Resumo da empresa

| NBF Resumo da Revisão | |

| Fundado | 1902 |

| País/Região Registrado | Canadá |

| Regulação | Organização Reguladora de Investimentos do Canadá (CIRO) |

| Produtos e Serviços | Gestão de patrimônio, gestão de portfólio, planejamento tributário, planejamento sucessório, soluções bancárias |

| Conta Demonstração | ❌ |

| Plataforma de Negociação | NBF Plataforma Online WM, Aplicativo NBC Wealth |

| Suporte ao Cliente | Telefone: 1-800-361-9522 |

Informações sobre NBF

Fundada em 1902, a National Bank Financial (NBF) é uma empresa financeira canadense administrada pela CIRO. Embora não forneça ferramentas de negociação convencionais como forex ou criptomoedas, ela se concentra em soluções bancárias, planejamento financeiro, gestão de patrimônio e portfólio.

Prós e Contras

| Prós | Contras |

| Fiscalização regulatória rigorosa (CIRO) | Sem acesso a negociação de forex, CFDs, criptomoedas |

| Serviços abrangentes de gestão de patrimônio | Taxas gerais mais altas em comparação com os padrões do setor |

| Plataformas móveis e online robustas | Sem conta demonstração |

NBF é Legítimo?

Autorizada pela Organização Reguladora de Investimentos do Canadá (CIRO) sob uma licença de Market Maker (MM), a National Bank Financial Inc. (NBF) é uma instituição financeira reconhecida e regulamentada. Embora o número de licença específico seja confidencial, NBF mantém um status controlado e opera de acordo com as regras financeiras canadenses.

Produtos e Serviços

NBF (National Bank Financial) oferece principalmente serviços abrangentes de gestão de patrimônio e consultoria financeira, incluindo gestão de portfólio, planejamento sucessório, estratégias tributárias e soluções bancárias.

| Produtos e Serviços | Suportados |

| Gestão de Patrimônio | ✅ |

| Gestão de Portfólio | ✅ |

| Planejamento Financeiro | ✅ |

| Planejamento Tributário | ✅ |

| Planejamento Sucessório | ✅ |

| Soluções Bancárias | ✅ |

| Gestão Discricionária | ✅ |

| Forex, CFDs, Ações, Criptomoedas, Commodities | ❌ |

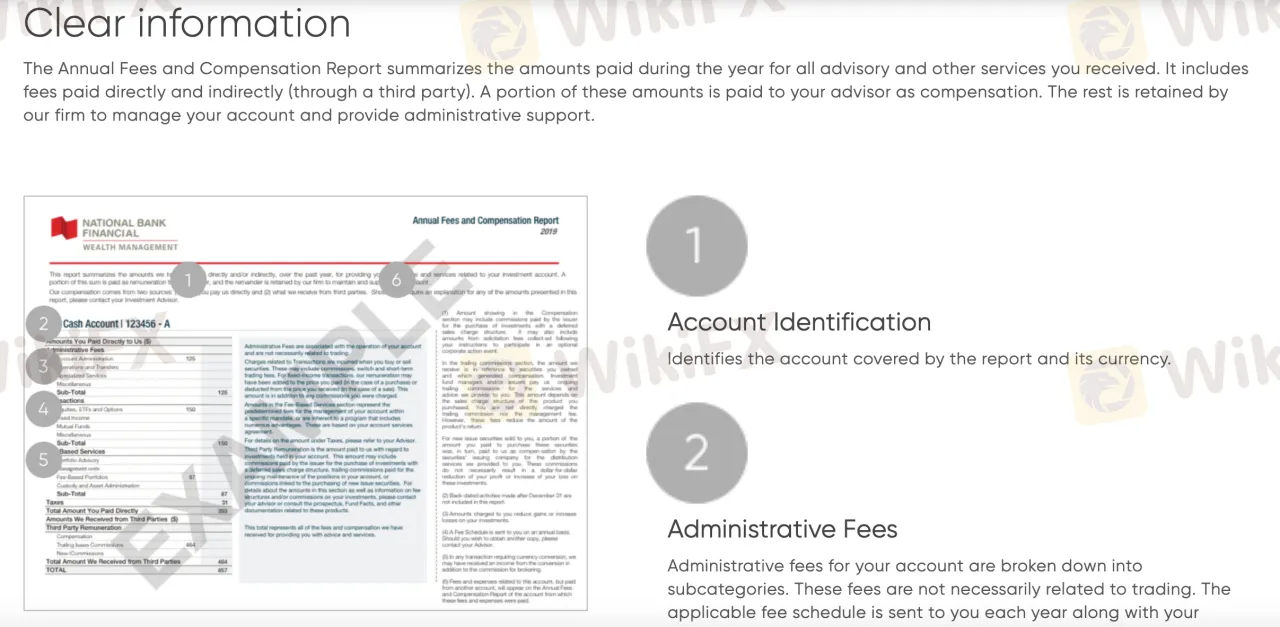

Taxas de NBF

Especialmente para serviços de consultoria e gestão de carteiras, a estrutura de taxas do NBF (National Bank Financial) geralmente é maior do que a média do setor. Embora os spreads específicos para itens negociáveis individuais não sejam divulgados publicamente, sua abordagem prioriza as taxas de consultoria e administrativas acima das despesas de negociação.

Plataforma de Negociação

| Plataforma de Negociação | Suportada | Dispositivos Disponíveis | Indicado para Quais Tipos de Traders |

| NBFWM Plataforma Online | ✔ | Navegadores da Web (PC/Mac) | Clientes que desejam gerenciar e visualizar carteiras com informações detalhadas |

| NBC Wealth App | ✔ | Dispositivos móveis iOS, Android | Usuários móveis que precisam de acesso aos seus investimentos em qualquer lugar |

| MetaTrader 4 / MT5 | ❌ | – | Não suportado |

| TradingView | ❌ | – | Não suportado |