Resumo da empresa

| IFIC Bank Resumo da Revisão | |

| Fundação | 1999 |

| País/Região Registrada | Bangladesh |

| Regulação | Sem regulação |

| Produtos | IFIC Aamar Bhobishawt, Esquema de Poupança de Pensão (PSS), PSS-Joma, Depósito de Aviso Especial (SND), IFIC Corporate Plus, Depósitos Fixos, Esquema de Renda Mensal (MIS) e o produto de depósito em moeda estrangeira NFCD |

| Plataforma/Aplicativo | Aplicativo de Banco Digital IFIC |

| Suporte ao Cliente | Telefone: 09666716250 |

| Fax: 880-2-44850205 | |

| Email: info@ificbankbd.com | |

| Endereço: IFIC Tower, 61 Purana Paltan, Dhaka-1000 | |

Informações sobre IFIC Bank

IFIC Bank foi fundado em 1999 e está sediado em Bangladesh, oferecendo uma variedade de produtos de poupança e renda, juntamente com um aplicativo de banco digital conveniente. O banco oferece vários tipos de contas e taxas de depósito competitivas, mas atualmente não é regulamentado.

Prós e Contras

| Prós | Contras |

| Oferece vários produtos de depósito e geração de renda | Sem regulação |

| Vários tipos de contas | |

| Plataforma de banco digital conveniente disponível |

IFIC Bank é Legítimo?

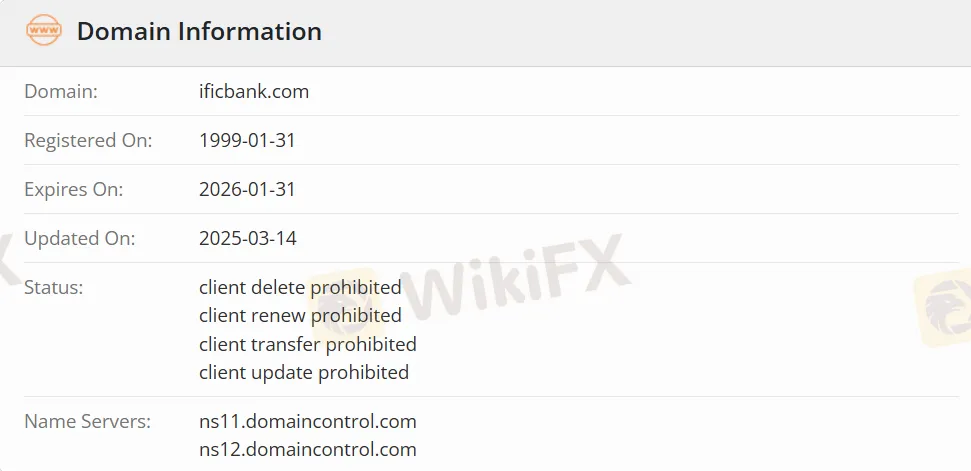

IFIC Bank é não regulamentado. Seu nome de domínio, ificbank.com, foi registrado em 31 de janeiro de 1999 e expirará em 31 de janeiro de 2026.

Produtos IFIC Bank

IFIC Bank oferece um total de sete produtos de depósito e geração de renda, a saber, IFIC Aamar Bhobishawt, Esquema de Poupança de Pensão (PSS), PSS-Joma, Depósito de Aviso Especial (SND), IFIC Corporate Plus, Depósitos Fixos, Esquema de Renda Mensal (MIS) e o produto de depósito em moeda estrangeira NFCD.

| Produtos | Suportado |

| IFIC Aamar Bhobishawt | ✔ |

| Esquema de Poupança de Pensão (PSS) | ✔ |

| PSS-Joma, Depósito de Aviso Especial (SND) | ✔ |

| IFIC Corporate Plus | ✔ |

| Depósitos Fixos | ✔ |

| Esquema de Renda Mensal (MIS) | ✔ |

| NFCD | ✔ |

Tipo de Conta

IFIC Bank oferece um total de seis tipos de contas: Conta IFIC Aamar, Conta IFIC Shohoj, Conta IFIC Freelancer, IFIC Women Banking, Conta de Poupança Geral (incluindo Conta de Estudante) e Conta Corrente.

Plataforma de Negociação

A plataforma de negociação do IFIC Bank é o Aplicativo de Banco Digital IFIC, que suporta dispositivos Android (disponível no Google Play) e dispositivos Apple iOS (disponível na App Store).

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis |

| Aplicativo de Banco Digital IFIC | ✔ | Android, iOS |

Depósito e Retirada

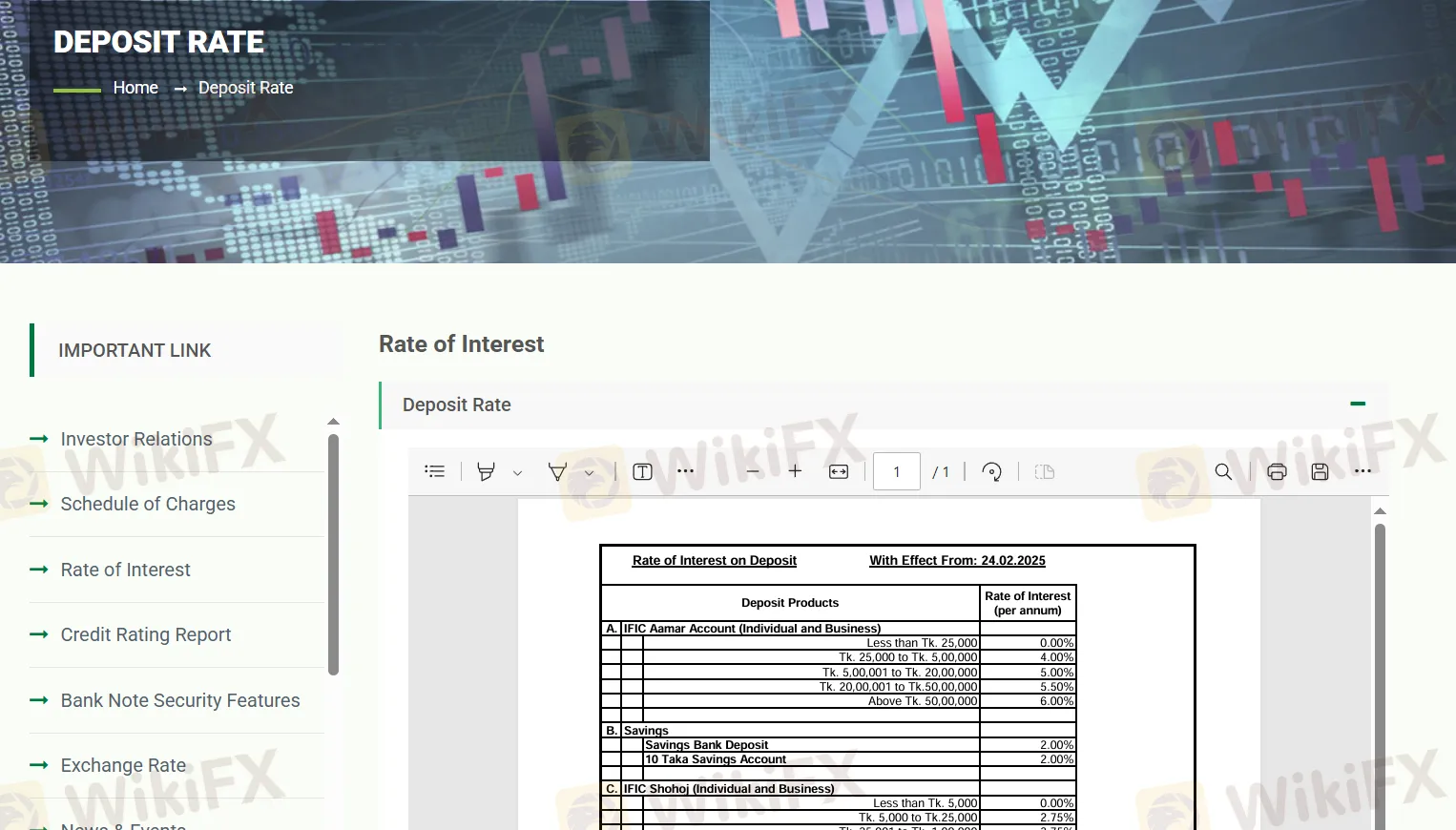

O esquema de poupança "IFIC Aamar Bhobishawt" oferece uma taxa de juros anual de 10% com parcelas mensais, proporcionando diferentes retornos de maturidade pré-impostos para prazos de 1 a 10 anos; as taxas de imposto aplicáveis são de 10% e 15%. Ao mesmo tempo, o "Esquema de Poupança de Pensão (PSS)" oferece uma taxa de juros anual de 7,75%, enquanto o "PSS-Joma" oferece 8,00%. A conta de poupança regular tem uma taxa de juros de 2%, e a conta "IFIC Shohoj" oferece taxas escalonadas variando de 2,75% a 4,25% com base no saldo. Os depósitos de Aviso Especial (SND) e as contas "IFIC Corporate Plus" também fornecem taxas escalonadas, com um máximo de até 5%.

Para depósitos a prazo fixo, o prazo de 1 mês oferece 9,5%, enquanto prazos de 3 meses ou mais oferecem uma taxa fixa de 10,5%. O Esquema de Renda Mensal (MIS) oferece taxas de juros de 11%, 11,5% e 12% para prazos de 1, 2 e 3 anos, respectivamente. Taxas de juros separadas se aplicam a depósitos em moeda estrangeira.