公司简介

| Dragon Capital 评论摘要 | |

| 成立时间 | 2006 |

| 注册国家/地区 | 塞浦路斯 |

| 监管 | CySEC |

| 产品与服务 | 投资服务、交易、投资建议、承销、托管、外汇、衍生品 |

| 模拟账户 | ❌ |

| 交易平台 | / |

| 最低存款 | / |

| 客户支持 | 电话:+357 25 376 300 |

| 传真:+357 25 376 301 | |

| 电子邮件:svitlana.rusakova@dragon-capital.com | |

Dragon Capital 信息

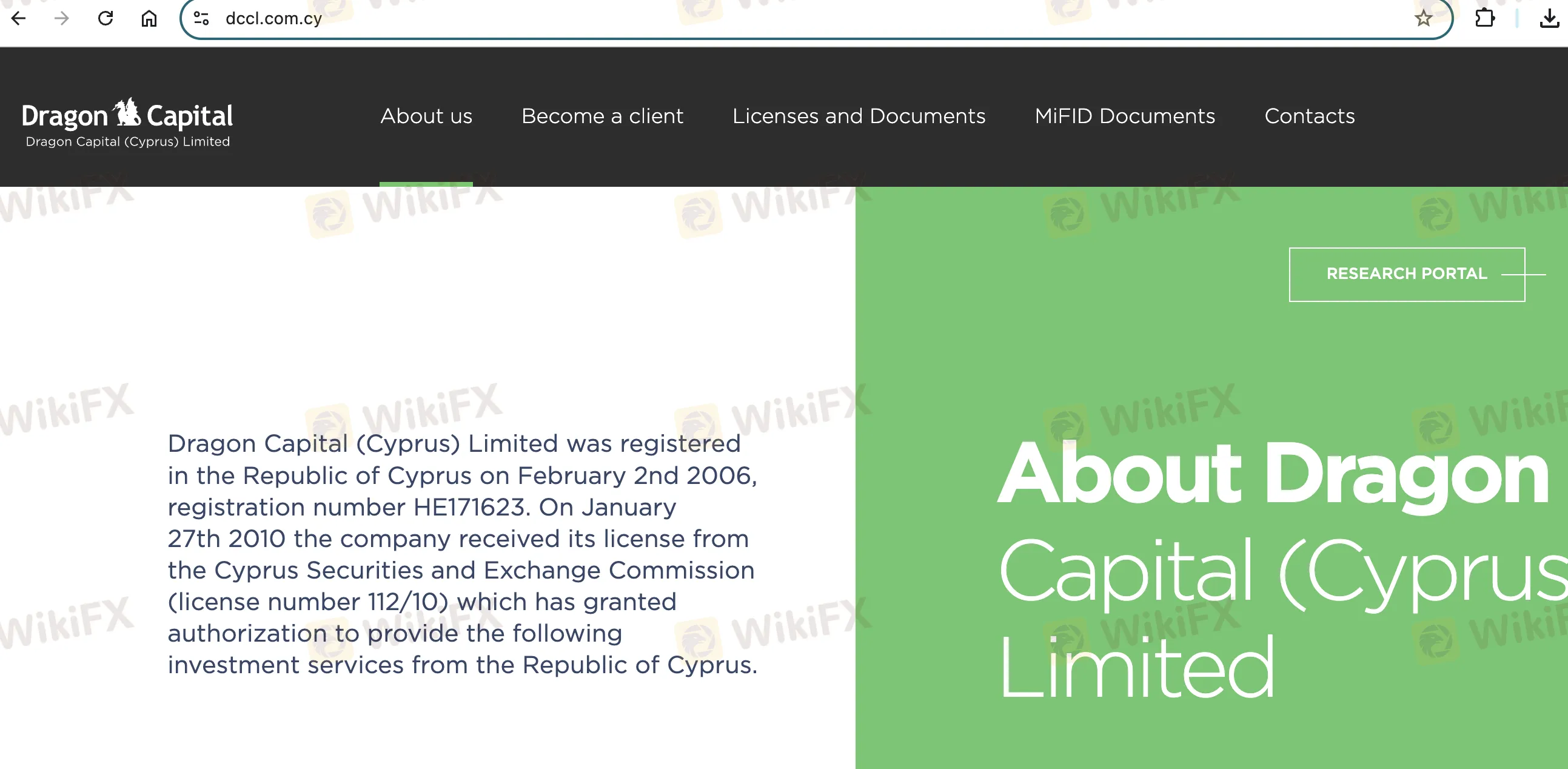

Dragon Capital(塞浦路斯)有限公司是一家成立于2006年的塞浦路斯持牌投资公司,受CySEC监管,监管许可证号为112/10。该公司提供一系列投资服务,包括订单执行、自营交易、托管和投资建议,适用于不同的金融工具。

优点和缺点

| 优点 | 缺点 |

| 受CySEC监管 | 部分手续费(如乌克兰债券服务)高于国际同行 |

| 提供广泛的金融工具和服务 | 无演示账户 |

| 全面的投资和托管解决方案 | 无平台细节 |

Dragon Capital 是否合法?

Dragon Capital(塞浦路斯)有限公司是一家持有塞浦路斯证券交易委员会(CySEC)颁发的许可证号112/10的持牌和受监管实体,作为做市商(MM)运营。

产品与服务

Dragon Capital(塞浦路斯)有限公司提供一系列全面的投资和相关服务,如执行订单、自营交易、提供投资建议、承销和托管服务。这些服务涵盖了各种金融工具,包括股票、衍生品和货币市场工具。

| 产品 & 服务 | 支持 |

| 证券(股票、债券) | ✔ |

| 衍生品 & 差价合约 | ✔ |

| 投资建议 | ✔ |

| 承销 & 配售 | ✔ |

| 托管服务 | ✔ |

| 保证金 & 信贷服务 | ✔ |

| 外汇(与投资相关联) | ✔ |

| 投资研究 | ✔ |

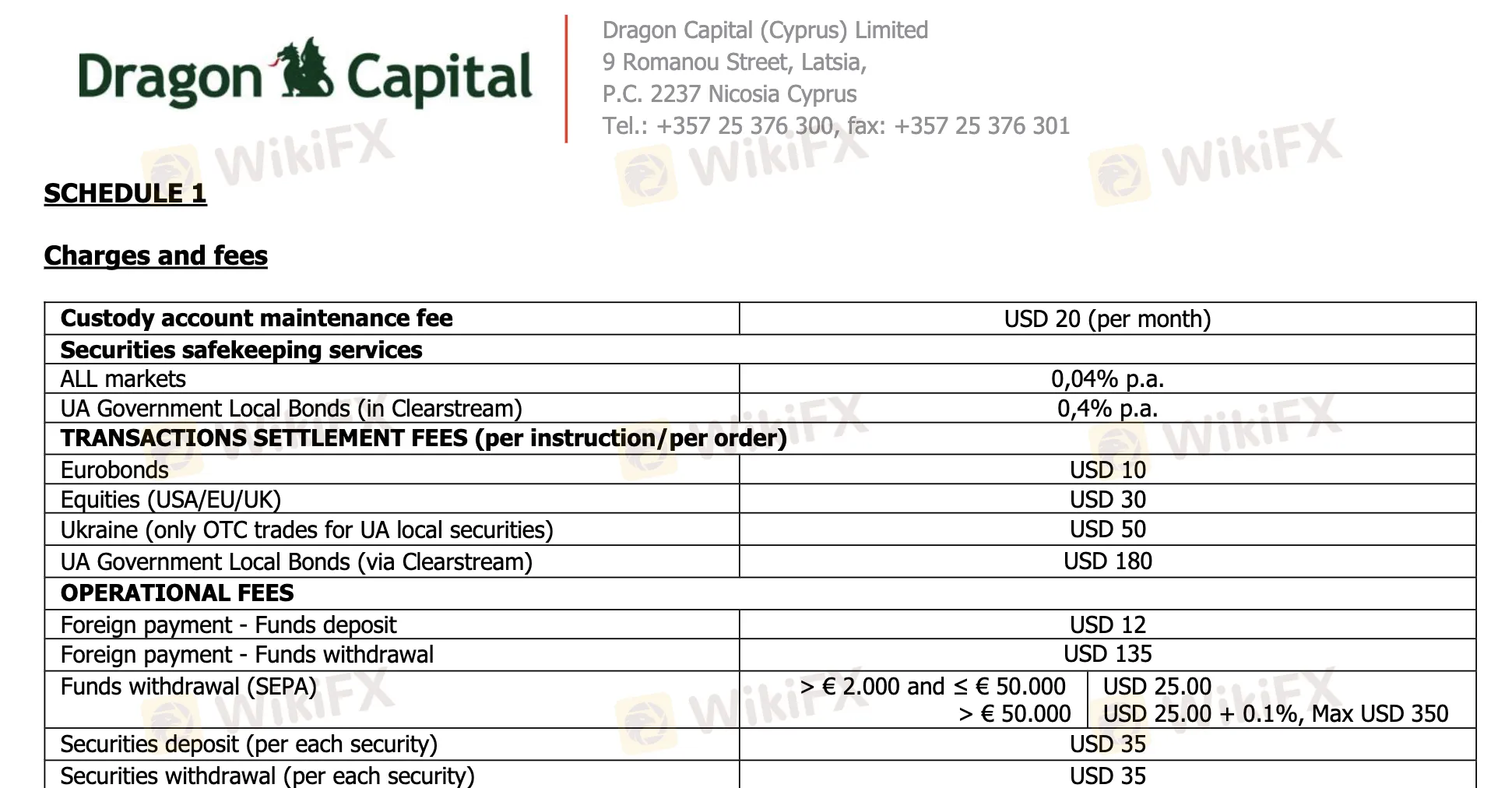

Dragon Capital 费用

Dragon Capital的手续费基本上与其他国际投资公司的相符。但对于一些专业服务,如乌克兰本地债券、公司行动和外汇提取,可能会有更多费用。

| 费用类型 | 金额 |

| 托管账户维护 | 每月20美元 |

| 证券保管(所有市场) | 年费0.04% |

| 乌克兰政府本地债券(Clearstream) | 年费0.4% |

| 欧元债券结算 | 每笔订单10美元 |

| 股票(美国/欧盟/英国)结算 | 每笔订单30美元 |

| 乌克兰本地证券(场外交易)结算 | 每笔订单50美元 |

| 乌克兰政府债券(Clearstream)结算 | 每笔订单180美元 |

非交易费用

| 非交易费用 | 金额 |

| 外汇支付(存款) | 12美元 |

| 外汇支付(提取) | 135美元 |

| SEPA提取 > €2,000–50,000 | 25美元 |

| SEPA提取 > €50,000 | 25美元 + 0.1%(最高350美元) |

| 证券存取款 | 每笔35美元 |

| 股息收入收取(仅限乌克兰) | 0.2%(最低15美元,最高300美元) |

| 股息收入入账(仅限乌克兰) | 20美元 |

| 全权代理投票 | 100–200美元 + 外部成本 |

| 回购(乌克兰本地) | 100美元 + 外部成本 |

| 外汇操作欧洲银行 | 0.1%(最低20美元) |

| 外汇操作乌克兰银行 | 0.2%(最低40美元) |

| DR转换、审计请求等 | 20–100美元 + 第三方手续费 |