회사 소개

일반 정보 및 규정

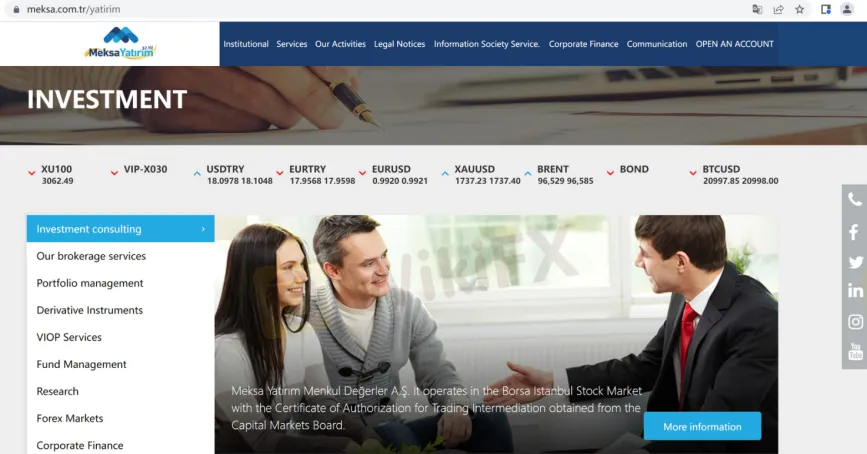

MEKSA, 상품명 Meksa Yatırım Menkul Değerler A.Ş 은 1990년 6월 28일에 설립되어 터키에 등록된 금융 중개 회사라고 합니다. 브로커는 개인 및 기업 고객에게 다양한 금융 서비스를 제공한다고 주장하면서 자본 시장위원회에서 얻은 거래 중개 승인 인증서로 borsa 이스탄불 주식 시장에서 운영한다고 말했습니다. 이 브로커 공식 사이트의 홈페이지는 다음과 같습니다.

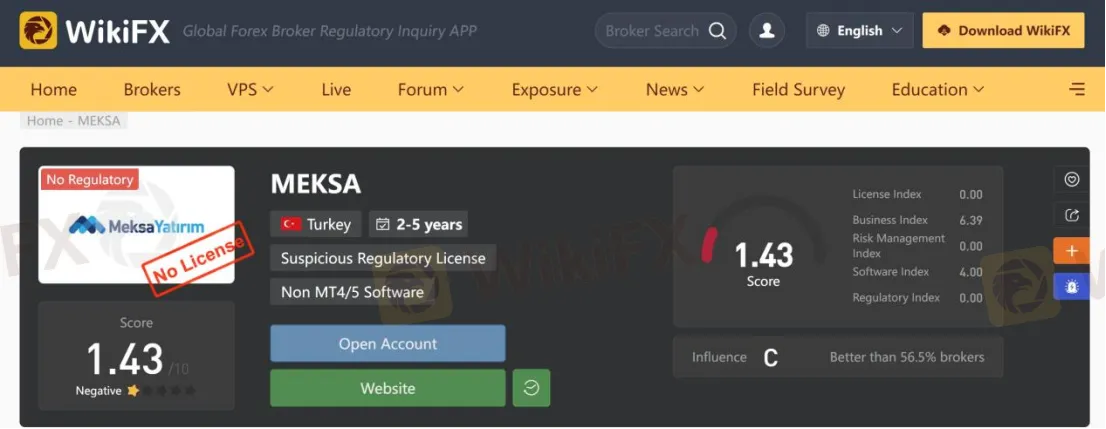

규제에 관해서는 다음과 같이 확인되었습니다. MEKSA 유효한 규정에 속하지 않습니다. 이것이 wikifx의 규제 상태가 "라이선스 없음"으로 표시되고 상대적으로 낮은 1.43/10의 점수를 받는 이유입니다. 위험성을 인지하시기 바랍니다.

부정적인 리뷰

한 상인이 자신의 끔찍한 거래 경험을 공유했습니다. MEKSA wikifx의 플랫폼. 그는 말했다 MEKSA 사기 중개인이며 날짜가 도착했을 때 약속된 50% 보증금을 받지 못했습니다. 트레이더는 사기로 사기를 당할 경우를 대비하여 외환 브로커를 선택하기 전에 일부 사용자가 남긴 리뷰를 읽어야 합니다.

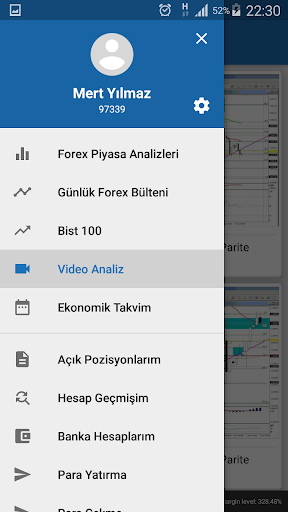

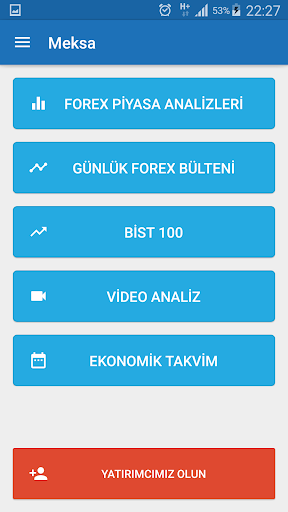

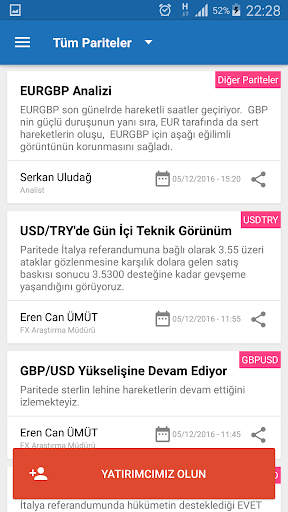

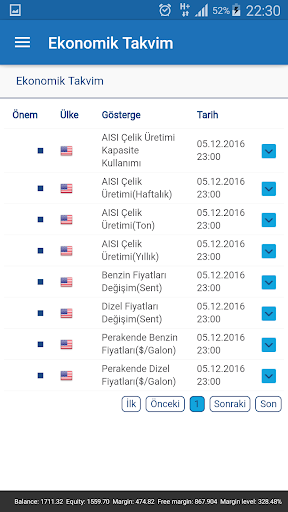

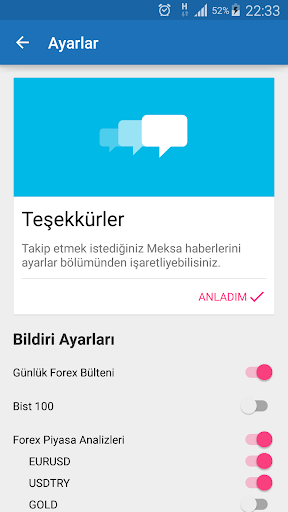

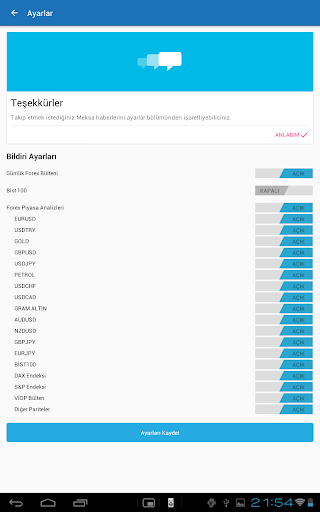

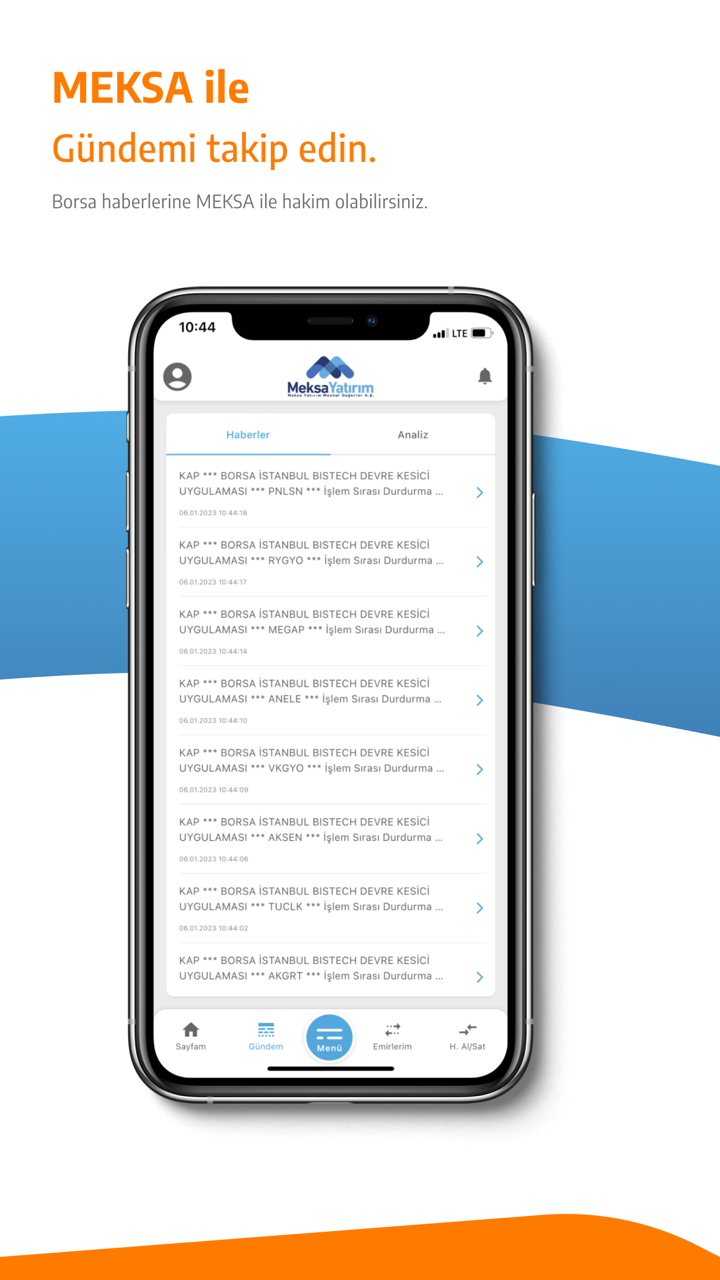

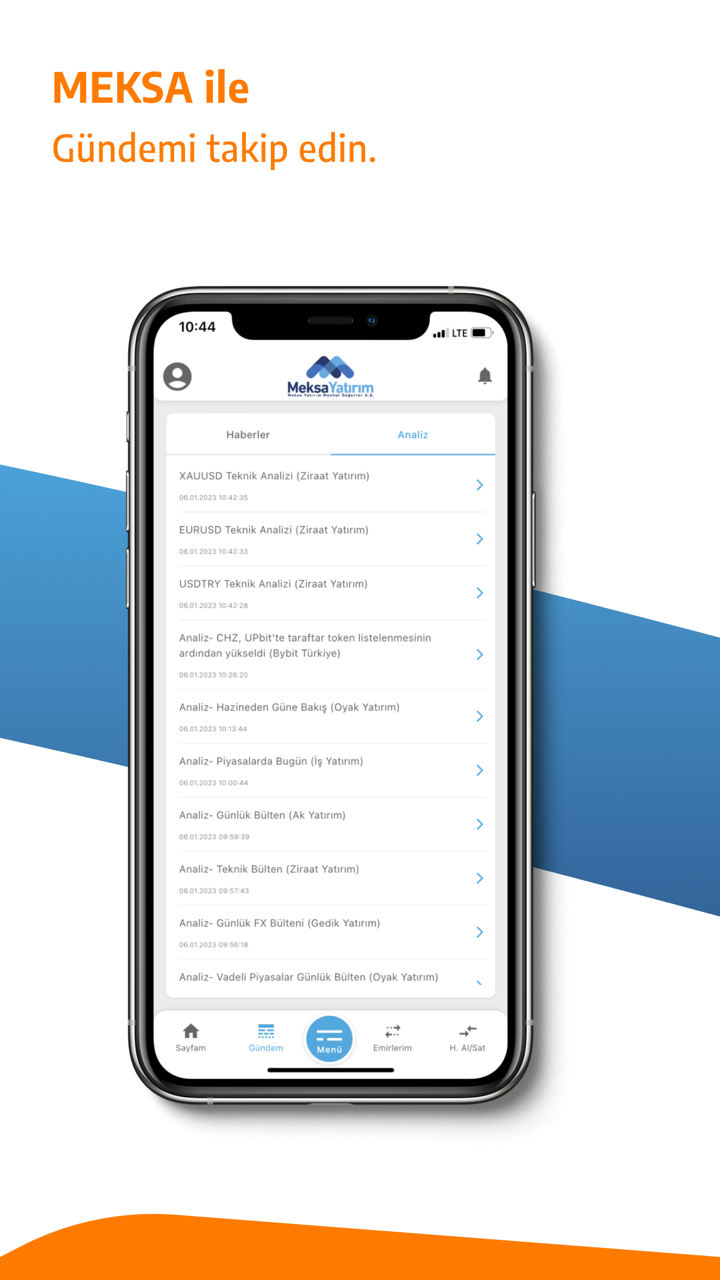

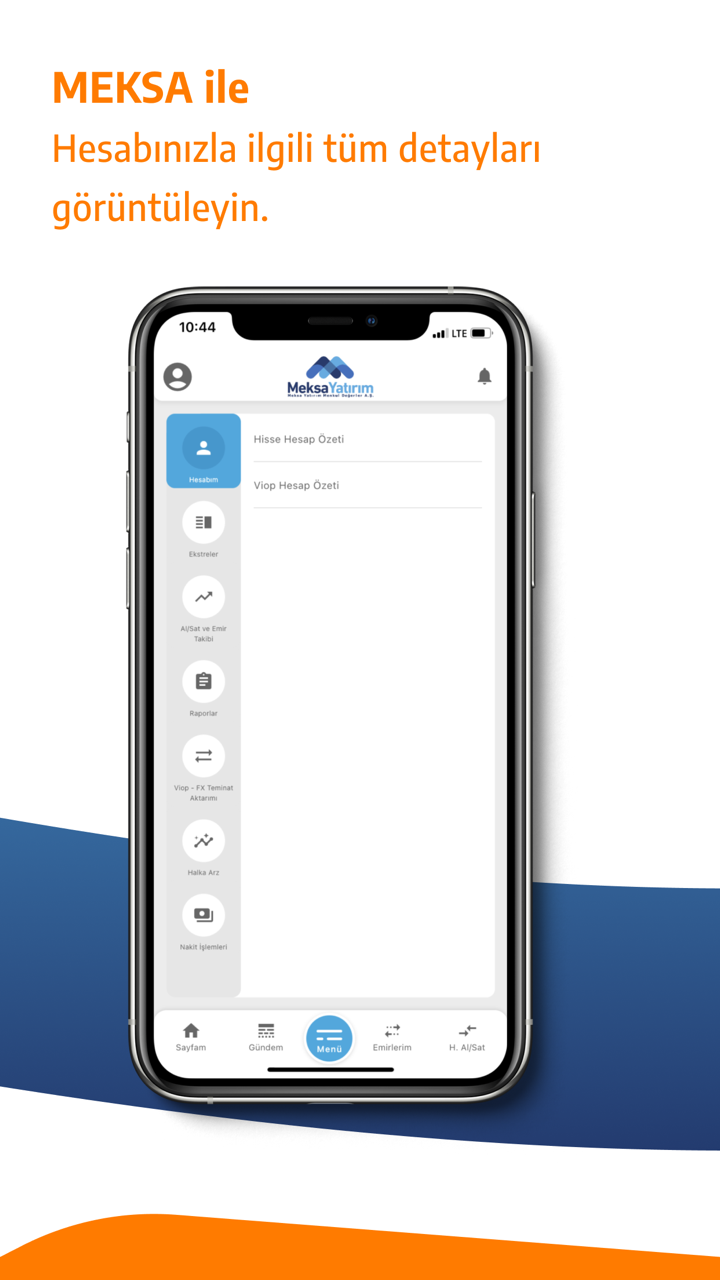

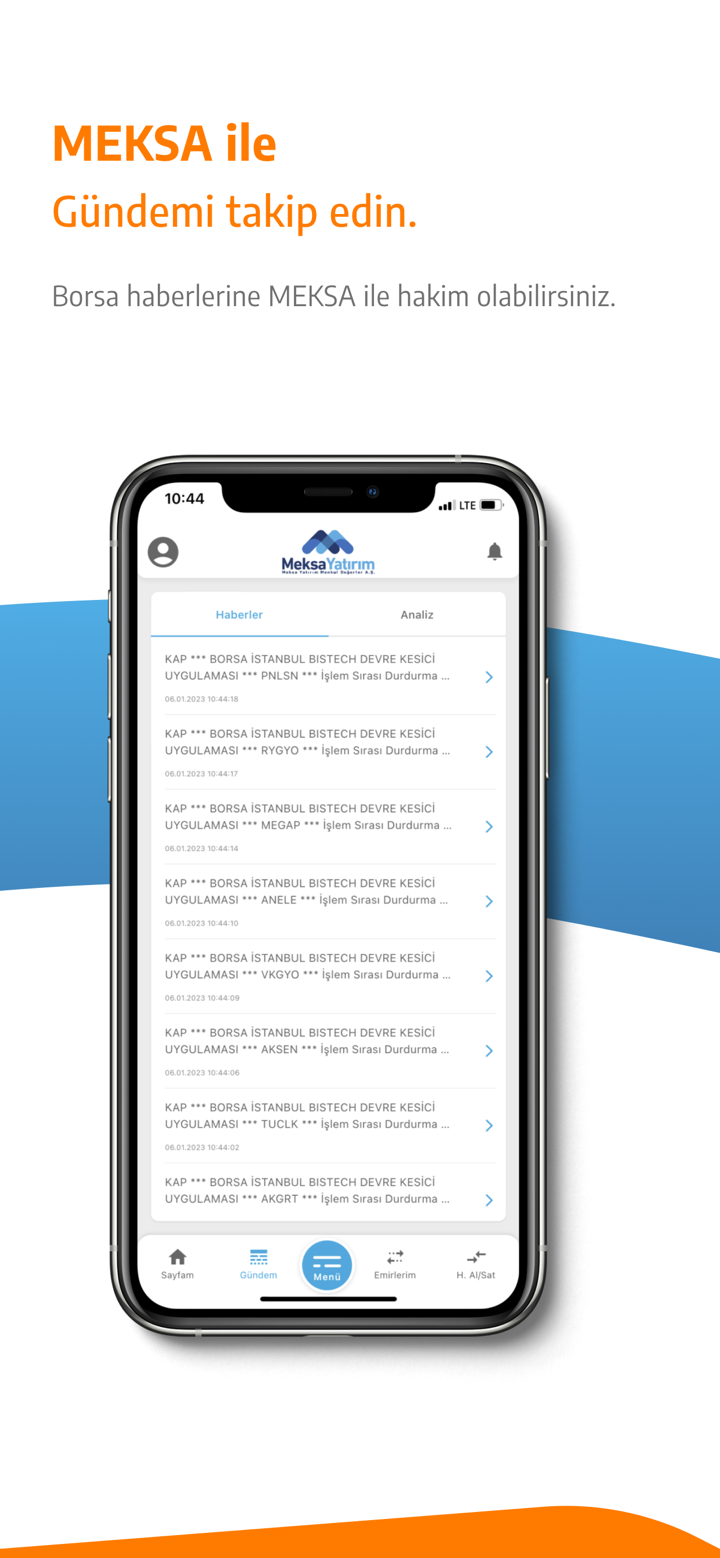

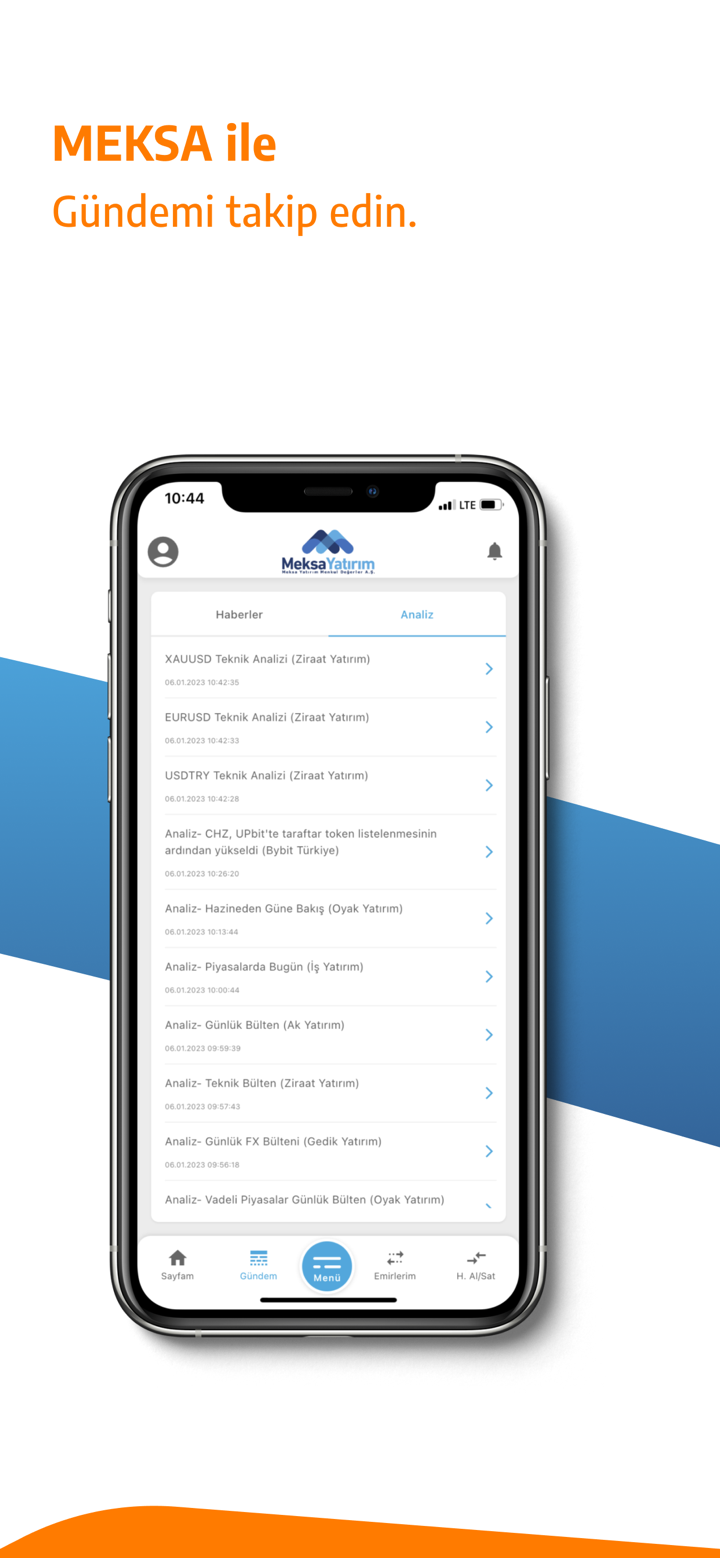

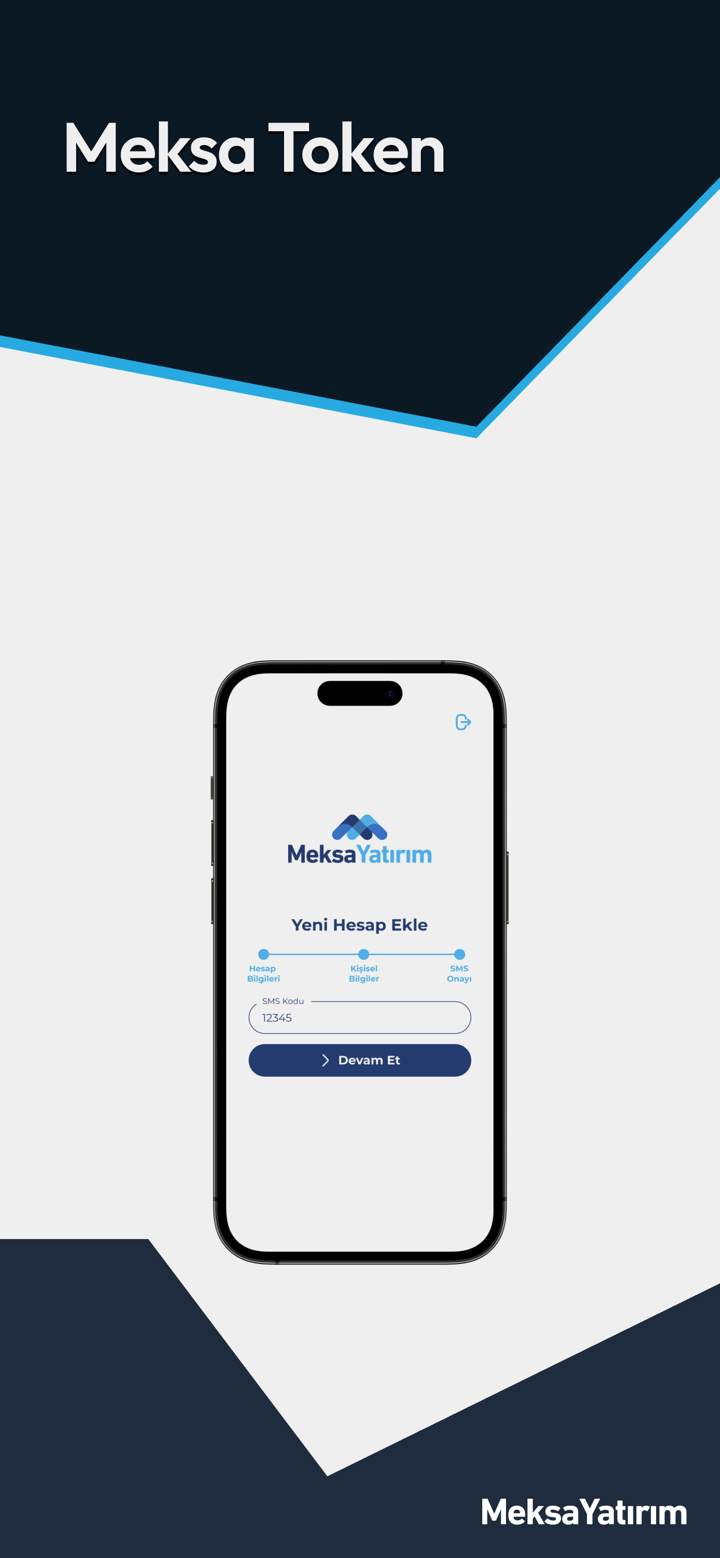

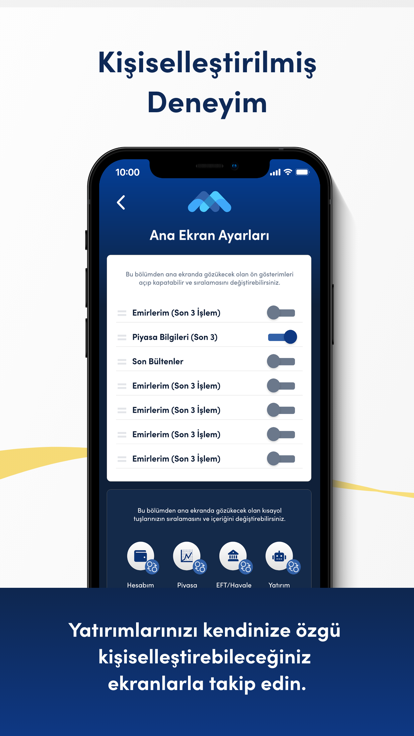

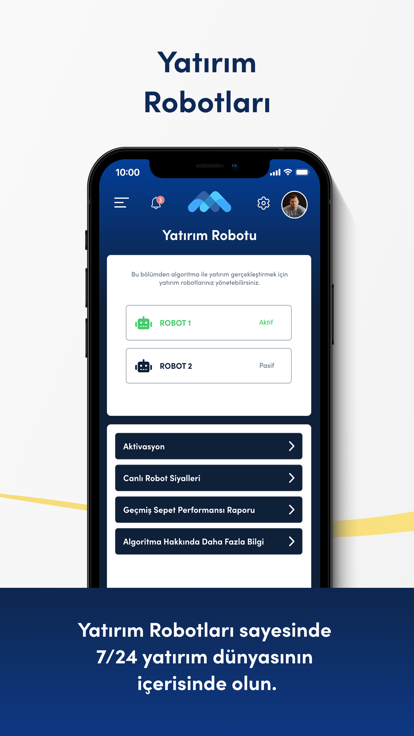

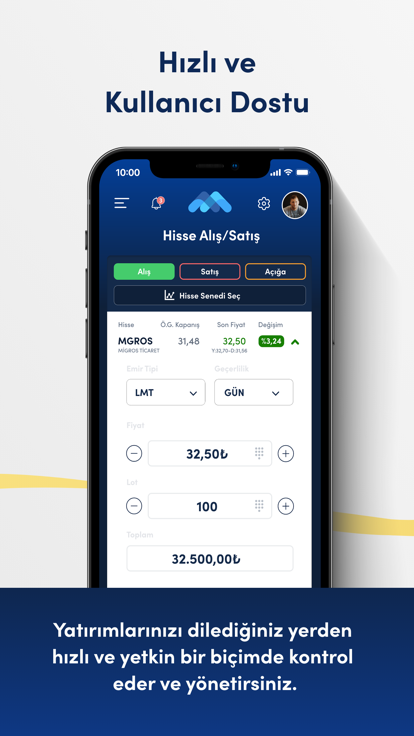

서비스

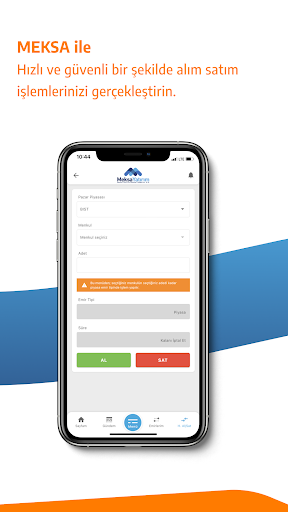

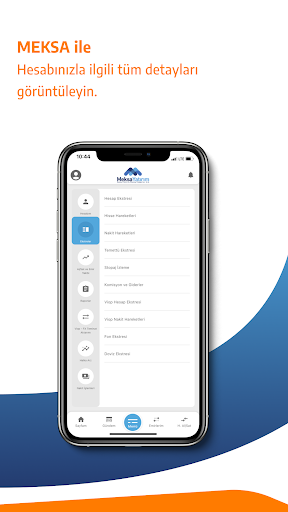

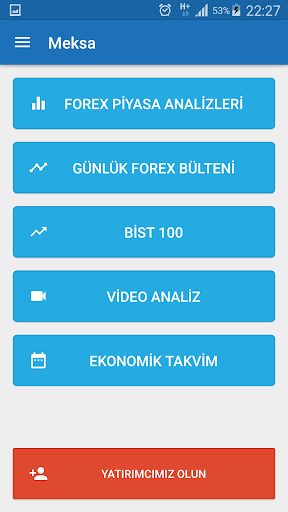

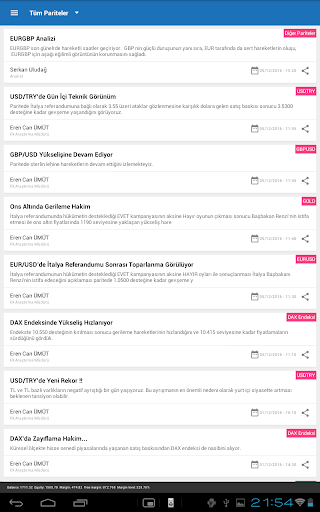

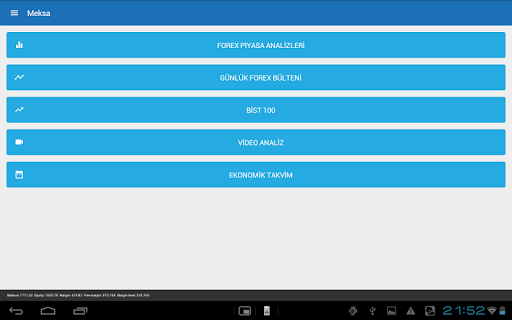

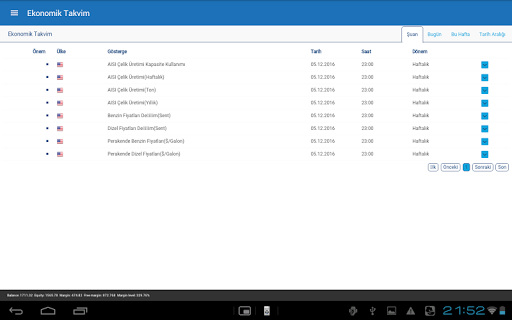

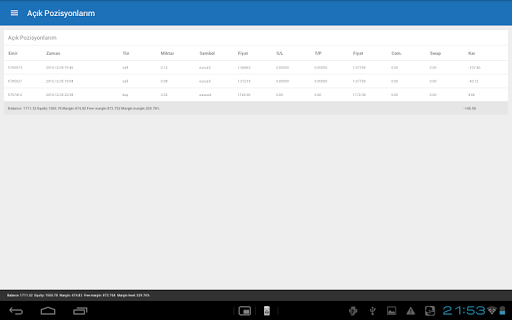

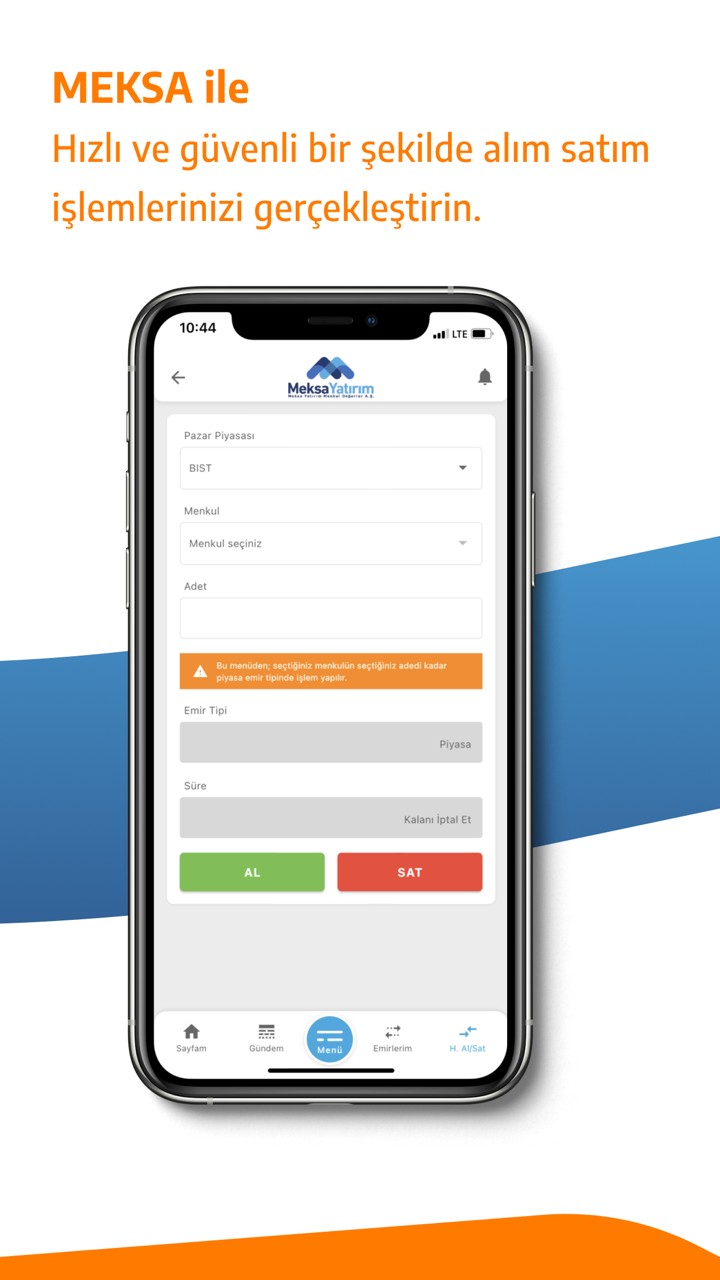

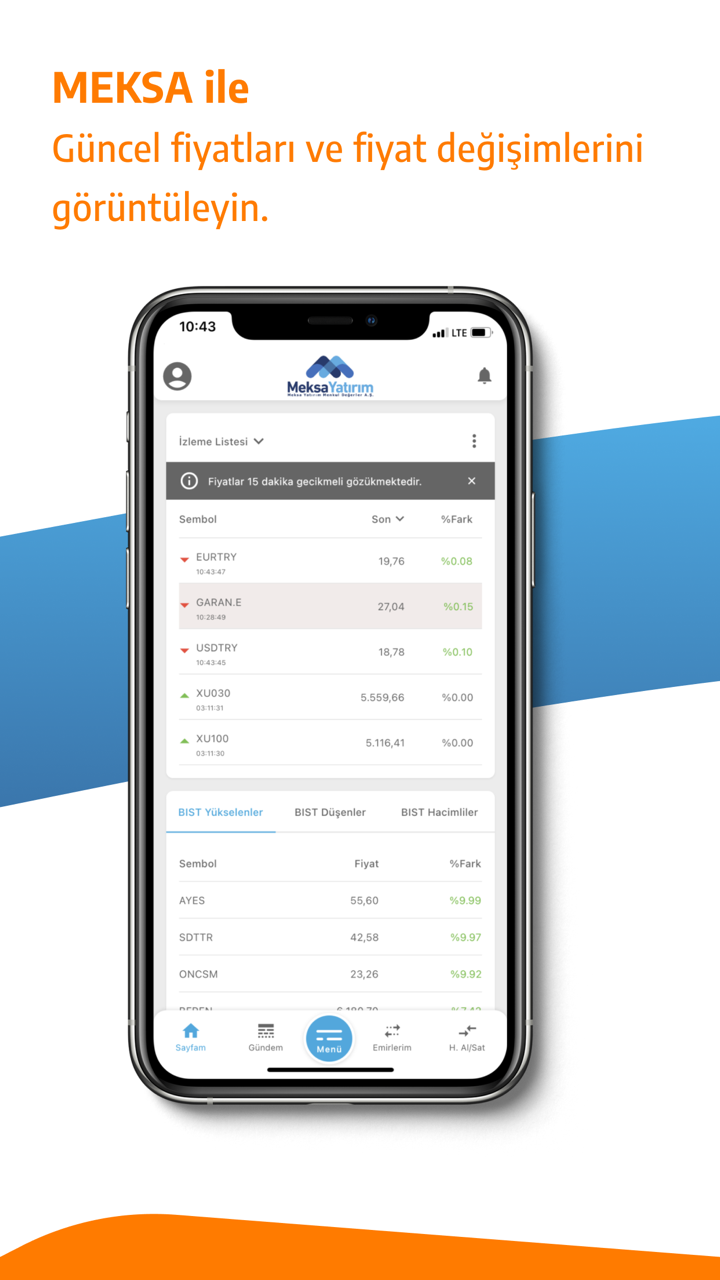

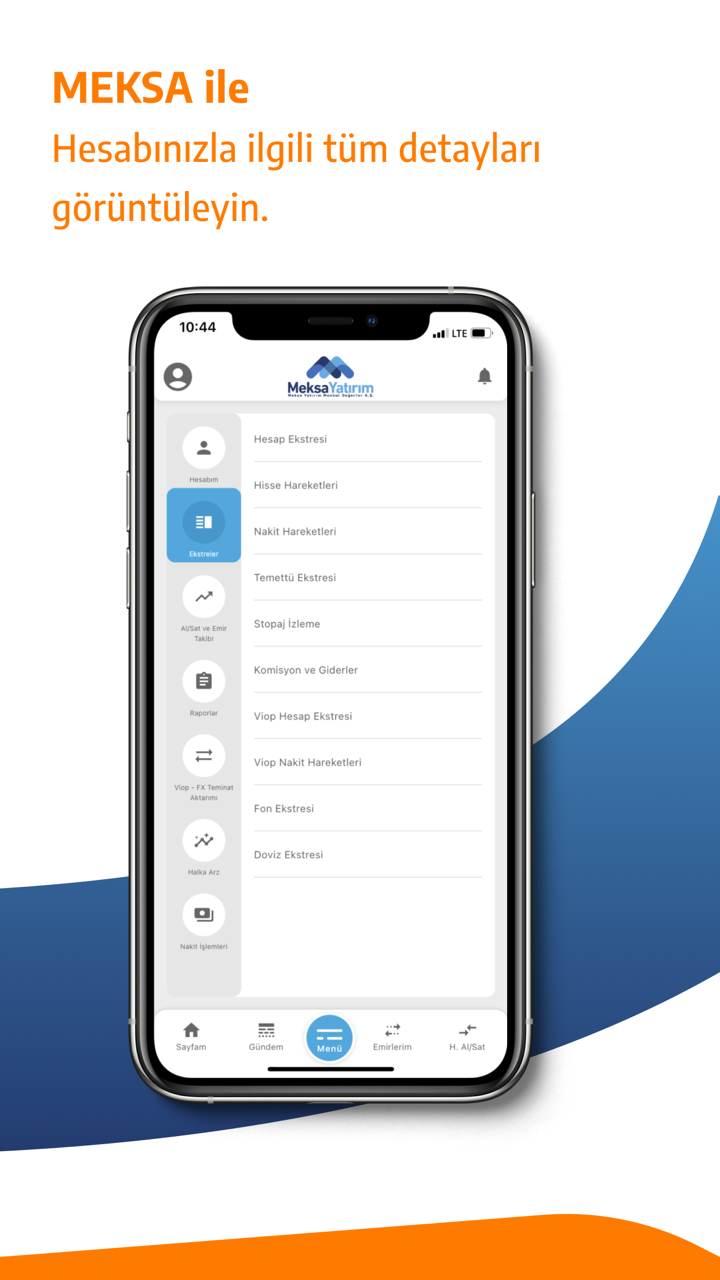

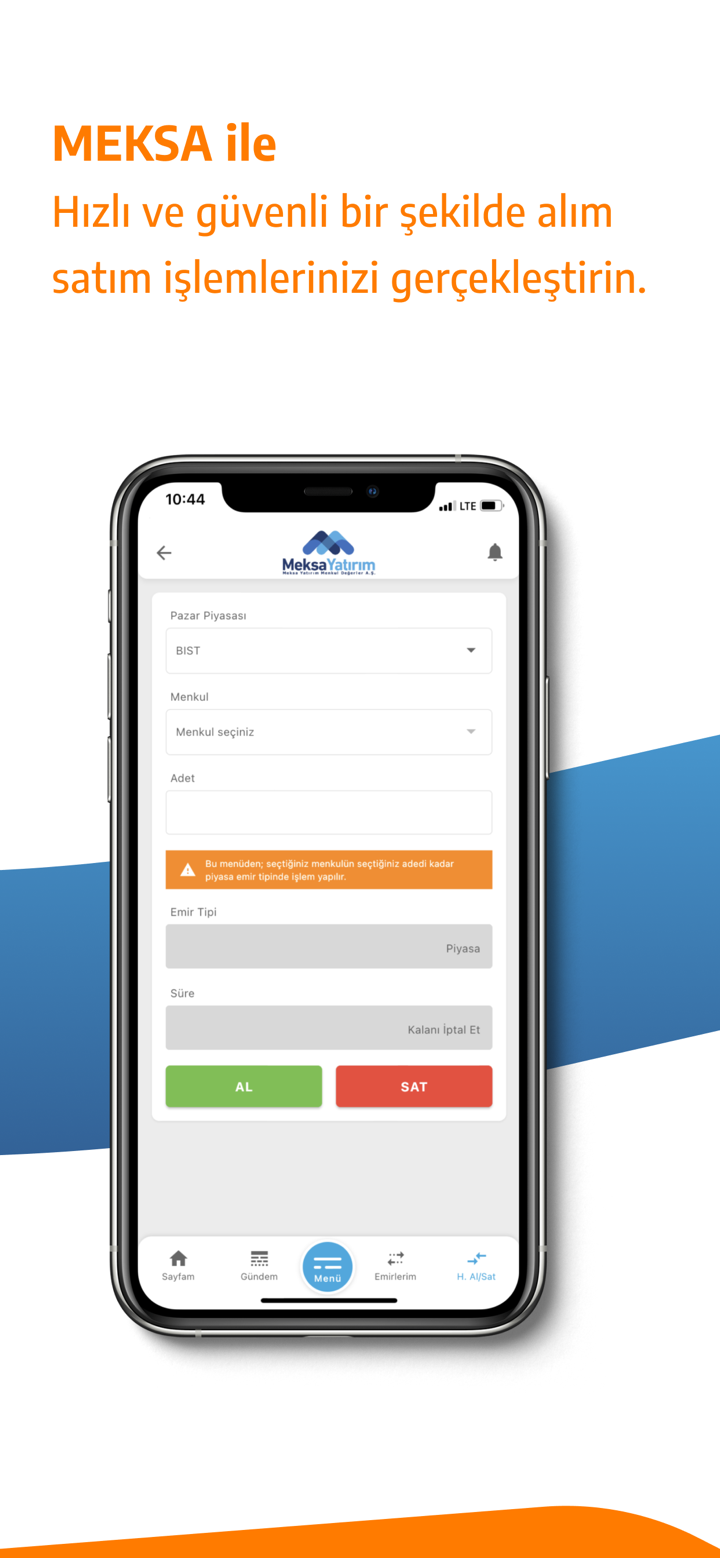

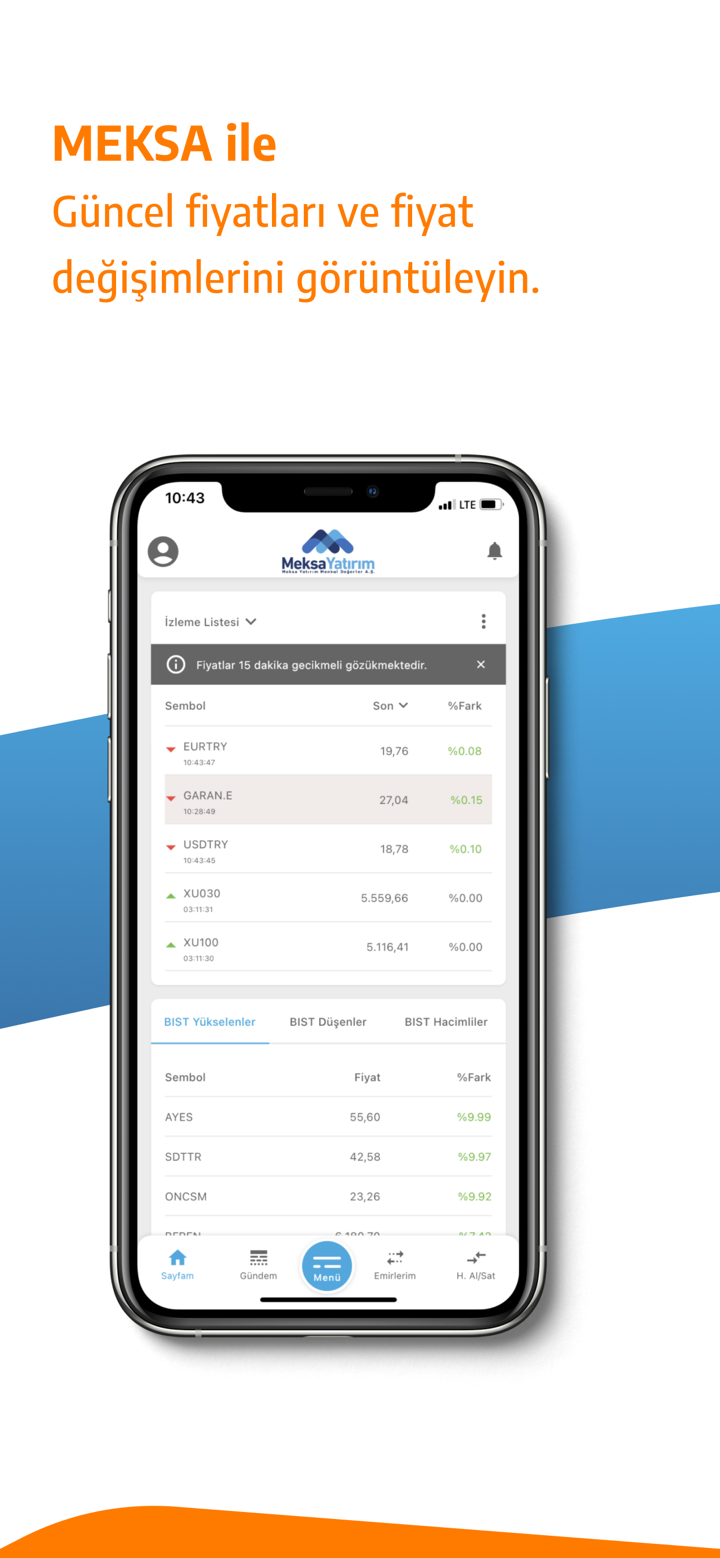

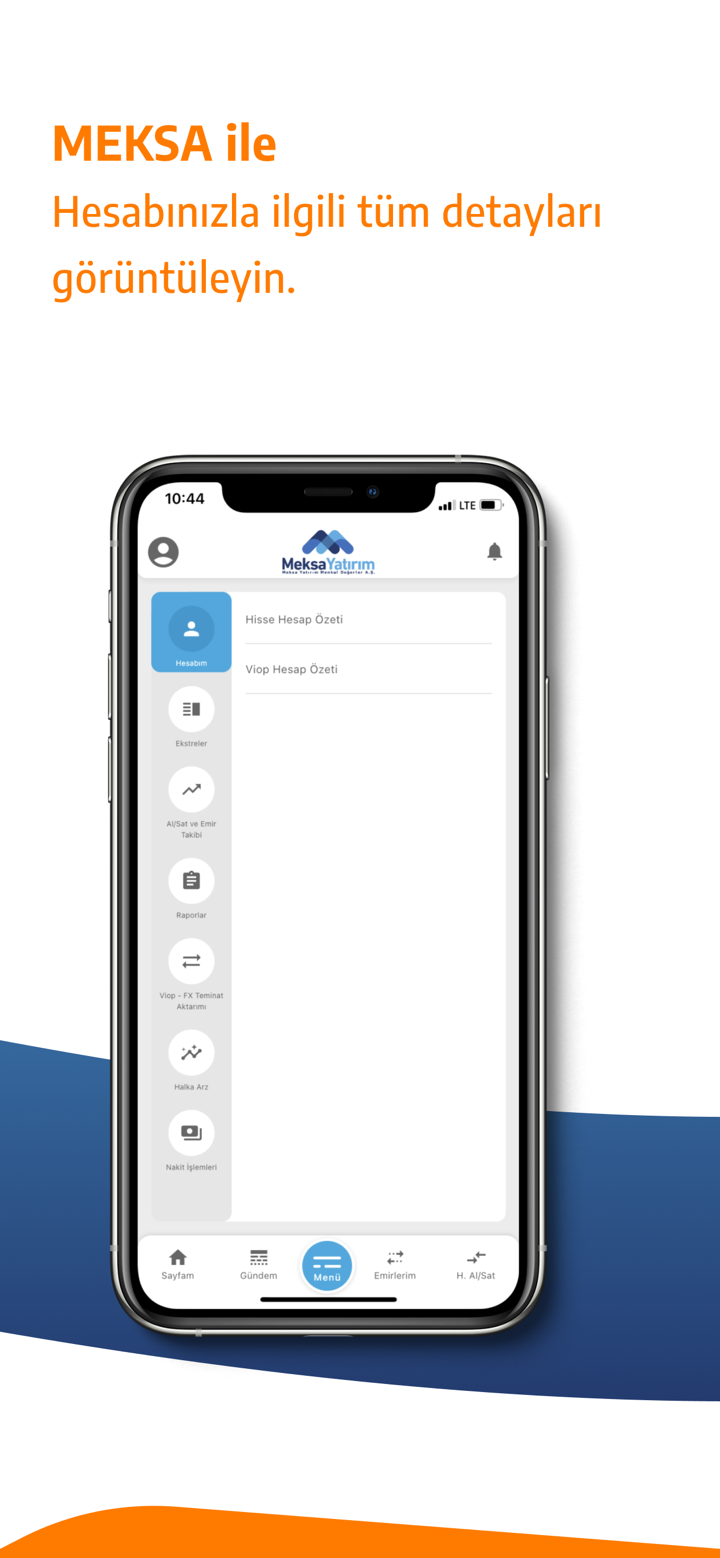

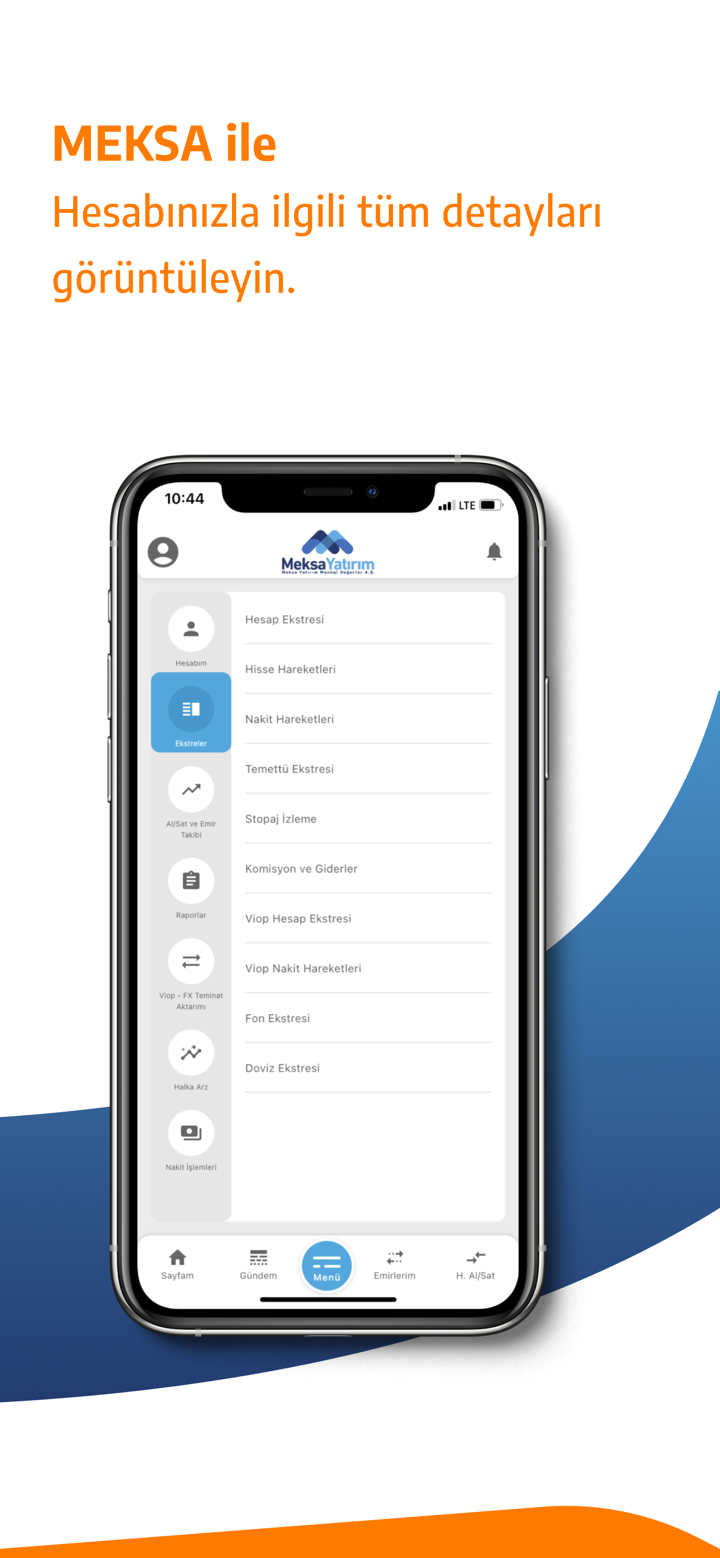

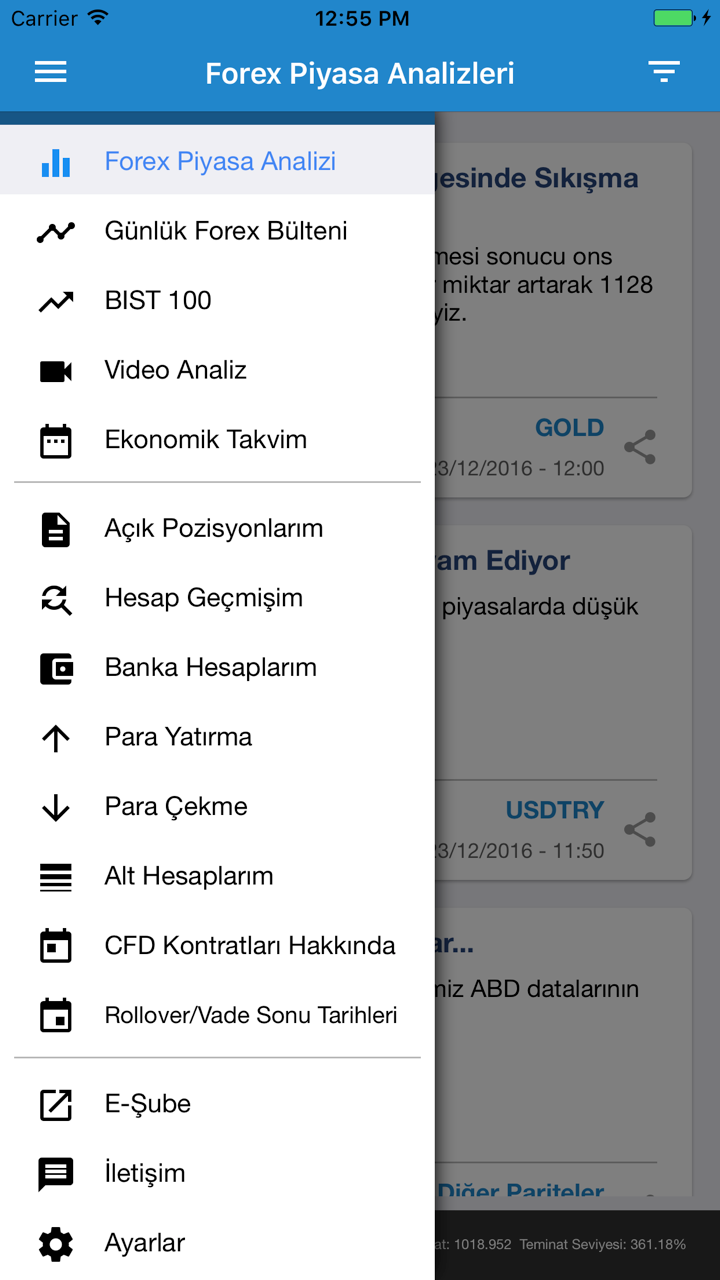

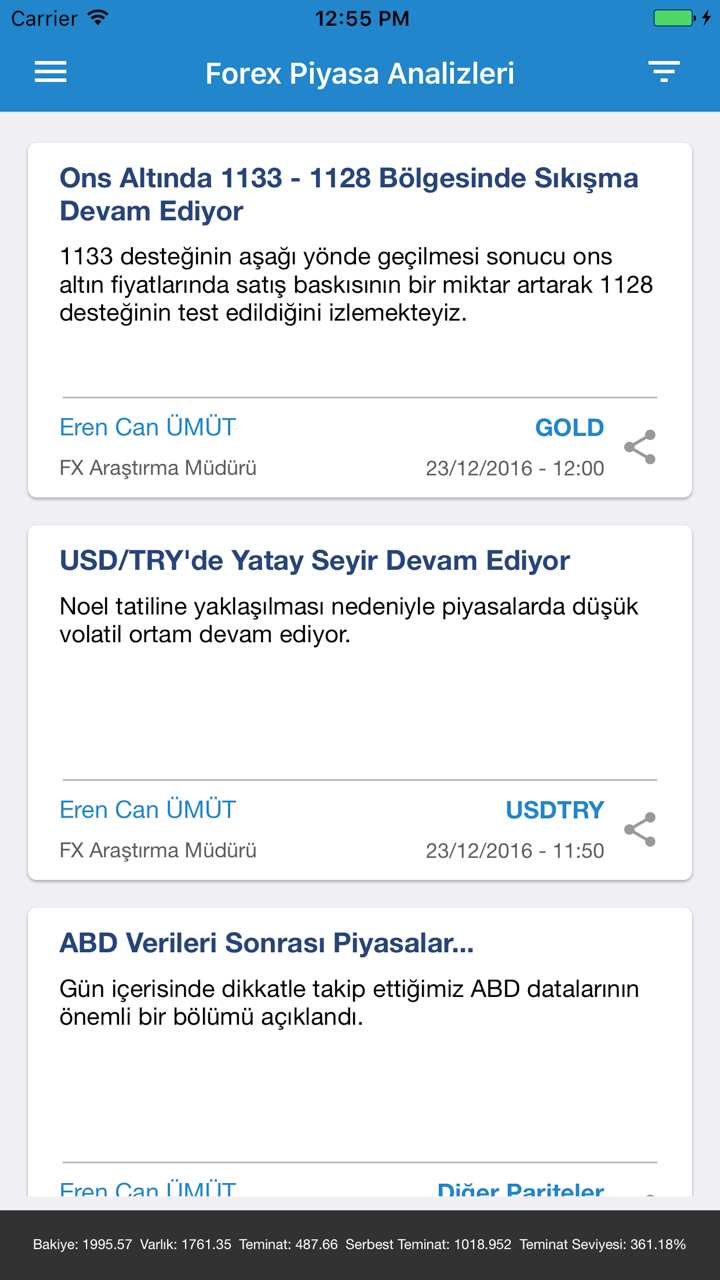

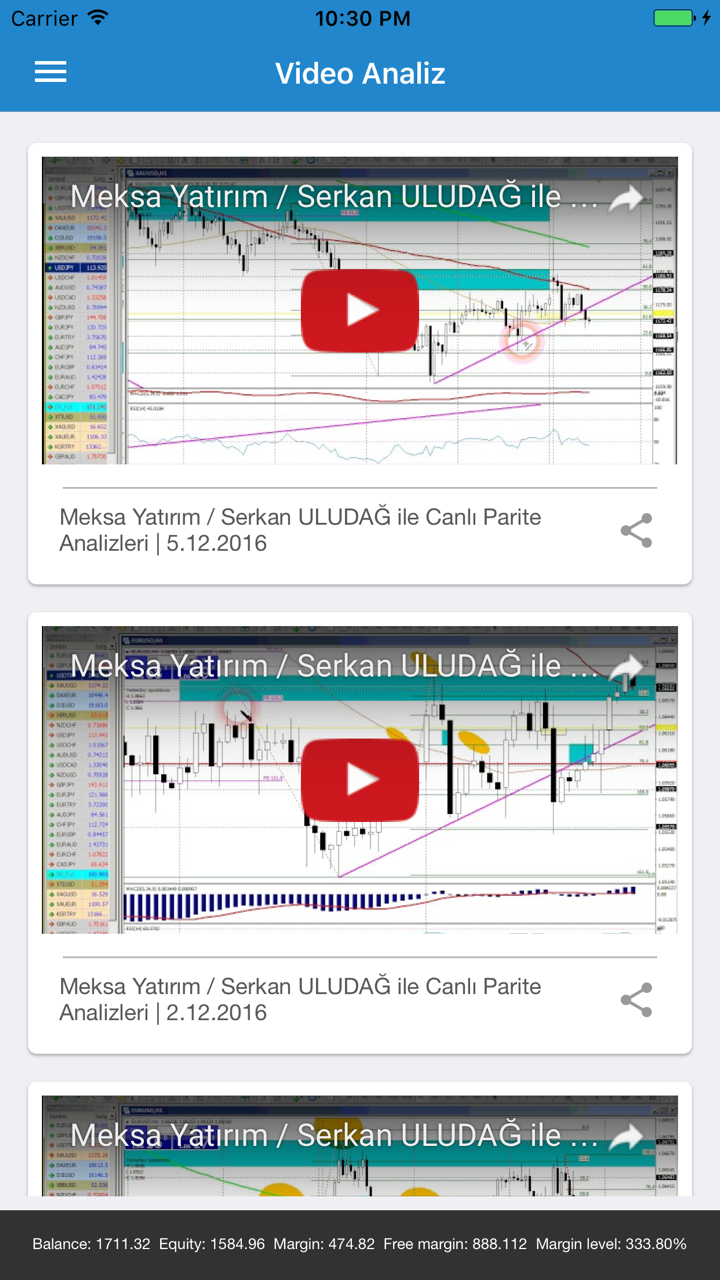

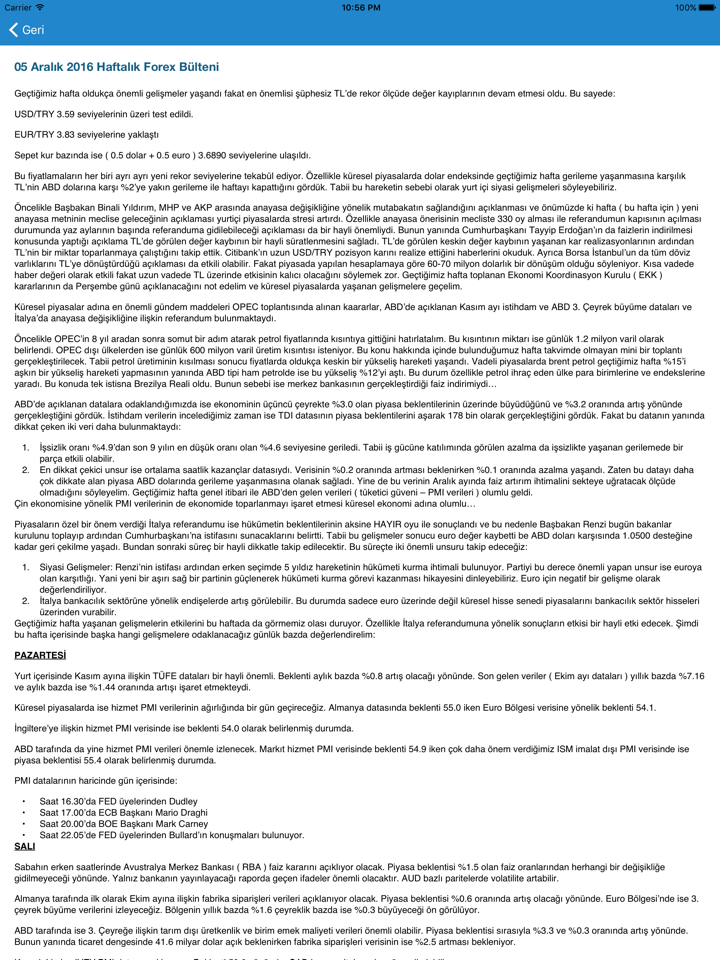

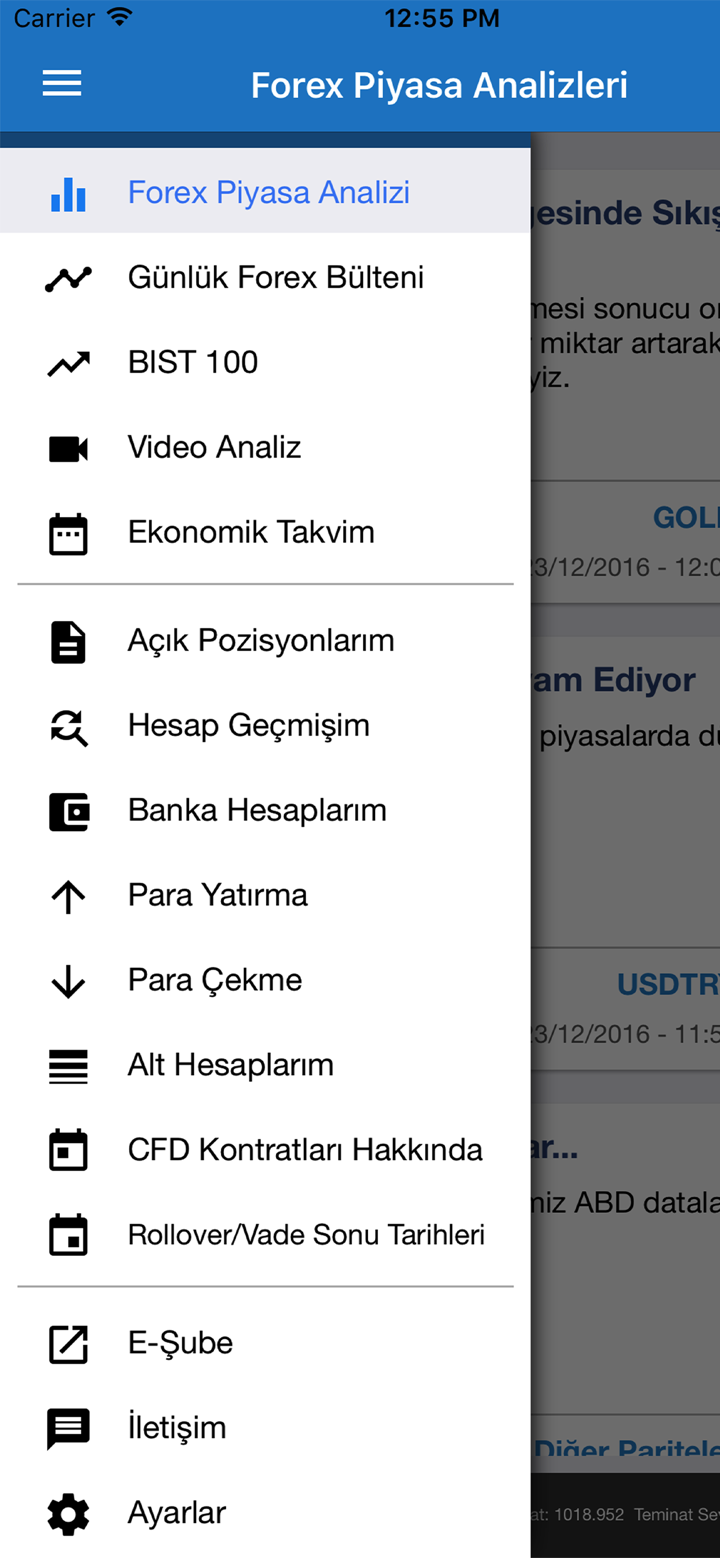

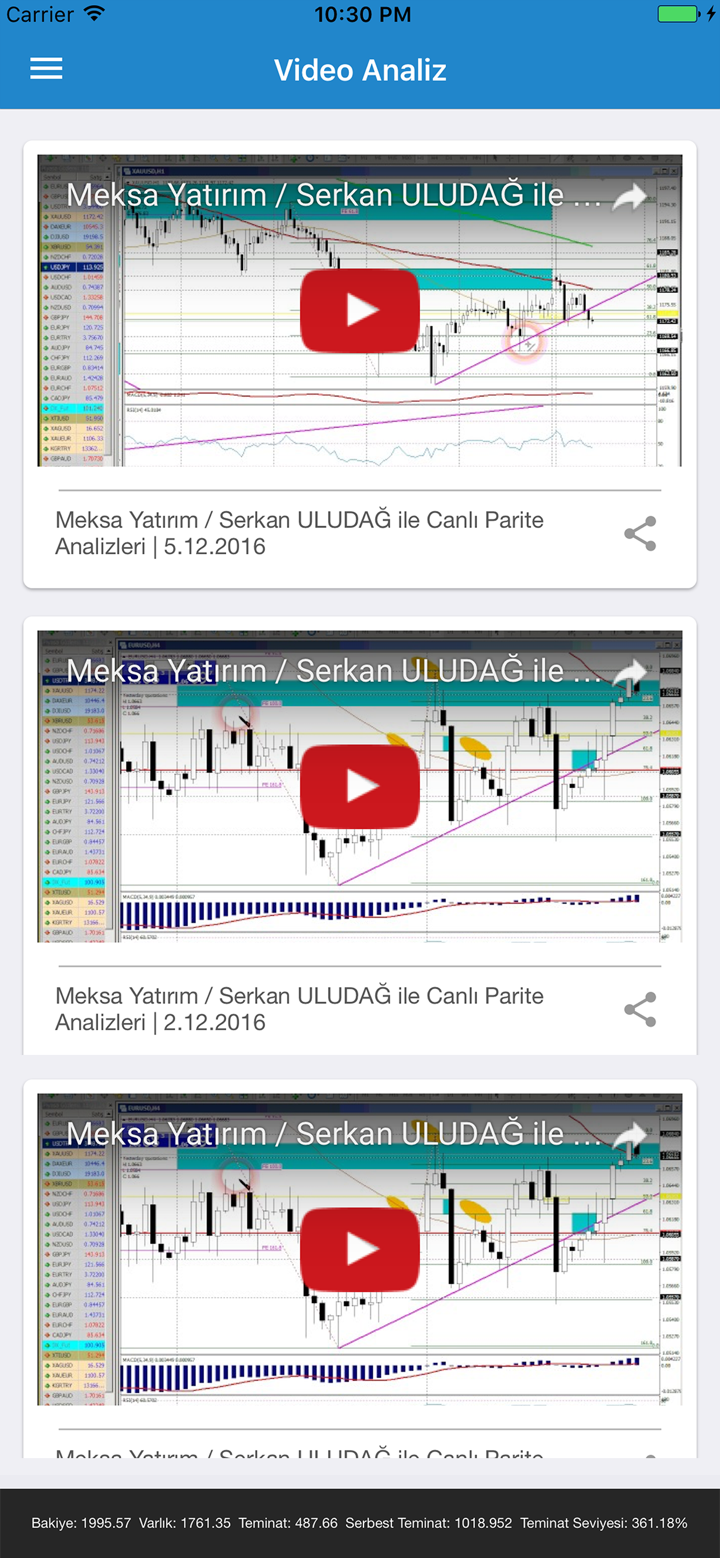

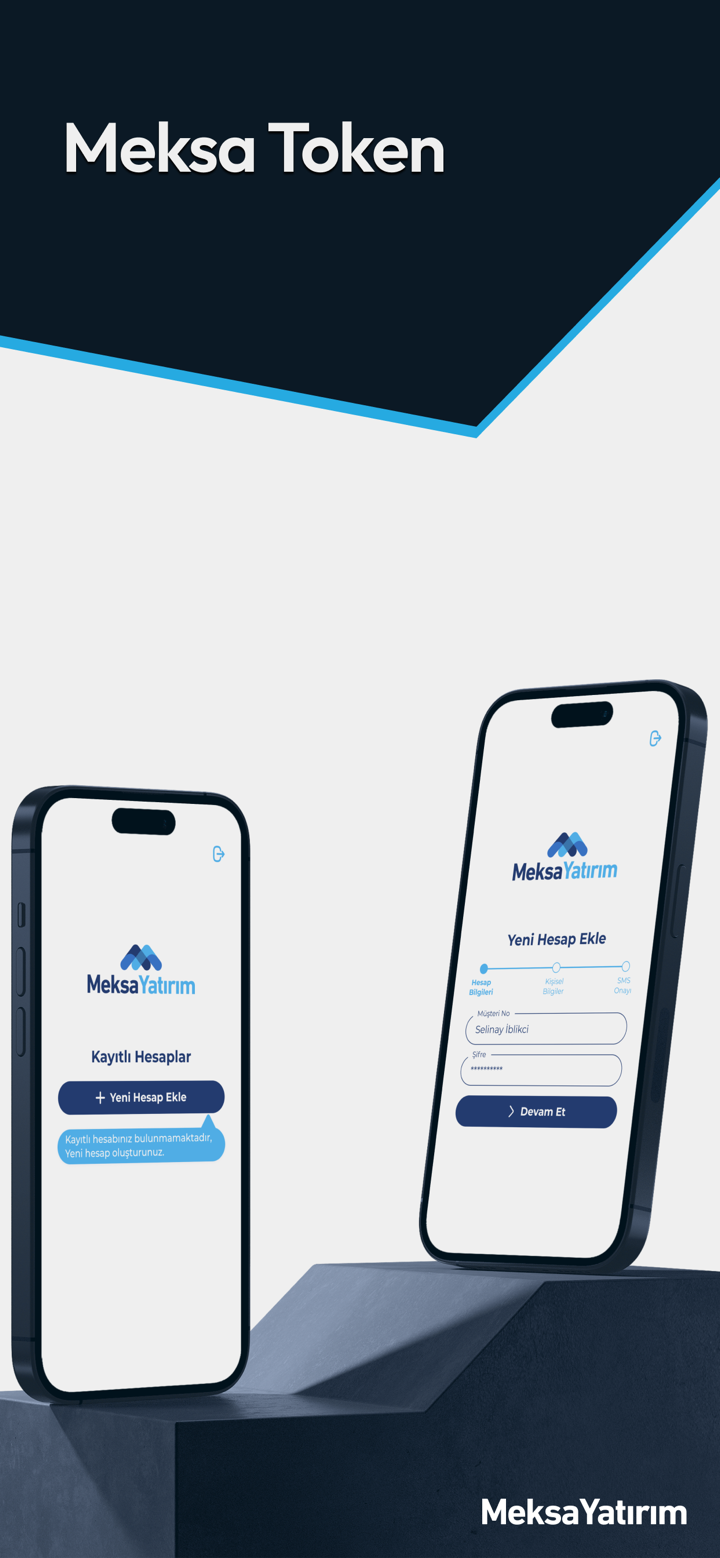

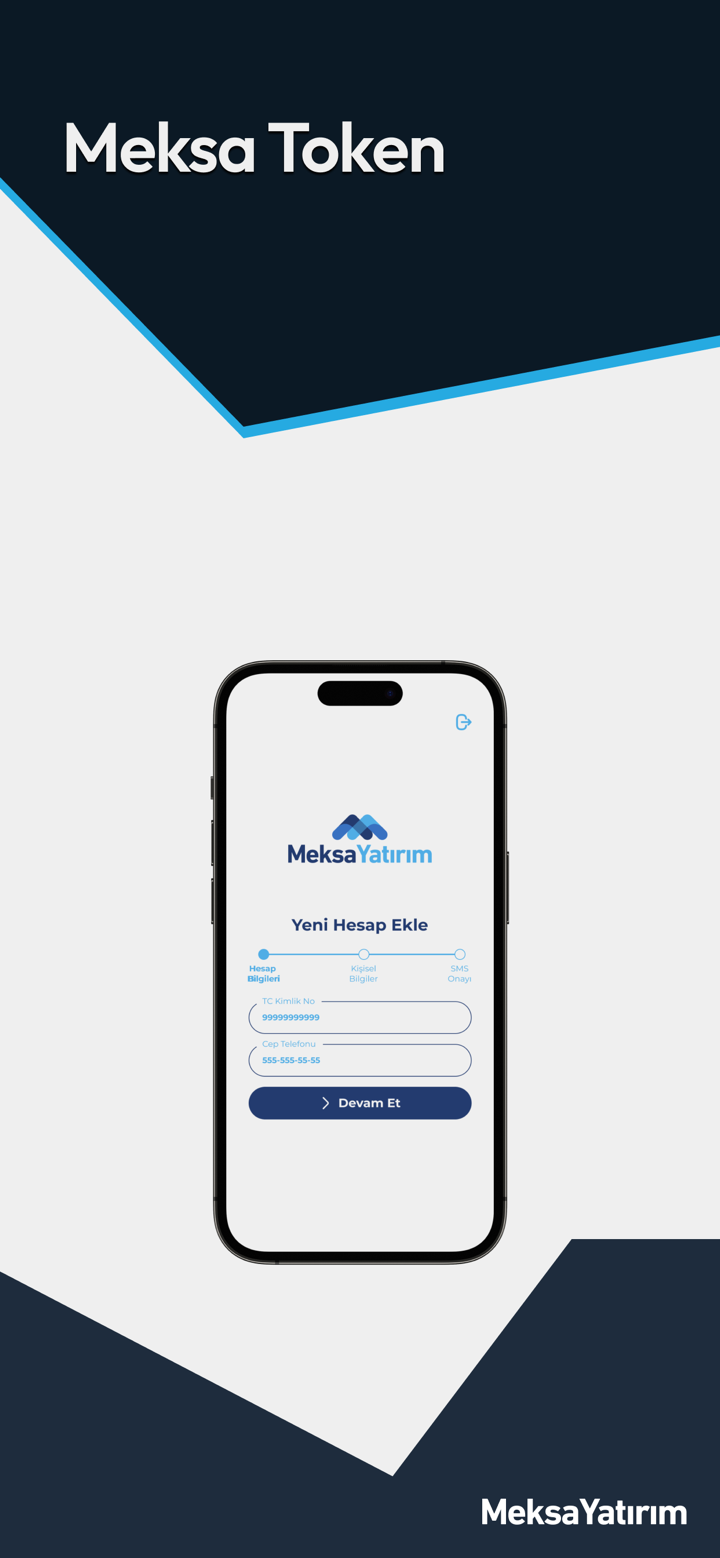

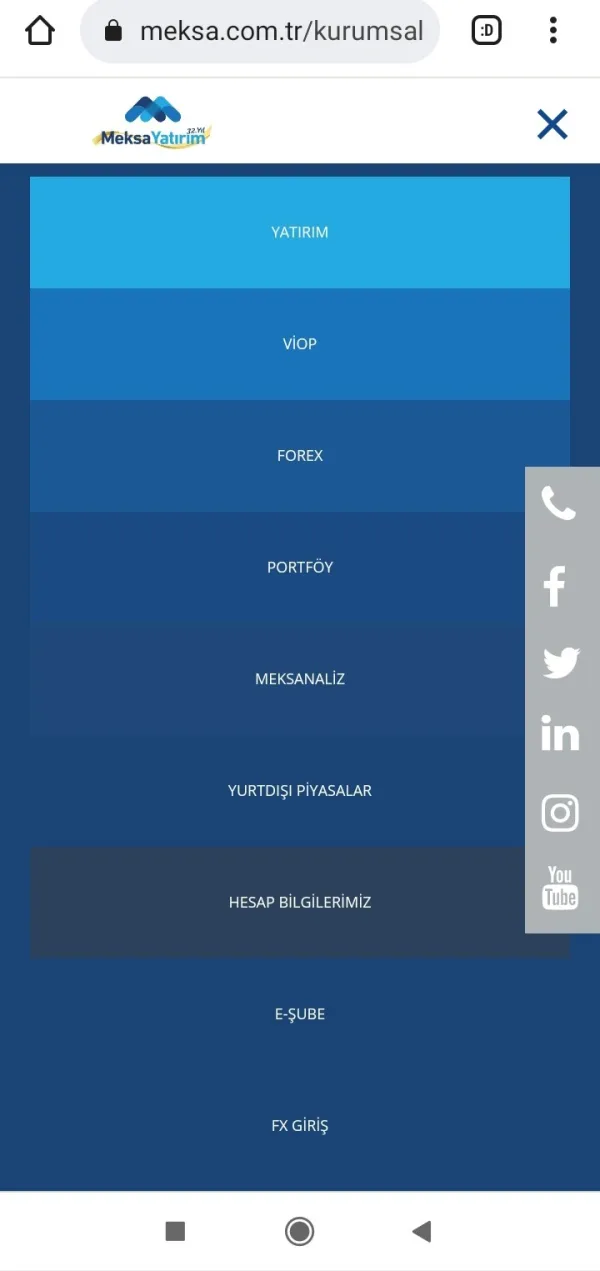

MEKSA투자 컨설팅, 중개 서비스, 포트폴리오 관리, 파생 상품, viop 서비스, 펀드 관리, 연구, 외환 시장 및 기업 금융을 포함한 다양한 서비스를 제공한다고 광고합니다.

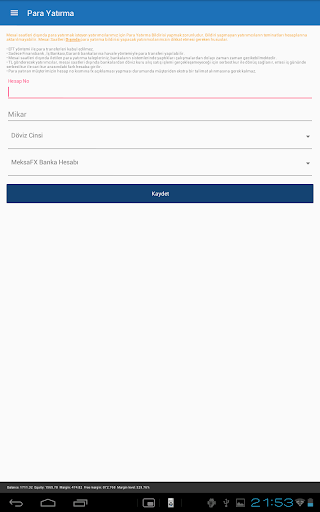

입금 및 출금

외환 투자를 실현하기 위한 최소 입금액 MEKSA cmb로 50,000 tl이라고합니다. 그러나 브로커는 허용되는 입출금 방법에 대한 정보를 공개하지 않았습니다.

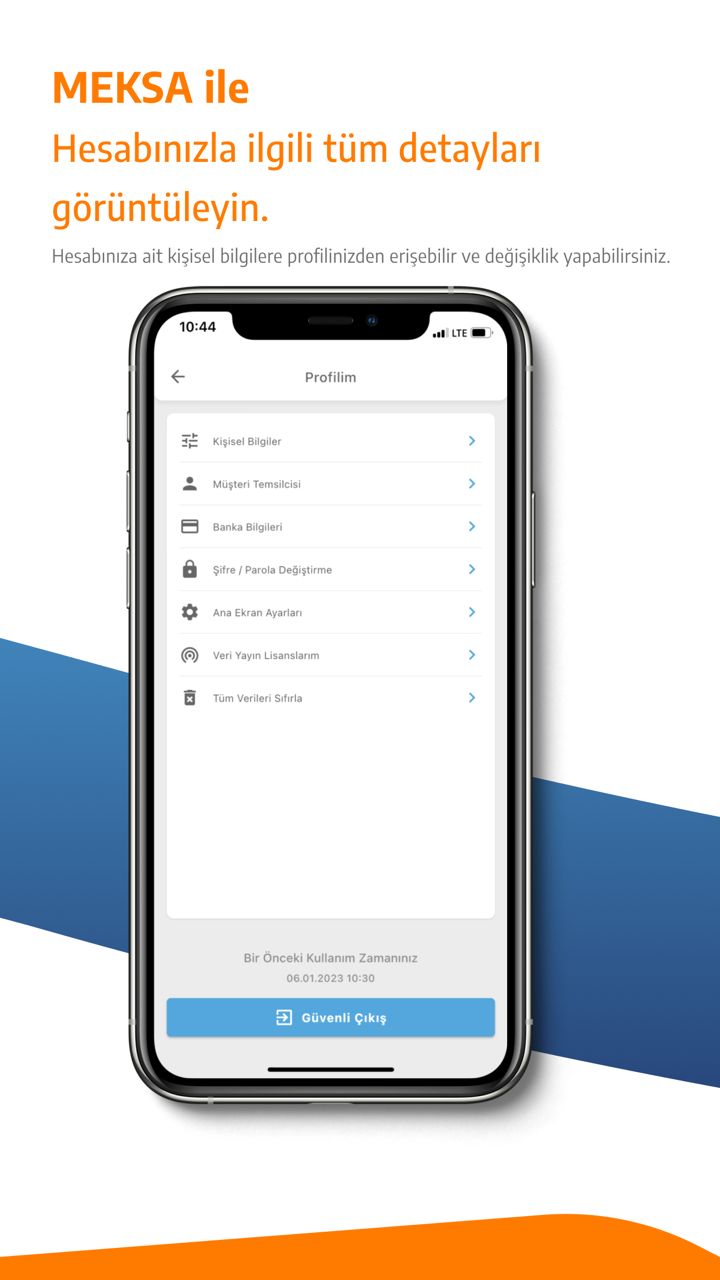

고객 지원

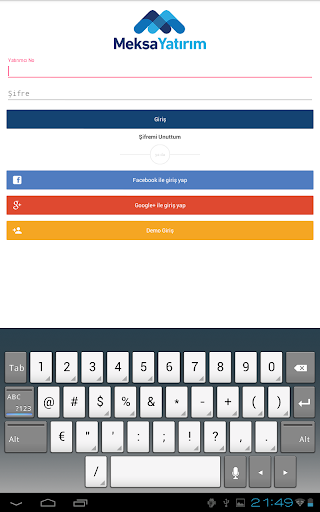

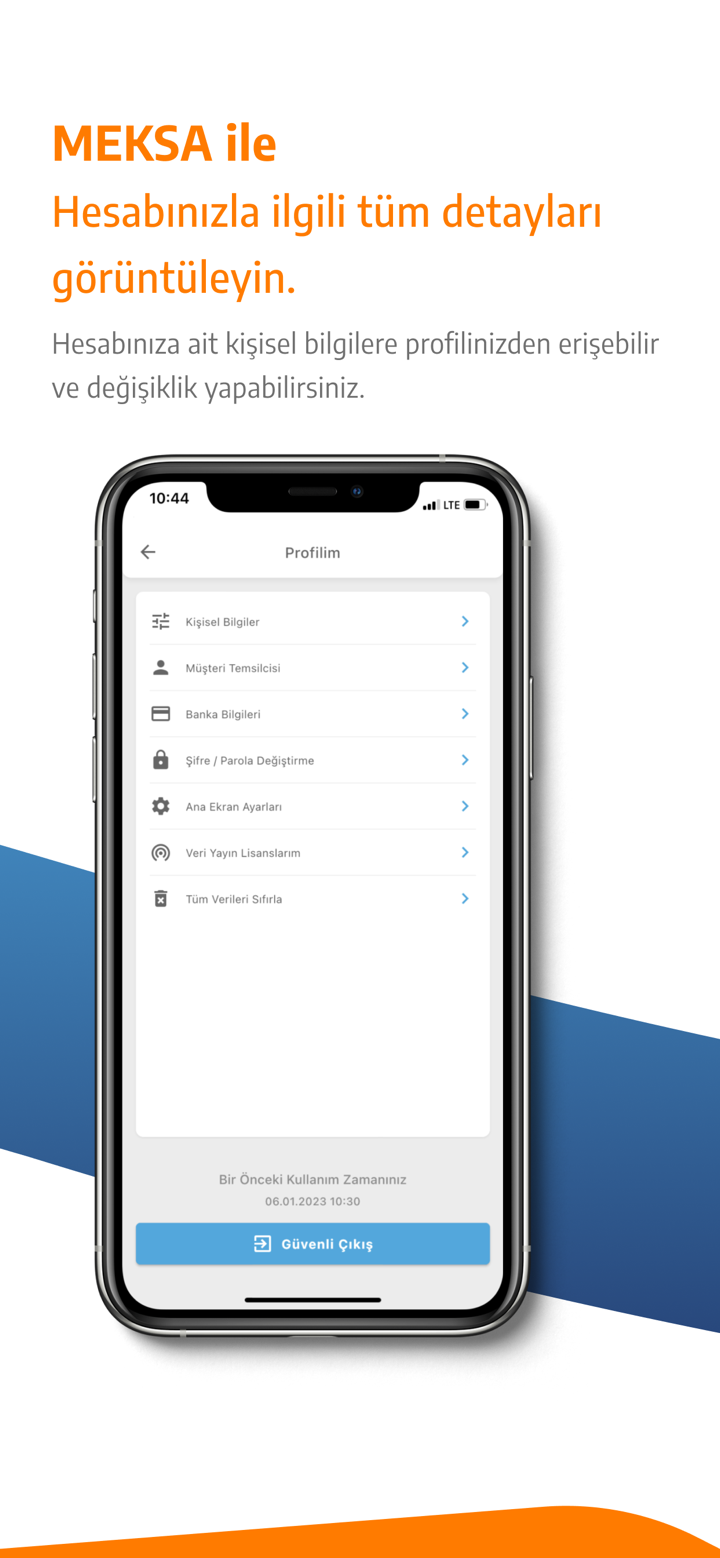

MEKSA의 고객 지원은 전화로 연락할 수 있습니다: 02166813400, 팩스: +90 (216) 6930570, +90 (216) 6930571, +90 (216) 6930572, 이메일: destek@ MEKSA fx.com 또는 온라인으로 메시지를 보내 연락하십시오. 트위터, 페이스북, 인스타그램, 유튜브, 링크드인과 같은 소셜 미디어 플랫폼에서 이 브로커를 팔로우할 수도 있습니다. 회사 주소: şehit teğmen ali yılmaz sok. güven sazak plaza a blok no:13 kat: 3-4 34810 kavacık - beykoz / istanbul.

위험 경고

온라인 거래에는 상당한 수준의 위험이 수반되며 투자한 자본을 모두 잃을 수도 있습니다. 모든 거래자 또는 투자자에게 적합하지 않습니다. 관련된 위험을 이해하고 있는지 확인하고 이 문서에 포함된 정보는 일반적인 정보 목적으로만 제공된다는 점에 유의하십시오.