Présentation de l'entreprise

| TD Résumé de l'examen | |

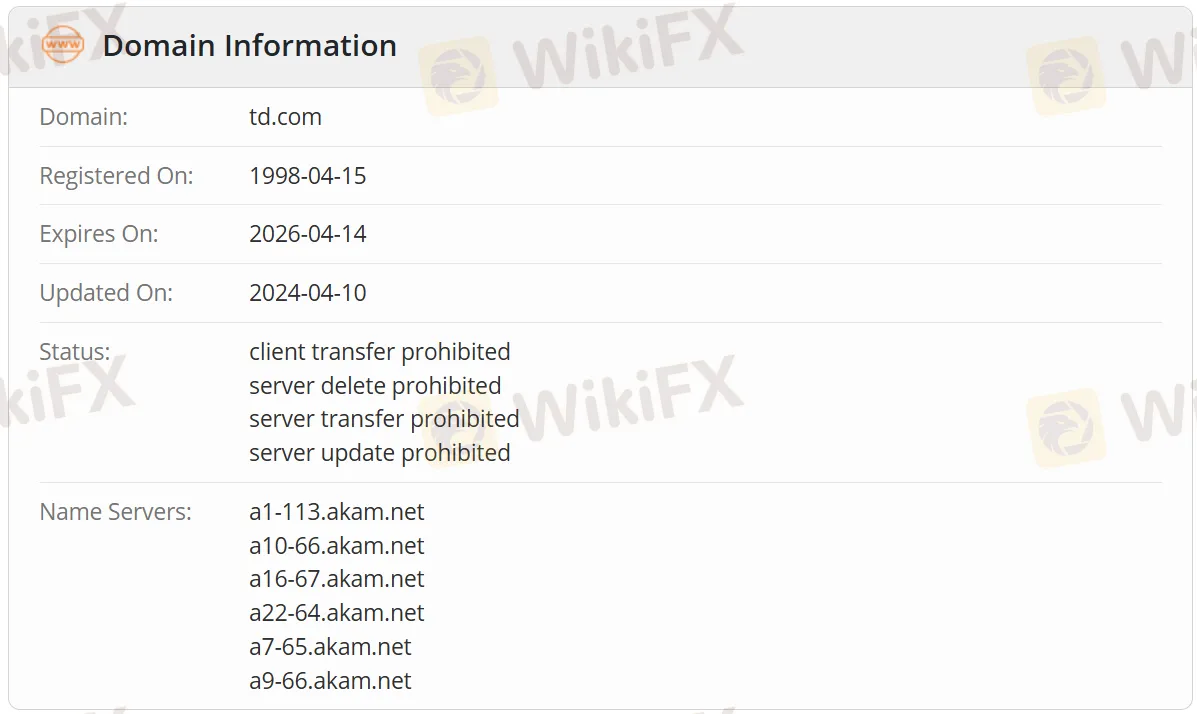

| Fondé | 1998 |

| Pays/Région d'enregistrement | Canada |

| Régulation | Pas de régulation |

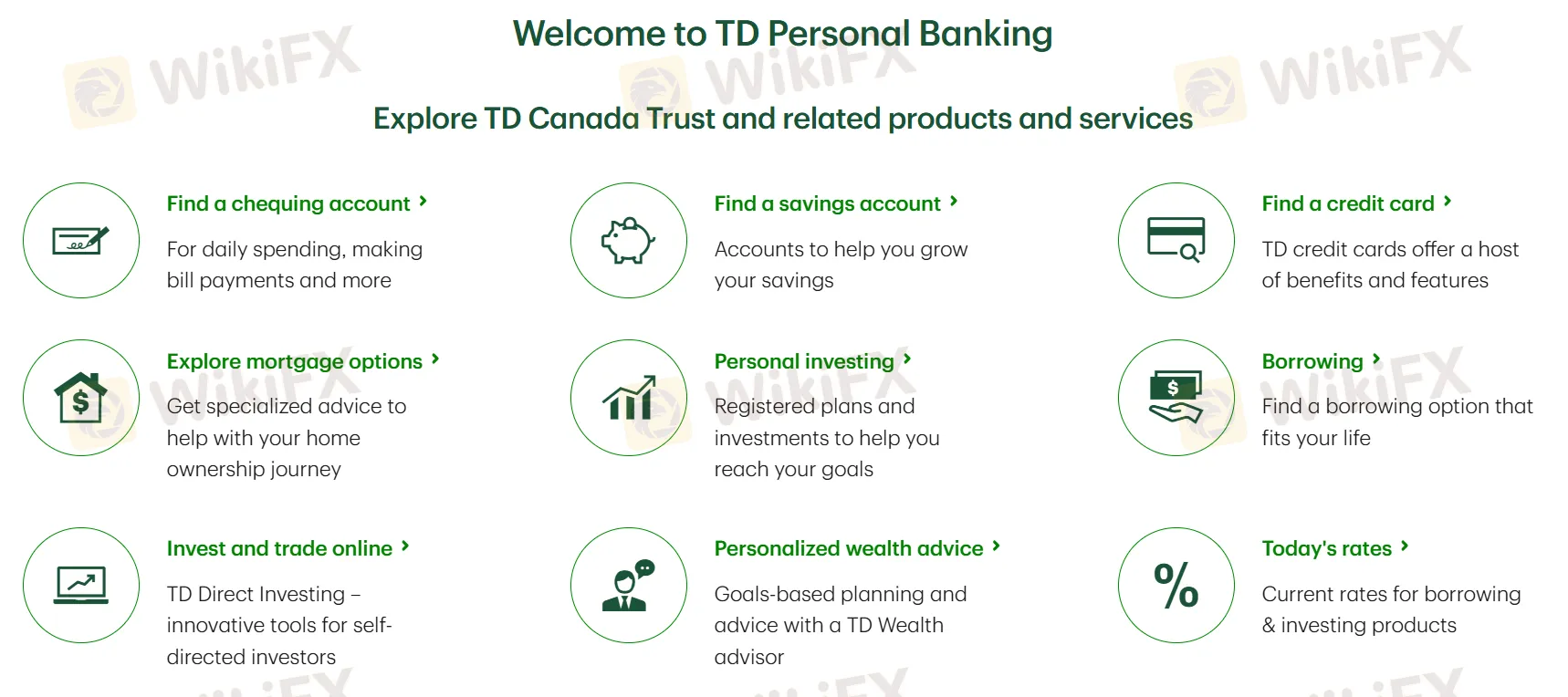

| Produits & Services | Comptes chèques et d'épargne, cartes de crédit, options de prêt hypothécaire, investissement personnel, emprunt, investissement et trading en ligne, conseils en gestion de patrimoine personnalisés |

| Plateforme/Application | Application TD |

| Support Client | Anglais : 1-800-983-8472, Français : 1-800-983-8472, Mandarin : 1-877-233-5844 |

Informations sur TD

TD est une société de trading en ligne qui propose des services bancaires personnels complets, y compris des cartes de crédit, des prêts hypothécaires et diverses options d'investissement accessibles via son application conviviale TD. Cependant, elle n'est actuellement pas réglementée par les autorités financières.

Avantages et Inconvénients

| Avantages | Inconvénients |

| Divers services bancaires personnels | Plateforme non réglementée |

| Structure tarifaire peu claire |

TD est-il légitime ?

Non. TD est une plateforme non réglementée. Le nom de domaine td.com a été enregistré sur WHOIS le 15 avril 1998 et expire le 14 avril 2026. Son statut actuel est "client transfer prohibited, server delete/transfer/update prohibited".

Produits et Services

TD propose des produits et services incluant comptes chèques et d'épargne, cartes de crédit, options de prêt hypothécaire, investissement personnel, emprunt, investissement et trading en ligne, conseils en gestion de patrimoine personnalisés, etc.

Plateforme/Application

| Plateforme/Application | Pris en charge | Appareils Disponibles |

| TD App | ✔ | Apple, Android |