Unternehmensprofil

| KKJSEC Überprüfungszusammenfassung | |

| Gegründet | 1986 |

| Registriertes Land/Region | Indien |

| Regulierung | Keine Regulierung |

| Dienstleistungen | Aktien & Derivate, Rohstoffe, Versicherungen, IPOs |

| Demo-Konto | ❌ |

| Handelsplattform | ODIN (Financial Technologies), COMTEK (BackOffice) |

| Kundenbetreuung | Allgemein: info@kkjsec.com |

| Beschwerden: grief@kkjsec.com | |

| Management: nikhil@kkjsec.com | |

| Hauptbeauftragter: Herr Nikhil Jalan - Mobil: +91 9833915980 | |

KKJSEC Informationen

Im Jahr 1986 gegründet und mit Sitz in Indien bietet KKJSEC eine Reihe von Finanzdienstleistungen an, darunter Investmentfonds, Versicherungen, Rohstoffe, BSE/NSE-Aktien und Derivatehandel. Mit dem Ziel, lokale Einzelhandels- und institutionelle Kunden zu bedienen, bietet es Handelsdienstleistungen über die ODIN- und COMTEK-Systeme an. Es fehlt jedoch an Regulierung durch die indische Behörde Securities and Exchange Board of India (SEBI).

Vor- und Nachteile

| Vorteile | Nachteile |

| Langjährige Betriebsgeschichte | Keine Regulierung |

| Breites Spektrum an Finanzdienstleistungen einschließlich Aktien & Depot | Keine Demo-Konten angeboten |

| Bietet Zugang zum Backoffice und Online-Handelstools |

Ist KKJSEC legitim?

Nein, KKJSEC ist nicht reguliert. Es wurde in Indien gegründet, verfügt jedoch über keine Regulierungslizenz von einer anerkannten indischen Finanzbehörde, einschließlich der Securities and Exchange Board of India (SEBI).

Die letzte Änderung der Domain kkjsec.com erfolgte am 11. April 2025, und sie wurde am 23. April 2005 registriert. Das Ablaufdatum der Domain ist der 23. April 2028. Es verwendet die Nameserver ns1.cp-ht-10.webhostbox.net und ns2.cp-ht-10.webhostbox.net.

KKJSEC Dienstleistungen

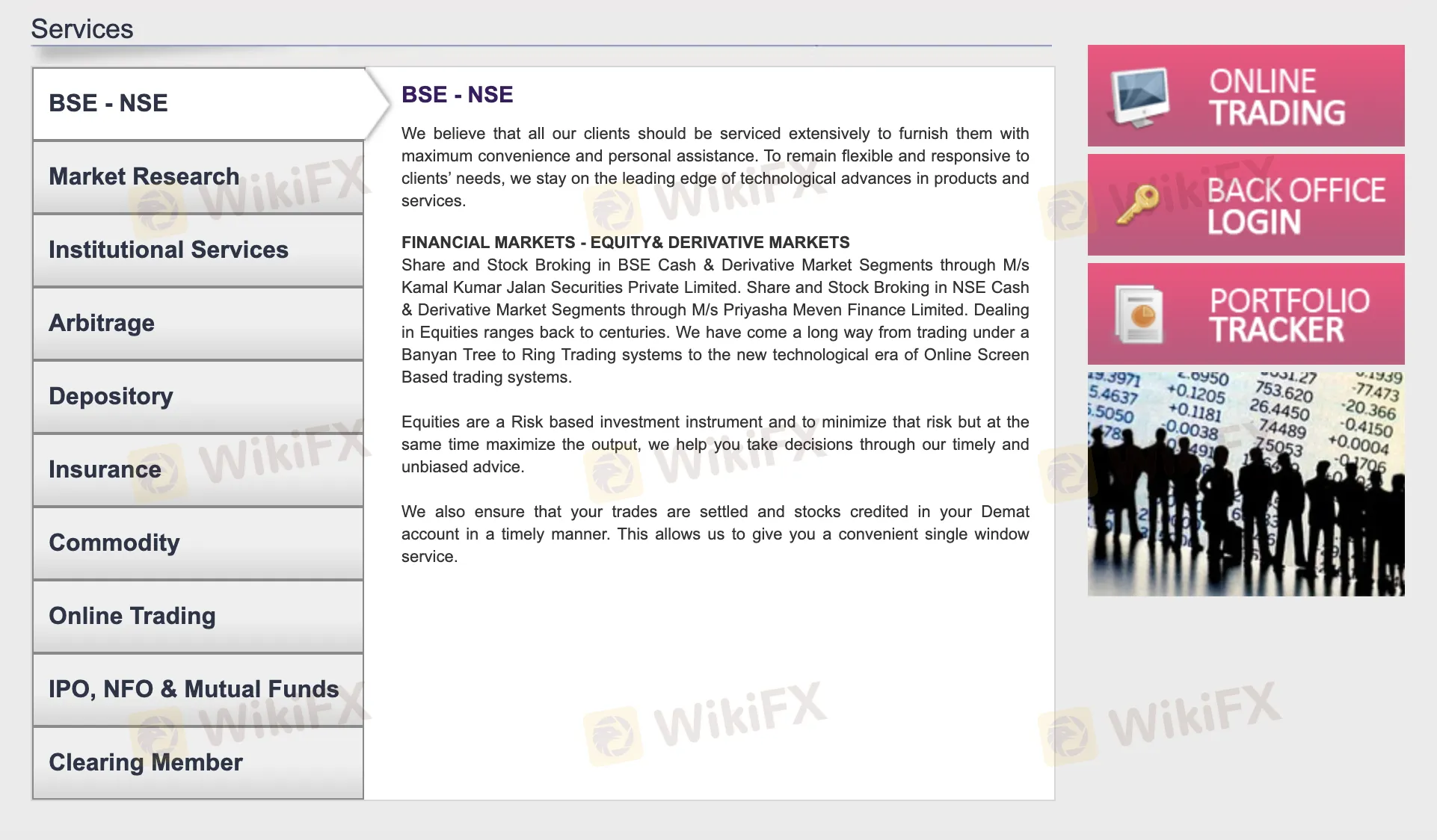

Online-Handel, Rohstoffe, Versicherungen, Depotdienstleistungen sowie Aktien- und Derivatehandel sind nur einige der vielen Finanzdienstleistungen, die KKJSEC anbietet. Es erleichtert den Handel an den BSE- und NSE-Börsen durch seine Tochtergesellschaften.

| Dienstleistungen | Merkmal |

| BSE - NSE Handel | Aktien- und Derivatehandel an den BSE- und NSE-Märkten |

| Marktforschung | Marktanalysen und Forschungsdienstleistungen |

| Institutionelle Dienstleistungen | Maßgeschneiderte Finanzdienstleistungen für institutionelle Kunden |

| Arbitrage | Arbitrage-Handelsstrategien |

| Depotdienstleistungen | Demat-Kontodienste und Aktienabwicklung |

| Versicherung | Versicherungsprodukte und Beratung |

| Rohstoffhandel | Investitionen in Rohstoffmärkte |

| Online-Handel | Online-Handelsplattform für Benutzerkomfort |

| IPO, NFO & Investmentfonds | Dienstleistungen im Zusammenhang mit IPOs, neuen Fondsangeboten und Investmentfonds |

| Clearing-Mitglied | Clearing-Dienstleistungen zur Sicherstellung einer rechtzeitigen Handelsabwicklung |

Handelsplattform

KKJSEC bietet eine von ODIN betriebene Online-Handelsplattform, die es Benutzern ermöglicht, Trades sicher und unabhängig zu platzieren. Ein von COMTEK betriebenes Backoffice zur Prüfung von Handelsberichten und Hauptbüchern ist ebenfalls enthalten.

| Handelsplattform | Unterstützt | Verfügbare Geräte | Geeignet für |

| ODIN (Financial Technologies) | ✔ | Desktop, Web | Aktive Trader, die mehr Kontrolle über direkte Handelseingaben wünschen |

| E-BackOffice (COMTEK) | ✔ | Web | Investoren, die Echtzeitzugriff auf Hauptbücher und Handelszusammenfassungen benötigen |