Buod ng kumpanya

| KKJSEC Buod ng Pagsusuri | |

| Itinatag | 1986 |

| Rehistradong Bansa/Rehiyon | India |

| Regulasyon | Walang regulasyon |

| Mga Serbisyo | Equities & derivatives, commodities, insurance, IPOs |

| Demo Account | ❌ |

| Plataporma ng Trading | ODIN (Financial Technologies), COMTEK (BackOffice) |

| Suporta sa Customer | Pangkalahatan: info@kkjsec.com |

| Reklamo: grief@kkjsec.com | |

| Pamamahala: nikhil@kkjsec.com | |

| Punong Opisyal: G. Nikhil Jalan - Mobile: +91 9833915980 | |

Impormasyon Tungkol sa KKJSEC

Itinatag noong 1986 at nakabase sa India, nagbibigay ang KKJSEC ng serye ng mga serbisyong pinansiyal, kabilang ang mutual funds, insurance, commodities, BSE/NSE stocks at derivative trading. Layunin nitong magbigay ng mga serbisyong pangkalakal sa lokal na mga nagtitinda at institusyon, nag-aalok ito ng mga serbisyong pangkalakal sa pamamagitan ng mga sistema ng ODIN at COMTEK. Gayunpaman, kulang ito sa regulasyon mula sa awtoridad ng India na Securities and Exchange Board of India (SEBI).

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Mahabang kasaysayan ng operasyon | Walang regulasyon |

| Malawak na hanay ng mga serbisyong pinansiyal kabilang ang equity & depository | Walang alok na demo accounts |

| Nagbibigay ng access sa back office at online trading tools |

Tunay ba ang KKJSEC?

Hindi, ang KKJSEC ay hindi nairegulate. Natagpuan ito sa India, ngunit wala itong lisensiyang regulasyon mula sa anumang kinikilalang awtoridad sa India sa larangan ng pinansiyal, kabilang ang Securities and Exchange Board of India (SEBI).

Ang pinakabagong pagbabago sa domain na kkjsec.com ay ginawa noong Abril 11, 2025, at nirehistro ito noong Abril 23, 2005. Ang petsa ng pag-expire ng domain ay Abril 23, 2028. Gumagamit ito ng mga name server na ns1.cp-ht-10.webhostbox.net at ns2.cp-ht-10.webhostbox.net.

Mga Serbisyo ng KKJSEC

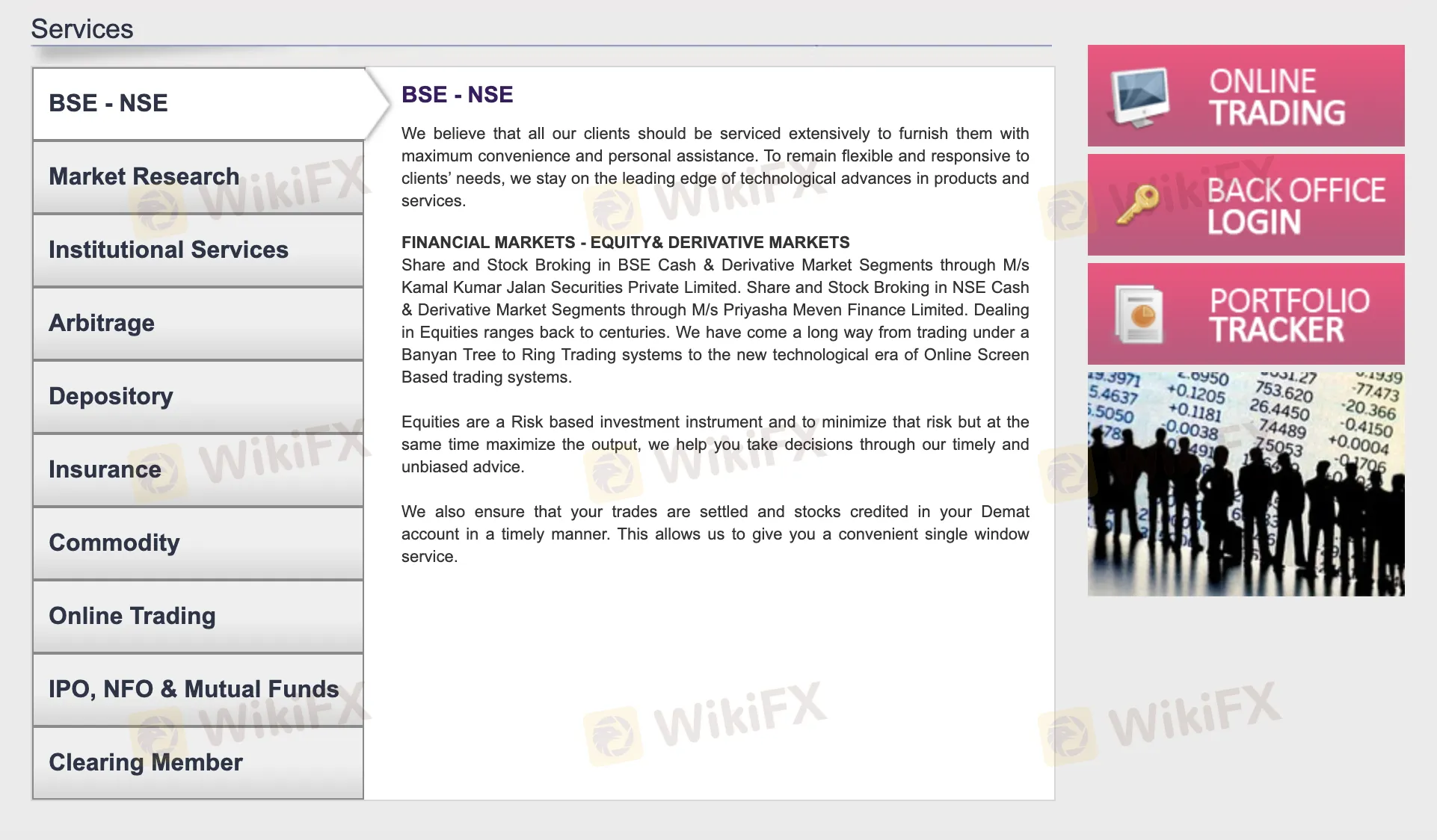

Ang online trading, commodities, insurance, depository services, at equities at derivative trading ay ilan lamang sa maraming serbisyong pinansyal na ibinibigay ng KKJSEC. Ginagawa nitong mas madali ang pag-trade sa mga palitan ng BSE at NSE sa pamamagitan ng mga sangay nito.

| Mga Serbisyo | Tampok |

| BSE - NSE Trading | Equity at derivatives trading sa BSE at NSE markets |

| Market Research | Market analysis at research services |

| Institutional Services | Customized financial services para sa institutional clients |

| Arbitrage | Arbitrage trading strategies |

| Depository Services | Demat account services at stock settlement |

| Insurance | Insurance products at advisory |

| Commodity Trading | Investment sa commodity markets |

| Online Trading | Online trading platform para sa kaginhawahan ng user |

| IPO, NFO & Mutual Funds | Mga serbisyo kaugnay ng IPOs, New Fund Offers, at mutual fund investments |

| Clearing Member | Clearing services upang tiyakin ang maagang paglutas ng kalakalan |

Plataforma ng Pag-trade

Nagbibigay ang KKJSEC ng isang ODIN-powered online trading platform na nagbibigay-daan sa mga user na ligtas at independiyenteng maglagay ng mga trades. Kasama rin dito ang isang COMTEK-powered back office para suriin ang mga ulat ng kalakalan at ledgers.

| Plataforma ng Pag-trade | Supported | Available Devices | Suitable for |

| ODIN (Financial Technologies) | ✔ | Desktop, Web | Mga aktibong trader na naghahanap ng mas maraming kontrol sa direktang pagpasok ng kalakalan |

| E-BackOffice (COMTEK) | ✔ | Web | Mga investor na nangangailangan ng real-time access sa ledgers at trade summaries |