Perfil de la compañía

| NBF Resumen de revisión | |

| Fundado | 1902 |

| País/Región registrado | Canadá |

| Regulación | Organización Reguladora de Inversiones de Canadá (CIRO) |

| Productos y servicios | Gestión de patrimonio, gestión de cartera, planificación fiscal, planificación patrimonial, soluciones bancarias |

| Cuenta de demostración | ❌ |

| Plataforma de trading | NBF Plataforma en línea WM, NBC Wealth App |

| Soporte al cliente | Teléfono: 1-800-361-9522 |

Información de NBF

Fundada en 1902, National Bank Financial (NBF) es una empresa financiera canadiense dirigida por CIRO. Aunque no ofrece herramientas de trading minorista convencionales como forex o criptomonedas, se centra en soluciones bancarias, planificación financiera, gestión de patrimonio y cartera.

Ventajas y desventajas

| Ventajas | Desventajas |

| Fuerte supervisión regulatoria (CIRO) | No acceso a forex, CFD, trading de criptomonedas |

| Servicios integrales de gestión de patrimonio | Tarifas generales más altas en comparación con los estándares de la industria |

| Plataformas móviles y en línea robustas | Sin cuenta de demostración |

¿Es NBF legítimo?

Autorizado por la Organización Reguladora de Inversiones de Canadá (CIRO) bajo una licencia de Market Maker (MM), National Bank Financial Inc. (NBF) es una entidad financiera reconocida y regulada. Aunque el número de licencia específico es confidencial, NBF mantiene un estado controlado y opera de acuerdo con las normas financieras canadienses.

Productos y servicios

NBF (National Bank Financial) principalmente ofrece servicios integrales de gestión de patrimonio y asesoramiento financiero, que incluyen gestión de cartera, planificación patrimonial, estrategias fiscales y soluciones bancarias.

| Productos y servicios | Compatibles |

| Gestión de patrimonio | ✅ |

| Gestión de cartera | ✅ |

| Planificación financiera | ✅ |

| Planificación fiscal | ✅ |

| Planificación patrimonial | ✅ |

| Soluciones bancarias | ✅ |

| Gestión discrecional | ✅ |

| Forex, CFD, Acciones, Criptomonedas, Materias primas | ❌ |

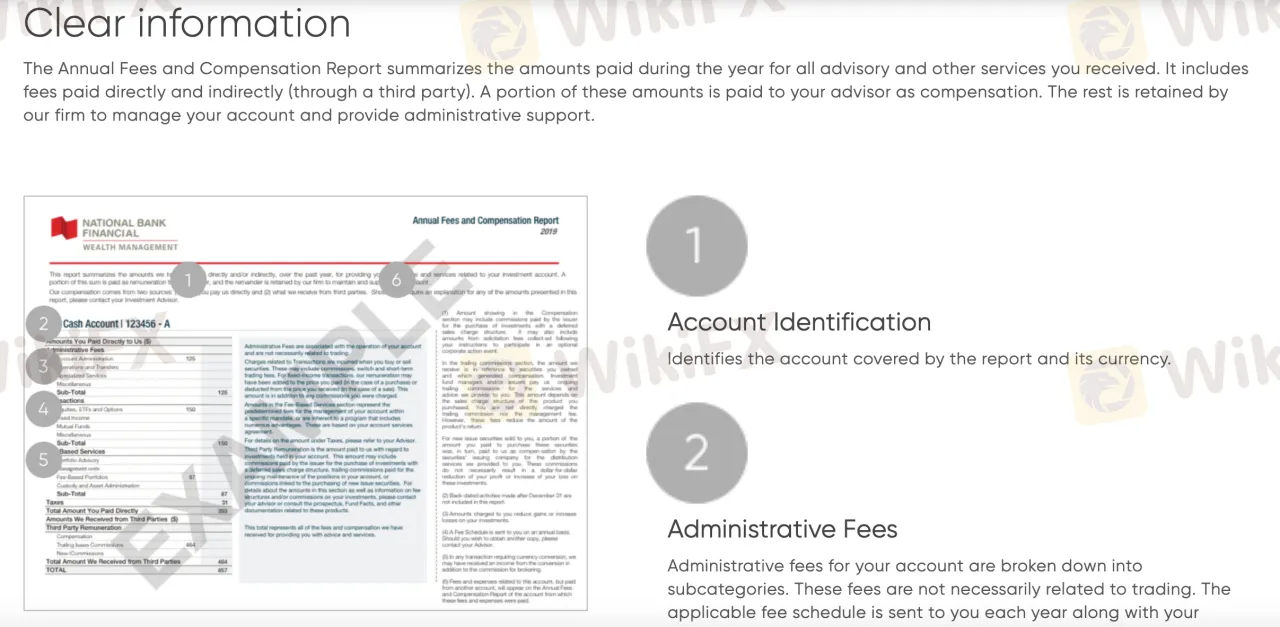

Tarifas de NBF

Especialmente para los servicios de asesoramiento y gestión de carteras, la estructura de tarifas de NBF (National Bank Financial) suele ser mayor que la norma de la industria. Aunque no se hacen públicos los spreads específicos para cada elemento negociable, su enfoque prioriza las tarifas de asesoramiento y administrativas por encima de los gastos de negociación.

Plataforma de Trading

| Plataforma de Trading | Soportada | Dispositivos Disponibles | Adecuada para qué tipo de Traders |

| NBFWM Plataforma Online | ✔ | Navegadores web (PC/Mac) | Clientes que desean gestionar y ver carteras con información detallada |

| NBC Wealth App | ✔ | Dispositivos móviles iOS, Android | Usuarios móviles que necesitan acceso a sus inversiones sobre la marcha |

| MetaTrader 4 / MT5 | ❌ | – | No soportado |

| TradingView | ❌ | – | No soportado |