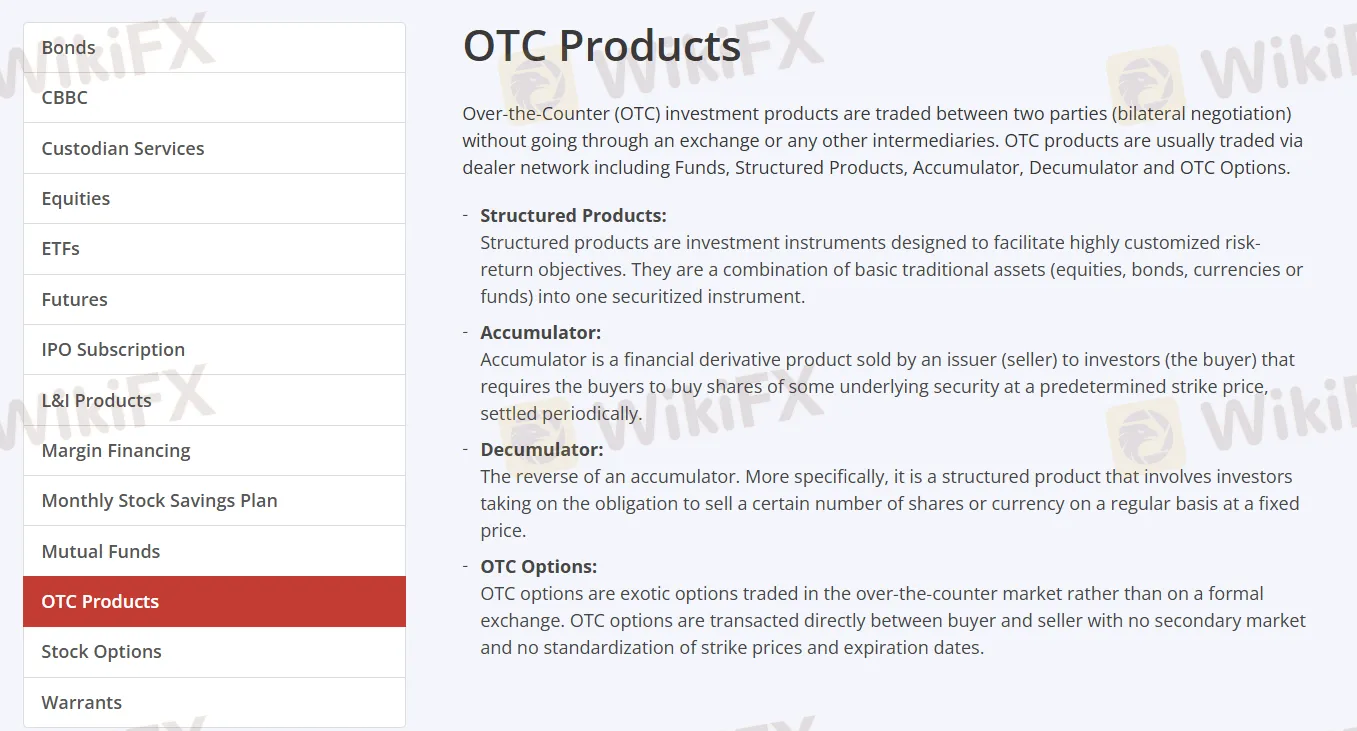

我可以在 大華継显 交易什麼?

| 交易工具 | 支援 |

| 股票 | ✔ |

| ETF | ✔ |

| REIT | ✔ |

| 期權 | ✔ |

| 期貨 | ✔ |

| 牛熊證 | ✔ |

| 債券 | ✔ |

| 認股證 | ✔ |

| 外匯 | ❌ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 股票 | ❌ |

| 加密貨幣 | ❌ |

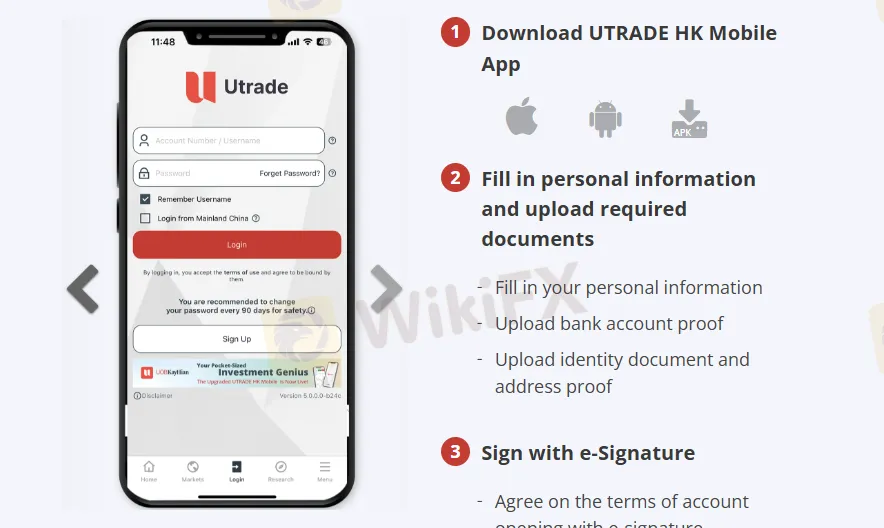

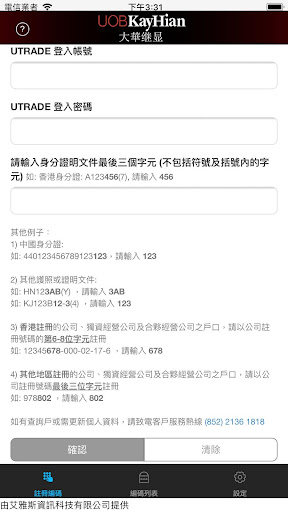

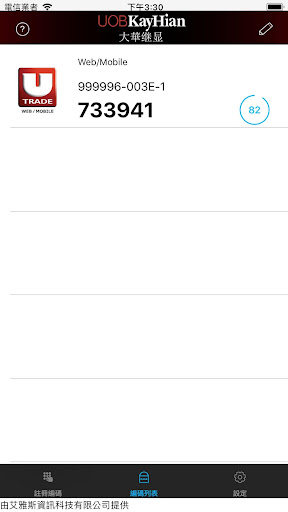

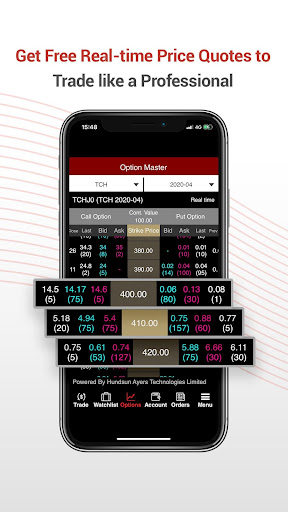

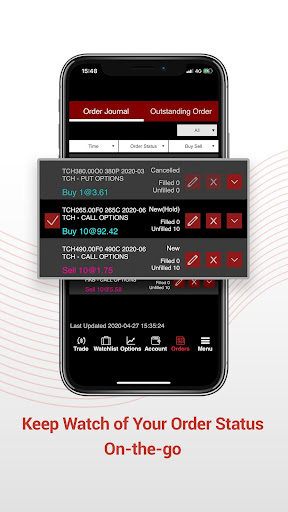

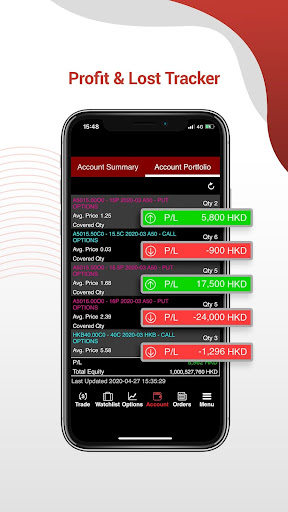

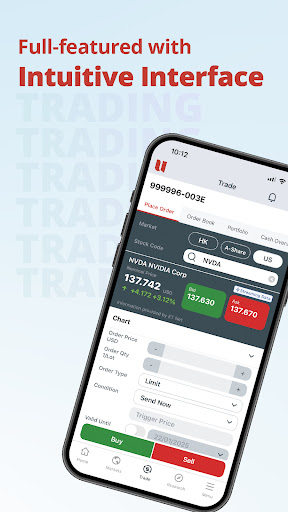

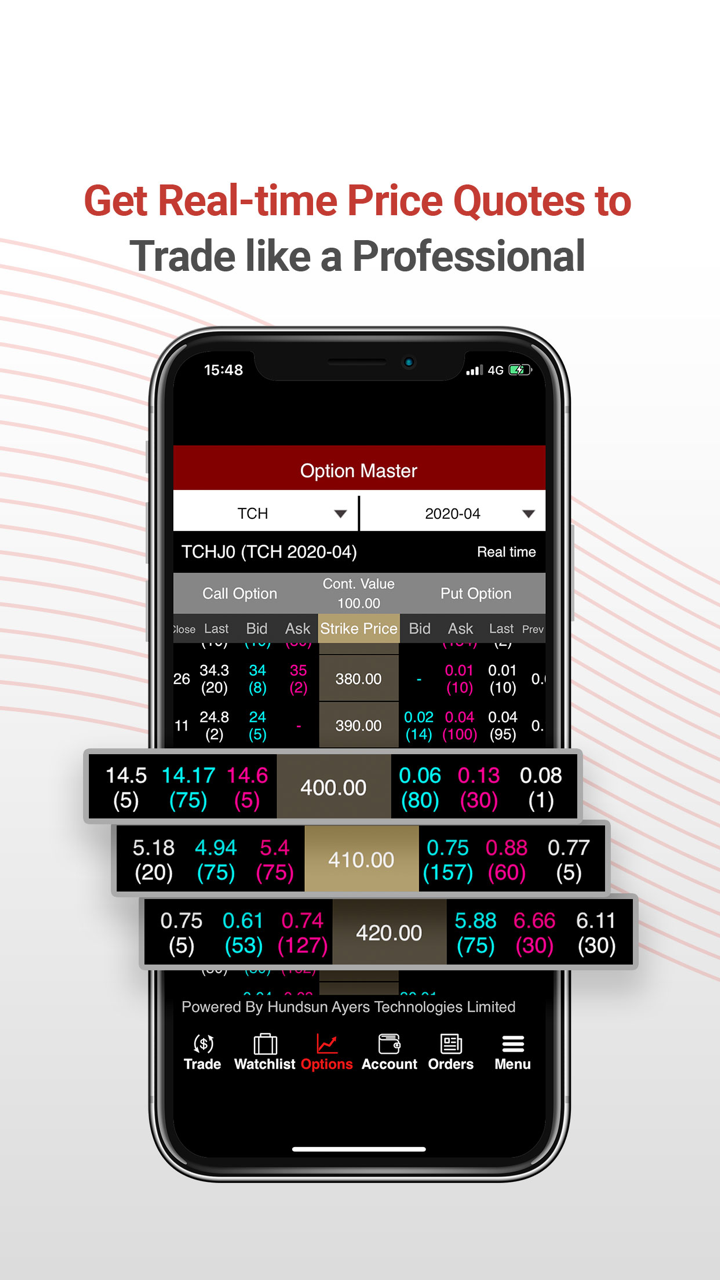

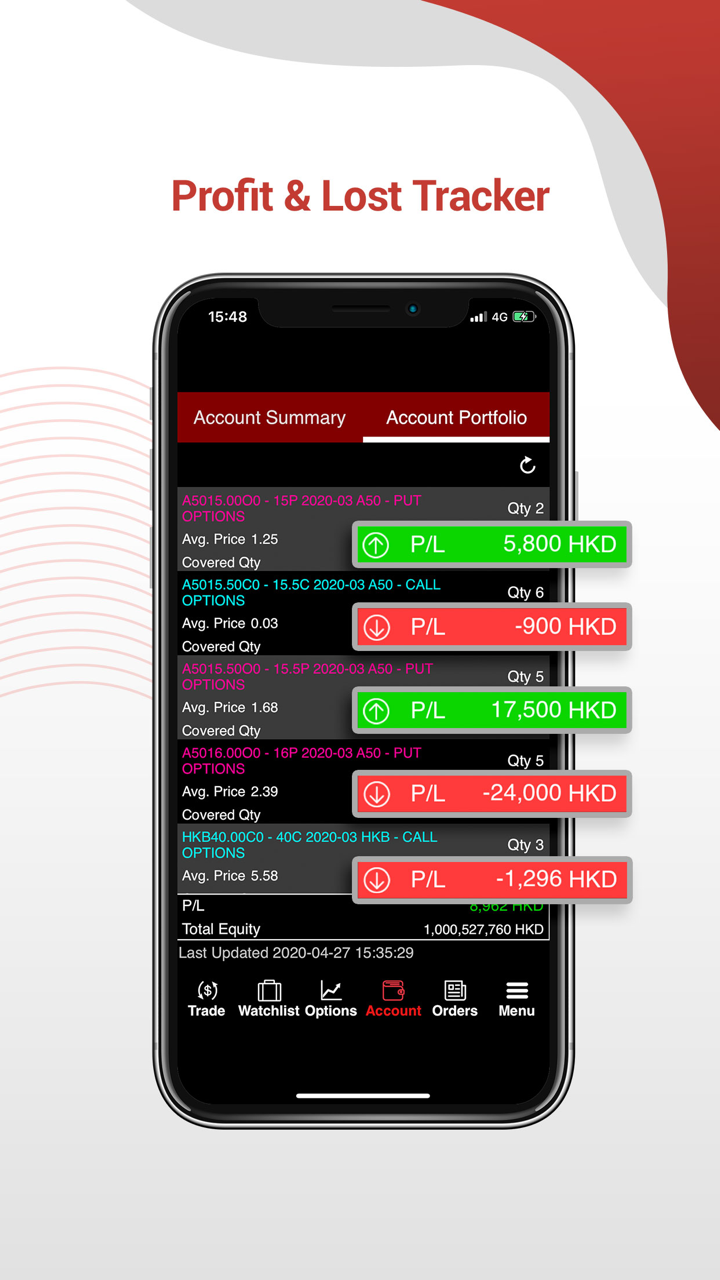

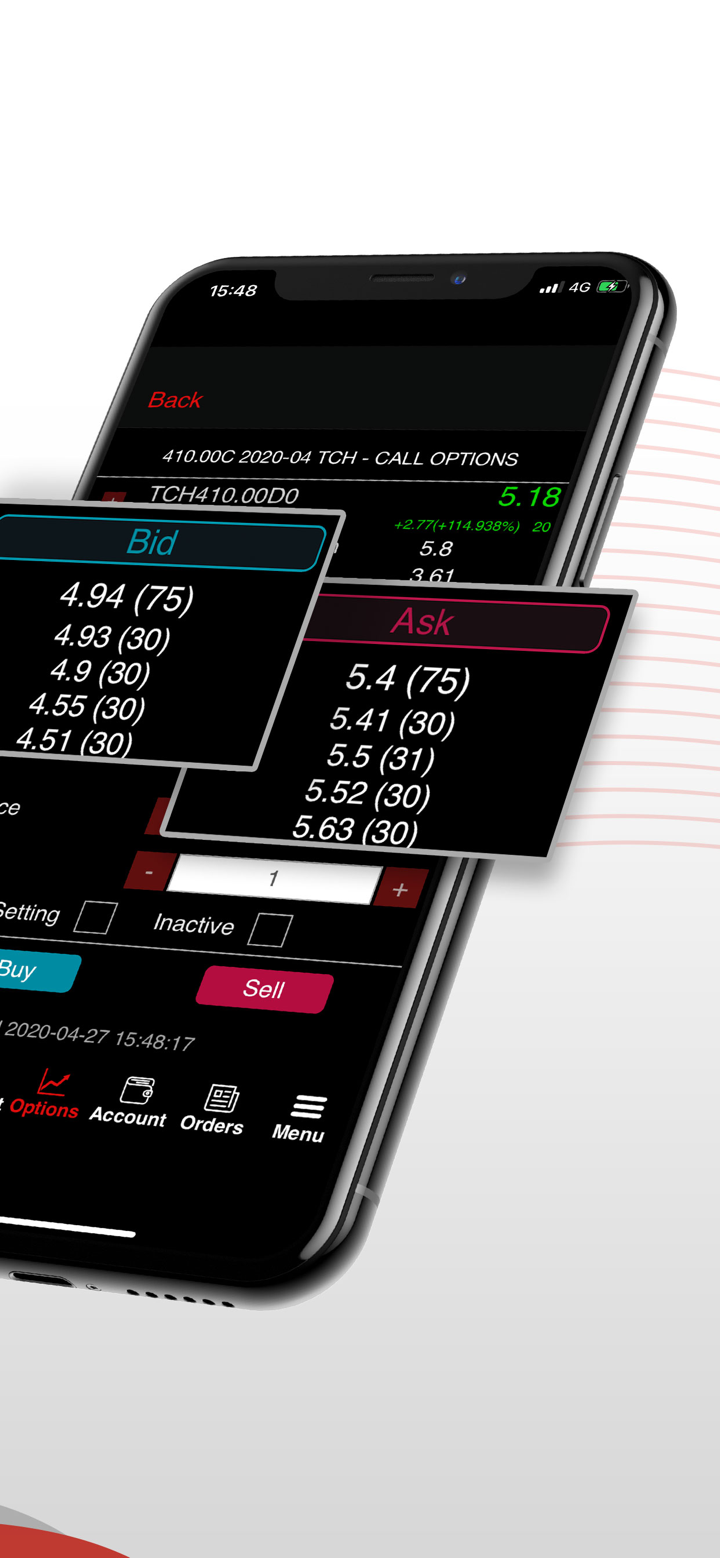

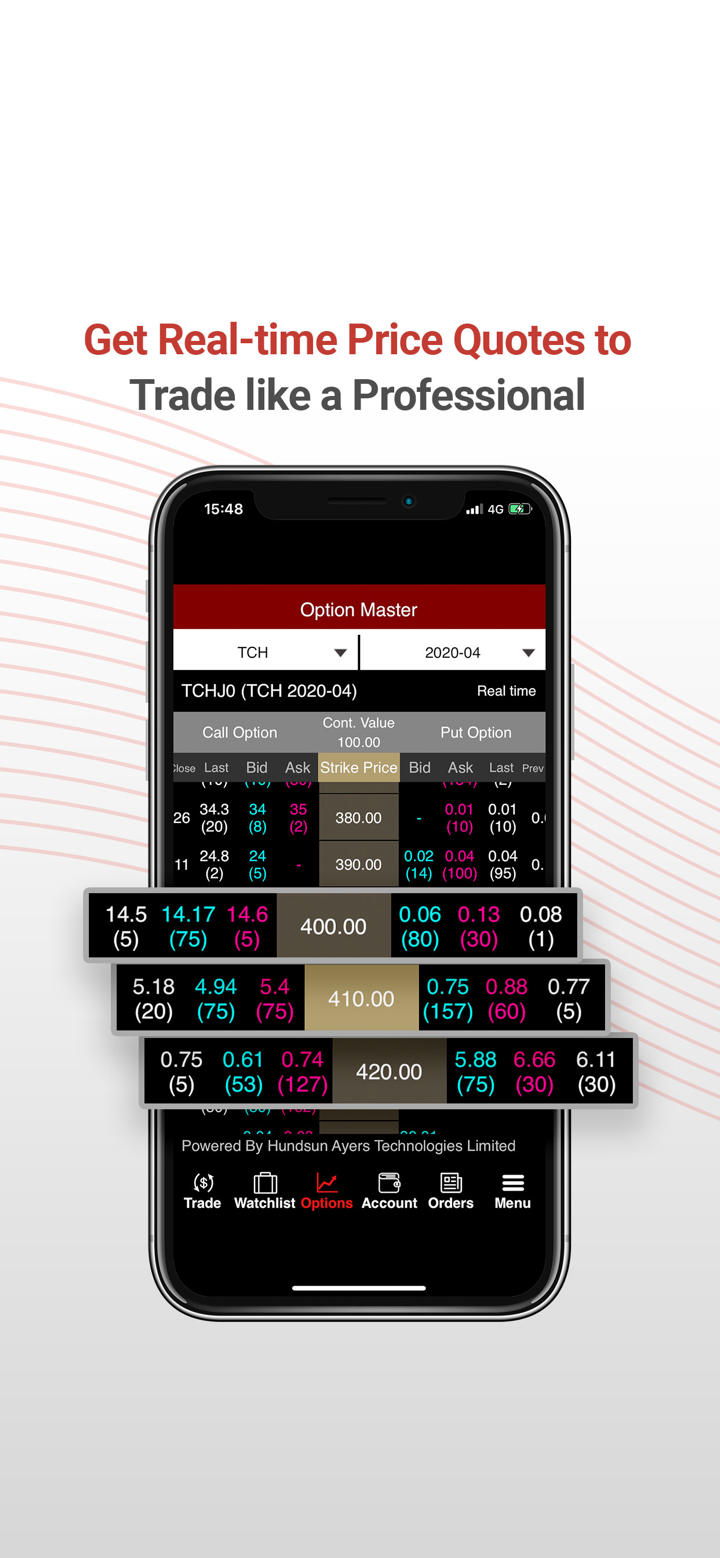

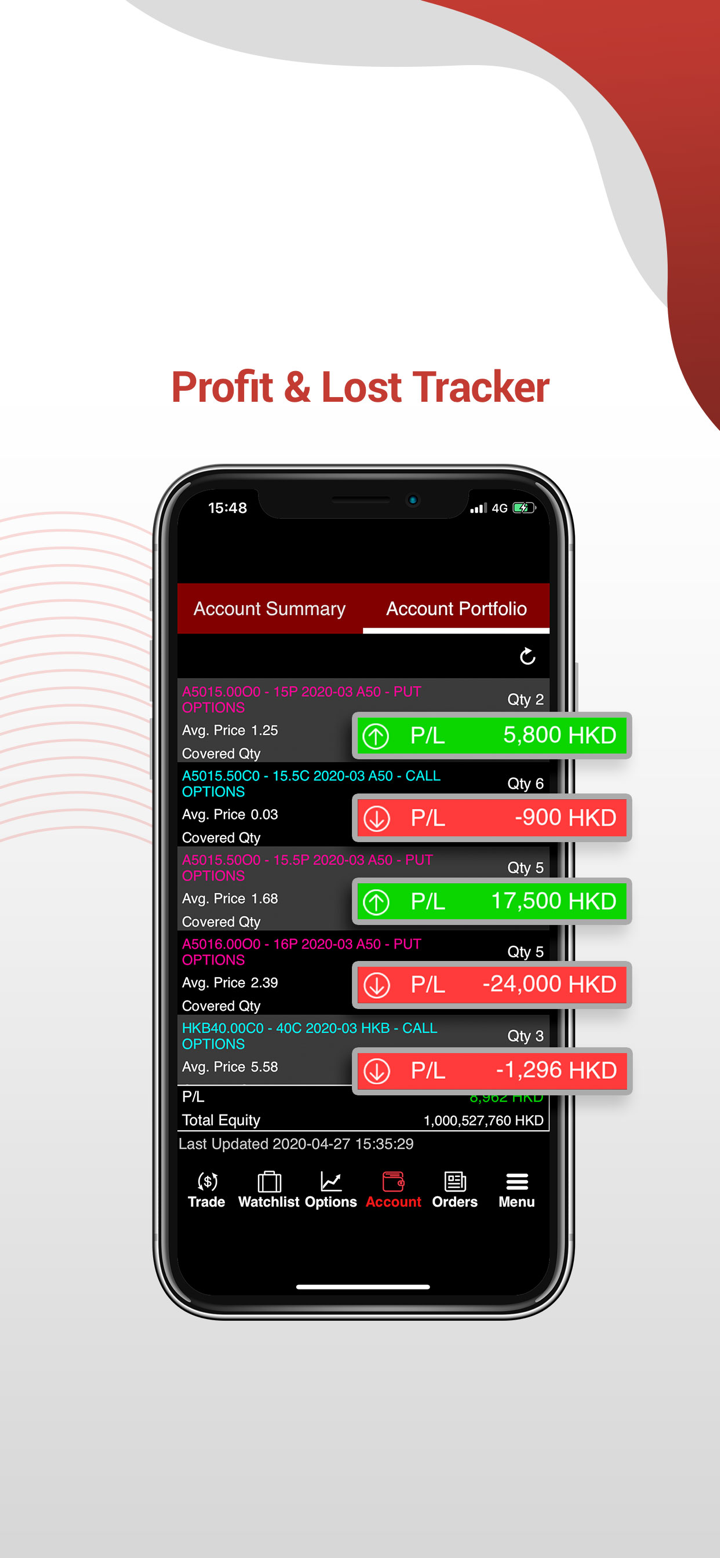

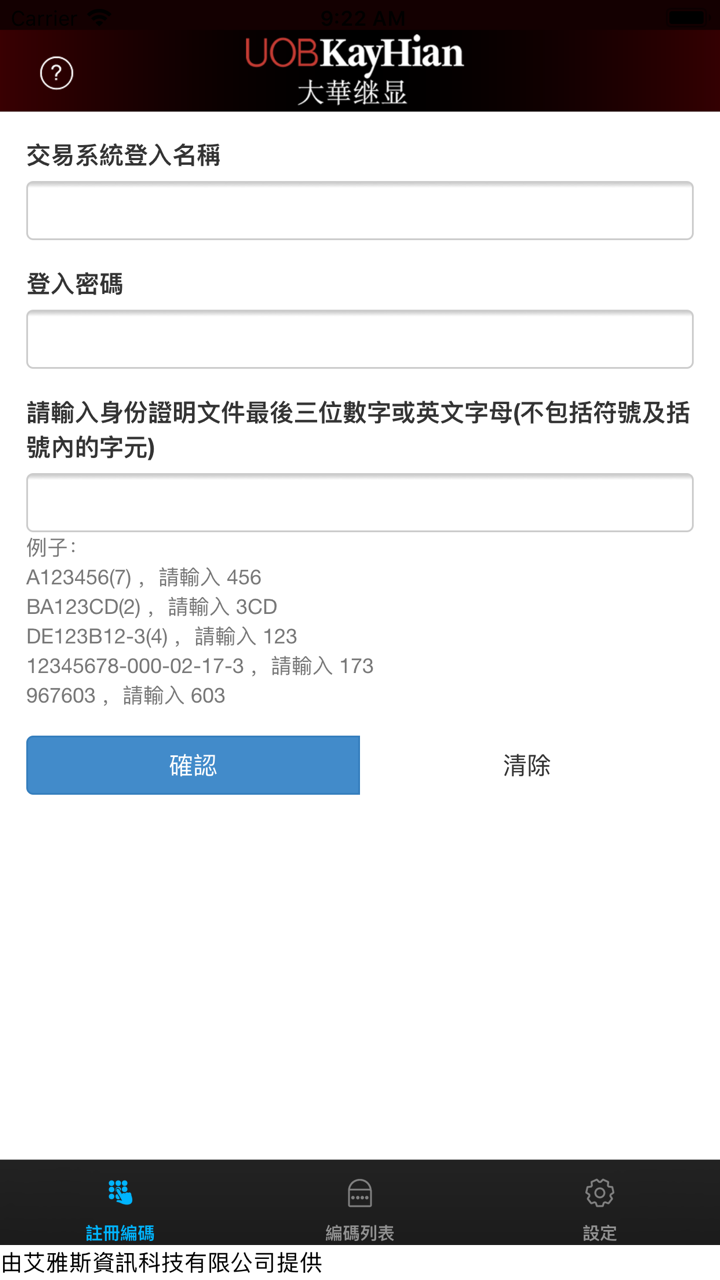

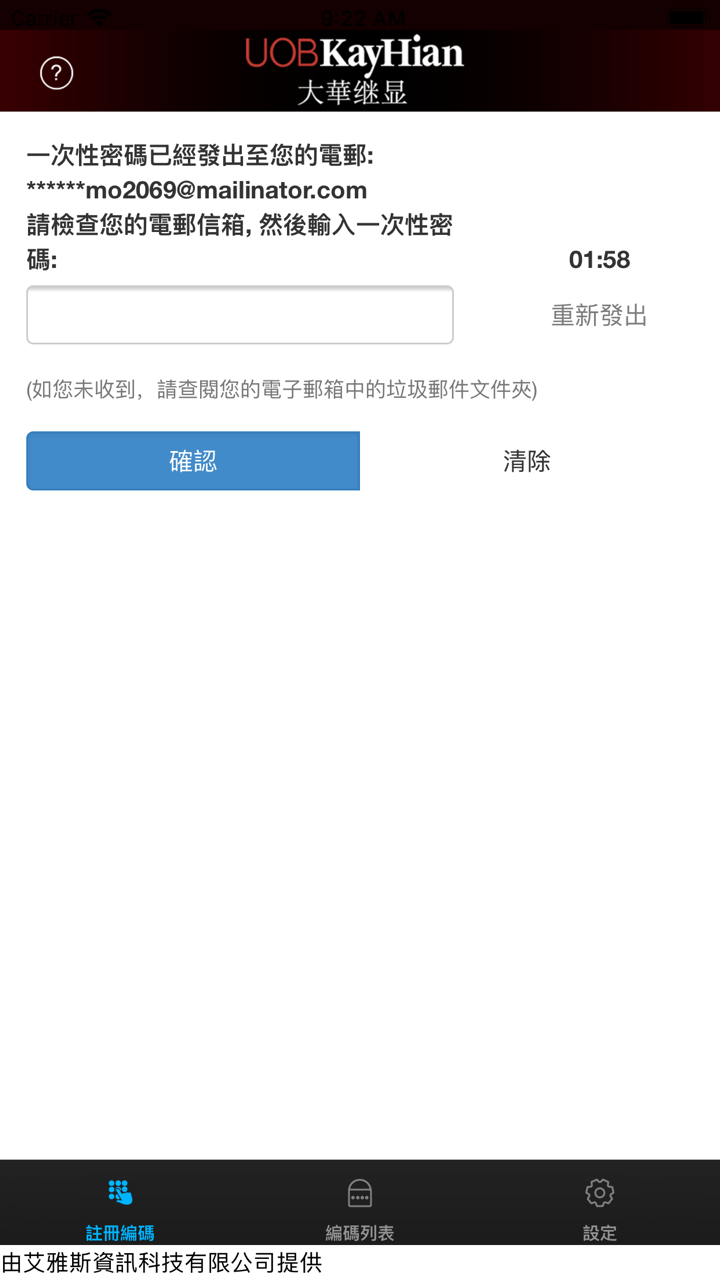

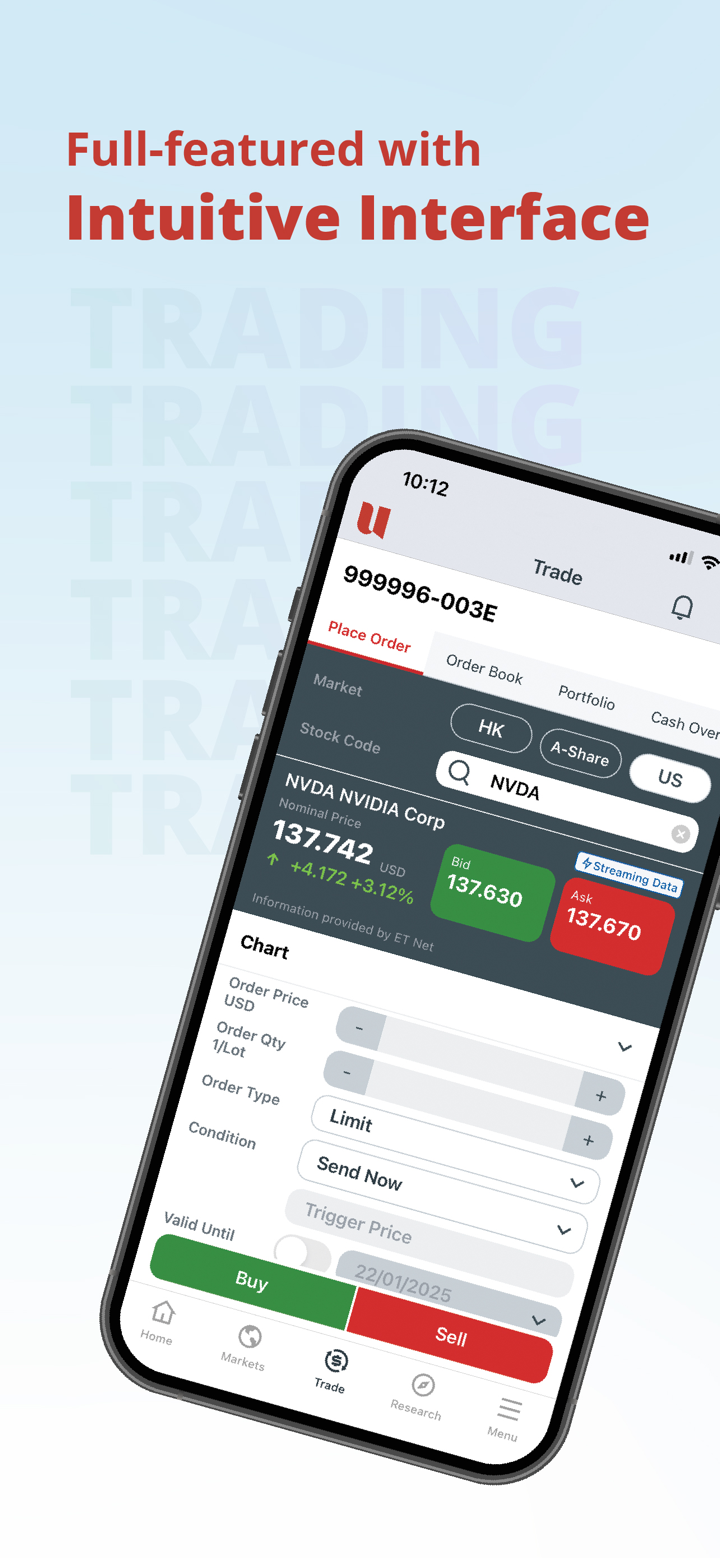

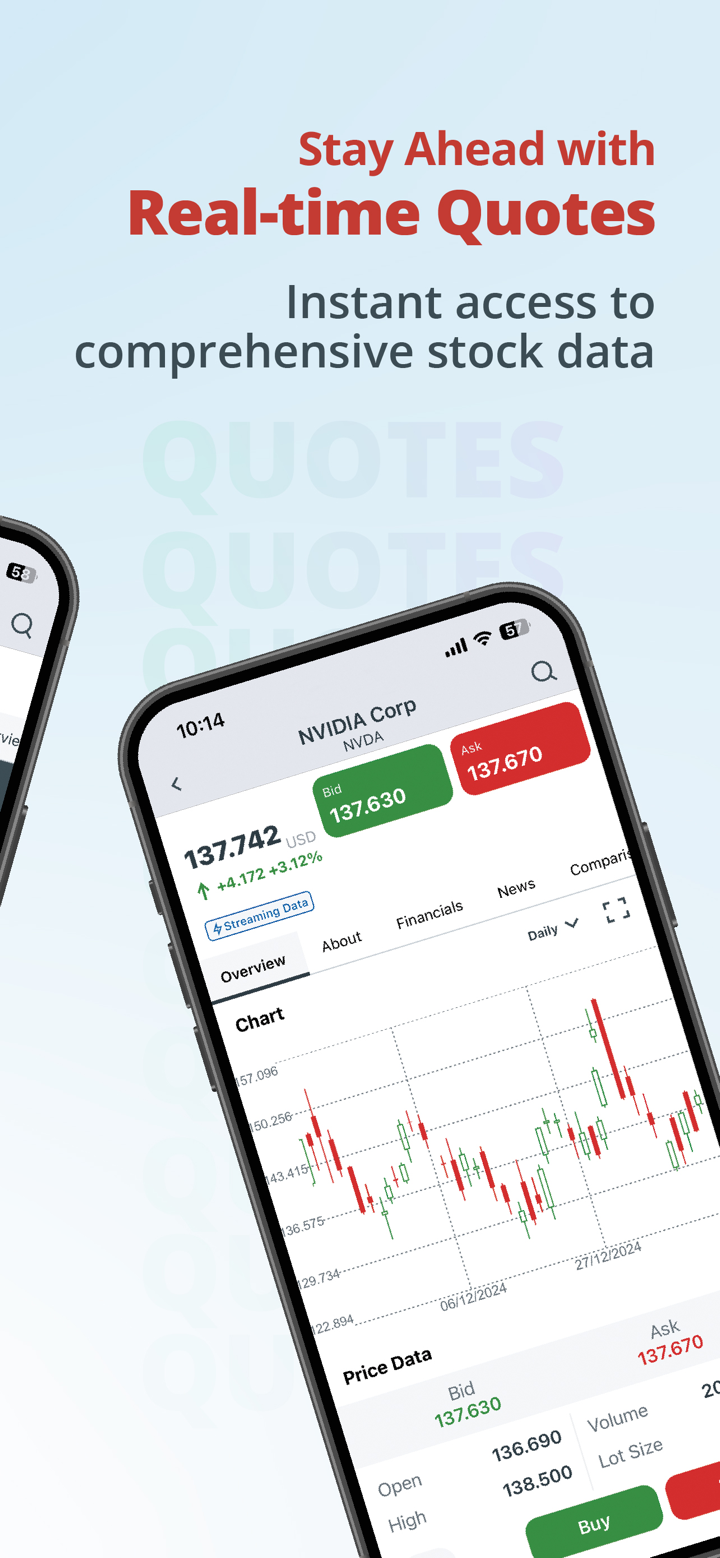

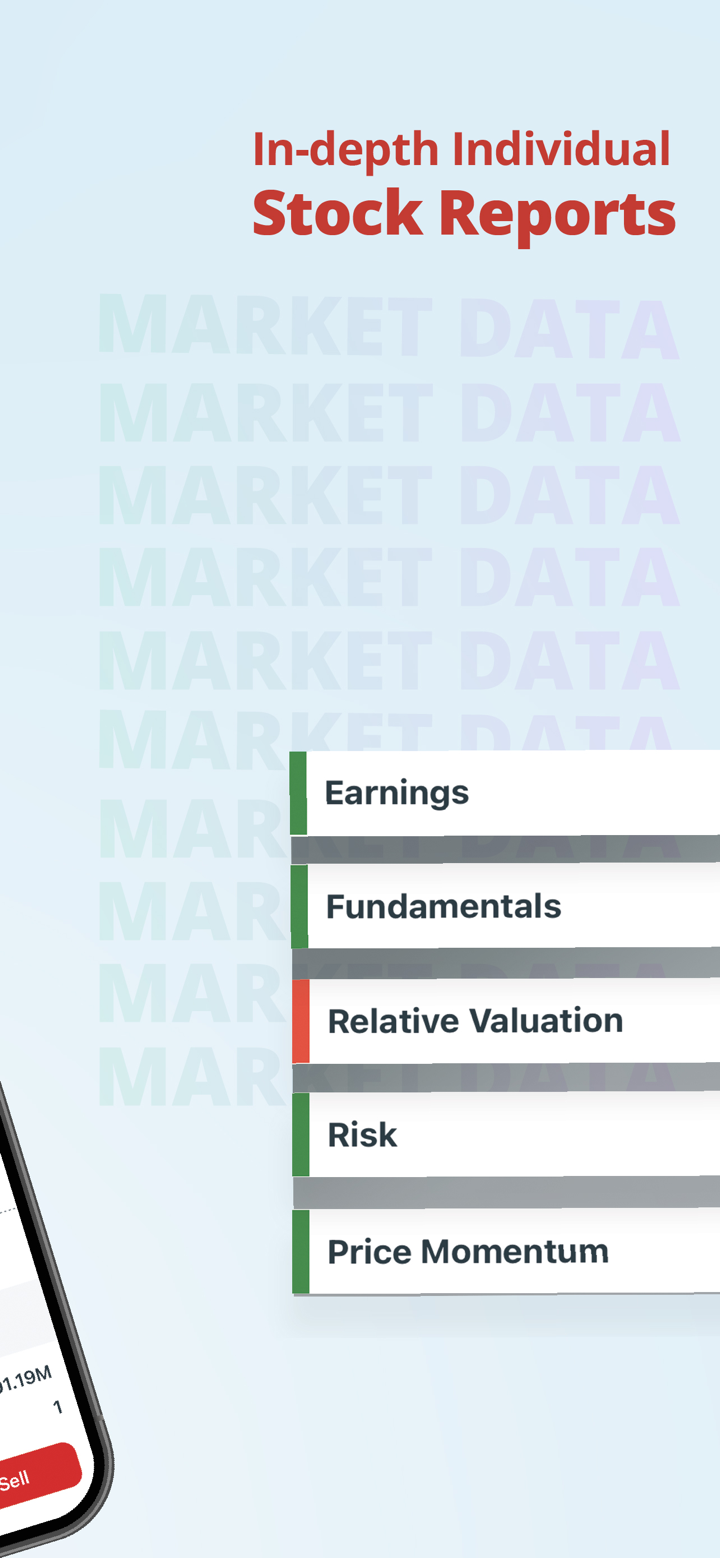

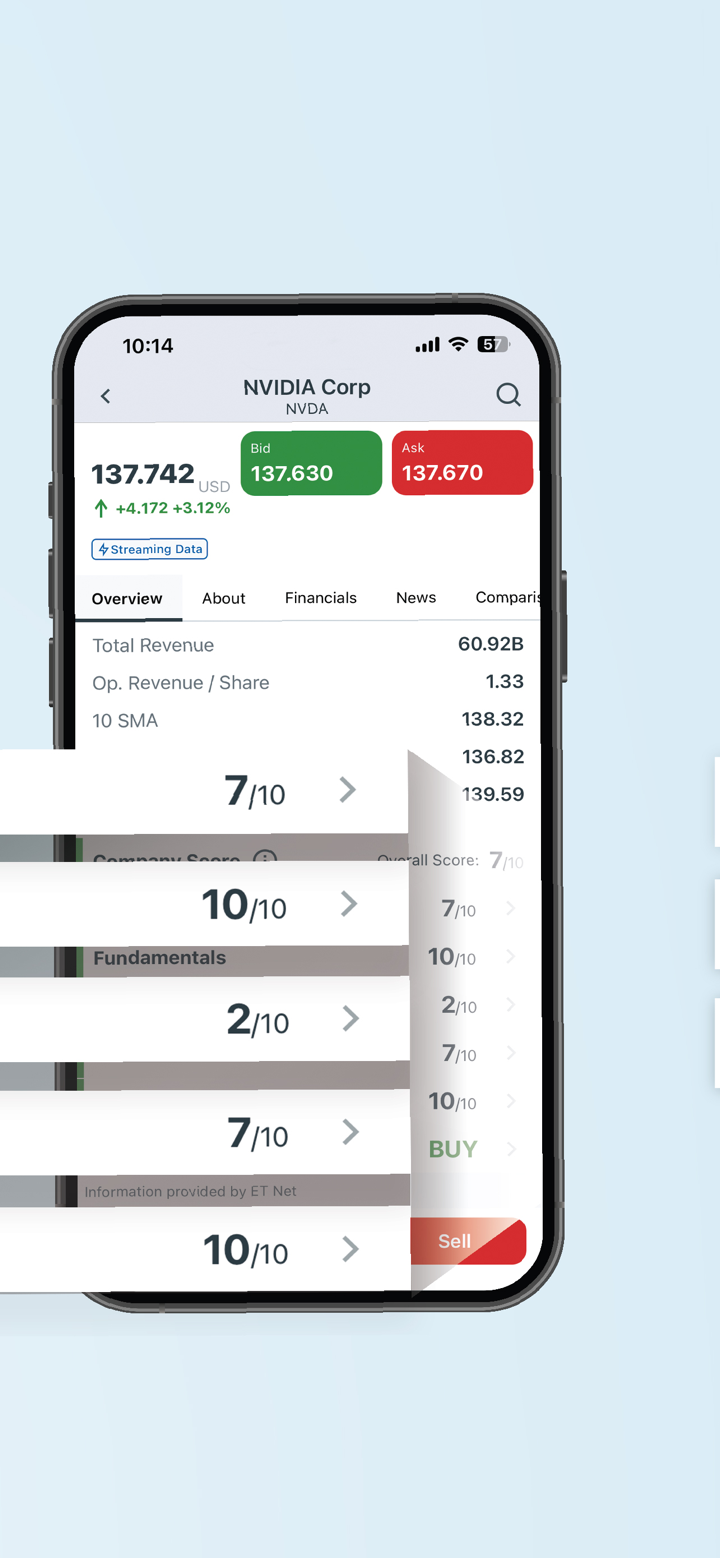

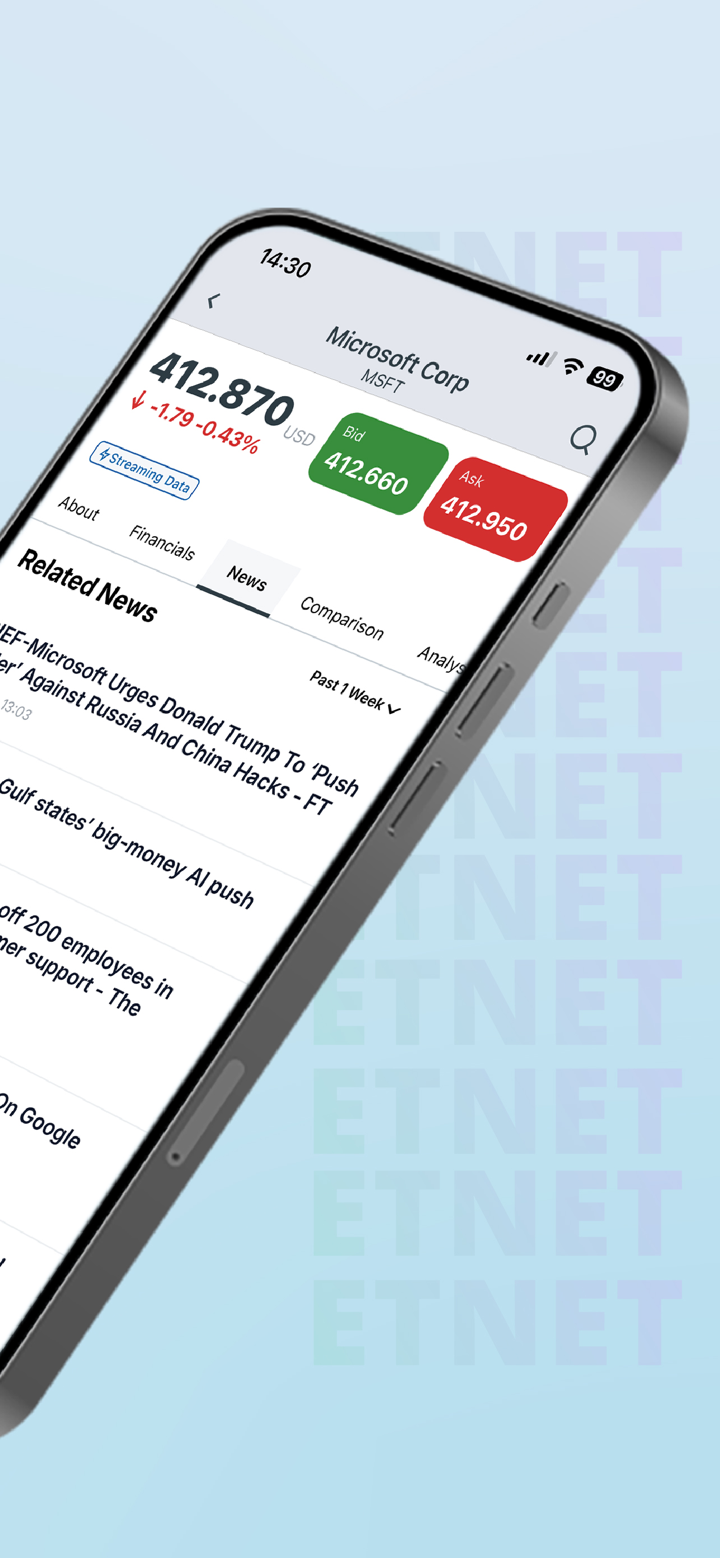

交易平台

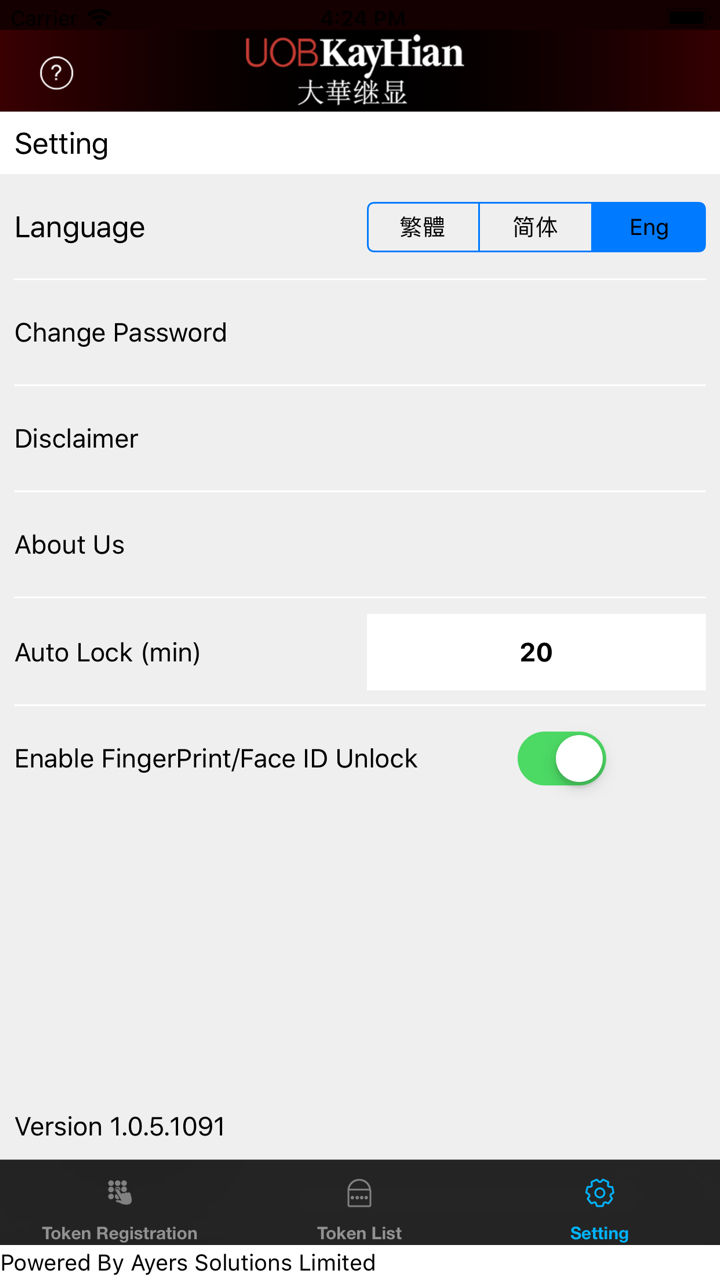

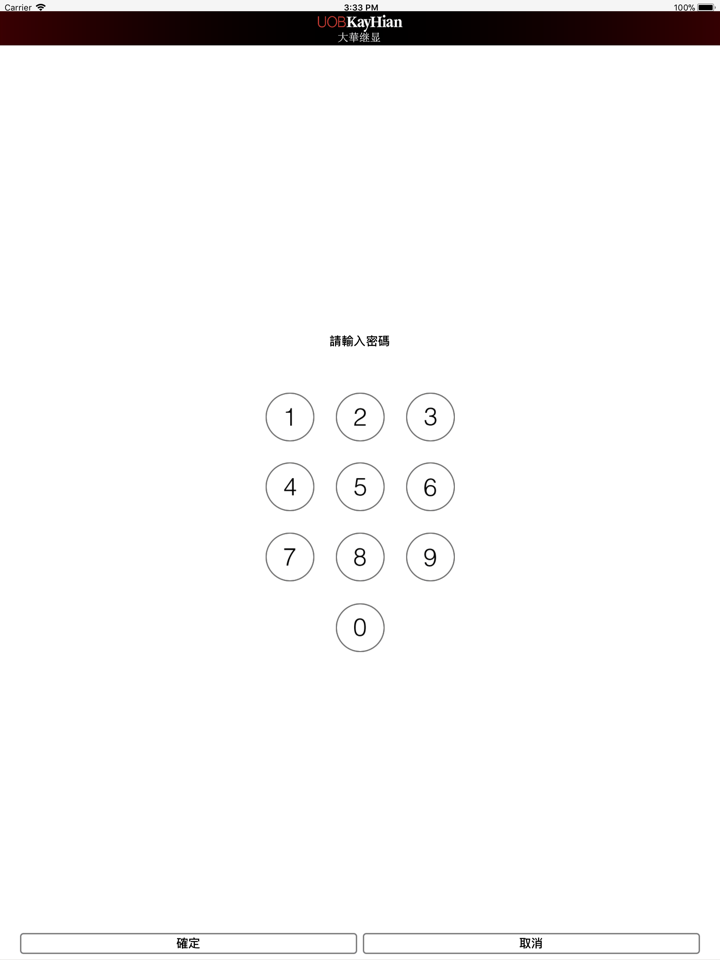

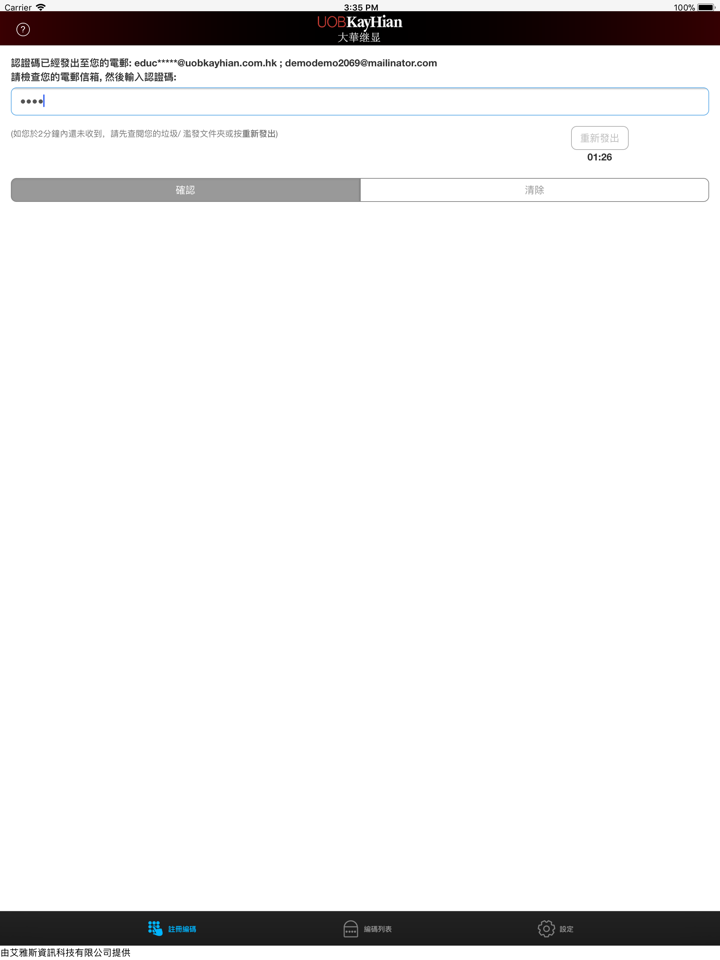

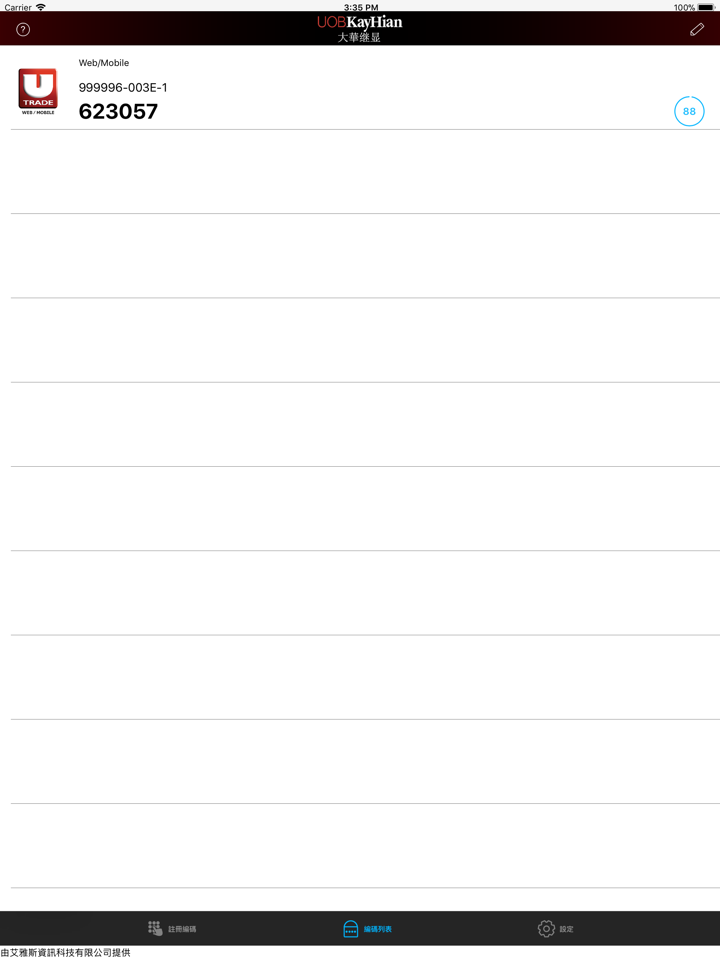

| 交易平台 | 支援 | 可用設備 |

| WebTrader | ✔ | Web(基於瀏覽器) |

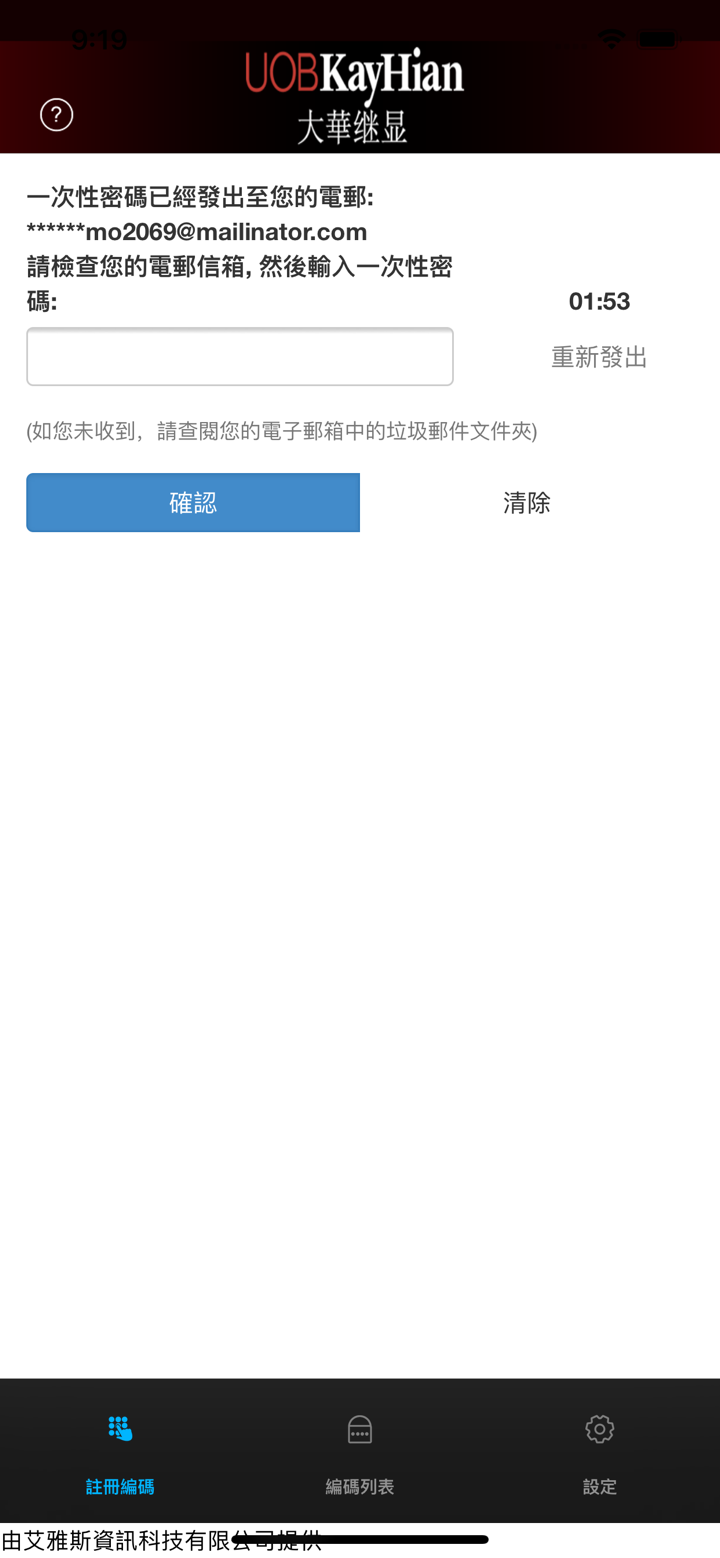

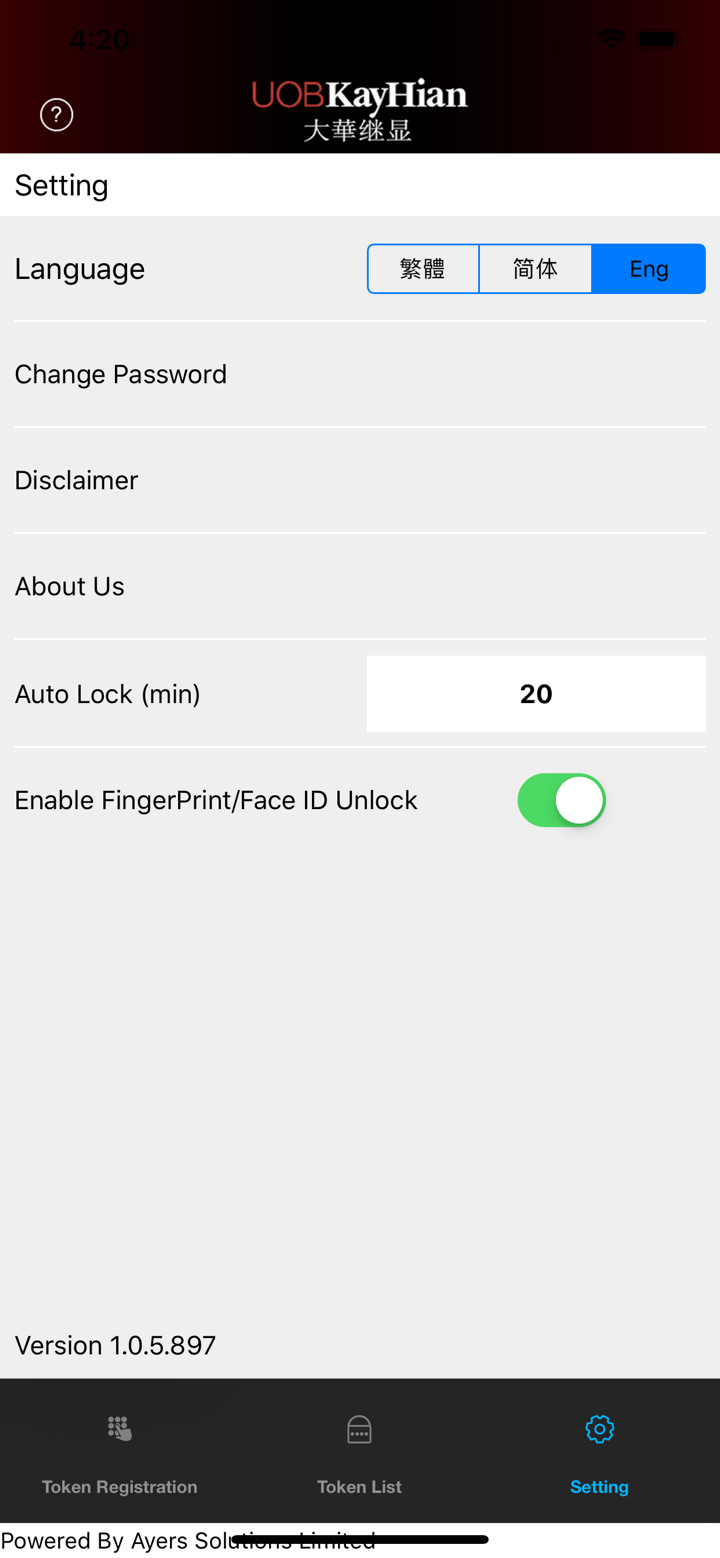

| 大華継显 手機應用程式 | ✔ | Windows、macOS、iOS、Android |