公司简介

| BBH 评论摘要 | |

| 成立时间 | 1995 |

| 注册国家/地区 | 美国 |

| 监管 | SFC(受监管),FCA(超出) |

| 服务 | 另类基金服务,BBH 连接器,跨境基金服务,托管和基金服务,托管人和受托人,ETF 服务,外汇,监管情报,证券借贷,共享基础设施解决方案,转让机构 |

| 客户支持 | 电子邮件:contactus@bbh.com |

| LinkedIn/Facebook/Twitter | |

BBH 信息

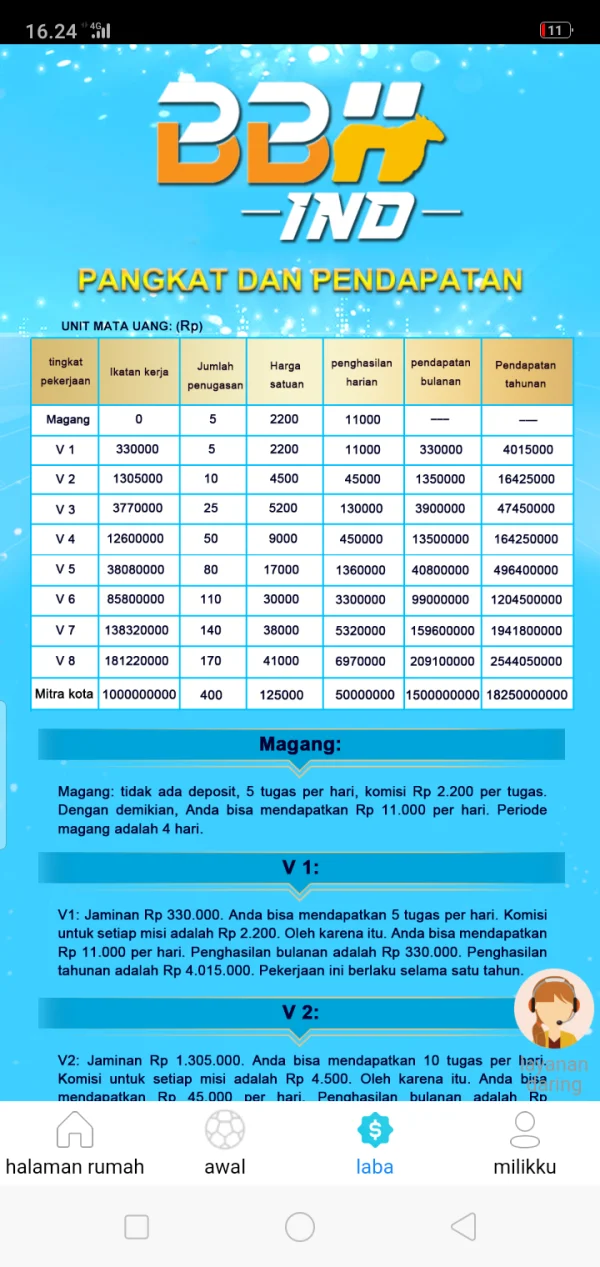

BBH 是一家在美国注册的经纪商,拥有 30 年的历史,提供各种金融服务。由于其超出的地位,BBH 仍然存在风险。

优缺点

| 优点 | 缺点 |

| 自 1995 年以来的悠久历史 | 没有全天候客户支持 |

| 受 SFC 监管 | 没有特定的转账方式 |

| 多样的金融服务 | 超出 FCA 许可 |

BBH 是否合法?

| 监管国家 | 当前状态 | 监管机构 | 受监管实体 | 许可类型 | 许可证号码 |

| 中国(香港) | 受监管 | 香港证监会(SFC) | BROWN BR开放交易HERS HARRIMAN(香港)有限公司 | 杠杆外汇交易所交易 | AAF778 |

| 英国 | 超出 | 金融行为监管局(FCA) | Brown Brothers Harriman 投资者服务有限公司 | 投资咨询许可 | 190266 |

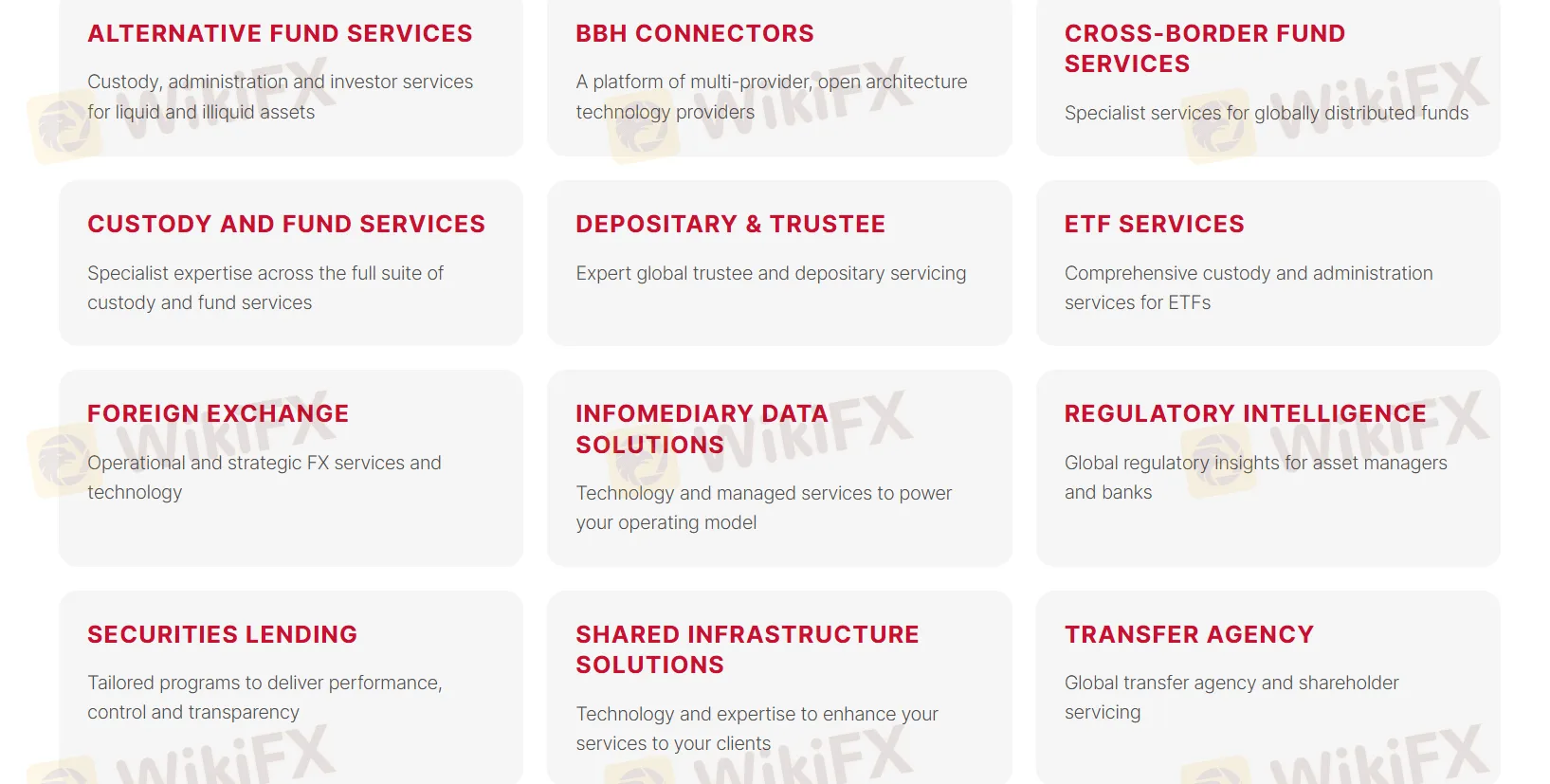

BBH 服务

BBH 提供多种服务,包括:

另类基金服务: 对流动性和非流动性资产的托管、管理和投资者服务。

BBH 连接器: 多供应商、开放架构技术提供商的平台。

跨境基金服务: 为全球分布的基金提供专业服务。

托管和基金服务: 在托管和基金服务的全部领域提供专业知识。

托管人和受托人: 全球专业的受托人和托管服务。

ETF 服务: 为 ETF 提供全面的托管和管理服务。

外汇: 操作性和战略性的外汇服务和技术。

监管情报: 为资产管理公司和银行提供全球监管见解。

证券借贷: 定制方案,提供绩效、控制和透明度。

共享基础设施解决方案: 利用技术和专业知识提升您向客户提供的服务。

转让机构: 全球转让机构和股东服务。

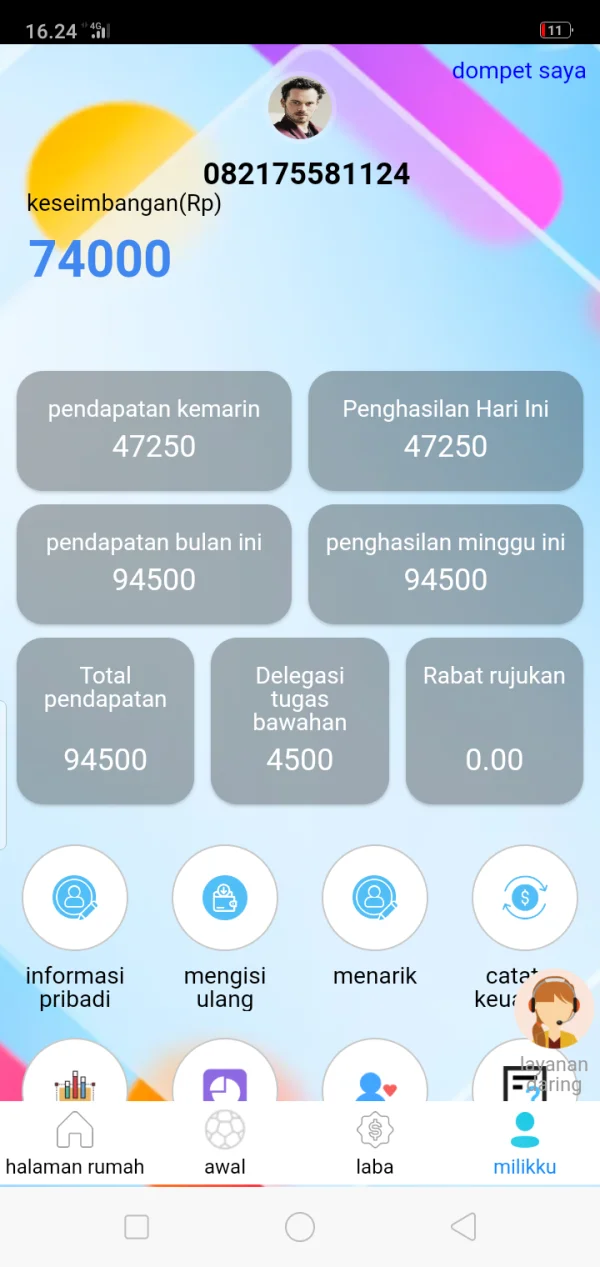

FX3413326667

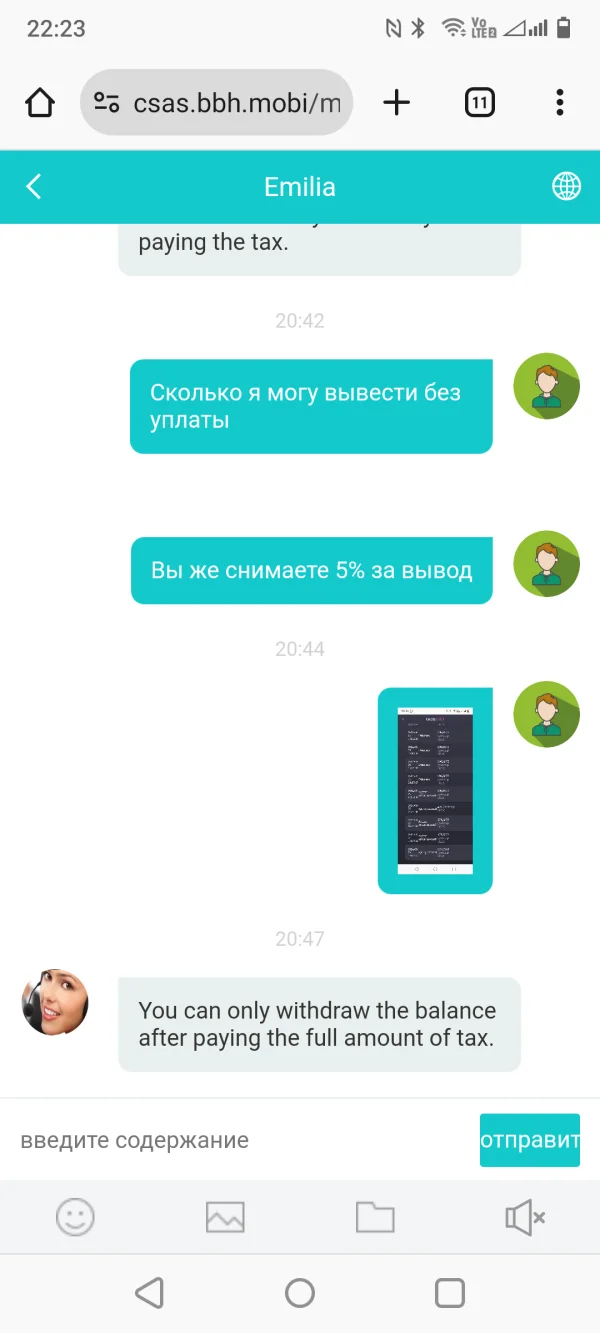

俄罗斯

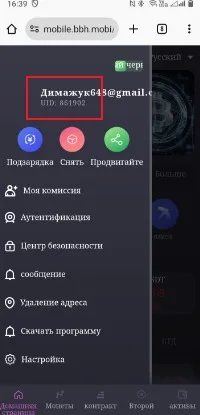

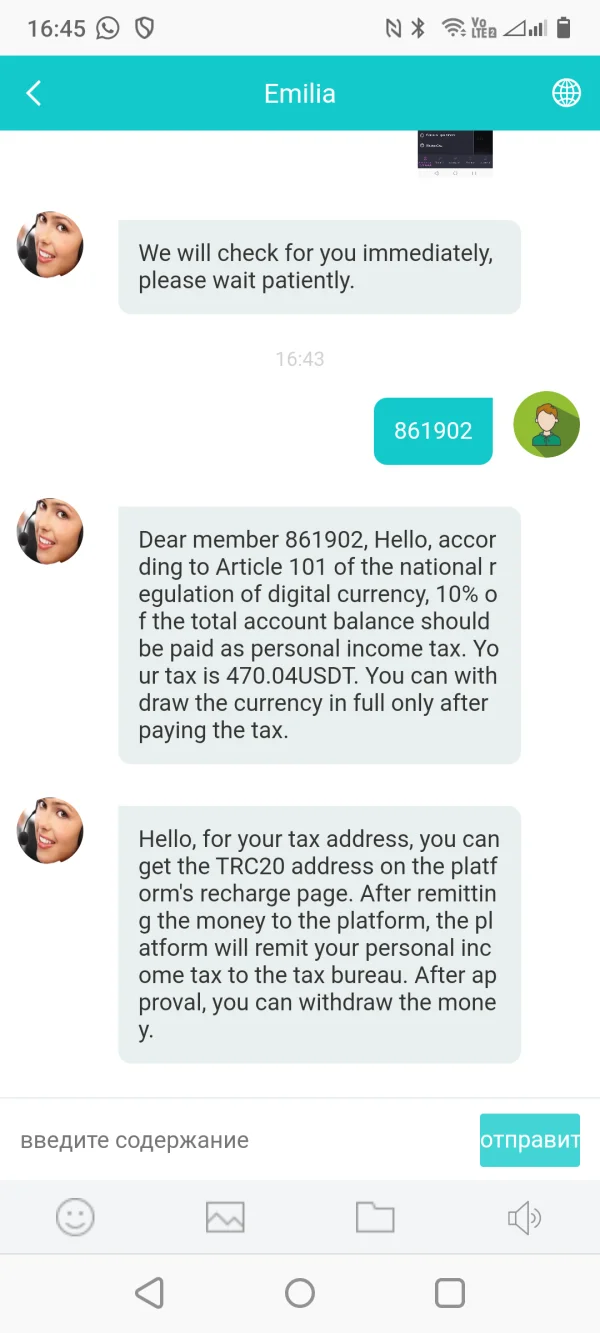

中国女孩,遇见并提供这种交流 BBH,作为投资。有几次他们允许我提款,然后就无法提款了,他们要求我支付10%的提款税。小心,他们是勒索者和骗子!

曝光

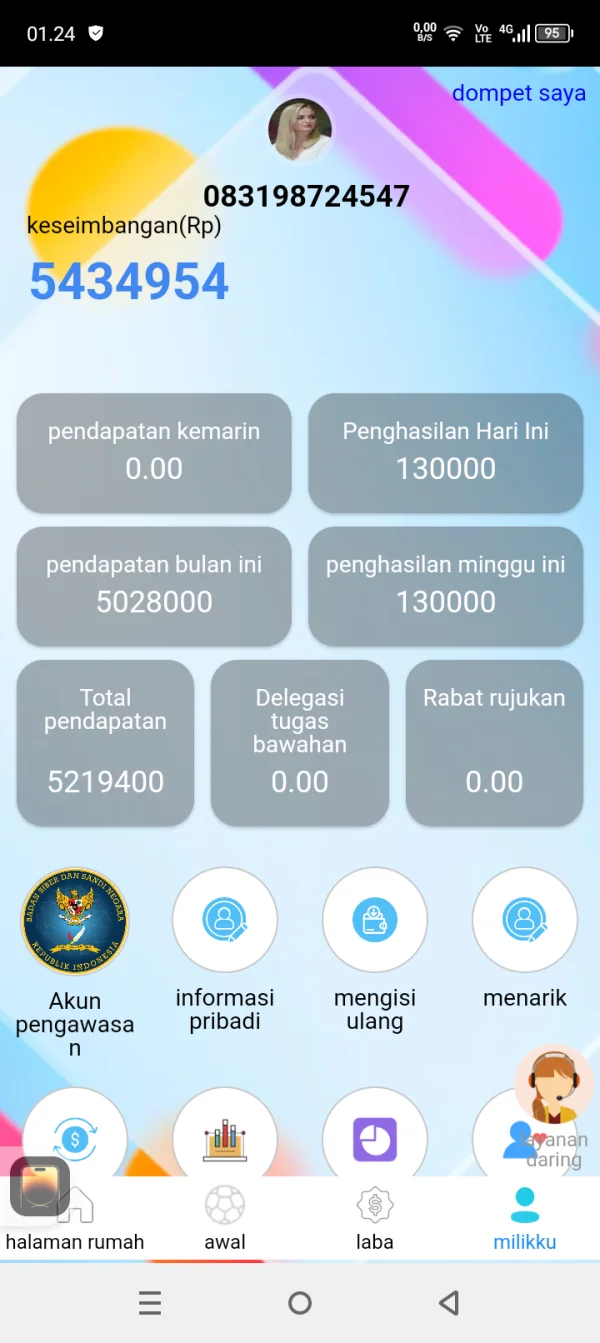

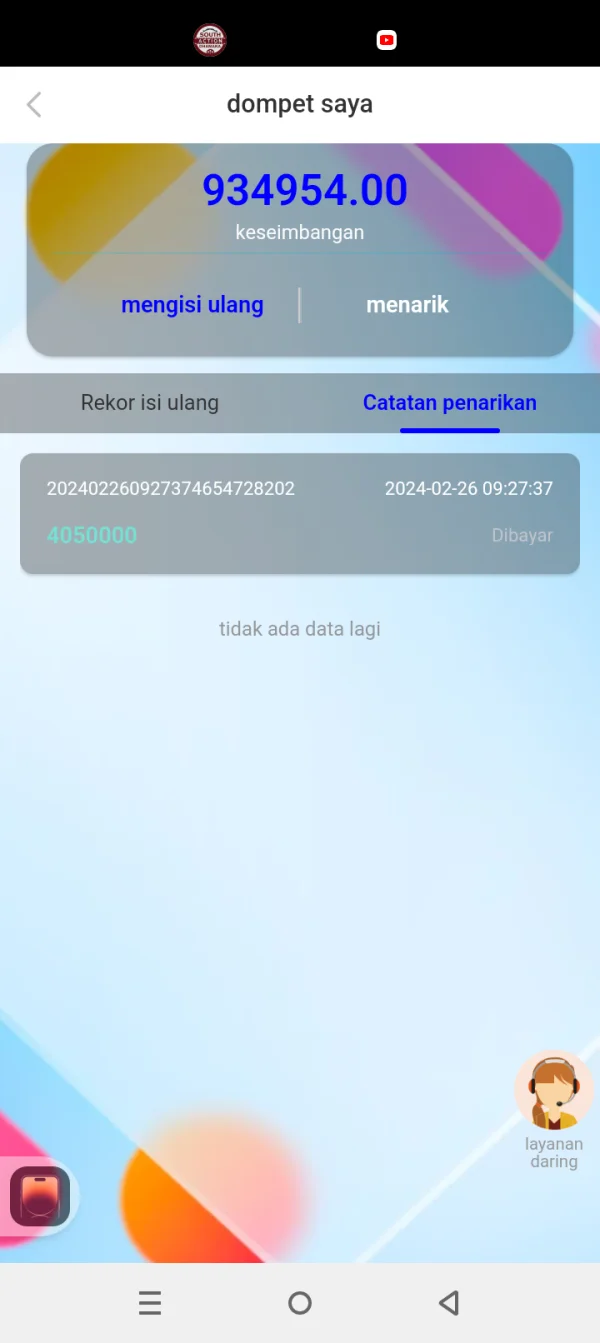

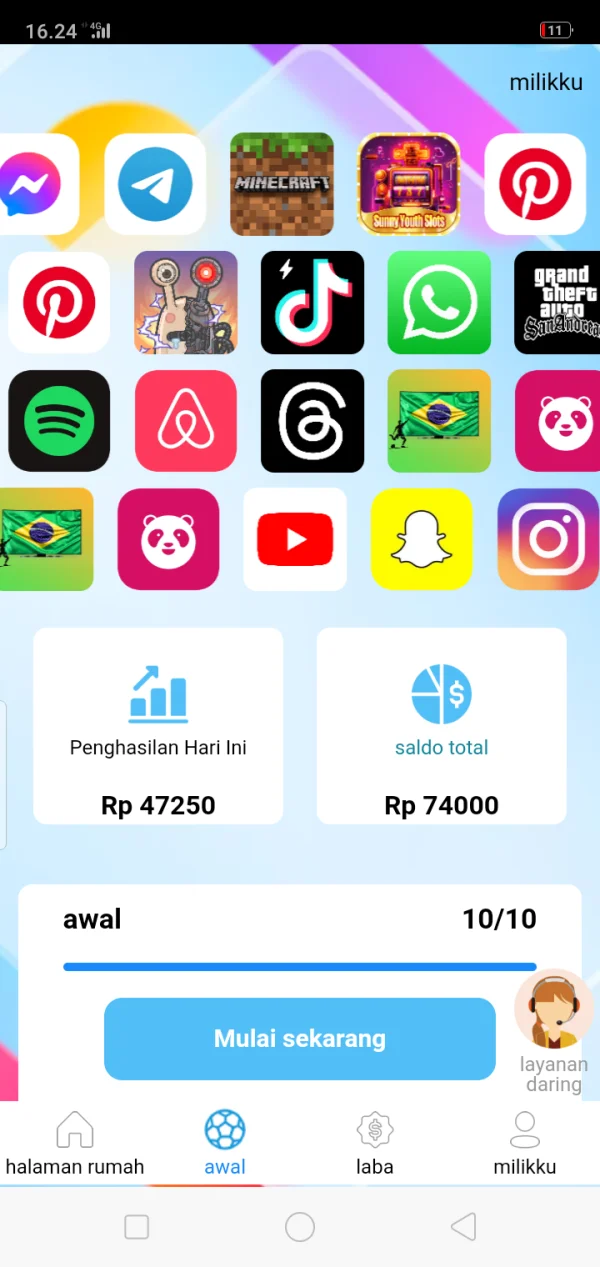

hendra164

印尼

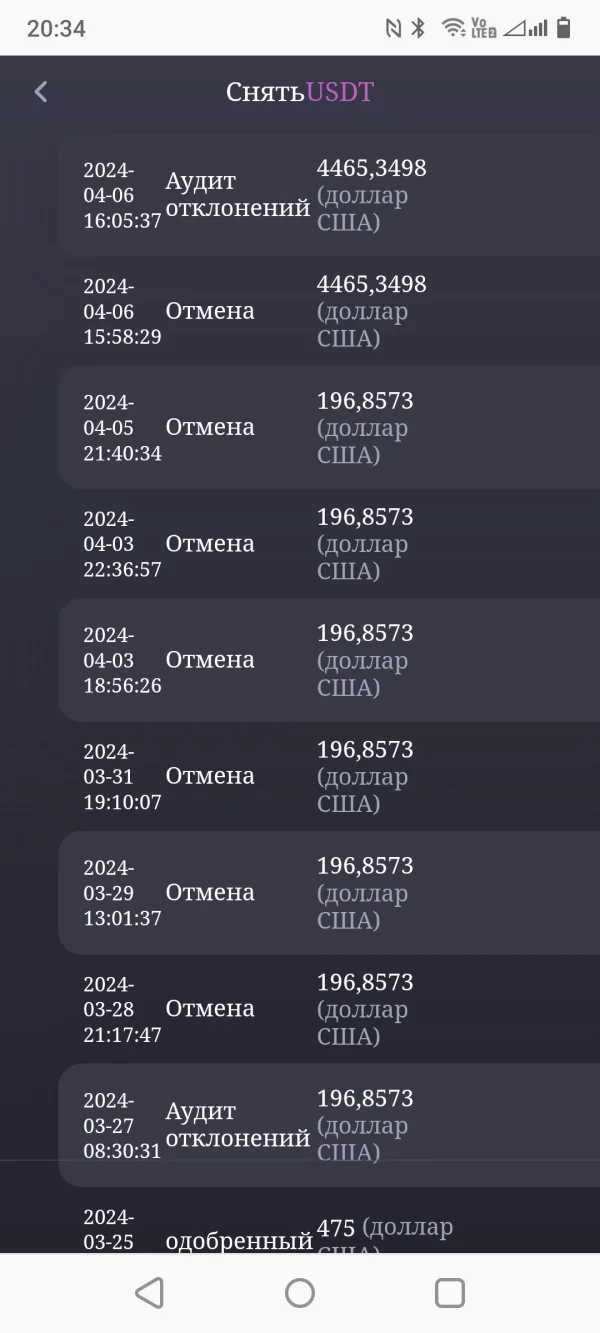

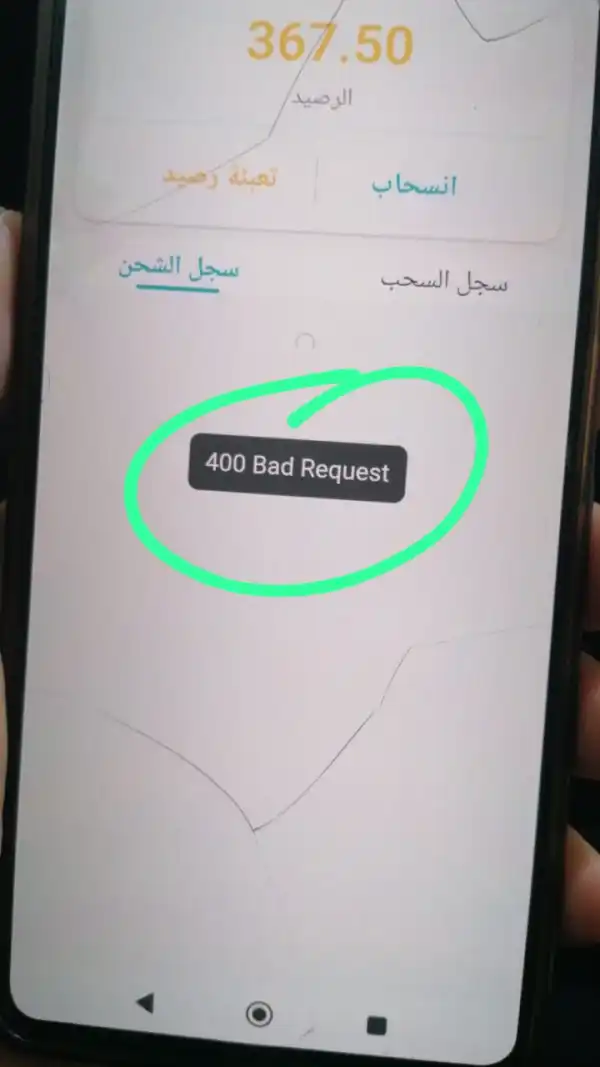

我已提款,尚未提现

曝光

indra518

印尼

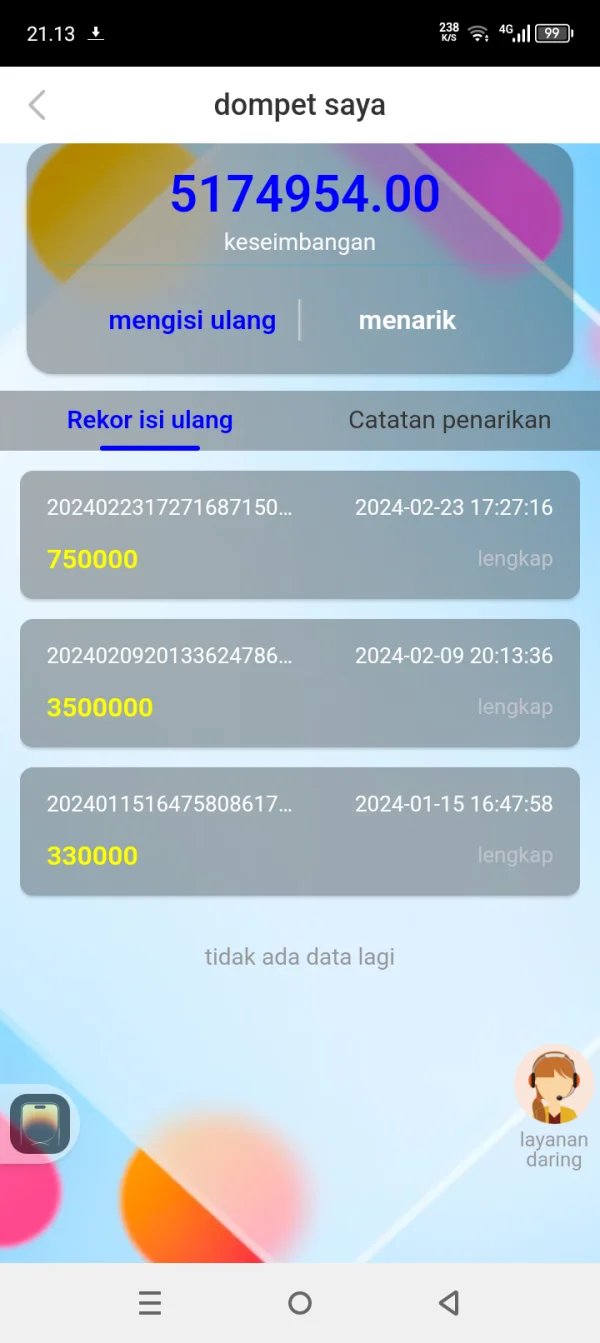

他们清空了我们的余额..我们的余额应该是 2000000 到 0,他们告诉我们要纳税

曝光

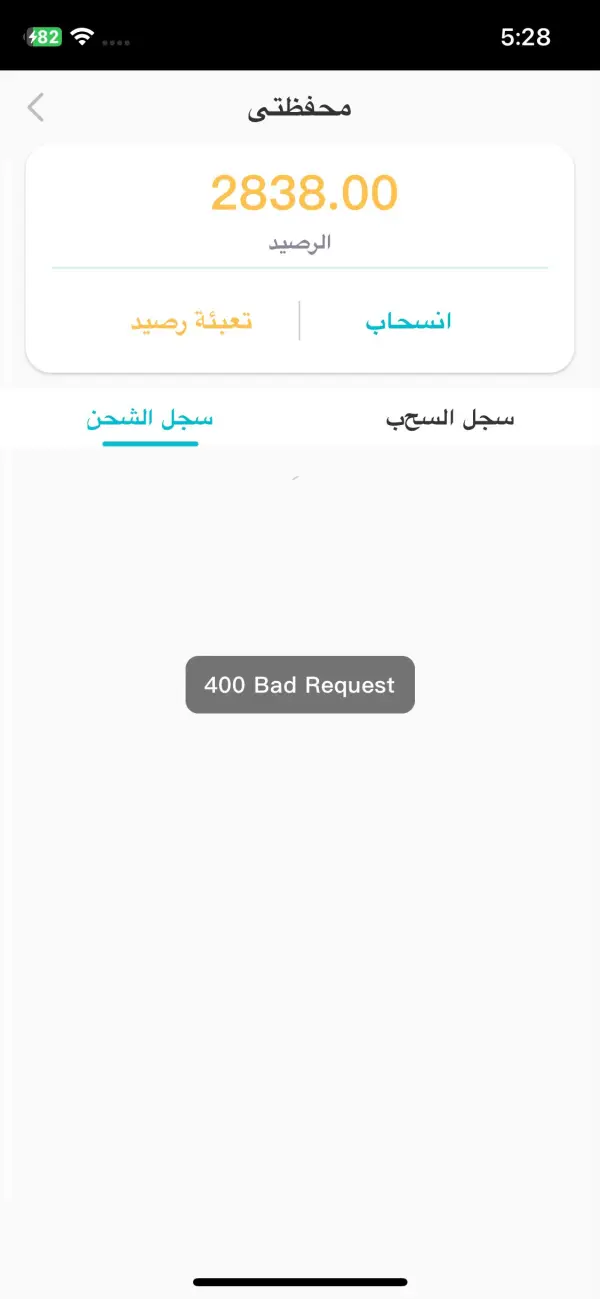

FX3147252051

伊拉克

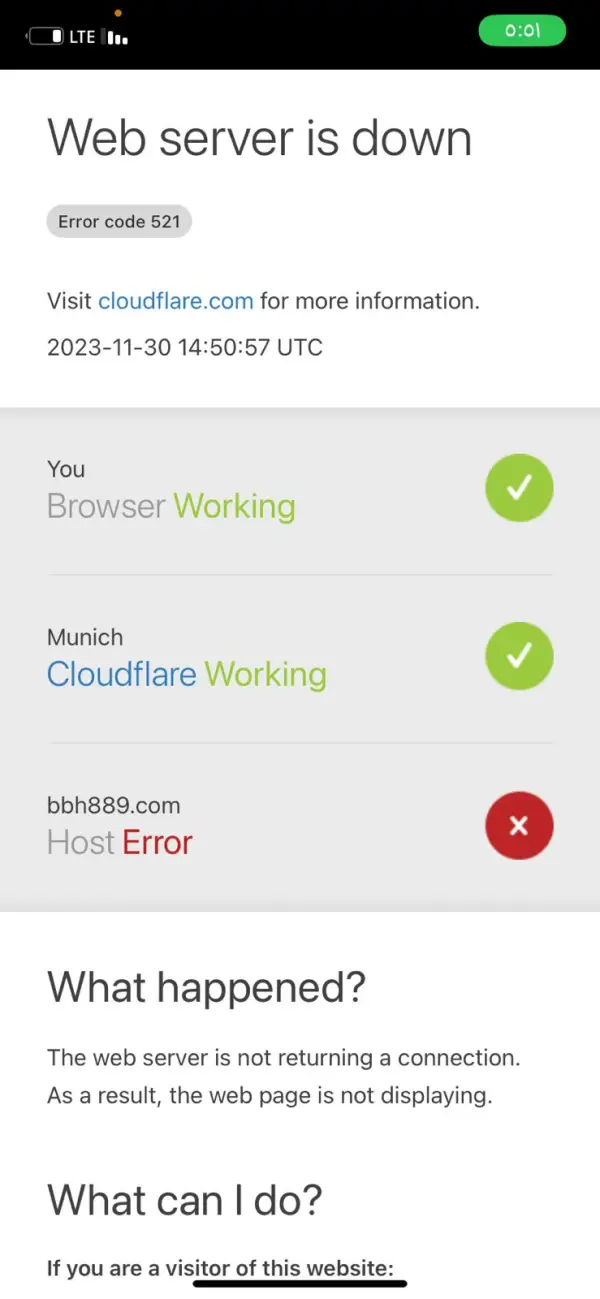

他们关闭了项目。我们被骗了一大笔钱。他们承诺每周四我们会收到利润,但他们没有回应。

曝光

alfalahi

伊拉克

他们承诺人们每周四抽奖,但现在他们已经关闭了该计划,经纪人也没有回应订阅者

曝光