회사 소개

| IFIC Bank 리뷰 요약 | |

| 설립 연도 | 1999 |

| 등록 국가/지역 | 방글라데시 |

| 규제 | 규제 없음 |

| 제품 | IFIC Aamar Bhobishawt, Pension Savings Scheme (PSS), PSS-Joma, Special Notice Deposit (SND), IFIC Corporate Plus, Fixed Deposits, Monthly Income Scheme (MIS), 그리고 외화 예금 제품 NFCD |

| 플랫폼/앱 | IFIC Digital Banking App |

| 고객 지원 | 전화: 09666716250 |

| 팩스: 880-2-44850205 | |

| 이메일: info@ificbankbd.com | |

| 주소: IFIC Tower, 61 Purana Paltan, Dhaka-1000 | |

IFIC Bank 정보

IFIC Bank은 1999년에 설립되었으며 방글라데시에 기반을 두고 있으며 편리한 디지털 뱅킹 앱과 함께 다양한 저축 및 수입 제품을 제공합니다. 은행은 다양한 계정 유형과 경쟁력 있는 예금 금리를 제공하지만 현재 규제를 받고 있지 않습니다.

장단점

| 장점 | 단점 |

| 여러 예금 및 수입 창출 제품 제공 | 규제 없음 |

| 다양한 계정 유형 | |

| 편리한 디지털 뱅킹 플랫폼 제공 |

IFIC Bank 합법성

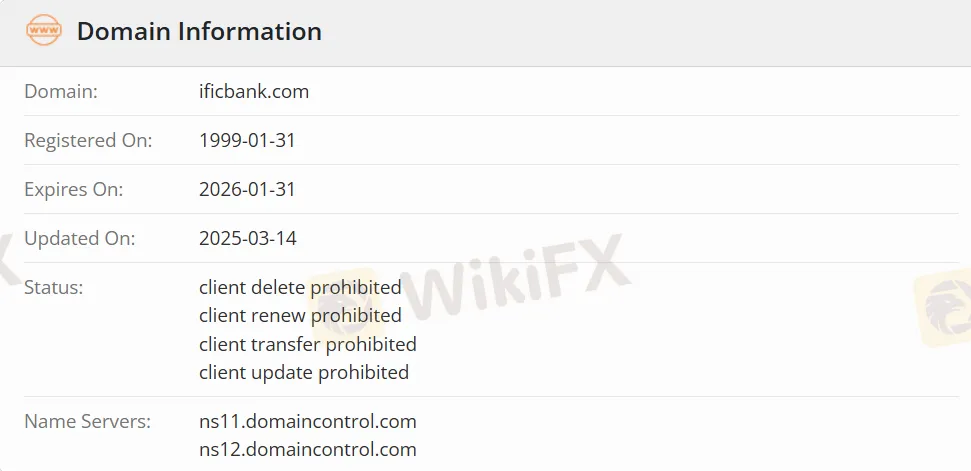

IFIC Bank은 규제를 받지 않는 상태입니다. 해당 도메인 이름인 ificbank.com은 1999년 1월 31일에 등록되었으며 2026년 1월 31일에 만료될 예정입니다.

IFIC Bank 제품

IFIC Bank은 IFIC Aamar Bhobishawt, Pension Savings Scheme (PSS), PSS-Joma, Special Notice Deposit (SND), IFIC Corporate Plus, Fixed Deposits, Monthly Income Scheme (MIS), 그리고 외화 예금 제품 NFCD 등 총 일곱 가지의 예금 및 수입 창출 제품을 제공합니다.

| 제품 | 지원 |

| IFIC Aamar Bhobishawt | ✔ |

| Pension Savings Scheme (PSS) | ✔ |

| PSS-Joma, Special Notice Deposit (SND) | ✔ |

| IFIC Corporate Plus | ✔ |

| Fixed Deposits | ✔ |

| Monthly Income Scheme (MIS) | ✔ |

| NFCD | ✔ |

계정 유형

IFIC Bank은 IFIC Aamar Account, IFIC Shohoj Account, IFIC Freelancer Account, IFIC Women Banking, General Savings Account(학생 계좌 포함), 그리고 Current Account 등 총 여섯 가지 유형의 계좌를 제공합니다.

거래 플랫폼

IFIC Bank의 거래 플랫폼은 IFIC Digital Banking App으로, 안드로이드 기기(Google Play에서 사용 가능)와 Apple iOS 기기(App Store에서 사용 가능)를 모두 지원합니다.

| 거래 플랫폼 | 지원 | 사용 가능한 기기 |

| IFIC Digital Banking App | ✔ | Android, iOS |

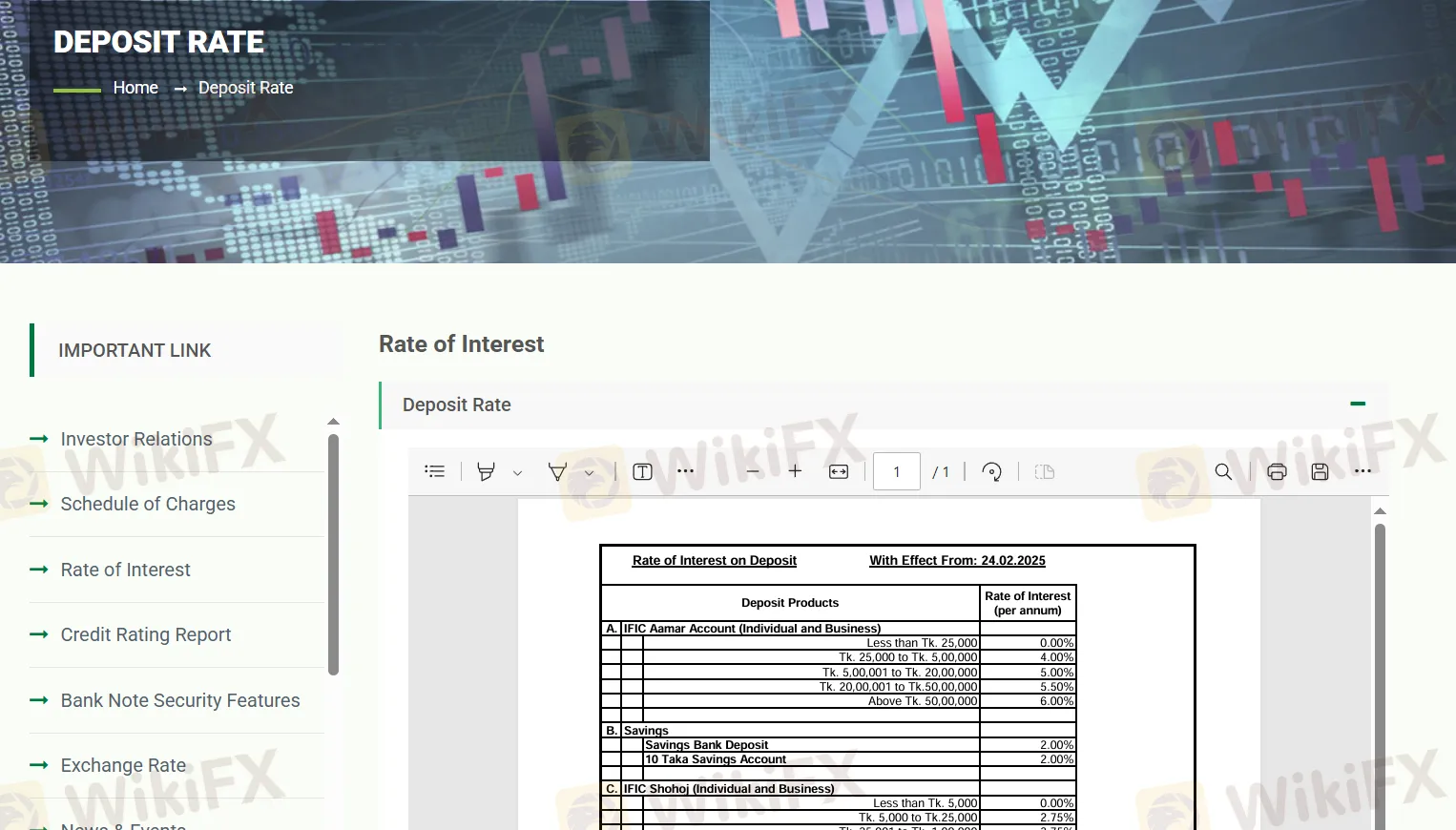

입출금

"IFIC Aamar Bhobishawt" 저축 계획은 연 10%의 이자율을 제공하며 월 납입액을 통해 1년부터 10년까지의 기간에 대해 세전 만기 수익을 제공합니다. 적용 세율은 10%와 15%입니다. 동시에 "Pension Savings Scheme (PSS)"은 연 7.75%의 이자율을 제공하며 "PSS-Joma"는 8.00%를 제공합니다. 일반 저축 계좌는 2%의 이자율을 가지며 "IFIC Shohoj" 계좌는 잔액에 따라 2.75%에서 4.25%까지의 계층별 이율을 제공합니다. Special Notice Deposit (SND) 및 "IFIC Corporate Plus" 계좌도 최대 5%까지의 계층별 이율을 제공합니다.

고정 예금의 경우, 1개월 기간은 9.5%를 제공하며 3개월 이상의 기간은 10.5%의 고정 이율을 제공합니다. 월 수입 스키마(MIS)는 각각 1년, 2년, 3년의 기간에 대해 11%, 11.5%, 12%의 이자율을 제공합니다. 외화 예금에는 별도의 이율이 적용됩니다.