Présentation de l'entreprise

| IFIC Bank Résumé de l'examen | |

| Fondé | 1999 |

| Pays/Région d'enregistrement | Bangladesh |

| Régulation | Pas de régulation |

| Produits | IFIC Aamar Bhobishawt, Régime d'épargne-retraite (PSS), PSS-Joma, Dépôt de préavis spécial (SND), IFIC Corporate Plus, Dépôts à terme, Régime de revenu mensuel (MIS) et le produit de dépôt en devises étrangères NFCD |

| Plateforme/Application | Application bancaire numérique IFIC |

| Support Client | Téléphone : 09666716250 |

| Fax : 880-2-44850205 | |

| Email : info@ificbankbd.com | |

| Adresse : IFIC Tower, 61 Purana Paltan, Dhaka-1000 | |

Informations sur IFIC Bank

IFIC Bank a été fondé en 1999 et est basé au Bangladesh, offrant une variété de produits d'épargne et de revenus ainsi qu'une application bancaire numérique pratique. La banque propose plusieurs types de comptes et des taux de dépôt compétitifs, mais elle n'est actuellement pas réglementée.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Propose plusieurs produits de dépôt et de génération de revenus | Pas de régulation |

| Divers types de comptes | |

| Plateforme bancaire numérique pratique disponible |

IFIC Bank Est-il Légitime ?

IFIC Bank est non réglementé. Son nom de domaine, ificbank.com, a été enregistré le 31 janvier 1999 et expirera le 31 janvier 2026.

Produits de IFIC Bank

IFIC Bank propose un total de sept produits de dépôt et de génération de revenus, à savoir IFIC Aamar Bhobishawt, Régime d'épargne-retraite (PSS), PSS-Joma, Dépôt de préavis spécial (SND), IFIC Corporate Plus, Dépôts à terme, Régime de revenu mensuel (MIS) et le produit de dépôt en devises étrangères NFCD.

| Produits | Pris en charge |

| IFIC Aamar Bhobishawt | ✔ |

| Régime d'épargne-retraite (PSS) | ✔ |

| PSS-Joma, Dépôt de préavis spécial (SND) | ✔ |

| IFIC Corporate Plus | ✔ |

| Dépôts à terme | ✔ |

| Régime de revenu mensuel (MIS) | ✔ |

| NFCD | ✔ |

Type de Compte

IFIC Bank propose un total de six types de comptes : IFIC Aamar Account, IFIC Shohoj Account, IFIC Freelancer Account, IFIC Women Banking, General Savings Account (y compris Student Account) et Current Account.

Plateforme de trading

La plateforme de trading de IFIC Bank est l'application bancaire numérique IFIC, qui prend en charge à la fois les appareils Android (disponible sur Google Play) et les appareils Apple iOS (disponible sur l'App Store).

| Plateforme de trading | Pris en charge | Appareils disponibles |

| Application bancaire numérique IFIC | ✔ | Android, iOS |

Dépôt et retrait

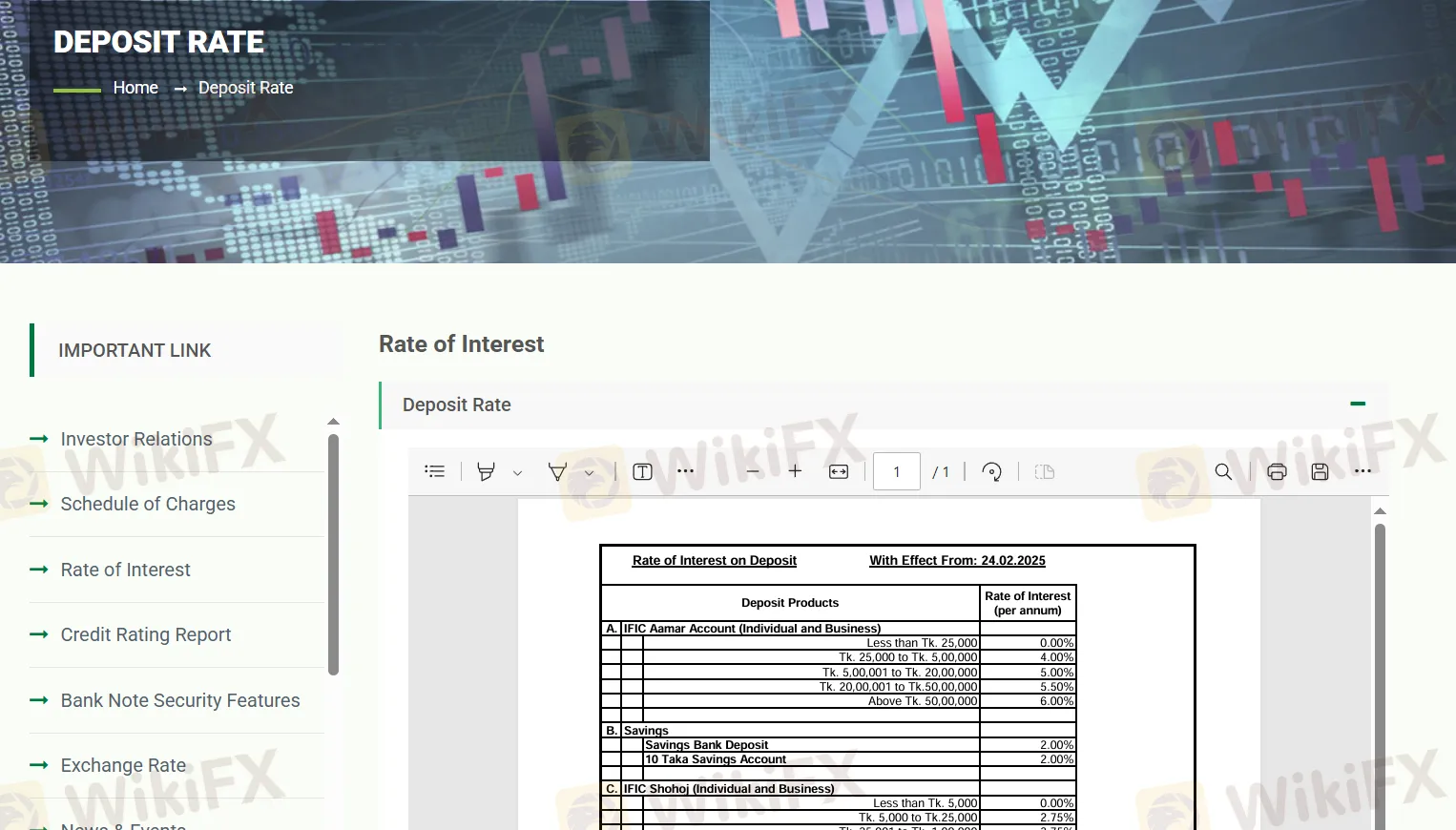

Le régime d'épargne "IFIC Aamar Bhobishawt" offre un taux d'intérêt annuel de 10% avec des versements mensuels, offrant différents rendements de maturité avant impôts pour des durées allant de 1 à 10 ans ; les taux d'imposition applicables sont de 10% et 15%. En même temps, le "Pension Savings Scheme (PSS)" offre un taux d'intérêt annuel de 7,75%, tandis que le "PSS-Joma" offre 8,00%. Le compte d'épargne régulier a un taux d'intérêt de 2%, et le compte "IFIC Shohoj" propose des taux échelonnés allant de 2,75% à 4,25% en fonction du solde. Les comptes de Dépôt à Avis Spécial (SND) et "IFIC Corporate Plus" offrent également des taux échelonnés, avec un maximum allant jusqu'à 5%.

Pour les dépôts à terme, la durée d'1 mois offre 9,5%, tandis que les durées de 3 mois ou plus offrent un taux fixe de 10,5%. Le Schéma de Revenu Mensuel (MIS) propose des taux d'intérêt de 11%, 11,5% et 12% pour des durées de 1, 2 et 3 ans respectivement. Des taux d'intérêt séparés s'appliquent aux dépôts en devises étrangères.