회사 소개

| KKJSEC 리뷰 요약 | |

| 설립 연도 | 1986 |

| 등록 국가/지역 | 인도 |

| 규제 | 규제 없음 |

| 서비스 | 주식 및 파생상품, 상품, 보험, IPO |

| 데모 계정 | ❌ |

| 거래 플랫폼 | ODIN (Financial Technologies), COMTEK (BackOffice) |

| 고객 지원 | 일반 문의: info@kkjsec.com |

| 불만 제기: grief@kkjsec.com | |

| 경영진: nikhil@kkjsec.com | |

| 책임자: Mr. Nikhil Jalan - 휴대폰: +91 9833915980 | |

KKJSEC 정보

1986년에 설립된 KKJSEC은 인도를 기반으로 하며 상호펀드, 보험, 상품, BSE/NSE 주식 및 파생상품 거래를 포함한 다양한 금융 서비스를 제공합니다. 지역 소매 및 기관 고객을 대상으로 하며 ODIN 및 COMTEK 시스템을 통해 거래 서비스를 제공합니다. 그러나 인도 권위자인 증권거래위원회(SEBI)의 규제를 받지 않고 있습니다.

장단점

| 장점 | 단점 |

| 긴 운영 역사 | 규제 없음 |

| 주식 및 예탁 서비스를 포함한 다양한 금융 서비스 제공 | 데모 계정 미제공 |

| 백오피스 접근 및 온라인 거래 도구 제공 |

KKJSEC 합법성

KKJSEC은 규제를 받지 않는 업체입니다. 인도에서 설립되었지만 증권거래위원회(SEBI)를 포함한 어떤 인정받은 인도 금융 권위기관으로부터 규제 라이선스를 받지 않았습니다.

도메인 kkjsec.com의 가장 최근 수정은 2025년 4월 11일에 이루어졌으며, 2005년 4월 23일에 등록되었습니다. 도메인의 만료일은 2028년 4월 23일입니다. ns1.cp-ht-10.webhostbox.net 및 ns2.cp-ht-10.webhostbox.net 호스팅 이름 서버를 사용합니다.

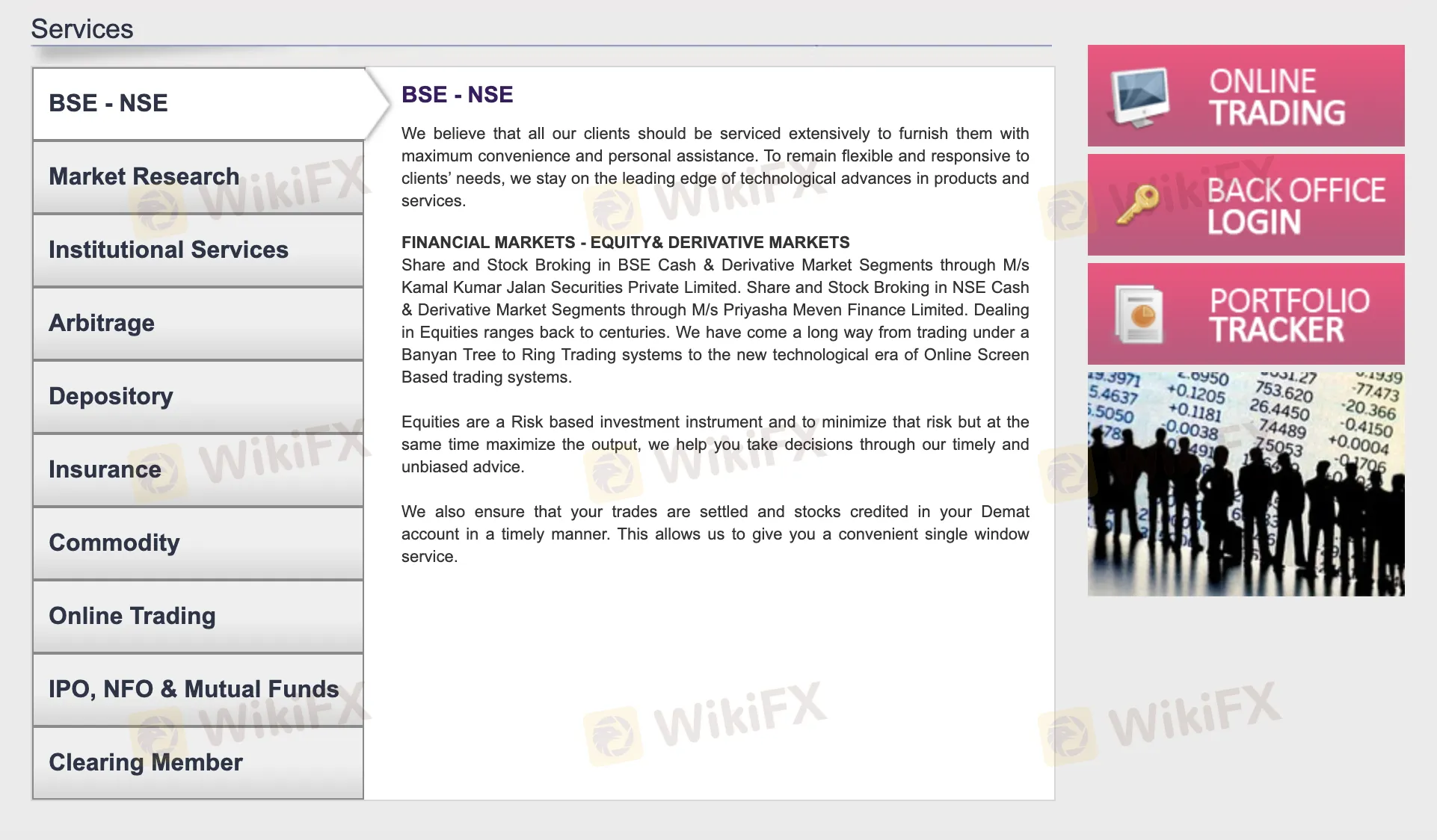

KKJSEC 서비스

온라인 거래, 상품, 보험, 예탁 서비스, 그리고 주식 및 파생상품 거래는 KKJSEC가 제공하는 다양한 금융 서비스 중 일부에 불과합니다. 이 회사는 자회사를 통해 BSE 및 NSE 거래를 보다 쉽게 만들어줍니다.

| 서비스 | 특징 |

| BSE - NSE 거래 | BSE 및 NSE 시장에서의 주식 및 파생상품 거래 |

| 시장 조사 | 시장 분석 및 연구 서비스 |

| 기관 서비스 | 기관 고객을 위한 맞춤형 금융 서비스 |

| 아비트라지 | 아비트라지 거래 전략 |

| 예탁 서비스 | Demat 계좌 서비스 및 주식 결제 |

| 보험 | 보험 상품 및 자문 |

| 상품 거래 | 상품 시장 투자 |

| 온라인 거래 | 사용자 편의를 위한 온라인 거래 플랫폼 |

| IPO, NFO 및 투자 펀드 | IPO, 신규 펀드 공모 및 투자 펀드 관련 서비스 |

| 청산 회원 | 시간적인 거래 결제를 보장하기 위한 청산 서비스 |

거래 플랫폼

KKJSEC은 사용자가 안전하고 독립적으로 거래를 할 수 있는 ODIN 기반 온라인 거래 플랫폼을 제공합니다. 거래 보고서 및 원장을 검토하기 위한 COMTEK 기반 백 오피스도 포함되어 있습니다.

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

| ODIN (금융 기술) | ✔ | 데스크톱, 웹 | 직접 거래 입력에 대한 더 많은 통제를 원하는 활발한 거래자 |

| E-백오피스 (COMTEK) | ✔ | 웹 | 원장 및 거래 요약에 대한 실시간 액세스가 필요한 투자자 |