Profil perusahaan

| IFIC Bank Ringkasan Ulasan | |

| Didirikan | 1999 |

| Negara/Daerah Terdaftar | Bangladesh |

| Regulasi | Tidak diatur |

| Produk | IFIC Aamar Bhobishawt, Skema Tabungan Pensiun (PSS), PSS-Joma, Simpanan Berjangka Khusus (SND), IFIC Corporate Plus, Deposito Tetap, Skema Pendapatan Bulanan (MIS), dan produk deposito mata uang asing NFCD |

| Platform/APP | IFIC Digital Banking App |

| Dukungan Pelanggan | Telepon: 09666716250 |

| Fax: 880-2-44850205 | |

| Email: info@ificbankbd.com | |

| Alamat: Menara IFIC, 61 Purana Paltan, Dhaka-1000 | |

Informasi IFIC Bank

IFIC Bank didirikan pada tahun 1999 dan berbasis di Bangladesh, menawarkan berbagai produk tabungan dan pendapatan bersama dengan aplikasi perbankan digital yang nyaman. Bank ini menyediakan berbagai jenis akun dan tingkat deposito yang kompetitif, namun saat ini tidak diatur.

Pro dan Kontra

| Pro | Kontra |

| Menyediakan berbagai produk deposito dan penghasilan | Tidak diatur |

| Berbagai jenis akun | |

| Platform perbankan digital yang nyaman tersedia |

Apakah IFIC Bank Legal?

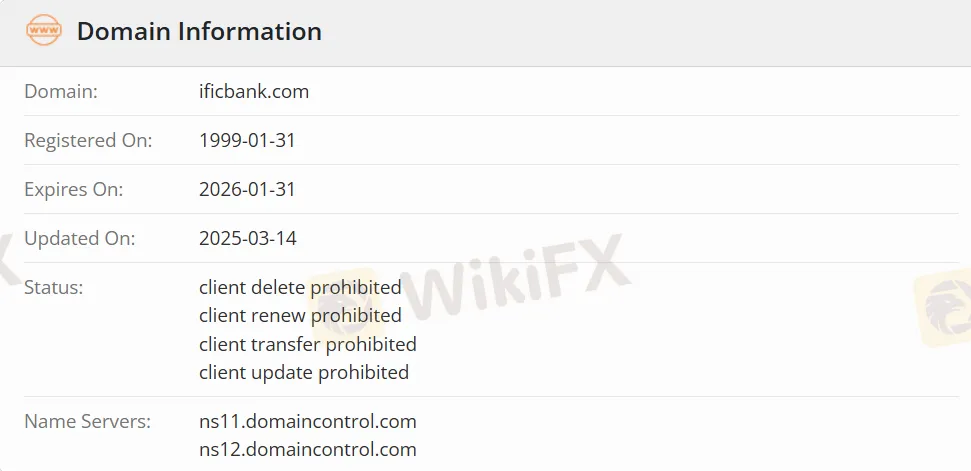

IFIC Bank tidak diatur. Nama domainnya, ificbank.com, didaftarkan pada 31 Januari 1999, dan akan kedaluwarsa pada 31 Januari 2026.

Produk IFIC Bank

IFIC Bank menawarkan total tujuh produk deposito dan penghasilan, yaitu IFIC Aamar Bhobishawt, Skema Tabungan Pensiun (PSS), PSS-Joma, Simpanan Berjangka Khusus (SND), IFIC Corporate Plus, Deposito Tetap, Skema Pendapatan Bulanan (MIS), dan produk deposito mata uang asing NFCD.

| Produk | Didukung |

| IFIC Aamar Bhobishawt | ✔ |

| Skema Tabungan Pensiun (PSS) | ✔ |

| PSS-Joma, Simpanan Berjangka Khusus (SND) | ✔ |

| IFIC Corporate Plus | ✔ |

| Deposito Tetap | ✔ |

| Skema Pendapatan Bulanan (MIS) | ✔ |

| NFCD | ✔ |

Jenis Akun

IFIC Bank menawarkan total enam jenis akun: IFIC Aamar Account, IFIC Shohoj Account, IFIC Freelancer Account, IFIC Women Banking, General Savings Account (termasuk Student Account), dan Current Account.

Platform Perdagangan

Platform perdagangan IFIC Bank adalah Aplikasi Perbankan Digital IFIC, yang mendukung perangkat Android (tersedia di Google Play) dan perangkat Apple iOS (tersedia di App Store).

| Platform Perdagangan | Didukung | Perangkat Tersedia |

| Aplikasi Perbankan Digital IFIC | ✔ | Android, iOS |

Deposit dan Penarikan

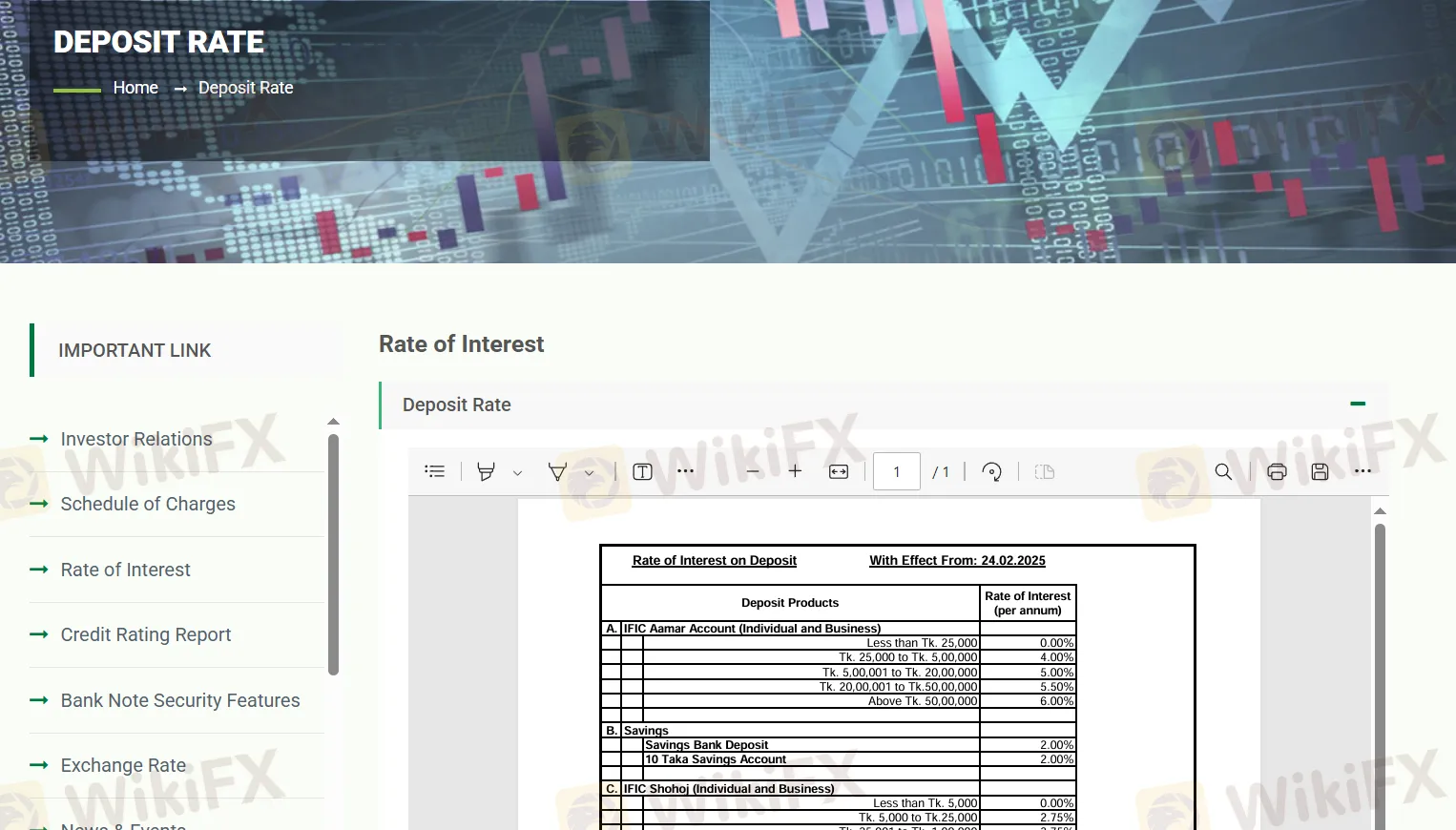

Skema tabungan "IFIC Aamar Bhobishawt" menawarkan tingkat bunga tahunan 10% dengan cicilan bulanan, memberikan pengembalian kematangan sebelum pajak yang berbeda untuk jangka waktu mulai dari 1 hingga 10 tahun; tarif pajak yang berlaku adalah 10% dan 15%. Pada saat yang sama, "Pension Savings Scheme (PSS)" menawarkan tingkat bunga tahunan 7.75%, sementara "PSS-Joma" menawarkan 8.00%. Akun tabungan reguler memiliki tingkat bunga 2%, dan akun "IFIC Shohoj" menawarkan tingkat berjenjang mulai dari 2.75% hingga 4.25% berdasarkan saldo. Special Notice Deposit (SND) dan akun "IFIC Corporate Plus" juga memberikan tingkat berjenjang, dengan maksimum hingga 5%.

Untuk deposito berjangka, jangka waktu 1 bulan menawarkan 9.5%, sementara jangka waktu 3 bulan atau lebih menawarkan tingkat tetap 10.5%. Skema Pendapatan Bulanan (MIS) menyediakan tingkat bunga 11%, 11.5%, dan 12% untuk jangka waktu masing-masing 1, 2, dan 3 tahun. Tingkat bunga terpisah berlaku untuk deposito valuta asing.