Şirket özeti

| RKFS İnceleme Özeti | |

| Kuruluş Tarihi | 2020-06-08 |

| Kayıtlı Ülke/Bölge | Hindistan |

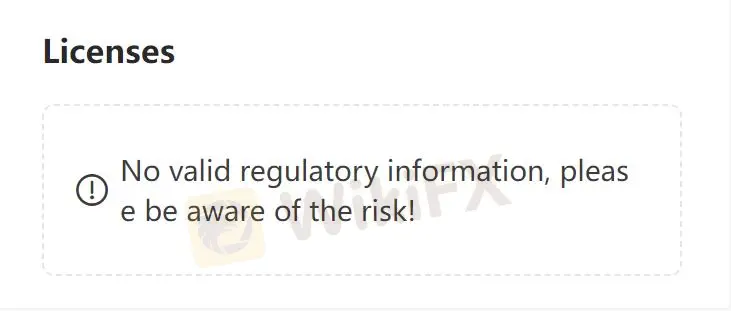

| Düzenleme | Düzenlenmemiş |

| Piyasa Araçları | menkul kıymetler, yatırım fonları, hisse senetleri, sigorta, danışmanlık hizmetleri, vb. |

| Deneme Hesabı | Belirtilmemiş |

| İşlem Platformu | Sanjhi Poonji (Web, Android ve iOS) ve arka uç |

| Minimum Yatırım | Sınırsız |

| Müşteri Desteği | Telefon: +91-011-485644440+91-7834834444 |

| E-posta: Mcustomercare@rkfml.com | |

| Canlı sohbet | |

| Sosyal Medya (Facebook, Instagram, LinkedIn, YouTube, vb.) | |

RKFS Bilgileri

RKFS, menkul kıymetler, yatırım fonları, hisse senetleri, sigorta, danışmanlık hizmetleri, vb. dahil olmak üzere çeşitli ürün ve hizmetler sunan bir finansal danışmanlık şirketidir. Ücretsiz komisyonlu demat ve RKFS-INDIA INX küresel hesapları bulunmaktadır.

Artıları ve Eksileri

| Artıları | Eksileri |

| Çeşitli ürün ve hizmetler | Düzenlenmemiş |

| 7/24 canlı destek |

RKFS Güvenilir mi?

RKFS, düzenlenmemiş olduğundan düzenlenmiş olanlardan daha güvenli değildir.

RKFS Hangi Ürün ve Hizmetlere Sahiptir?

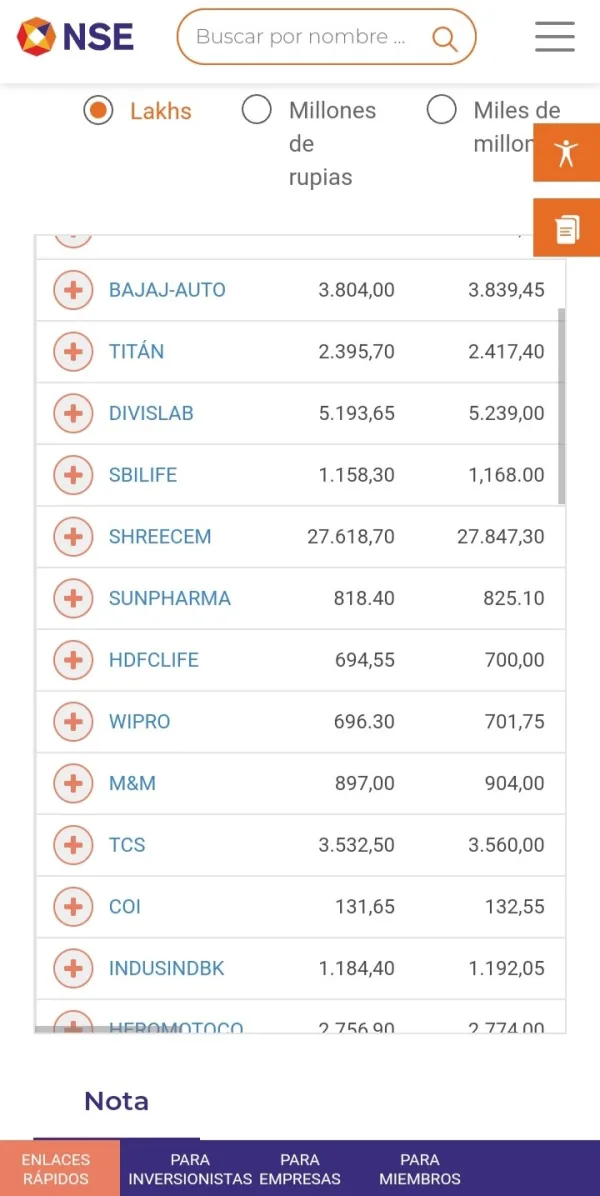

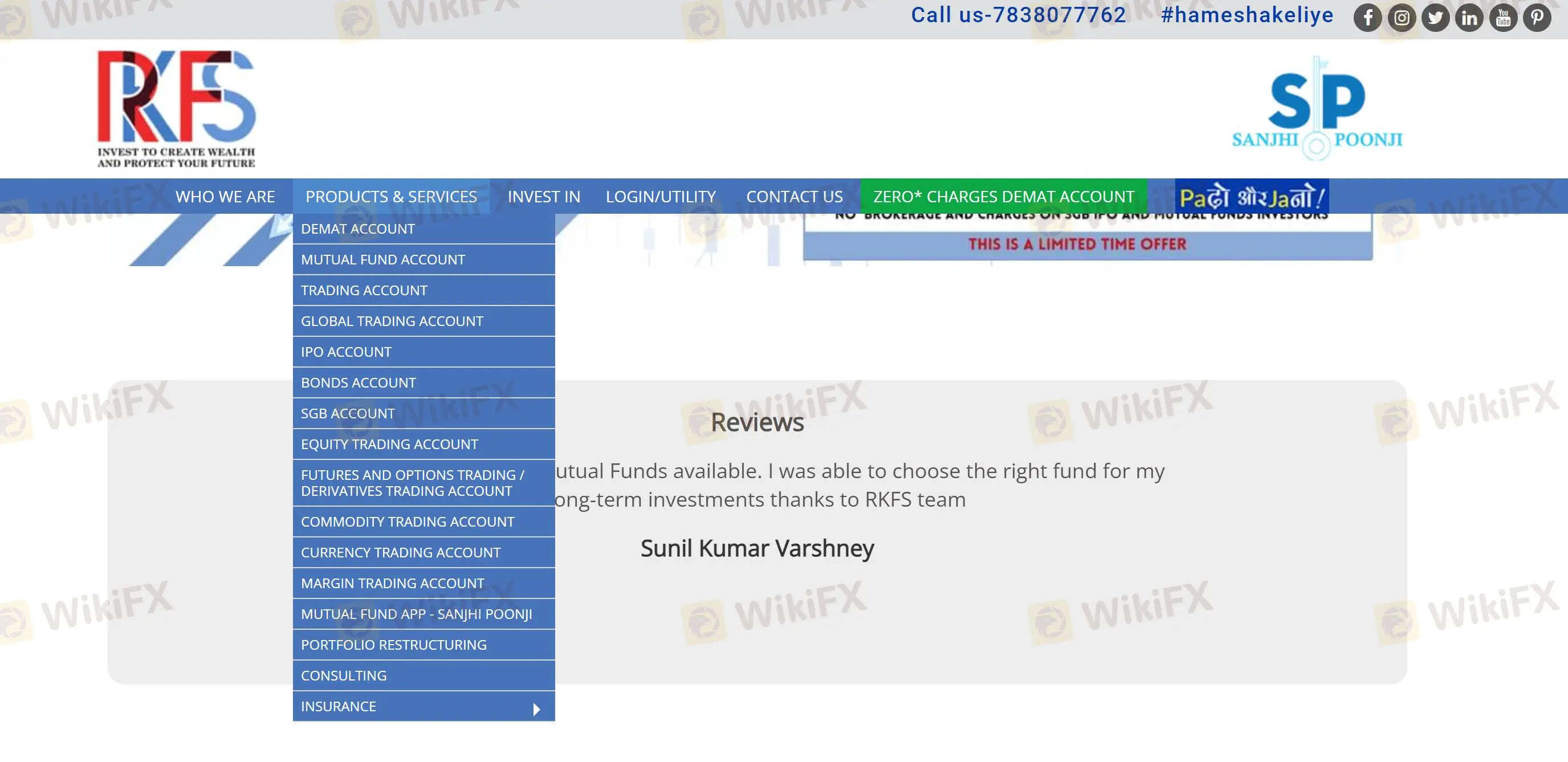

Tüccarlar, menkul kıymetler, yatırım fonları, halka arz, hisse senetleri, opsiyonlar, vadeli işlemler ve marj ticareti gibi çeşitli ticaret varlıklarına yatırım yapmak için bir hesap açabilirler, ayrıca ETF'ler, para birimleri, tahviller vb. yanı sıra sigorta ve danışmanlık hizmetleri de sunmaktadır.

| Ticaret Enstrümanları | Desteklenen |

| Menkul Kıymetler | ✔ |

| Yatırım Fonları | ✔ |

| Halka Arz | ✔ |

| Hisse Senetleri | ✔ |

| Opsiyonlar ve Vadeli İşlemler | ✔ |

| Marj Ticareti | ✔ |

| ETF'ler | ✔ |

| Para Birimleri | ✔ |

| Yatırım Fonları | ✔ |

| Sigorta | ✔ |

| Danışmanlık | ✔ |

Hesap Türü

RKFS, demat ve RKFS-INDIA INX global hesapları sağlar. GA, yatırımcıların tek bir entegre hesaptan küresel olarak hisse senetleri, ETF'ler, opsiyonlar, vadeli işlemler, para birimleri, tahviller, yatırım fonlarına yatırım yapmalarına olanak tanır ve yukarıdaki varlık hizmetlerinin yanı sıra demat, halka arzlara, emtialara vb. de yatırım yapabilir.

| Hesap Türü | Desteklenen |

| Demat Hesabı | ✔ |

| RKFS-INDIA INX GLOBAL HESABI(GA) | ✔ |

RKFS Ücretleri

Komisyon sıfır'dır.

Ticaret Platformu

RKFS, halka arzlarla ilgili olarak Sanjhi Poonjis Android, iOS veya web sürümü aracılığıyla halka açık fonlara yatırım yapabilir. Diğer varlık yatırımları, arka ofis aracılığıyla öğrenilebilir ve indirilebilir.

| Ticaret Platformu/Yazılımı | Desteklenen | Kullanılabilir Cihazlar |

| Sanjhi Poonji | ✔ | Web, Android ve iOS |

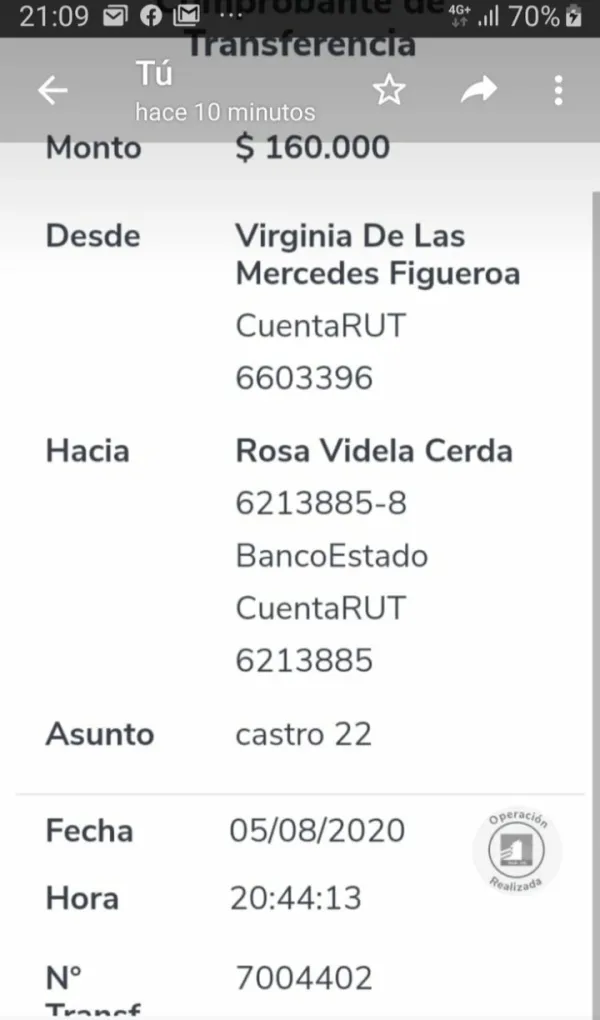

Para Yatırma ve Çekme

Minimum depozito sınırsızdır. RKFS, çevrimiçi fon transferlerini destekler ve ortak bankalar HDFC ve ICICI bankalarına sahiptir.

Müşteri Destek Seçenekleri

Tüccarlar, 7/24 canlı destek gibi değerli hizmetlerden yararlanır. RKFS, telefon ve e-posta ile iletişim sağlar, ayrıca Facebook, Instagram, LinkedIn, YouTube vb. gibi sosyal medya üzerinden de iletişim kurulabilir.

| İletişim Seçenekleri | Detaylar |

| Telefon | +91-011-485644440+91-7834834444 |

| E-posta | Mcustomercare@rkfml.com |

| Canlı sohbet | ✔ |

| Sosyal Medya | Facebook, Instagram, LinkedIn, YouTube, vb. |

| Desteklenen Dil | İngilizce |

| Web Sitesi Dili | İngilizce |

| Fiziksel Adres | R. K. Financial Services (RKFS)A-7, Block B1, Mohan Co-operative Ind.Estate, Mathura Road, New Delhi-110044 |