Présentation de l'entreprise

| KKJSEC Résumé de l'examen | |

| Fondé | 1986 |

| Pays/Région d'enregistrement | Inde |

| Régulation | Pas de régulation |

| Services | Actions et dérivés, matières premières, assurances, introductions en bourse |

| Compte de démonstration | ❌ |

| Plateforme de trading | ODIN (Financial Technologies), COMTEK (BackOffice) |

| Support client | Général : info@kkjsec.com |

| Réclamation : grief@kkjsec.com | |

| Gestion : nikhil@kkjsec.com | |

| Officier principal : M. Nikhil Jalan - Mobile : +91 9833915980 | |

Informations sur KKJSEC

Fondé en 1986 et basé en Inde, KKJSEC propose une série de services financiers, y compris des fonds communs de placement, des assurances, des matières premières, des actions BSE/NSE et des opérations sur dérivés. Ciblant les clients locaux de détail et institutionnels, il offre des services de trading via les systèmes ODIN et COMTEK. Cependant, il ne bénéficie pas de régulation de la part de l'autorité indienne, la Securities and Exchange Board of India (SEBI).

Avantages et inconvénients

| Avantages | Inconvénients |

| Longue histoire opérationnelle | Pas de régulation |

| Large gamme de services financiers incluant des actions et des dépôts | Absence de comptes de démonstration |

| Fournit un accès au back office et des outils de trading en ligne |

KKJSEC est-il légitime ?

Non, KKJSEC n'est pas réglementé. Il a été fondé en Inde, mais il ne possède pas de licence réglementaire délivrée par une autorité financière indienne reconnue, y compris la Securities and Exchange Board of India (SEBI).

La modification la plus récente du domaine kkjsec.com a été effectuée le 11 avril 2025, et il a été enregistré le 23 avril 2005. La date d'expiration du domaine est le 23 avril 2028. Il utilise les serveurs de noms d'hébergement ns1.cp-ht-10.webhostbox.net et ns2.cp-ht-10.webhostbox.net.

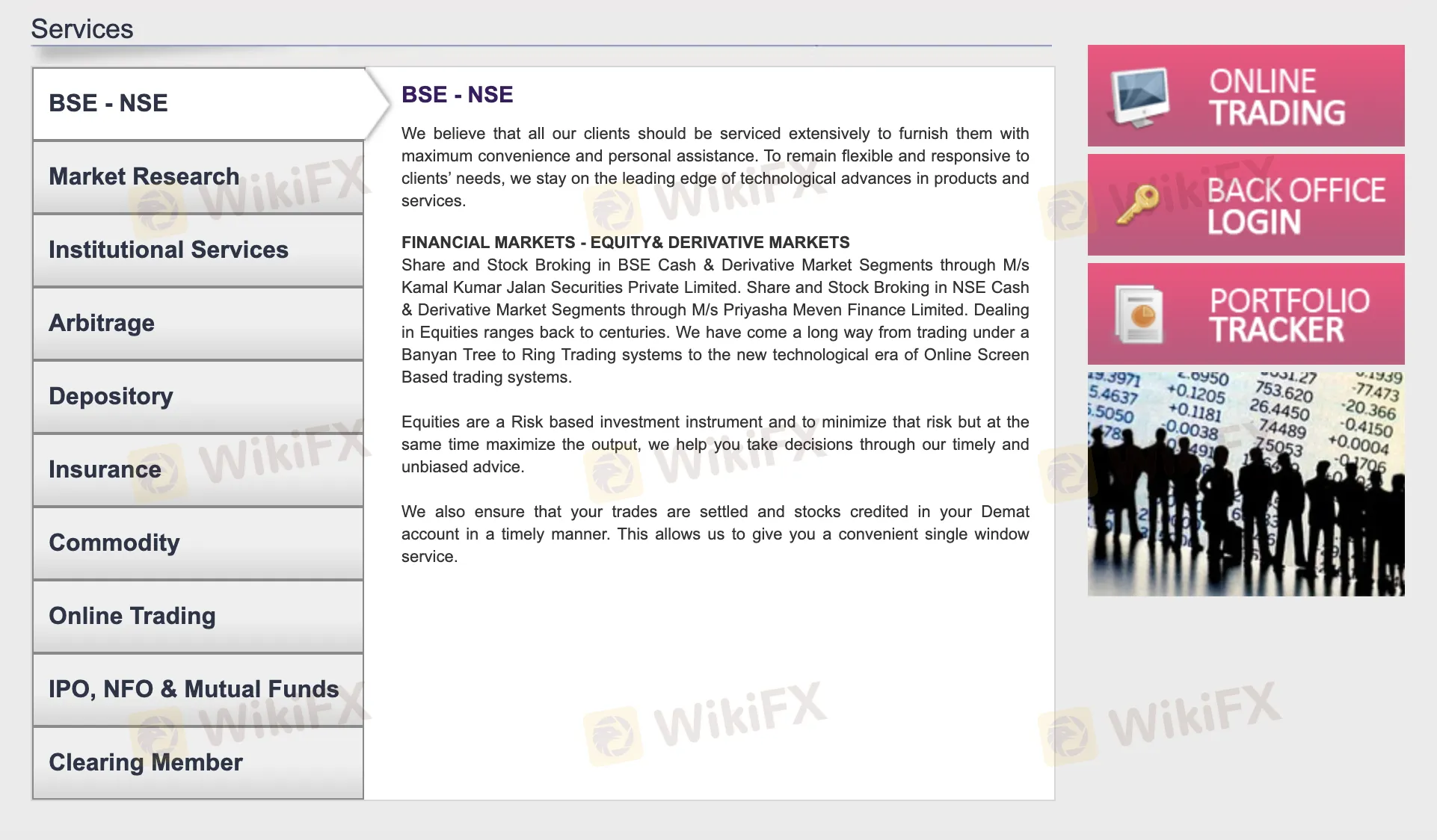

Services de KKJSEC

Le trading en ligne, les matières premières, les services d'assurance, les services de dépôt, ainsi que le trading d'actions et de dérivés ne sont que quelques-uns des nombreux services financiers fournis par KKJSEC. Il facilite le trading sur les bourses BSE et NSE grâce à ses filiales.

| Services | Fonctionnalité |

| Trading BSE - NSE | Trading d'actions et de dérivés sur les marchés BSE et NSE |

| Recherche de marché | Services d'analyse et de recherche de marché |

| Services Institutionnels | Services financiers personnalisés pour les clients institutionnels |

| Arbitrage | Stratégies de trading d'arbitrage |

| Services de Dépôt | Services de compte Demat et de règlement des actions |

| Assurance | Produits d'assurance et conseils |

| Trading de Matières Premières | Investissement sur les marchés de matières premières |

| Trading en Ligne | Plateforme de trading en ligne pour la commodité des utilisateurs |

| IPO, NFO & Fonds Communs de Placement | Services liés aux introductions en bourse, nouvelles offres de fonds et investissements en fonds communs de placement |

| Membre de Compensation | Services de compensation pour assurer le règlement des transactions en temps voulu |

Plateforme de Trading

KKJSEC propose une plateforme de trading en ligne alimentée par ODIN qui permet aux utilisateurs de passer des transactions en toute sécurité et de manière indépendante. Un back-office alimenté par COMTEK pour examiner les rapports de transactions et les registres est également inclus.

| Plateforme de Trading | Pris en Charge | Appareils Disponibles | Adapté pour |

| ODIN (Financial Technologies) | ✔ | Bureau, Web | Traders actifs cherchant plus de contrôle sur la saisie directe des transactions |

| E-BackOffice (COMTEK) | ✔ | Web | Investisseurs ayant besoin d'un accès en temps réel aux registres et résumés de transactions |