Profil perusahaan

| INVASTRingkasan Ulasan | |

| Didirikan | 2004 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | FSA |

| Instrumen Pasar | Forex, ETF |

| Akun Demo | / |

| Leverage | Hingga 1:25 |

| Spread | Beragam |

| Platform Perdagangan | Click 365 |

| Deposit Minimum | / |

| Dukungan Pelanggan | Telepon: 0120-659-274 |

| Formulir Kontak | |

Informasi INVAST

Invast, berpusat di Tokyo, Jepang, adalah perusahaan layanan keuangan terkemuka yang mengkhususkan diri dalam perdagangan online. Perusahaan ini menawarkan berbagai layanan, termasuk margin FX, CFD, dan solusi perdagangan otomatis. Saat ini, INVAST beroperasi di bawah Financial Services Agency (FSA).

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Diatur oleh FSA | Instrumen pasar terbatas |

| Akun demo tidak tersedia | |

| Informasi terbatas tentang kondisi perdagangan |

Apakah INVAST Legal?

INVAST diatur oleh Otoritas Jasa Keuangan (FSA), memegang Lisensi Forex Ritel (No.26).

| Negara yang Diatur | Otoritas yang Diatur | Status Regulasi | Entitas yang Diatur | Tipe Lisensi | Nomor Lisensi |

| Otoritas Jasa Keuangan (FSA) | Diatur | INVAST Securities Co., Ltd | Lisensi Forex Ritel | 関東財務局長(金商)第26号 |

Apa yang Bisa Saya Perdagangkan di INVAST?

INVAST menawarkan produk yang dapat diperdagangkan termasuk forex dan ETF.

| Aset Perdagangan | Tersedia |

| forex | ✔ |

| ETF | ✔ |

| komoditas | ❌ |

| indeks | ❌ |

| saham | ❌ |

| cryptocurrency | ❌ |

| obligasi | ❌ |

| opsi | ❌ |

| dana | ❌ |

Jenis Akun

INVAST menawarkan akun pribadi dan akun korporat.

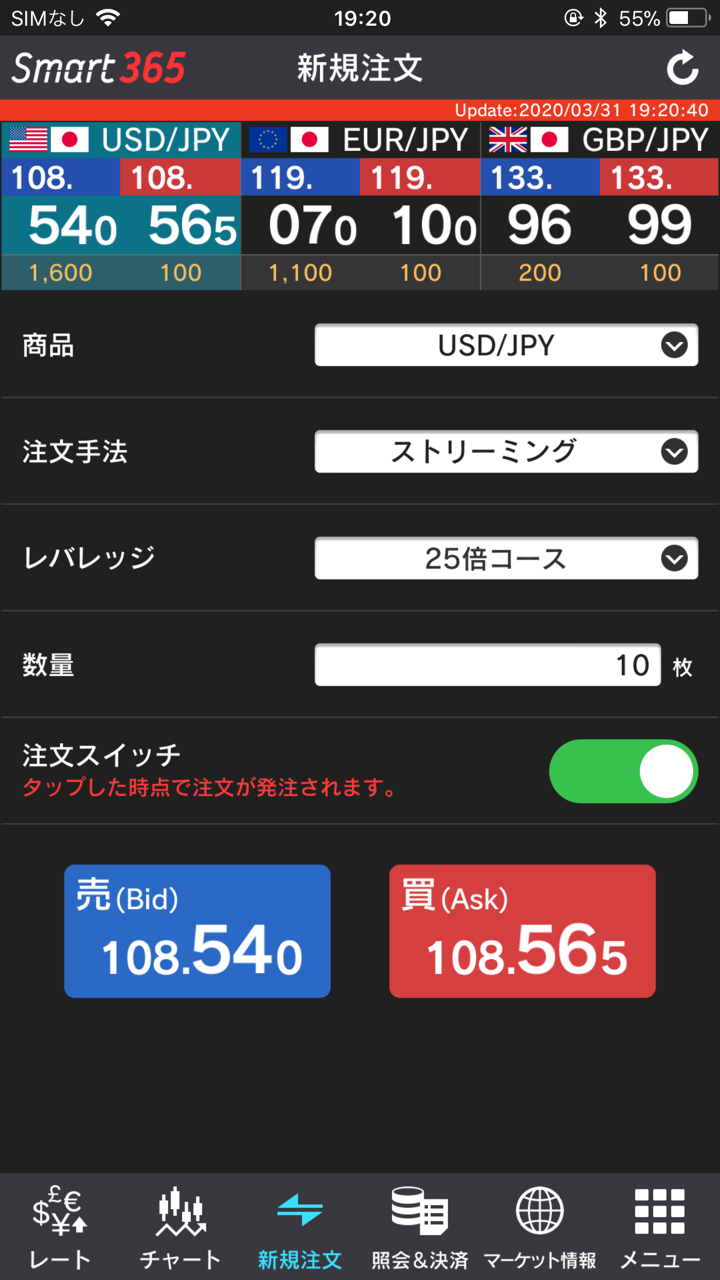

Leverage

INVAST menawarkan berbagai tingkat leverage.

Leverage akun pribadi: 25x, 10x, 5x, dan 1x.

Hanya ada satu akun korporat: leverage.

Biaya

Spread ditentukan oleh Bursa Keuangan Tokyo.

Untuk detailnya, silakan kunjungi website Bursa Keuangan Tokyo.

Biaya perdagangan biasanya JPY 330. Namun ada pengecualian:

- Lebih dari 1.000 lembar: Biaya yang lebih rendah sebesar JPY 88 berlaku jika lebih dari 1.000 lembar diperdagangkan dalam sebulan.

- Lebih dari 3.000 lembar: Biaya yang lebih rendah lagi (atau tanpa biaya) berlaku jika lebih dari 3.000 lembar diperdagangkan dalam sebulan.

| 1 lembar (termasuk pajak) | biasanya | Diskon Volume (Meter Transaksi Bulanan) | |||

| Lebih dari 1.000 lembar | Lebih dari 3.000 lembar | ||||

| Biaya satu arah normal | JPY 330 | JPY 88 | JPY 0 | ||

Selain itu, biaya yang terakumulasi akan dikurangkan dari jumlah deposit margin pada akhir perdagangan tanggal 1.

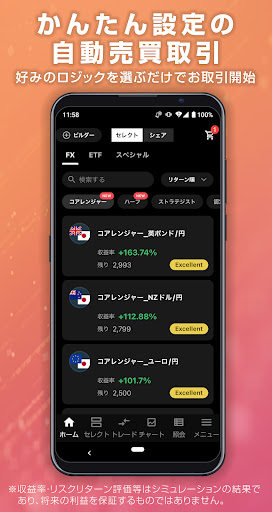

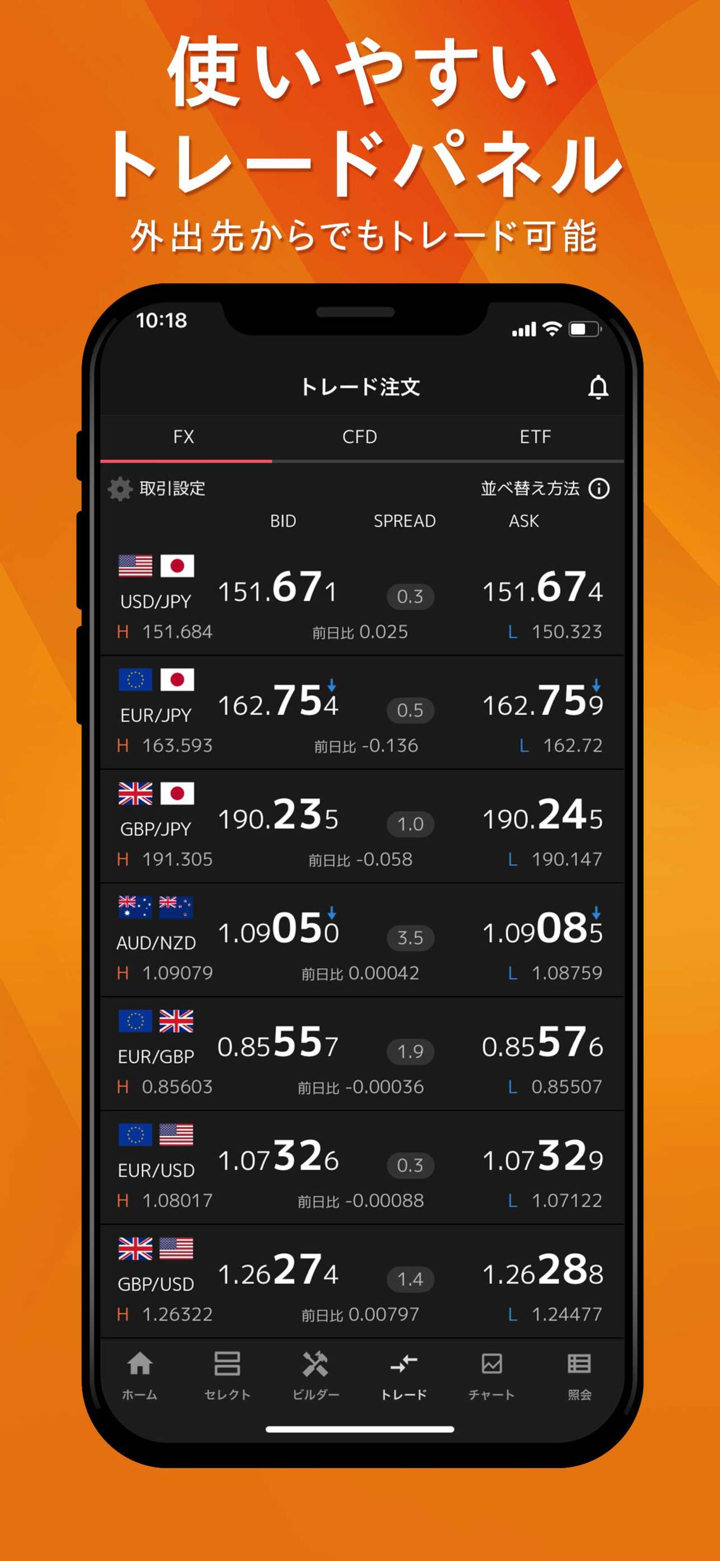

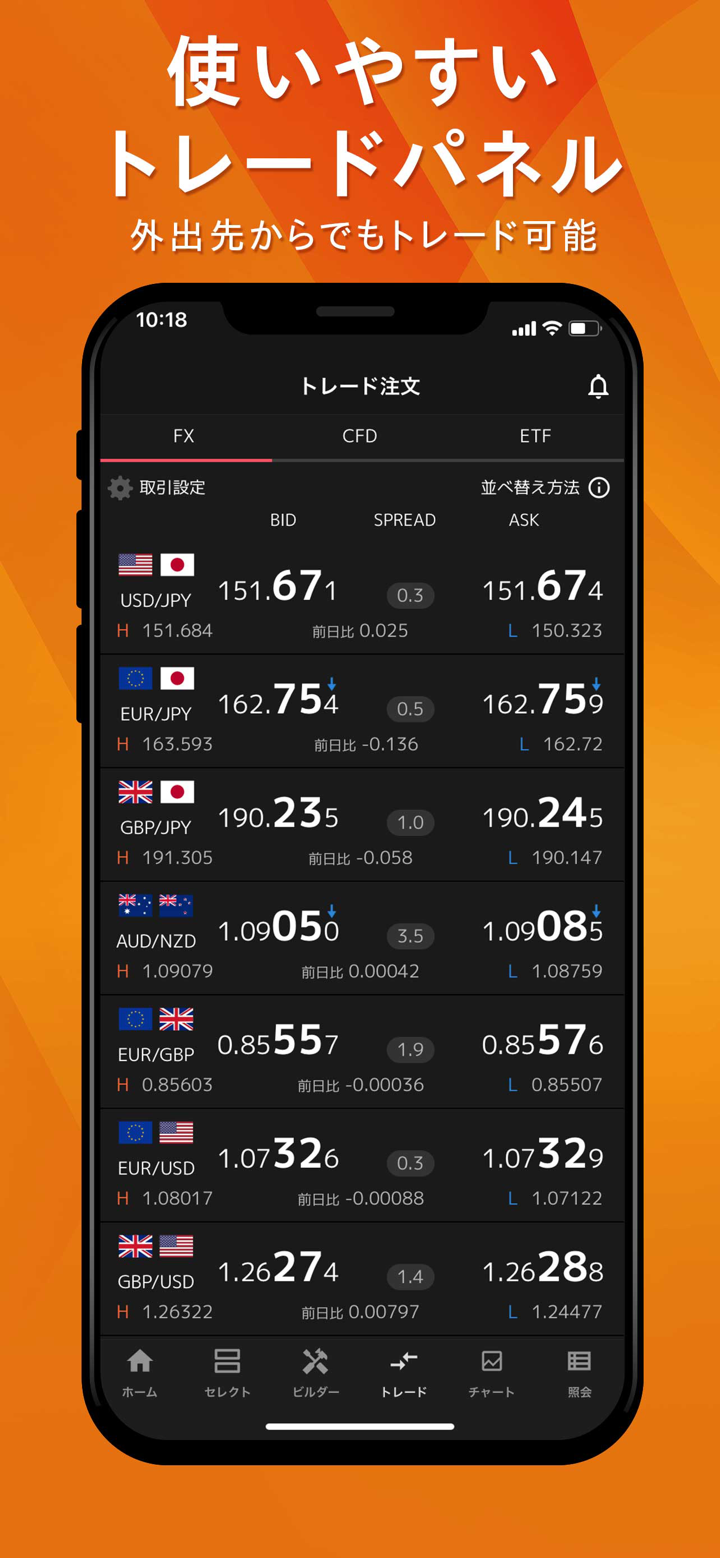

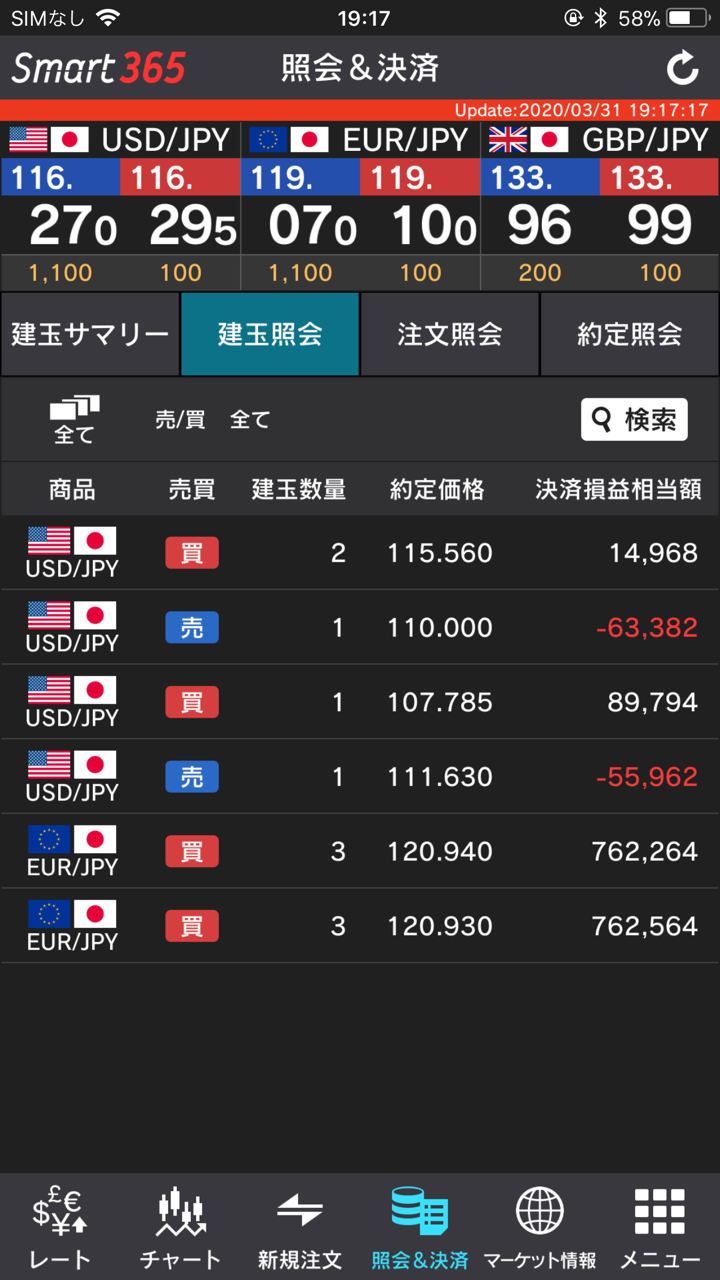

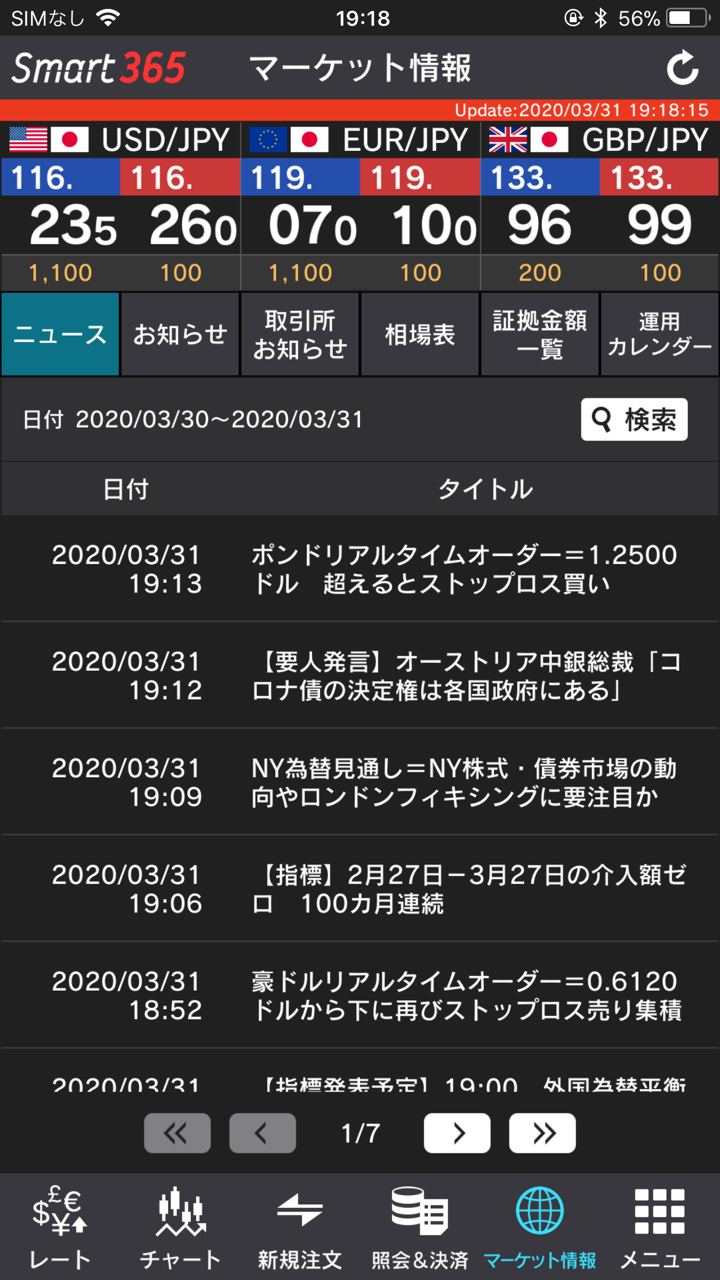

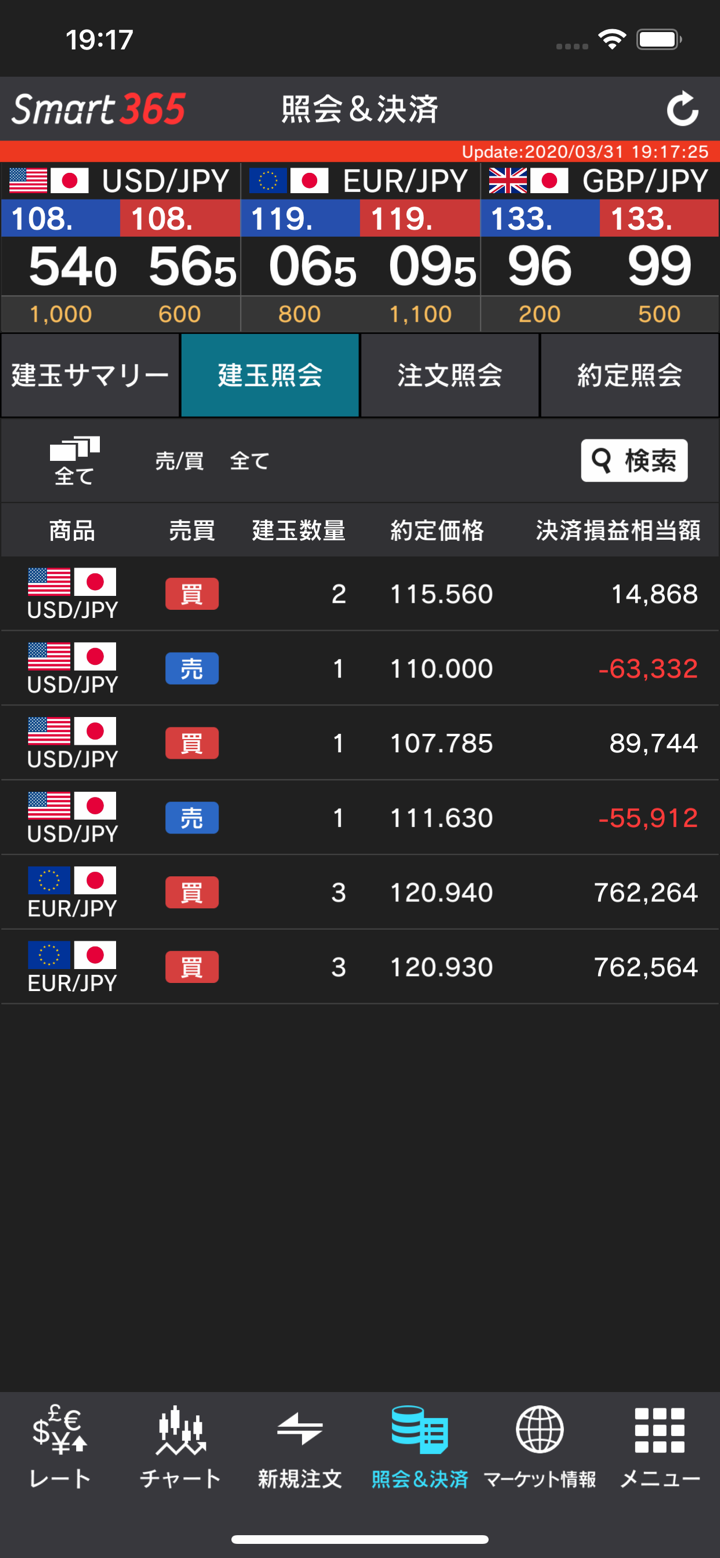

Platform Perdagangan

Click 365 adalah platform perdagangan online milik Invast Securities yang dirancang untuk investor ritel Jepang.

| Platform Perdagangan | Dukungan | Perangkat Tersedia | Cocok untuk |

| Click 365 | ✔ | Desktop, Mobile, Web | / |

| MT5 | ❌ | / | Trader berpengalaman |

| MT4 | ❌ | / | Pemula |

Deposit dan Penarikan

Trader dapat melakukan deposit melalui loket bank, ATM, atau perbankan online.

- Biaya untukDeposit Biaya untuk mendepositkan uang ke akun perdagangan Anda akan dihapus jika Anda menggunakan layanan deposit instan.

Jika Anda tidak menggunakan layanan deposit instan dan melakukan transfer reguler, Anda bertanggung jawab atas biaya transfer dari setiap lembaga keuangan.

- Biaya untuk Penarikan Biaya untuk penarikan dari akun perdagangan Anda akan ditanggung oleh Invast Securities (gratis untuk Anda).

FX3196354740

Hong Kong

Merasa cukup baik, kecepatan penarikan dana cepat, pembukaan akun sederhana dan cepat, operasinya juga mudah, hanya saja pembaruan data agak lambat, variasi instrumen terbatas, karena bukan platform dalam negeri, komunikasi dengan layanan pelanggan juga tidak begitu mudah, tetapi layanan pelanggan tetap sabar, masih cukup dapat diandalkan.

Baik

周红玉

Hong Kong

Saya memberikan tempat ini 5 bintang. Dan juga merekomendasikannya kepada semua. Anda pasti akan menghasilkan banyak uang jika Anda mulai berdagang di tempat ini. Tidak ada platform lain seperti ini di pasar saat ini. Saya tidak punya keluhan tentang tempat ini. Saya telah menerima dukungan setiap kali saya mencari dari kru layanan pelanggan di sini.

Baik

FX1182046228

Hong Kong

Penyebarannya sangat sempit, dan kecepatan deposit dan penarikannya juga sangat cepat. Meskipun opsinya masih sedikit, saya berharap untuk mempertahankan yang sekarang dan terus meningkatkan. Akan lebih baik lagi jika dapat mendukung pembayaran elektronik, sehingga transaksi menjadi lebih nyaman!

Baik

杰出青年

Hong Kong

Perusahaan Jepang ini kelihatannya oke, tapi sayangnya saya tidak mengerti bahasa Jepang dan saya merasa akan lebih baik berbisnis dengan perusahaan lokal. Apakah ada perusahaan serupa di Hong Kong? Apakah Anda punya teman Hui untuk direkomendasikan?

Baik