회사 소개

| NBF 리뷰 요약 | |

| 설립 | 1902년 |

| 등록 국가/지역 | 캐나다 |

| 규제 | 캐나다 투자 규제 기구 (CIRO) |

| 제품 및 서비스 | 재무 관리, 포트폴리오 관리, 세금 계획, 재산 계획, 은행 솔루션 |

| 데모 계정 | ❌ |

| 거래 플랫폼 | NBFWM 온라인 플랫폼, NBC Wealth 앱 |

| 고객 지원 | 전화: 1-800-361-9522 |

NBF 정보

National Bank Financial (NBF)은 1902년에 설립된 CIRO가 운영하는 캐나다 금융 회사입니다. 외환이나 암호화폐와 같은 전통적인 소매 거래 도구를 제공하지는 않지만, 은행 솔루션, 재무 계획, 재산 및 포트폴리오 관리에 초점을 맞추고 있습니다.

장단점

| 장점 | 단점 |

| 강력한 규제 감독 (CIRO) | 외환, CFD, 암호화폐 거래 불가 |

| 포괄적인 재무 관리 서비스 | 산업 기준에 비해 높은 전반적인 수수료 |

| 강력한 모바일 및 온라인 플랫폼 | 데모 계정 없음 |

NBF의 신뢰성

National Bank Financial Inc. (NBF)은 캐나다 투자 규제 기구 (CIRO)의 시장 메이커 (MM) 라이선스로 승인받은 인증된 규제된 금융 기관입니다. 특정 라이선스 번호는 비밀로 유지되지만, NBF은 통제 상태를 유지하며 캐나다 금융 규칙에 따라 운영됩니다.

제품 및 서비스

NBF (National Bank Financial)은 주로 포트폴리오 관리, 재산 계획, 세금 전략, 은행 솔루션을 포함한 포괄적인 재무 관리 및 금융 자문 서비스를 제공합니다.

| 제품 및 서비스 | 지원 |

| 재무 관리 | ✅ |

| 포트폴리오 관리 | ✅ |

| 재무 계획 | ✅ |

| 세금 계획 | ✅ |

| 재산 계획 | ✅ |

| 은행 솔루션 | ✅ |

| 자율 관리 | ✅ |

| 외환, CFD, 주식, 암호화폐, 상품 | ❌ |

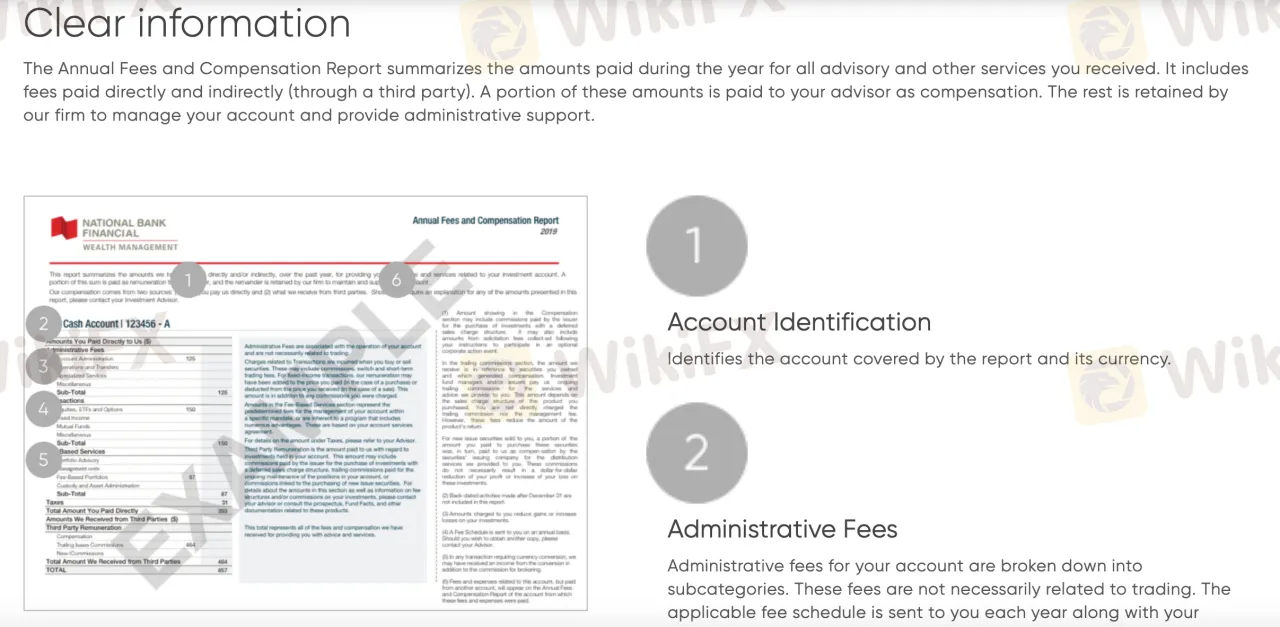

NBF 수수료

특히 자문 및 포트폴리오 관리 서비스에 있어서, NBF (National Bank Financial)의 요금 구조는 일반적인 업계 기준보다 높습니다. 개별 거래 가능 항목에 대한 구체적인 스프레드는 공개되지 않았지만, 그들의 접근 방식은 자문 및 행정 수수료를 거래 비용보다 우선시합니다.

거래 플랫폼

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 어떤 유형의 트레이더에게 적합한가요? |

| NBFWM 온라인 플랫폼 | ✔ | 웹 브라우저 (PC/Mac) | 자세한 통찰력을 가진 포트폴리오를 관리하고 보려는 고객 |

| NBC Wealth 앱 | ✔ | iOS, Android 모바일 장치 | 투자에 대한 이동 중 접근이 필요한 모바일 사용자 |

| MetaTrader 4 / MT5 | ❌ | – | 지원되지 않음 |

| TradingView | ❌ | – | 지원되지 않음 |