회사 소개

| BBH 리뷰 요약 | |

| 설립 연도 | 1995 |

| 등록 국가/지역 | 미국 |

| 규제 | SFC (규제), FCA (초과) |

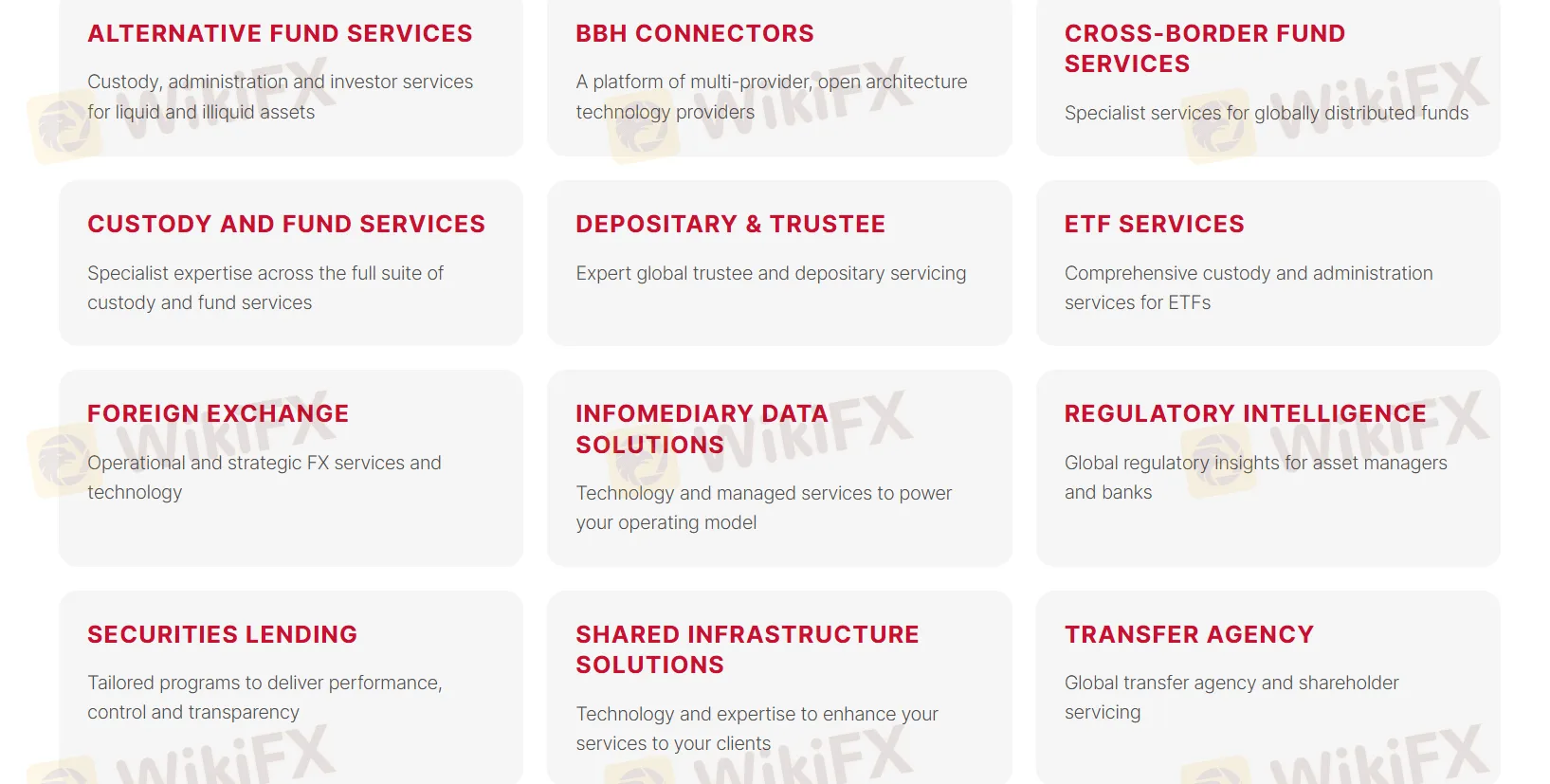

| 서비스 | 대체 펀드 서비스, BBH 커넥터, 국경을 넘는 펀드 서비스, 보관 및 펀드 서비스, 예탁 및 수탁, ETF 서비스, 외환, 규제 정보, 증권 대여, 공유 인프라 솔루션, 이체 대행 |

| 고객 지원 | 이메일: contactus@bbh.com |

| LinkedIn/Facebook/Twitter | |

BBH 정보

BBH은 미국에 등록된 30년 역사를 자랑하는 브로커로 다양한 금융 서비스를 제공합니다. BBH은 여전히 초과된 상태로 인해 위험합니다.

장단점

| 장점 | 단점 |

| 1995년 이후 장기 운영 역사 | 24시간 고객 지원 미제공 |

| SFC 규제 | 구체적인 이체 방법 미제공 |

| 다양한 금융 서비스 | 초과된 FCA 라이선스 |

BBH 합법성

| 규제 국가 | 현재 상태 | 규제 기관 | 규제 업체 | 라이선스 유형 | 라이선스 번호 |

| 중국 (홍콩) | 규제됨 | 홍콩 증권 및 선물 위원회 (SFC) | 브라운 브라더스 해리만 (홍콩) 리미티드 | 레버리지 외환 거래 | AAF778 |

| 영국 | 초과됨 | 금융행정청 (FCA) | Brown Brothers Harriman 투자자 서비스 리미티드 | 투자 자문 라이선스 | 190266 |

BBH 서비스

BBH은 다음과 같은 다양한 서비스를 제공합니다:

대체 펀드 서비스: 유동성 및 비유동성 자산을 위한 보관, 관리 및 투자자 서비스.

BBH 커넥터: 다중 제공업체, 개방형 아키텍처 기술 제공자 플랫폼.

국경을 넘는 펀드 서비스: 글로벌로 분산된 펀드를 위한 전문 서비스.

보관 및 펀드 서비스: 보관 및 펀드 서비스의 전반적인 전문 지식.

예탁 및 수탁: 전문 글로벌 수탁 및 예탁 서비스.

ETF 서비스: ETF를 위한 포괄적인 보관 및 관리 서비스.

외환: 운영 및 전략적 외환 서비스 및 기술.

규제 정보: 자산 관리자 및 은행을 위한 글로벌 규제 통찰력.

증권 대여: 성과, 통제 및 투명성을 제공하기 위한 맞춤형 프로그램.

공유 인프라 솔루션: 귀하의 고객 서비스를 향상시키기 위한 기술과 전문 지식.

이체 대행: 글로벌 이체 대행 및 주주 서비스.

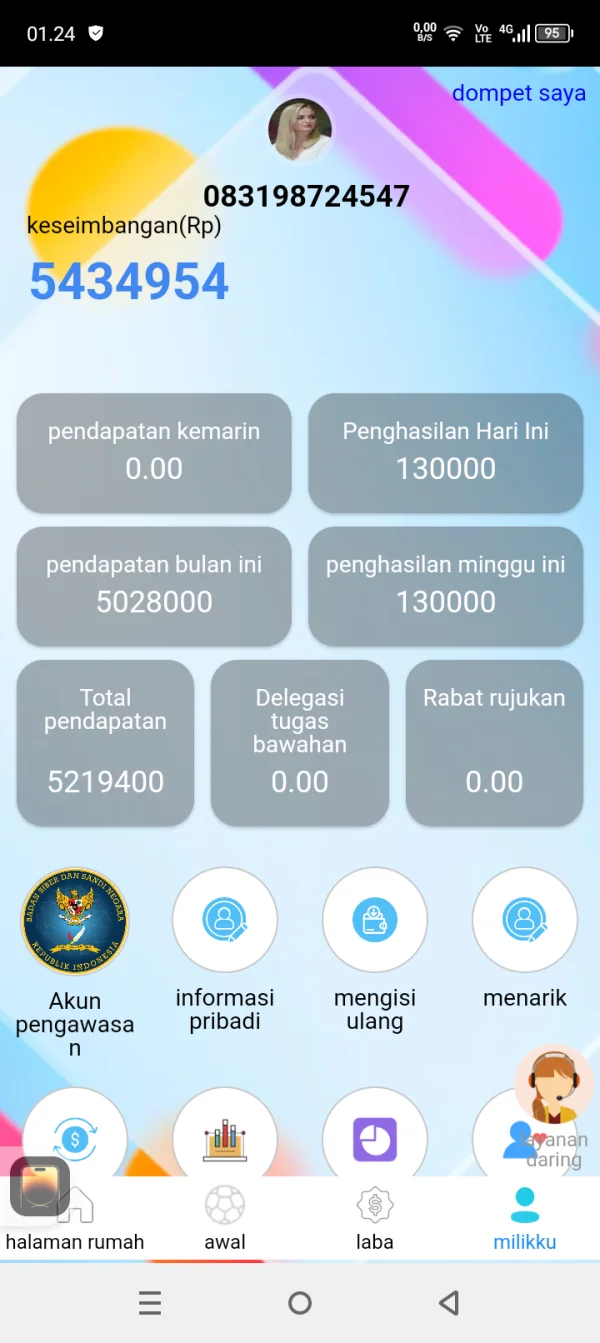

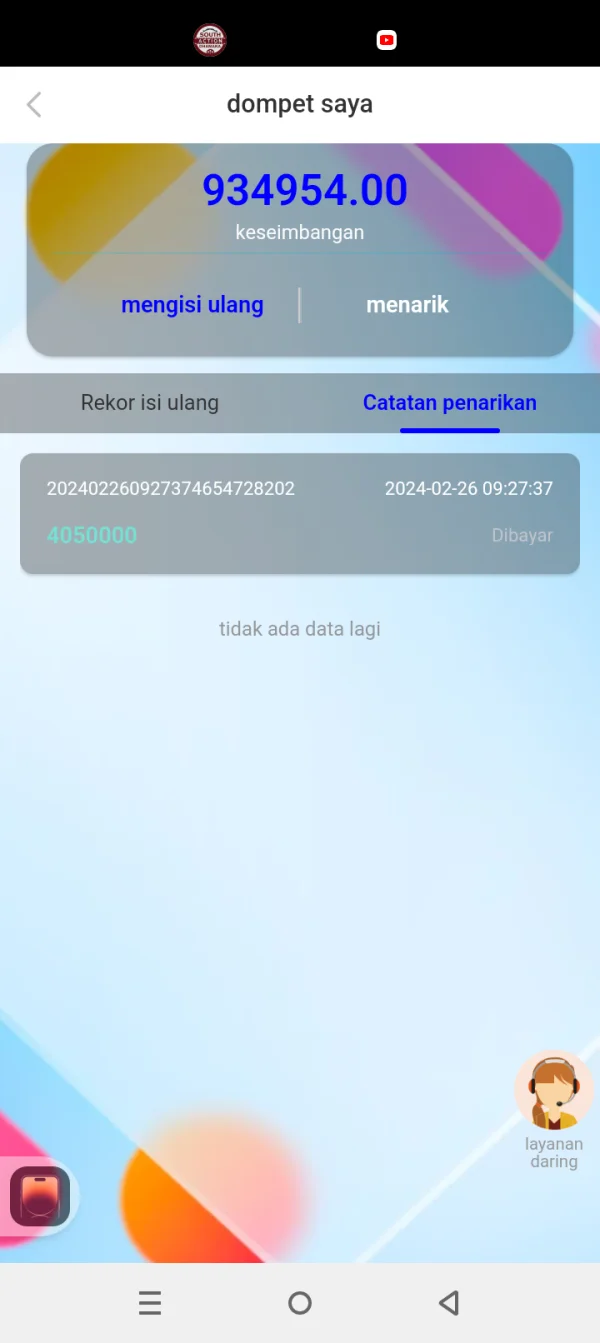

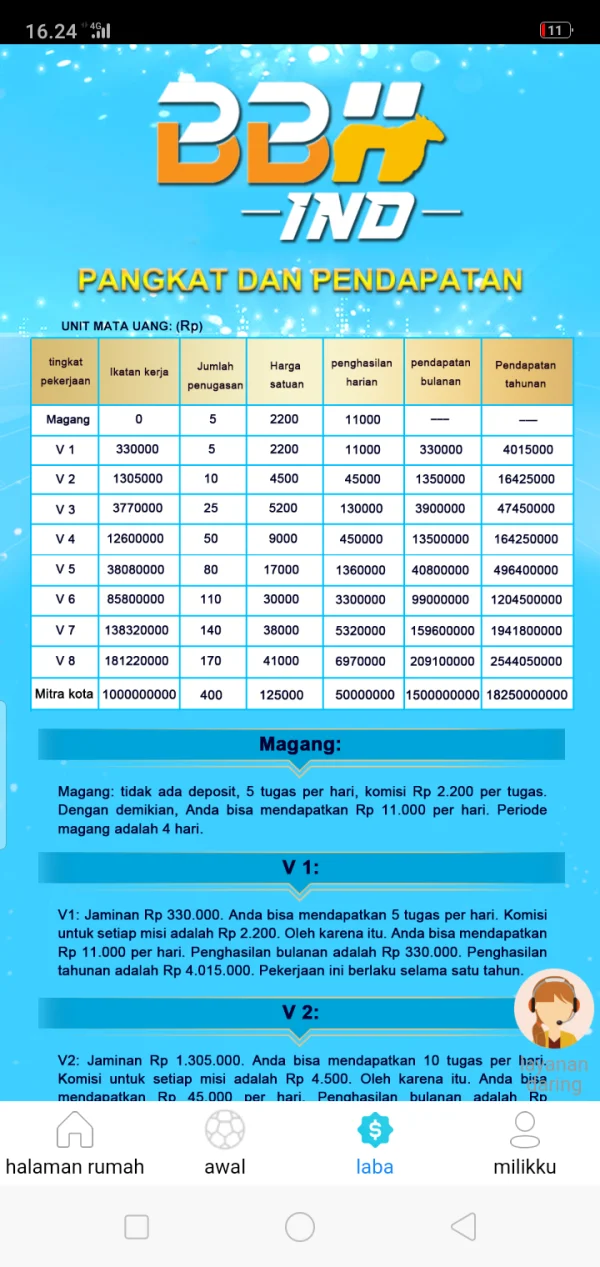

FX3413326667

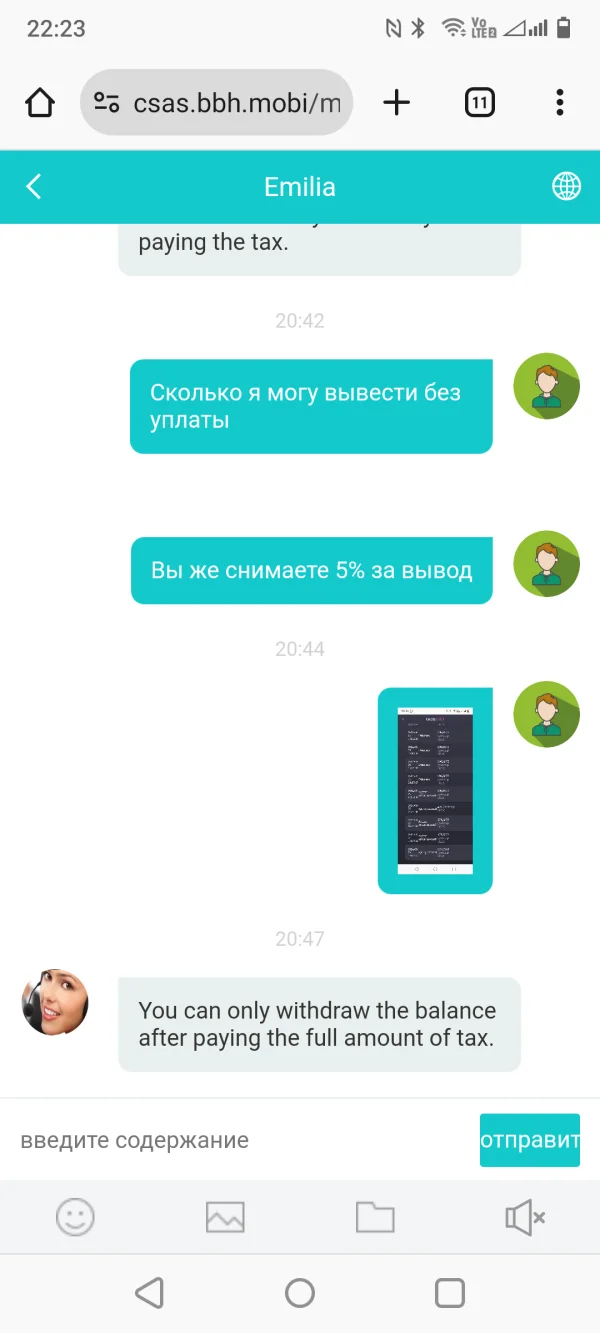

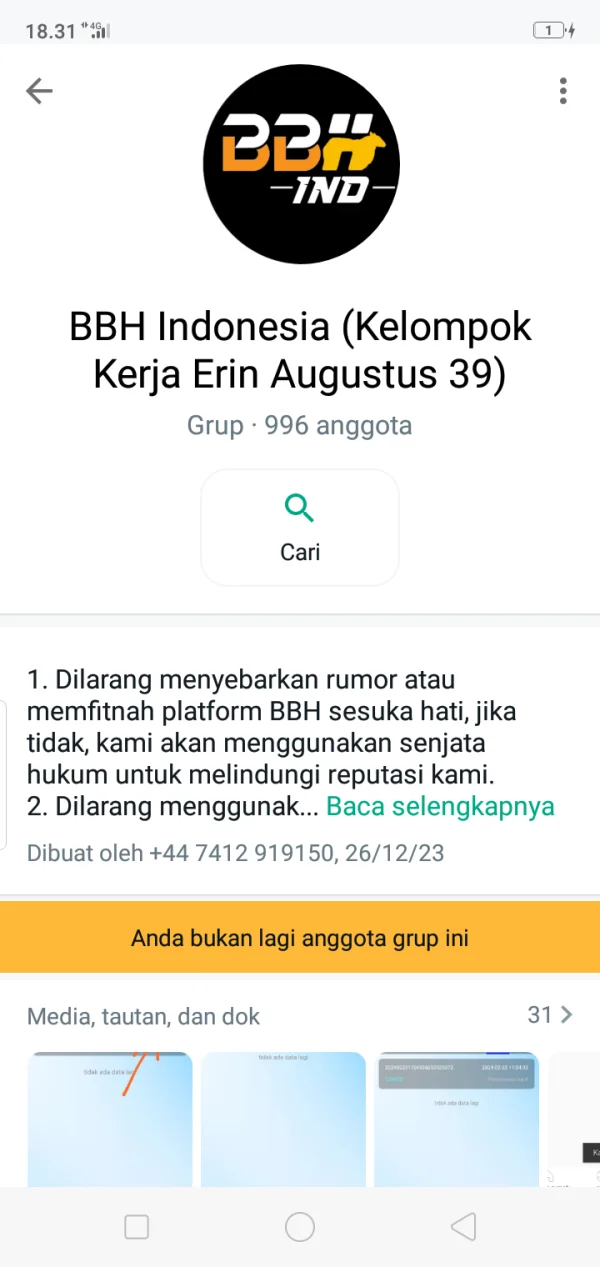

러시아

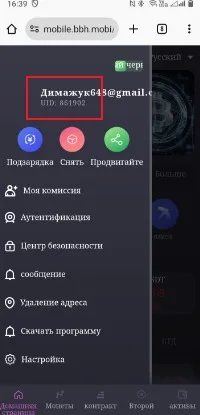

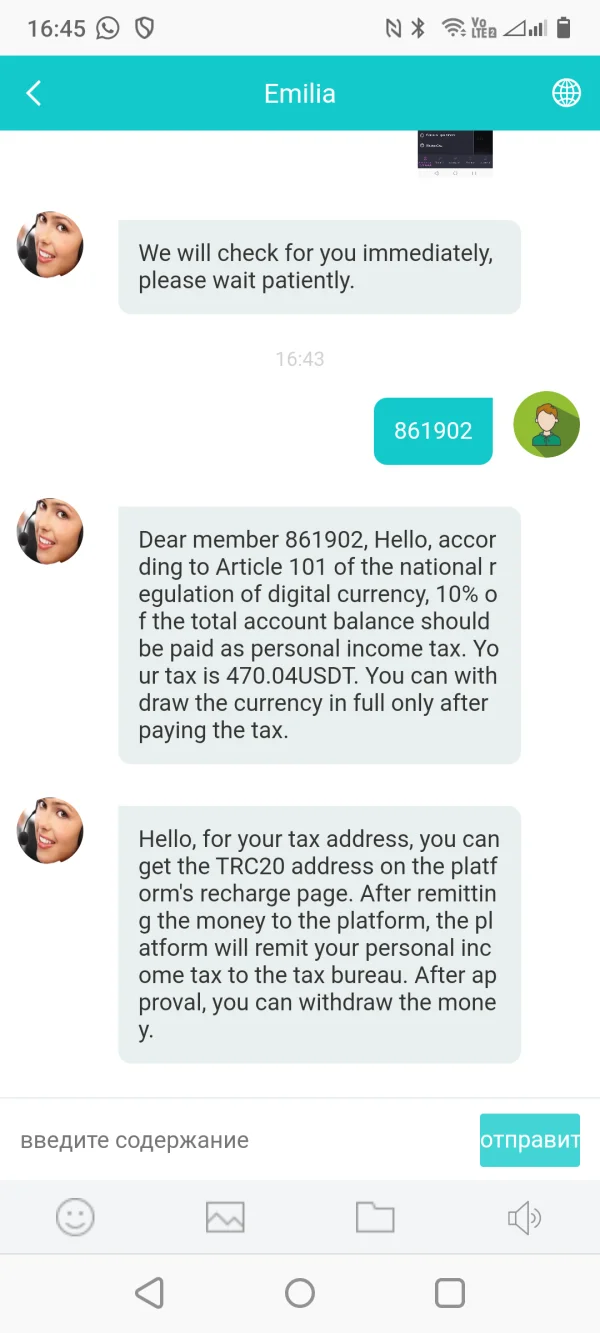

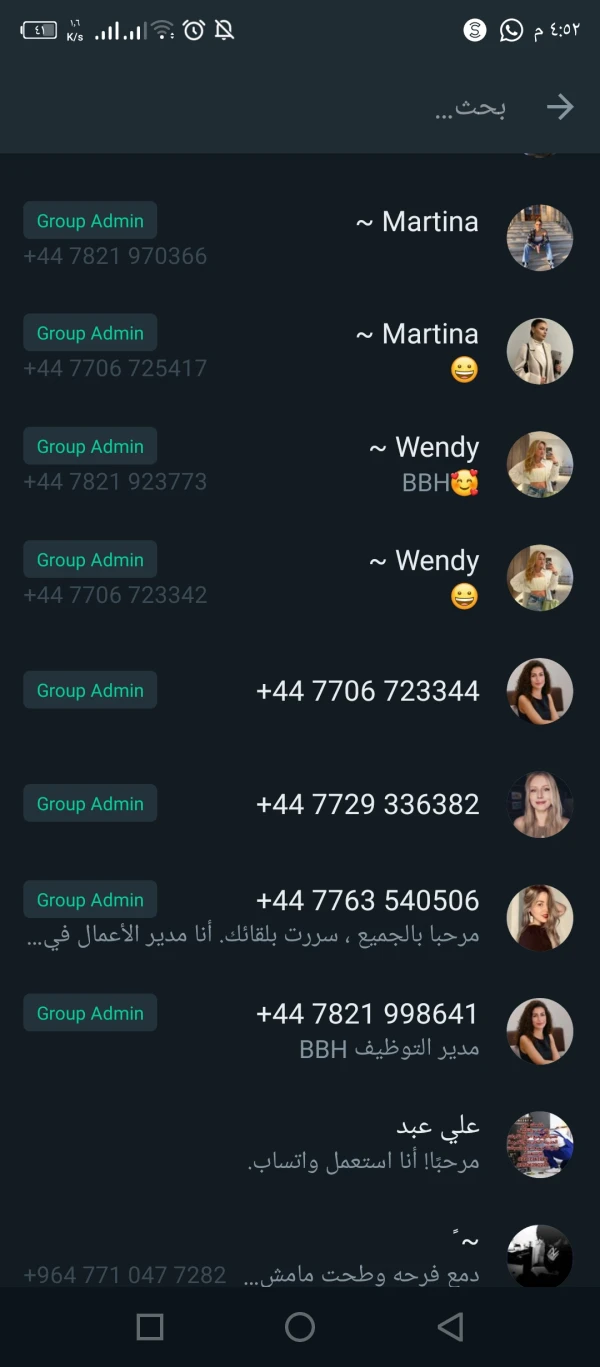

중국 소녀가 만나서 투자로 이 BBH 환전을 제안합니다. 몇 번 돈을 인출할 수 있게 허용하지만, 이후에는 인출이 불가능합니다. 인출에 대해 10% 세금을 지불하라고 요구합니다. 조심하세요, 그들은 갈취자이자 사기꾼입니다!

신고

hendra164

인도네시아

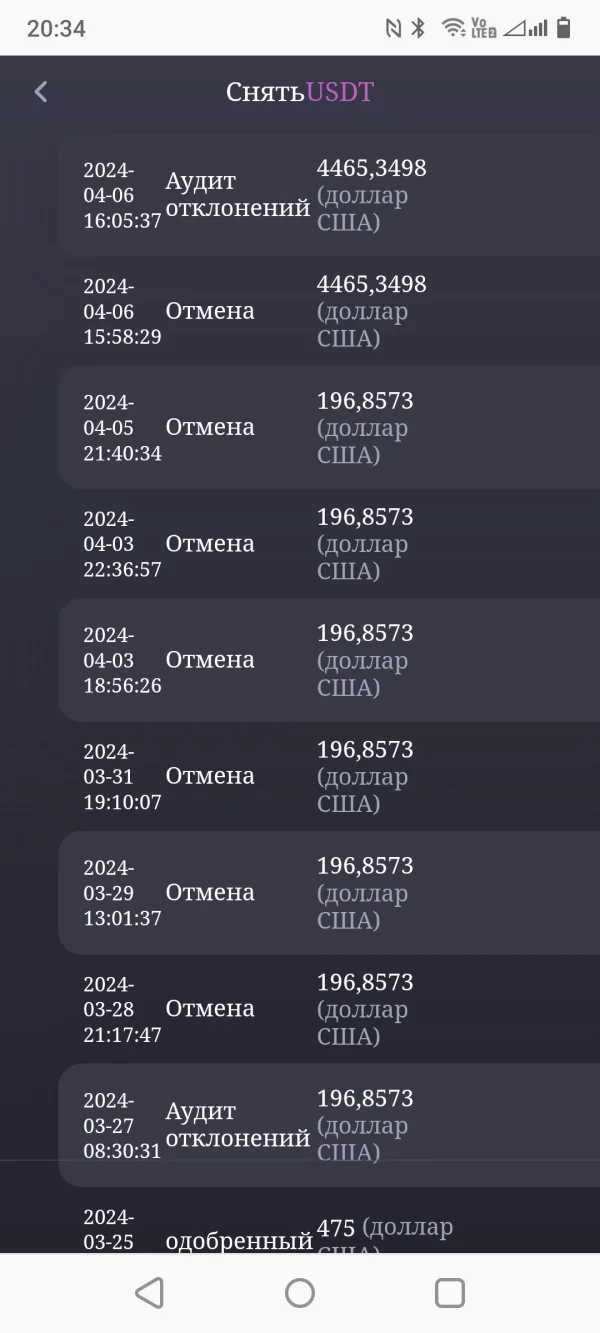

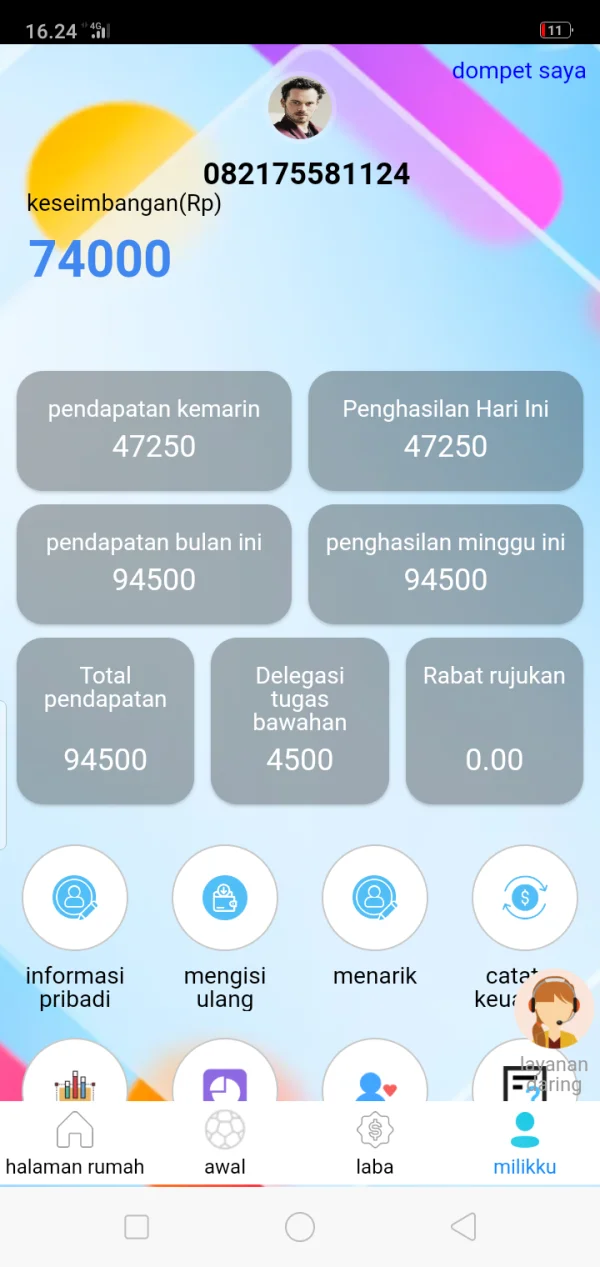

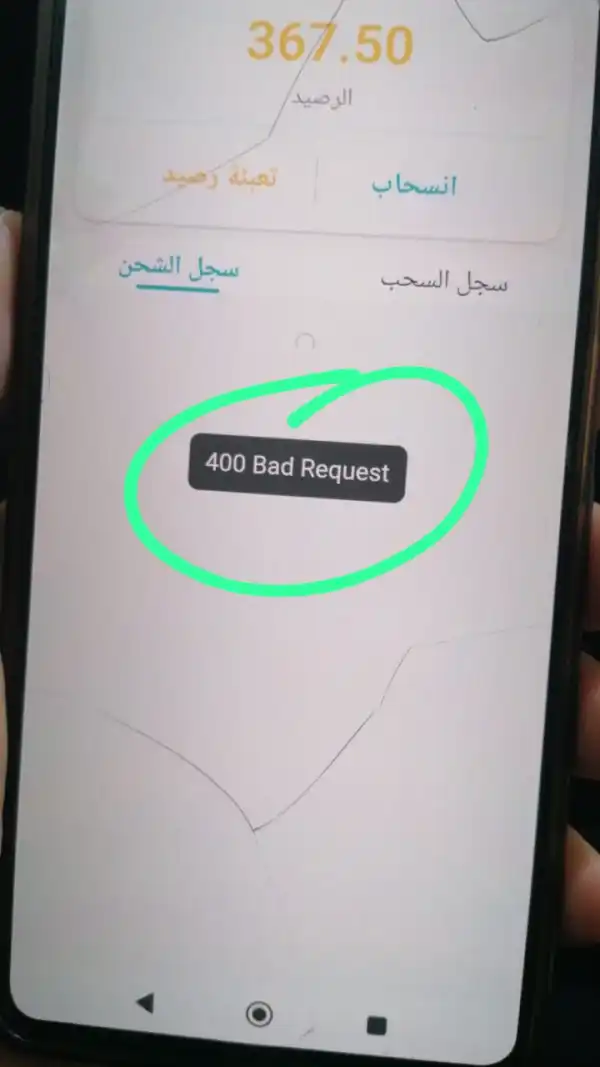

출금을 했는데 아직 현금화되지 않았어요

신고

indra518

인도네시아

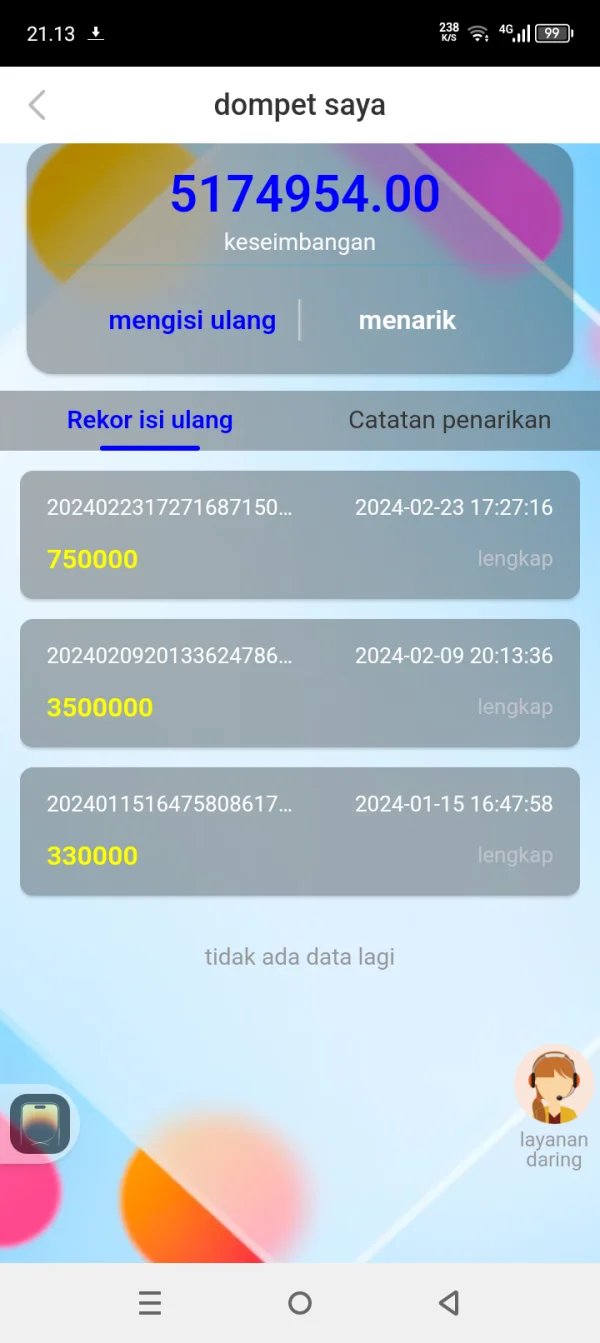

그들은 우리의 잔고를 비웠어요... 우리의 잔고는 2000000에서 0이어야 했는데 세금을 내라고 했어요, 우리는 2주 동안 자금을 인출할 수 없어요... 그는 우리에게 세금을 내라고 했어요... V2에 200만을... 우리의 돈이 잔고에서 비어 있더라도 어떻게 세금을 낼 수 있을까요...

신고

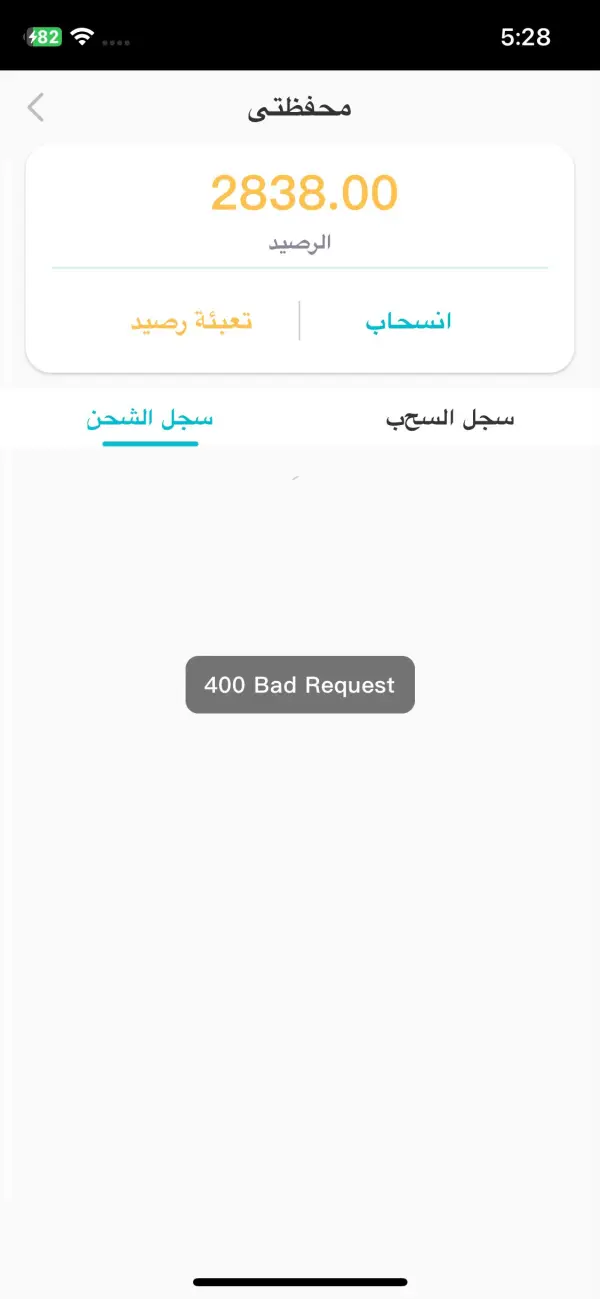

FX3147252051

이라크

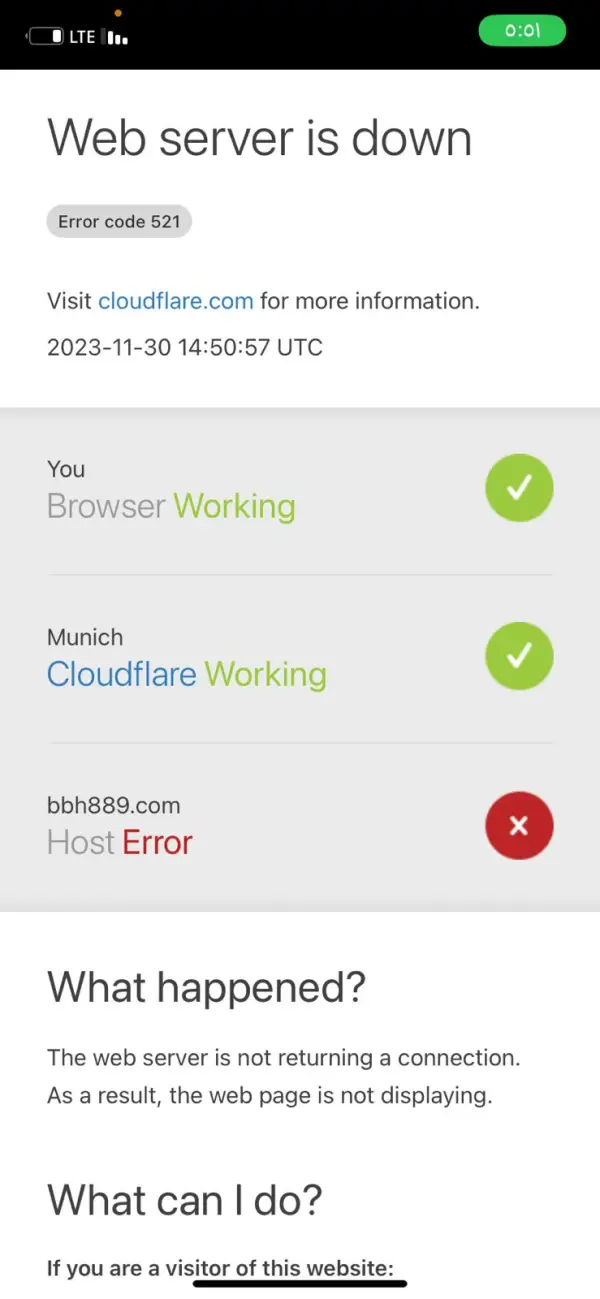

그들은 프로그램을 닫았습니다. 우리는 거액의 사기를 당했습니다. 매주 목요일마다 수익금을 지급하겠다고 약속했는데, 그 약속을 어겼습니다.

신고

alfalahi

이라크

그들은 매주 목요일에 탈퇴하겠다고 사람들에게 약속했지만 지금은 프로그램을 종료했고 브로커는 가입자에게 응답하지 않습니다.

신고