Şirket özeti

| NBF İnceleme Özeti | |

| Kuruluş | 1902 |

| Kayıtlı Ülke/Bölge | Kanada |

| Düzenleme | Kanada Yatırım Düzenleme Kurulu (CIRO) |

| Ürünler ve Hizmetler | Varlık yönetimi, portföy yönetimi, vergi planlaması, miras planlaması, bankacılık çözümleri |

| Demo Hesabı | ❌ |

| İşlem Platformu | NBFWM Çevrimiçi Platformu, NBC Wealth Uygulaması |

| Müşteri Desteği | Telefon: 1-800-361-9522 |

NBF Bilgileri

1902 yılında kurulan National Bank Financial (NBF), CIRO tarafından yönetilen bir Kanada finans şirketidir. Forex veya kripto gibi geleneksel perakende ticaret araçları sunmasa da, bankacılık çözümlerine, finansal planlamaya ve varlık ve portföy yönetimine odaklanmaktadır.

Artıları ve Eksileri

| Artıları | Eksileri |

| Güçlü düzenleyici denetim (CIRO) | Forex, CFD, kripto ticaretine erişim yok |

| Kapsamlı varlık yönetimi hizmetleri | Endüstri standartlarına göre daha yüksek genel ücretler |

| Güçlü mobil ve çevrimiçi platformlar | Demo hesabı yok |

NBF Güvenilir mi?

Kanada Yatırım Düzenleme Kurulu (CIRO) tarafından bir Piyasa Yapıcısı (MM) lisansıyla yetkilendirilen National Bank Financial Inc. (NBF), tanınan ve düzenlenen bir finansal kurumdur. Özel lisans numarası gizli olsa da, NBF kontrollü bir statüyü korur ve Kanada finansal kurallarına göre işler.

Ürünler ve Hizmetler

NBF (National Bank Financial), öncelikli olarak portföy yönetimi, miras planlaması, vergi stratejileri ve bankacılık çözümleri de dahil olmak üzere kapsamlı varlık yönetimi ve finansal danışmanlık hizmetleri sunmaktadır.

| Ürünler ve Hizmetler | Desteklenen |

| Varlık Yönetimi | ✅ |

| Portföy Yönetimi | ✅ |

| Finansal Planlama | ✅ |

| Vergi Planlaması | ✅ |

| Miras Planlaması | ✅ |

| Bankacılık Çözümleri | ✅ |

| Takdiri Yönetim | ✅ |

| Forex, CFD'ler, Hisse Senetleri, Kripto, Emtialar | ❌ |

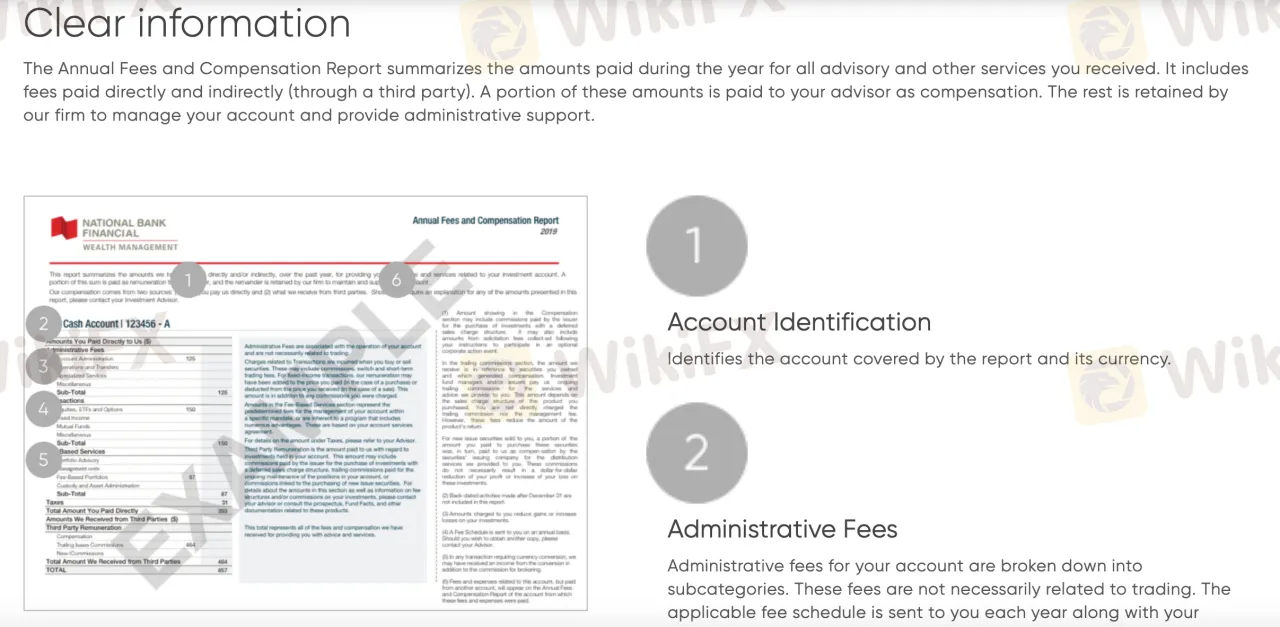

NBF Ücretleri

Özellikle danışmanlık ve portföy yönetimi hizmetleri için, NBF (National Bank Financial) ücret yapısı genellikle sektör normundan daha yüksektir. Bireysel işlem yapılabilir varlıklar için belirli spreadler açıklanmamış olsa da, yaklaşımları danışmanlık ve idari ücretleri işlem masraflarının üzerinde tutmayı önceliklendirir.

İşlem Platformu

| İşlem Platformu | Desteklenir | Kullanılabilir Cihazlar | Hangi Tür Yatırımcılar İçin Uygun |

| NBFWM Çevrimiçi Platformu | ✔ | Web tarayıcıları (PC/Mac) | Detaylı bilgilerle portföyleri yönetmek ve görüntülemek isteyen müşteriler |

| NBC Wealth Uygulaması | ✔ | iOS, Android mobil cihazlar | Yatırımlarına her an erişim sağlamak isteyen mobil kullanıcılar |

| MetaTrader 4 / MT5 | ❌ | – | Desteklenmez |

| TradingView | ❌ | – | Desteklenmez |