Buod ng kumpanya

| BBH Buod ng Pagsusuri | |

| Itinatag | 1995 |

| Rehistradong Bansa/Rehiyon | Estados Unidos |

| Regulasyon | SFC (regulated), FCA (exceeded) |

| Mga Serbisyo | Alternative fund services, BBH Connectors, Cross-Border Fund Services, Custody and Fund Services, Depositary & Trustee, ETF Services, Foreign Exchange, Regulatory Intelligence, Securities Lending, Shared Infrastructure Solutions, Transfer Agency |

| Suporta sa Customer | Email: contactus@bbh.com |

| LinkedIn/Facebook/Twitter | |

Impormasyon Tungkol sa BBH

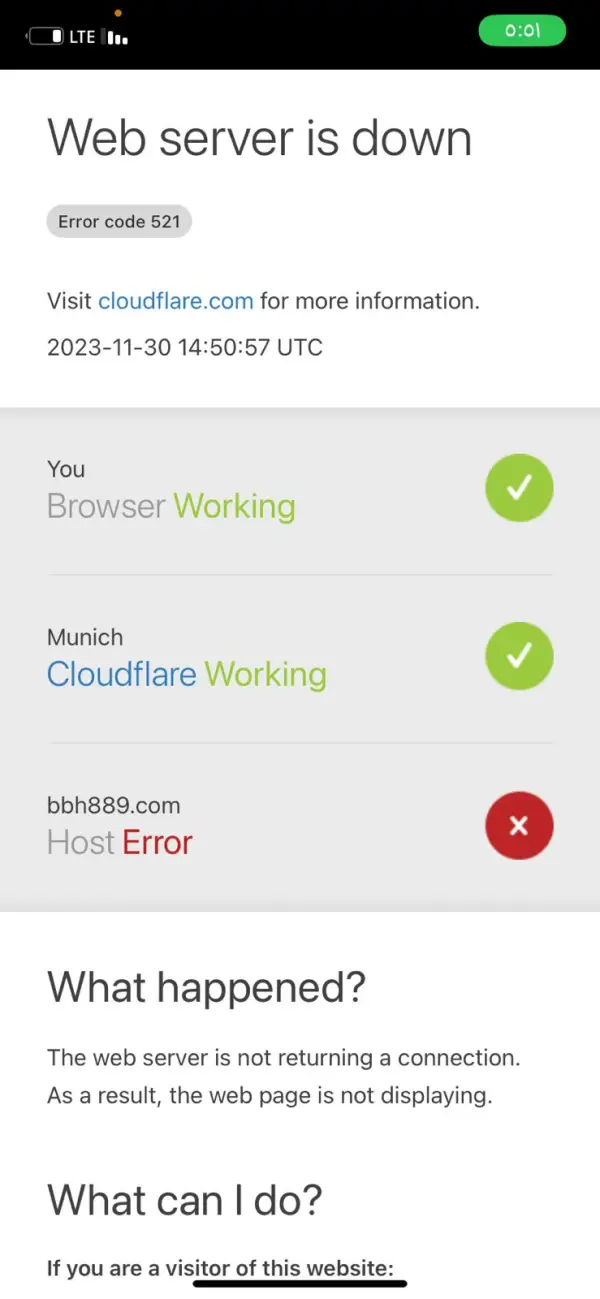

BBH ay isang broker na rehistrado sa Estados Unidos na may 30 taon nang kasaysayan, na nag-aalok ng iba't ibang uri ng mga serbisyong pinansiyal. Ang BBH ay patuloy pa ring may panganib dahil sa kanyang exceeded status.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Mahabang kasaysayan ng operasyon mula 1995 | Walang 24/7 suporta sa customer |

| Regulado ng SFC | Walang partikular na paraan ng paglipat |

| Iba't ibang mga serbisyong pinansiyal | Exceeded FCA lisensya |

Tunay ba ang BBH?

| Reguladong Bansa | Kasalukuyang Kalagayan | Otoridad na Nagreregula | Regulated Entity | Uri ng Lisensya | Numero ng Lisensya |

| China (Hong Kong) | Regulated | Securities and Futures Commission of Hong Kong (SFC) | BROWN BROTHERS HARRIMAN (HONG KONG) LIMITED | Leveraged foreign exchange trading | AAF778 |

| United Kingdom | Exceeded | Financial Conduct Authority (FCA) | Brown Brothers Harriman Investor Services Ltd | Investment Advisory License | 190266 |

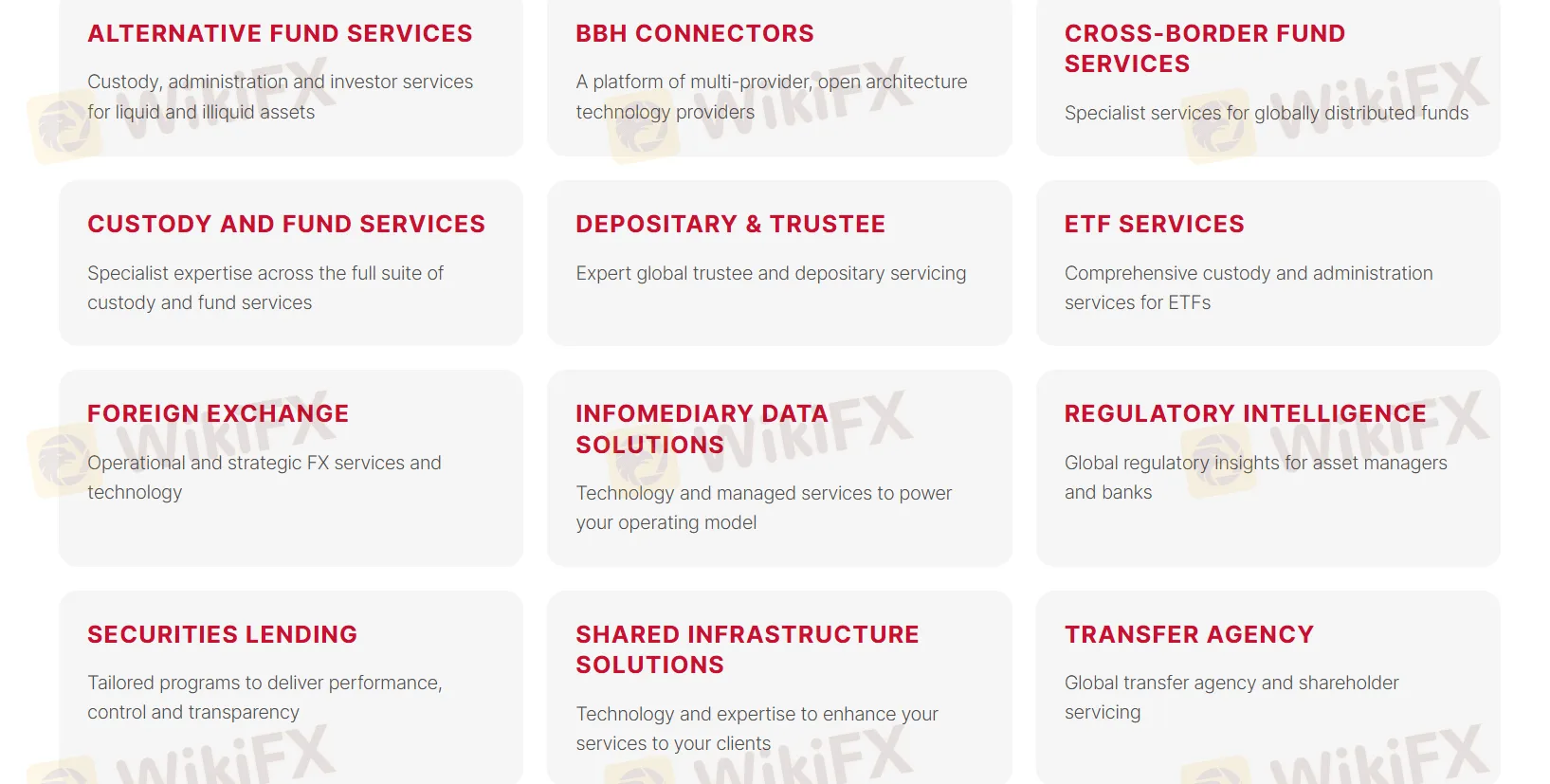

Mga Serbisyo ng BBH

BBH ay nag-aalok ng iba't ibang mga serbisyo, kabilang ang:

Alternative fund services: Custody, administration, at investor services para sa liquid at illiquid assets.

BBH Connectors: Isang plataporma ng mga multi-provider, open architecture technology providers.

Cross-Border Fund Services: Espesyalistang serbisyo para sa globally distributed funds.

Custody and Fund Services: Espesyalistang kasanayan sa buong suite ng custody at fund services.

Depositary & Trustee: Eksperto sa global trustee at depositary servicing.

ETF Services: Komprehensibong custody at administration services para sa ETFs.

Foreign Exchange: Operational at strategic FX services at teknolohiya.

Regulatory Intelligence: Global regulatory insights para sa asset managers at mga bangko.

Securities Lending: Mga programang hinulma upang magbigay ng performance, control, at transparency.

Mga Solusyon sa Infrastuktura na Nakabahagi: Teknolohiya at kasanayan upang mapabuti ang iyong mga serbisyo sa iyong mga kliyente.

Ahensya ng Paglilipat: Pang-global na ahensya ng paglilipat at paglilingkod sa mga shareholder.

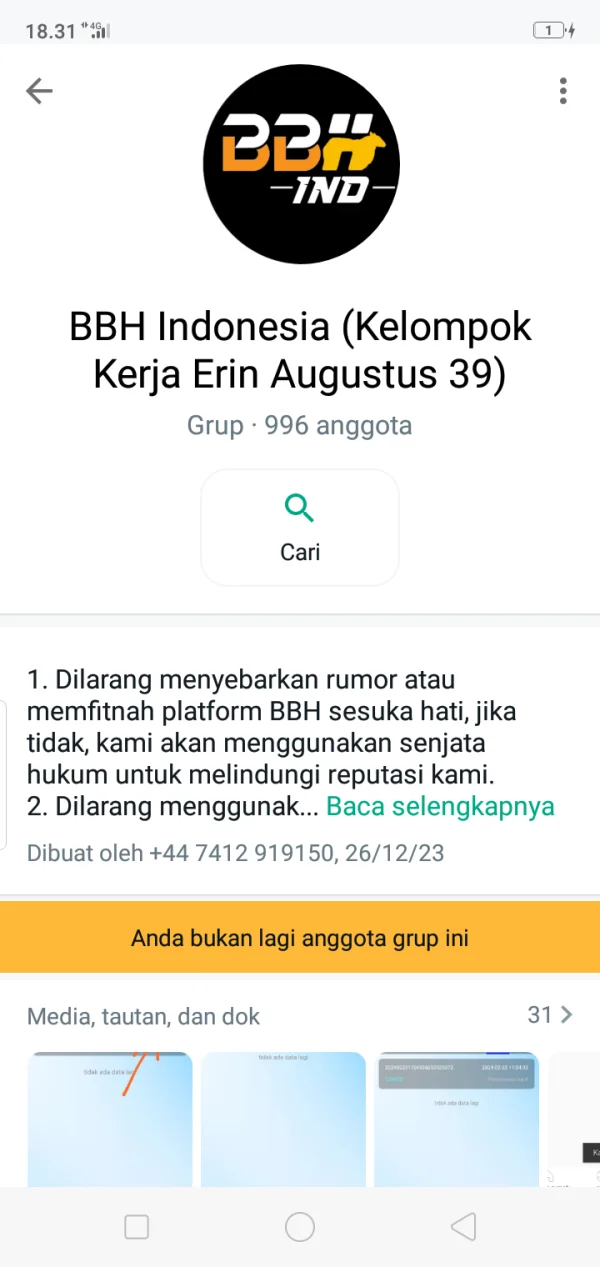

FX3413326667

Russia

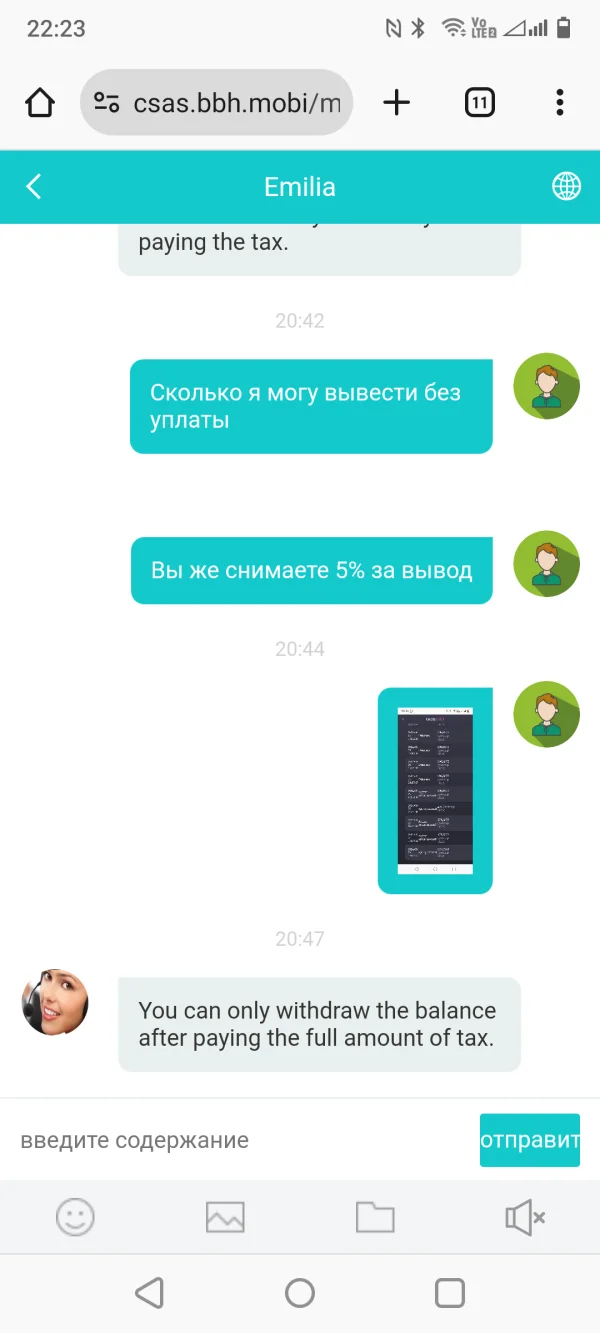

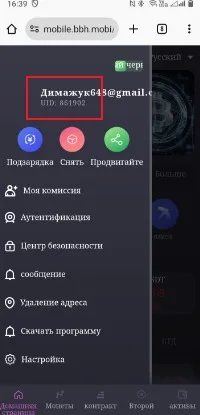

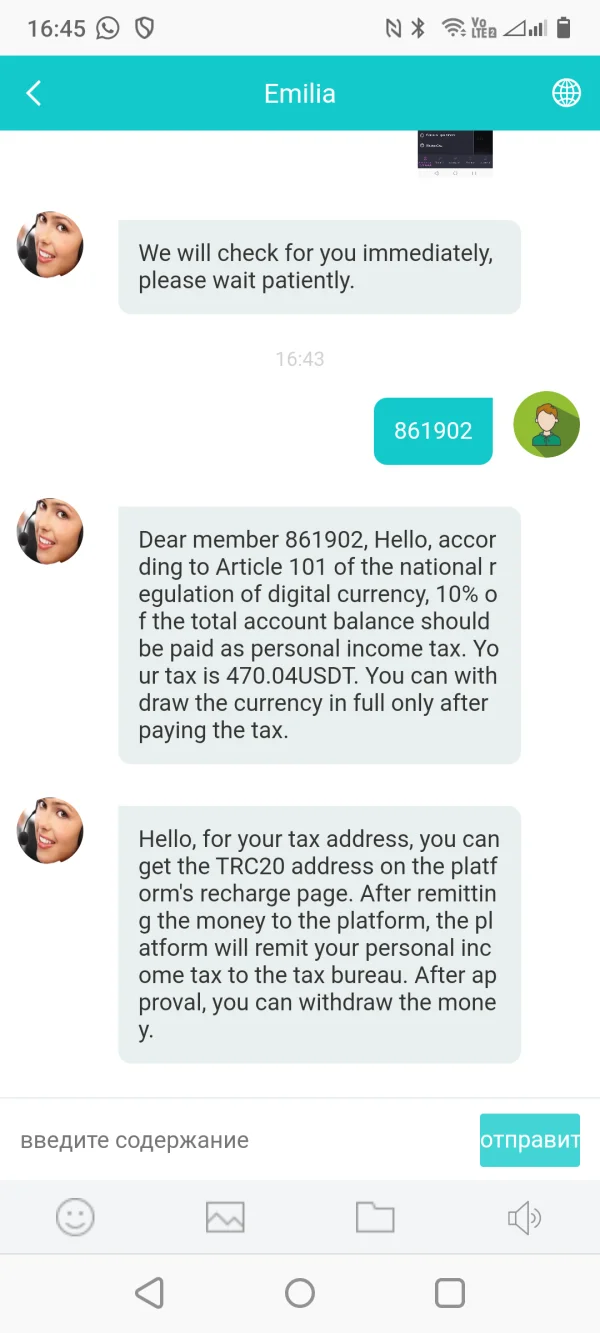

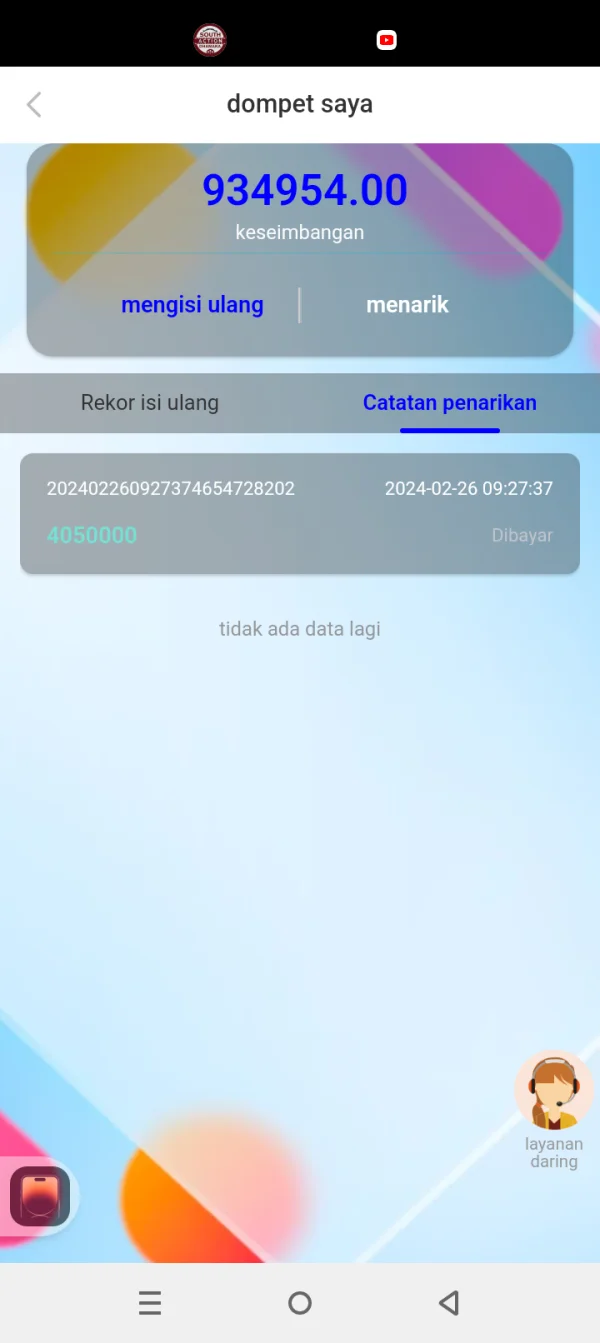

Isang Chinese girl ang nakakakilala at nag-aalok ng BBH exchange bilang isang investment. Minsan pinapayagan nila akong mag-withdraw ng pera, pero ngayon hindi na posible ang withdrawal. Hinihingi nila sa akin na magbayad ng 10% na buwis para sa withdrawal. Mag-ingat, sila ay mga extortionist at scammers!

Paglalahad

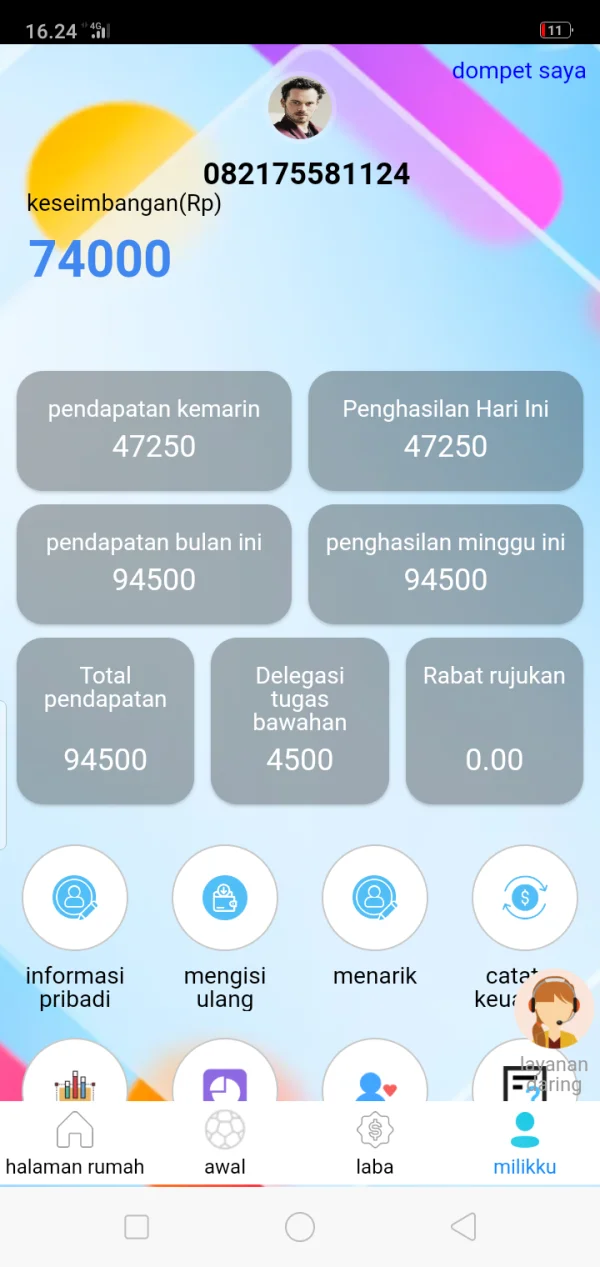

hendra164

Indonesia

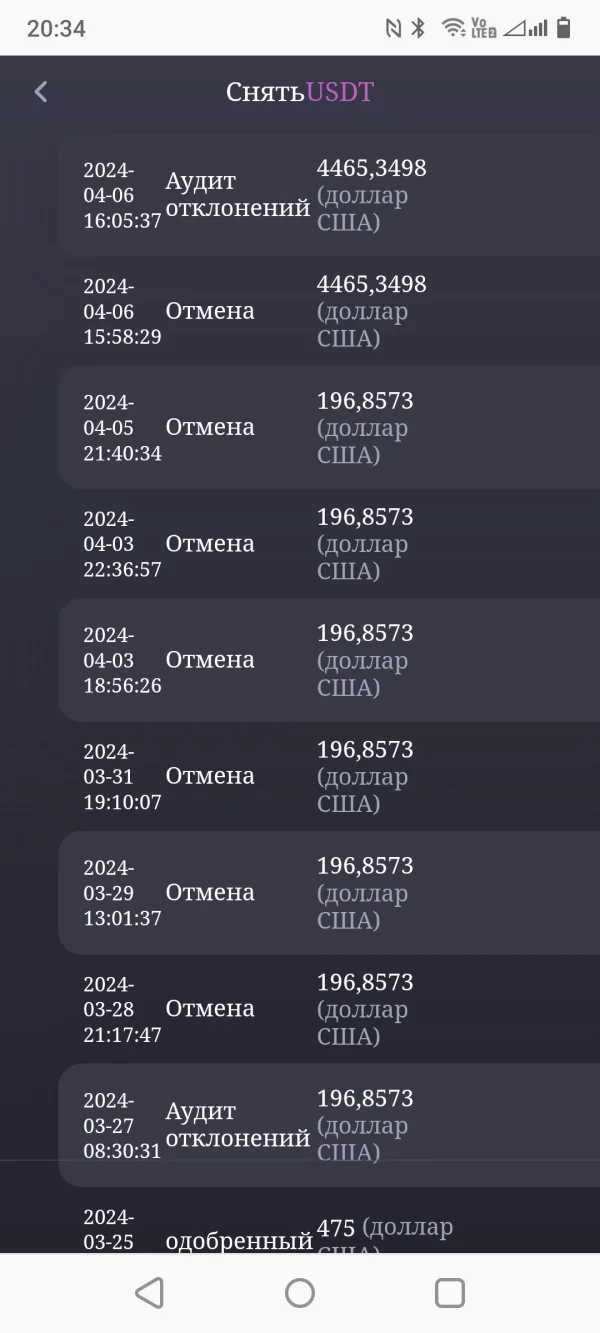

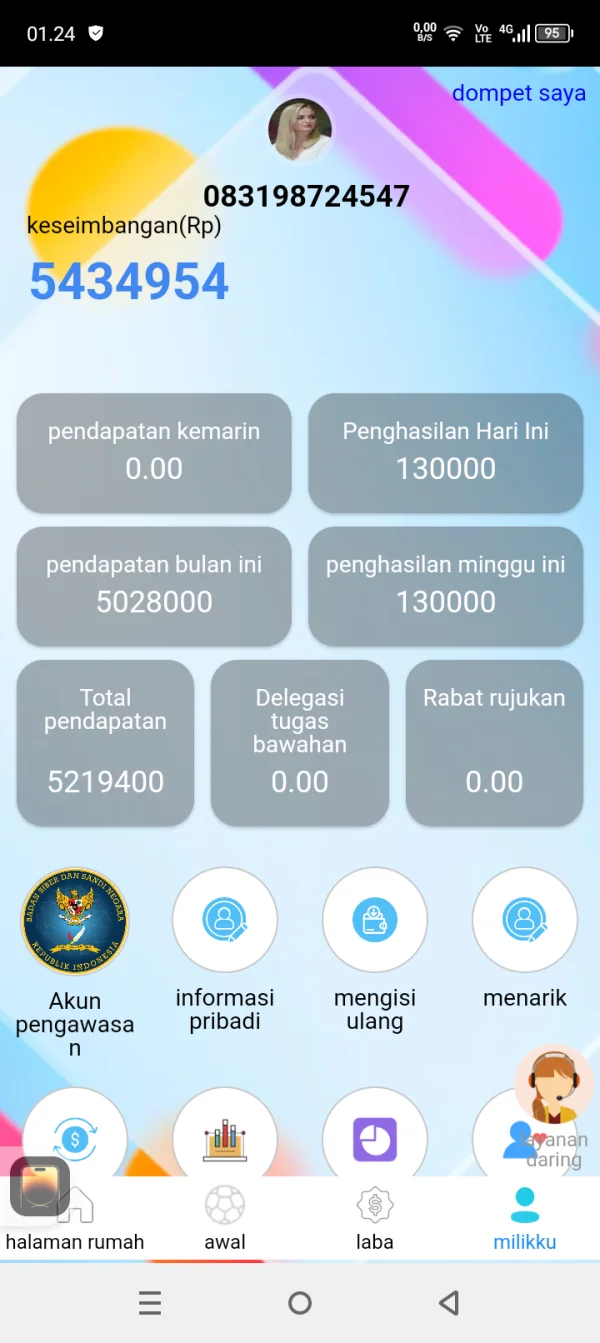

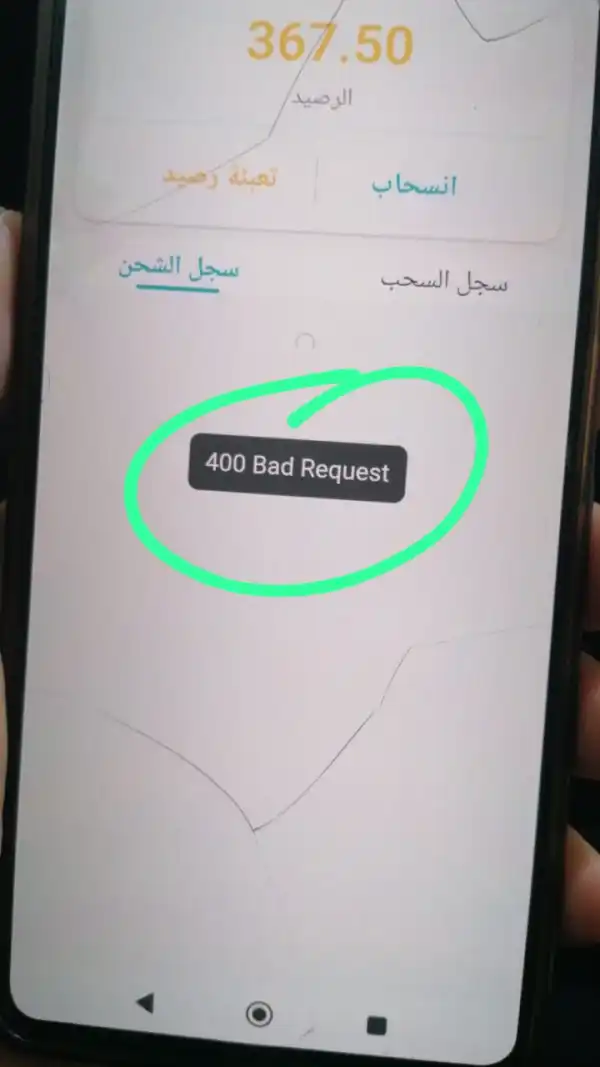

Nag-withdraw ako, hindi pa ito na-cash out

Paglalahad

indra518

Indonesia

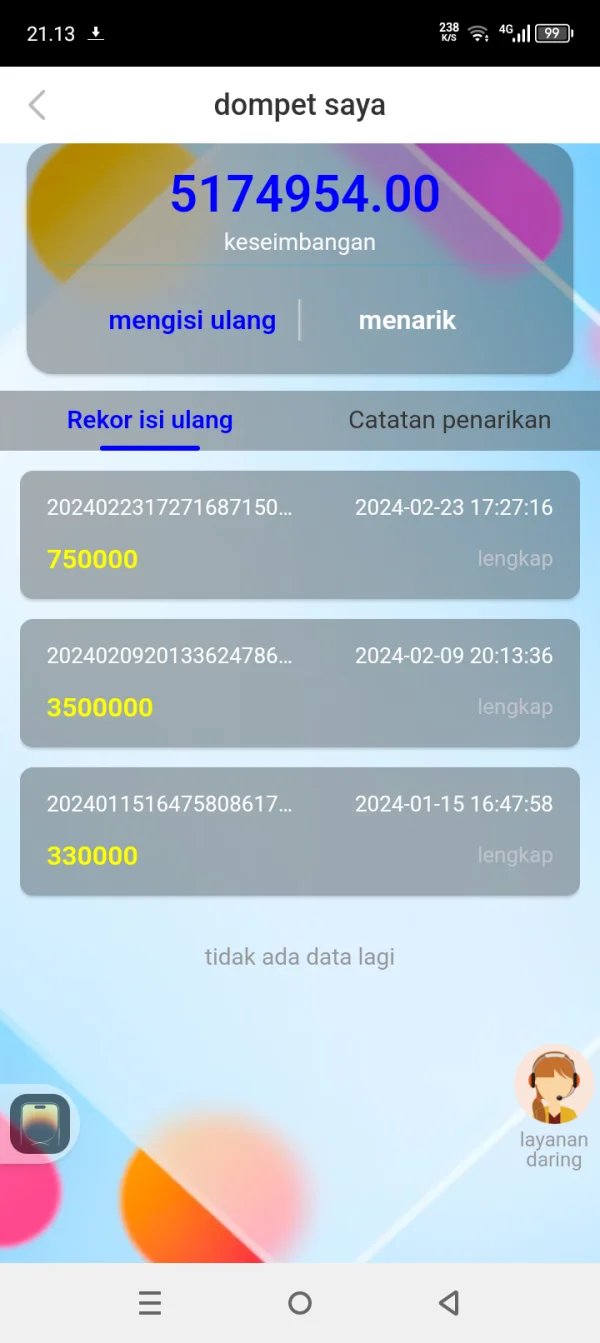

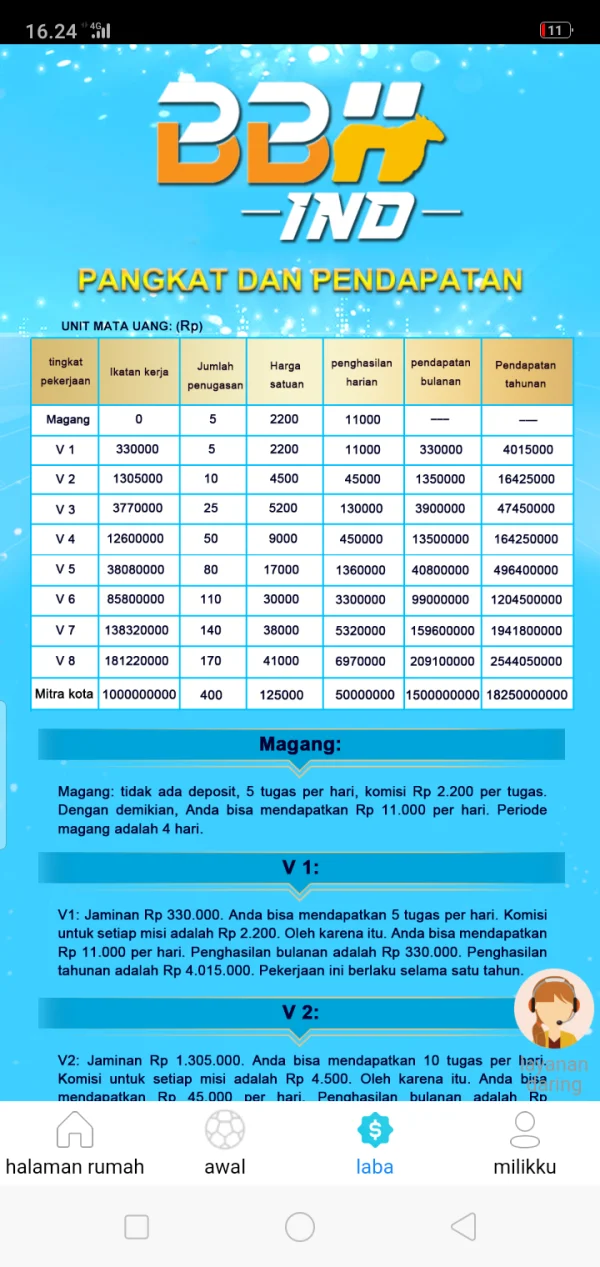

Ini-empty nila ang aming balanse... dapat sana ay 2000000 to 0 ang aming balanse at sinabihan kami na magbayad ng buwis, hindi kami makakawithdraw ng pondo sa loob ng 2 linggo... sinabihan kami na magbayad ng buwis... 2 milyon para sa V2... kahit na walang pera sa aming balanse... paano kami magbabayad ng buwis...

Paglalahad

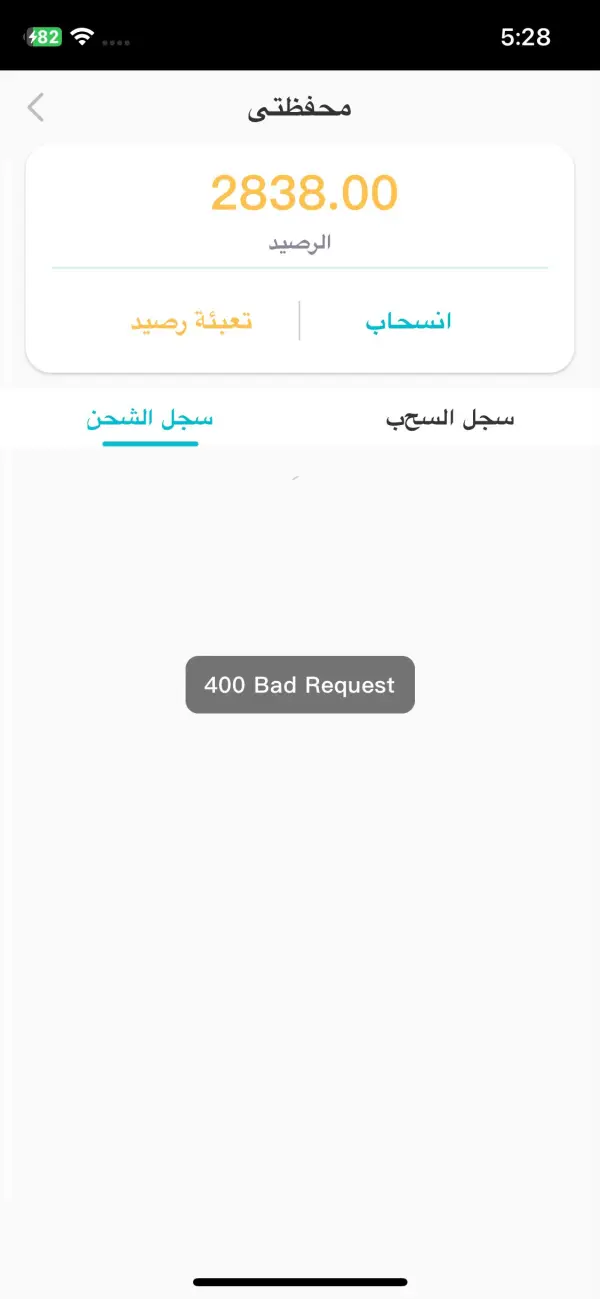

FX3147252051

Iraq

Isinara nila ang programa. Na-scam kami ng malaking halaga ng pera. Nangako sila sa amin na matatanggap namin ang tubo tuwing Huwebes, ngunit sinira nila ang kanilang salita.

Paglalahad

alfalahi

Iraq

Nangako sila sa mga tao na mag-withdraw tuwing Huwebes, ngunit ngayon ay isinara na nila ang programa at ang mga broker ay hindi tumutugon sa mga subscriber.

Paglalahad