Perfil de la compañía

| KKJSEC Resumen de la reseña | |

| Establecido | 1986 |

| País/Región Registrada | India |

| Regulación | Sin regulación |

| Servicios | Acciones y derivados, materias primas, seguros, OPIs |

| Cuenta Demo | ❌ |

| Plataforma de Trading | ODIN (Financial Technologies), COMTEK (BackOffice) |

| Soporte al Cliente | General: info@kkjsec.com |

| Reclamos: grief@kkjsec.com | |

| Gerencia: nikhil@kkjsec.com | |

| Oficial Principal: Sr. Nikhil Jalan - Móvil: +91 9833915980 | |

Información de KKJSEC

Fundada en 1986 y con sede en India, KKJSEC ofrece una serie de servicios financieros, incluyendo fondos mutuos, seguros, materias primas, acciones de BSE/NSE y trading de derivados. Dirigido a clientes minoristas e institucionales locales, ofrece servicios de trading a través de los sistemas ODIN y COMTEK. Sin embargo, carece de regulación por parte de la autoridad india Securities and Exchange Board of India (SEBI).

Pros y Contras

| Pros | Contras |

| Larga historia operativa | Sin regulación |

| Amplia gama de servicios financieros incluyendo acciones y depósito | No se ofrecen cuentas demo |

| Ofrece acceso a oficina de respaldo y herramientas de trading en línea |

¿Es KKJSEC Legítimo?

No, KKJSEC no está regulado. Fue fundado en India, pero no tiene licencia regulatoria de ninguna autoridad financiera india reconocida, incluida la Securities and Exchange Board of India (SEBI).

La modificación más reciente al dominio kkjsec.com se realizó el 11 de abril de 2025, y se registró el 23 de abril de 2005. La fecha de vencimiento del dominio es el 23 de abril de 2028. Utiliza los servidores de nombres de hosting ns1.cp-ht-10.webhostbox.net y ns2.cp-ht-10.webhostbox.net.

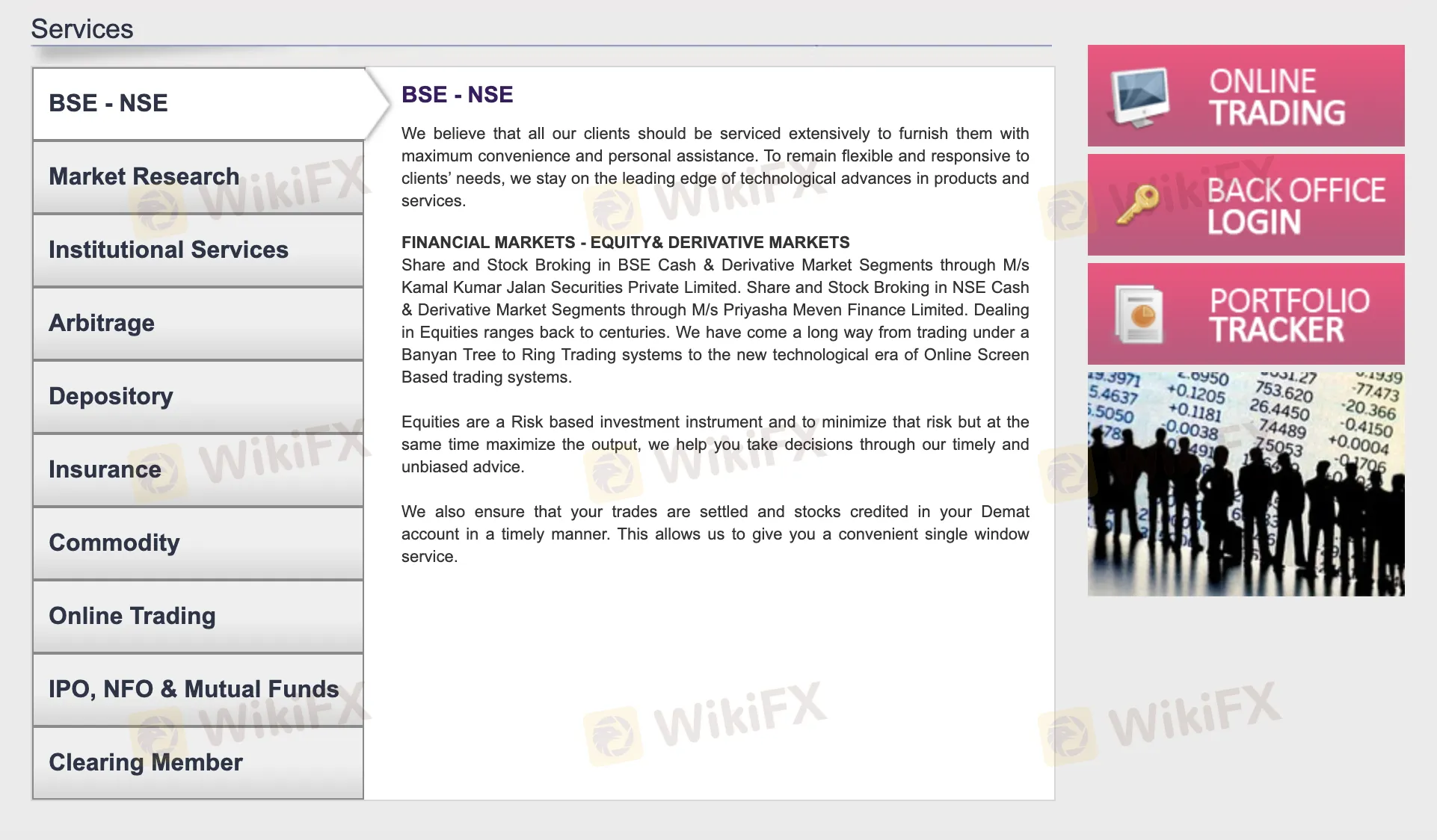

Servicios de KKJSEC

El comercio en línea, productos básicos, seguros, servicios de depósito, y el comercio de acciones y derivados son solo algunos de los muchos servicios financieros que KKJSEC proporciona. Facilita el comercio en las bolsas BSE y NSE a través de sus subsidiarias.

| Servicios | Característica |

| Comercio BSE - NSE | Comercio de acciones y derivados en los mercados BSE y NSE |

| Investigación de Mercado | Análisis de mercado y servicios de investigación |

| Servicios Institucionales | Servicios financieros personalizados para clientes institucionales |

| Arbitraje | Estrategias de comercio de arbitraje |

| Servicios de Depósito | Servicios de cuenta demat y liquidación de acciones |

| Seguros | Productos de seguros y asesoramiento |

| Comercio de Productos Básicos | Inversión en mercados de productos básicos |

| Comercio en Línea | Plataforma de comercio en línea para la conveniencia del usuario |

| OPI, FND y Fondos Mutuos | Servicios relacionados con OPI, Ofertas de Nuevos Fondos y inversiones en fondos mutuos |

| Miembro de Compensación | Servicios de compensación para garantizar la liquidación oportuna de operaciones |

Plataforma de Comercio

KKJSEC proporciona una plataforma de comercio en línea impulsada por ODIN que permite a los usuarios realizar operaciones de forma segura e independiente. También se incluye una oficina trasera impulsada por COMTEK para examinar informes comerciales y libros contables.

| Plataforma de Comercio | Compatible | Dispositivos Disponibles | Adecuado para |

| ODIN (Tecnologías Financieras) | ✔ | Escritorio, Web | Operadores activos que buscan más control sobre la entrada directa de operaciones |

| E-BackOffice (COMTEK) | ✔ | Web | Inversores que necesitan acceso en tiempo real a libros contables y resúmenes comerciales |