Resumo da empresa

| BitMart Resumo da Revisão | |

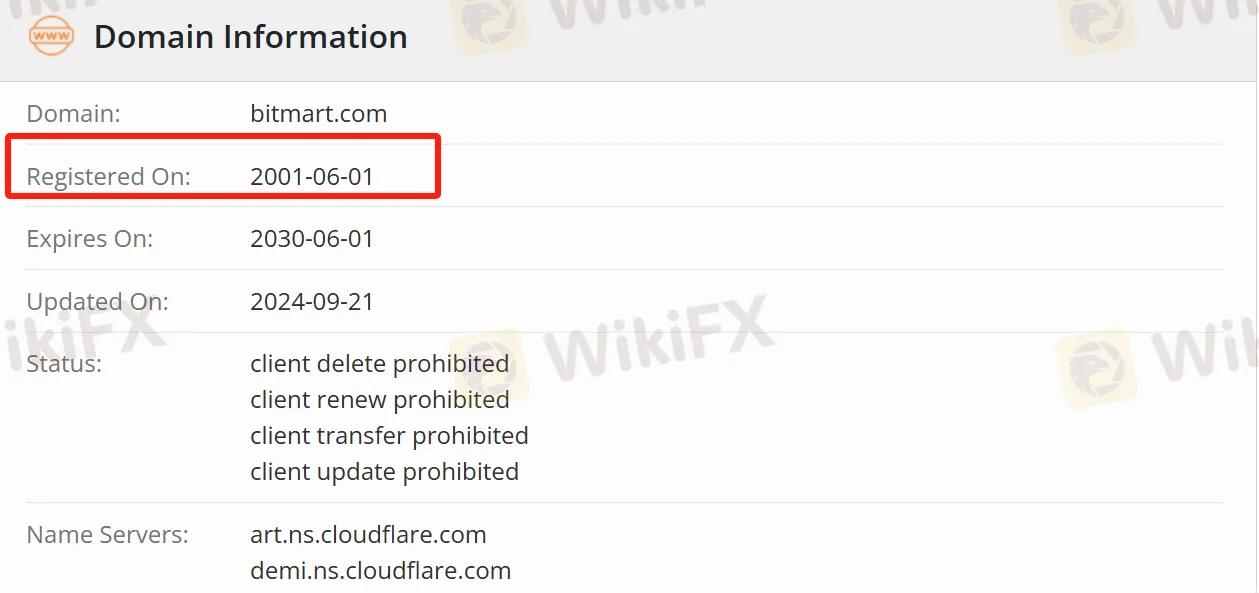

| Registrado Em | 2001-06-01 |

| País/Região Registrada | Nova Zelândia |

| Regulação | Revogada |

| Instrumentos de Mercado | 1.700 criptomoedas, futuros |

| Simulação de Negociação | ✅ |

| Alavancagem | / |

| Spread | / |

| Plataforma de Negociação | BitMart (web e mobile) |

| Depósito Mínimo | / |

| Suporte ao Cliente | Twitter, Telegram, Facebook, Instagram, YouTube, LinkedIn, TikTok, etc. |

Informações sobre BitMart

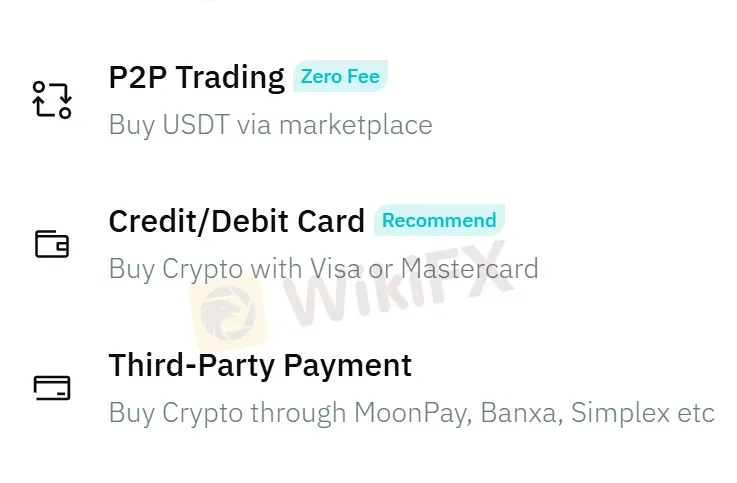

BitMart é uma plataforma de negociação de criptomoedas para usuários globais, suportando mais de 1.700 criptomoedas e oferecendo vários tipos de negociação, como negociação à vista, negociação com margem e futuros. Também suporta a compra de criptomoedas com moeda fiduciária, permitindo que os usuários comprem moedas de forma conveniente por meio de métodos de pagamento de terceiros como Google Pay, Apple Pay, cartões de crédito/débito, MoonPay, Banxa e Simplex, com suporte 24 horas por dia, 7 dias por semana para responder às necessidades a qualquer momento.

Prós e Contras

| Prós | Contras |

| Mais de 1.700 criptomoedas | Não regulamentado |

| Negociação de cópia disponível | Informações de taxas não específicas |

| Recompensas de atividade generosas | Informações de conta pouco claras |

| Desconto de 50% na taxa de negociação (para VIPs) |

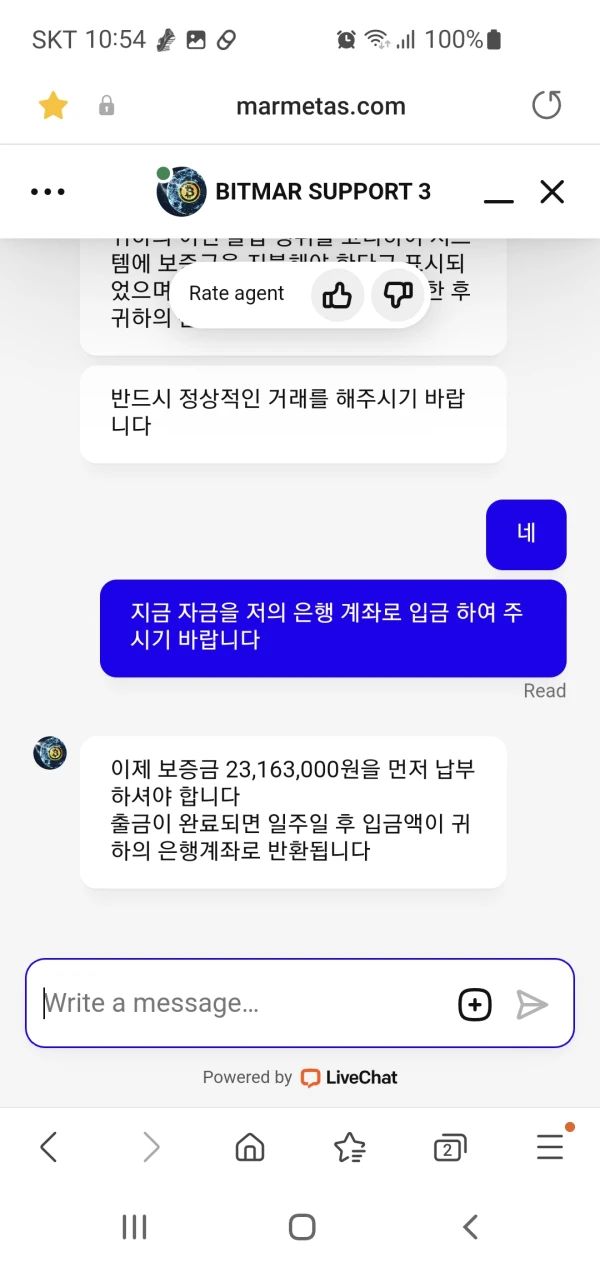

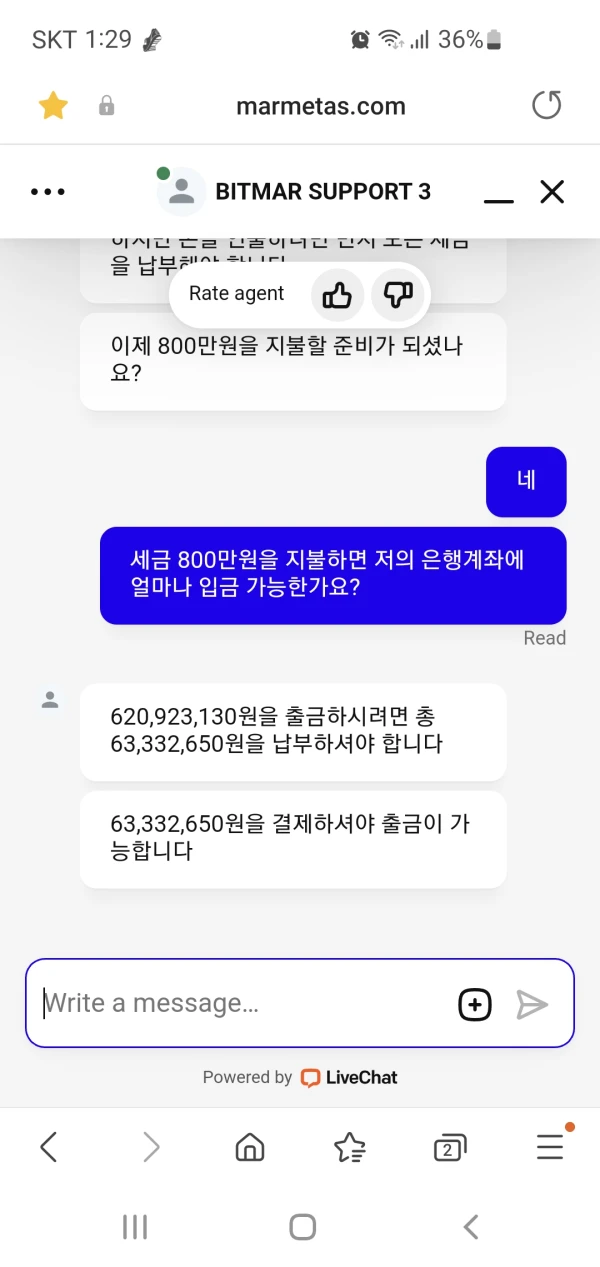

BitMart é Legítimo?

BitMart atua no campo de negociação de criptomoedas há muitos anos, mas não é regulamentado. É recomendável que os traders priorizem corretores regulamentados por agências reguladoras autorizadas.

O Que Posso Negociar na BitMart?

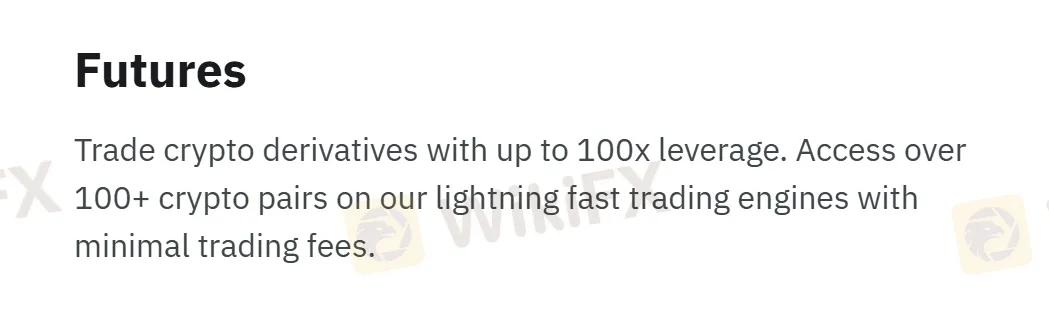

Na BitMart, os traders podem realizar vários tipos de transações. Para negociação à vista, há mais de 1.700 criptomoedas para escolher; a negociação de futuros suporta mais de 100 pares de criptomoedas.

Taxas BitMart

Às 00:00 UTC todos os dias, o sistema atualizará os níveis de taxas de transação dos usuários, que entrarão em vigor duas horas depois. Todos os traders podem usar BMX para dedução e desfrutar de um desconto de 25%.

Alavancagem

Na negociação de futuros, BitMart oferece alavancagem de até 100x, tornando-a adequada para investidores com conhecimento de mercado aprofundado e alta tolerância ao risco.

Plataforma de Negociação

A plataforma de negociação BitMart suporta acesso multi-terminal, incluindo dispositivos baseados na web e móveis.

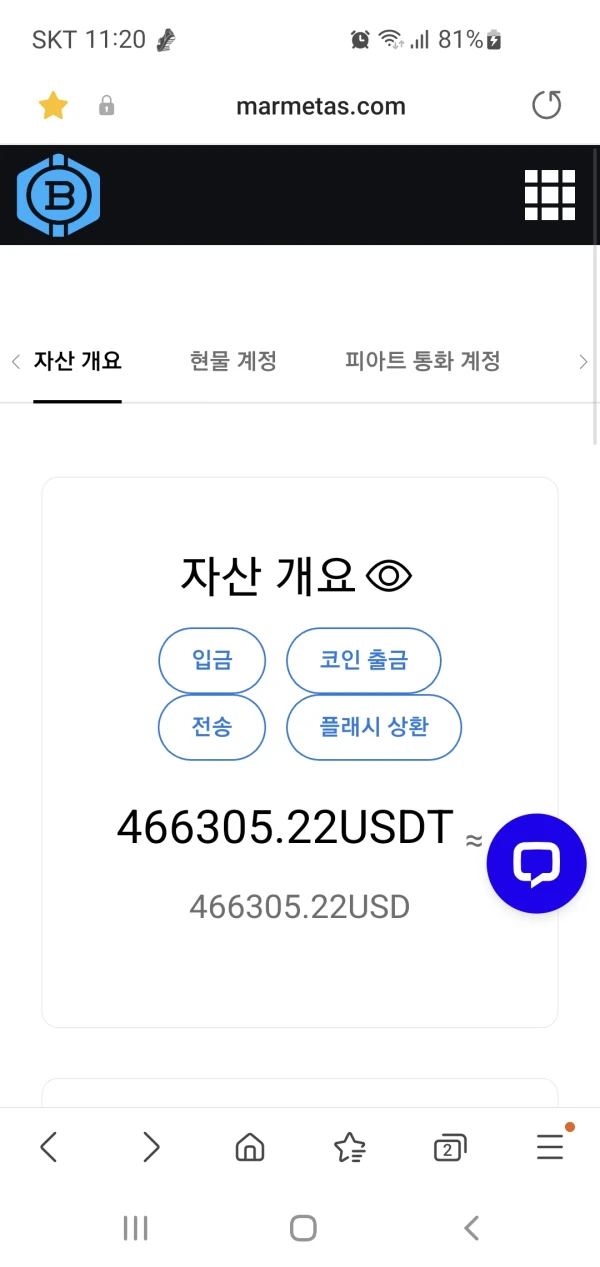

Depósito e Saque

Os traders podem comprar criptomoedas via cartões de crédito/débito e métodos de pagamento de terceiros como MoonPay, Banxa, Simplex, Visa e Mastercard.

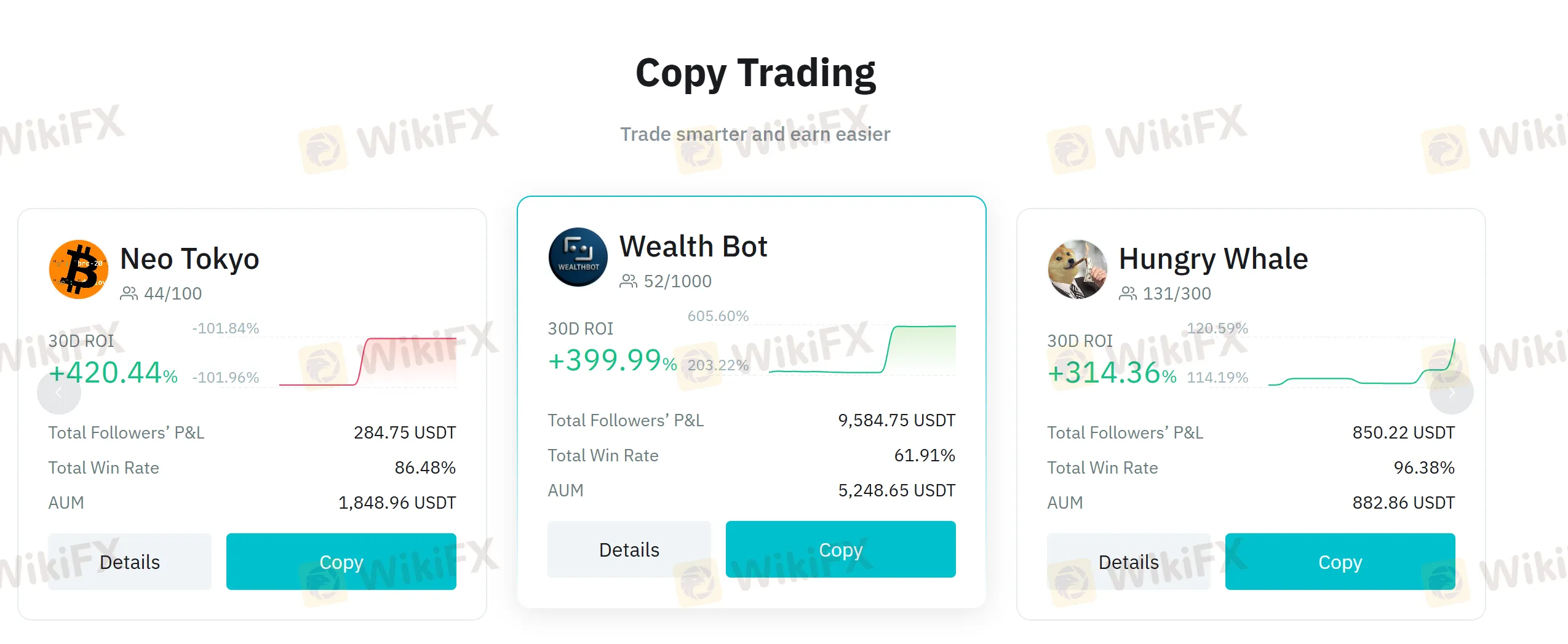

Copy Trading

O copy trading é um recurso chave da BitMart. O sistema possui um mecanismo de proteção de deslizamento padrão de 0,5%. Quando as flutuações de mercado fazem com que o deslizamento exceda esse valor, o copy trading será pausado automaticamente, tornando-o adequado para investidores que não possuem experiência ou tempo para negociar.

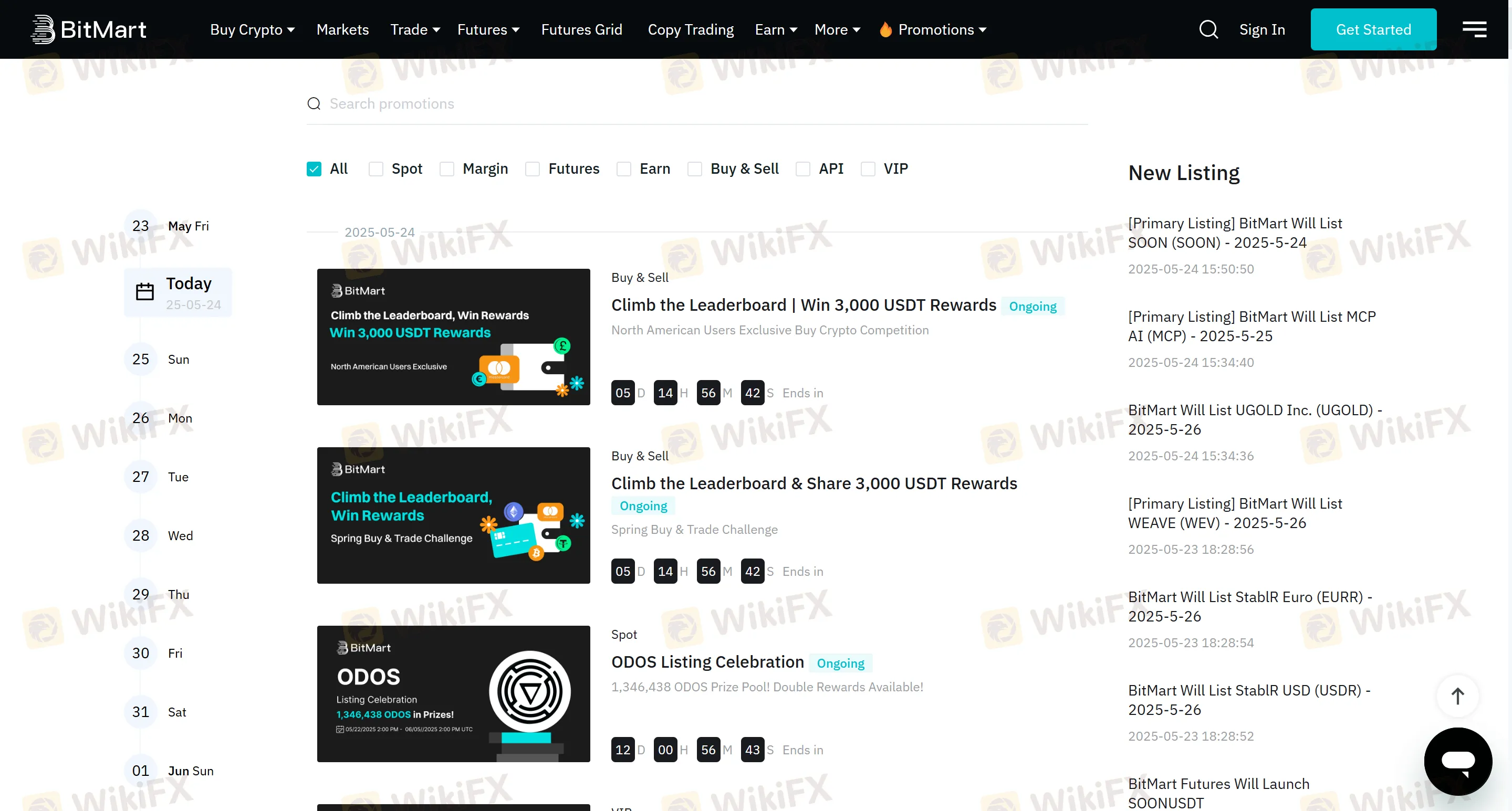

Bônus

A plataforma oferece diversas atividades recompensadoras e atualmente há um concurso exclusivo de compra de criptomoedas para usuários da América do Norte. Durante o período de 00:00:00 UTC em 23 de maio de 2025, até 23:59:59 UTC em 29 de maio de 2025, os 100 principais usuários da América do Norte que comprarem criptomoedas com moedas fiduciárias como USD e CAD irão compartilhar um prêmio de 3.000 USDT.

| Classificação | Recompensa Total (USDT) |

| Top 1 | 288 |

| 2 - 10 | 792 |

| 11 - 30 | 870 |

| 31 - 100 | 1.050 |