Unternehmensprofil

| NBF Überprüfungszusammenfassung | |

| Gegründet | 1902 |

| Registriertes Land/Region | Kanada |

| Regulierung | Canadian Investment Regulatory Organization (CIRO) |

| Produkte und Dienstleistungen | Vermögensverwaltung, Portfolioverwaltung, Steuerplanung, Nachlassplanung, Banklösungen |

| Demo-Konto | ❌ |

| Handelsplattform | NBFWM Online-Plattform, NBC Wealth App |

| Kundensupport | Telefon: 1-800-361-9522 |

NBF Informationen

National Bank Financial (NBF) wurde 1902 gegründet und ist ein kanadisches Finanzunternehmen, das von CIRO betrieben wird. Obwohl es keine herkömmlichen Einzelhandels-Handelstools wie Forex oder Krypto bietet, konzentriert es sich auf Banklösungen, Finanzplanung sowie Vermögens- und Portfolioverwaltung.

Vor- und Nachteile

| Vorteile | Nachteile |

| Starke Aufsicht (CIRO) | Kein Zugang zu Forex, CFD, Kryptohandel |

| Umfassende Vermögensverwaltungsdienstleistungen | Höhere Gesamtgebühren im Vergleich zur Branchenstandards |

| Robuste mobile und Online-Plattformen | Kein Demo-Konto |

Ist NBF legitim?

National Bank Financial Inc. (NBF) ist von der Canadian Investment Regulatory Organization (CIRO) unter einer Market Maker (MM)-Lizenz autorisiert und ein anerkanntes und reguliertes Finanzinstitut. Obwohl die konkrete Lizenznummer vertraulich ist, behält NBF einen kontrollierten Status und arbeitet gemäß den kanadischen Finanzregeln.

Produkte und Dienstleistungen

NBF (National Bank Financial) bietet hauptsächlich umfassende Vermögensverwaltungs- und Finanzberatungsdienstleistungen an, einschließlich Portfolioverwaltung, Nachlassplanung, Steuerstrategien und Banklösungen.

| Produkte und Dienstleistungen | Unterstützt |

| Vermögensverwaltung | ✅ |

| Portfolioverwaltung | ✅ |

| Finanzplanung | ✅ |

| Steuerplanung | ✅ |

| Nachlassplanung | ✅ |

| Banklösungen | ✅ |

| Diskretionäre Verwaltung | ✅ |

| Forex, CFDs, Aktien, Krypto, Rohstoffe | ❌ |

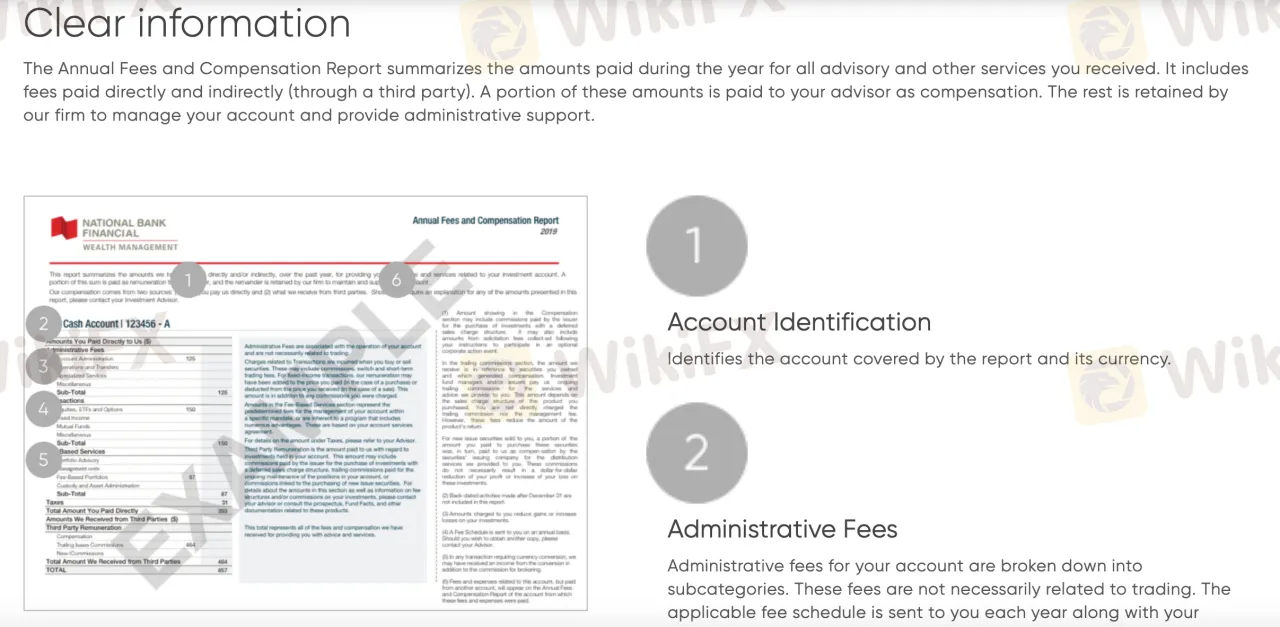

NBF Gebühren

Insbesondere für Beratungs- und Portfolioverwaltungsdienstleistungen ist die Gebührenstruktur von NBF (National Bank Financial) in der Regel höher als der Branchendurchschnitt. Obwohl spezifische Spreads für einzelne handelbare Positionen nicht öffentlich gemacht werden, liegt ihr Ansatz darin, Beratungs- und Verwaltungsgebühren über Handelskosten zu priorisieren.

Handelsplattform

| Handelsplattform | Unterstützt | Verfügbare Geräte | Für welche Art von Händlern geeignet |

| NBFWM Online Plattform | ✔ | Webbrowser (PC/Mac) | Kunden, die Portfolios verwalten und anzeigen möchten, mit detaillierten Einblicken |

| NBC Wealth App | ✔ | iOS, Android Mobilgeräte | Mobile Benutzer, die unterwegs Zugriff auf ihre Investitionen benötigen |

| MetaTrader 4 / MT5 | ❌ | – | Nicht unterstützt |

| TradingView | ❌ | – | Nicht unterstützt |