公司簡介

| BBH 檢討摘要 | |

| 成立年份 | 1995 |

| 註冊國家/地區 | 美國 |

| 監管 | SFC(受監管),FCA(超額) |

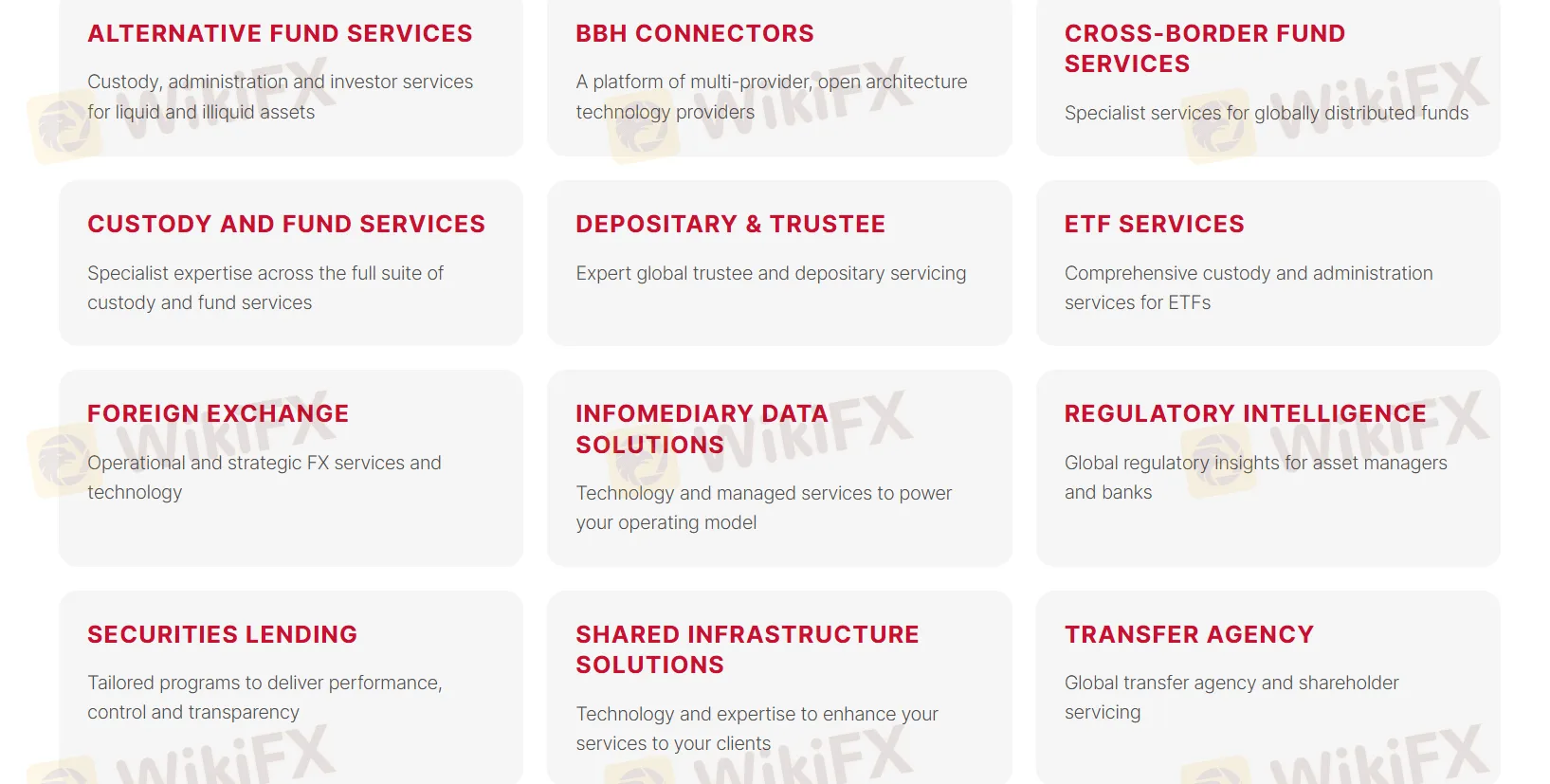

| 服務 | 替代基金服務,BBH 連接器,跨境基金服務,托管和基金服務,保管人和受託人,ETF 服務,外匯,監管情報,證券借貸,共享基礎設施解決方案,轉讓機構 |

| 客戶支援 | 電郵:contactus@bbh.com |

| LinkedIn/Facebook/Twitter | |

BBH 資訊

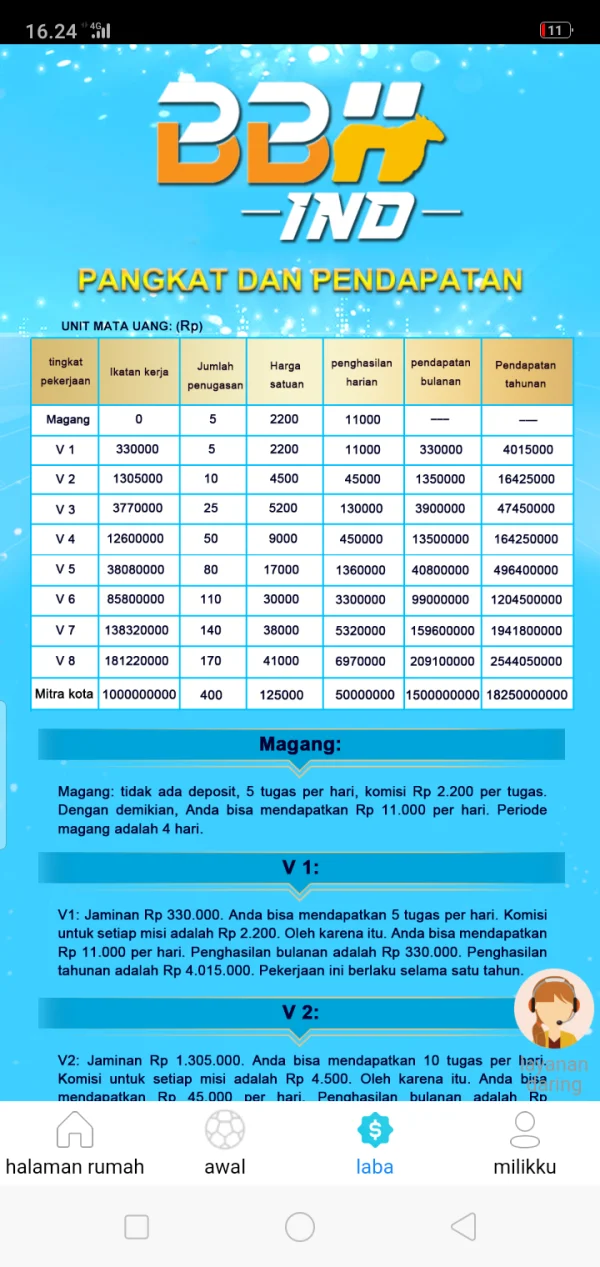

BBH 是一家在美國註冊的經紀商,擁有 30 年的歷史,提供多元化的金融服務。由於其超額地位,BBH 仍然存在風險。

優缺點

| 優點 | 缺點 |

| 自 1995 年以來的悠久運營歷史 | 沒有全天候客戶支援 |

| 受 SFC 監管 | 沒有特定的轉帳方式 |

| 多元化的金融服務 | 超額 FCA 牌照 |

BBH 是否合法?

| 監管國家 | 當前狀態 | 監管機構 | 受監管實體 | 牌照類型 | 牌照號碼 |

| 中國(香港) | 受監管 | 香港證券及期貨事務監察委員會(SFC) | BROWN BROTHERS HARRIMAN(HONG KONG)LIMITED | 槓桿外匯交易 | AAF778 |

| 英國 | 超額 | 金融行為監管局(FCA) | Brown Brothers Harriman Investor Services Ltd | 投資諮詢牌照 | 190266 |

BBH 服務

BBH 提供多元化的服務,包括:

替代基金服務: 對於流動性和非流動性資產的托管、管理和投資者服務。

BBH 連接器: 多供應商、開放式架構技術提供者平台。

跨境基金服務: 為全球分佈基金提供專業服務。

托管和基金服務: 在托管和基金服務的完整套件上具有專業知識。

保管人和受託人: 專業的全球受託人和托管服務。

ETF 服務: 為 ETF 提供全面的托管和管理服務。

外匯: 操作和戰略性外匯服務和技術。

監管情報: 為資產管理公司和銀行提供全球監管見解。

證券借貸: 量身定制的計劃,以提供表現、控制和透明度。

Shared Infrastructure Solutions: 科技和專業知識,以提升您向客戶提供的服務。

Transfer Agency: 全球轉讓機構和股東服務。

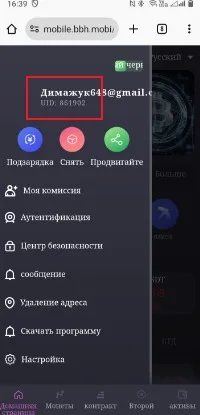

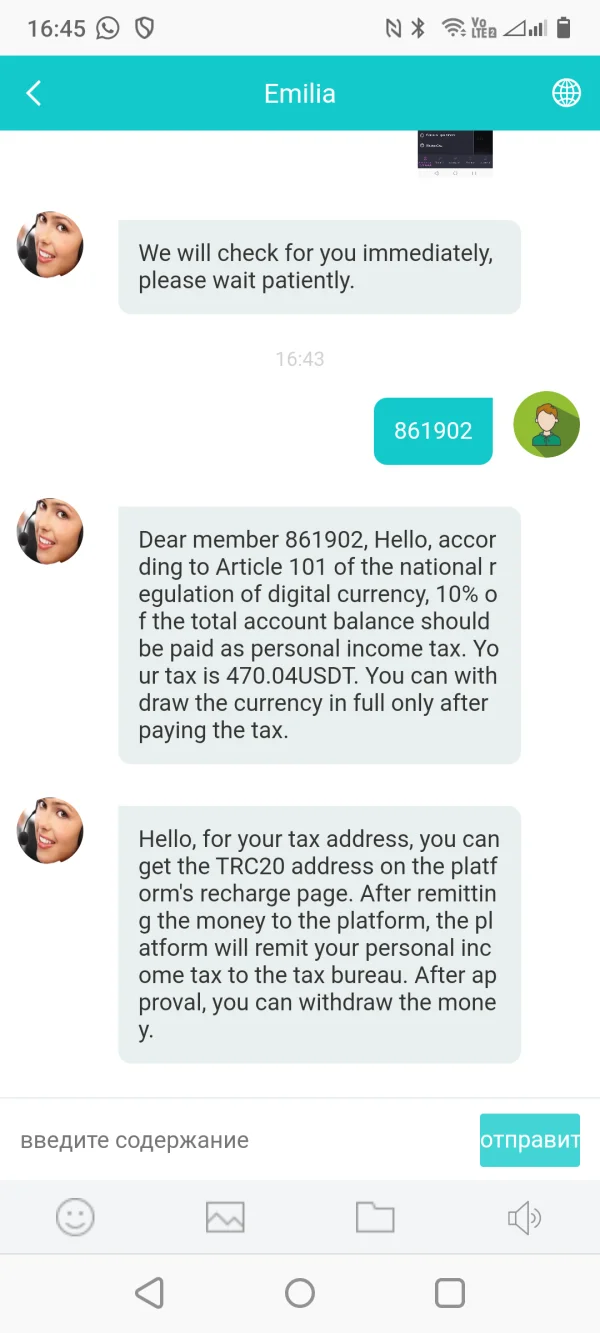

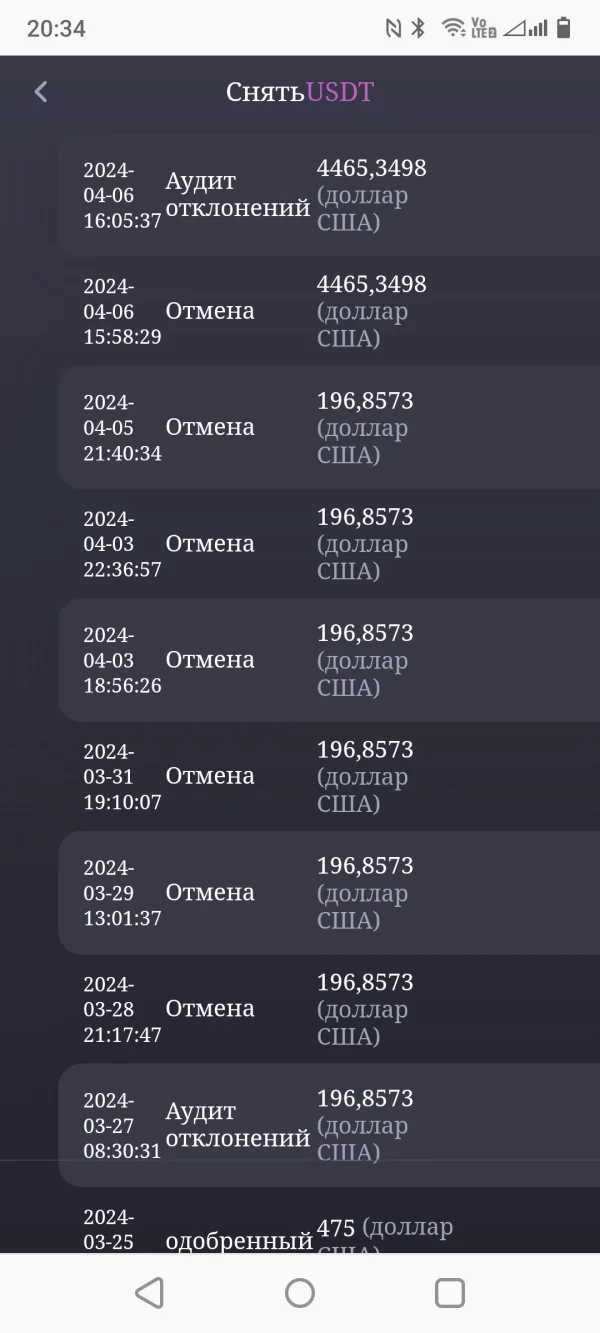

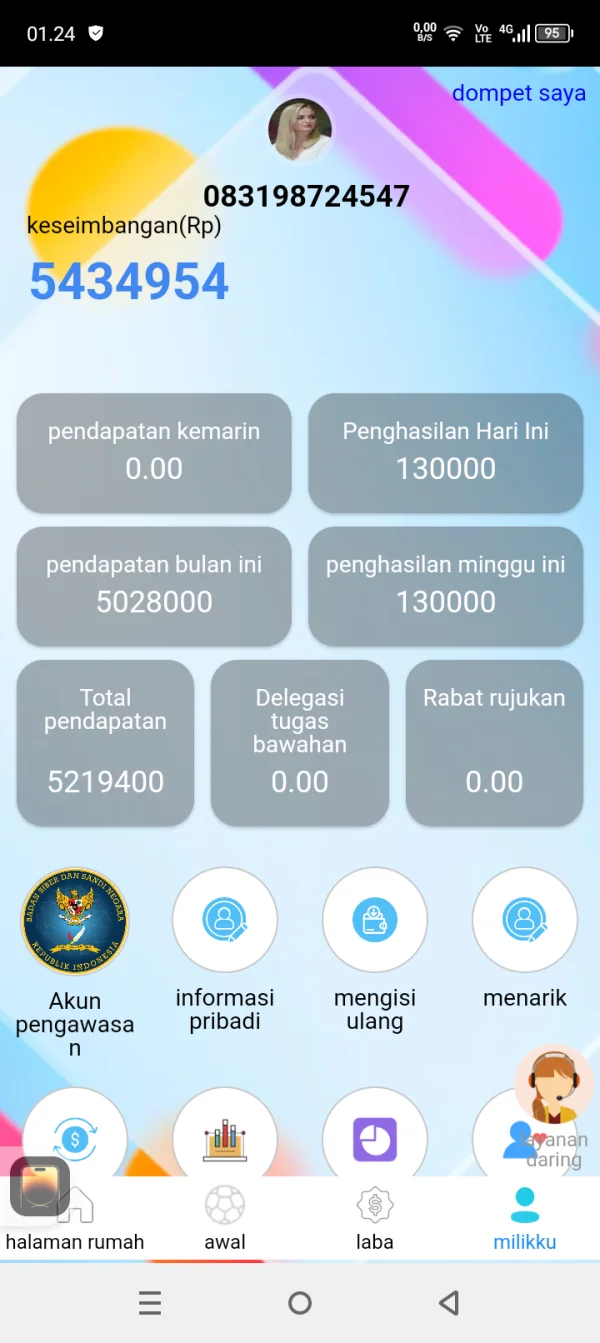

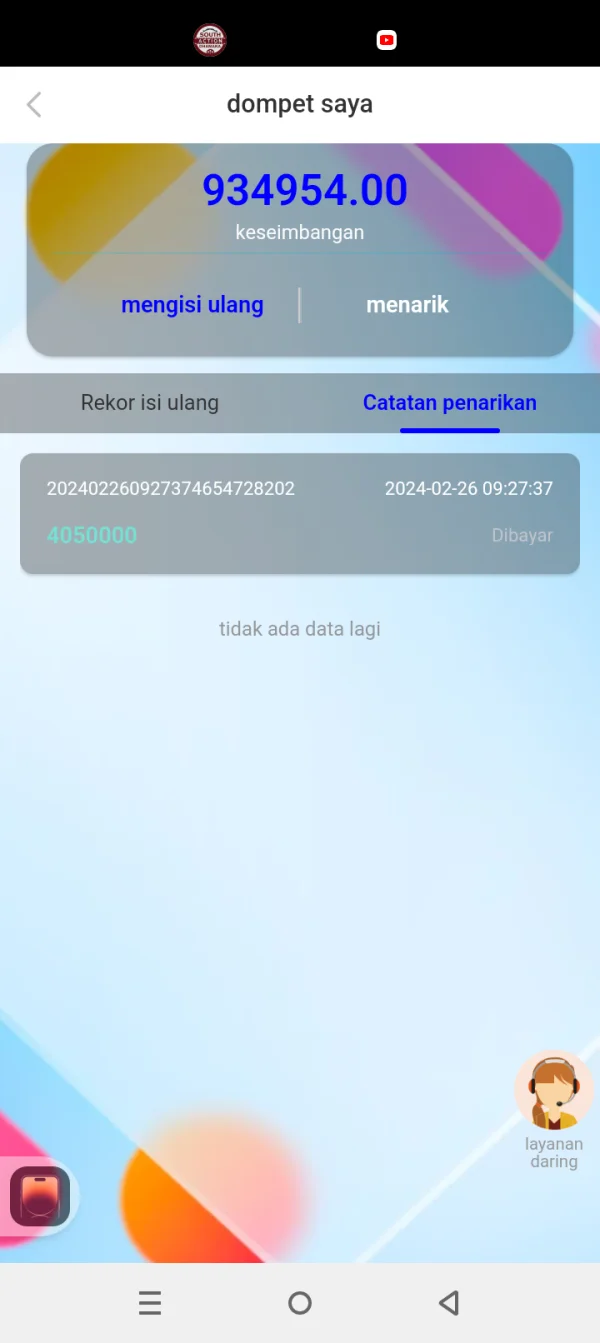

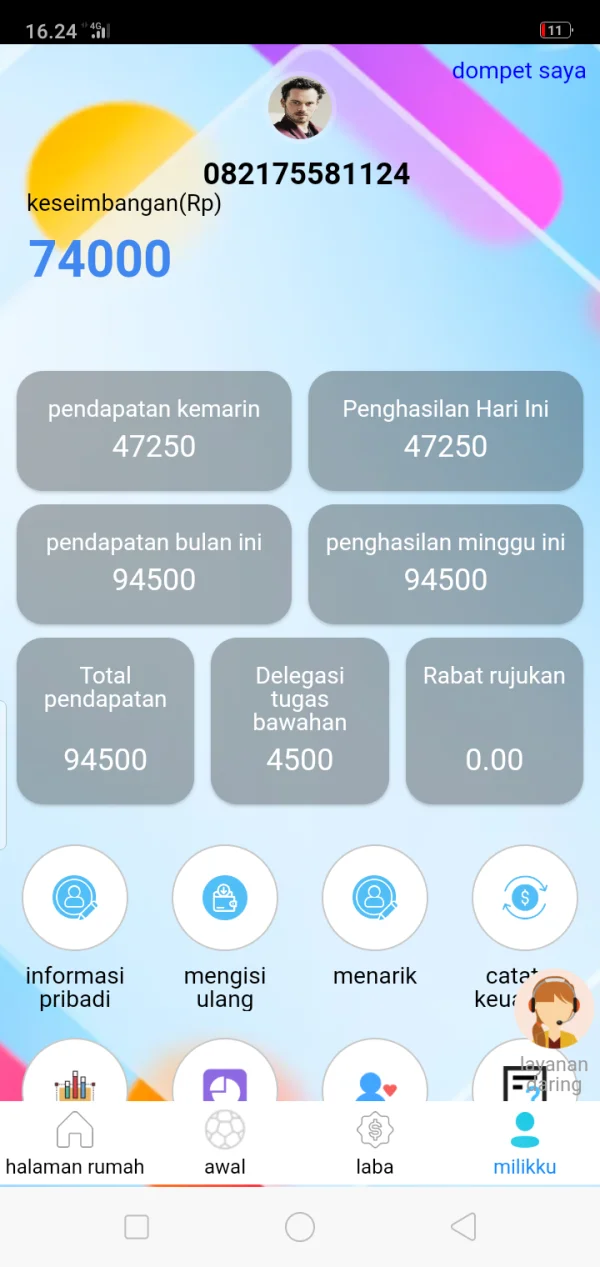

FX3413326667

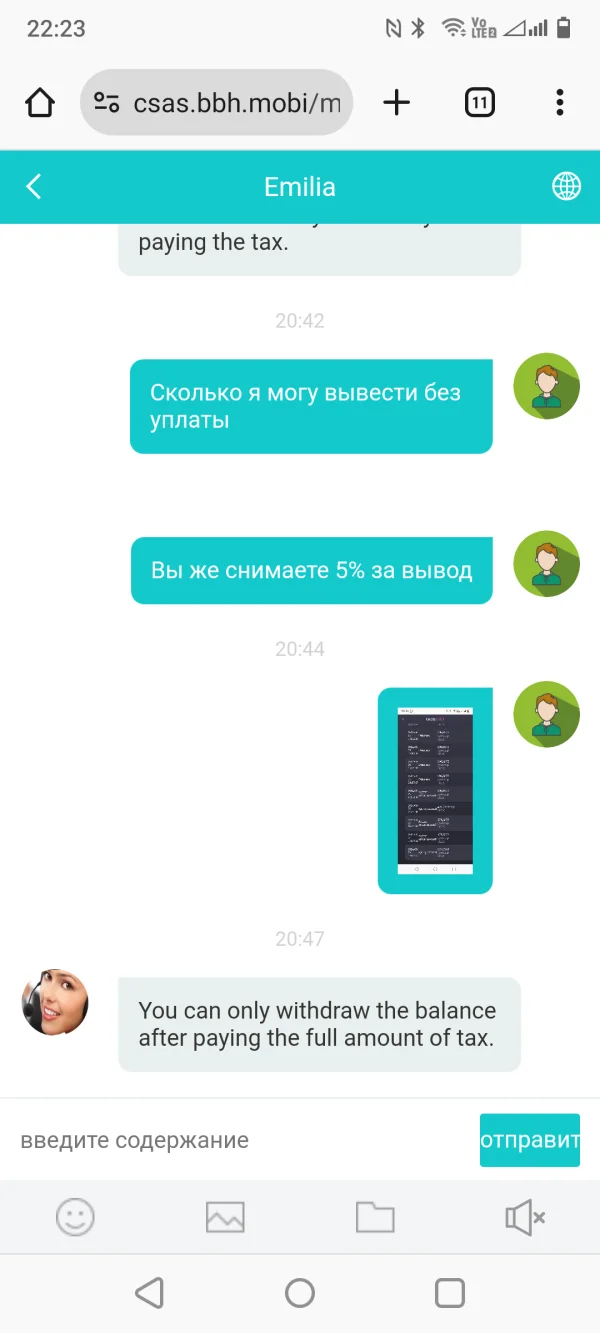

俄羅斯

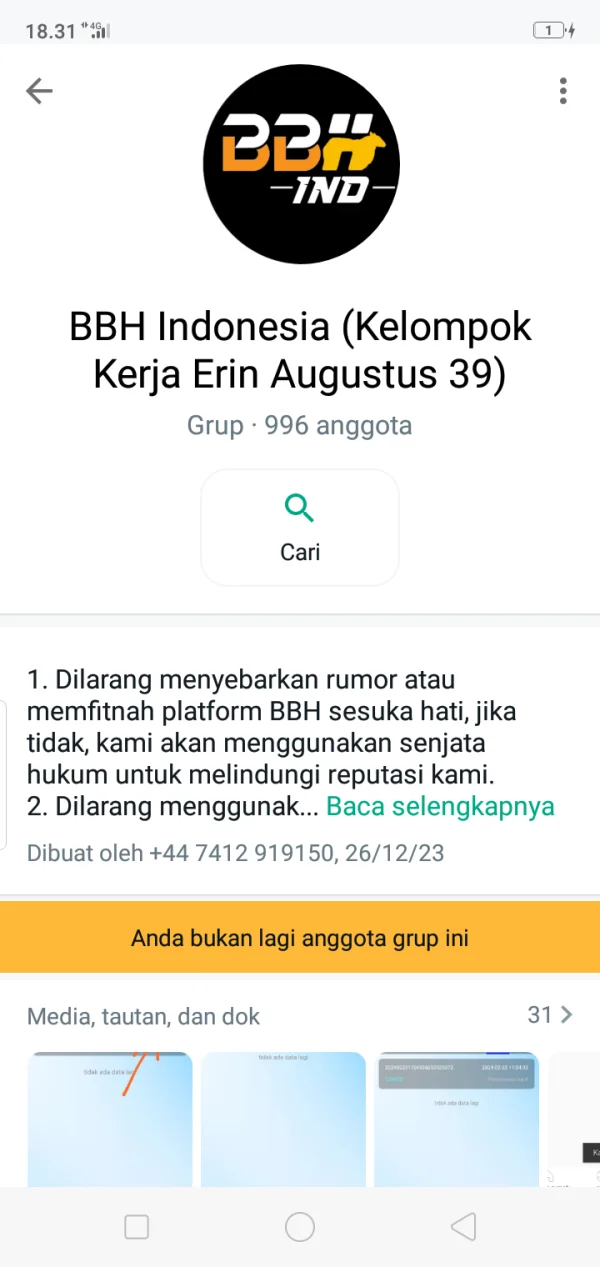

一位中國女孩遇見並提供了這個 BBH 交換作為投資。有幾次他們允許我提款,然後就無法提款了,他們要求我支付10%的提款稅。小心,他們是勒索者和騙子!

爆料

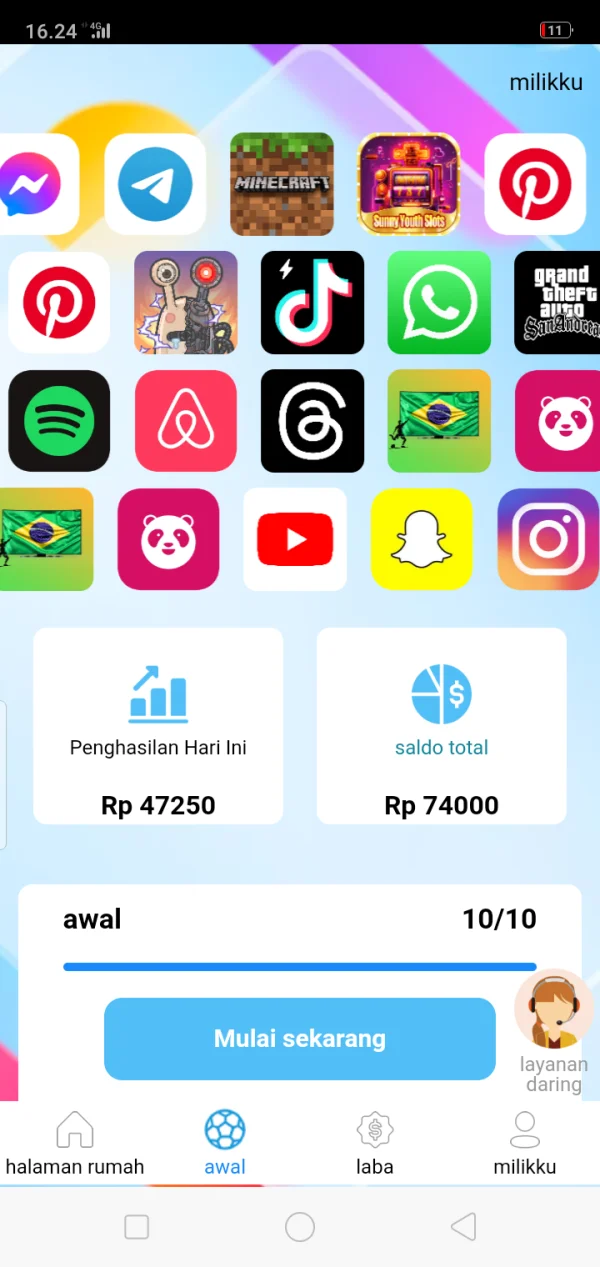

hendra164

印尼

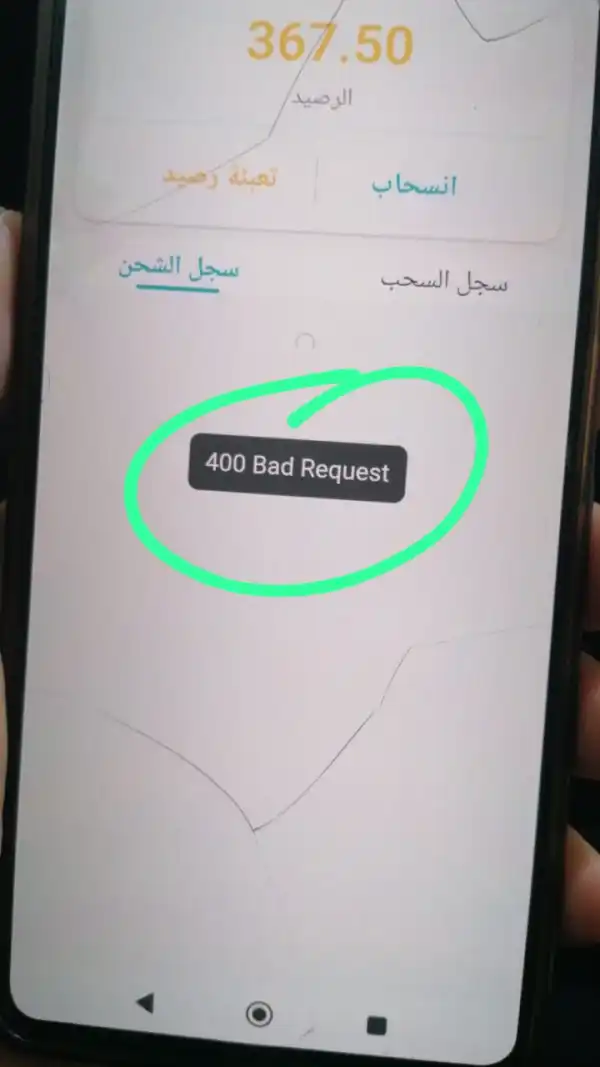

我已提款,尚未提現

爆料

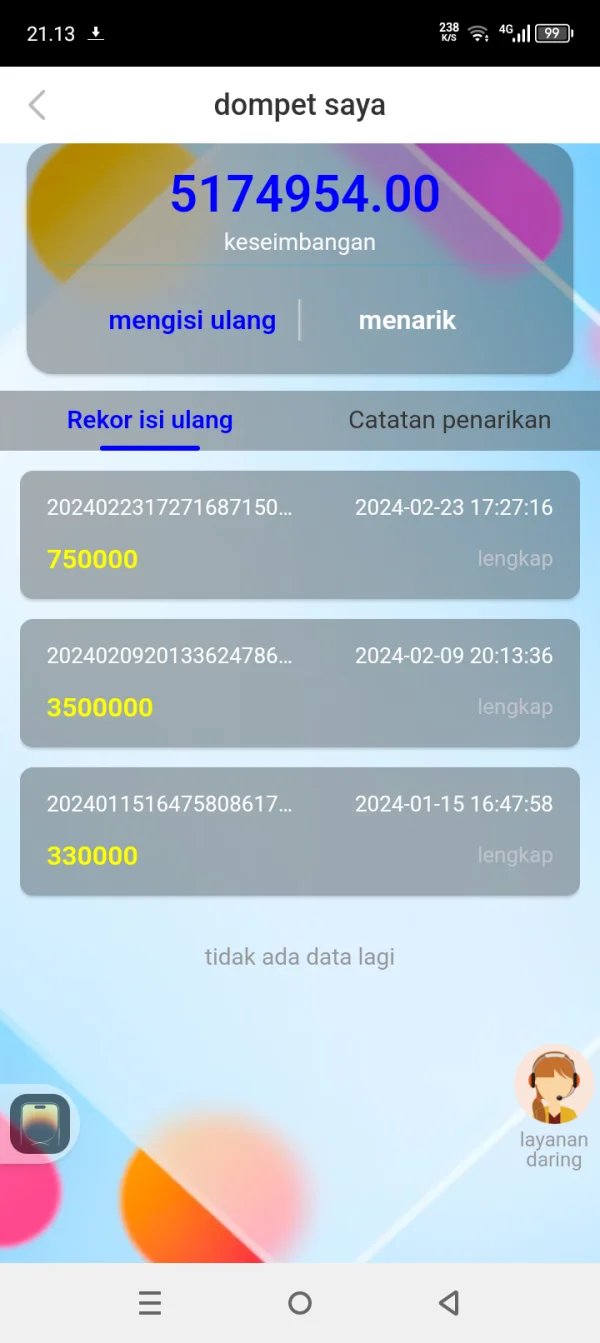

indra518

印尼

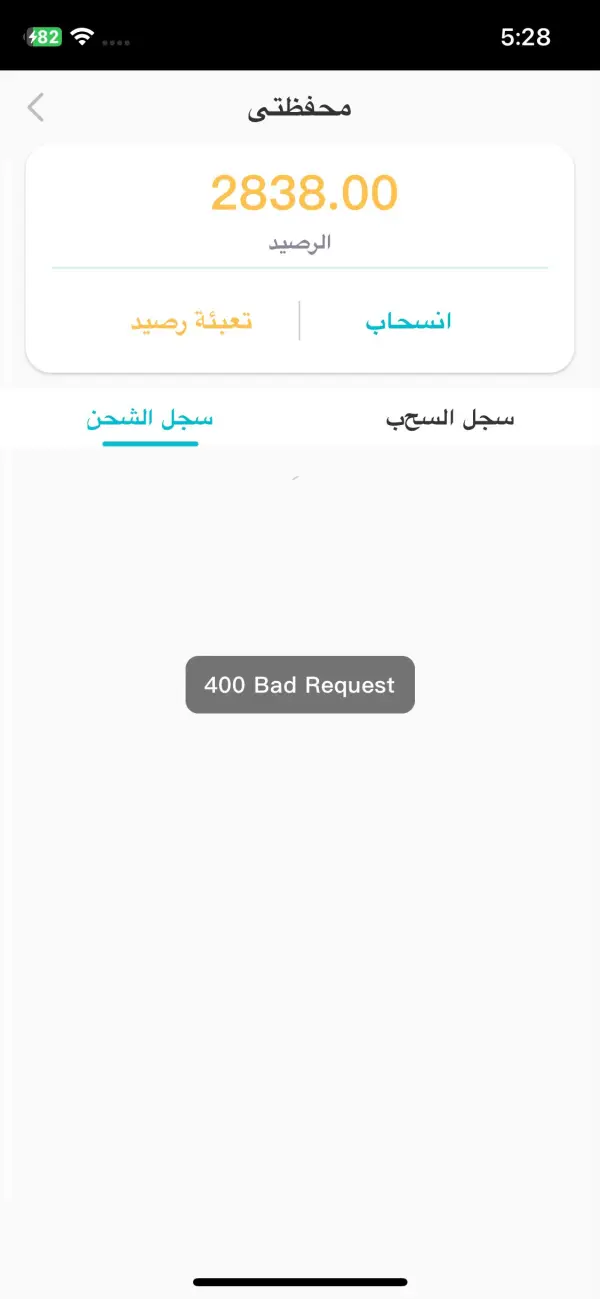

他們清空了我們的餘額..我們的餘額應該是 2000000 到 0,他們告訴我們要納稅

爆料

FX3147252051

伊拉克

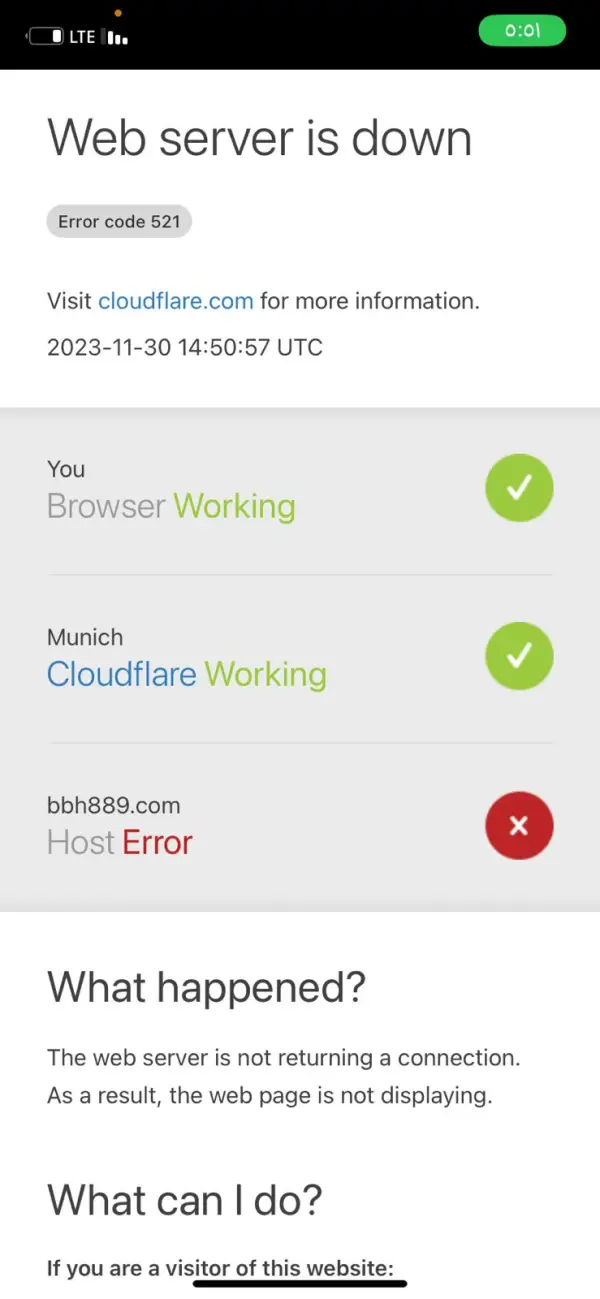

他們關閉了專案。我們被騙了一大筆錢。他們承諾每週四我們會收到利潤,但他們沒有回應。

爆料

alfalahi

伊拉克

他們承諾人們每週四抽獎,但現在他們已經關閉了該計劃,經紀人也沒有回應訂閱者

爆料