Şirket özeti

| IFIC Bank İnceleme Özeti | |

| Kuruluş | 1999 |

| Kayıtlı Ülke/Bölge | Bangladeş |

| Düzenleme | Düzenleme yok |

| Ürünler | IFIC Aamar Bhobishawt, Emeklilik Tasarruf Şeması (PSS), PSS-Joma, Özel Bildirim Mevduatı (SND), IFIC Kurumsal Plus, Sabit Mevduatlar, Aylık Gelir Şeması (MIS) ve yabancı para mevduat ürünü NFCD |

| Platform/Uygulama | IFIC Dijital Bankacılık Uygulaması |

| Müşteri Desteği | Telefon: 09666716250 |

| Faks: 880-2-44850205 | |

| E-posta: info@ificbankbd.com | |

| Adres: IFIC Kulesi, 61 Purana Paltan, Dhaka-1000 | |

IFIC Bank Bilgileri

IFIC Bank 1999 yılında kurulmuş olup Bangladeş merkezli olup çeşitli tasarruf ve gelir ürünleri sunmaktadır ve kullanışlı bir dijital bankacılık uygulaması sunmaktadır. Banka, çeşitli hesap türleri ve rekabetçi mevduat faiz oranları sunmaktadır, ancak şu anda düzenlenmemiştir.

Artıları ve Eksileri

| Artıları | Eksileri |

| Çeşitli mevduat ve gelir getirici ürünler sunar | Düzenleme yok |

| Çeşitli hesap türleri | |

| Kullanışlı dijital bankacılık platformu mevcut |

IFIC Bank Güvenilir mi?

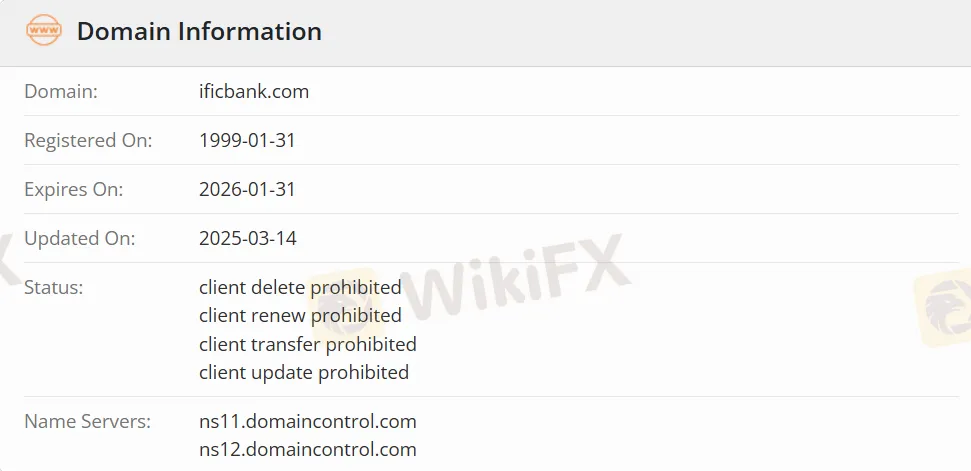

IFIC Bank düzenlenmemiştir. Alan adı ificbank.com, 31 Ocak 1999 tarihinde kaydedildi ve 31 Ocak 2026 tarihinde sona erecektir.

IFIC Bank Ürünleri

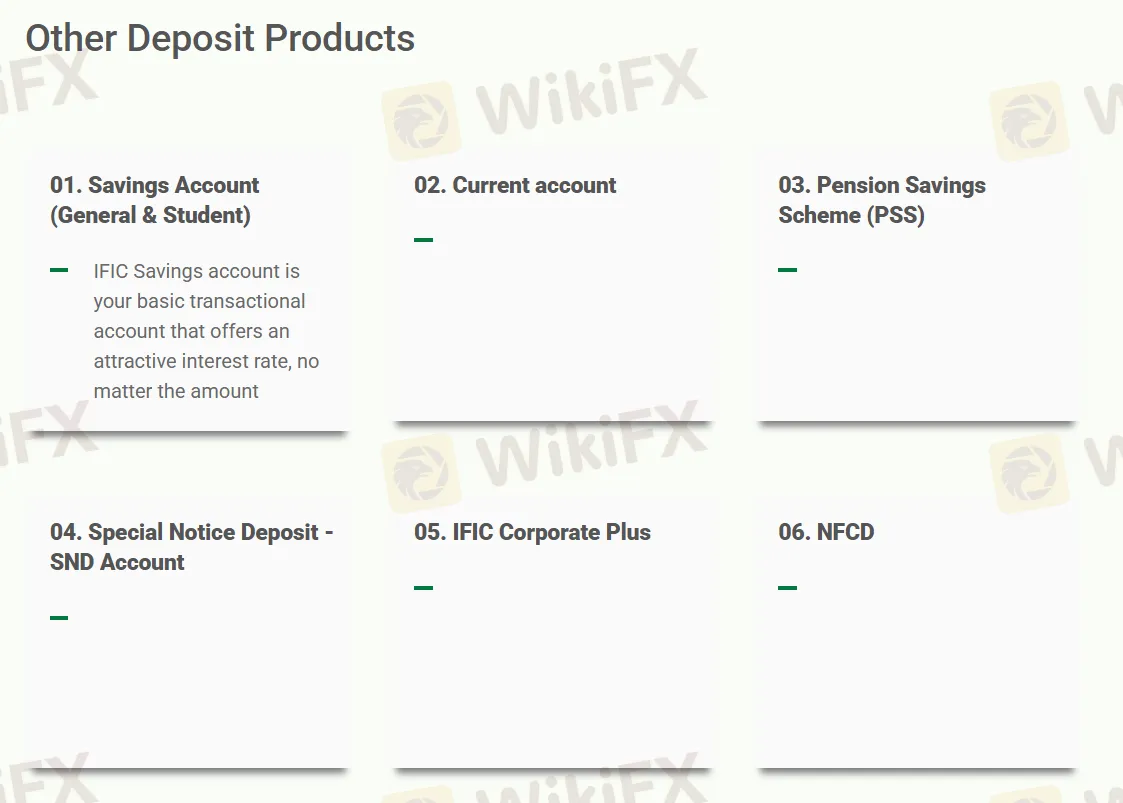

IFIC Bank, IFIC Aamar Bhobishawt, Emeklilik Tasarruf Şeması (PSS), PSS-Joma, Özel Bildirim Mevduatı (SND), IFIC Kurumsal Plus, Sabit Mevduatlar, Aylık Gelir Şeması (MIS) ve yabancı para mevduat ürünü NFCD olmak üzere toplam yedi mevduat ve gelir getirici ürün sunmaktadır.

| Ürünler | Desteklenen |

| IFIC Aamar Bhobishawt | ✔ |

| Emeklilik Tasarruf Şeması (PSS) | ✔ |

| PSS-Joma, Özel Bildirim Mevduatı (SND) | ✔ |

| IFIC Kurumsal Plus | ✔ |

| Sabit Mevduatlar | ✔ |

| Aylık Gelir Şeması (MIS) | ✔ |

| NFCD | ✔ |

Hesap Türü

IFIC Bank toplam altı tür hesap sunmaktadır: IFIC Aamar Hesabı, IFIC Shohoj Hesabı, IFIC Freelancer Hesabı, IFIC Kadın Bankacılığı, Genel Tasarruf Hesabı (Öğrenci Hesabı dahil) ve Vadesiz Hesap.

İşlem Platformu

IFIC Bank'nin işlem platformu IFIC Dijital Bankacılık Uygulaması'dır ve hem Android cihazları (Google Play'de mevcut) hem de Apple iOS cihazları (App Store'da mevcut) tarafından desteklenmektedir.

| İşlem Platformu | Desteklenen | Mevcut Cihazlar |

| IFIC Dijital Bankacılık Uygulaması | ✔ | Android, iOS |

Para Yatırma ve Çekme

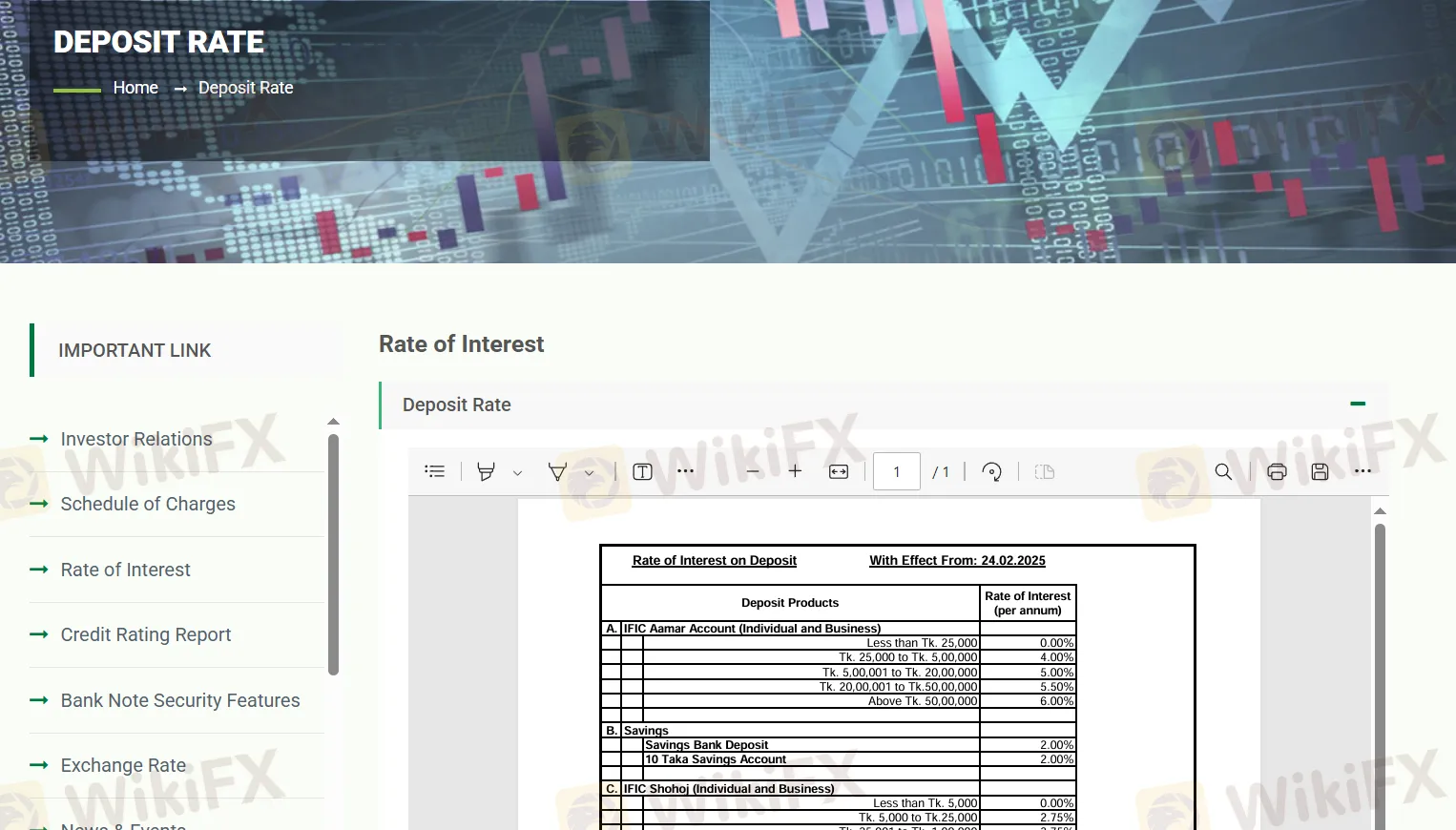

"IFIC Aamar Bhobishawt" tasarruf planı aylık taksitlerle %10 faiz oranı sunar ve 1 ila 10 yıl arasındaki vadeler için farklı vergi öncesi vade sonu getirileri sağlar; uygulanabilir vergi oranları %10 ve %15'tir. Aynı zamanda, "Emeklilik Tasarruf Planı (PSS)" %7.75 faiz oranı sunarken, "PSS-Joma" %8.00 sunar. Düzenli tasarruf hesabının faiz oranı %2'dir ve "IFIC Shohoj" hesabı bakiyeye bağlı olarak %2.75 ila %4.25 arasında değişen kademeli faiz oranları sunar. Özel Dikkat Mevduatı (SND) ve "IFIC Corporate Plus" hesapları da kademeli faiz oranları sağlar, maksimum %5'e kadar.

Vadeli mevduatlar için, 1 aylık vade %9.5 sunarken, 3 ay veya daha uzun vadeler için sabit %10.5 oranı sunar. Aylık Gelir Şeması (MIS) sırasıyla 1, 2 ve 3 yıllık vadeler için %11, %11.5 ve %12 faiz oranları sağlar. Yabancı para mevduatları için ayrı faiz oranları geçerlidir.