Profil perusahaan

| NBF Ringkasan Ulasan | |

| Didirikan | 1902 |

| Negara/Daerah Terdaftar | Kanada |

| Regulasi | Organisasi Regulasi Investasi Kanada (CIRO) |

| Produk dan Layanan | Manajemen kekayaan, manajemen portofolio, perencanaan pajak, perencanaan keuangan, solusi perbankan |

| Akun Demo | ❌ |

| Platform Perdagangan | NBF Platform Online WM, Aplikasi NBC Wealth |

| Dukungan Pelanggan | Telepon: 1-800-361-9522 |

Informasi NBF

Didirikan pada tahun 1902, National Bank Financial (NBF) adalah perusahaan keuangan Kanada yang dijalankan oleh CIRO. Meskipun tidak menyediakan alat perdagangan ritel konvensional seperti forex atau kripto, perusahaan ini fokus pada solusi perbankan, perencanaan keuangan, dan manajemen kekayaan dan portofolio.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Pengawasan regulasi yang kuat (CIRO) | Tidak dapat mengakses perdagangan forex, CFD, kripto |

| Layanan manajemen kekayaan yang komprehensif | Biaya keseluruhan yang lebih tinggi dibandingkan dengan standar industri |

| Platform mobile dan online yang tangguh | Tidak ada akun demo |

NBF Legal?

Diotorisasi oleh Organisasi Regulasi Investasi Kanada (CIRO) dengan lisensi Market Maker (MM), National Bank Financial Inc. (NBF) adalah badan keuangan yang diakui dan diatur. Meskipun nomor lisensi tertentu bersifat rahasia, NBF tetap memiliki status terkontrol dan beroperasi sesuai dengan aturan keuangan Kanada.

Produk dan Layanan

NBF (National Bank Financial) terutama menyediakan layanan manajemen kekayaan dan konsultasi keuangan yang komprehensif, termasuk manajemen portofolio, perencanaan keuangan, strategi pajak, dan solusi perbankan.

| Produk dan Layanan | Didukung |

| Manajemen Kekayaan | ✅ |

| Manajemen Portofolio | ✅ |

| Perencanaan Keuangan | ✅ |

| Perencanaan Pajak | ✅ |

| Perencanaan Estate | ✅ |

| Solusi Perbankan | ✅ |

| Manajemen Diskresioner | ✅ |

| Forex, CFD, Saham, Kripto, Komoditas | ❌ |

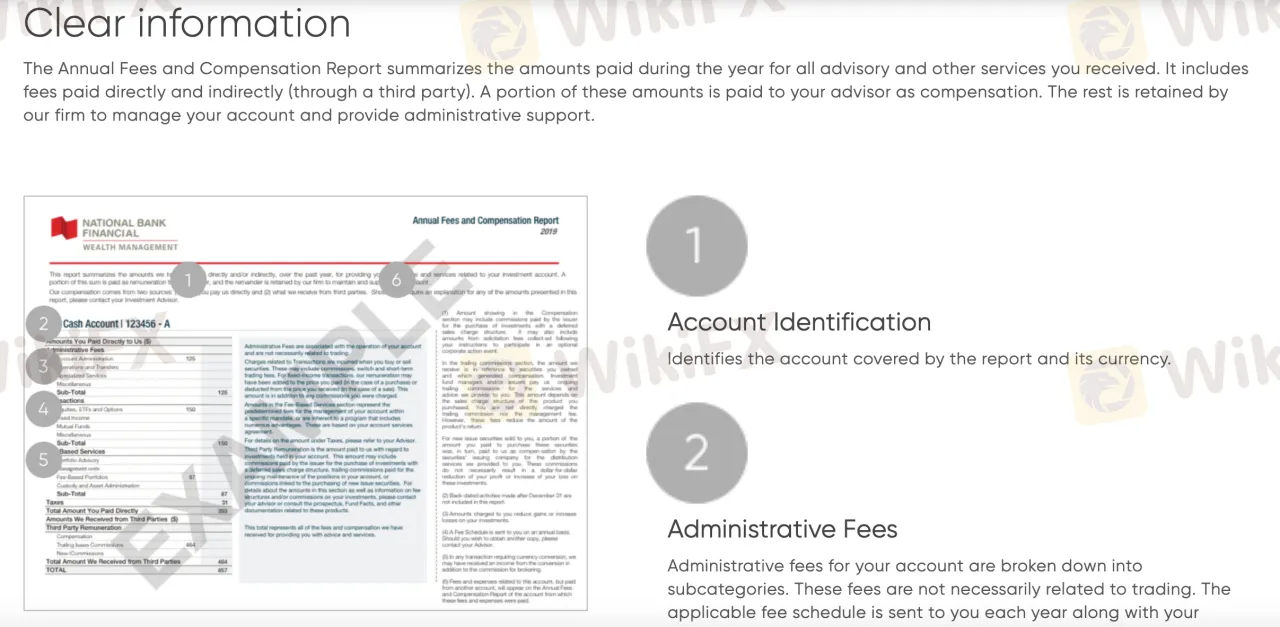

Biaya NBF

Terutama untuk layanan konsultasi dan manajemen portofolio, struktur biaya NBF (National Bank Financial) biasanya lebih tinggi dari norma industri. Meskipun spread spesifik untuk setiap item yang dapat diperdagangkan tidak diumumkan secara publik, pendekatan mereka mengutamakan biaya konsultasi dan administrasi di atas biaya perdagangan.

Platform Perdagangan

| Platform Perdagangan | Didukung | Perangkat yang Tersedia | Cocok untuk Jenis Trader Apa |

| NBFWM Platform Online | ✔ | Browser web (PC/Mac) | Klien yang ingin mengelola dan melihat portofolio dengan wawasan terperinci |

| NBC Wealth App | ✔ | Perangkat mobile iOS, Android | Pengguna mobile yang membutuhkan akses investasi saat bepergian |

| MetaTrader 4 / MT5 | ❌ | – | Tidak didukung |

| TradingView | ❌ | – | Tidak didukung |