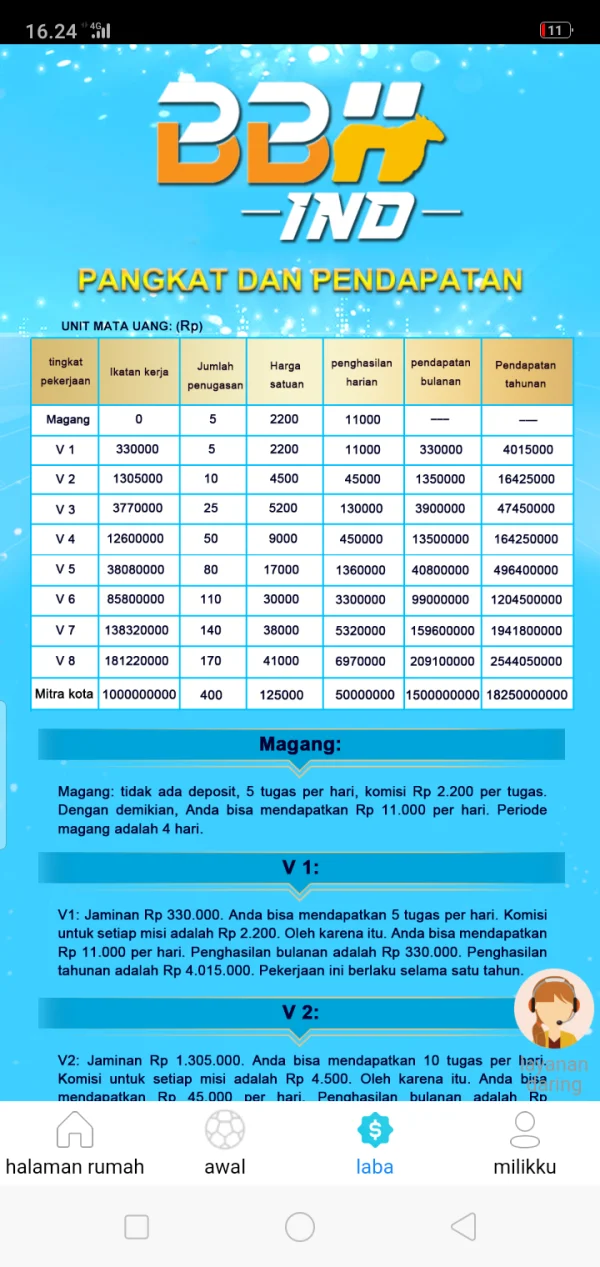

Resumo da empresa

| BBH Resumo da Revisão | |

| Fundação | 1995 |

| País/Região Registrada | Estados Unidos |

| Regulação | SFC (regulado), FCA (excedido) |

| Serviços | Serviços de fundos alternativos, Conectores BBH, Serviços de Fundos Transfronteiriços, Custódia e Serviços de Fundos, Depositário e Fiduciário, Serviços de ETF, Câmbio, Inteligência Regulatória, Empréstimo de Valores Mobiliários, Soluções de Infraestrutura Compartilhada, Agência de Transferência |

| Suporte ao Cliente | Email: contactus@bbh.com |

| LinkedIn/Facebook/Twitter | |

Informações sobre BBH

BBH é um corretor registrado nos Estados Unidos com uma história de 30 anos, que oferece uma ampla variedade de serviços financeiros. BBH ainda é arriscado devido ao seu status excedido.

Prós e Contras

| Prós | Contras |

| Longa história operacional desde 1995 | Sem suporte ao cliente 24/7 |

| Regulado pela SFC | Sem método de transferência específico |

| Vários serviços financeiros | Licença FCA excedida |

BBH é Legítimo?

| País Regulado | Status Atual | Autoridade Reguladora | Entidade Regulada | Tipo de Licença | Número da Licença |

| China (Hong Kong) | Regulado | Comissão de Valores Mobiliários e Futuros de Hong Kong (SFC) | BROWN BROTHERS HARRIMAN (HONG KONG) LIMITED | Negociação alavancada de câmbio estrangeiro | AAF778 |

| Reino Unido | Excedido | Autoridade de Conduta Financeira (FCA) | Brown Brothers Harriman Investor Services Ltd | Licença de Consultoria de Investimentos | 190266 |

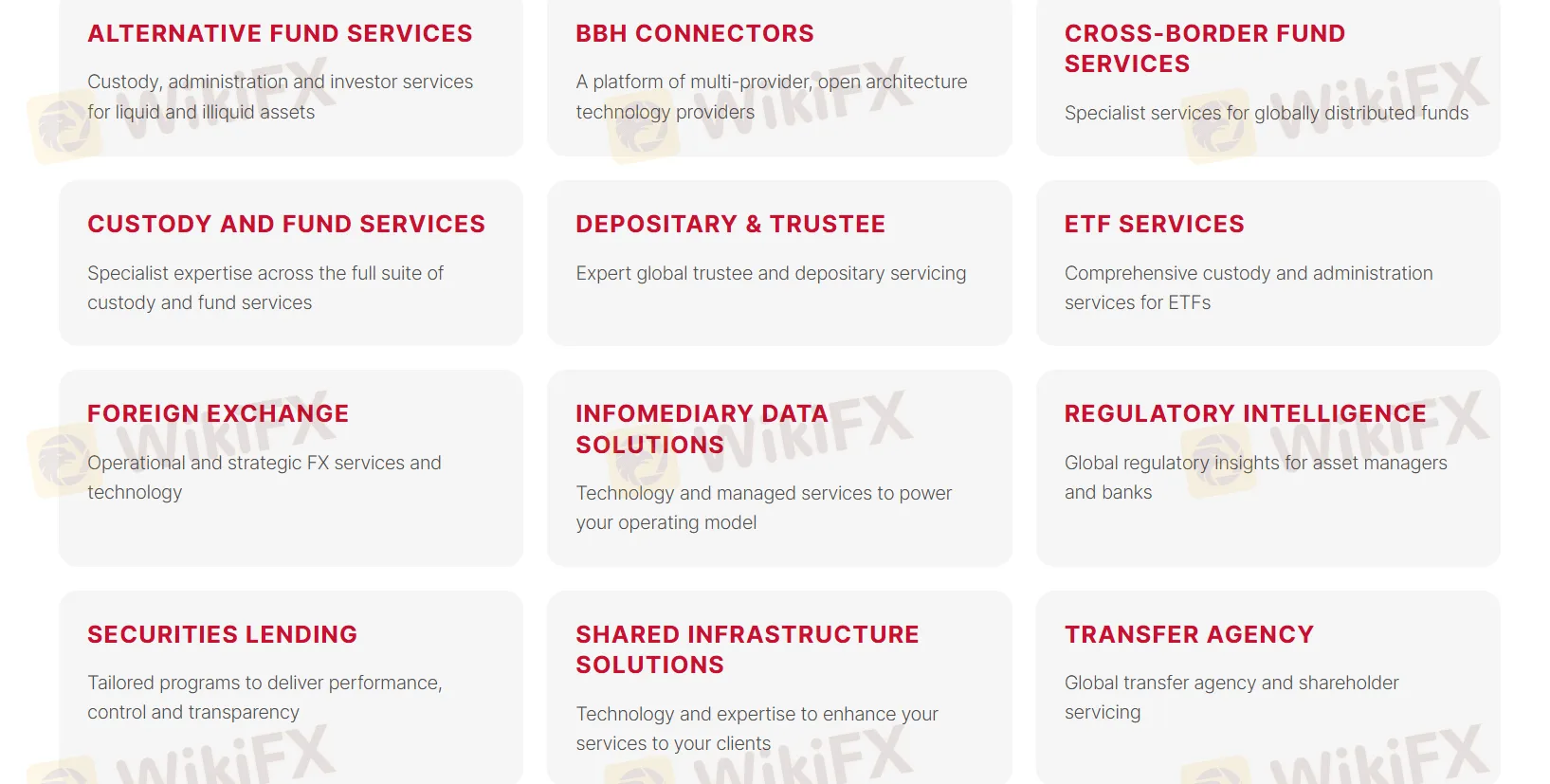

Serviços BBH

BBH oferece uma ampla gama de serviços, incluindo:

Serviços de fundos alternativos: Custódia, administração e serviços para investidores de ativos líquidos e ilíquidos.

Conectores BBH: Uma plataforma de provedores de tecnologia de arquitetura aberta de vários fornecedores.

Serviços de Fundos Transfronteiriços: Serviços especializados para fundos distribuídos globalmente.

Custódia e Serviços de Fundos: Expertise especializada em todos os serviços de custódia e fundos.

Depositário e Fiduciário: Serviços de trustee e depositário globais especializados.

Serviços de ETF: Serviços abrangentes de custódia e administração para ETFs.

Câmbio: Serviços e tecnologia operacionais e estratégicos de câmbio.

Inteligência Regulatória: Percepções regulatórias globais para gestores de ativos e bancos.

Empréstimo de Valores Mobiliários: Programas personalizados para oferecer desempenho, controle e transparência.

Soluções de Infraestrutura Compartilhada: Tecnologia e expertise para aprimorar seus serviços aos seus clientes.

Agência de Transferência: Agência de transferência global e serviços aos acionistas.

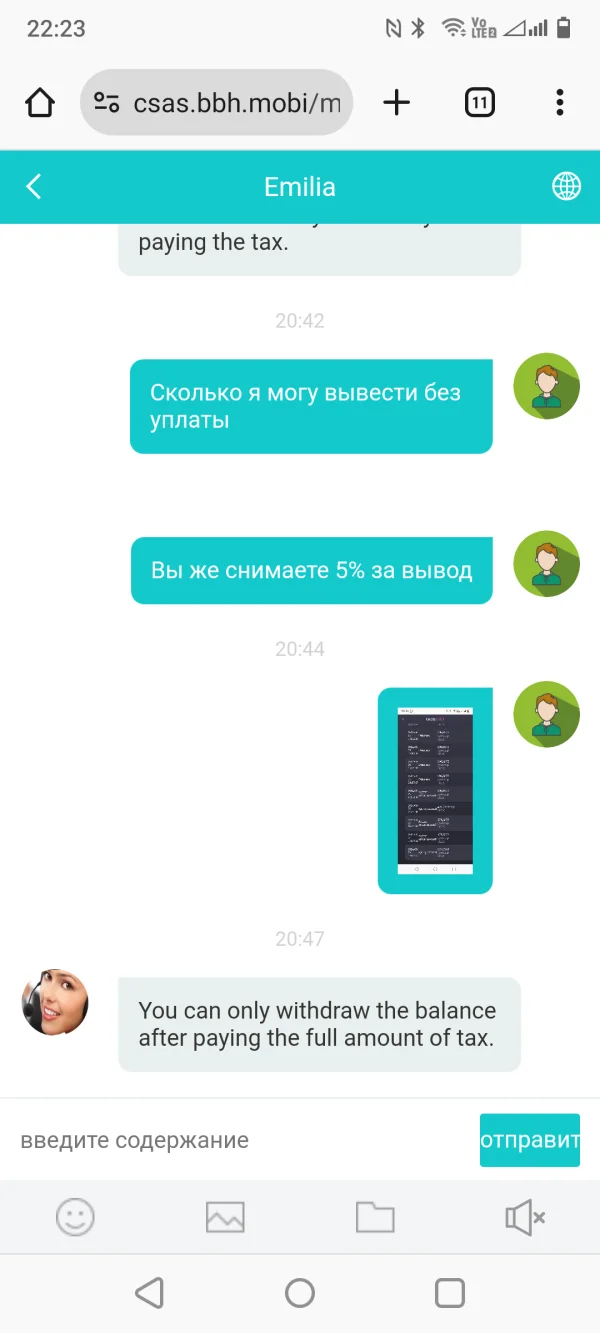

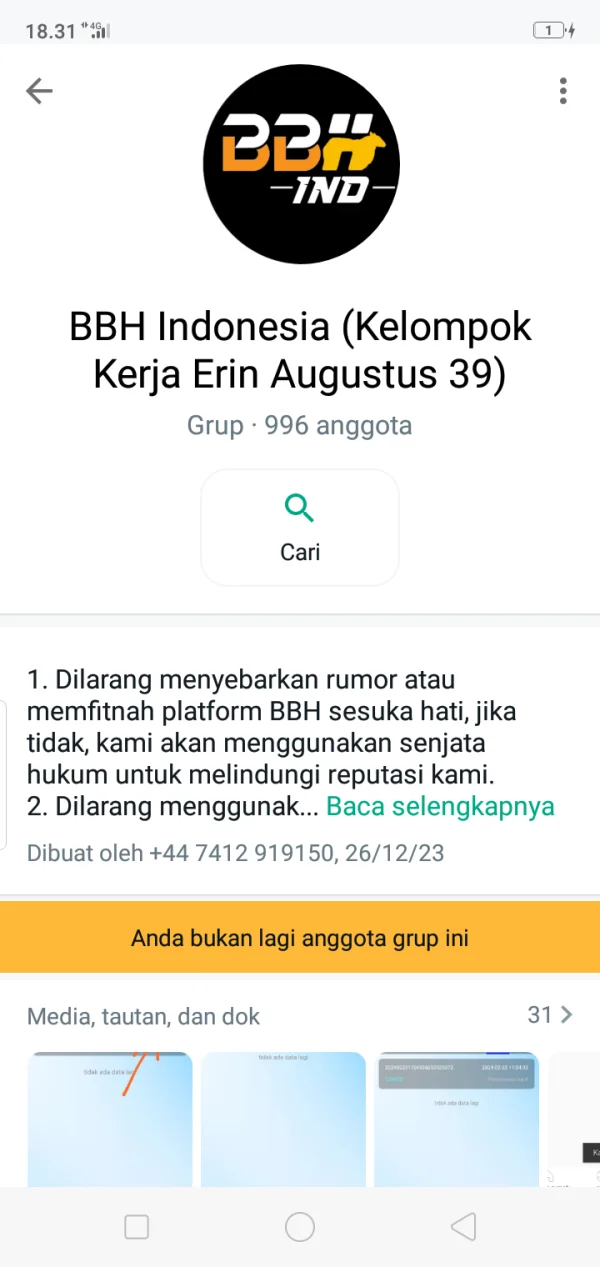

FX3413326667

Russia

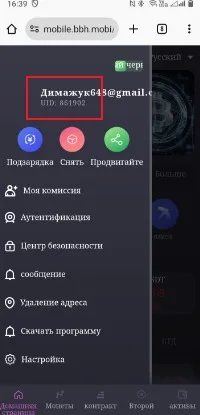

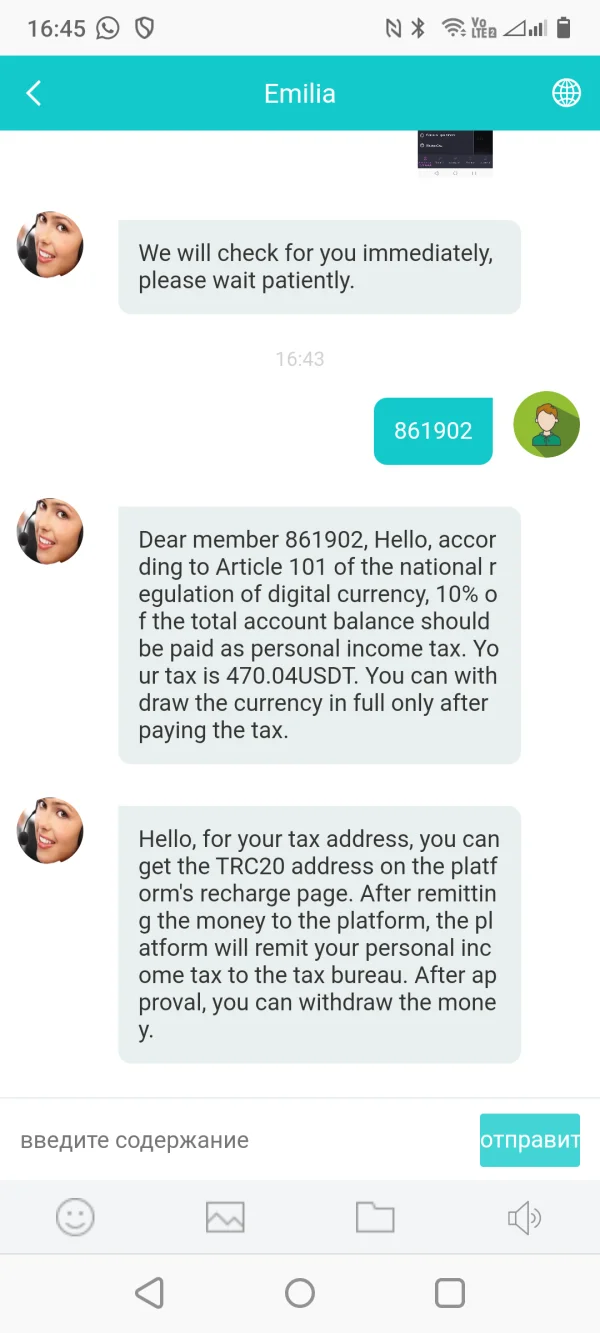

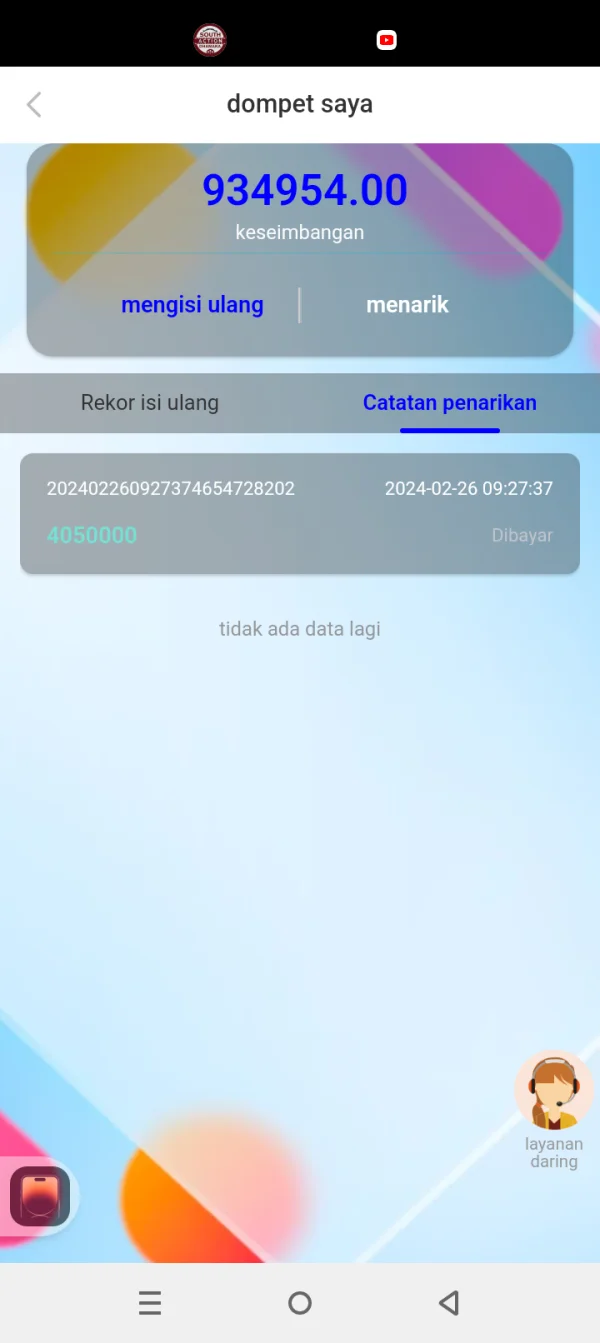

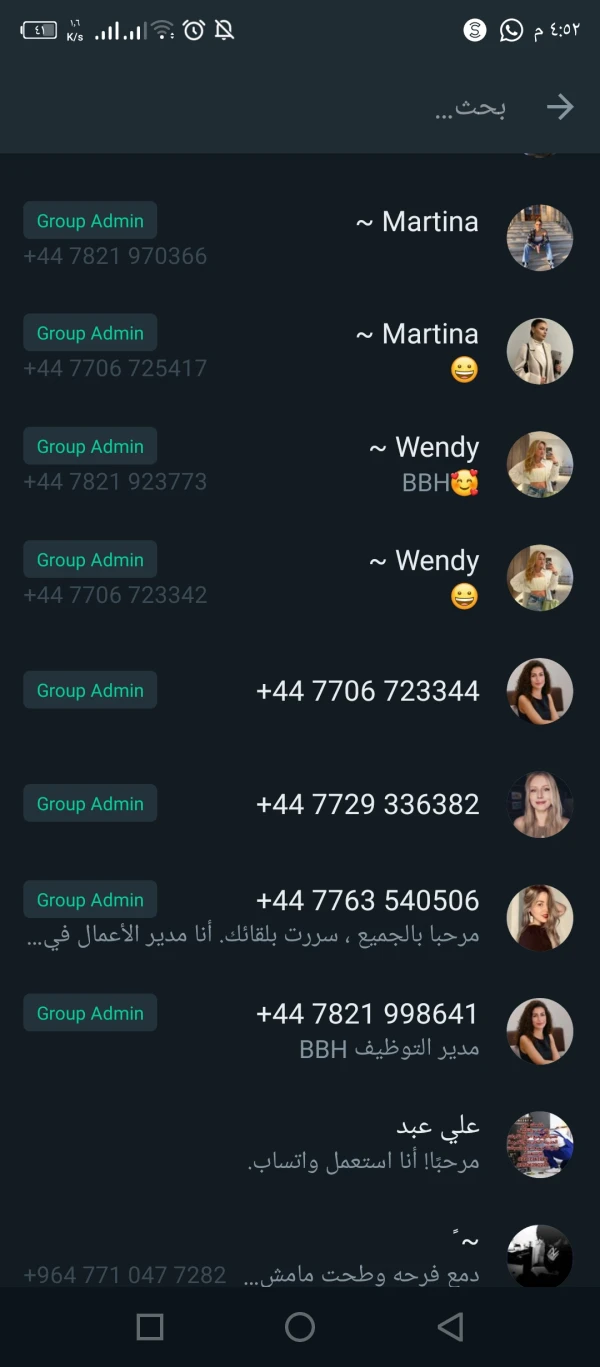

Uma garota chinesa conhece e oferece essa troca BBH como um investimento. Algumas vezes eles me permitem sacar dinheiro, mas depois a retirada não é possível. Eles me pedem para pagar uma taxa de 10% para a retirada. Tenha cuidado, eles são extorsionistas e golpistas!

Exposição

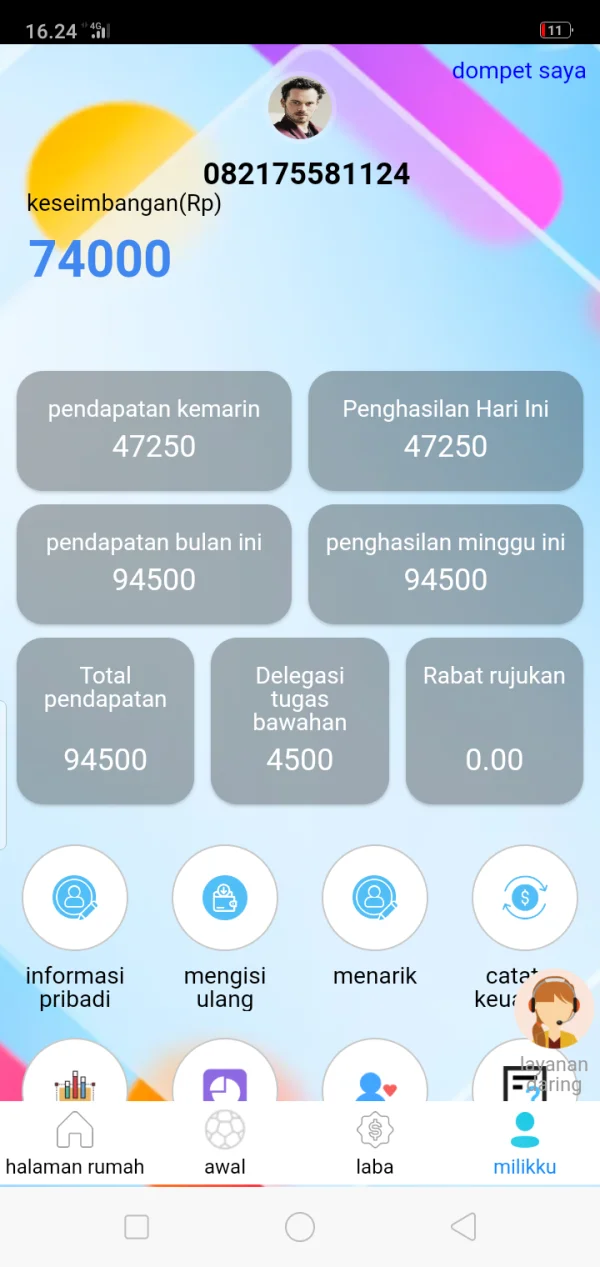

hendra164

Indonésia

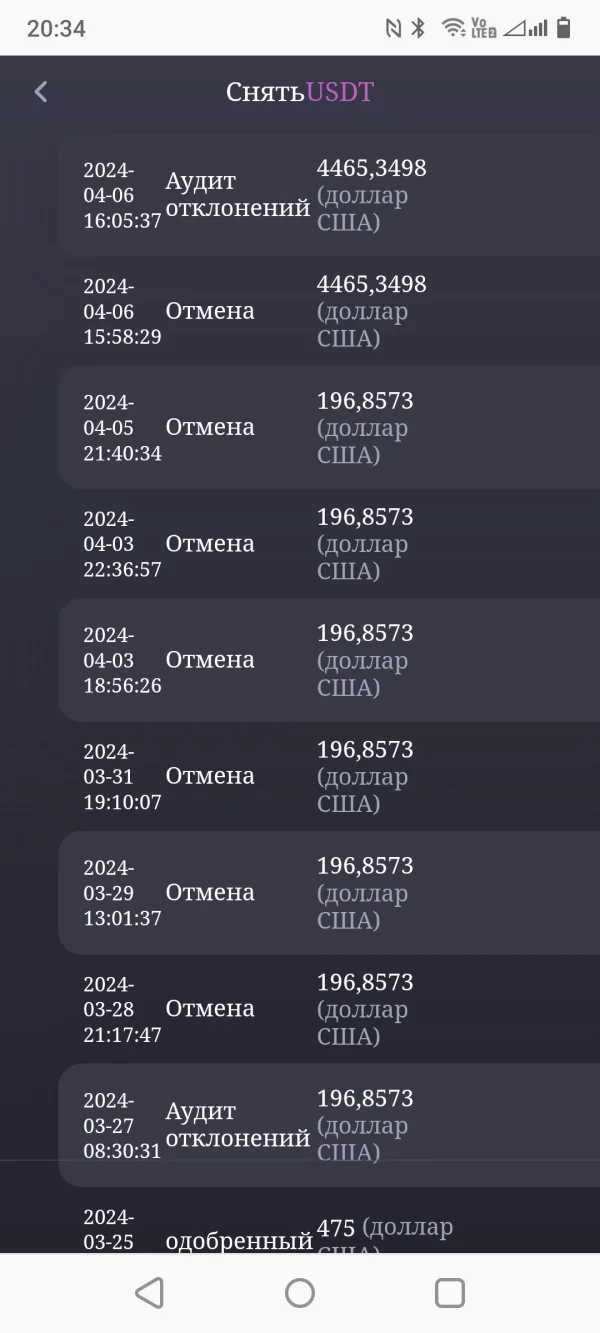

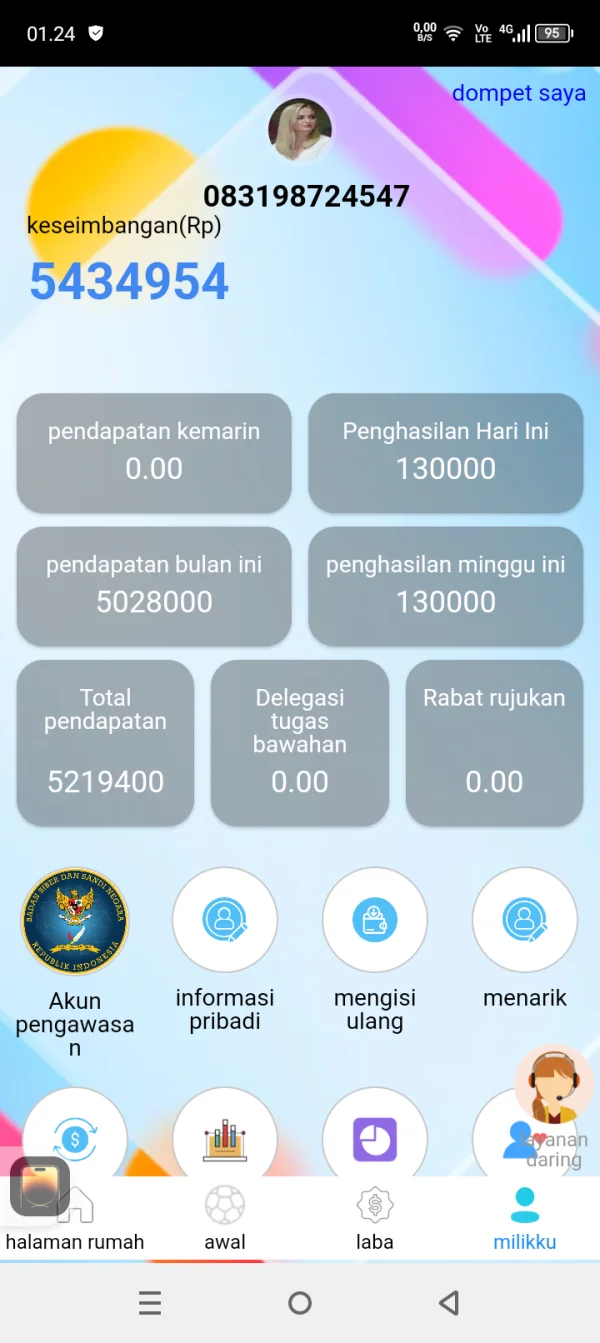

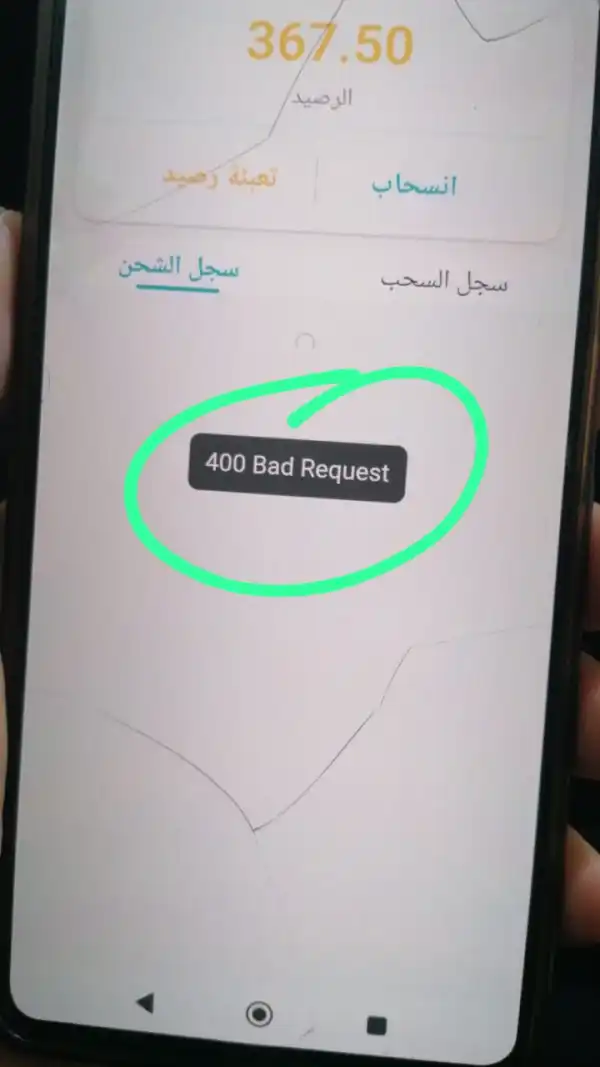

Já fiz um saque, mas ainda não foi creditado.

Exposição

indra518

Indonésia

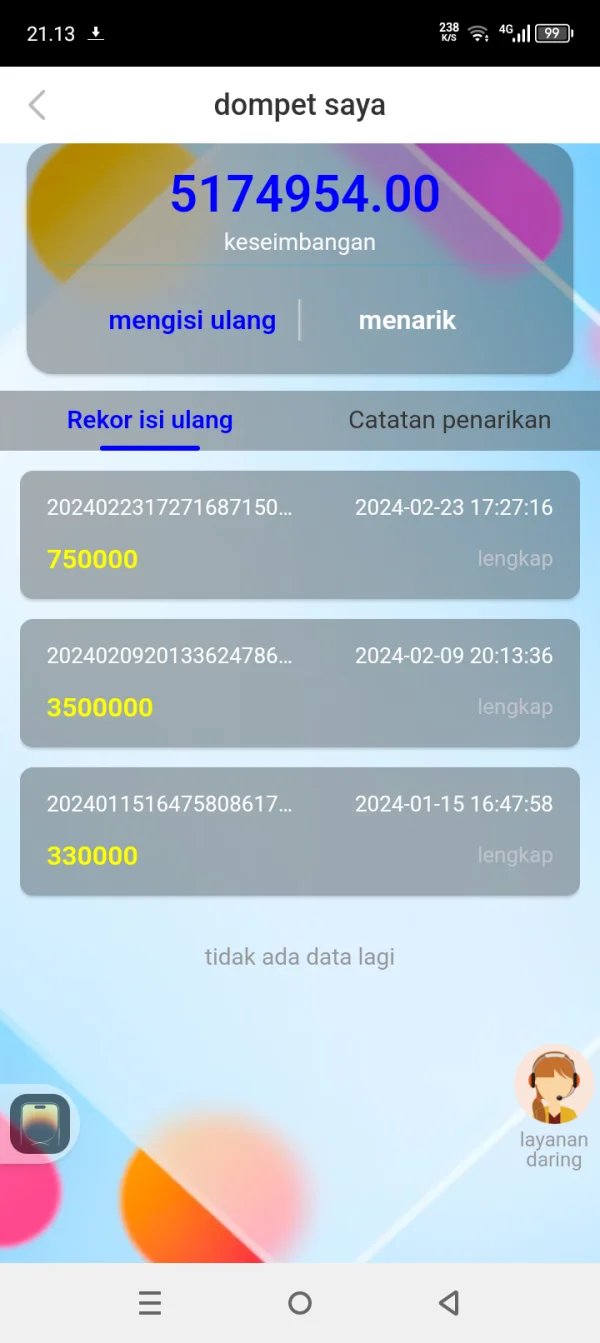

Eles esvaziaram nosso saldo... nosso saldo deveria ter sido de 2000000 para 0 e eles nos disseram para pagar impostos, não podemos sacar fundos por 2 semanas... ele nos disse para pagar impostos... 2 milhões para V2... mesmo que nosso dinheiro estivesse zerado no saldo... como podemos pagar impostos...

Exposição

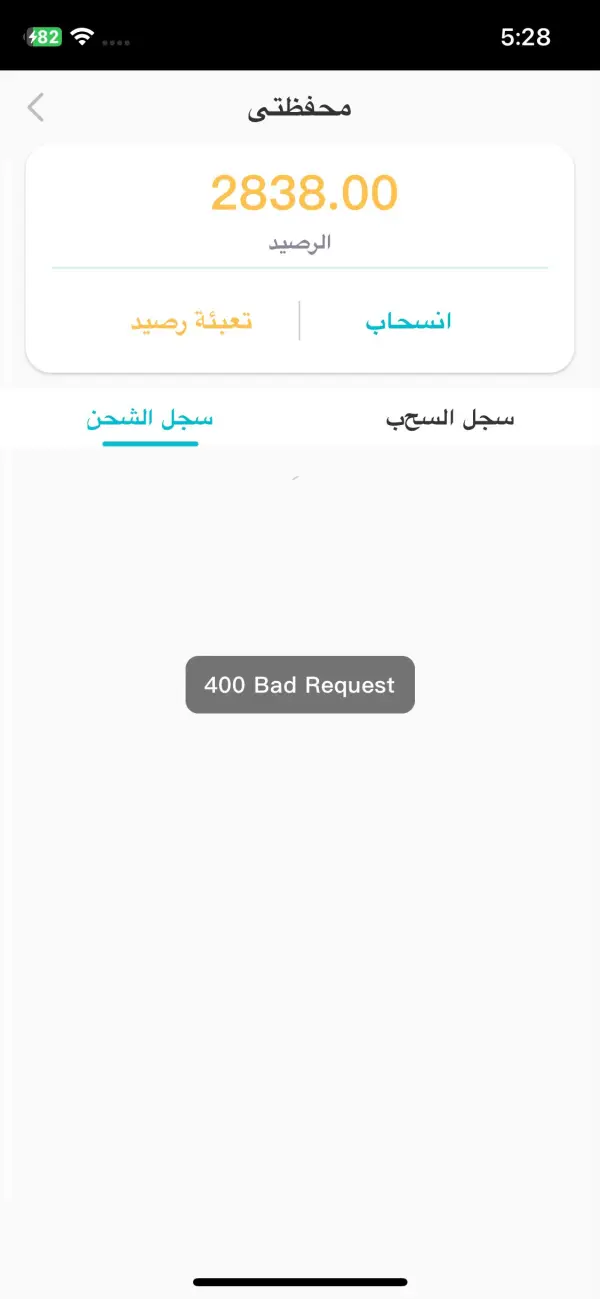

FX3147252051

Iraque

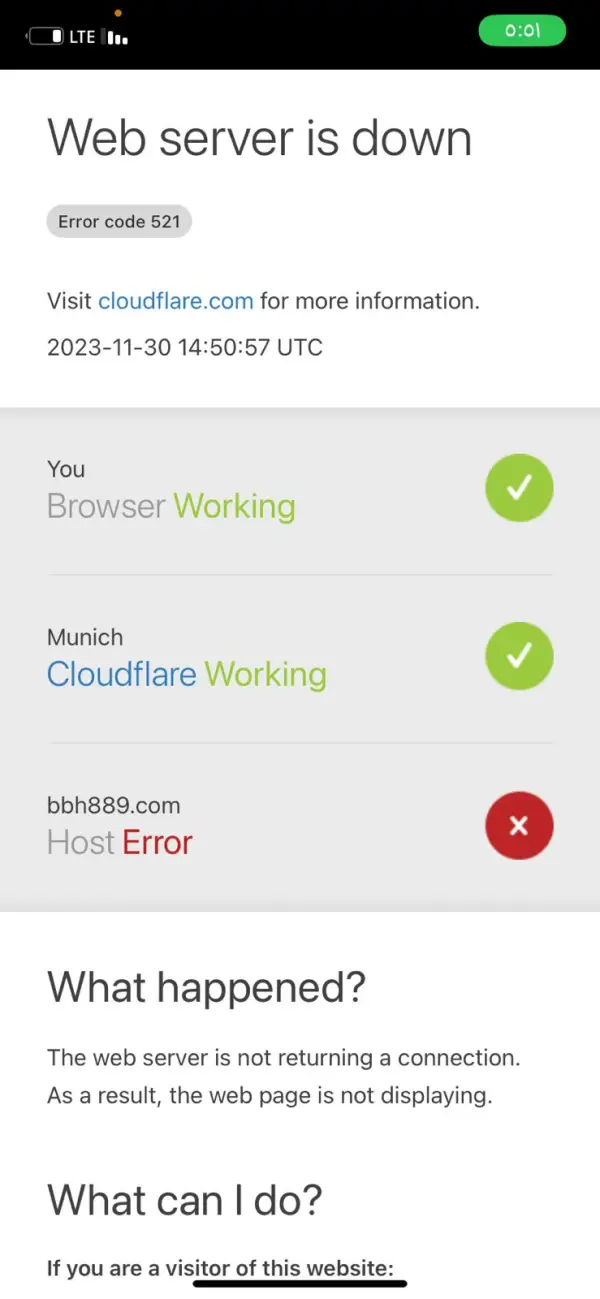

Eles fecharam o programa. Fomos enganados com uma grande quantia de dinheiro. Eles nos prometeram que receberíamos os lucros todas as quintas-feiras, mas quebraram a palavra.

Exposição

alfalahi

Iraque

Prometeram saque todas as quintas-feiras, mas agora fecharam o programa e as corretoras não estão respondendo aos assinantes

Exposição