مقدمة عن الشركة

| IFIC Bank ملخص المراجعة | |

| تأسست | 1999 |

| البلد/المنطقة المسجلة | بنغلاديش |

| التنظيم | لا يوجد تنظيم |

| المنتجات | IFIC Aamar Bhobishawt، Pension Savings Scheme (PSS)، PSS-Joma، Special Notice Deposit (SND)، IFIC Corporate Plus، Fixed Deposits، Monthly Income Scheme (MIS)، ومنتج الإيداع بالعملات الأجنبية NFCD |

| المنصة/التطبيق | تطبيق IFIC للخدمات المصرفية الرقمية |

| دعم العملاء | الهاتف: 09666716250 |

| الفاكس: 880-2-44850205 | |

| البريد الإلكتروني: info@ificbankbd.com | |

| العنوان: برج IFIC، 61 بورانا بالتان، دكا-1000 | |

معلومات IFIC Bank

تأسست IFIC Bank في عام 1999 ومقرها في بنغلاديش، حيث تقدم مجموعة متنوعة من منتجات التوفير والدخل بالإضافة إلى تطبيق مصرفي رقمي مريح. يوفر البنك أنواع حسابات متعددة وأسعار إيداع تنافسية، ولكنه غير منظم حاليًا.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| يوفر العديد من منتجات الإيداع وتوليد الدخل | لا يوجد تنظيم |

| أنواع حسابات متنوعة | |

| منصة مصرفية رقمية مريحة متاحة |

هل IFIC Bank شرعية؟

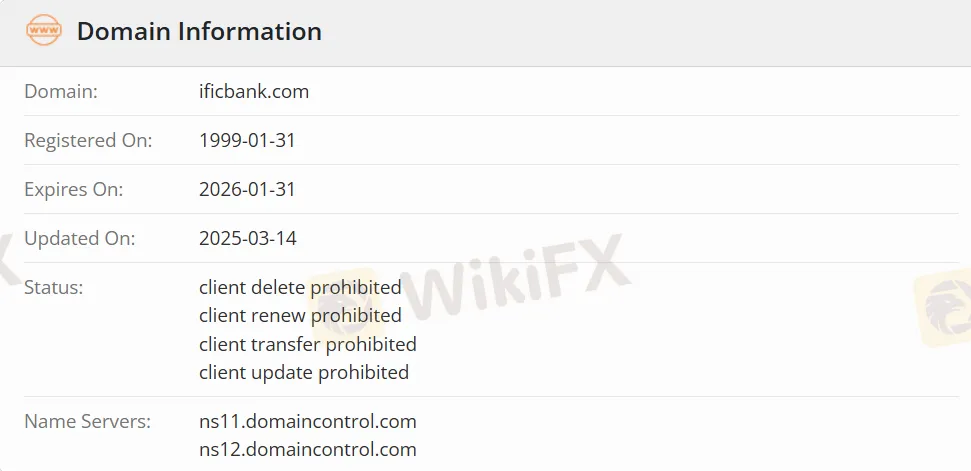

IFIC Bank هو غير منظم. تم تسجيل اسم نطاقه، ificbank.com، في 31 يناير 1999، وسينتهي في 31 يناير 2026.

منتجات IFIC Bank

IFIC Bank تقدم مجموعة من سبع منتجات إيداع وتوليد دخل، وهي IFIC Aamar Bhobishawt، Pension Savings Scheme (PSS)، PSS-Joma، Special Notice Deposit (SND)، IFIC Corporate Plus، Fixed Deposits، Monthly Income Scheme (MIS)، ومنتج الإيداع بالعملات الأجنبية NFCD.

| المنتجات | مدعوم |

| IFIC Aamar Bhobishawt | ✔ |

| Pension Savings Scheme (PSS) | ✔ |

| PSS-Joma, Special Notice Deposit (SND) | ✔ |

| IFIC Corporate Plus | ✔ |

| Fixed Deposits | ✔ |

| Monthly Income Scheme (MIS) | ✔ |

| NFCD | ✔ |

نوع الحساب

IFIC Bank تقدم مجموعة من ستة أنواع من الحسابات: حساب IFIC Aamar، حساب IFIC Shohoj، حساب IFIC Freelancer، حساب IFIC Women Banking، حساب التوفير العام (بما في ذلك حساب الطالب)، وحساب الجاري.

منصة التداول

منصة التداول لدى IFIC Bank هي تطبيق IFIC Digital Banking، الذي يدعم كل من أجهزة Android (متوفر على Google Play) وأجهزة Apple iOS (متوفر على App Store).

| منصة التداول | مدعومة | الأجهزة المتاحة |

| تطبيق IFIC Digital Banking | ✔ | Android، iOS |

الإيداع والسحب

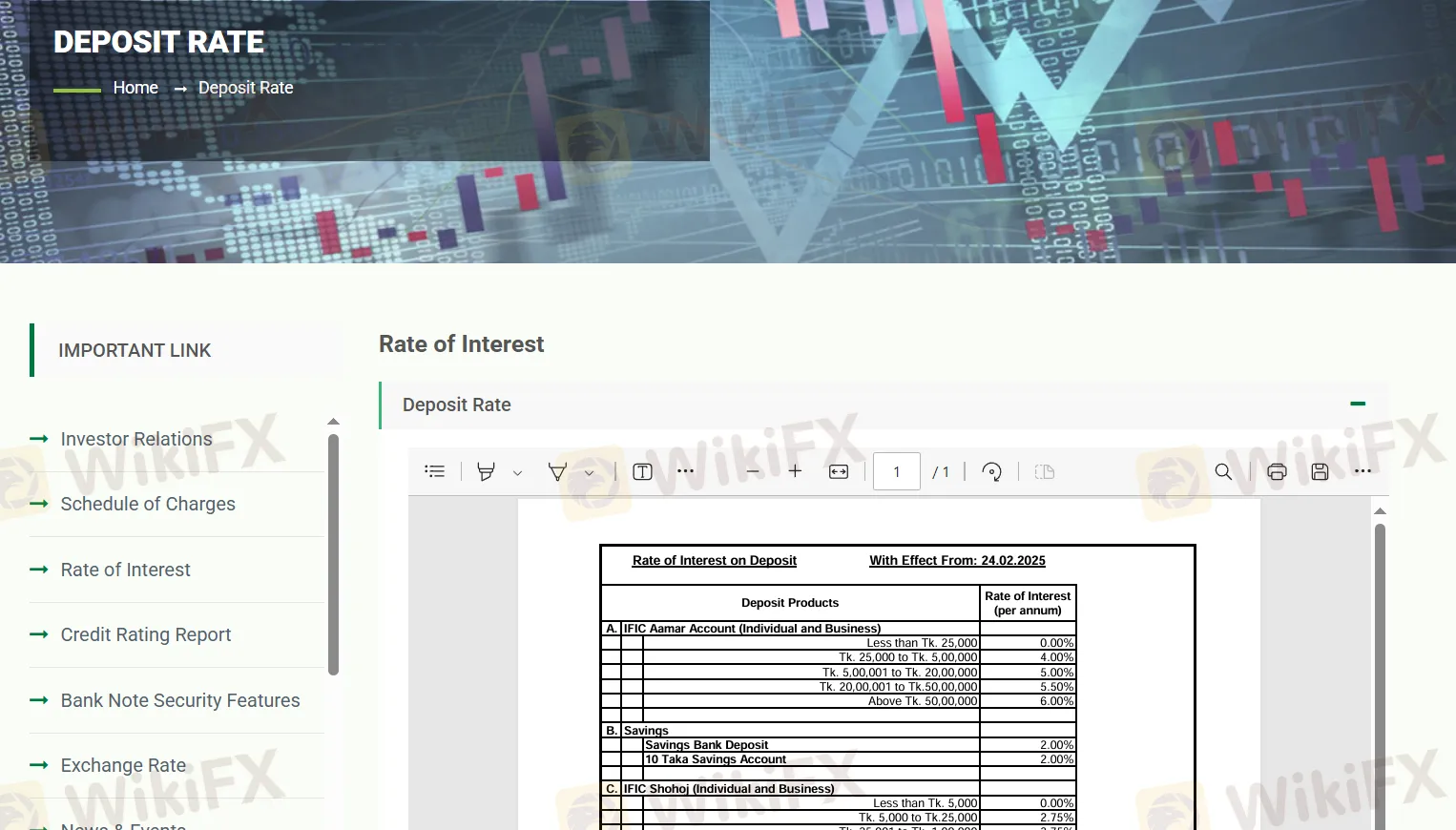

يقدم نظام التوفير "IFIC Aamar Bhobishawt" معدل فائدة سنوي يبلغ 10% مع أقساط شهرية، مما يوفر عوائد نضوية مختلفة قبل الضريبة لفترات تتراوح بين 1 و 10 سنوات؛ تبلغ أسعار الضريبة المعمول بها 10% و 15%. في الوقت نفسه، يقدم نظام التوفير للتقاعد (PSS) معدل فائدة سنوي يبلغ 7.75%، بينما يقدم "PSS-Joma" 8.00%. يبلغ معدل الفائدة للحساب العادي للتوفير 2%، ويقدم حساب "IFIC Shohoj" معدلات متدرجة تتراوح بين 2.75% و 4.25% استنادًا إلى الرصيد. تقدم حسابات الإشعار الخاص (SND) و "IFIC Corporate Plus" أيضًا معدلات متدرجة، بحد أقصى يصل إلى 5%.

بالنسبة للودائع الثابتة، يقدم الأجل لمدة شهر معدل فائدة يبلغ 9.5%، بينما تقدم فترات تزيد عن 3 أشهر معدل ثابت يبلغ 10.5%. يوفر نظام الدخل الشهري (MIS) معدلات فائدة تبلغ 11%، 11.5%، و 12% لفترات تبلغ 1، 2، و 3 سنوات على التوالي. تنطبق معدلات فائدة منفصلة على الودائع بالعملات الأجنبية.