Thanh Thao

1-2年

Does NetDania offer a swap-free (Islamic) account option for its traders?

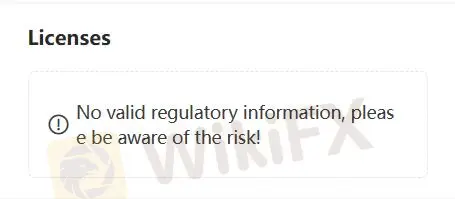

Based on my careful review of NetDania as an experienced forex trader, I have found no available information indicating that NetDania offers a swap-free or Islamic account option. In my own due diligence, I focus on transparency and regulatory oversight, especially when considering brokers for specialized account types like swap-free accounts—which are crucial for traders with religious considerations. Unfortunately, NetDania operates as an unregulated entity according to all the data I’ve examined, and there are significant concerns about non-transparent trading conditions and a general lack of clear details about their market instruments or account offerings. For me, this absence of regulatory supervision raises additional caution, as swap-free accounts—where overnight charges are replaced by administrative fees—require clear and trustworthy implementation to avoid hidden costs or unfair terms. Without explicit mention of Islamic account provisions, I am not comfortable assuming such a feature exists. I recommend that risk-averse and ethically focused traders seek out brokers with robust regulation and clearly advertised swap-free account options to ensure both compliance and peace of mind.

Broker Issues

Leverage

Platform

Instruments

Account

S jonas

1-2年

Could you break down what makes up the total trading cost for indices such as the US100 when using NetDania?

From my perspective as an experienced trader, understanding the full scope of trading costs is absolutely critical, especially for popular indices like the US100. In my assessment of NetDania, there are significant concerns when it comes to clarity around trading costs. The available information does not specify spreads, commissions, or any particular fee structure related to indices like the US100. This lack of transparency makes it incredibly challenging for me to calculate the exact total trading cost or even estimate the cost range. In well-regulated brokers, I would expect to see detailed disclosures about spreads, overnight swap rates, commissions per contract, and any hidden platform or withdrawal charges. These elements usually combine to form the actual cost of trading an index.

However, with NetDania operating as an unregulated entity, I am particularly cautious. The absence of clear cost structures and regulatory oversight heightens the potential for hidden fees or unfavorable trading conditions. For me, transparent fee schedules are non-negotiable because they directly impact risk management and profitability. Without definitive details from NetDania, I can't confidently analyze or trust the breakdown of trading costs for the US100 or any index on their platform. As such, I would urge any trader to approach with heightened vigilance and prioritize platforms that disclose all cost components openly and are subject to reputable financial regulation.

Broker Issues

Fees and Spreads

RichN

1-2年

In what ways does NetDania’s regulatory standing help safeguard my funds?

Speaking candidly as someone who has spent years navigating the forex space, I’m always deeply cautious about platforms that lack proper regulatory oversight. In the case of NetDania, my due diligence revealed that this broker is entirely unregulated and has even been flagged for a suspicious regulatory license and scope of business. As a result, there are no established safeguards or accountability mechanisms in place to protect my funds when using their services. This absence of external regulation means critical protections, such as the segregation of client accounts, regular audits, or participation in a compensation scheme, simply aren’t guaranteed here.

For me, regulatory backing isn’t just a box to tick; it’s what underpins transparency, dispute resolution options, and recourse in case something goes wrong. With NetDania, the lack of such oversight leaves traders exposed to significant risk, with no authority to address grievances or intervene in cases of malpractice. Based on my experience, I cannot place my trust—or my capital—with a platform whose operations aren’t independently monitored. To safeguard my own funds, I always seek brokers who can prove clear, strong regulatory credentials, something that, unfortunately, NetDania doesn’t offer.

Mohammed Mazhar

1-2年

Does NetDania charge a commission per lot on their ECN or raw spread accounts?

From my perspective as a trader with a focus on platform diligence, I approach questions about NetDania's commissions with significant caution. Based on my review of essential details, NetDania does not provide transparent or specific disclosures about its trading account types—there is no readily available information on ECN or raw spread accounts, nor any clear breakdown of commission structures per lot. This lack of basic trading information, particularly regarding fees or commissions, is a significant concern for me. Transparent cost structures are fundamental for managing trading expenses and understanding a broker’s business model.

Another issue I noted is that NetDania operates without any regulatory oversight. As someone who prioritizes regulated environments for capital protection, this alone would prevent me from opening any live account, let alone trading with unknown commission terms. In my experience, unregulated brokers that do not outline crucial facts like commission charges or account specifications present an even higher risk to traders, especially if disputes arise.

Because no official evidence clarifies whether NetDania charges a commission per lot on ECN or raw spread setups, I must conclude that prospective users are unable to make an informed decision about trading costs. This uncertainty is unacceptable for my trading standards, and I urge anyone considering this platform to exercise the utmost caution until comprehensive, verifiable details become available.

Broker Issues

Fees and Spreads