회사 소개

| CHIEF리뷰 요약 | |

| 설립 | 1979 |

| 등록 국가/지역 | 홍콩 |

| 규제 | 규제됨 |

| 시장 기구 | 증권선물 |

| 데모 계정 | ❌ |

| 레버리지 | / |

| 스프레드 | / |

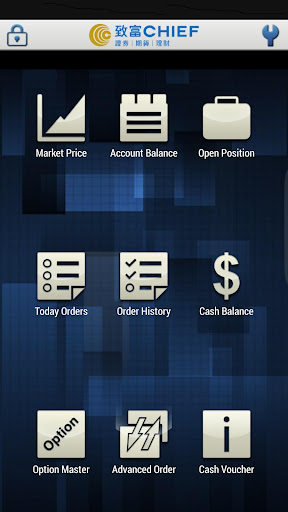

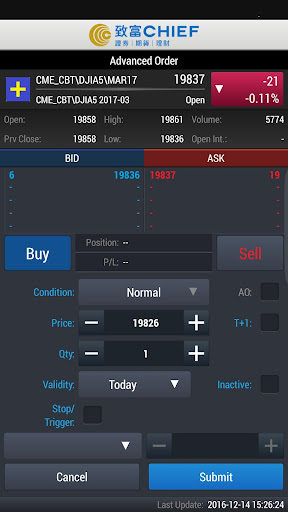

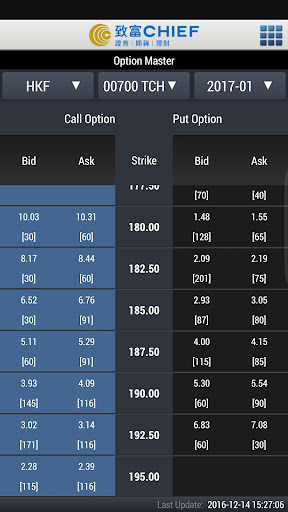

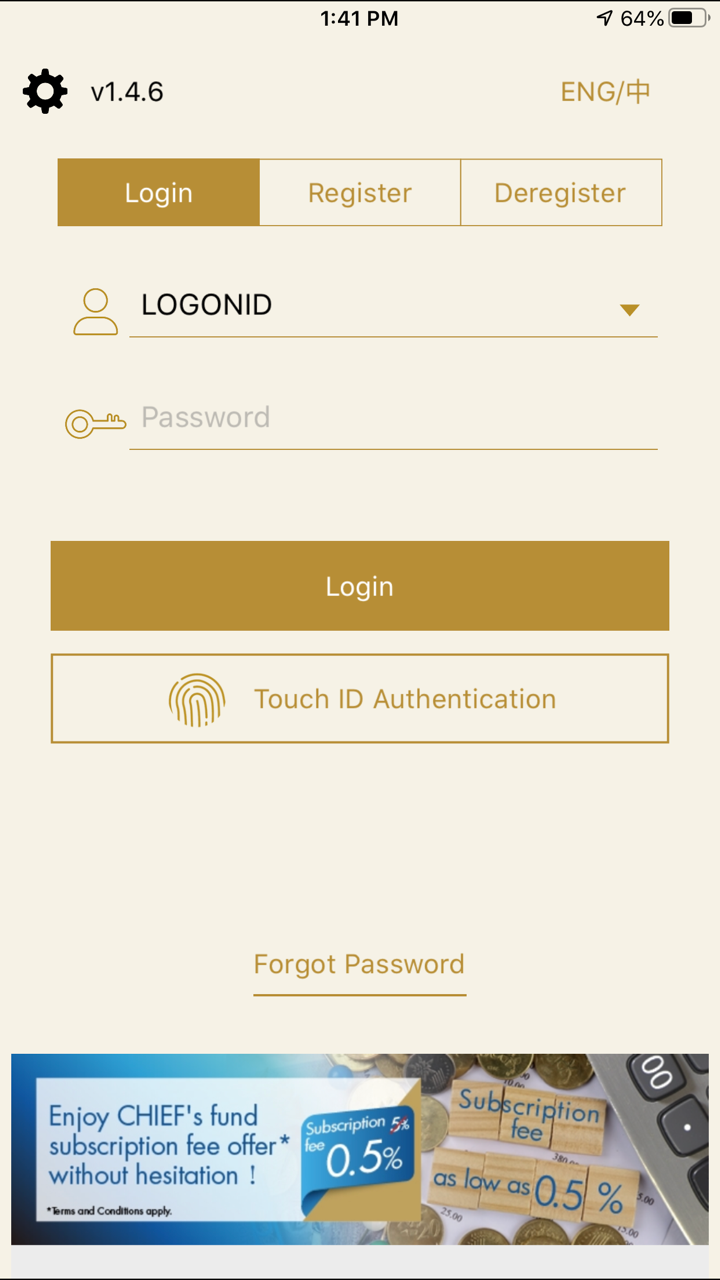

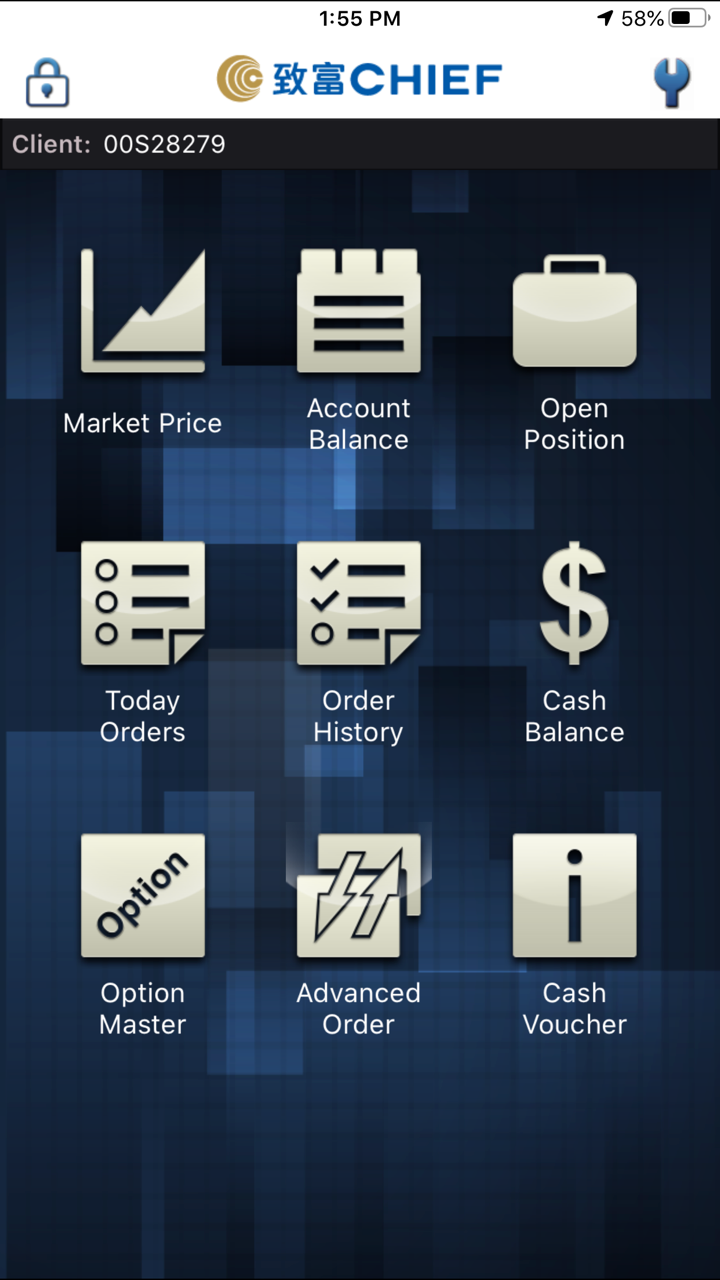

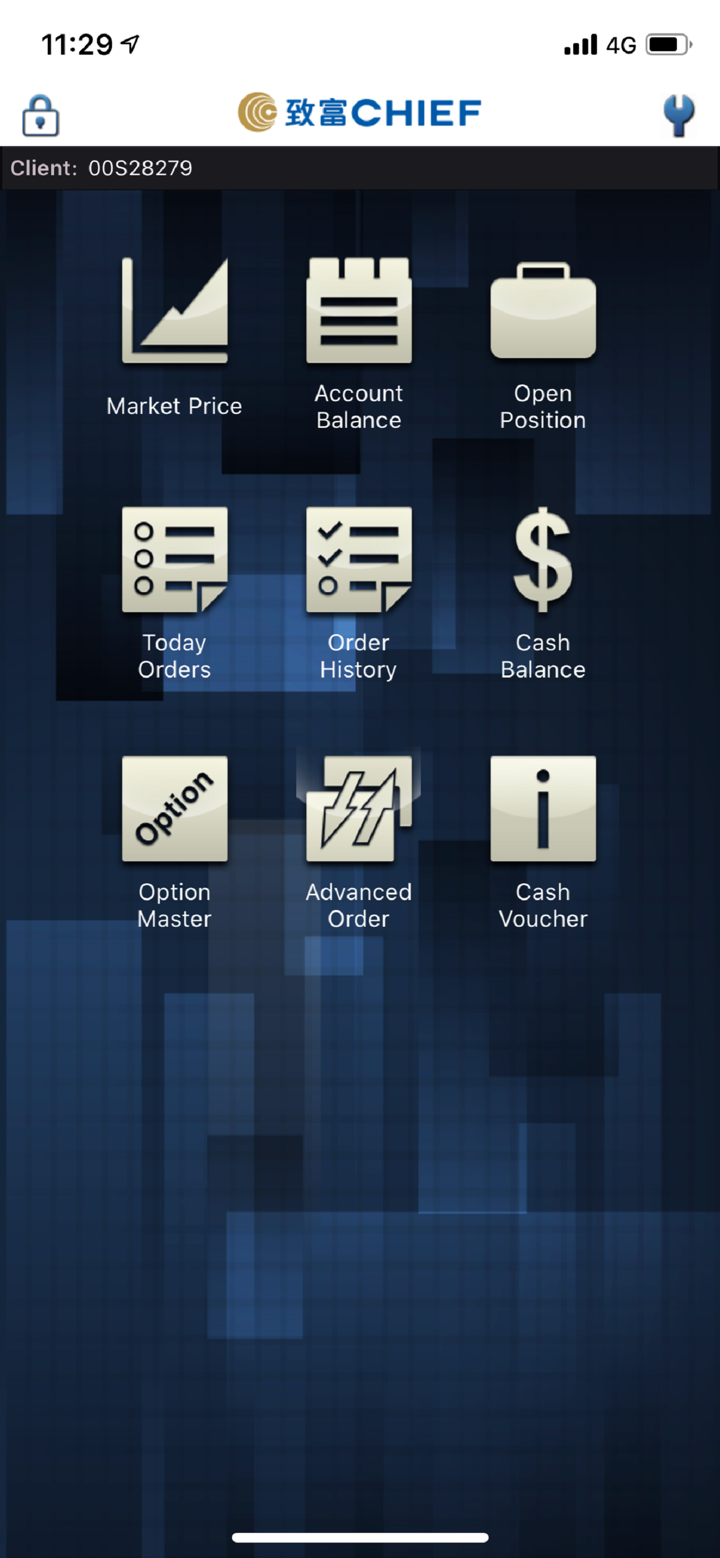

| 거래 플랫폼 | Chief Deal |

| 최소 입금액 | / |

| 고객 지원 | 이메일: cs@chiefgroup.com.hk |

| 소셜 미디어: Facebook, Linkedin, Youtube, Whatsapp, Wechat | |

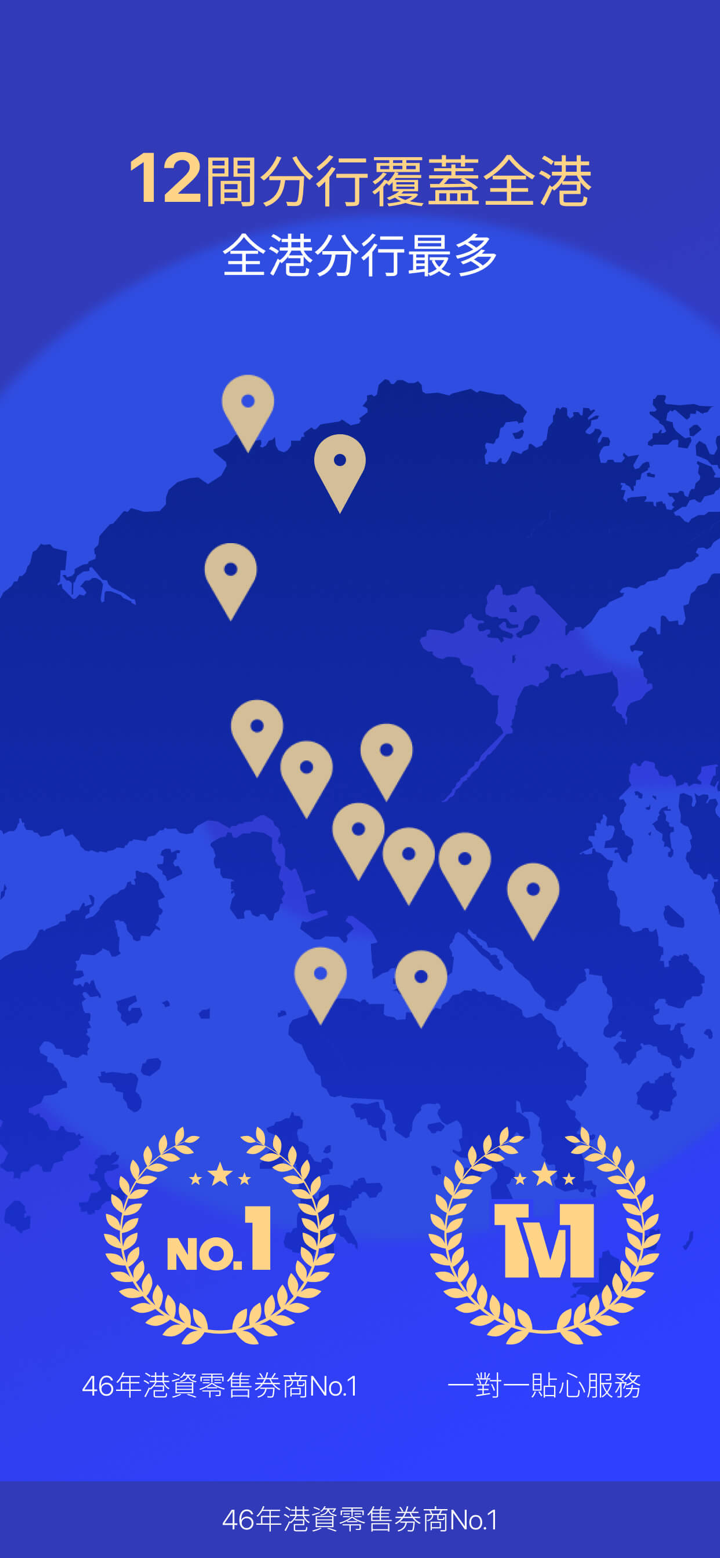

CHIEF 정보

CHIEF은 1979년에 홍콩에서 설립되었습니다. 현재 SFC에 의해 규제되며, 주로 증권 및 선물 거래를 제공하며, 자체 거래 플랫폼을 보유하고 있습니다.

장단점

| 장점 | 단점 |

| SFC 규제 | MT4/5 지원 안됨 |

| 데모 계정 사용 불가 |

CHIEF의 신뢰성

| 규제 국가/지역 |  |

| 규제 기관 | SFC |

| 규제 업체 | Chief Commodities Limited |

| 라이선스 유형 | 선물 계약 거래 |

| 라이선스 번호 | AAZ607 |

| 현재 상태 | 규제됨 |

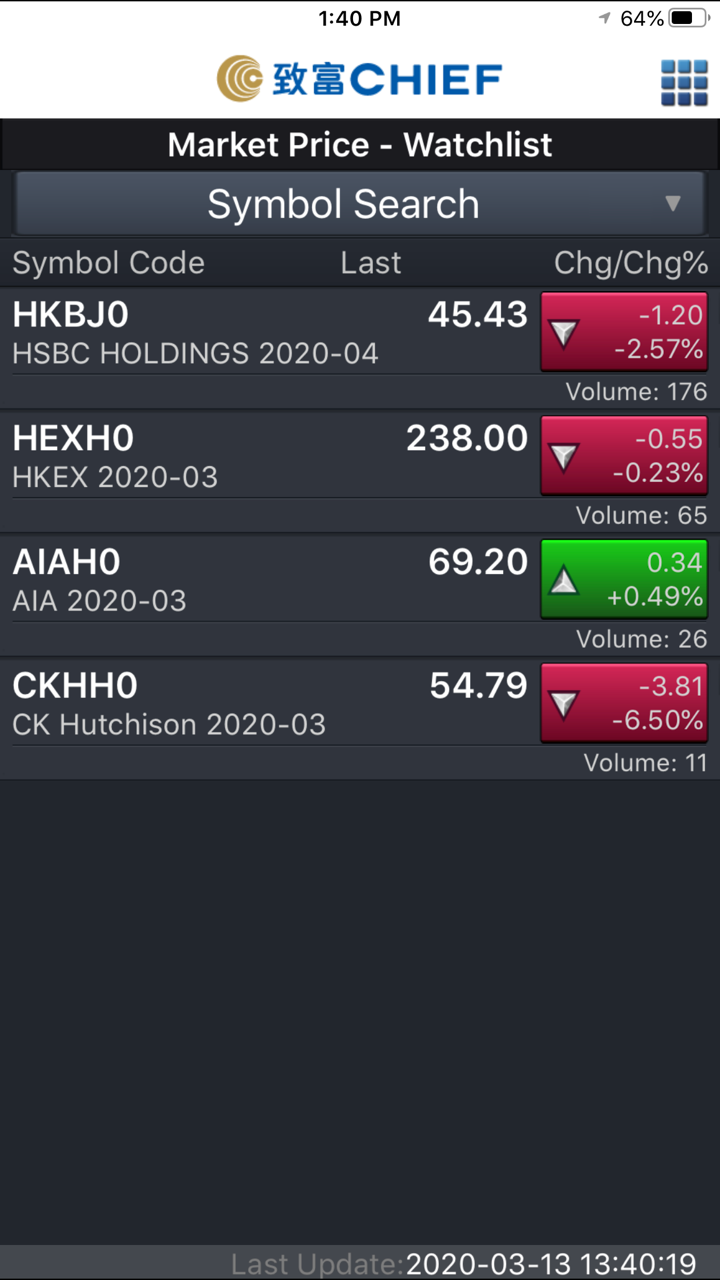

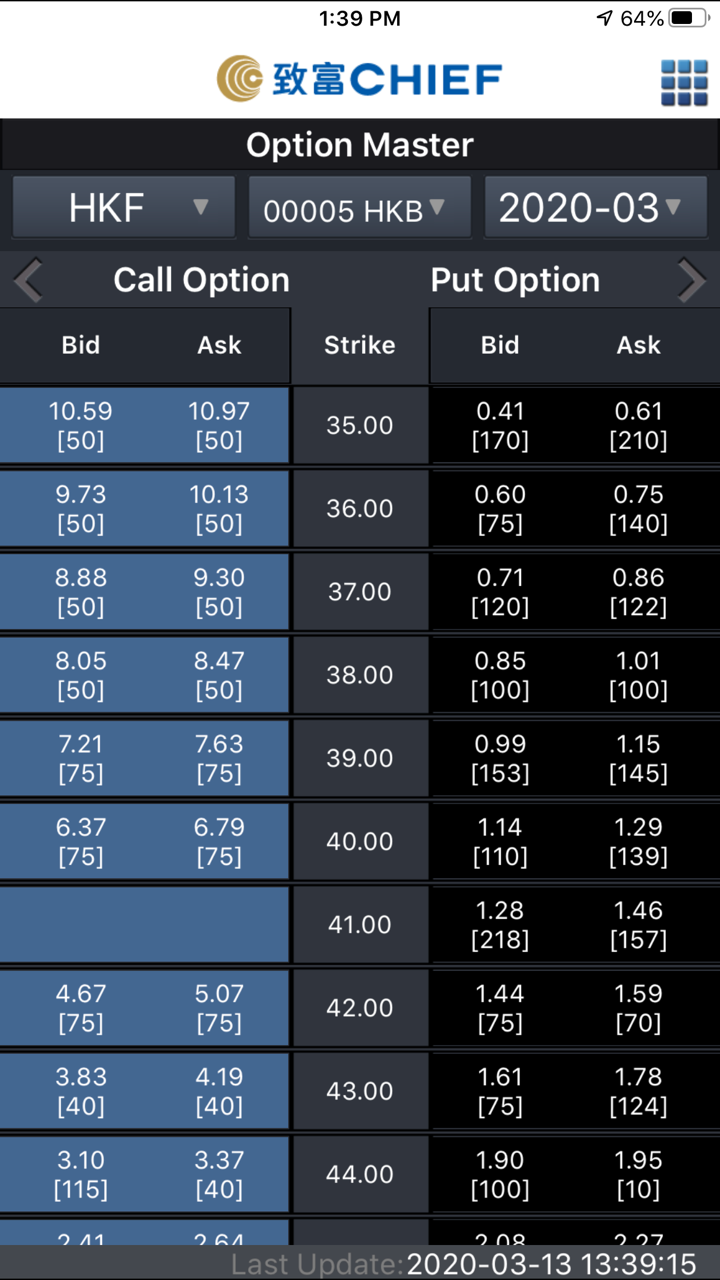

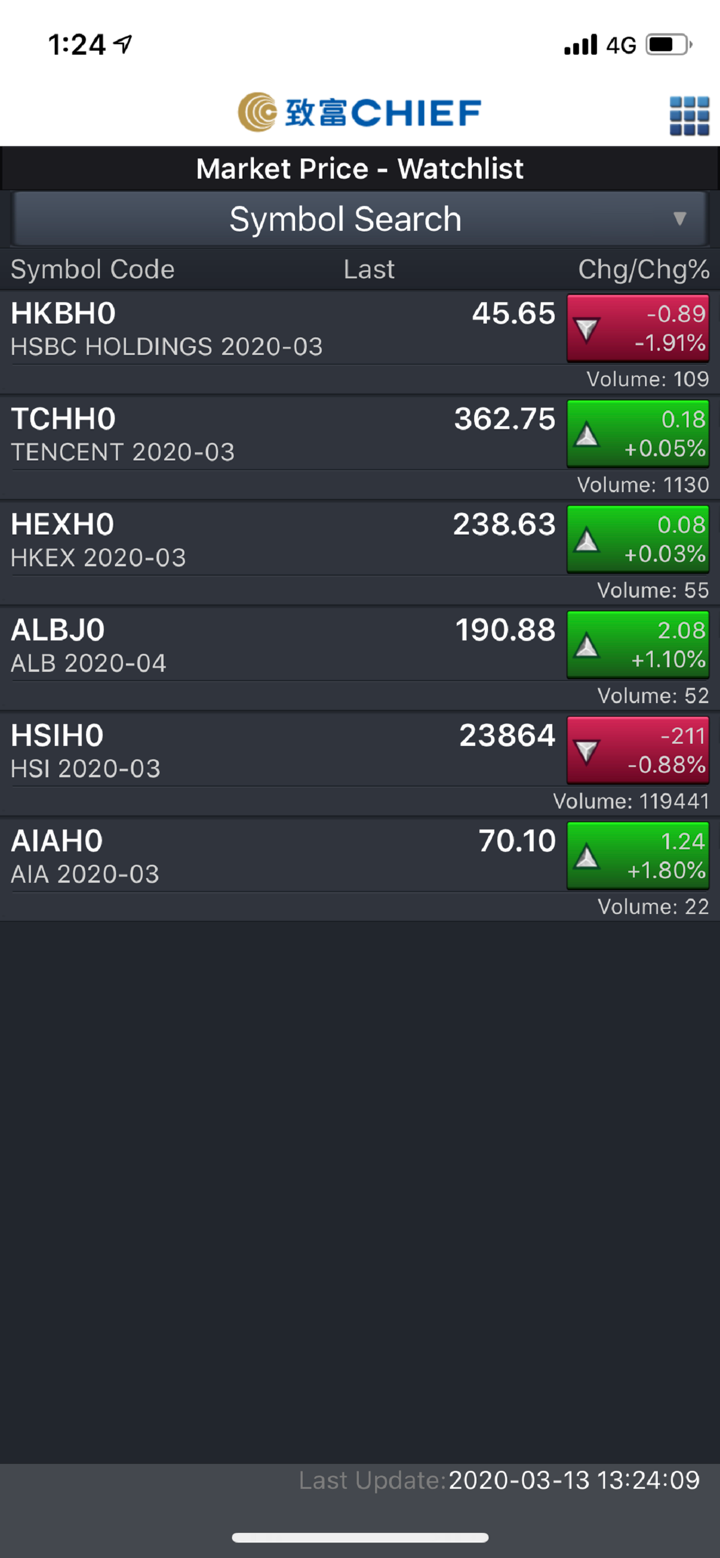

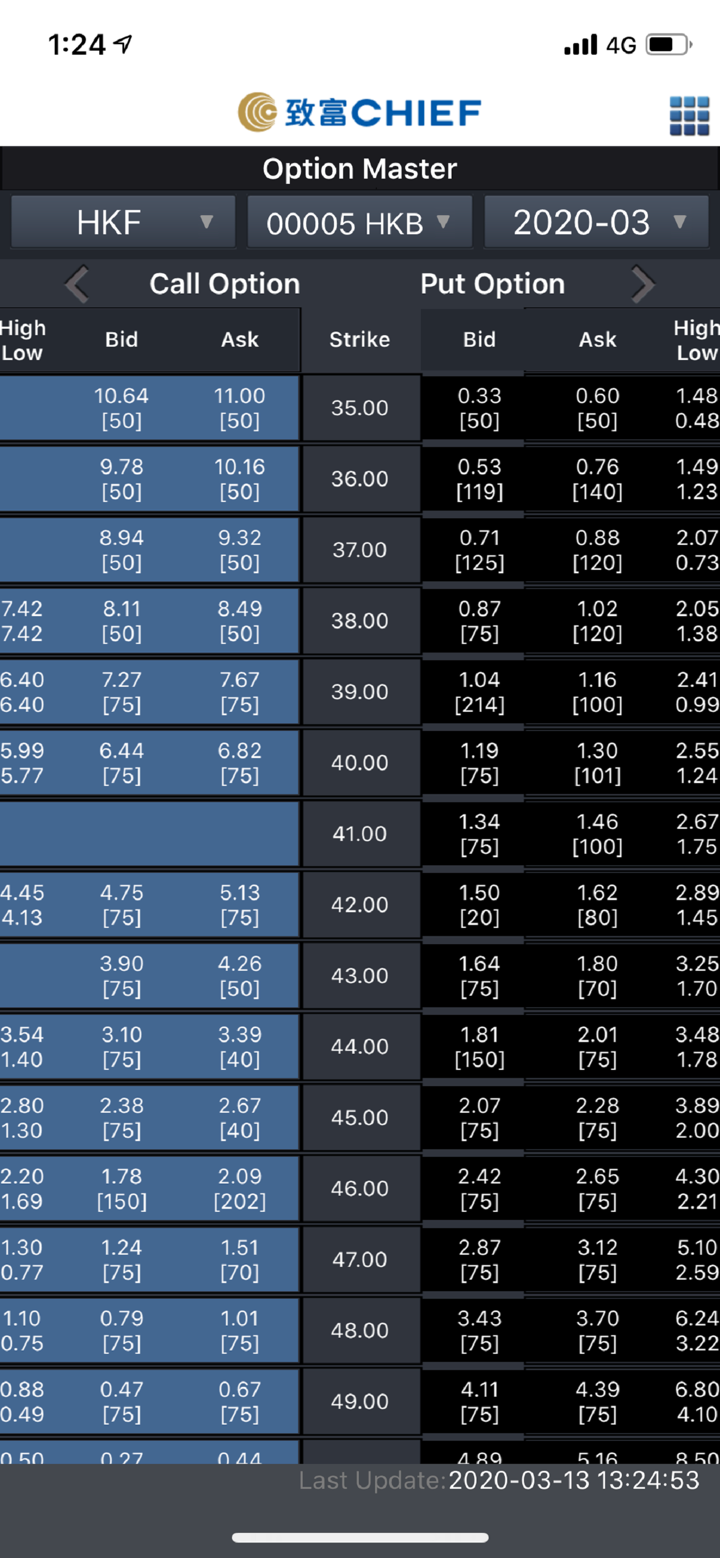

CHIEF에서 무엇을 거래할 수 있나요?

CHIEF은 증권 및 선물 거래를 지원합니다.

| 거래 가능한 기구 | 지원됨 |

| 증권 | ✔ |

| 선물 | ✔ |

| 외환 | ❌ |

| 귀금속 및 상품 | ❌ |

| 지수 | ❌ |

| 채권 | ❌ |

| ETF | ❌ |

계정 유형

CHIEF 계정 정보를 제공하지 않았습니다. 그러나 지원되는 계정 개설 방법은 "원격 계정 개설 패스" 예약, 직접 방문 및 우편 계정 개설입니다. 다음을 참조하십시오: https://www.chiefgroup.com.hk/hk/account?apply=e-account

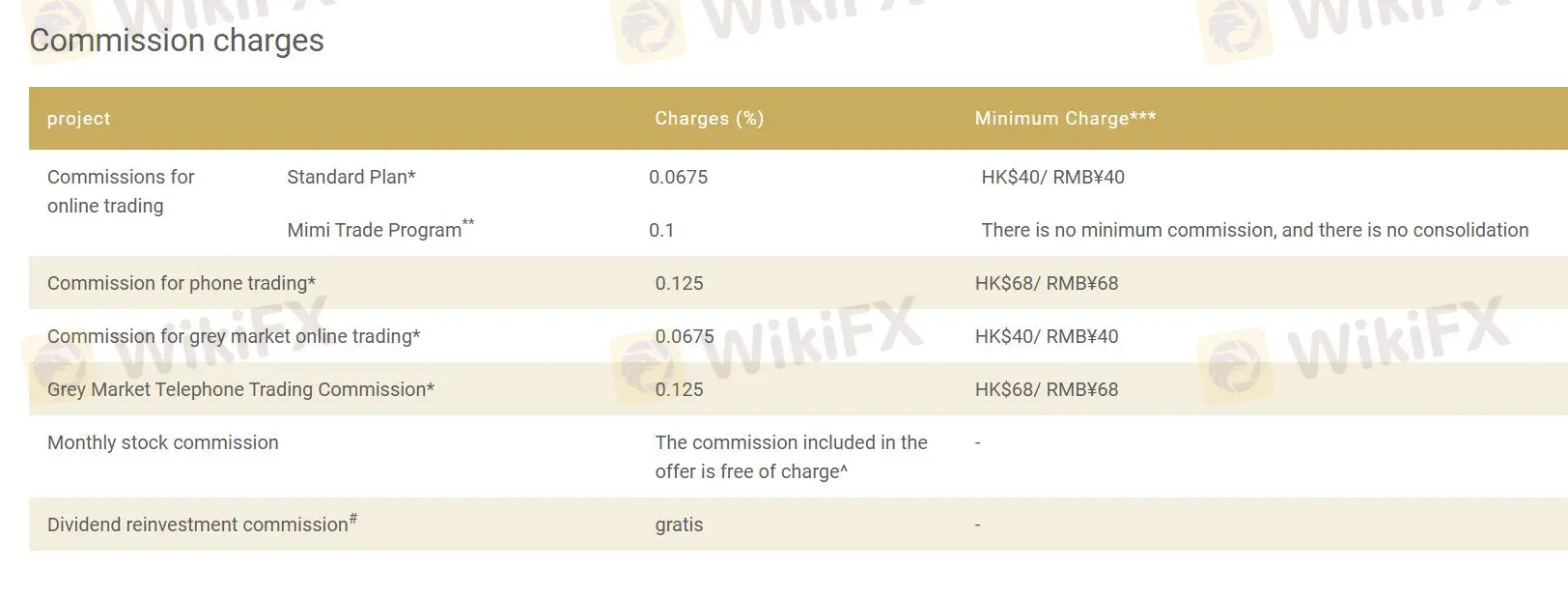

CHIEF 수수료

CHIEF은 일부 프로젝트에 대해 수수료를 면제하며, 프로젝트의 수수료율은 0.2%를 초과하지 않습니다. 최소 수수료는 HK $40에서 HK $68 및 RMB ¥40에서 RMB ¥68까지 범위가 있습니다.

| 프로젝트 | 수수료 (%) | 최소 수수료**** |

| 온라인 거래 수수료 | ||

| 표준 플랜* | 0.0675 | HK$40 / RMB¥40 |

| Mimi Trade 프로그램** | 0.1 | 최소 수수료 없음, 통합 없음 |

| 전화 거래 수수료* | 0.125 | HK$68 / RMB¥68 |

| 회색 시장 온라인 거래 수수료* | 0.0675 | HK$40 / RMB¥40 |

| 회색 시장 전화 거래 수수료* | 0.125 | HK$68 / RMB¥68 |

| 월간 주식 수수료 | 제안에 포함된 수수료는 무료* | - |

| 배당금 재투자 수수료# | 무료 | - |

거래 플랫폼

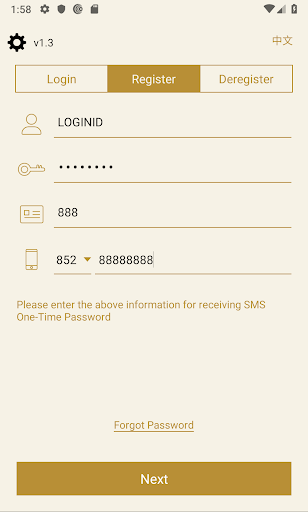

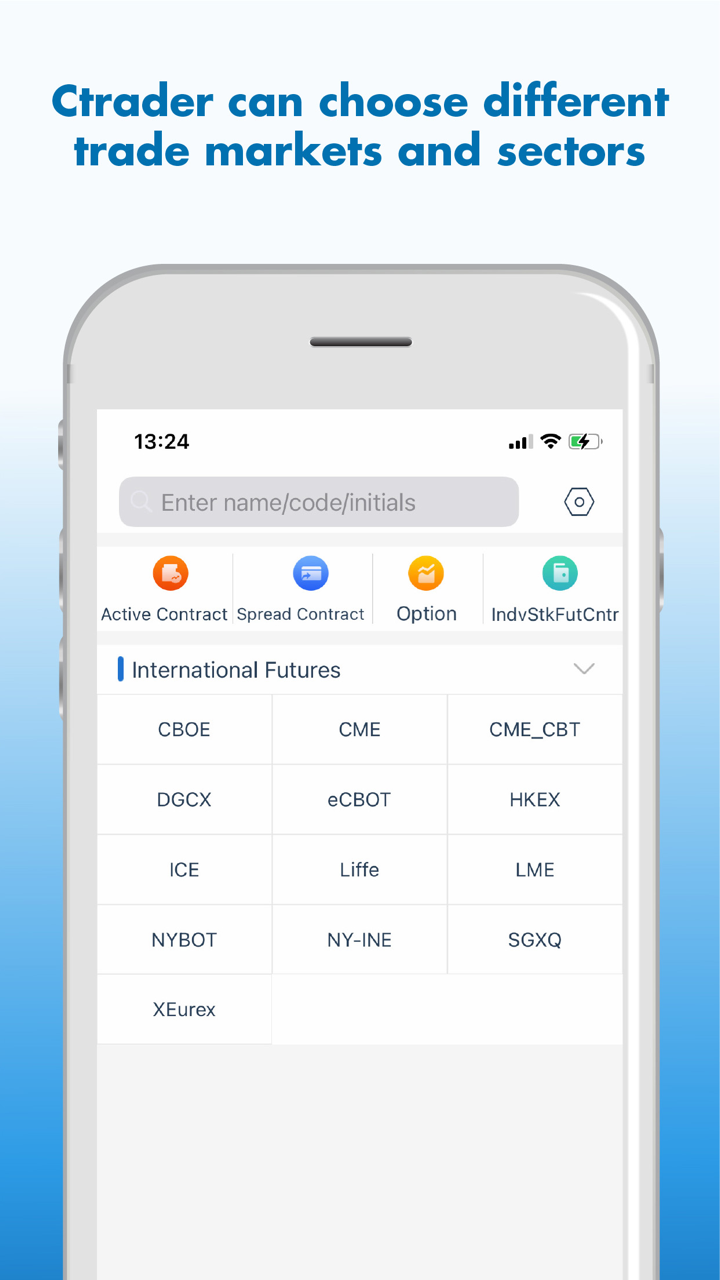

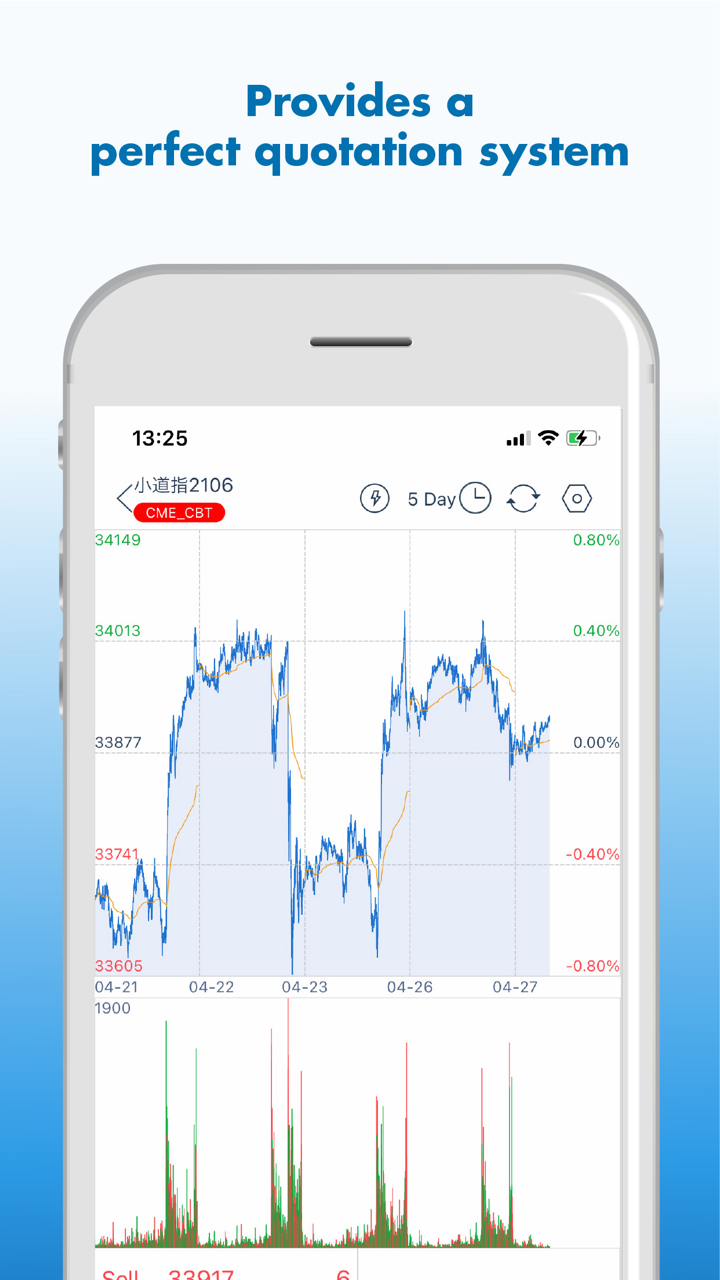

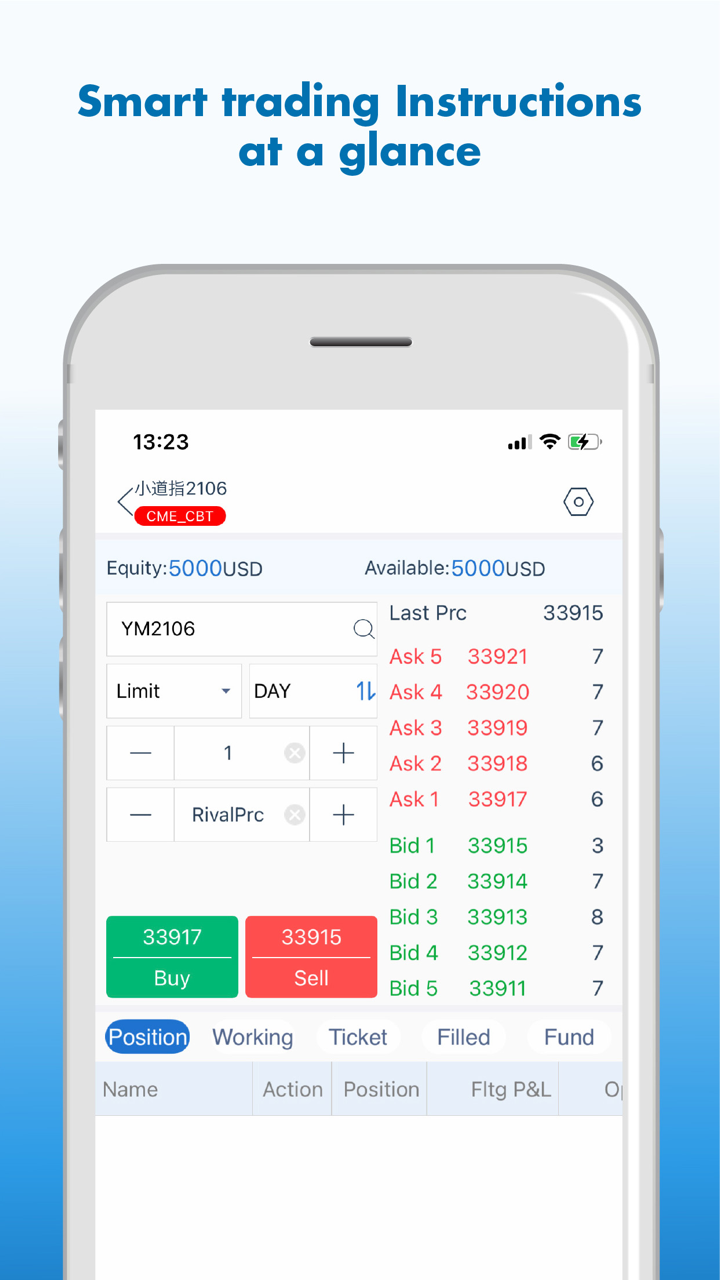

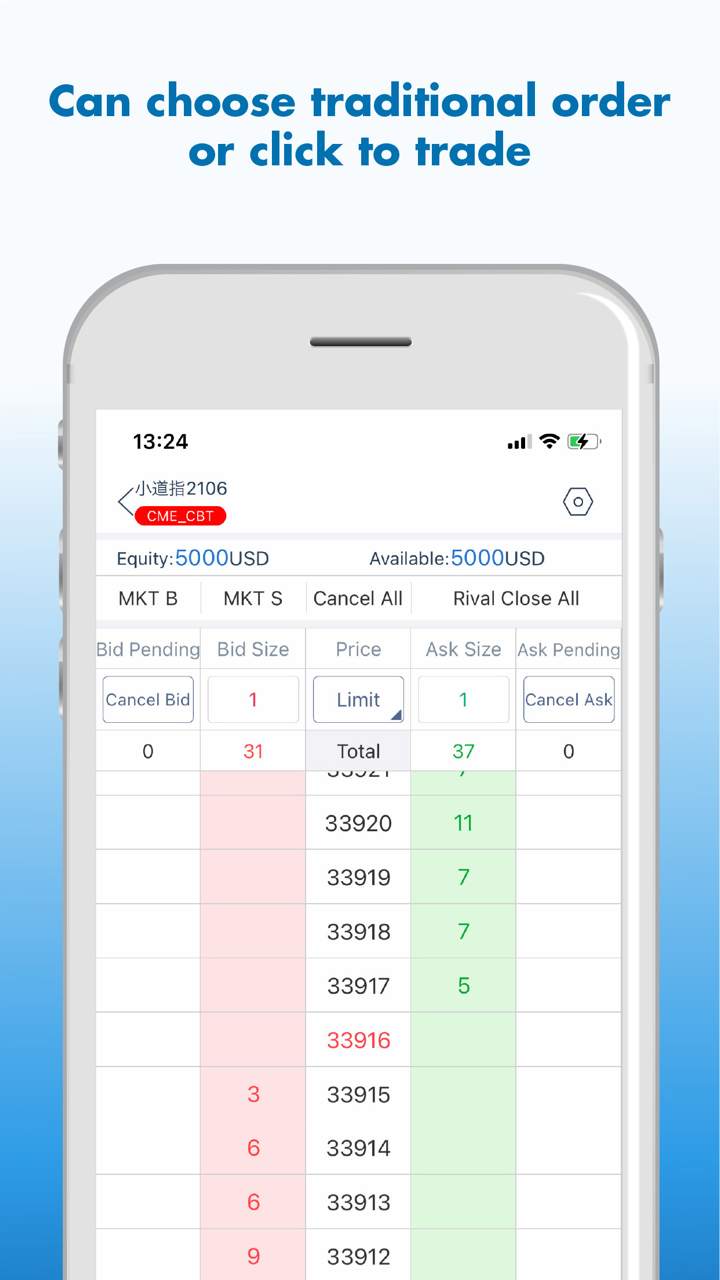

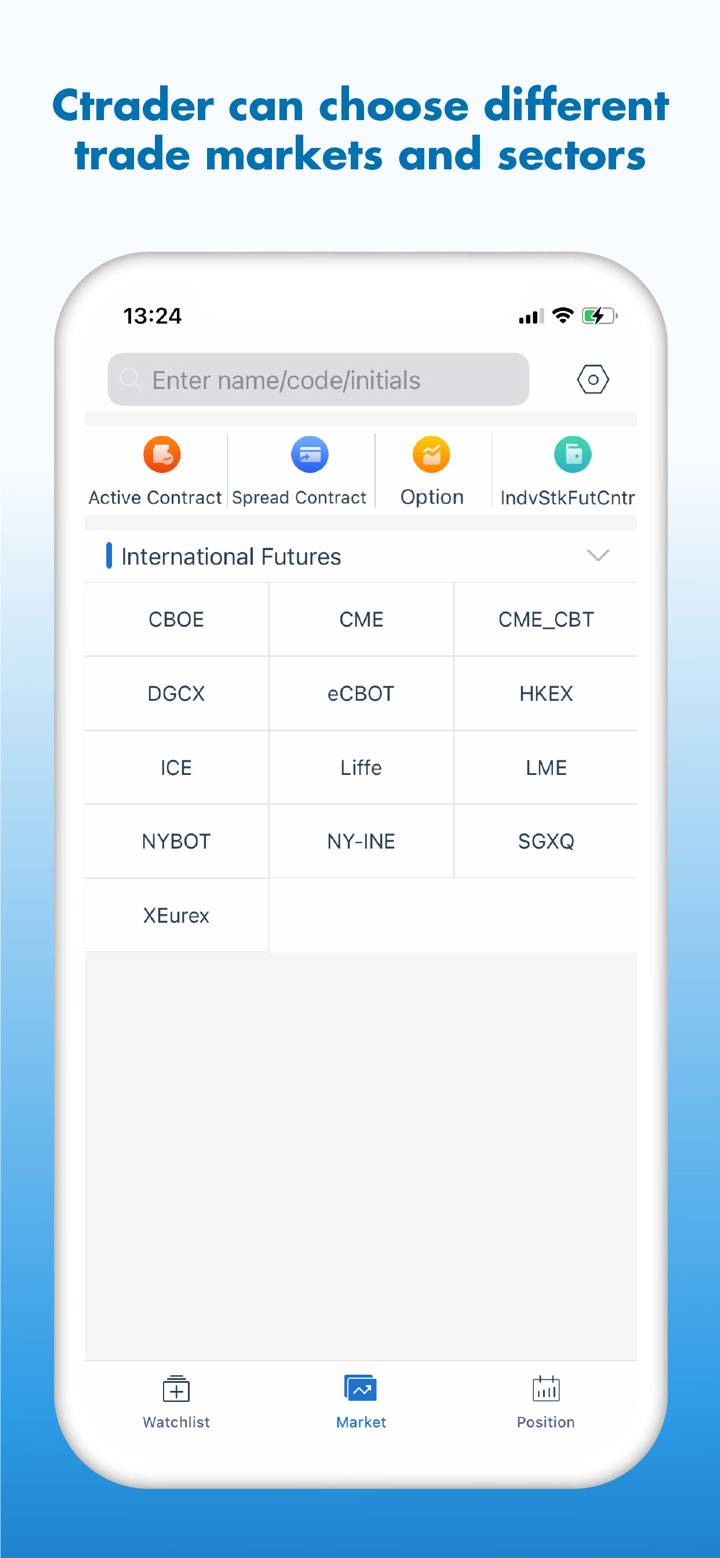

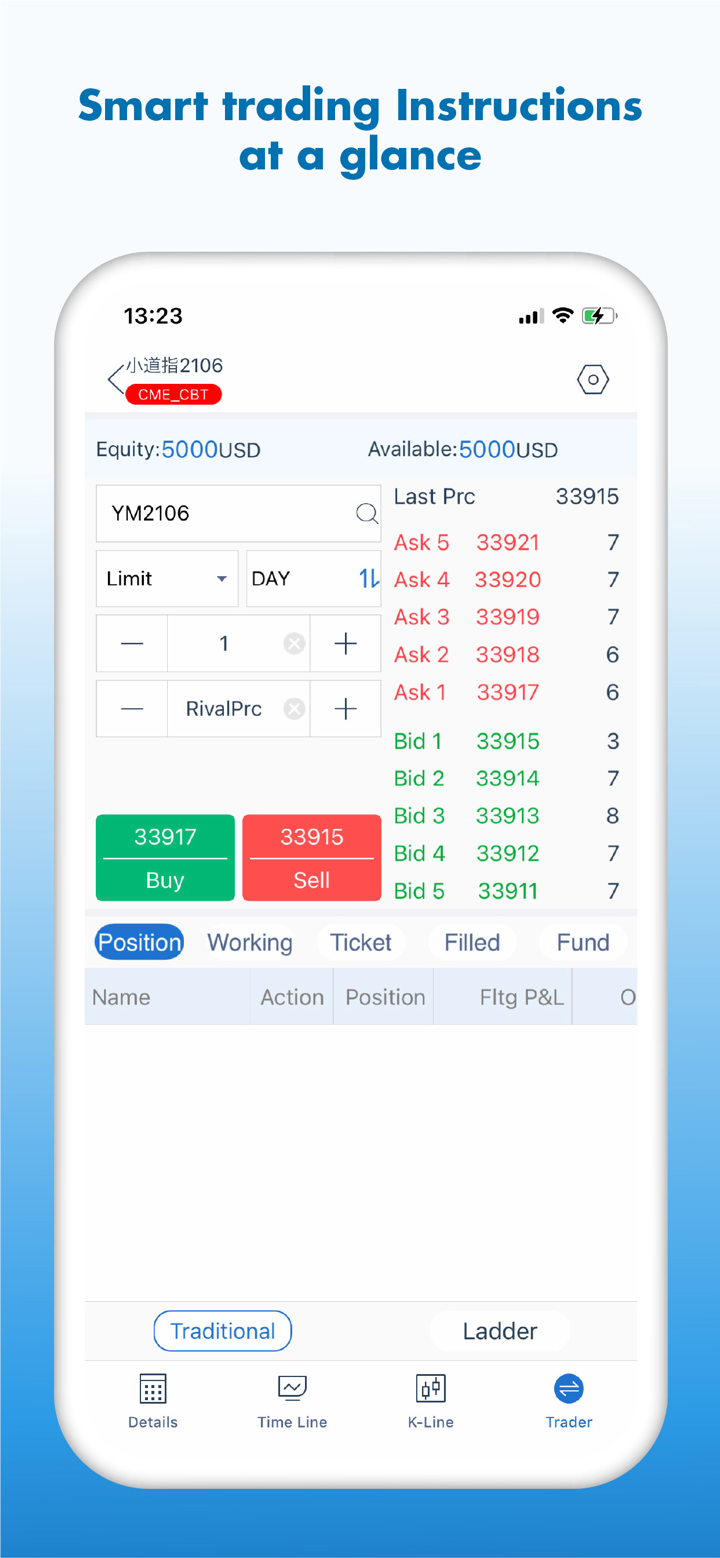

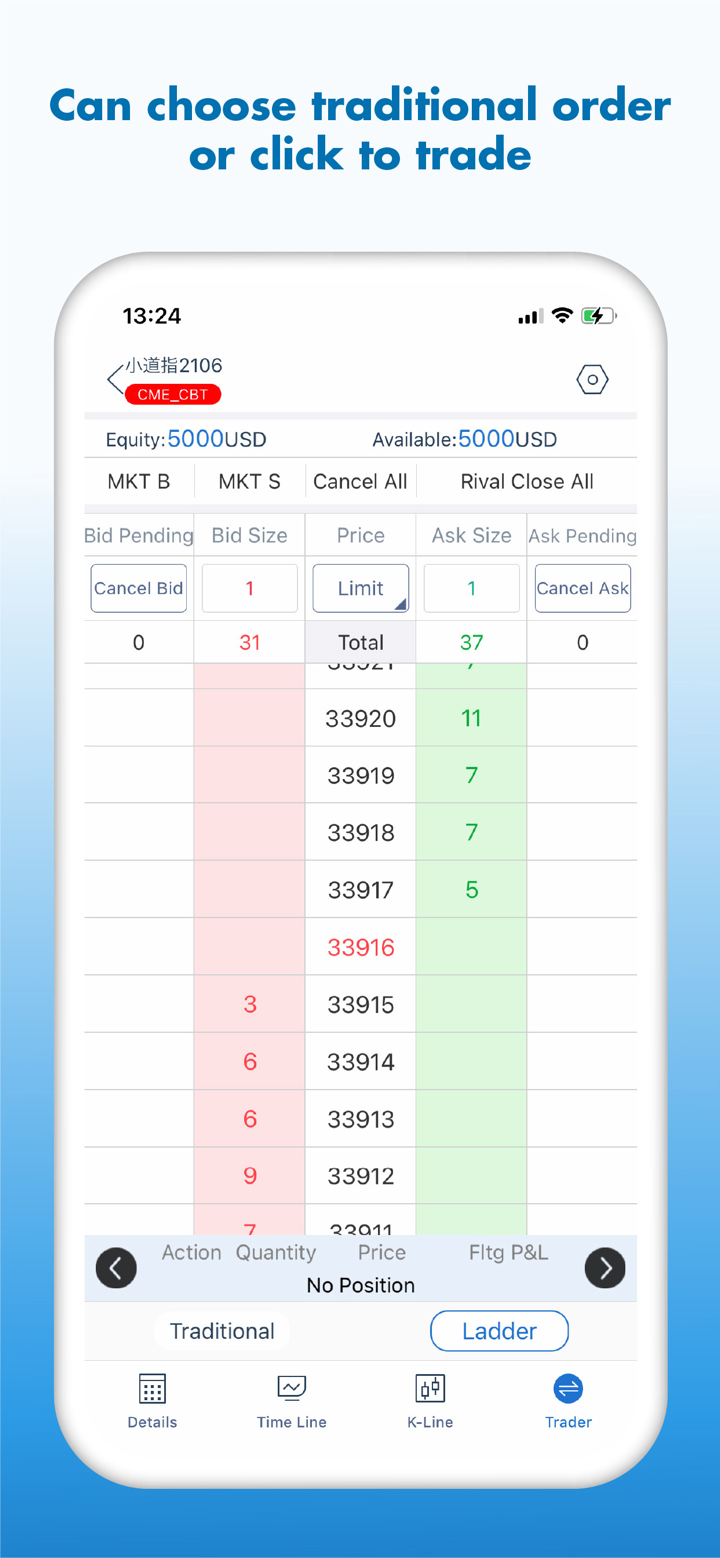

CHIEF은 자체 플랫폼인 Chief Deal을 제공하며, 모바일에서 사용할 수 있습니다.

| 거래 플랫폼 | 지원 | 사용 가능한 기기 | 적합 대상 |

| Chief Deal | ✔ | 모바일 | 모든 트레이더 |

| MT4 | ❌ | ||

| MT5 | ❌ |

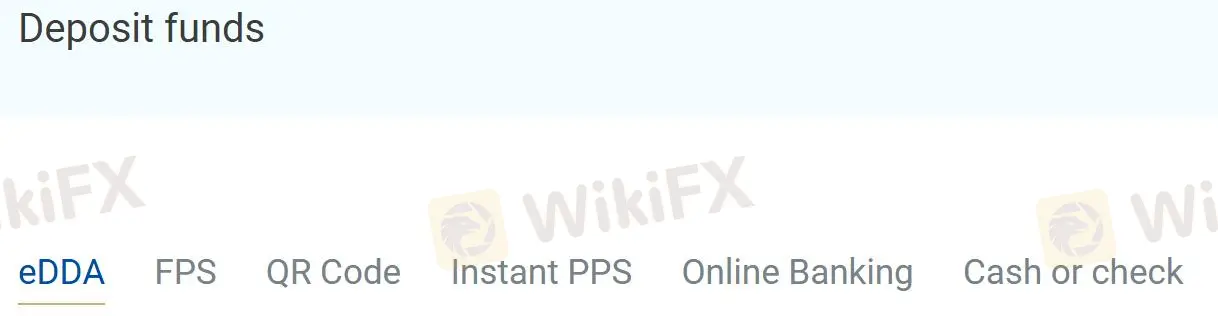

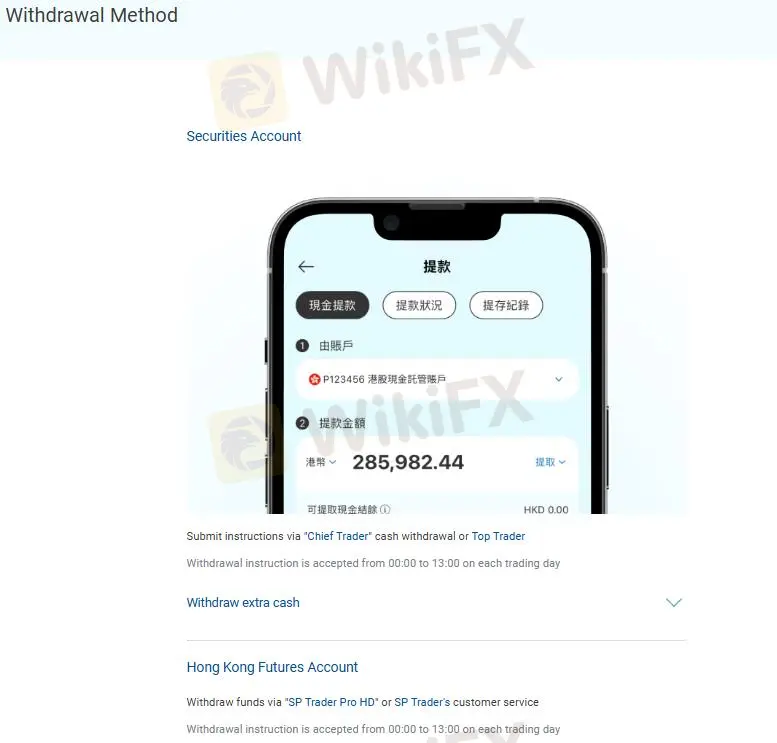

입출금

CHIEF은 6가지 입금 방법을 제공합니다: eDDA, FPS, QR 코드, 즉시 PPS, 온라인 뱅킹, 현금 또는 수표.

출금은 "Chief Trader" 현금 인출 또는 Top Trader를 통해 지시를 제출하거나 "SP Trader Pro HD" 또는 SP Trader의 고객 서비스를 통해 자금을 인출해야 합니다.