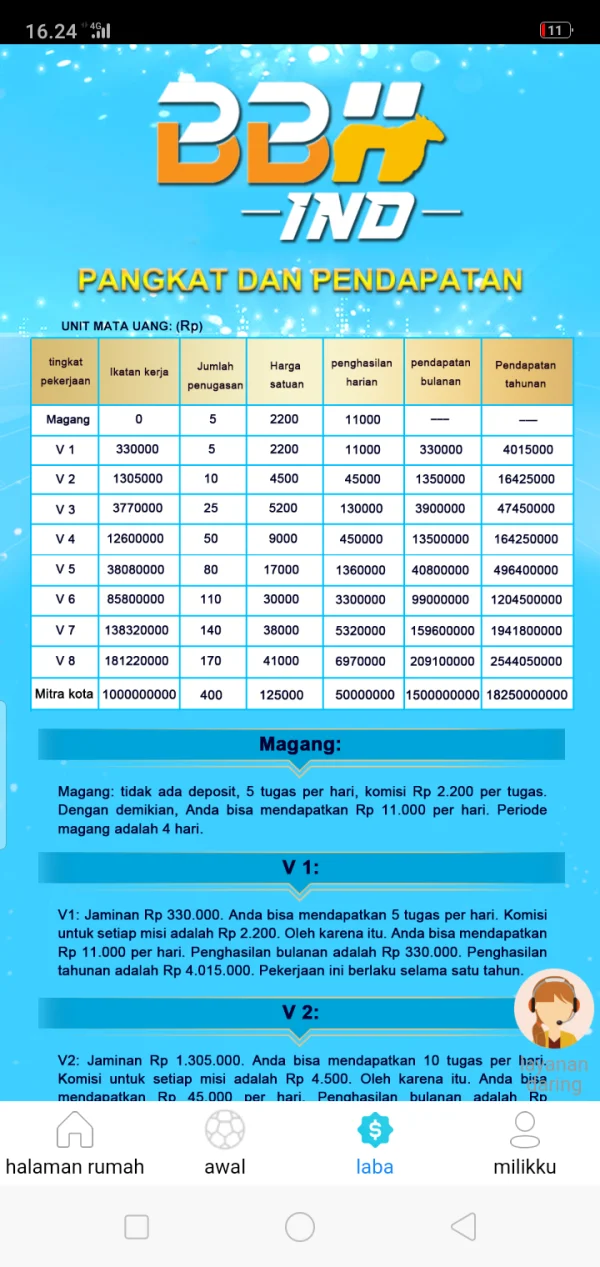

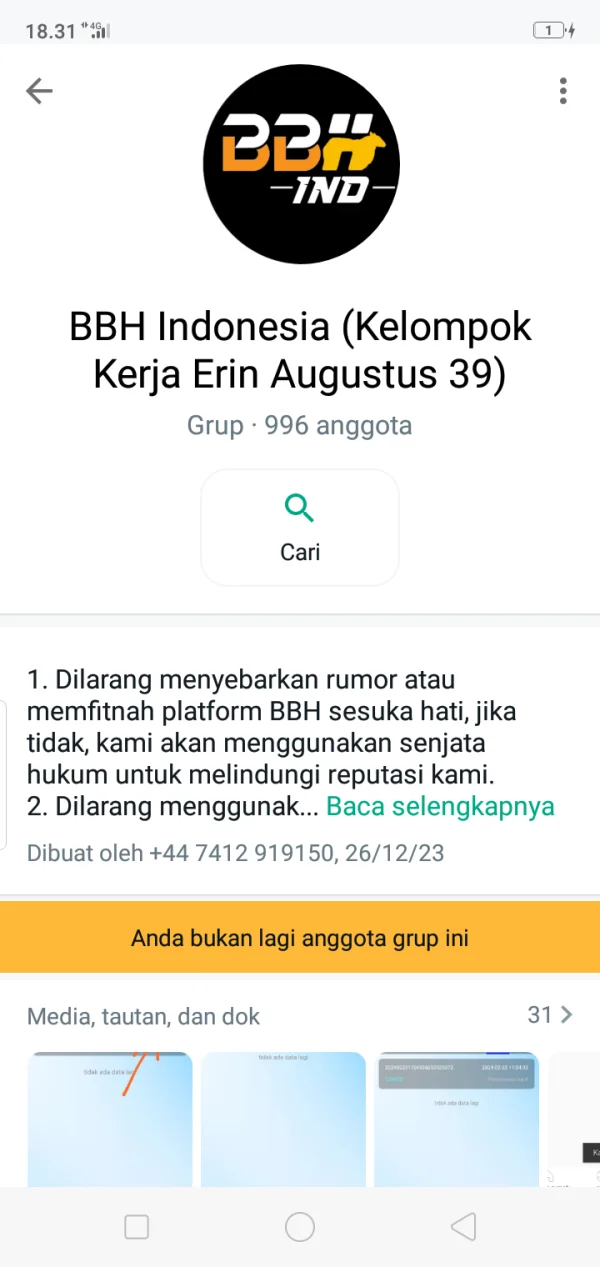

Profil perusahaan

| BBH Ringkasan Ulasan | |

| Dibentuk | 1995 |

| Negara/Daerah Terdaftar | Amerika Serikat |

| Regulasi | SFC (diatur), FCA (melebihi) |

| Layanan | Layanan dana alternatif, Konektor BBH, Layanan Dana Lintas Batas, Penitipan dan Layanan Dana, Layanan Deposit & Trustee, Layanan ETF, Valuta Asing, Intelijen Regulasi, Peminjaman Efek, Solusi Infrastruktur Bersama, Agen Transfer |

| Dukungan Pelanggan | Email: contactus@bbh.com |

| LinkedIn/Facebook/Twitter | |

Informasi BBH

BBH adalah broker yang terdaftar di Amerika Serikat dengan sejarah 30 tahun, yang menawarkan beragam layanan keuangan. BBH masih berisiko karena statusnya yang melebihi.

Pro dan Kontra

| Pro | Kontra |

| Sejarah operasional panjang sejak 1995 | Tidak ada dukungan pelanggan 24/7 |

| Diatur oleh SFC | Tidak ada metode transfer spesifik |

| Berbagai layanan keuangan | Lisensi FCA yang melebihi |

Apakah BBH Legal?

| Negara yang Diatur | Status Saat Ini | Otoritas yang Diatur | Entitas yang Diatur | Jenis Lisensi | Nomor Lisensi |

| China (Hong Kong) | Diatur | Komisi Sekuritas dan Berjangka Hong Kong (SFC) | BROWN BROTHERS HARRIMAN (HONG KONG) LIMITED | Perdagangan valuta asing ber-leverage | AAF778 |

| Inggris | Melebihi | Otoritas Jasa Keuangan (FCA) | Brown Brothers Harriman Investor Services Ltd | Lisensi Penasihat Investasi | 190266 |

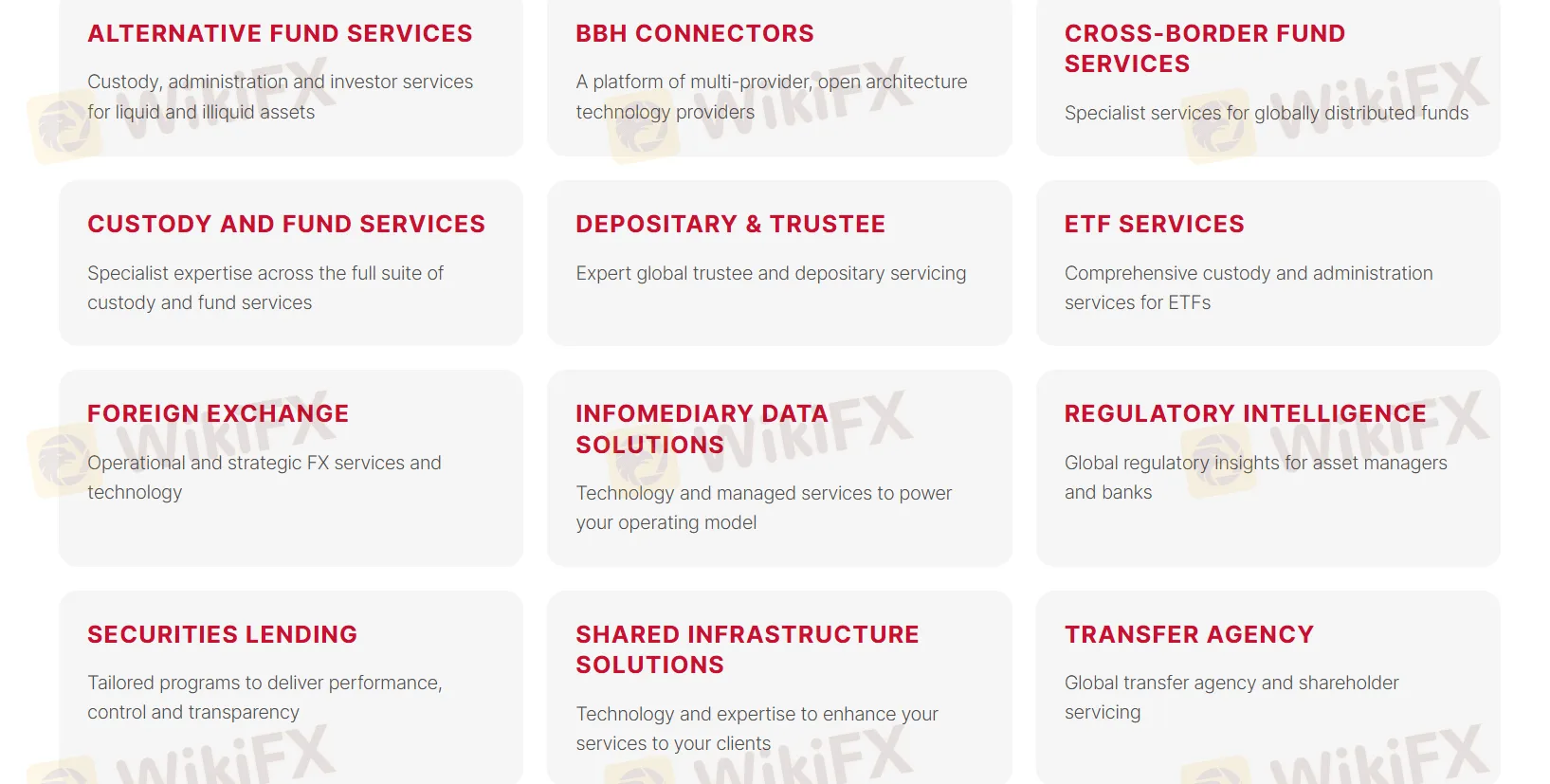

Layanan BBH

BBH menawarkan berbagai layanan, termasuk:

Layanan dana alternatif: Penitipan, administrasi, dan layanan investor untuk aset cair dan tidak cair.

Konektor BBH: Platform penyedia teknologi arsitektur terbuka multi-penyedia.

Layanan Dana lintas Batas: Layanan khusus untuk dana yang didistribusikan secara global.

Penitipan dan Layanan Dana: Keahlian khusus di seluruh rangkaian layanan penitipan dan dana.

Deposit & Trustee: Layanan penitipan dan trustee global yang ahli.

Layanan ETF: Layanan penitipan dan administrasi komprehensif untuk ETF.

Valuta Asing: Layanan dan teknologi FX operasional dan strategis.

Intelijen Regulasi: Wawasan regulasi global untuk manajer aset dan bank.

Peminjaman Efek: Program yang disesuaikan untuk memberikan kinerja, kontrol, dan transparansi.

Shared Infrastructure Solutions: Teknologi dan keahlian untuk meningkatkan layanan Anda kepada klien Anda.

Transfer Agency: Agen transfer global dan layanan pemegang saham.

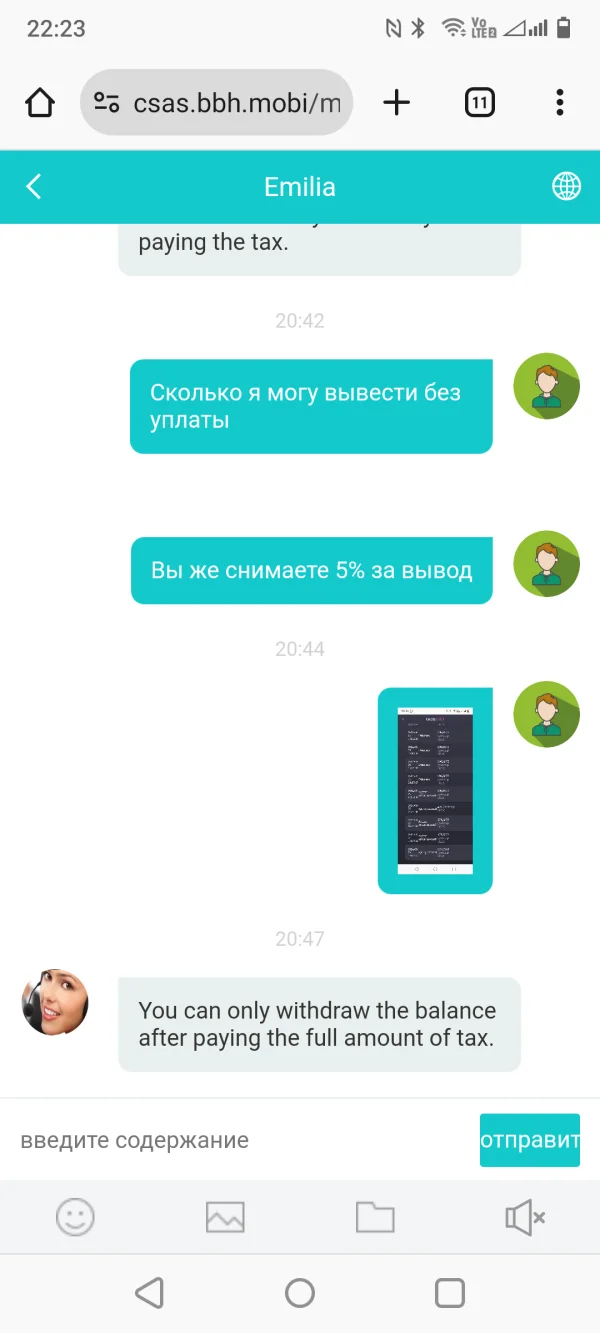

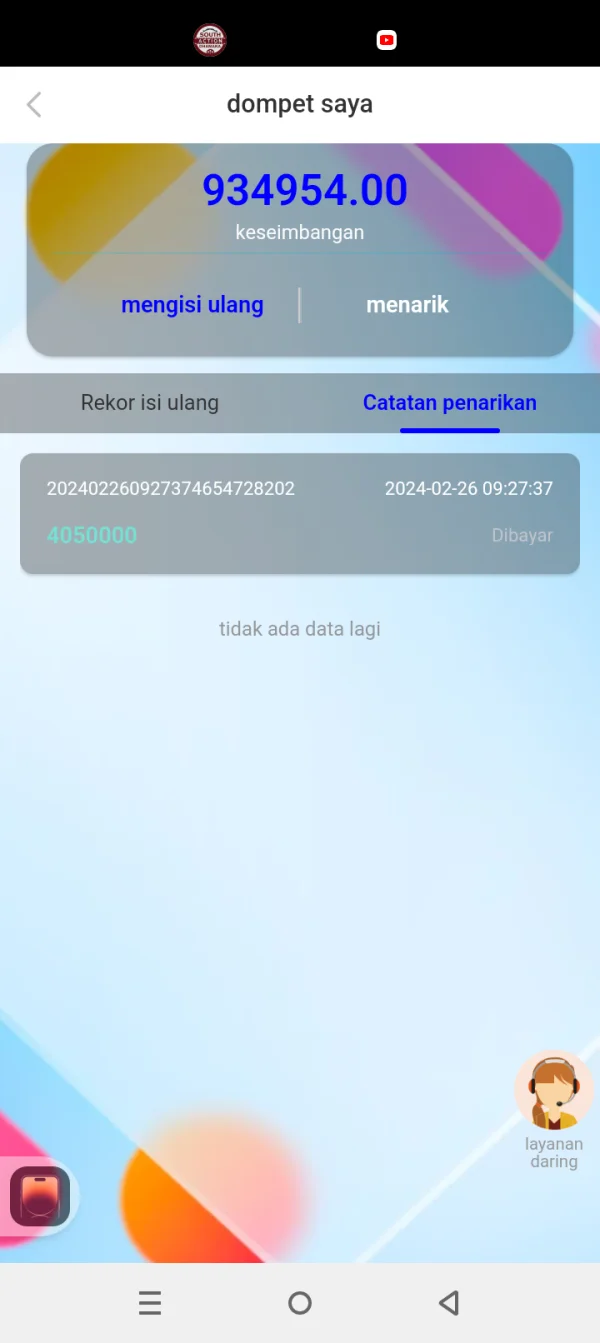

FX3413326667

Rusia

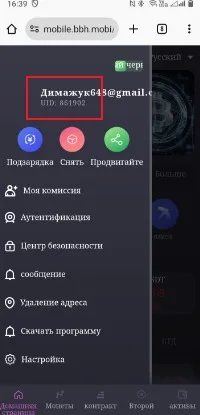

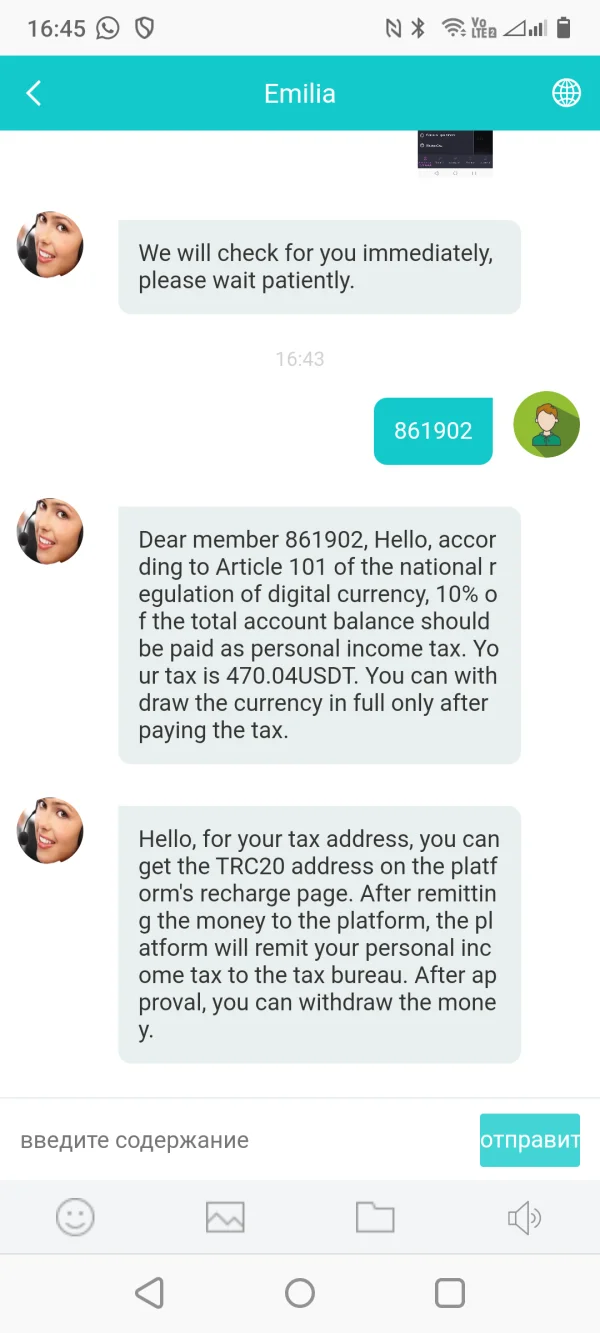

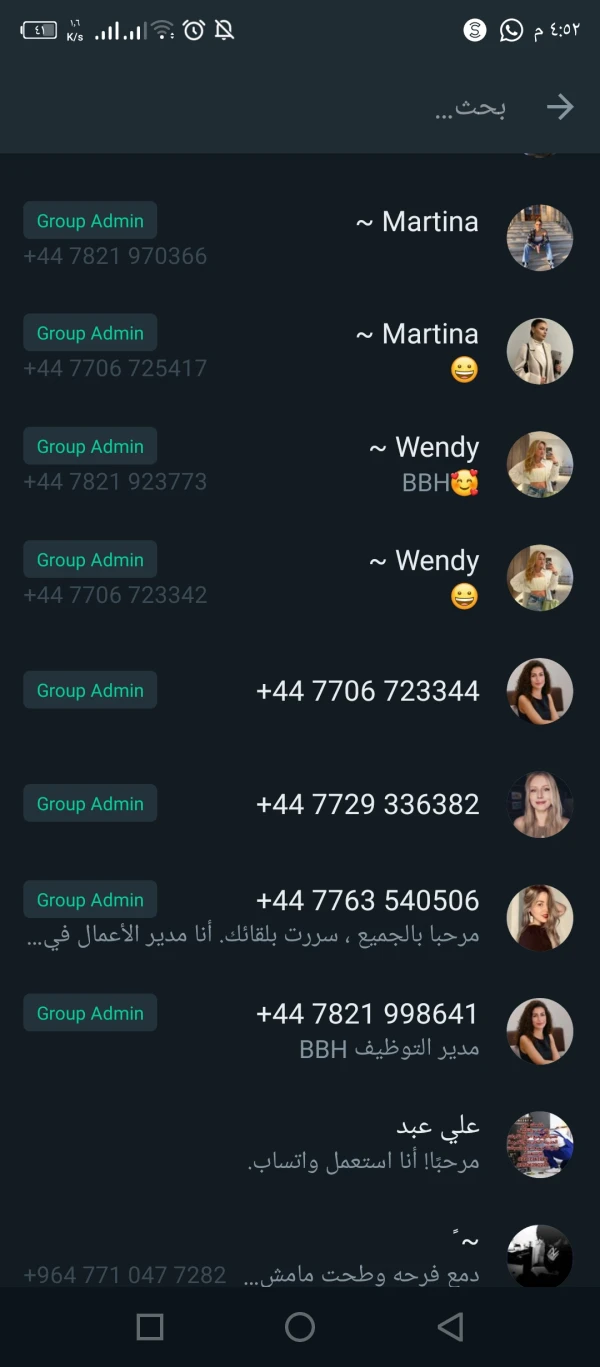

Seorang gadis Tiongkok bertemu dan menawarkan BBH Exchange ini sebagai investasi. Beberapa kali mereka mengizinkan saya menarik uang, kemudian penarikan tidak mungkin dilakukan. Mereka meminta saya membayar pajak sebesar 10% untuk penarikan. Hati-hati, mereka adalah penjahat pemeras dan penipu!

Paparan

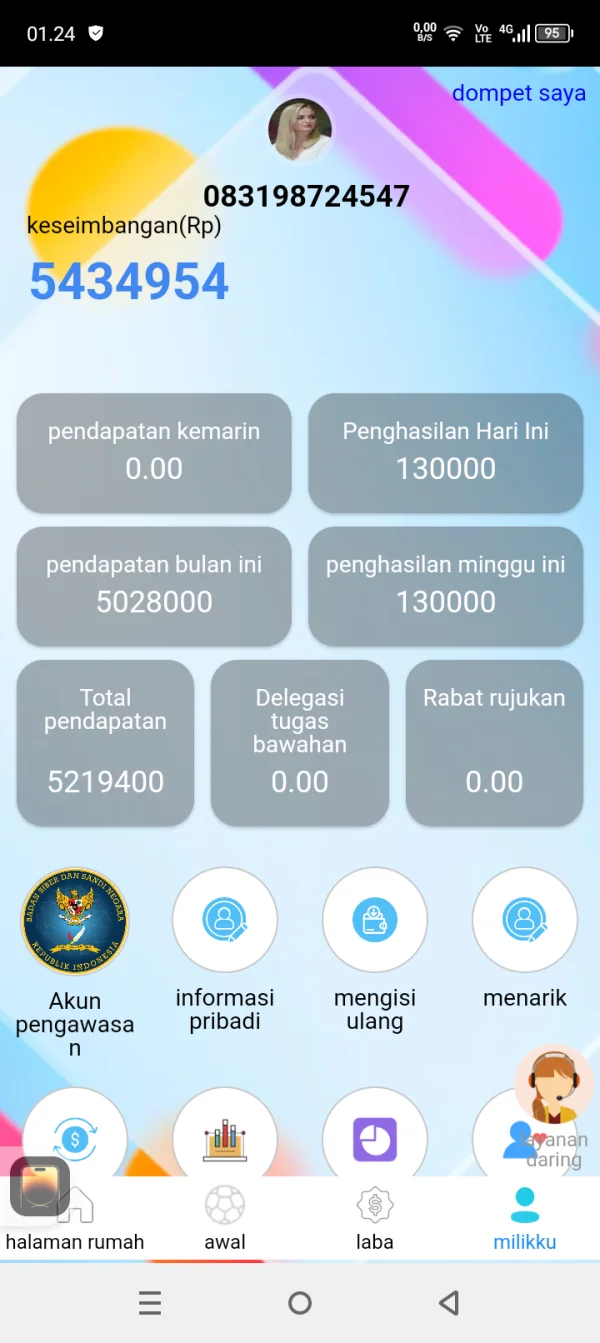

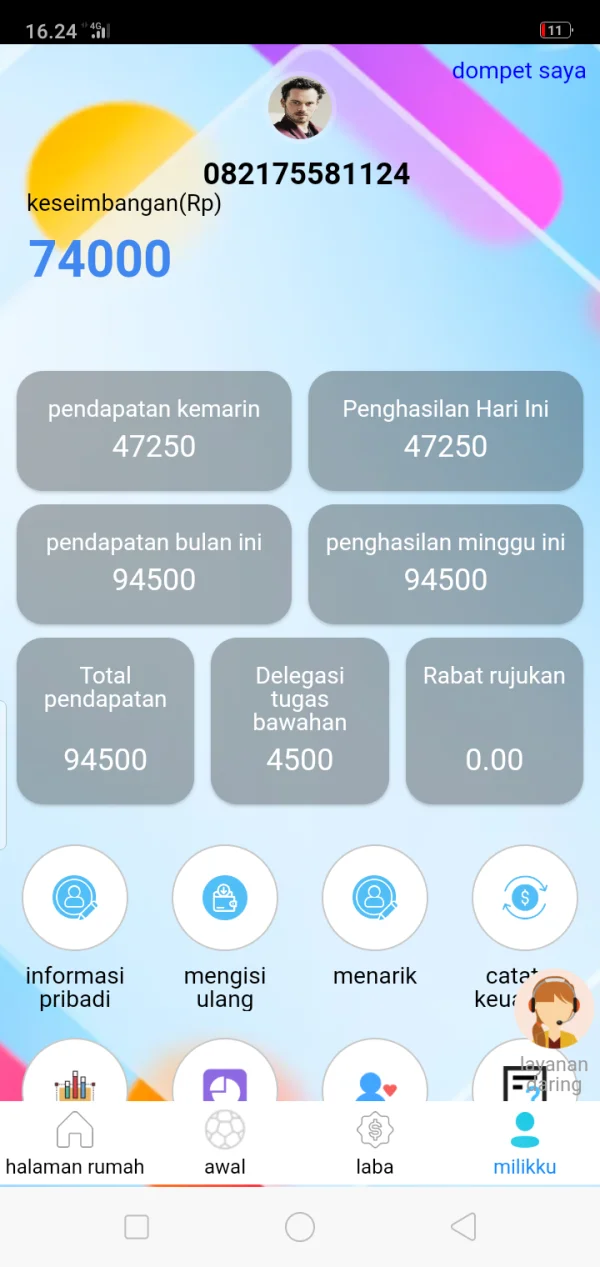

hendra164

Indonesia

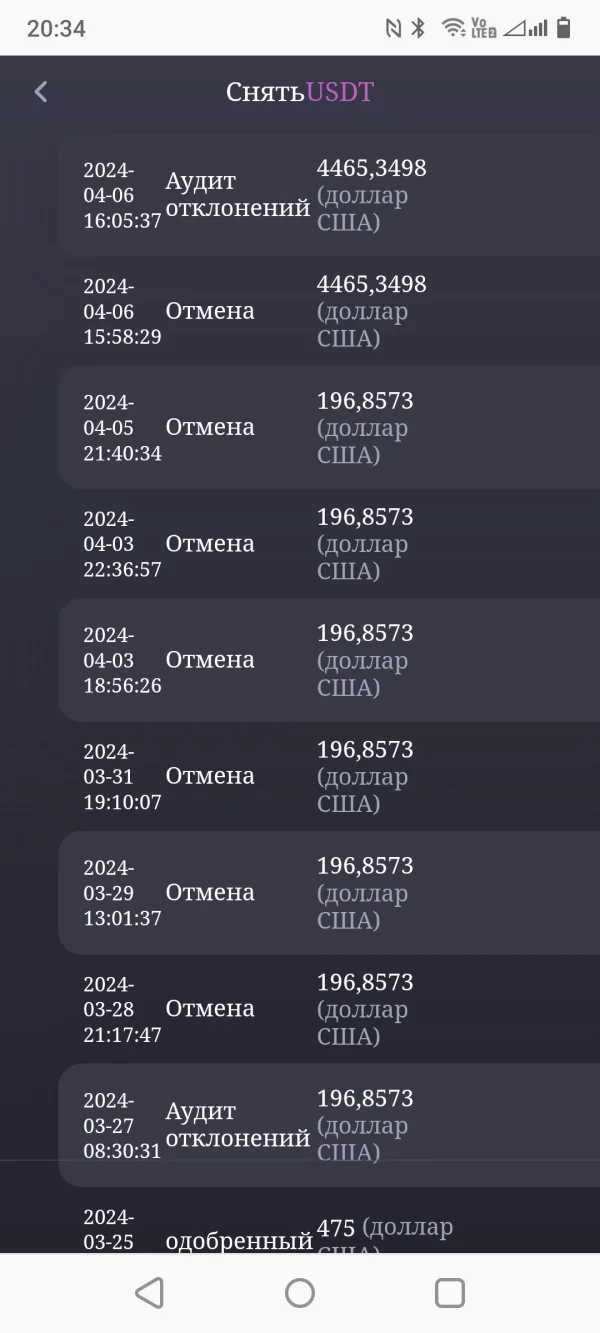

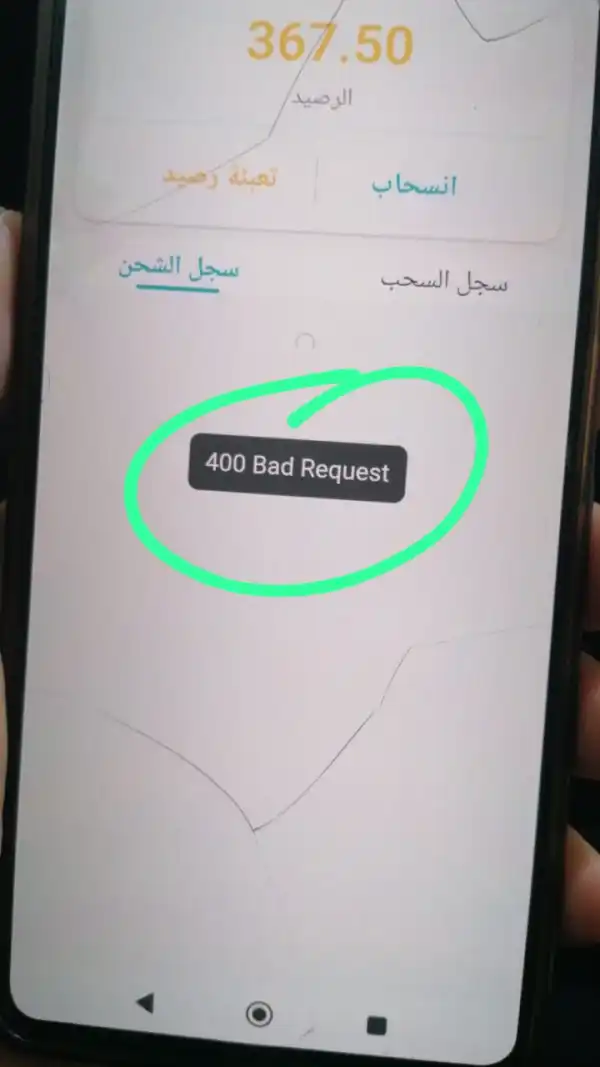

sudah melakukan penarikan,blm dicairkan

Paparan

indra518

Indonesia

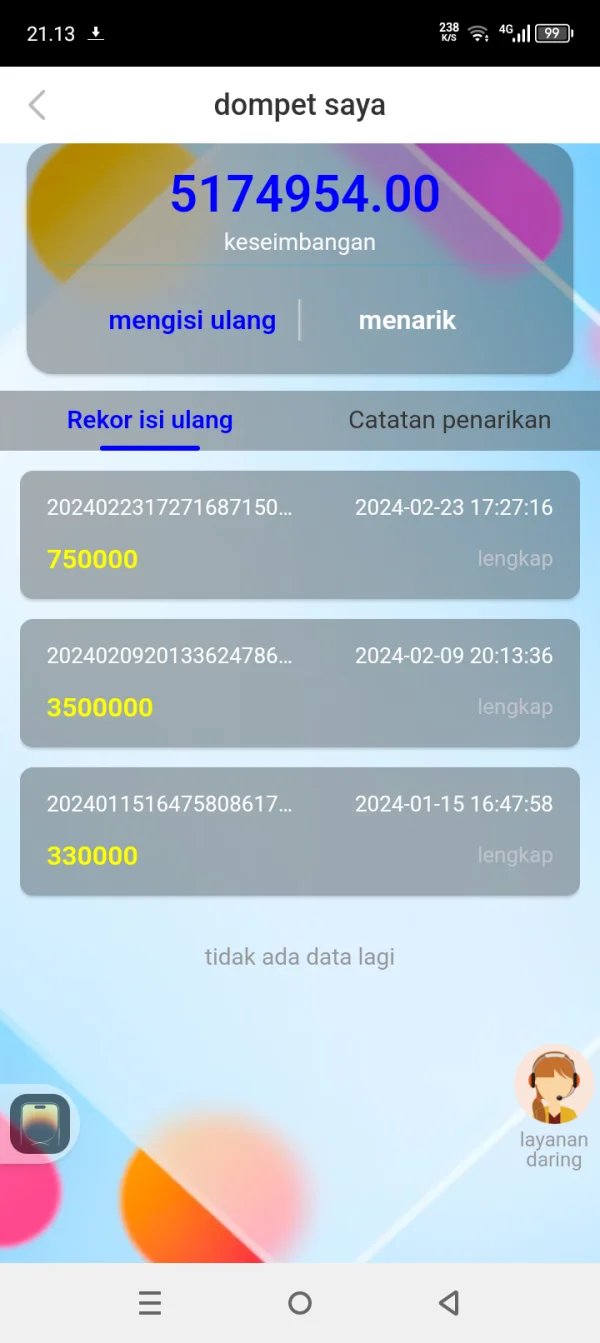

mereka telah mengosongkan saldo kami..harusnya saldo kami 2000000 menjadi 0 dan mereka menyuruh kami membayar pajak kami tidak dapat menarik dana sudah 2 Minggu,,,dia menyuruh membayar pajak ...sebesar 2juta untuk V2...padahal uang kami sudah kosong di dana keseimbangan...bagaimana kami bisa membayar pajak...

Paparan

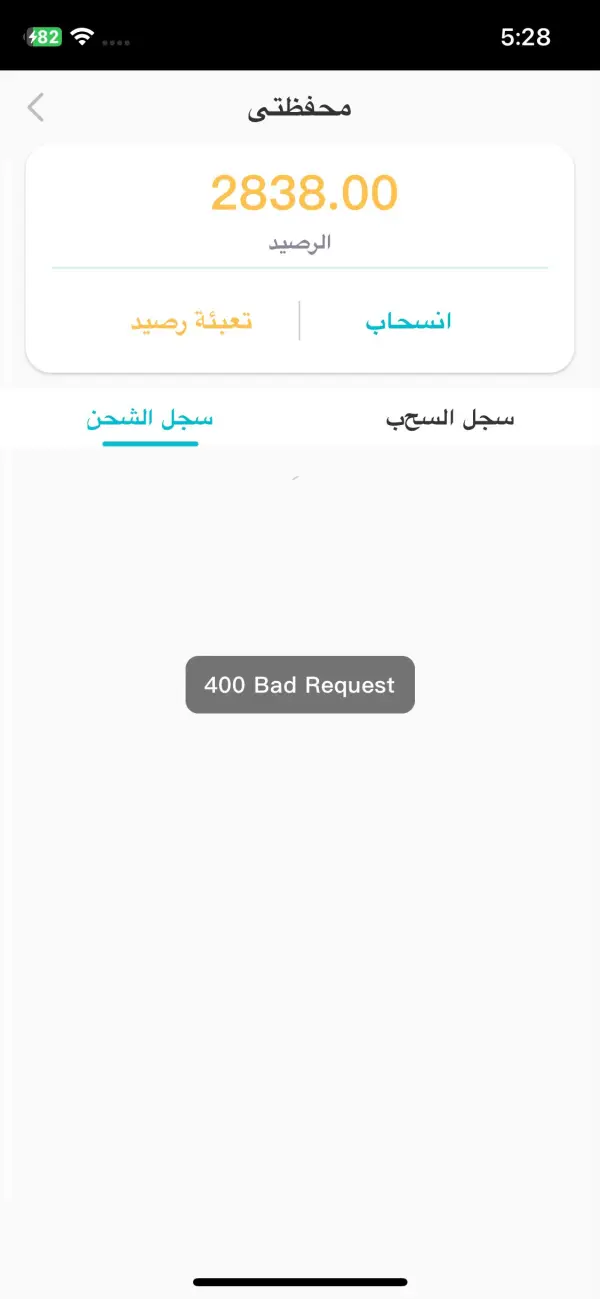

FX3147252051

Irak

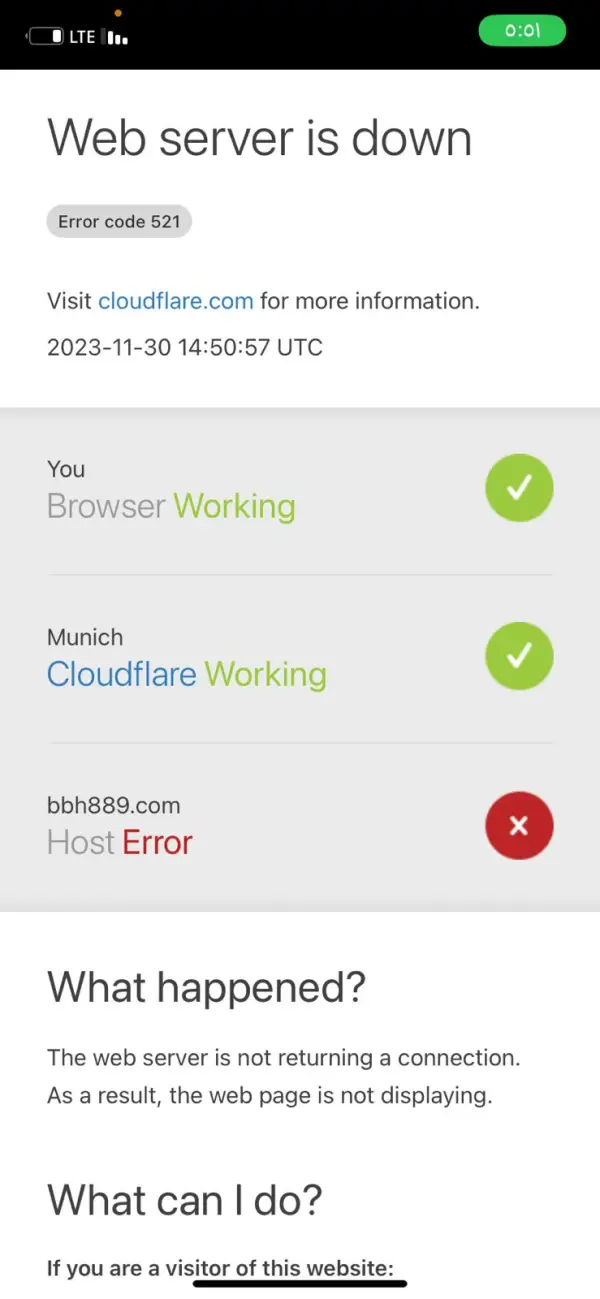

Mereka menutup program tersebut. Kami ditipu dengan sejumlah besar uang. Mereka berjanji kepada kami bahwa kami akan menerima keuntungannya setiap hari Kamis, namun mereka mengingkari janjinya.

Paparan

alfalahi

Irak

Mereka berjanji kepada orang-orang untuk menarik dana setiap hari Kamis, tetapi sekarang mereka telah menutup program tersebut dan broker tidak menanggapi pelanggan

Paparan