Buod ng kumpanya

| IFIC Bank Buod ng Pagsusuri | |

| Itinatag | 1999 |

| Rehistradong Bansa/Rehiyon | Bangladesh |

| Regulasyon | Walang regulasyon |

| Mga Produkto | IFIC Aamar Bhobishawt, Pension Savings Scheme (PSS), PSS-Joma, Special Notice Deposit (SND), IFIC Corporate Plus, Fixed Deposits, Monthly Income Scheme (MIS), at ang dayuhang produkto sa depositong salapi NFCD |

| Platform/APP | IFIC Digital Banking App |

| Suporta sa Customer | Telepono: 09666716250 |

| Fax: 880-2-44850205 | |

| Email: info@ificbankbd.com | |

| Address: IFIC Tower, 61 Purana Paltan, Dhaka-1000 | |

Impormasyon Tungkol sa IFIC Bank

Itinatag ang IFIC Bank noong 1999 at nakabase sa Bangladesh, nag-aalok ng iba't ibang mga produkto para sa pag-iipon at kita kasama ang isang kumportableng digital banking app. Nagbibigay ang bangko ng maraming uri ng account at competitive deposit rates, ngunit hindi ito nairehistro sa kasalukuyan.

Mga Kalamangan at Disadvantages

| Kalamangan | Disadvantages |

| Nagbibigay ng maraming produkto para sa deposito at kita | Walang regulasyon |

| Iba't ibang uri ng account | |

| Maginhawang digital banking platform na available |

Tunay ba ang IFIC Bank?

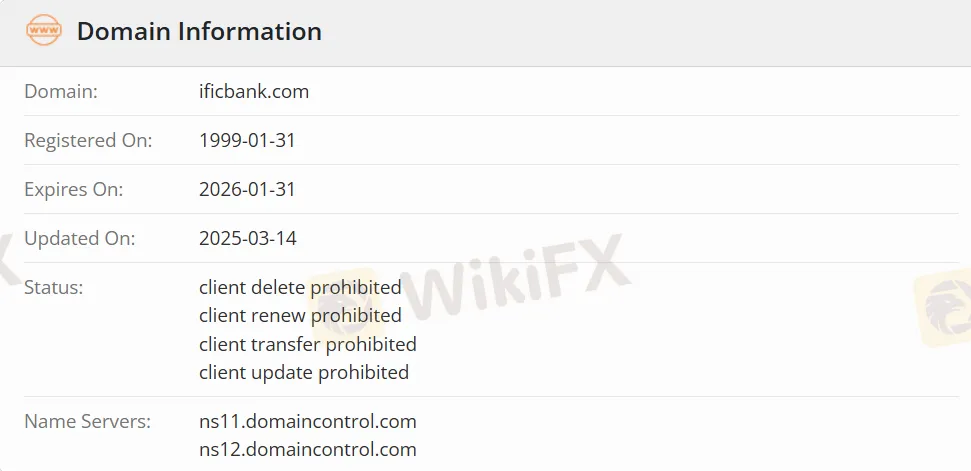

Ang IFIC Bank ay hindi nairehistro. Ang domain name nito, ificbank.com, ay nirehistro noong Enero 31, 1999, at mag-eexpire sa Enero 31, 2026.

Mga Produkto ng IFIC Bank

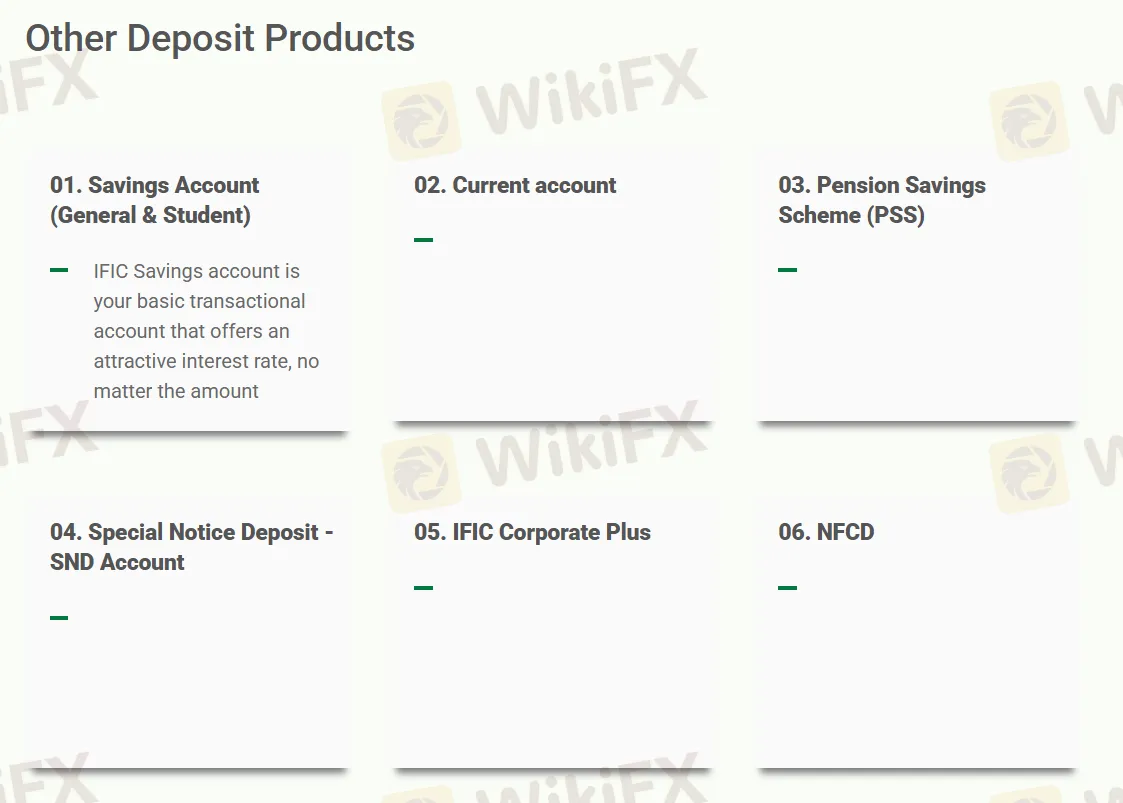

Nag-aalok ang IFIC Bank ng kabuuang pitong produkto para sa deposito at kita, namely IFIC Aamar Bhobishawt, Pension Savings Scheme (PSS), PSS-Joma, Special Notice Deposit (SND), IFIC Corporate Plus, Fixed Deposits, Monthly Income Scheme (MIS), at ang dayuhang produkto sa depositong salapi NFCD.

| Mga Produkto | Supported |

| IFIC Aamar Bhobishawt | ✔ |

| Pension Savings Scheme (PSS) | ✔ |

| PSS-Joma, Special Notice Deposit (SND) | ✔ |

| IFIC Corporate Plus | ✔ |

| Fixed Deposits | ✔ |

| Monthly Income Scheme (MIS) | ✔ |

| NFCD | ✔ |

Uri ng Account

IFIC Bank ay nag-aalok ng kabuuang anim na uri ng mga account: IFIC Aamar Account, IFIC Shohoj Account, IFIC Freelancer Account, IFIC Women Banking, General Savings Account (kasama ang Student Account), at Current Account.

Platform ng Paggagalaw

Ang platform ng paggagalaw ng IFIC Bank ay ang IFIC Digital Banking App, na sumusuporta sa parehong mga Android device (magagamit sa Google Play) at mga Apple iOS device (magagamit sa App Store).

| Platform ng Paggagalaw | Sumusuporta | Mga Magagamit na Device |

| IFIC Digital Banking App | ✔ | Android, iOS |

Deposito at Pag-Wiwithdraw

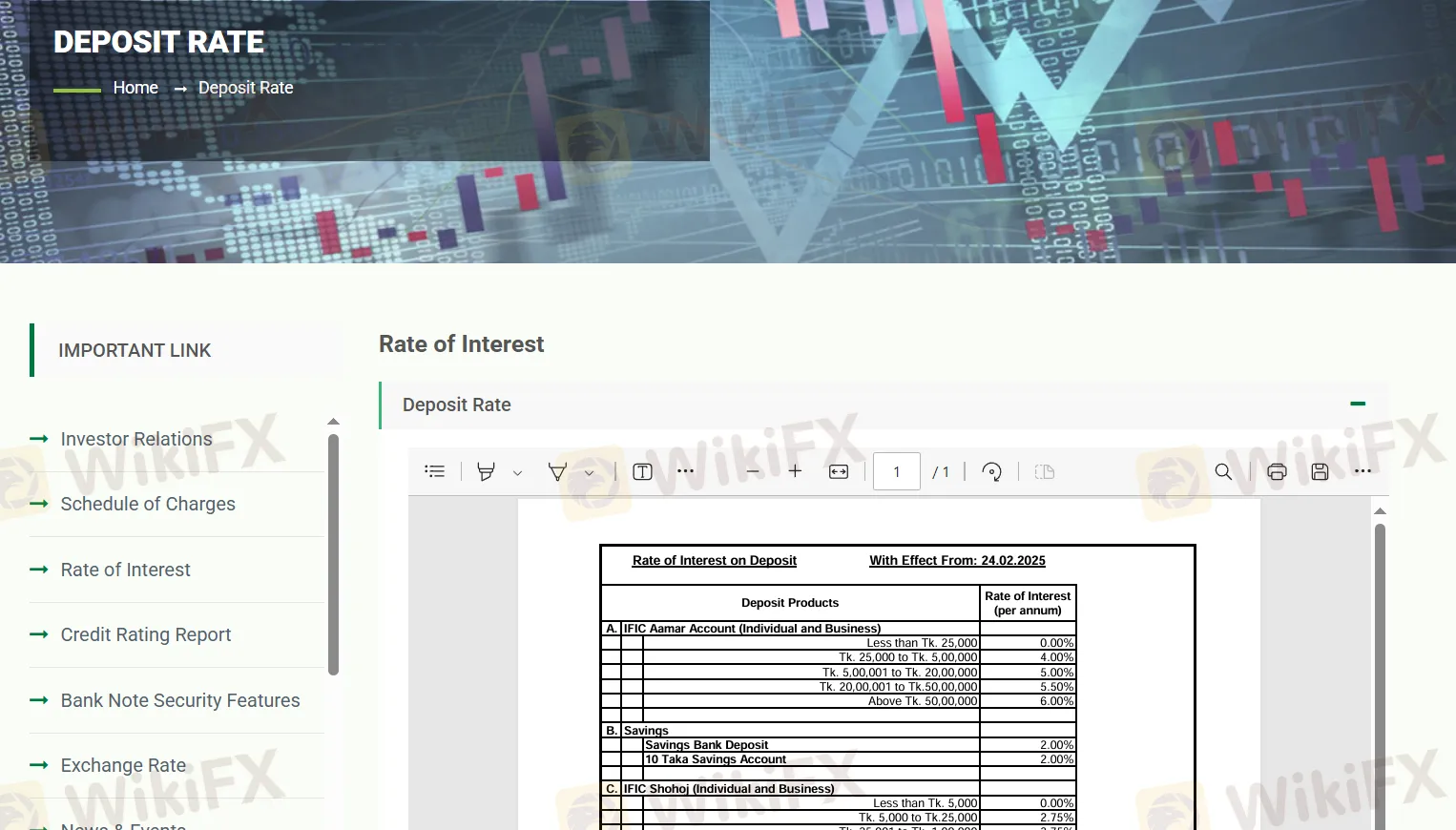

Ang "IFIC Aamar Bhobishawt" savings scheme ay nag-aalok ng taunang interes na rate na 10% na may buwanang installment, nagbibigay ng iba't ibang pre-tax maturity returns para sa mga term na umaabot mula 1 hanggang 10 taon; ang mga naaangkop na tax rate ay 10% at 15%. Sa parehong oras, ang "Pension Savings Scheme (PSS)" ay nag-aalok ng taunang interes na rate na 7.75%, habang ang "PSS-Joma" ay nag-aalok ng 8.00%. Ang regular savings account ay may interes rate na 2%, at ang "IFIC Shohoj" account ay nag-aalok ng tiered rates na umaabot mula 2.75% hanggang 4.25% batay sa balance. Ang Special Notice Deposit (SND) at "IFIC Corporate Plus" accounts ay nagbibigay din ng tiered rates, na may maximum na hanggang 5%.

Para sa fixed deposits, ang term na 1 buwan ay nag-aalok ng 9.5%, habang ang mga term na 3 buwan o higit pa ay nag-aalok ng flat rate na 10.5%. Ang Monthly Income Scheme (MIS) ay nagbibigay ng 11%, 11.5%, at 12% na mga interes rate para sa mga term na 1, 2, at 3 taon ayon sa pagkakasunod-sunod. May hiwalay na interes rates para sa foreign currency deposits.