회사 소개

| AM Broker 리뷰 요약 | |

| 설립 | 2021 |

| 등록 국가/지역 | 홍콩 |

| 규제 | ASIC에 의해 규제됨 |

| 시장 상품 | 외환, 주식, 암호화폐, CFD, 금속, 지수, 상품 |

| 데모 계정 | ✅ |

| 레버리지 | 최대 30:1 |

| 스프레드 | 0.0 픽셀 이상 |

| 거래 플랫폼 | MT4 |

| 최소 입금액 | 100 USD |

| 고객 지원 | 전화: +852 3069 6811, +853 2834 0707 |

| 이메일: support@am-broker.com, au.support@am-broker.com | |

| 주소: 홍콩 몽콕 파윈스트리트 2-16호 호킹상업센터 16층 5호 | |

| 8-12 King Street, Sydney, NSW, 2216, AUS | |

| 제한된 지역 | 미국, 호주, 중국 본토 또는 홍콩 SAR |

AM Broker은 2021년에 홍콩에서 설립되었습니다. MT4 플랫폼을 통해 외환, 주식, 암호화폐, CFD, 금속, 지수 및 상품 등 다양한 거래 상품을 제공합니다.

장점과 단점

| 장점 | 단점 |

| 다양한 시장 상품 | 지역 제한 |

| 데모 계정 | |

| 수수료 없음 | |

| MT4 지원 | |

| 인기 있는 결제 옵션 |

AM Broker이 신뢰할 수 있는가요?

네, AM Broker은(는) 리치 스마트의 지정 대리인(Appointed Representative, AR)으로 호주증권투자위원회(Australian Securities and Investments Commission, ASIC)의 라이선스 번호 001311143에 따라 규제를 받고 있습니다.

AM Broker에서 무엇을 거래할 수 있나요?

| 거래 가능한 상품 | 지원 여부 |

| 외환 | ✔ |

| CFD | ✔ |

| 상품 | ✔ |

| 금속 | ✔ |

| 지수 | ✔ |

| 주식 | ✔ |

| 암호화폐 | ✔ |

| 채권 | ❌ |

| 옵션 | ❌ |

| ETF | ❌ |

레버리지

AM Broker은(는) 최대 1:30의 레버리지를 제공합니다. 레버리지가 클수록 예치 자금을 잃을 위험이 커집니다. 레버리지의 사용은 유리하게 작용할 수도 있고 그 반대로 작용할 수도 있습니다.

스프레드와 수수료

스프레드는 0.0 픽셀부터 시작하며 수수료는 부과되지 않습니다.

거래 플랫폼

| 거래 플랫폼 | 지원 여부 | 사용 가능한 기기 | 적합 대상 |

| MT4 | ✔ | Windows, iOS 및 Android | 초보자 |

| MT5 | ❌ | / | 경험 있는 트레이더 |

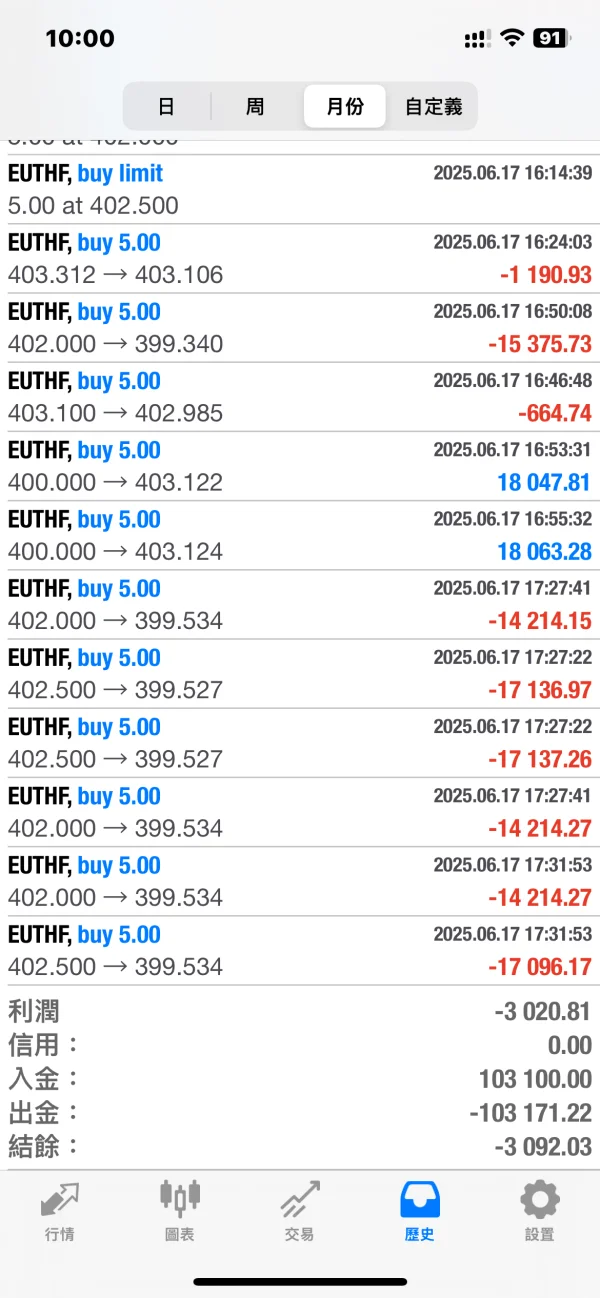

입출금

AM Broker은(는) 다음 결제 방법을 지원합니다: VISA, VISA SECURE, Mastercard, ID Check, NETELLER, Skrill, bitwallet, Perfect Money 및 STICPAY.