Présentation de l'entreprise

Informations générales et règlement

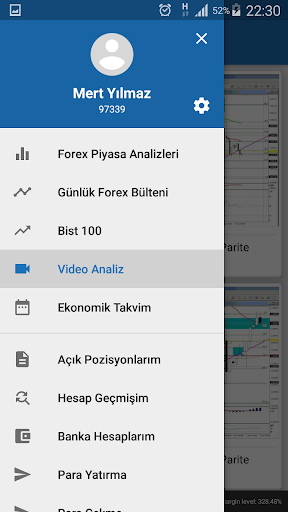

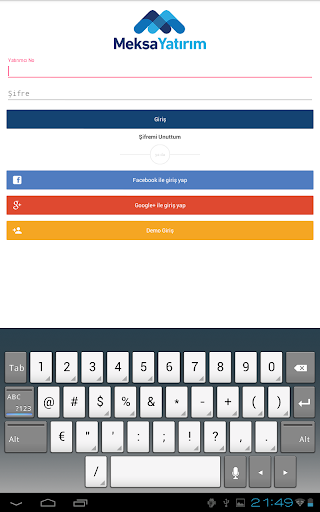

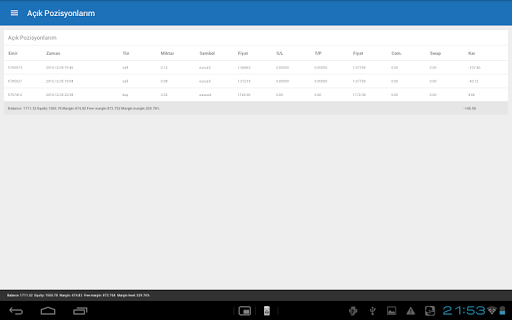

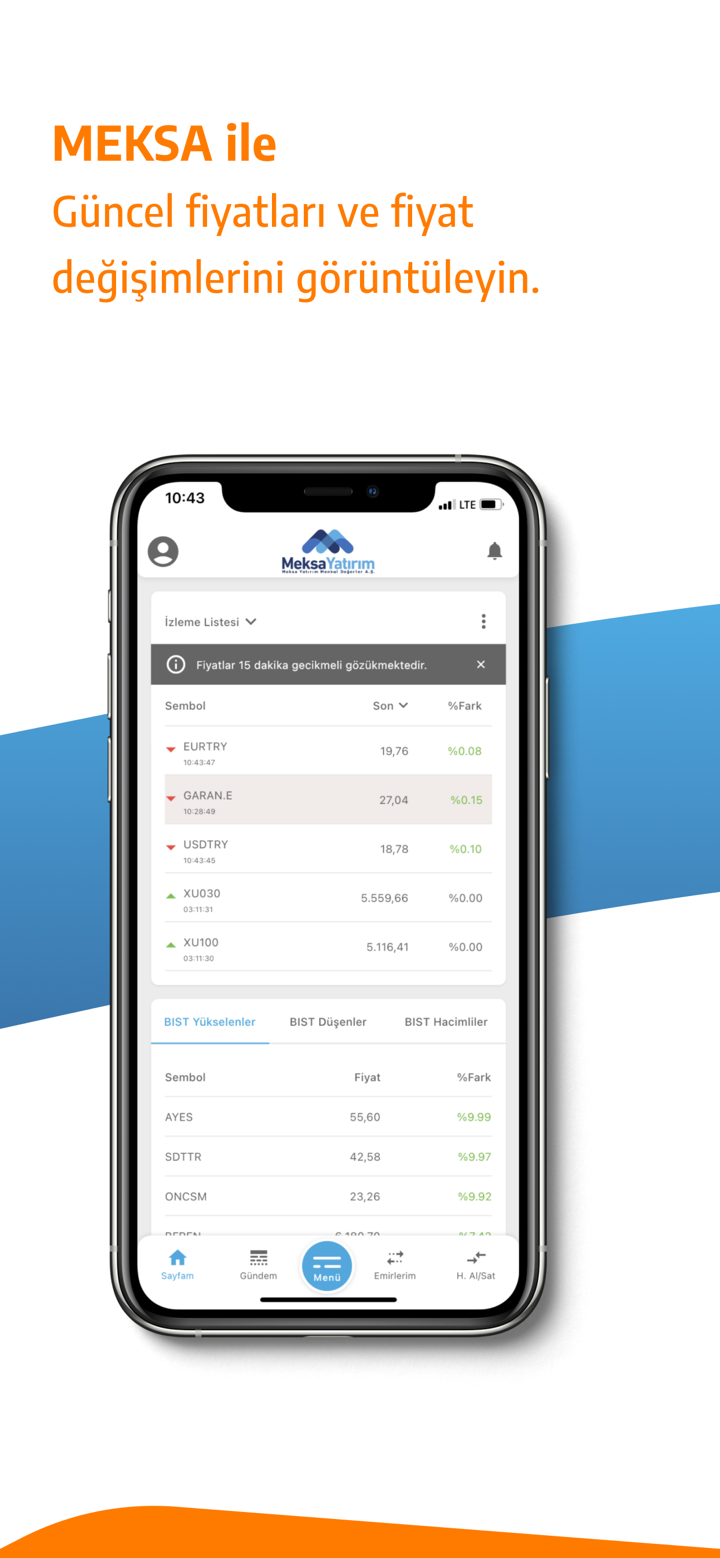

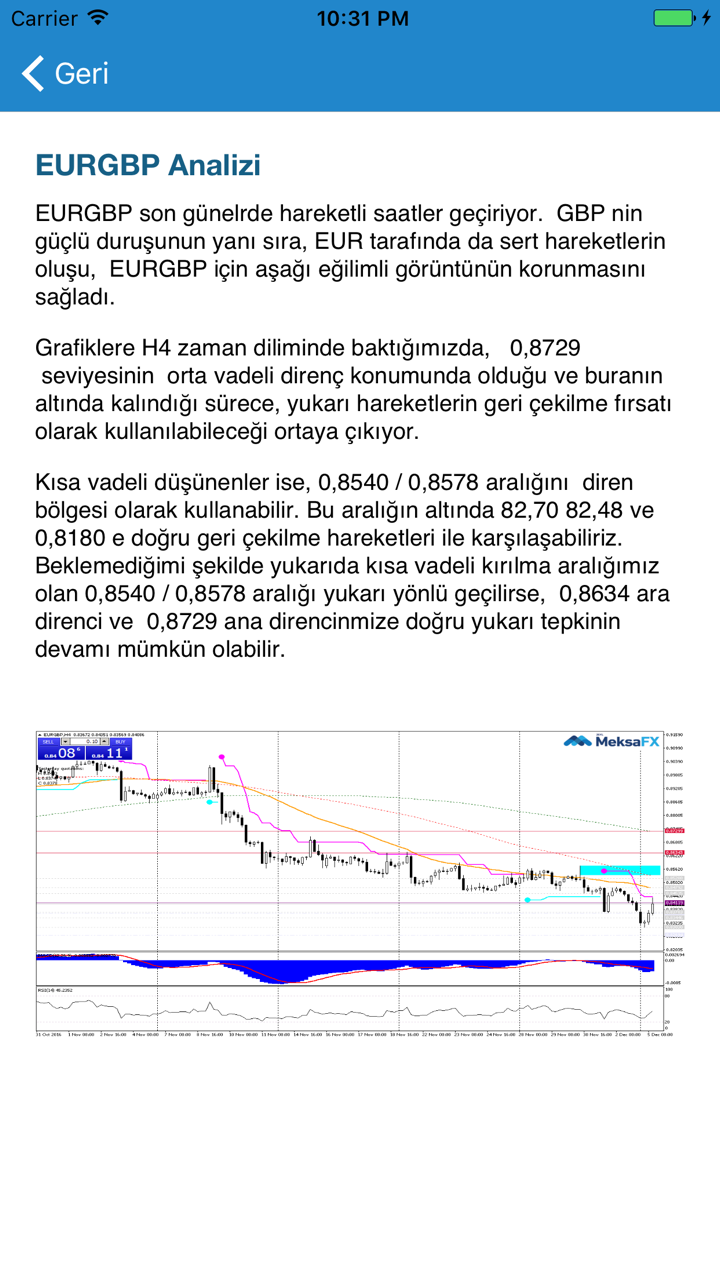

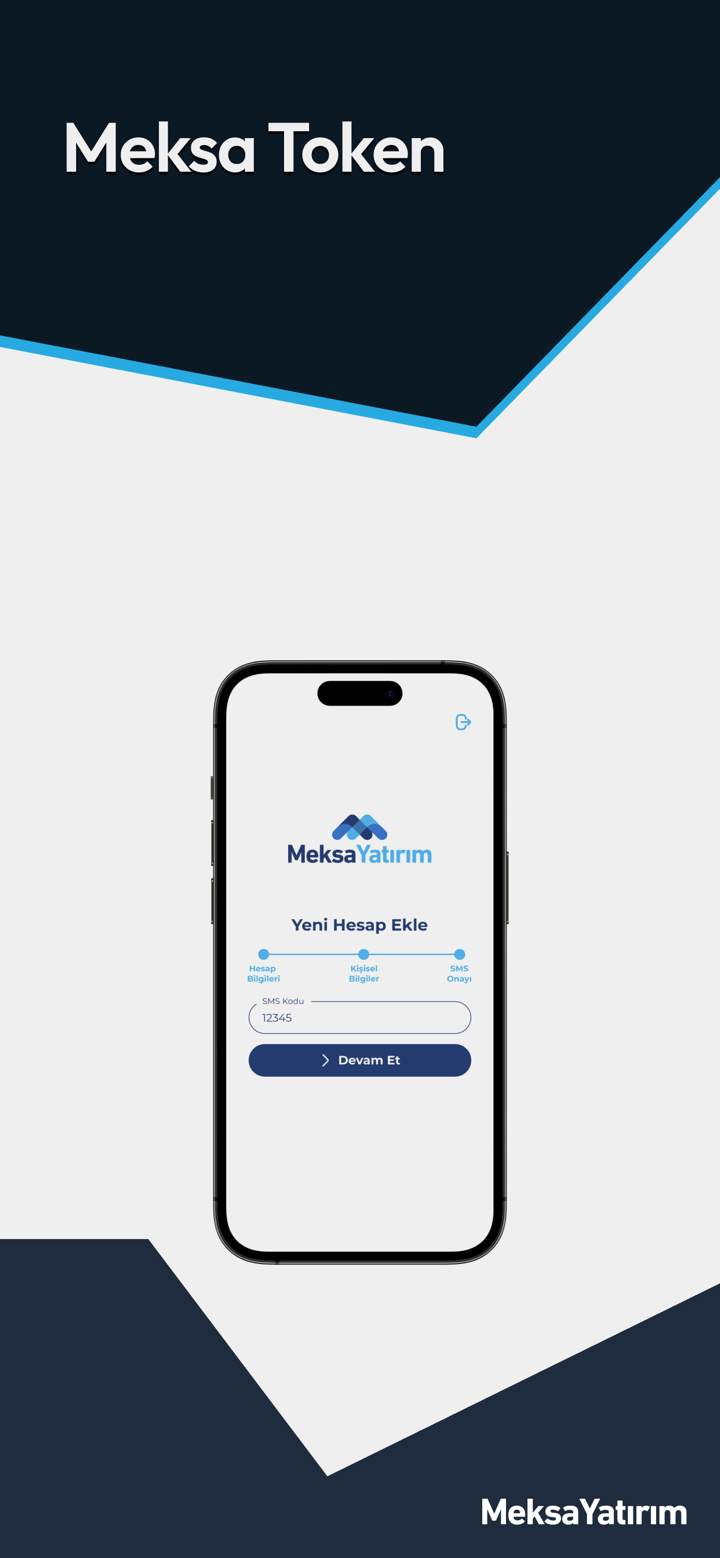

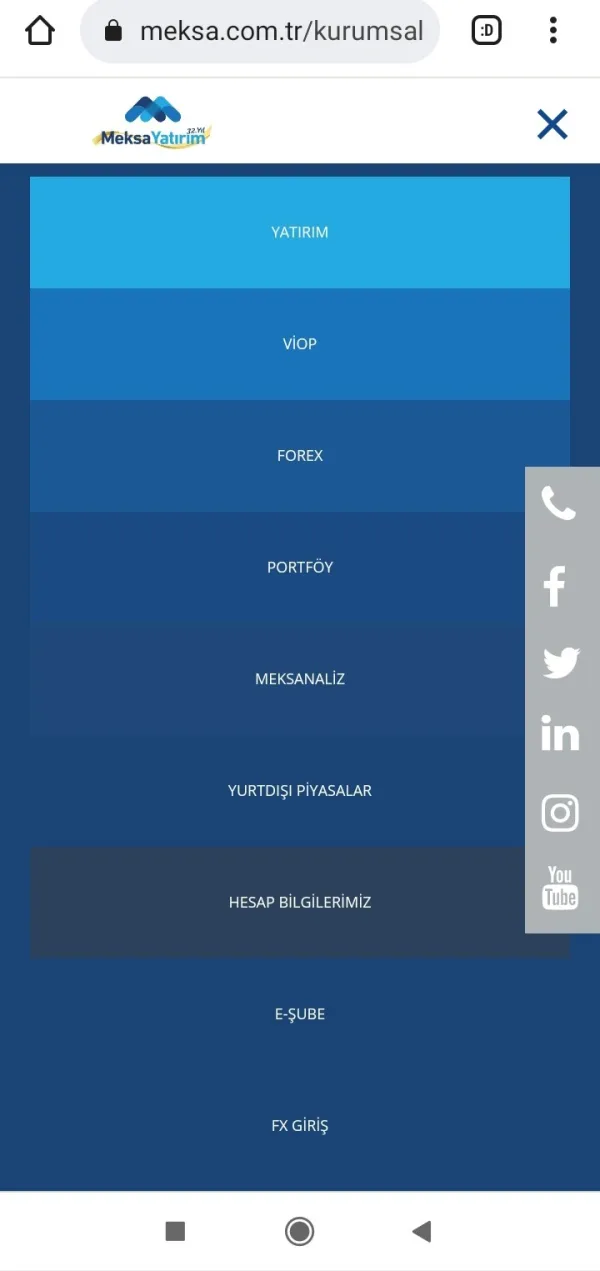

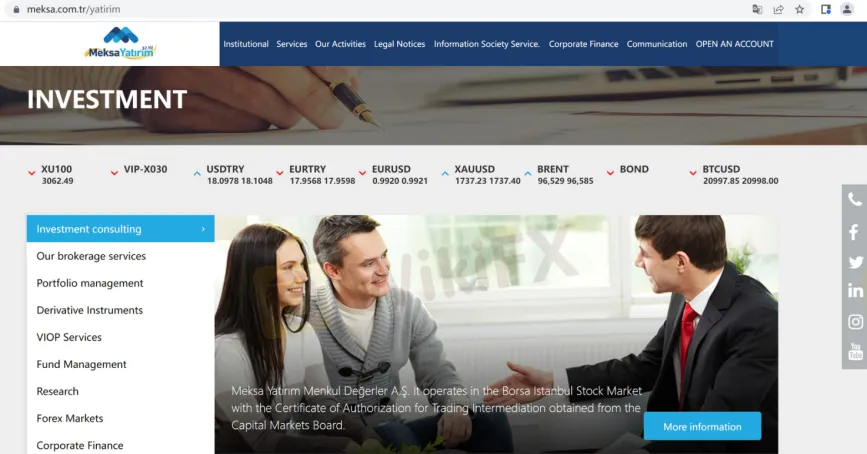

MEKSA, un nom commercial de Meksa Yatırım Menkul Değerler A.Ş , serait une société de courtage financier créée le 28 juin 1990 et enregistrée en Turquie. le courtier dit opérer sur le marché boursier borsa istanbul avec le certificat d'autorisation d'intermédiation commerciale obtenu auprès du conseil des marchés des capitaux, affirmant fournir à ses clients particuliers et entreprises divers services financiers. voici la page d'accueil du site officiel de ce broker :

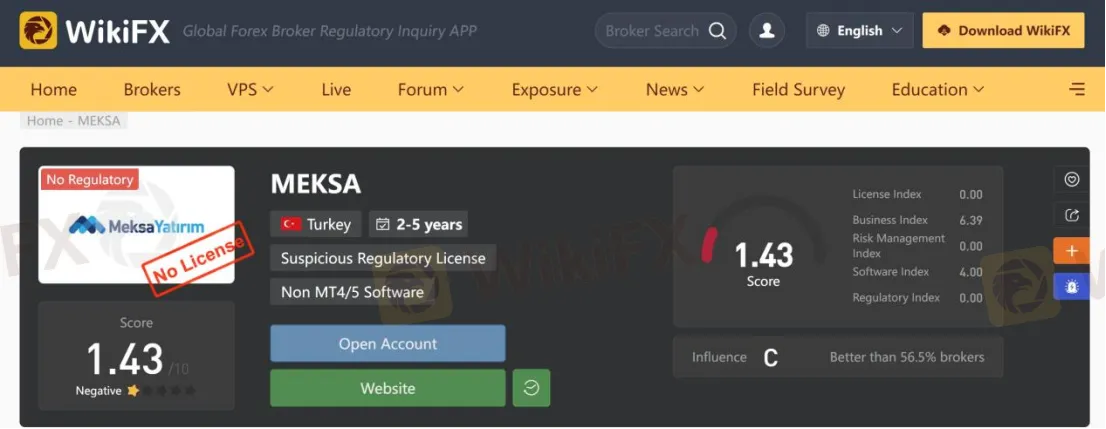

quant à la réglementation, il a été vérifié que MEKSA ne relève d'aucune réglementation en vigueur. c'est pourquoi son statut réglementaire sur wikifx est répertorié comme "sans licence" et il reçoit un score relativement faible de 1,43/10. s'il vous plaît soyez conscient du risque.

Avis négatifs

un commerçant a partagé sa terrible expérience commerciale dans le MEKSA plate-forme sur wikifx. il a dit que MEKSA est un courtier en escroquerie et il n'a pas reçu le dépôt promis de 50% lorsque la date est arrivée. il est nécessaire que les commerçants lisent les avis laissés par certains utilisateurs avant de choisir des courtiers forex, au cas où ils seraient fraudés par des escroqueries.

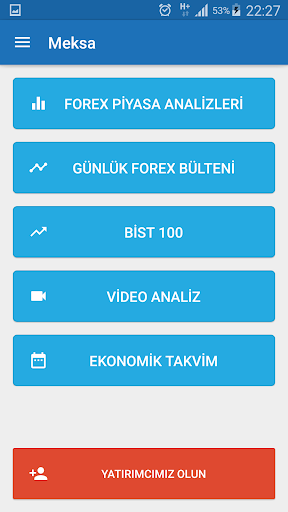

Prestations de service

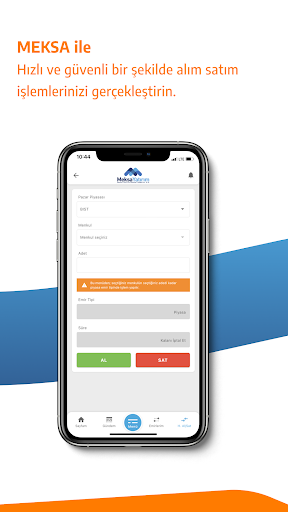

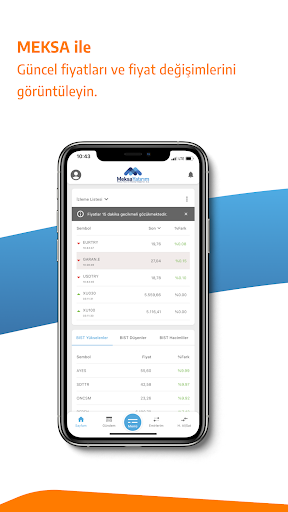

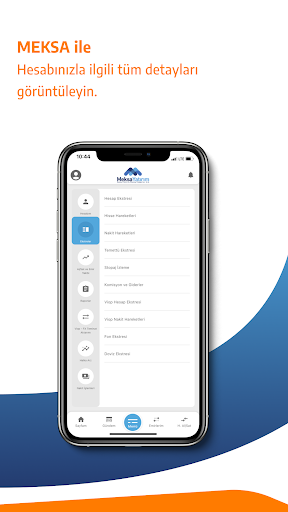

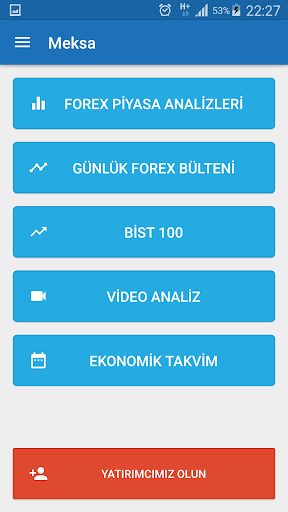

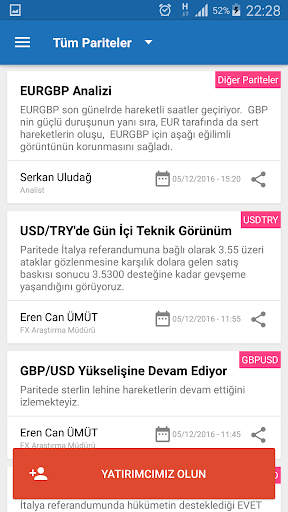

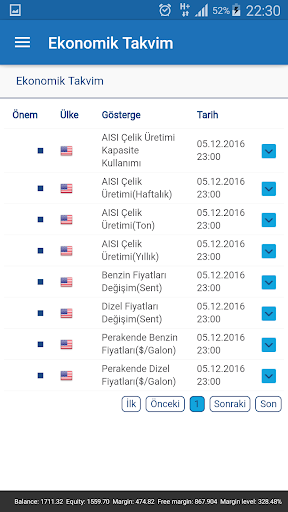

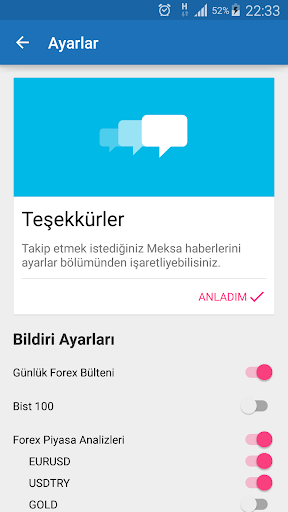

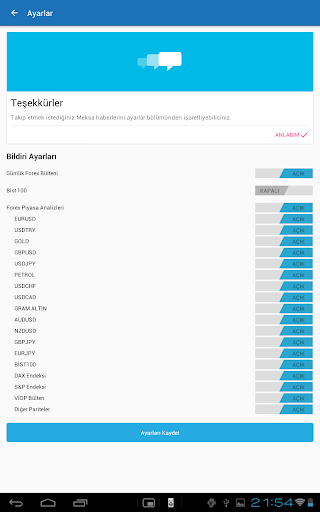

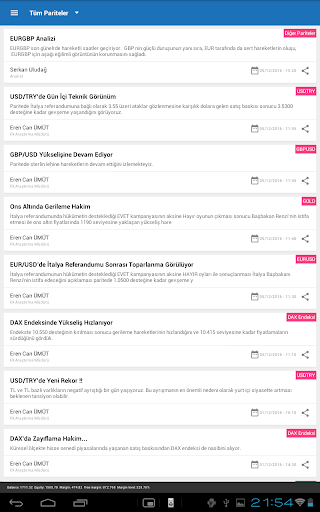

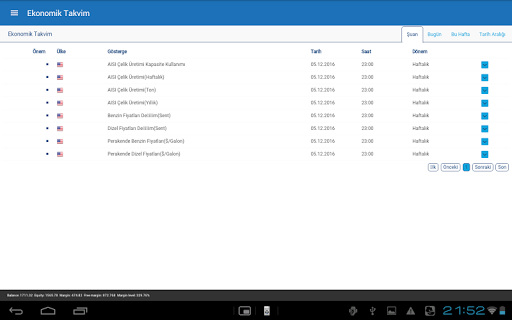

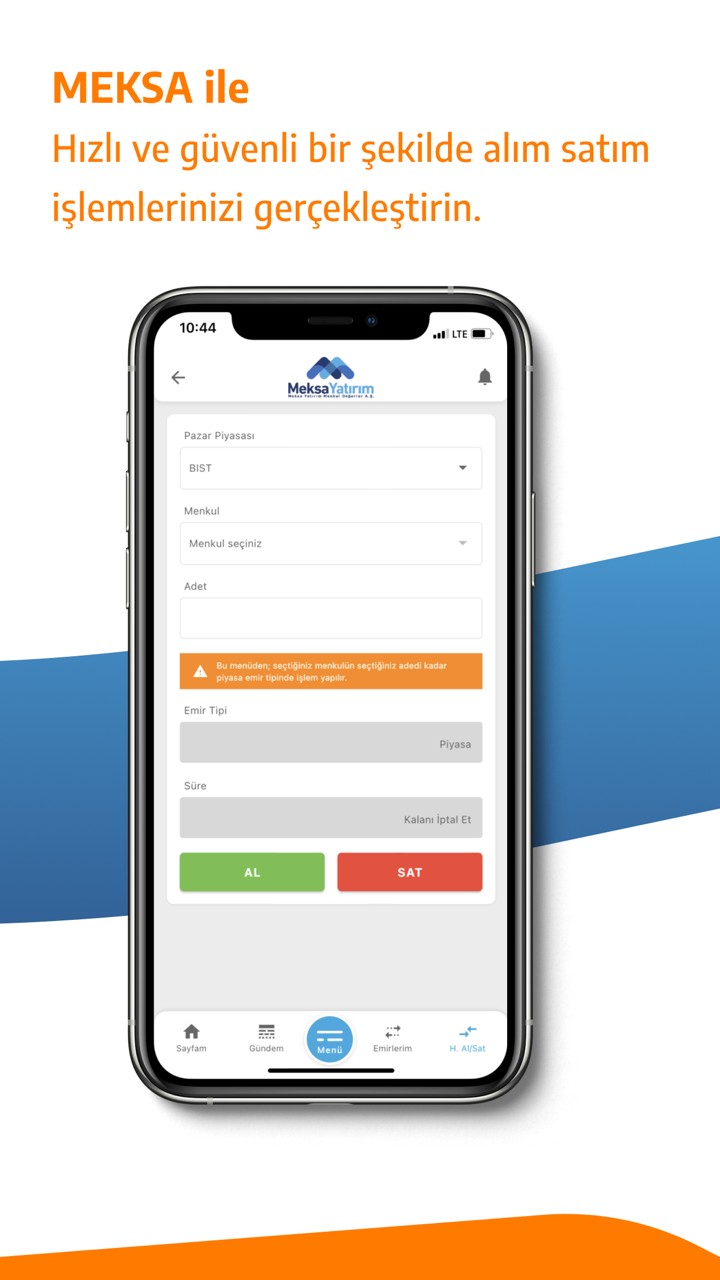

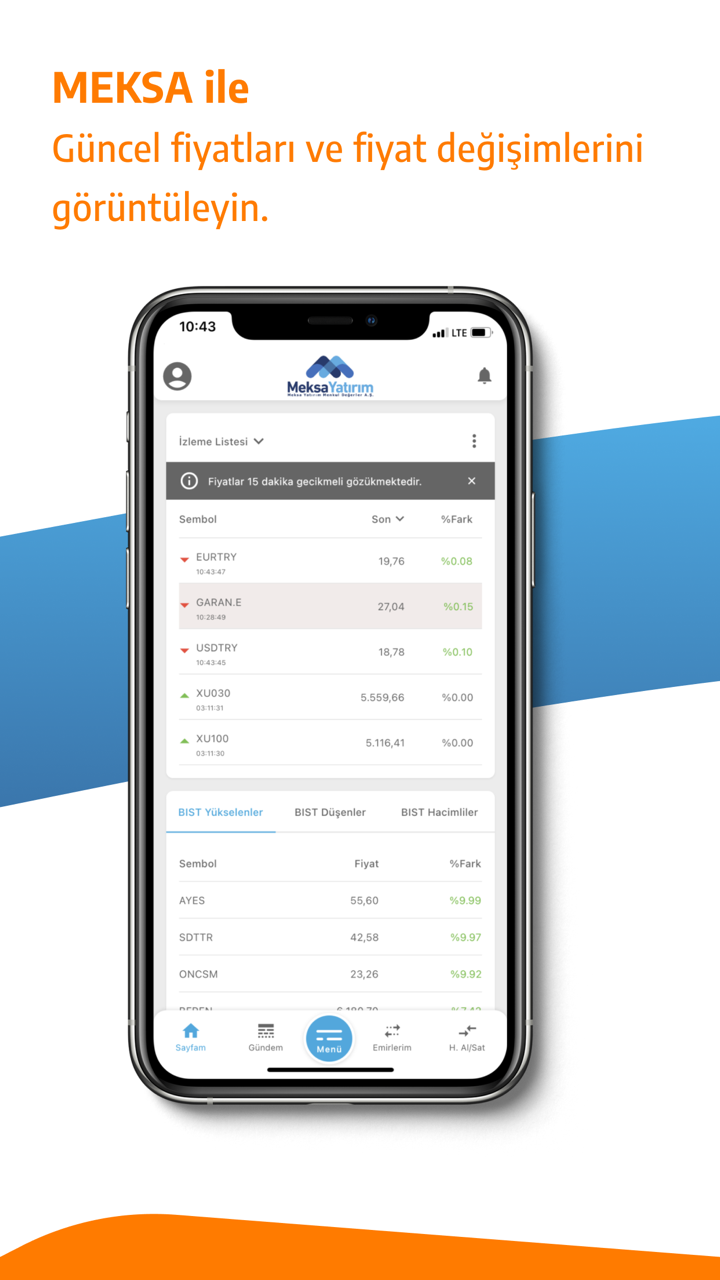

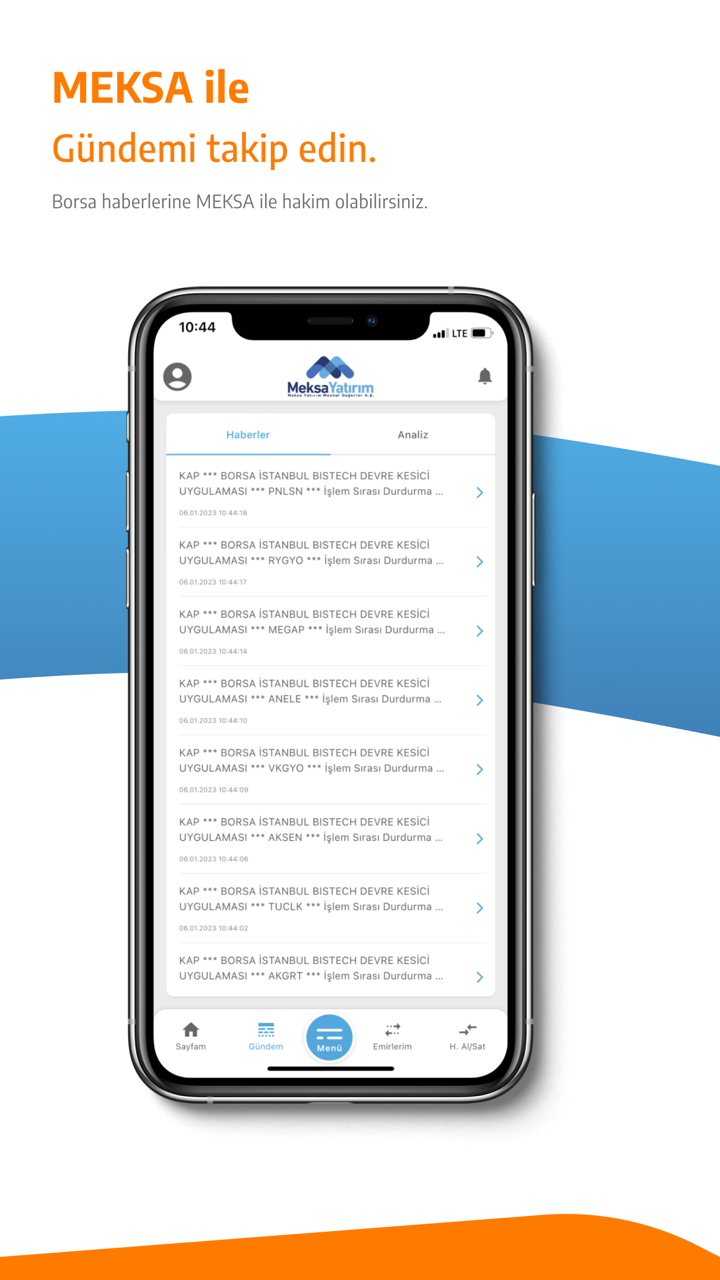

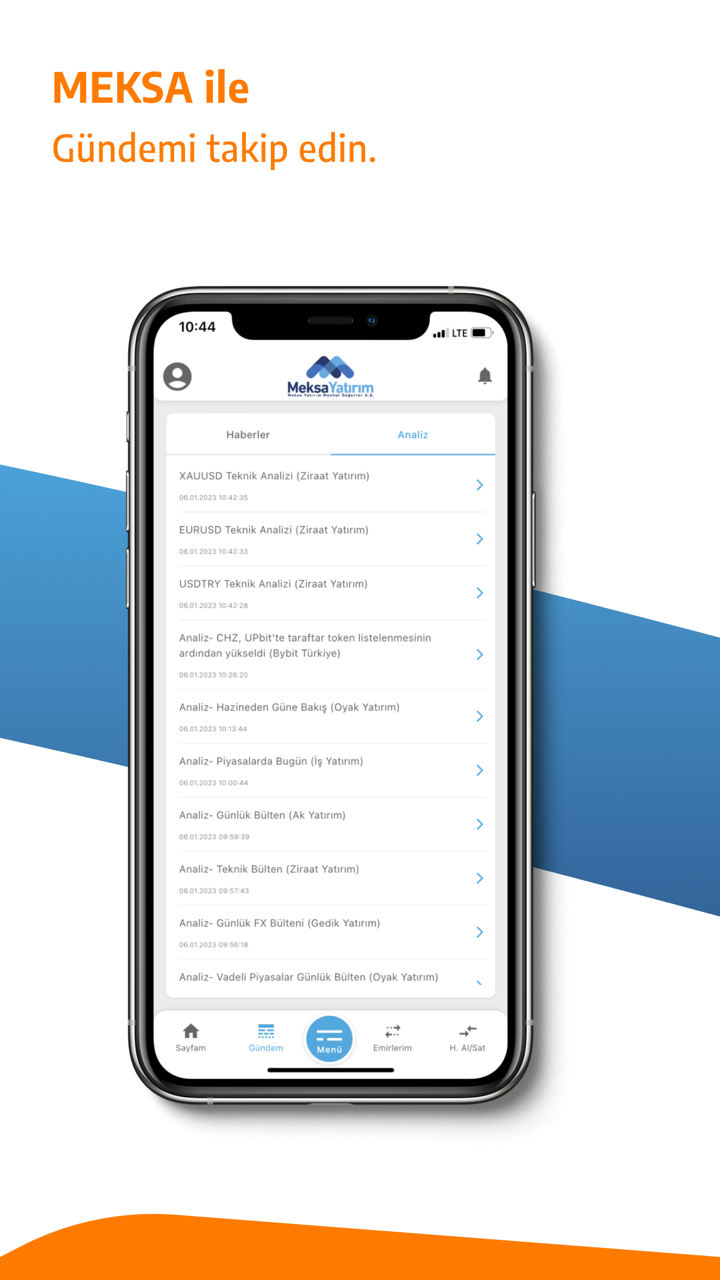

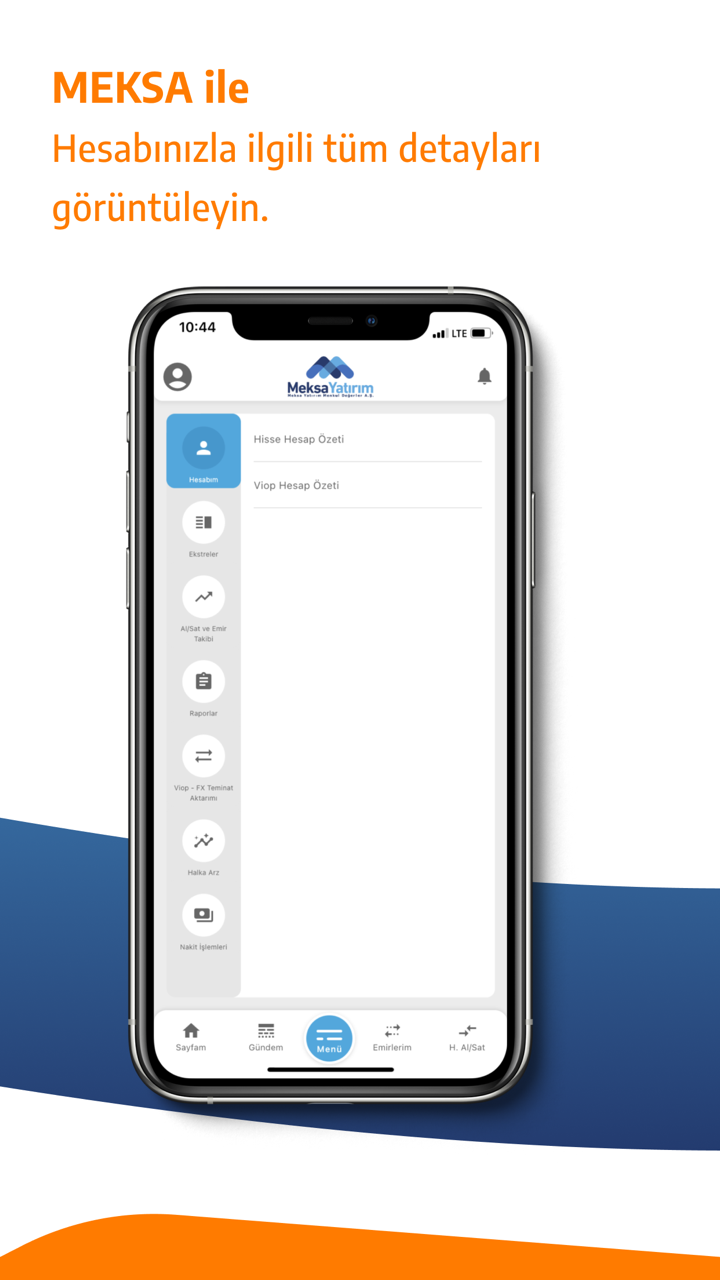

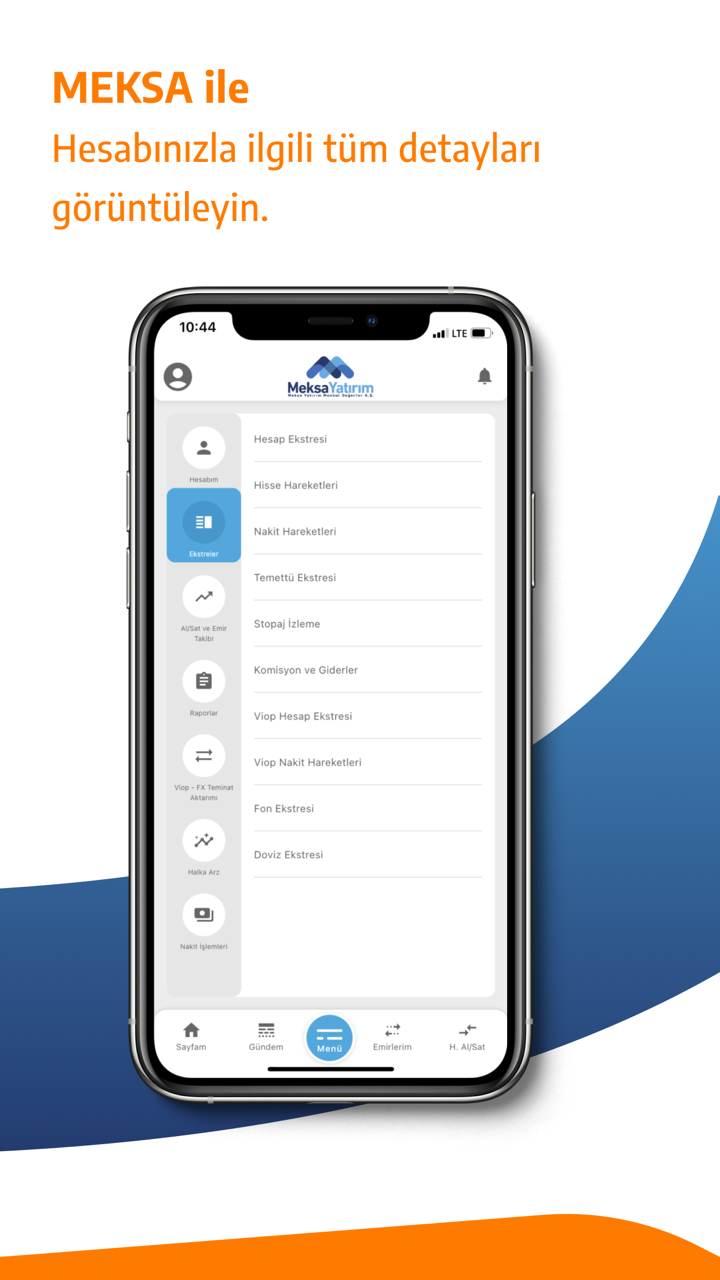

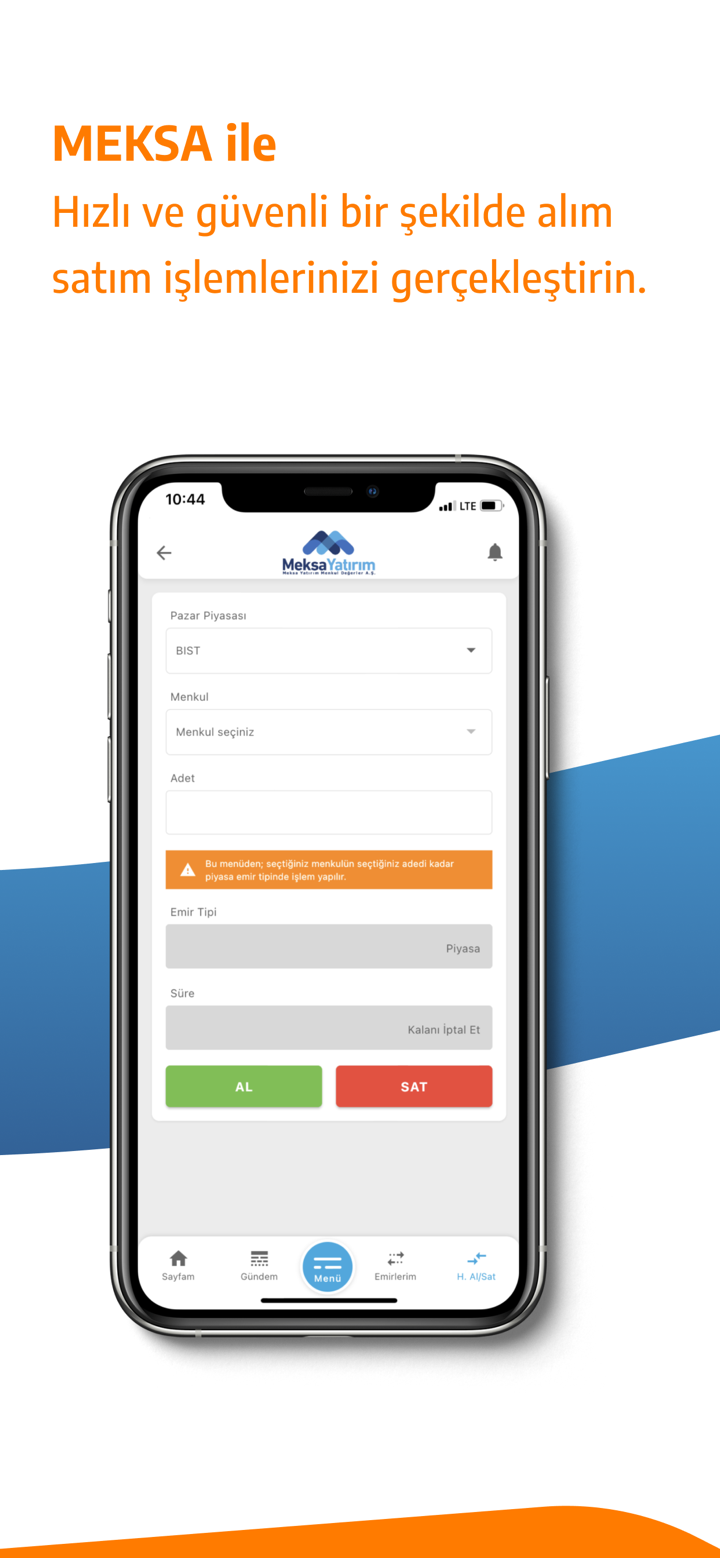

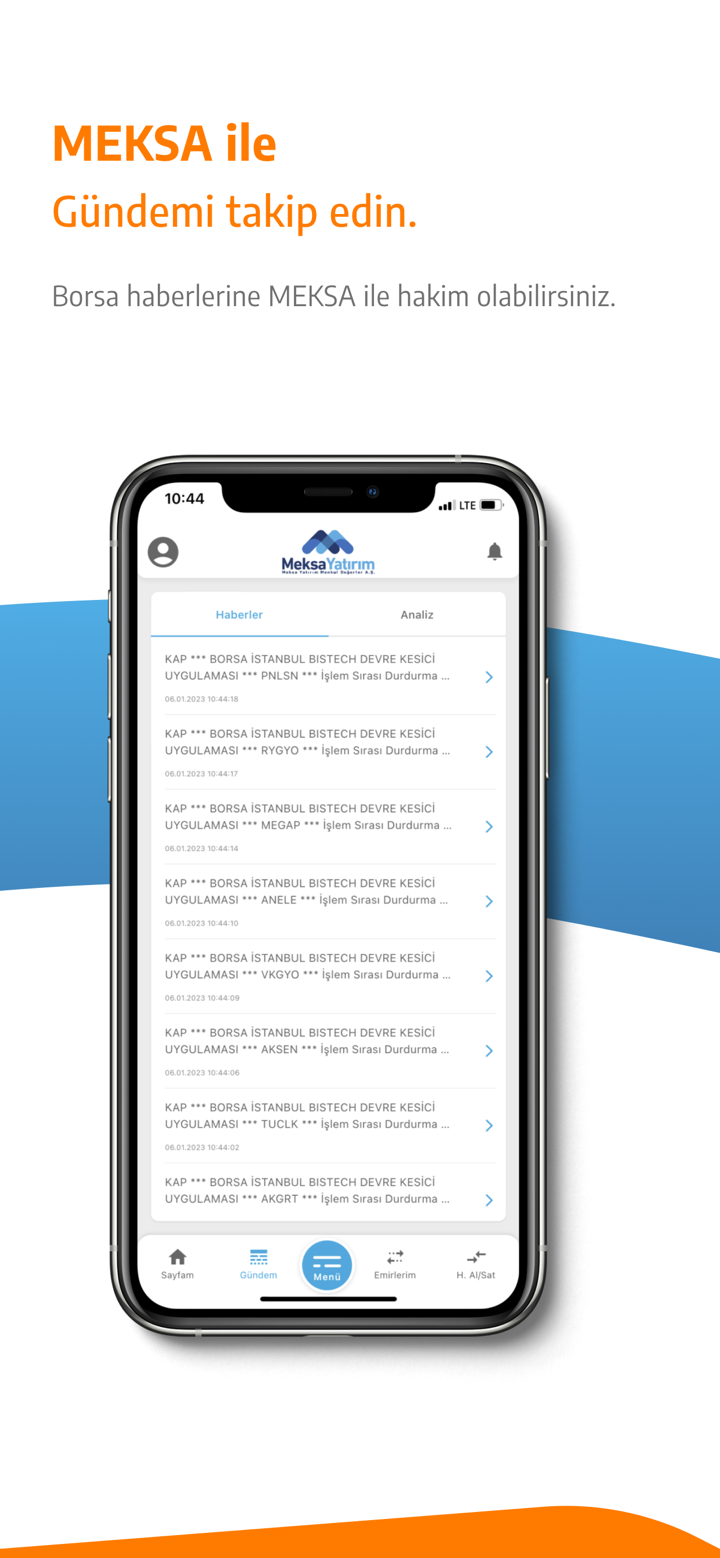

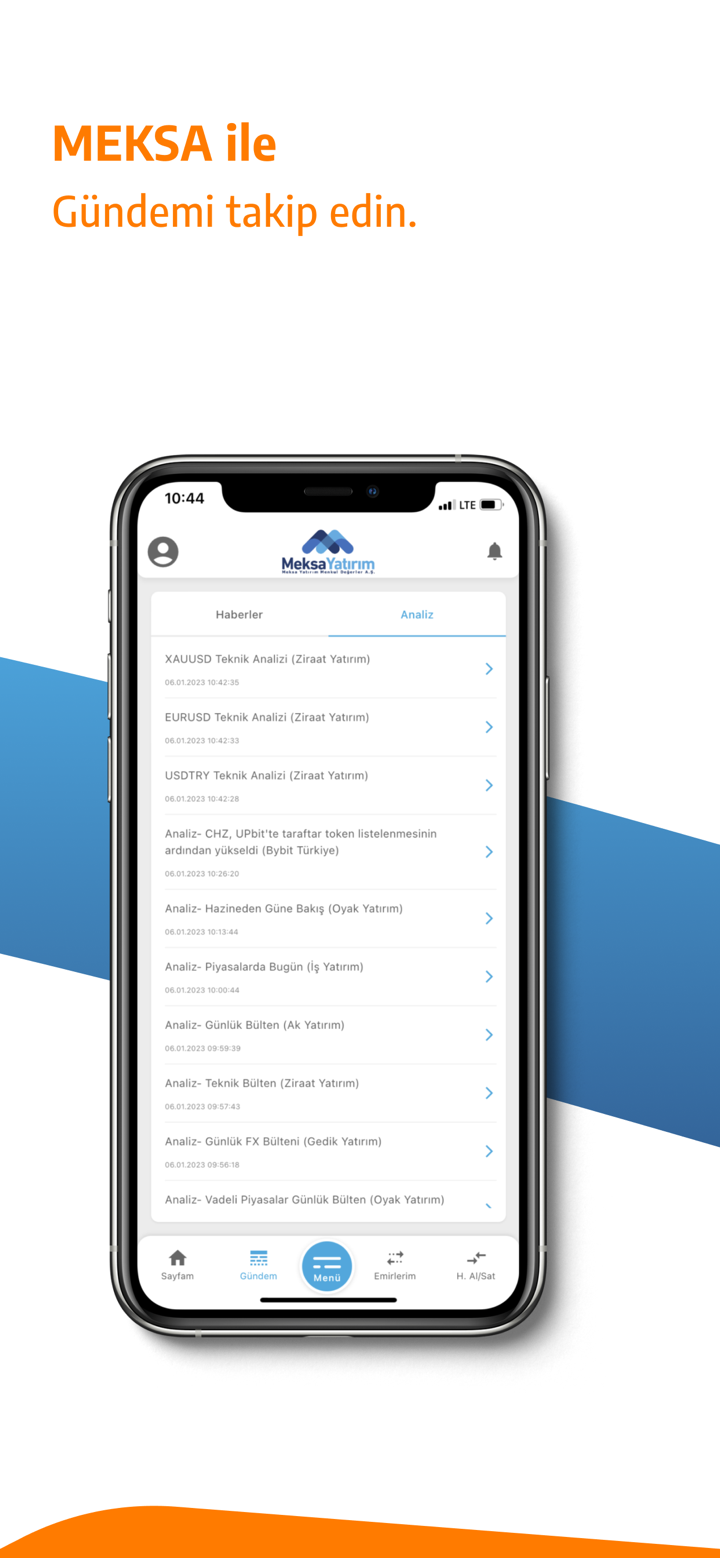

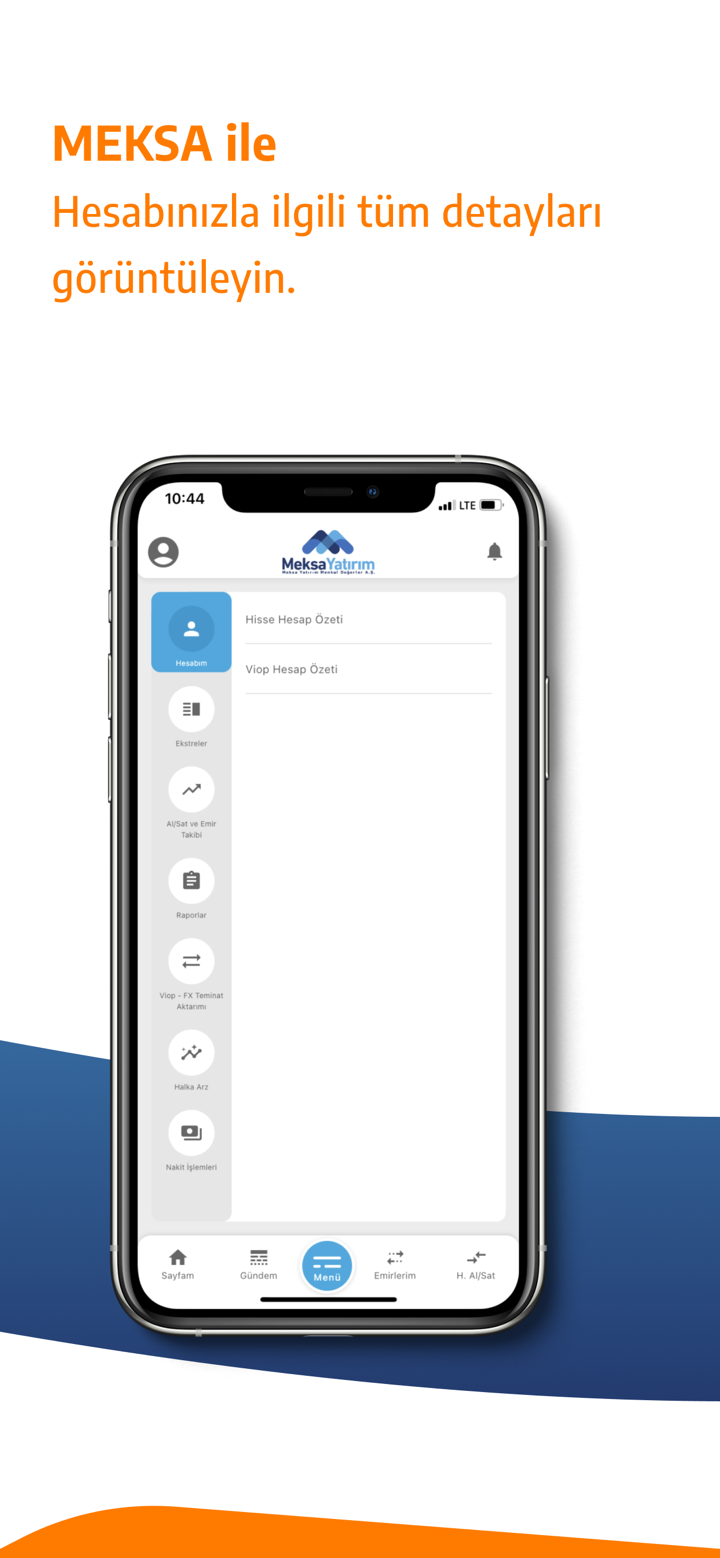

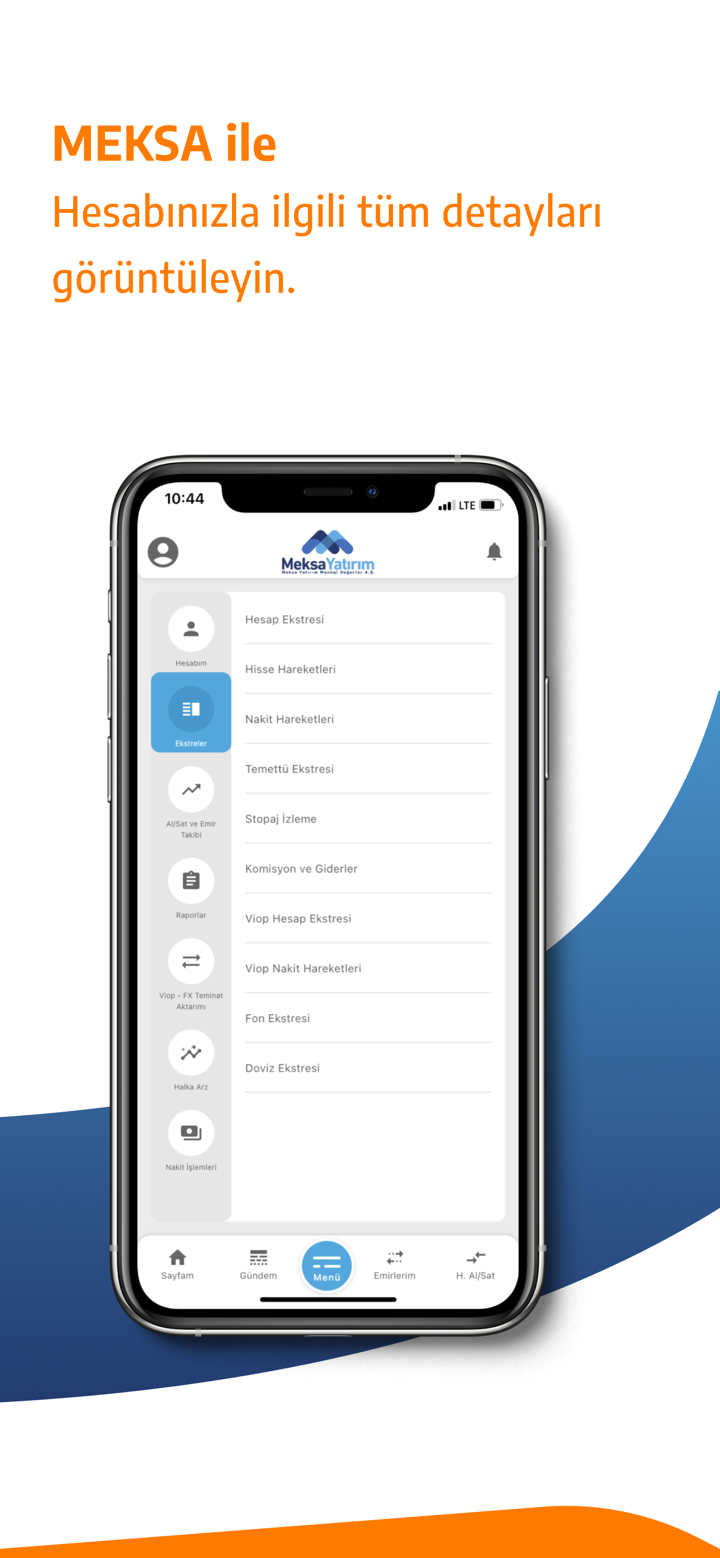

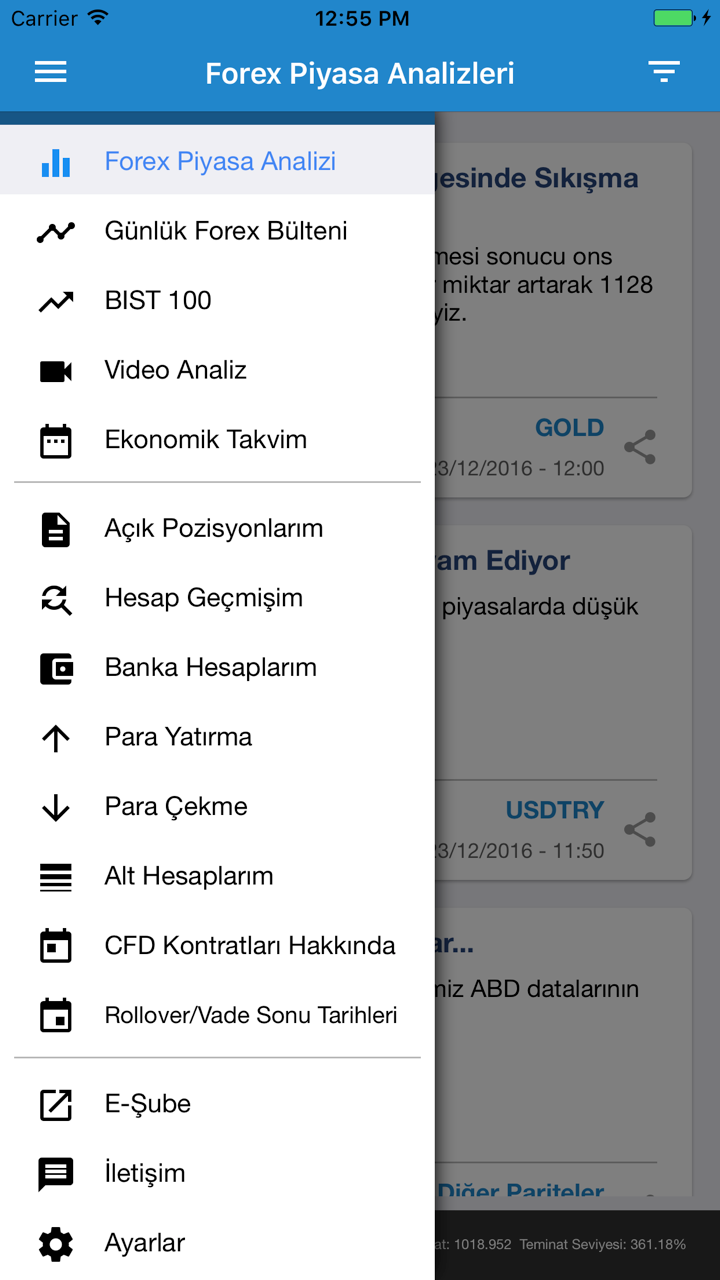

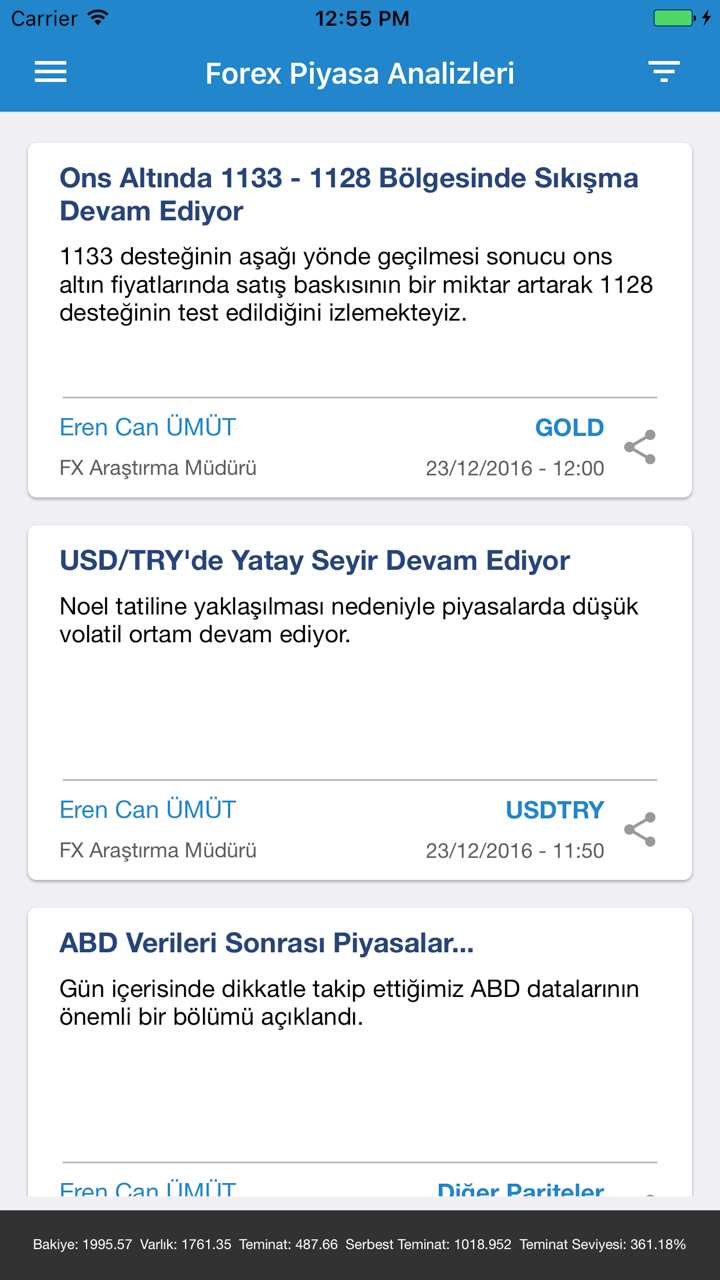

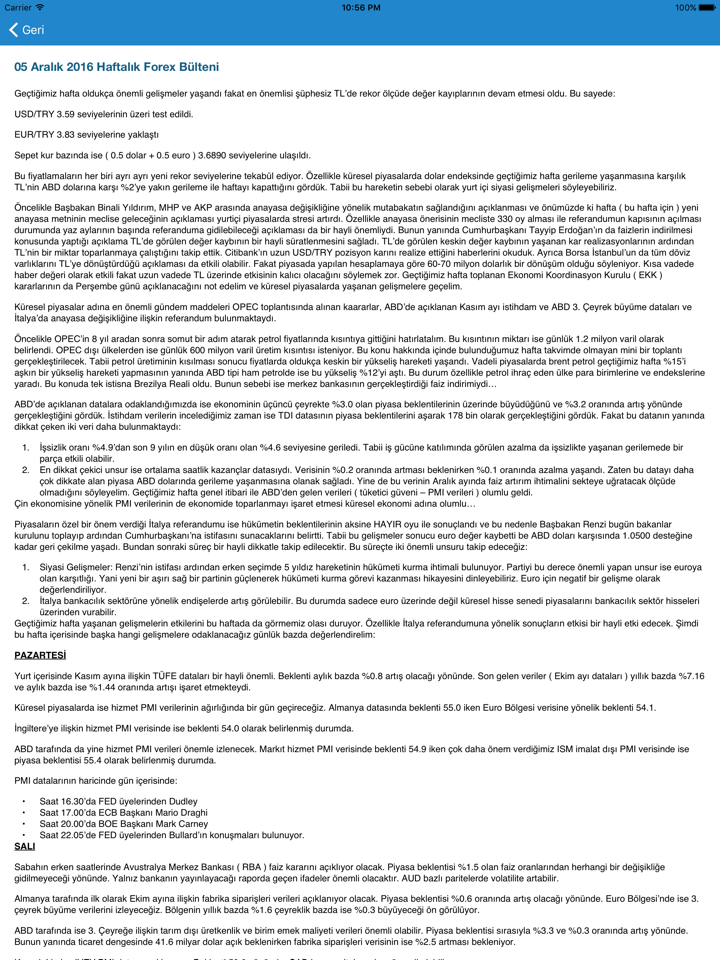

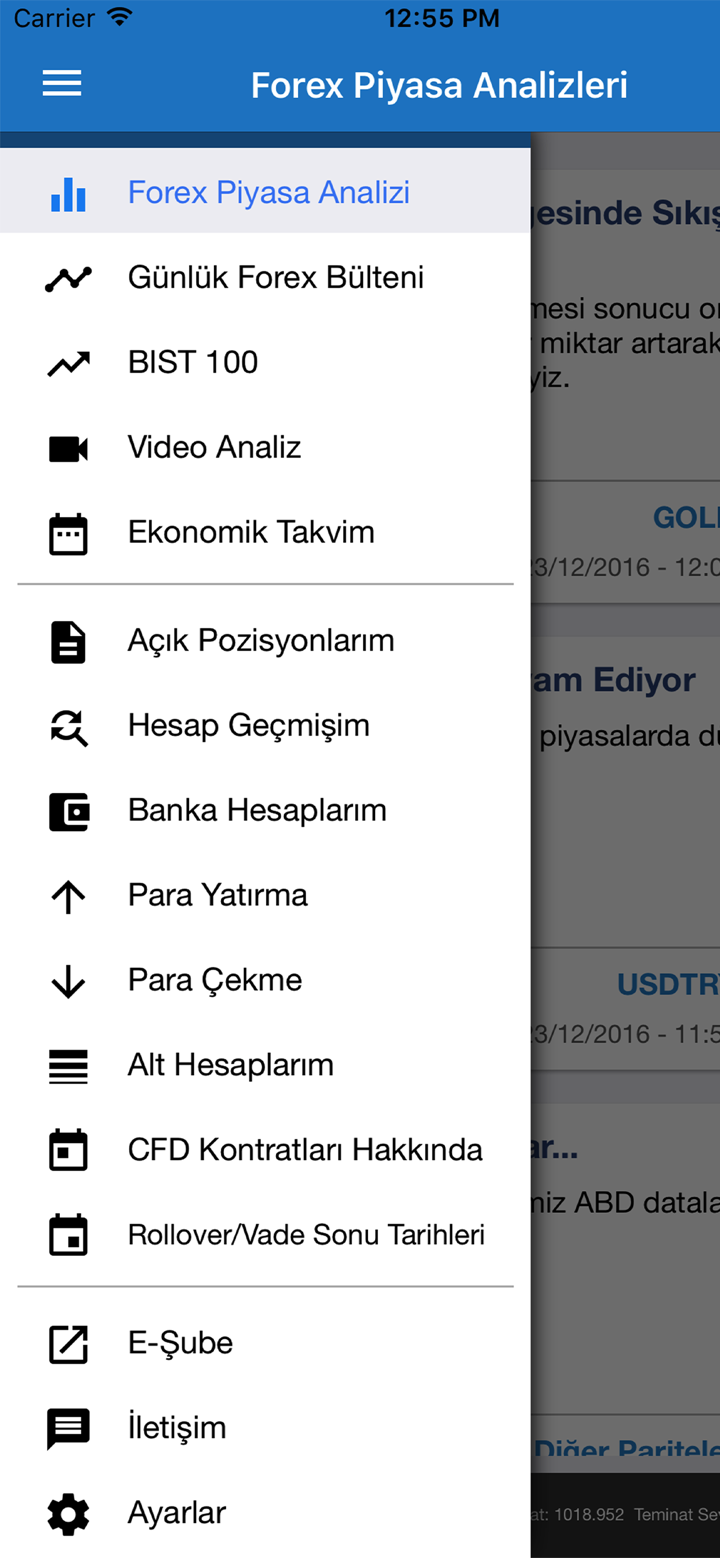

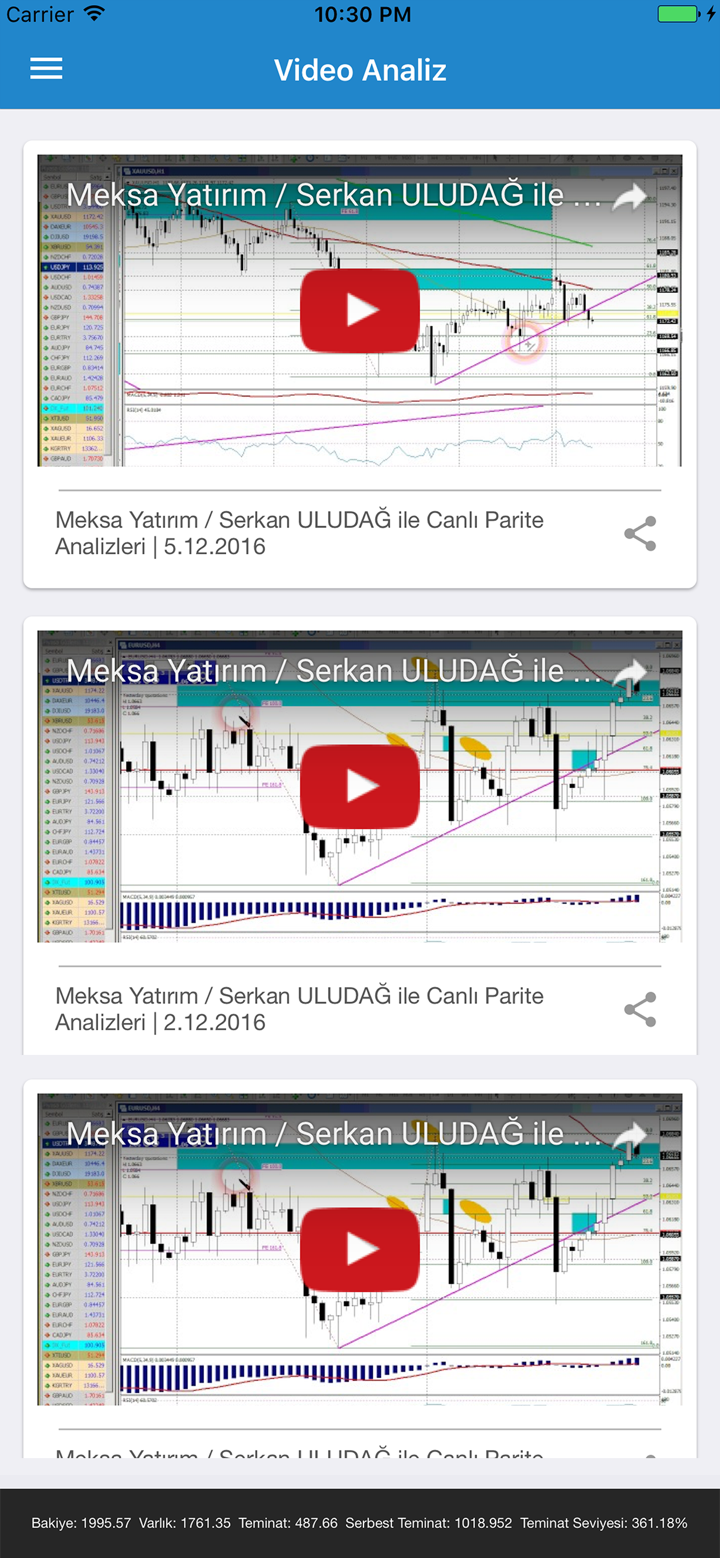

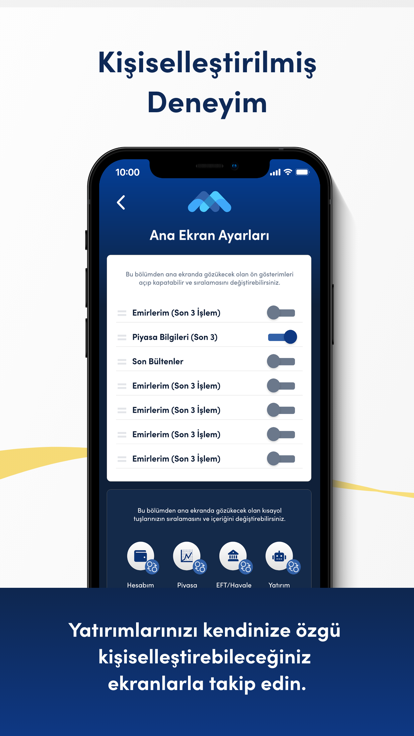

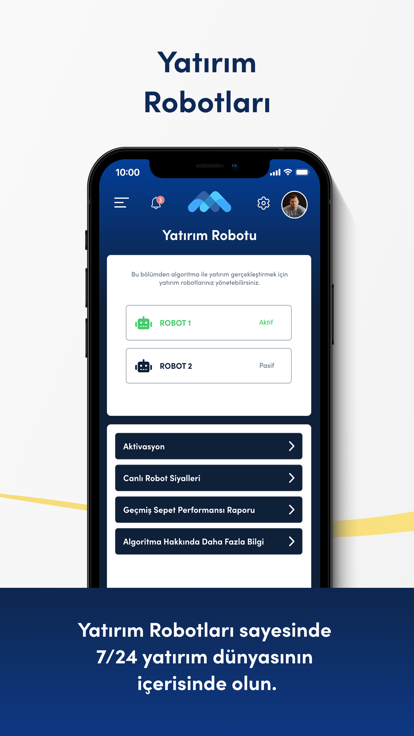

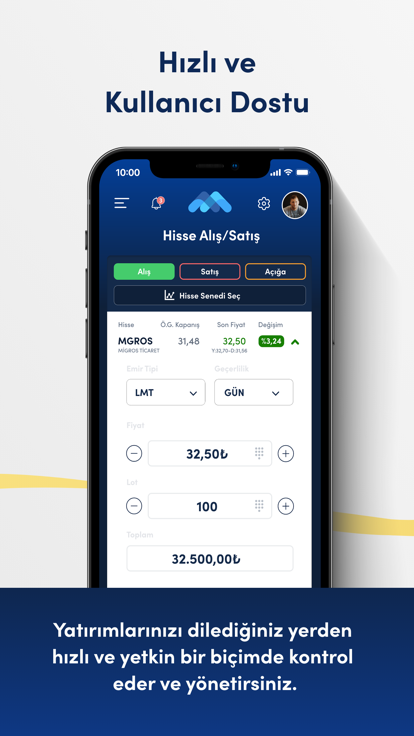

MEKSAannonce qu'elle offre une gamme diversifiée de services, qui comprennent le conseil en investissement, les services de courtage, la gestion de portefeuille, les instruments dérivés, les services viop, la gestion de fonds, la recherche, les marchés des changes et la finance d'entreprise.

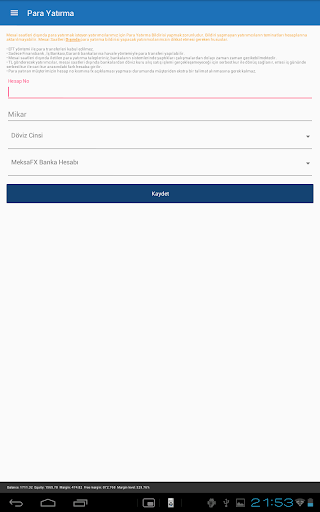

Dépôt et retrait

le montant minimum de dépôt pour réaliser les investissements forex dans MEKSA est dit être de 50 000 tl par cmb. cependant, le courtier n'a révélé aucune information sur les méthodes de dépôt et de retrait acceptables.

Service client

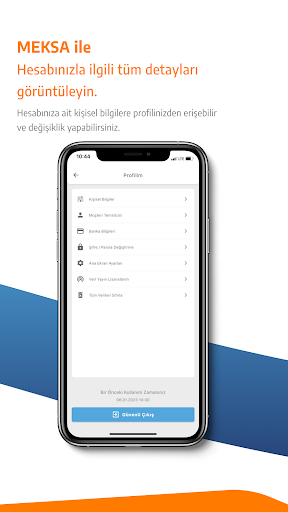

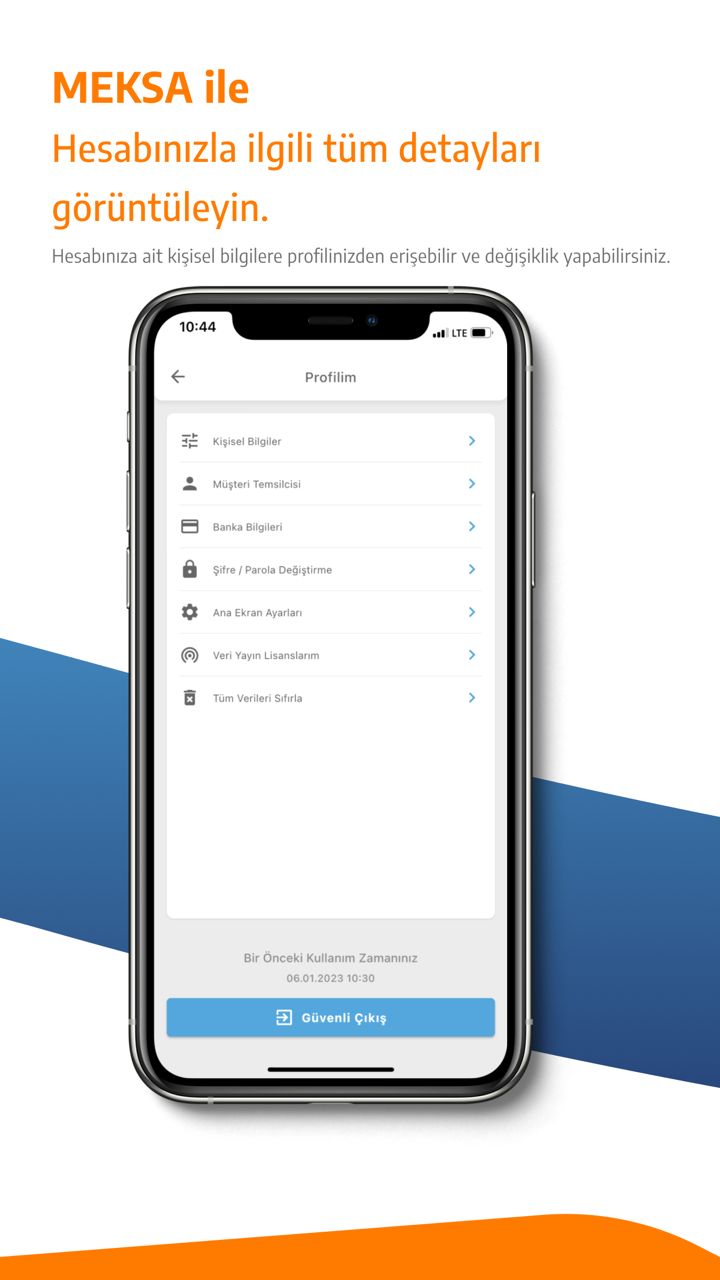

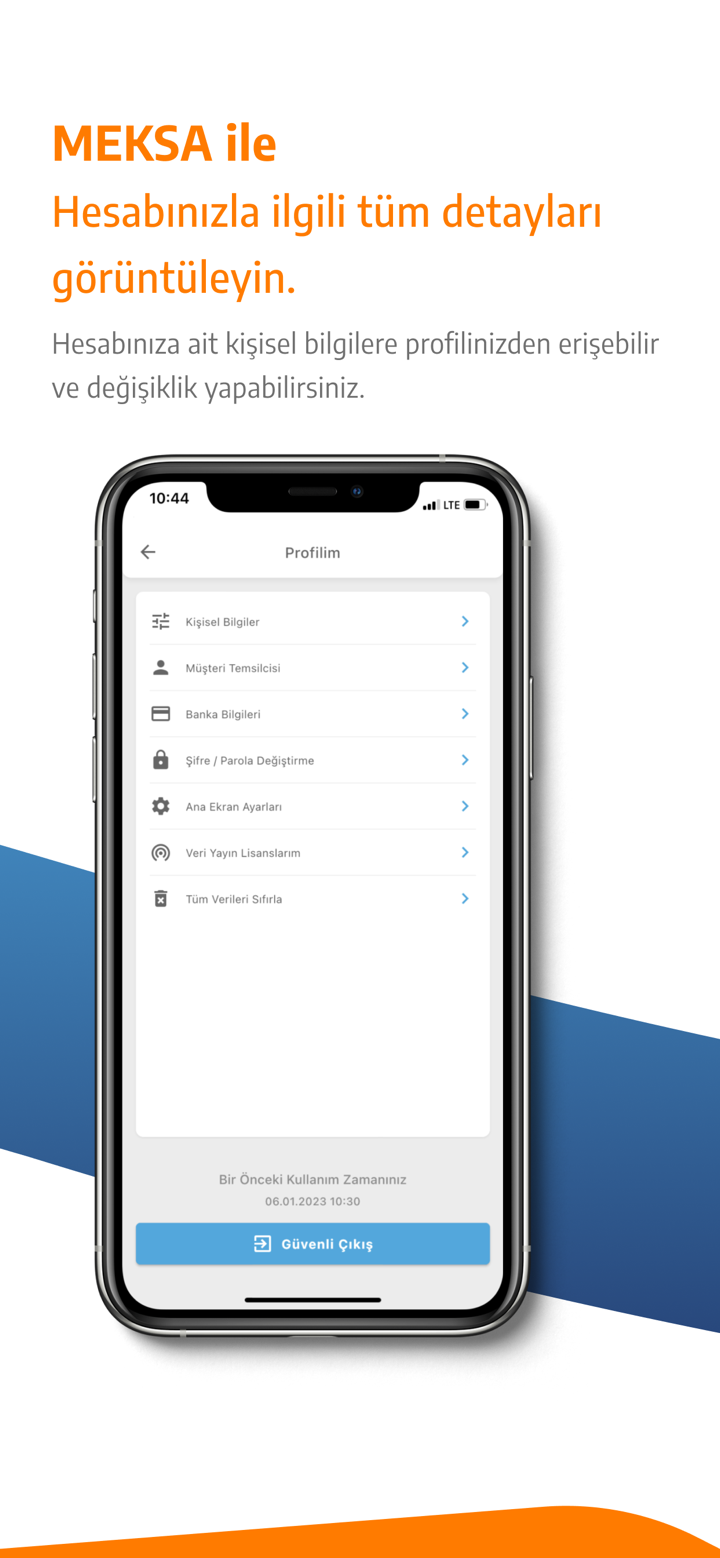

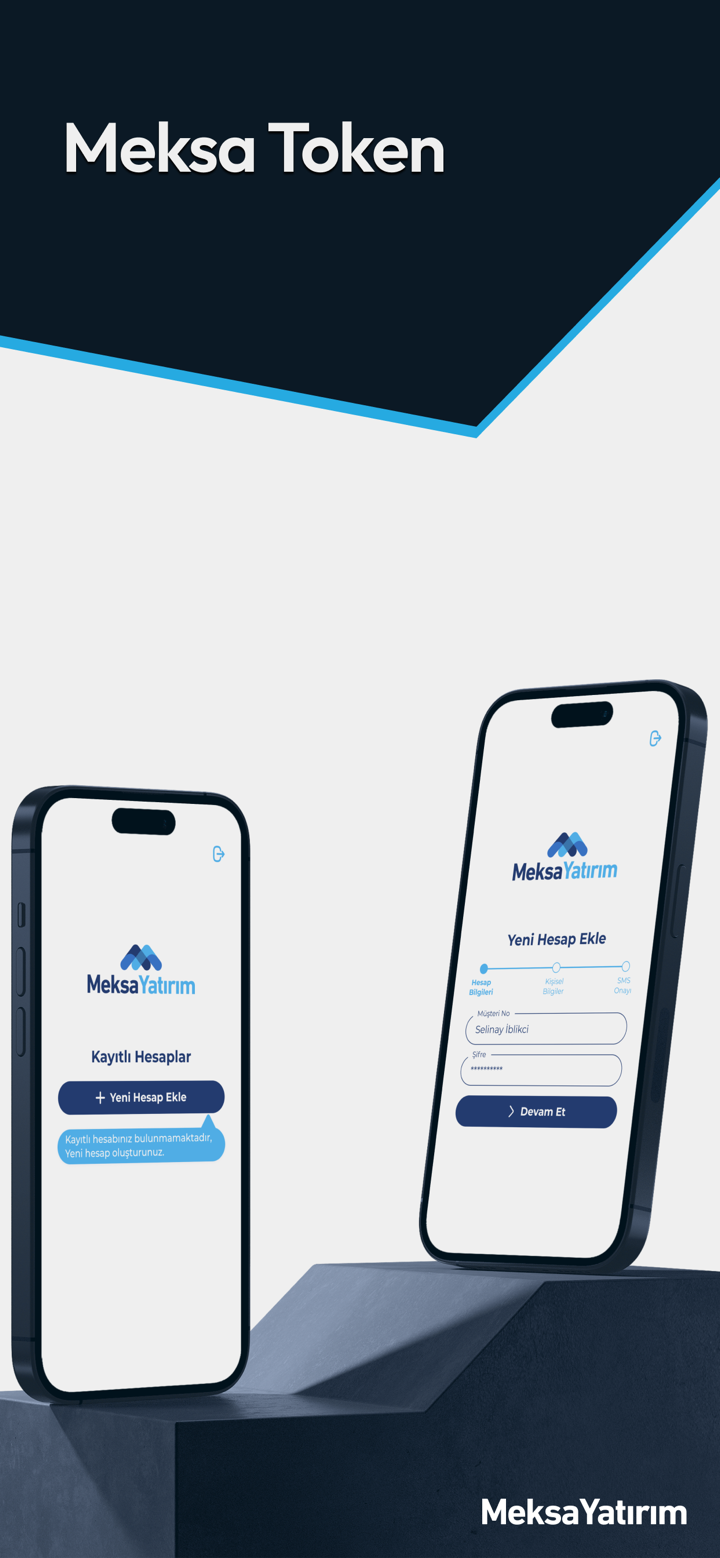

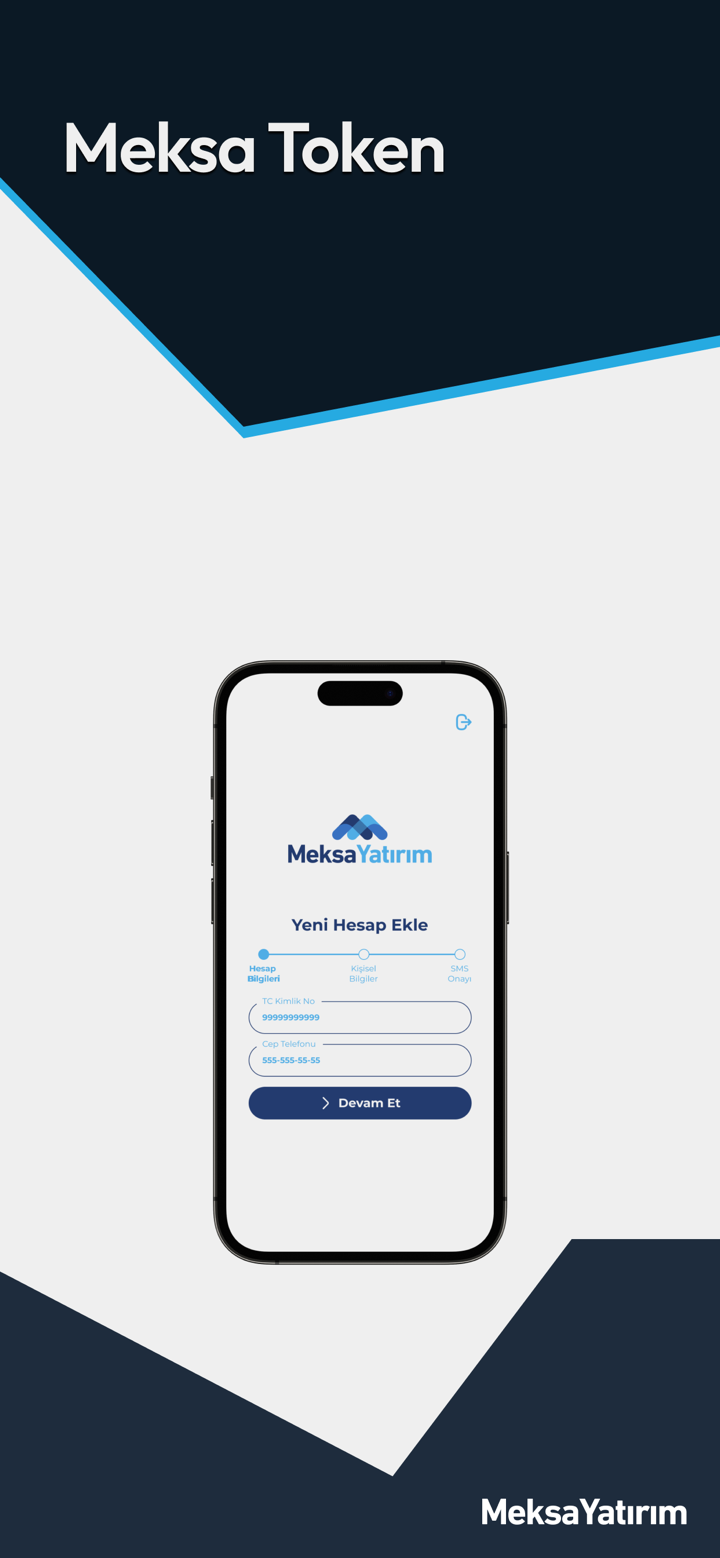

MEKSALe support client est joignable par téléphone : 02166813400, fax : +90 (216) 6930570, +90 (216) 6930571, +90 (216) 6930572, email : destek@ MEKSA fx.com ou envoyez des messages en ligne pour entrer en contact. vous pouvez également suivre ce courtier sur les plateformes de médias sociaux telles que twitter, facebook, instagram, youtube et linkedin. adresse de la société : şehit teğmen ali yılmaz sok. güven sazak plaza a blok no:13 kat: 3-4 34810 kavacık - beykoz / istanbul.

Avertissement de risque

Le trading en ligne implique un niveau de risque important et vous pouvez perdre tout votre capital investi. Il ne convient pas à tous les commerçants ou investisseurs. Veuillez vous assurer que vous comprenez les risques encourus et notez que les informations contenues dans cet article sont uniquement à des fins d'information générale.