Unternehmensprofil

Allgemeine Informationen und Vorschriften

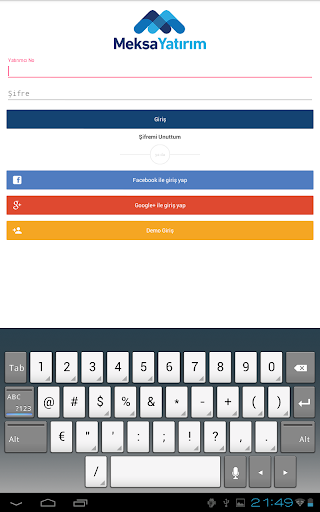

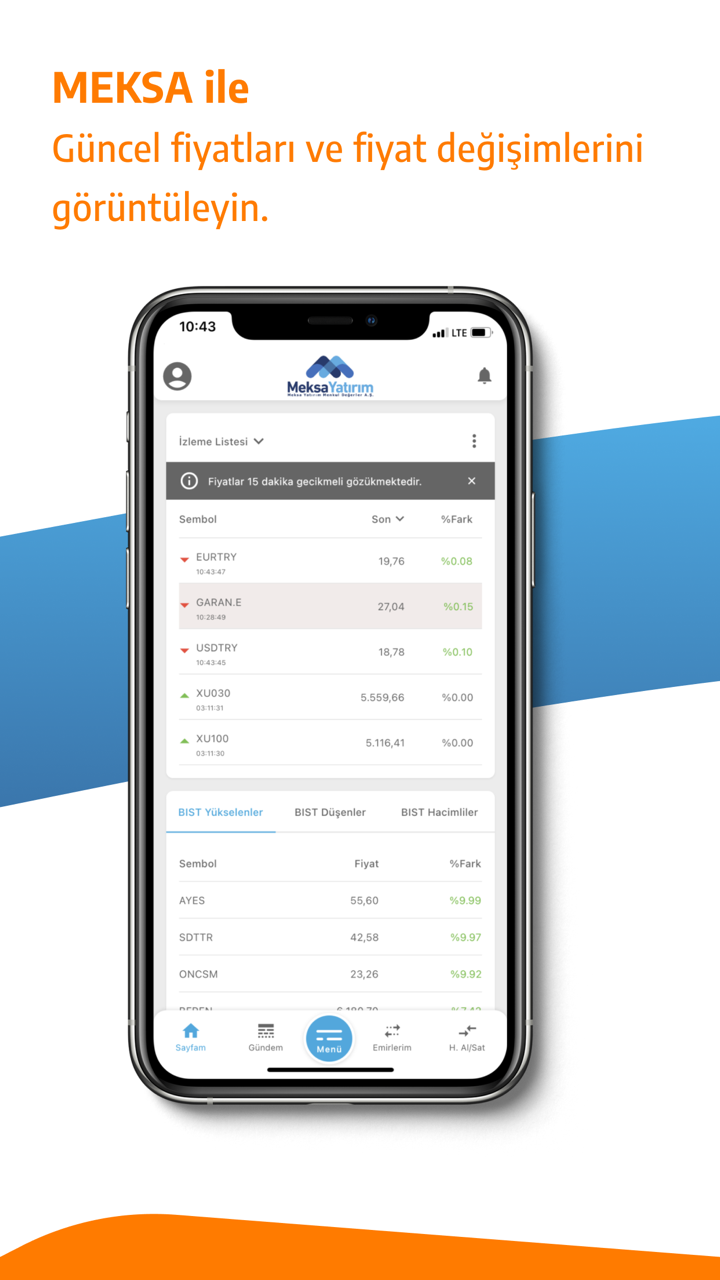

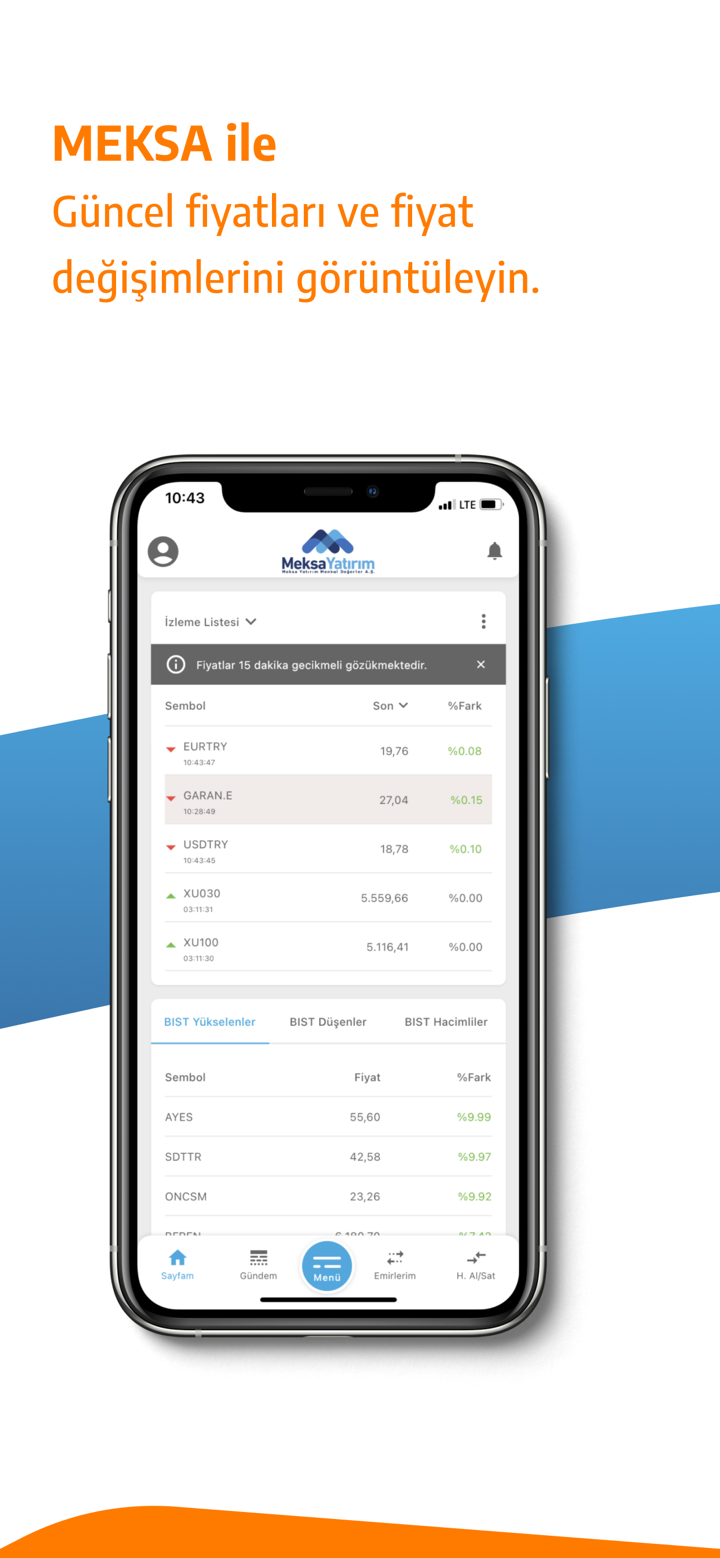

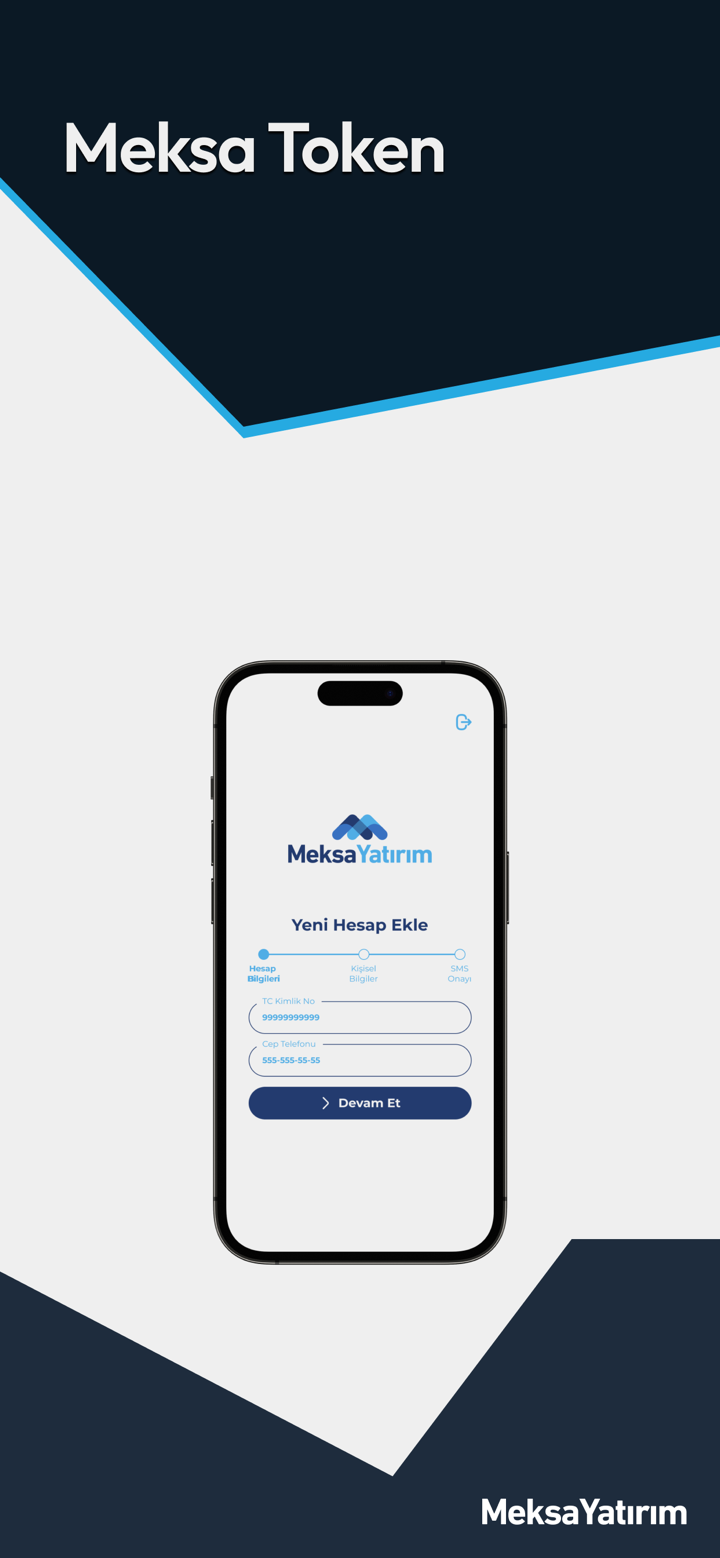

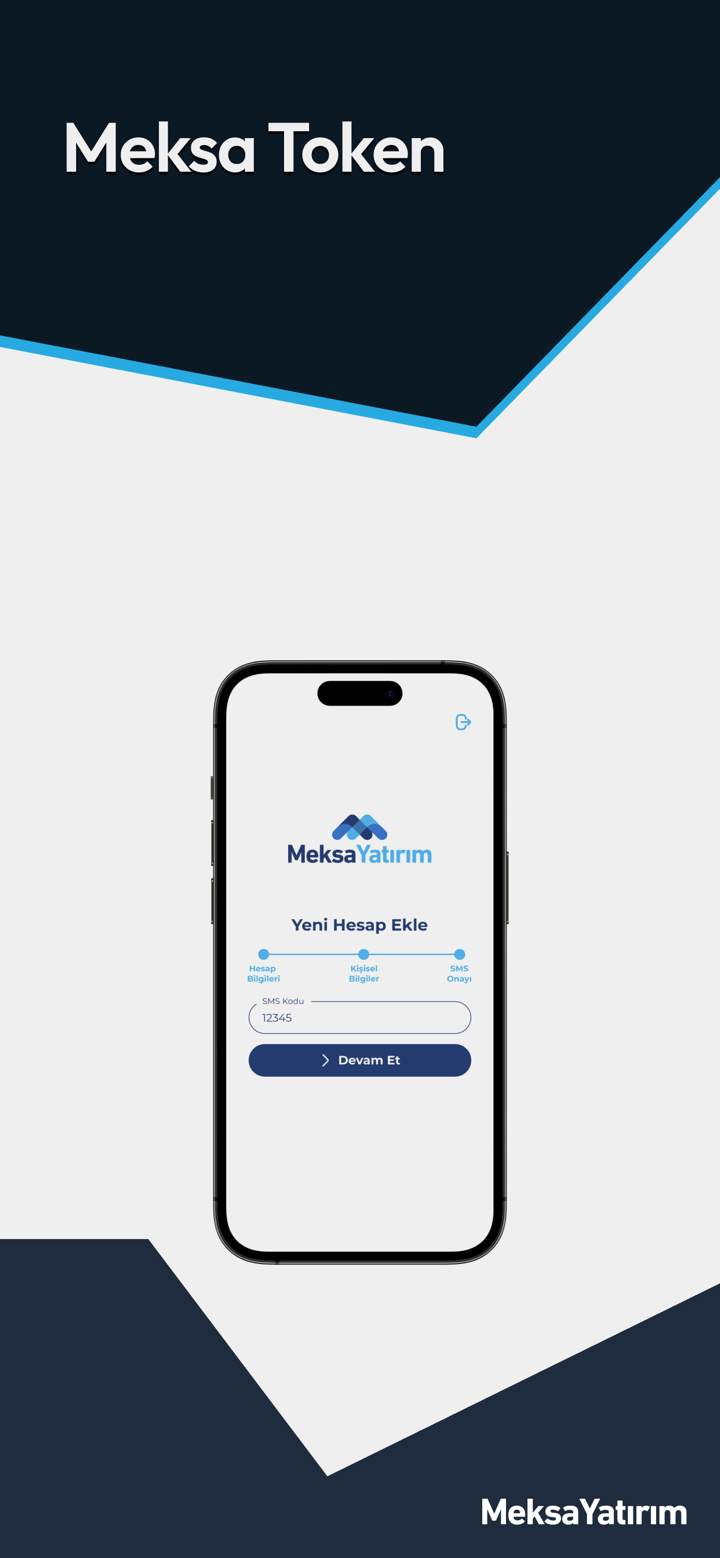

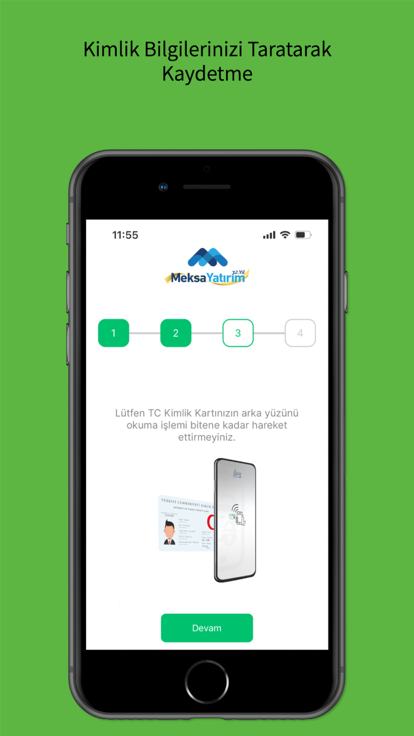

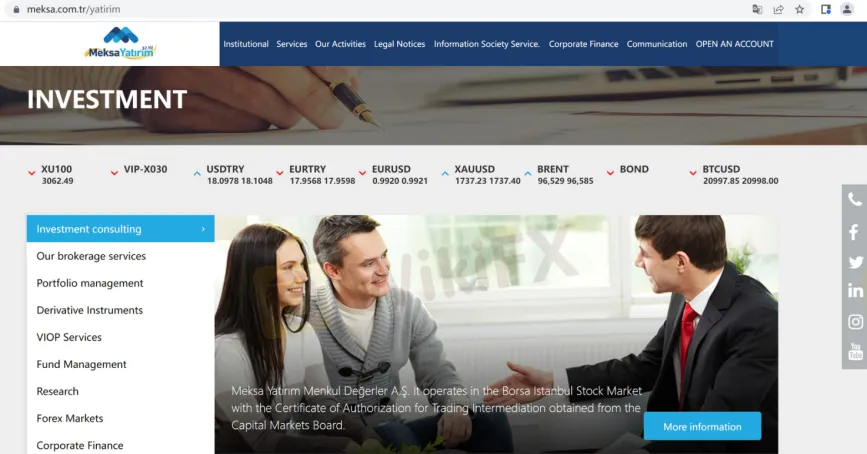

MEKSA, ein Handelsname von Meksa Yatırım Menkul Değerler A.Ş ist angeblich ein Finanzmaklerunternehmen, das am 28. Juni 1990 gegründet und in der Türkei registriert wurde. Der Broker gibt an, dass er an der Börse von Istanbul mit der Berechtigungsbescheinigung für die Handelsvermittlung tätig ist, die er von der Kapitalmarktbehörde erhalten hat, und behauptet, seinen Privat- und Firmenkunden verschiedene Finanzdienstleistungen anzubieten. Hier ist die Homepage der offiziellen Website dieses Brokers:

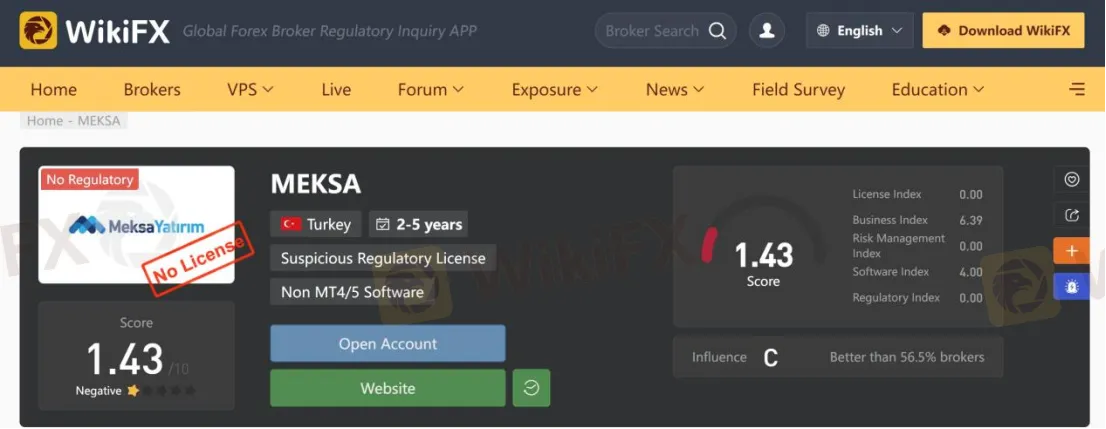

Was die Regulierung betrifft, so wurde dies überprüft MEKSA unter keine gültigen Vorschriften fällt. Aus diesem Grund wird sein Regulierungsstatus auf Wikifx als „keine Lizenz“ aufgeführt und es erhält eine relativ niedrige Bewertung von 1,43/10. Bitte seien Sie sich des Risikos bewusst.

Negative Bewertungen

Ein Händler teilte seine schrecklichen Handelserfahrungen mit MEKSA Plattform bei wikifx. er hat das gesagt MEKSA ist ein Betrugsmakler und hat die versprochene Anzahlung von 50 % nicht erhalten, als das Datum eintraf. Für Händler ist es notwendig, die Bewertungen einiger Benutzer zu lesen, bevor sie sich für einen Forex-Broker entscheiden, für den Fall, dass sie durch Betrügereien betrogen werden.

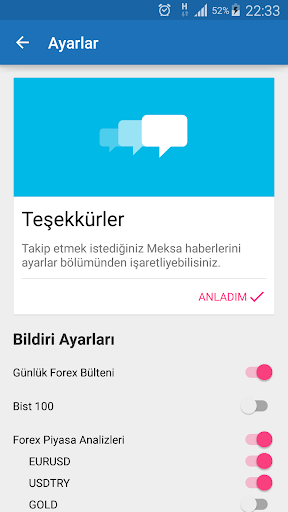

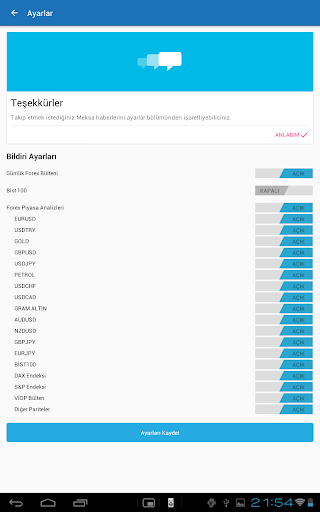

Dienstleistungen

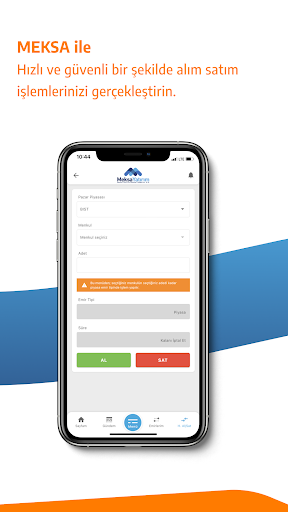

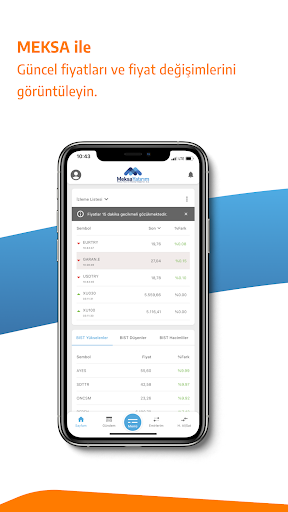

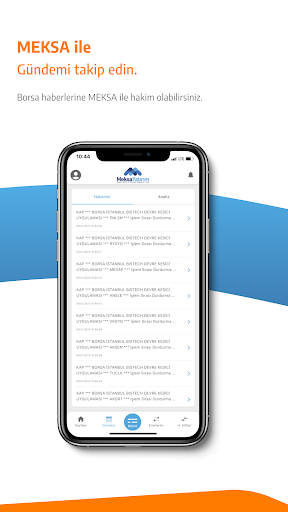

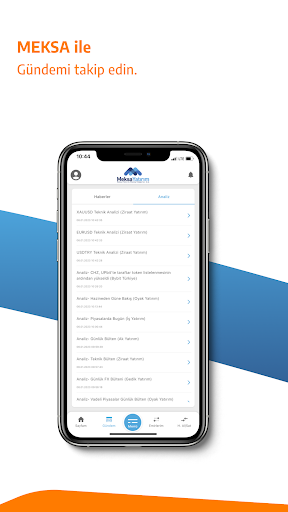

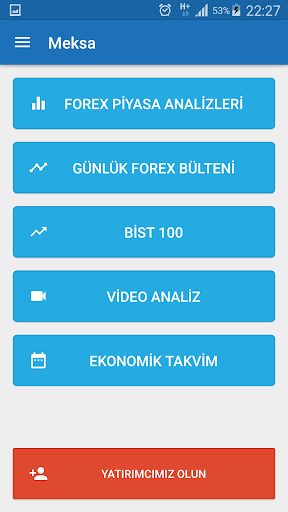

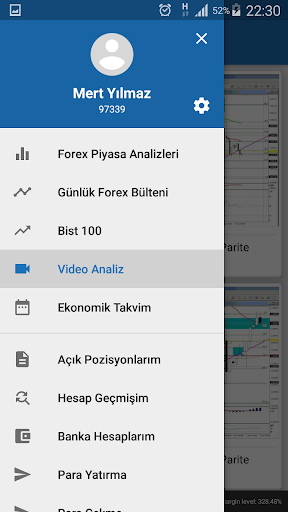

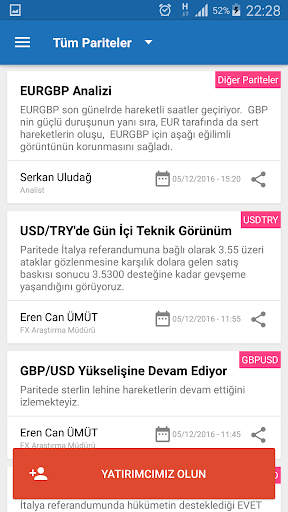

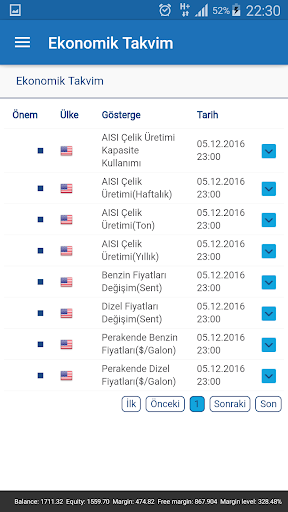

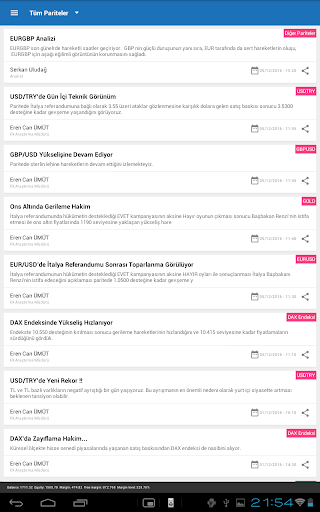

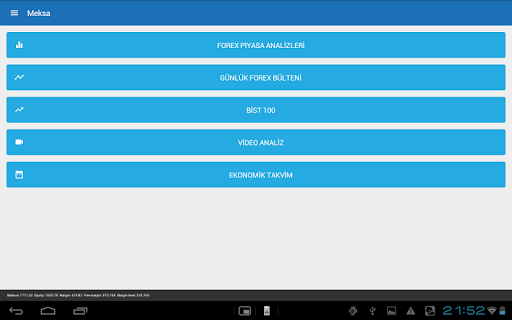

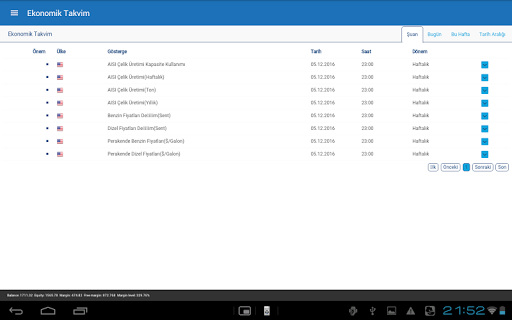

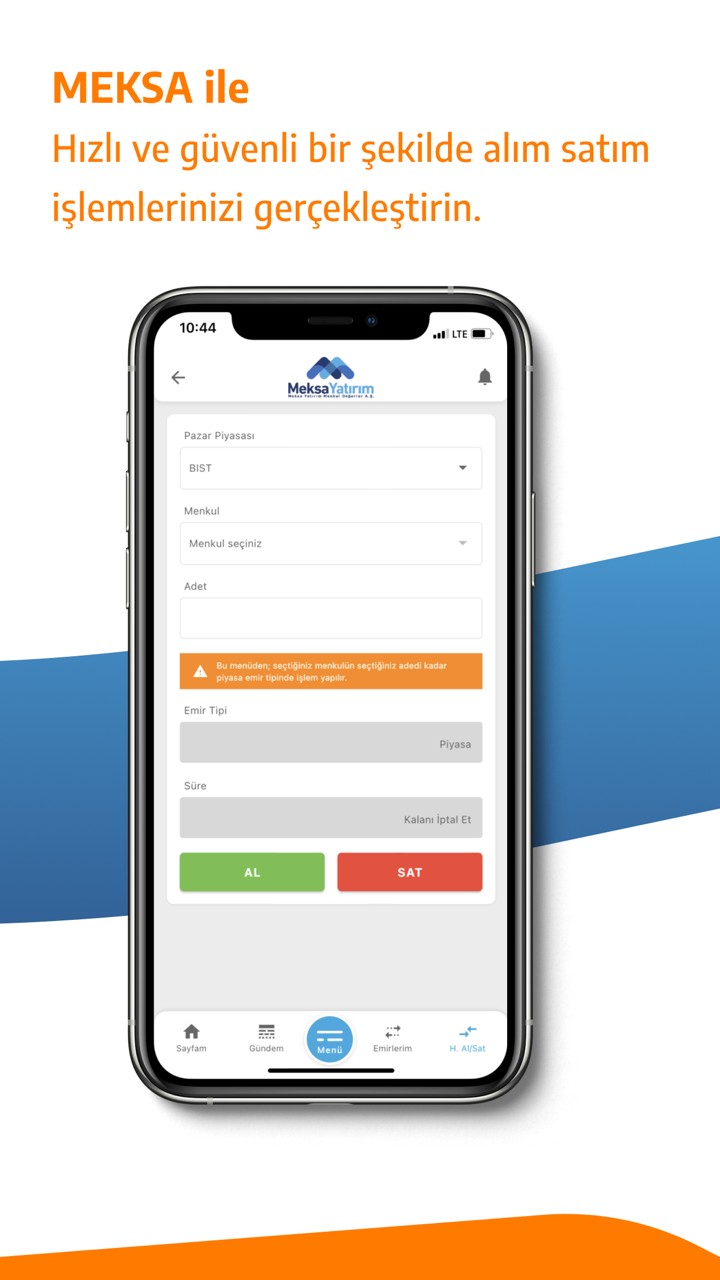

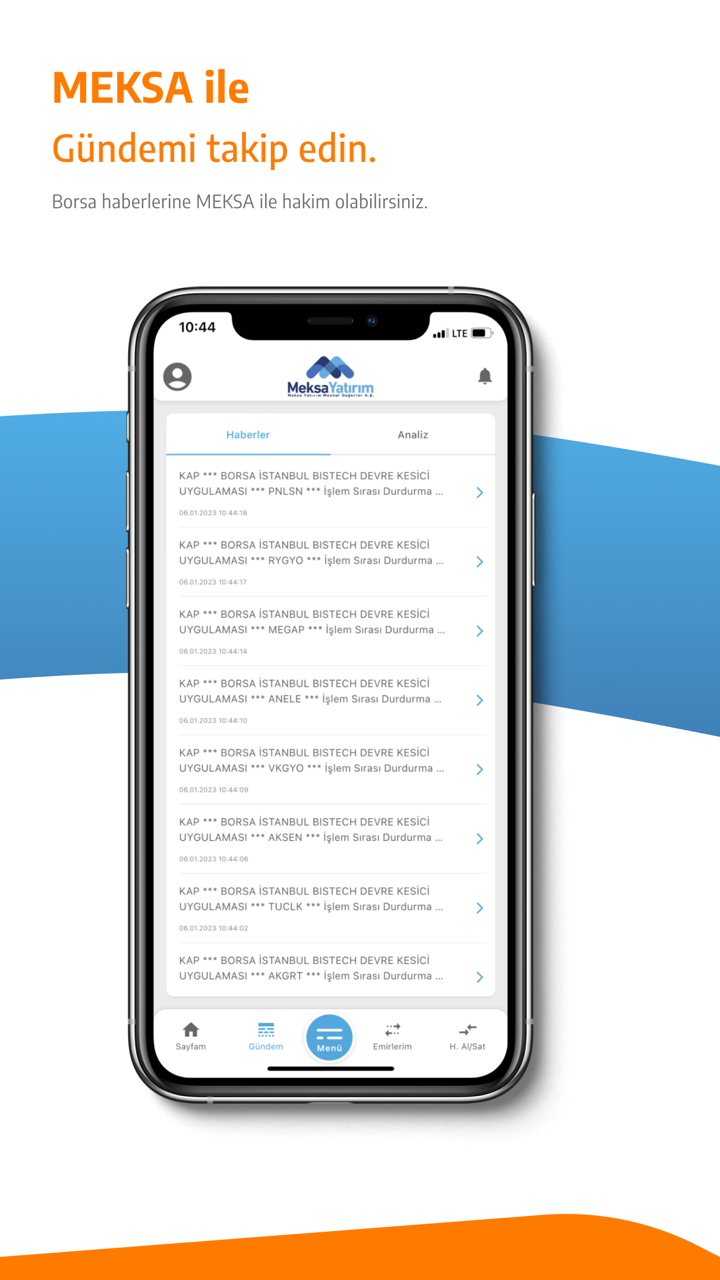

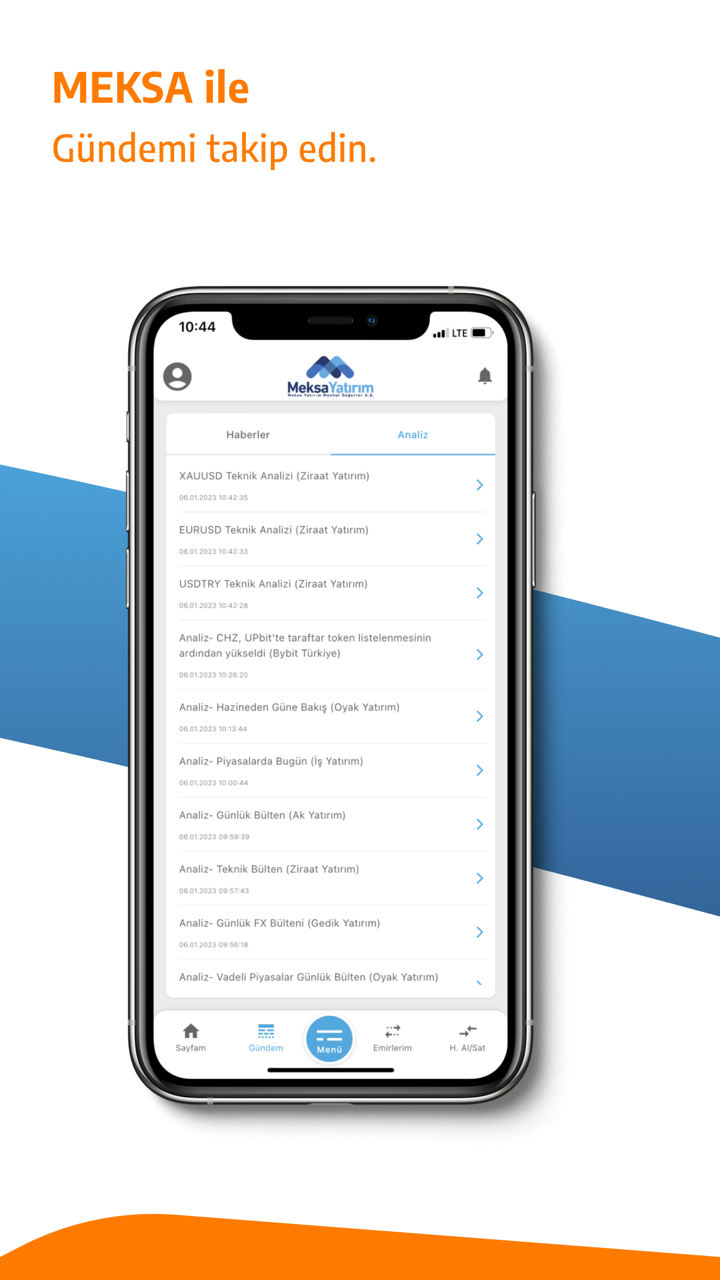

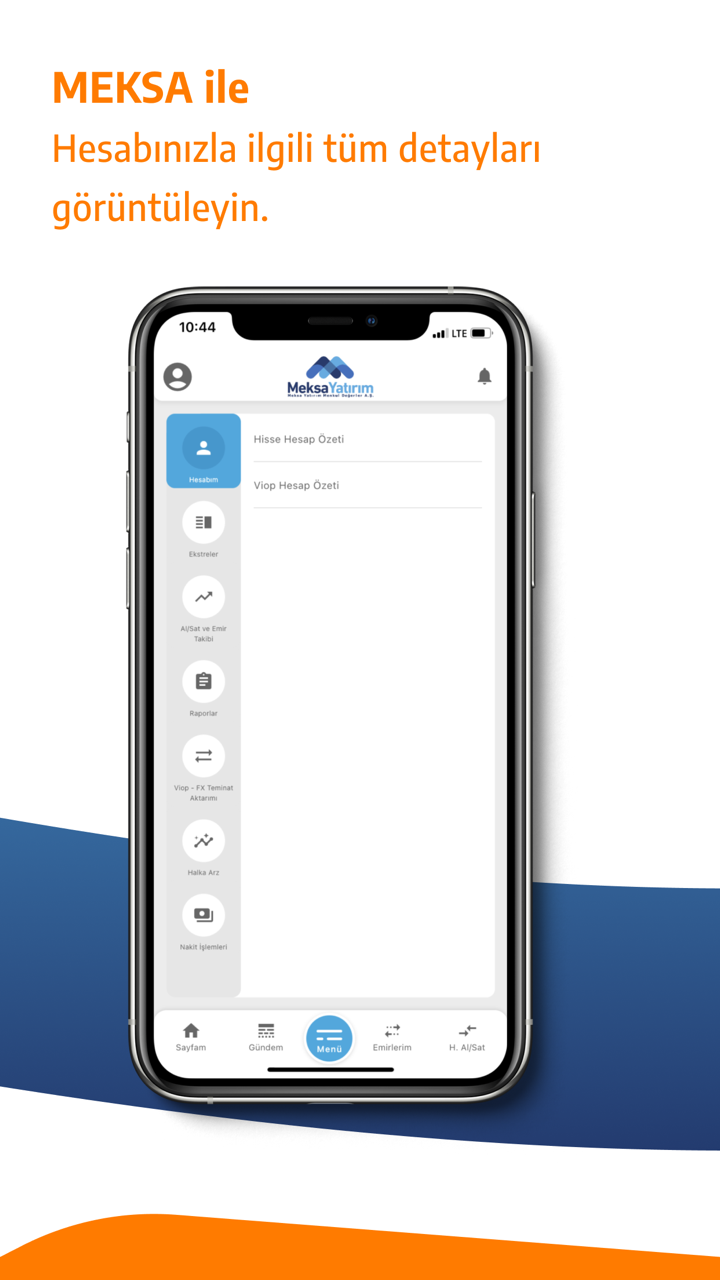

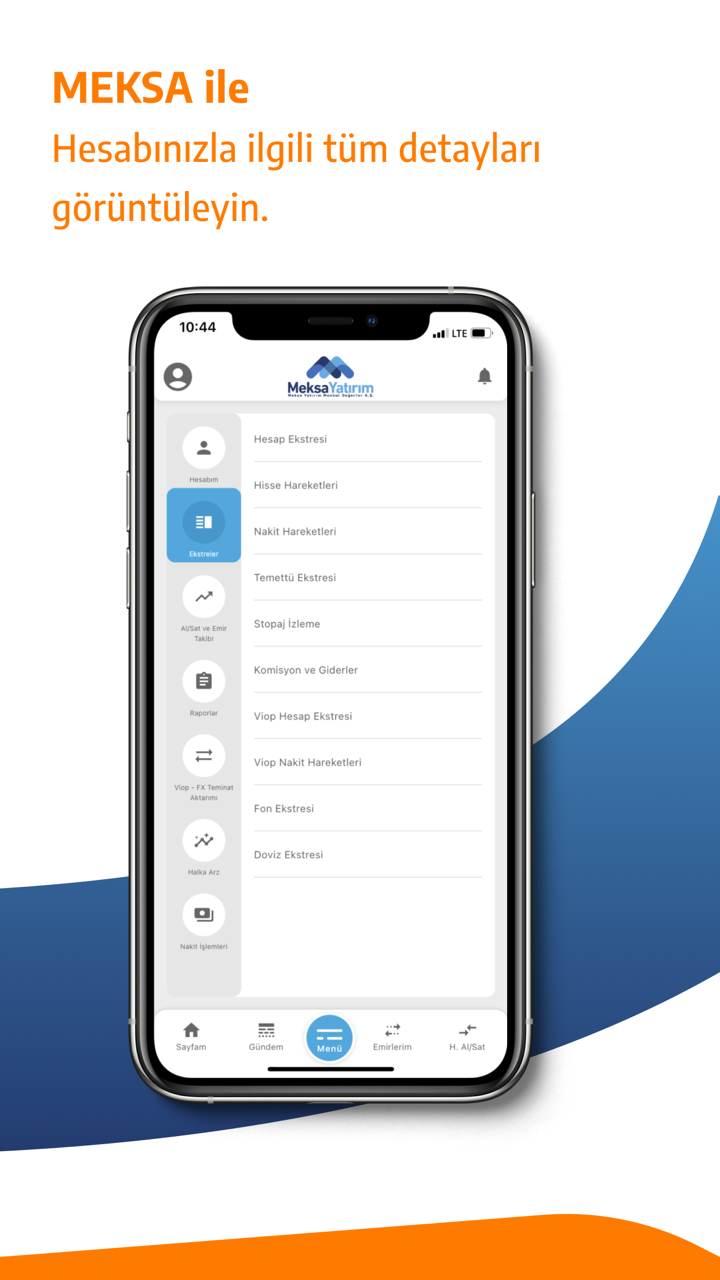

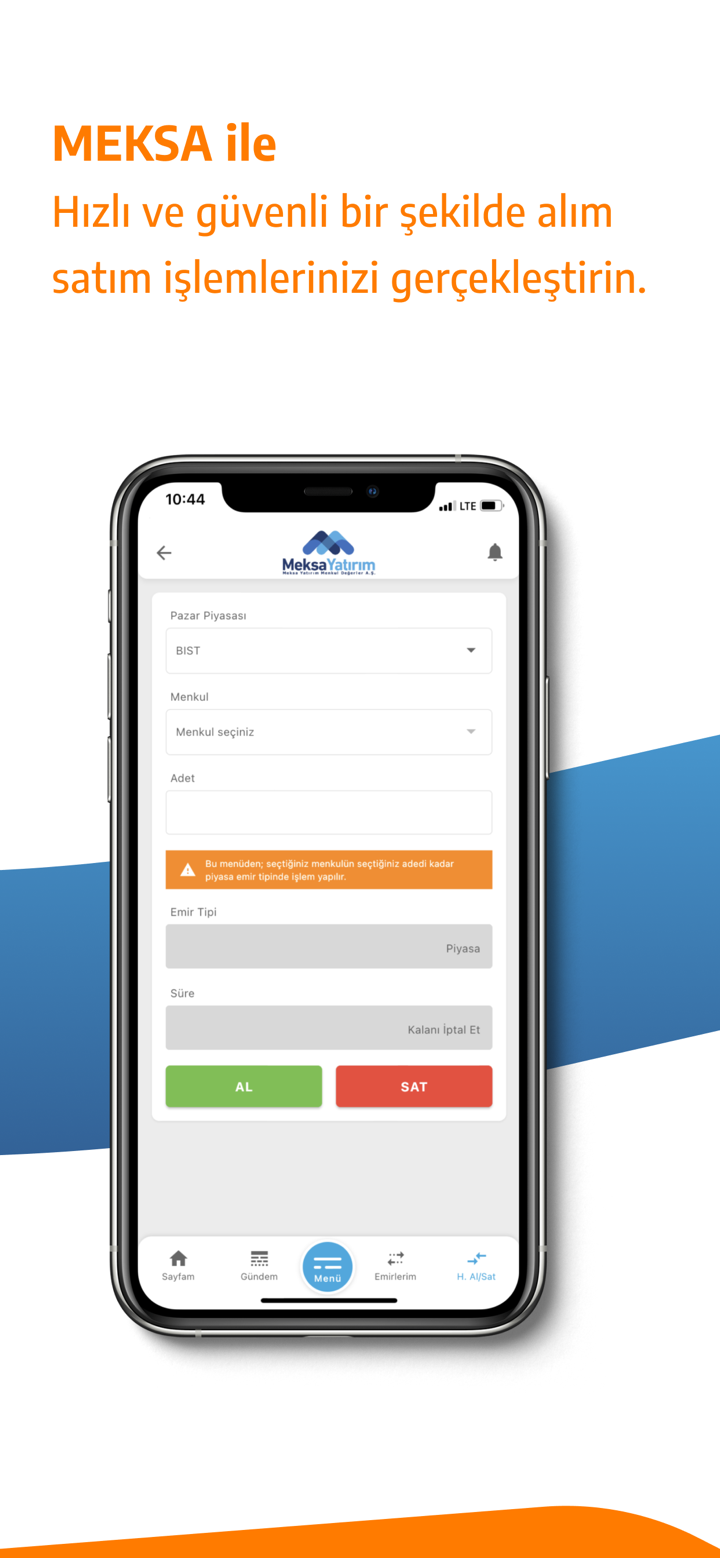

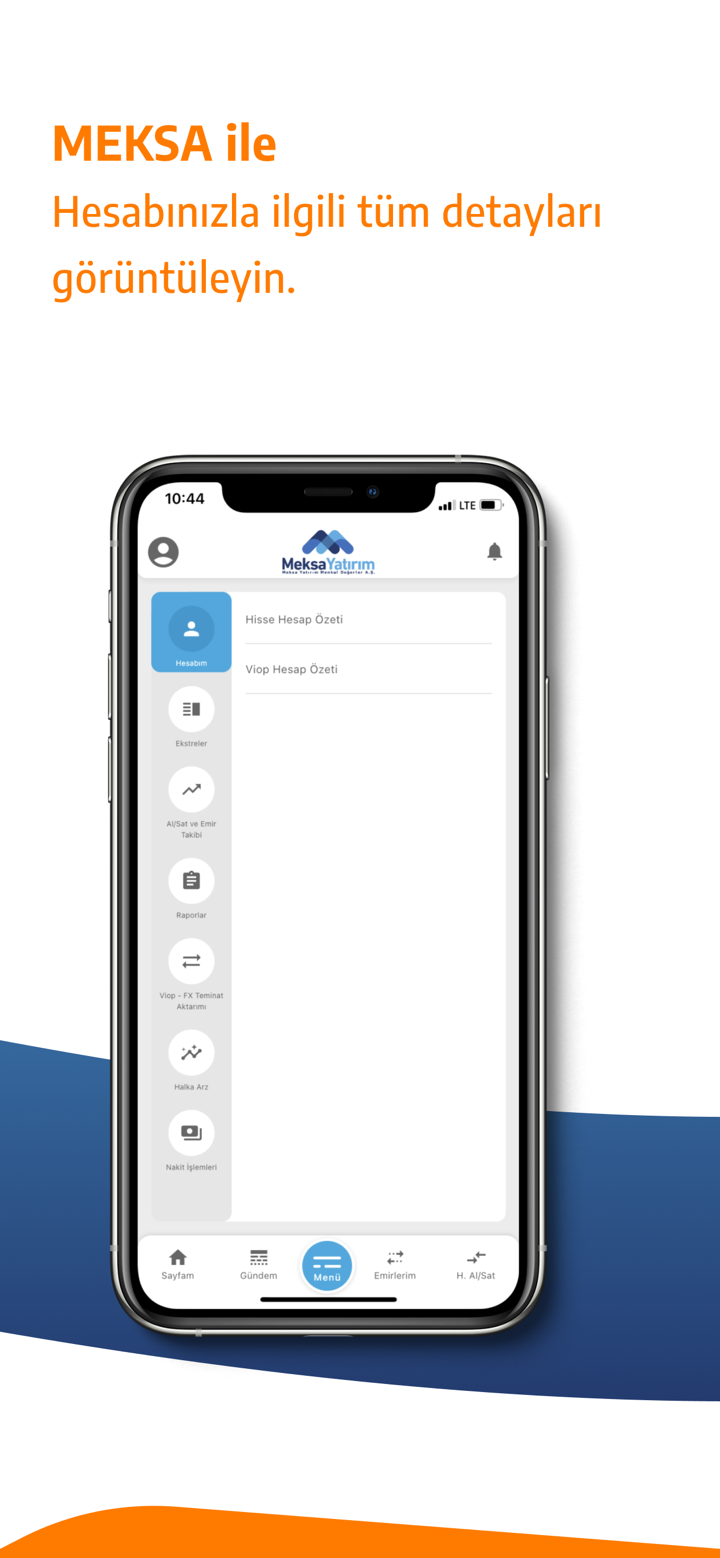

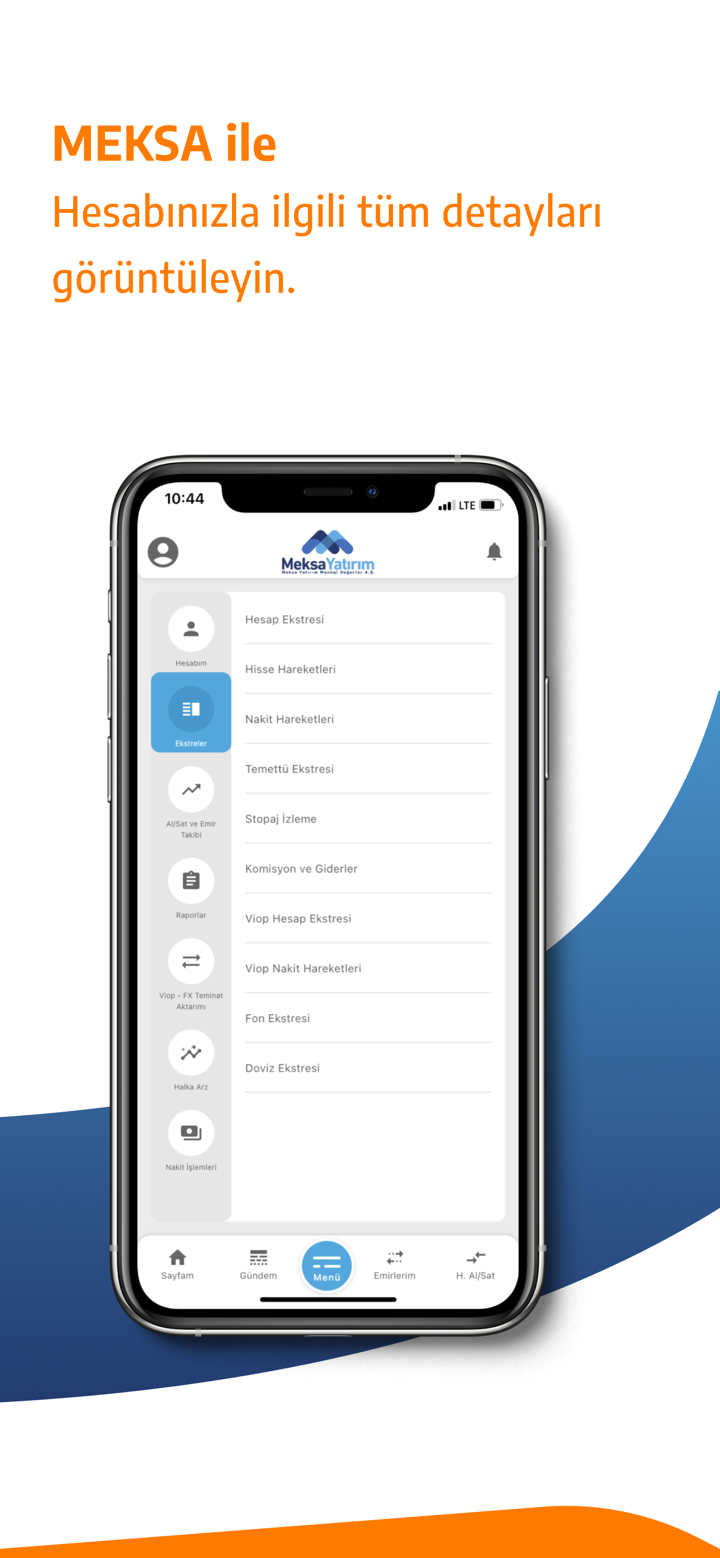

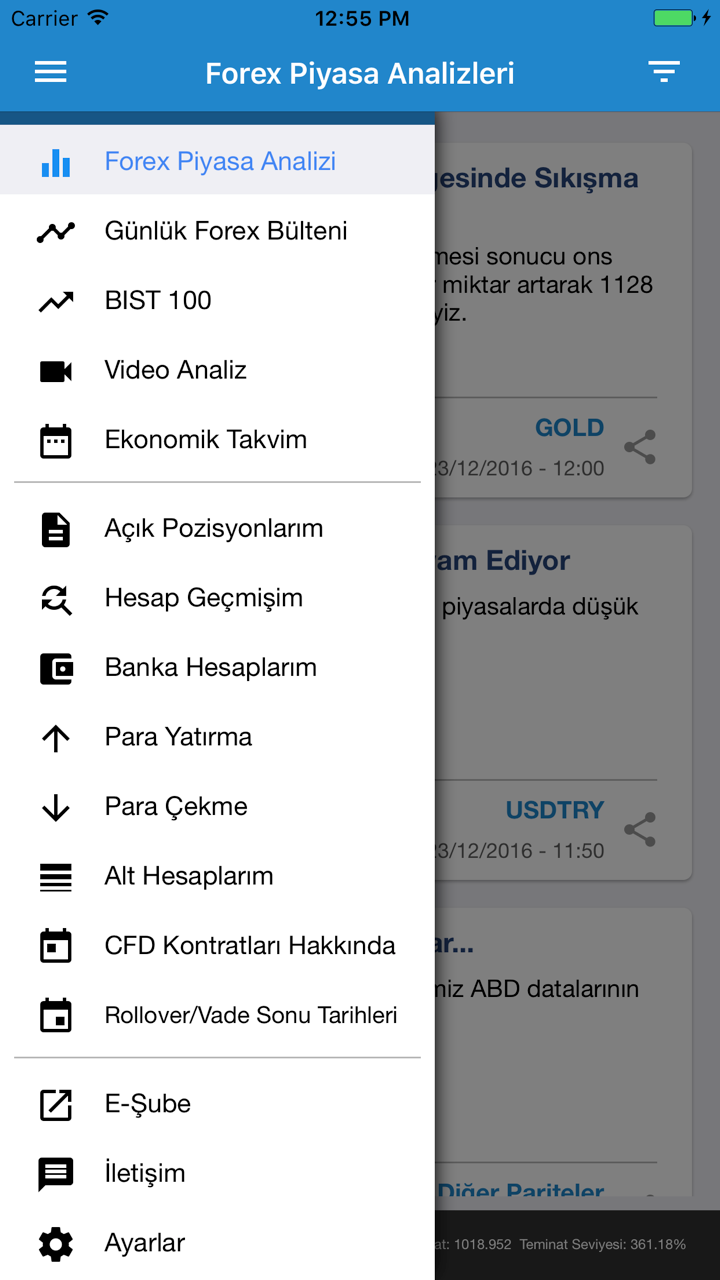

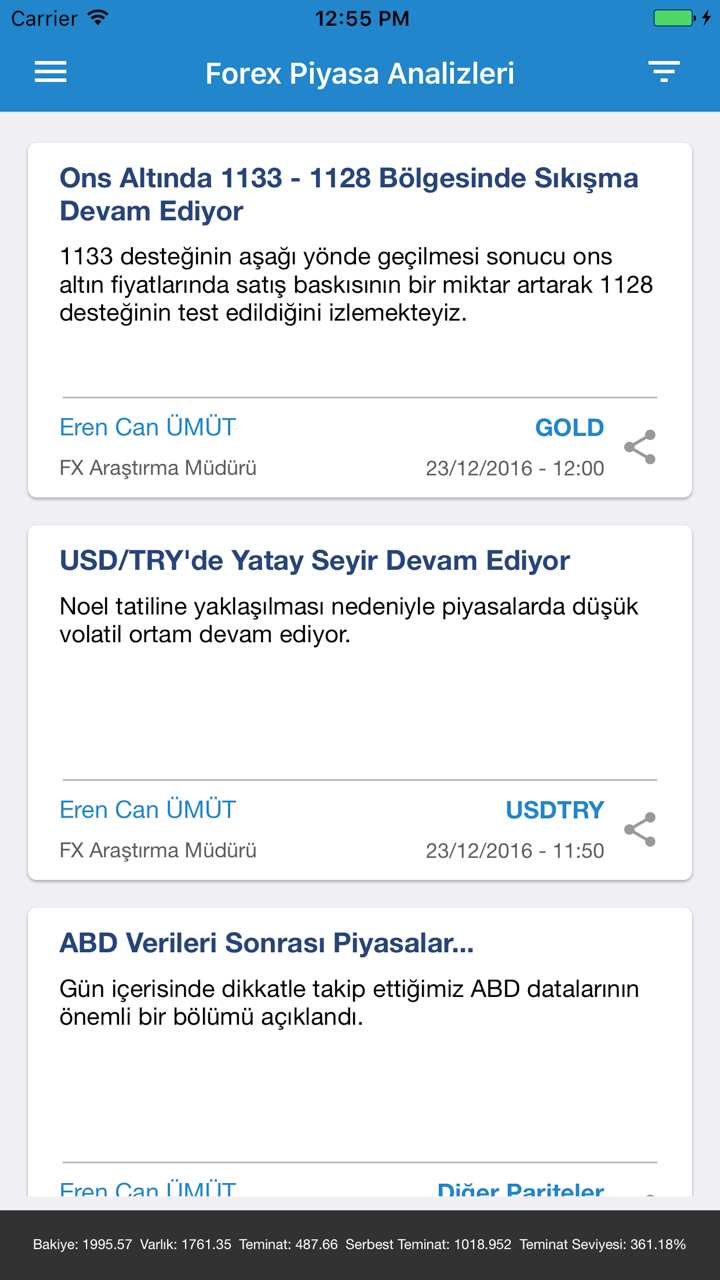

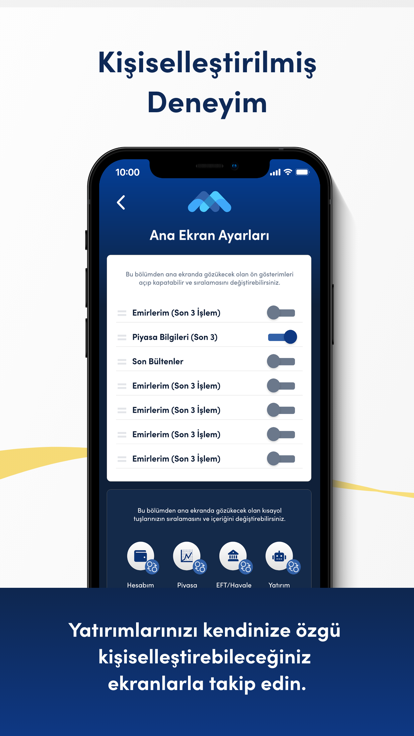

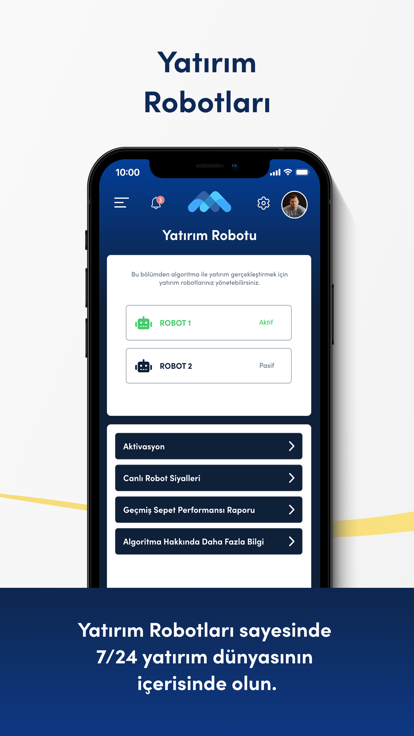

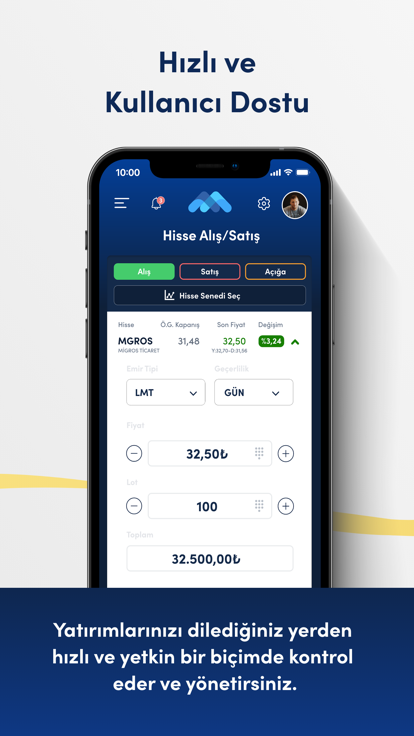

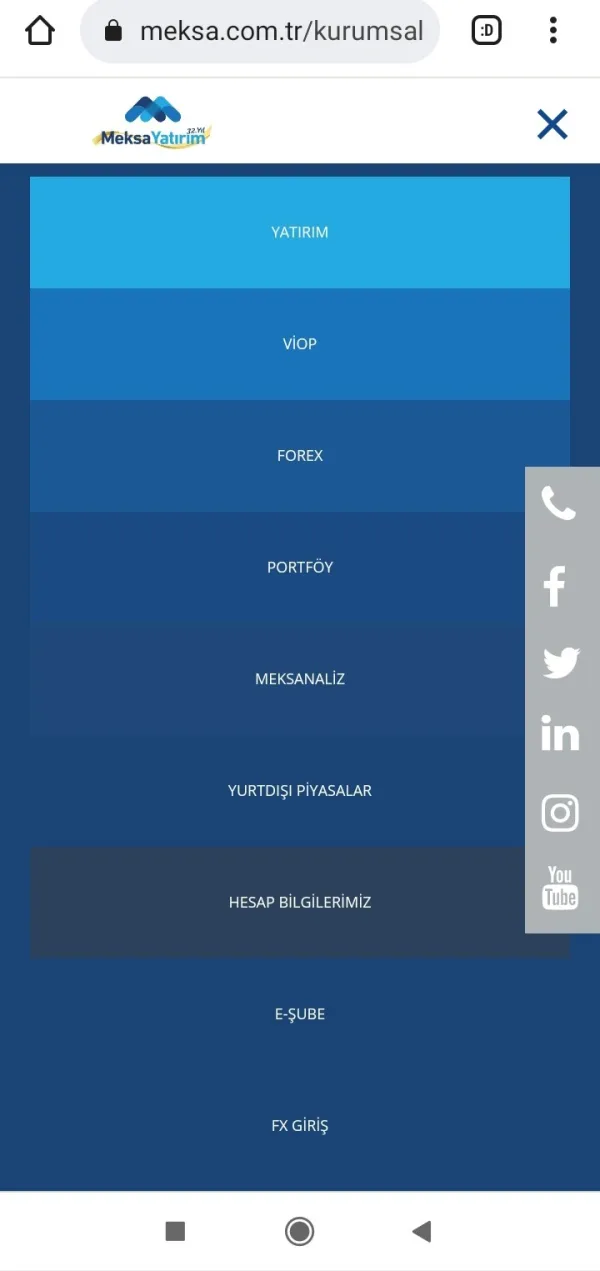

MEKSAwirbt damit, dass es eine vielfältige Palette von Dienstleistungen anbietet, darunter Anlageberatung, Maklerdienste, Portfoliomanagement, derivative Instrumente, Viop-Dienste, Fondsmanagement, Forschung, Devisenmärkte und Unternehmensfinanzierung.

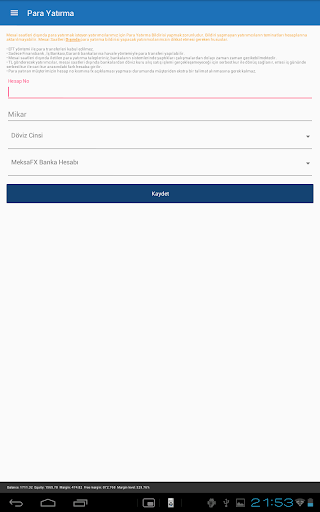

Ein- und Auszahlung

der Mindesteinzahlungsbetrag, um die darin enthaltenen Deviseninvestitionen zu realisieren MEKSA Laut CMB sollen es 50.000 TL sein. Der Broker machte jedoch keine Angaben zu den akzeptablen Ein- und Auszahlungsmethoden.

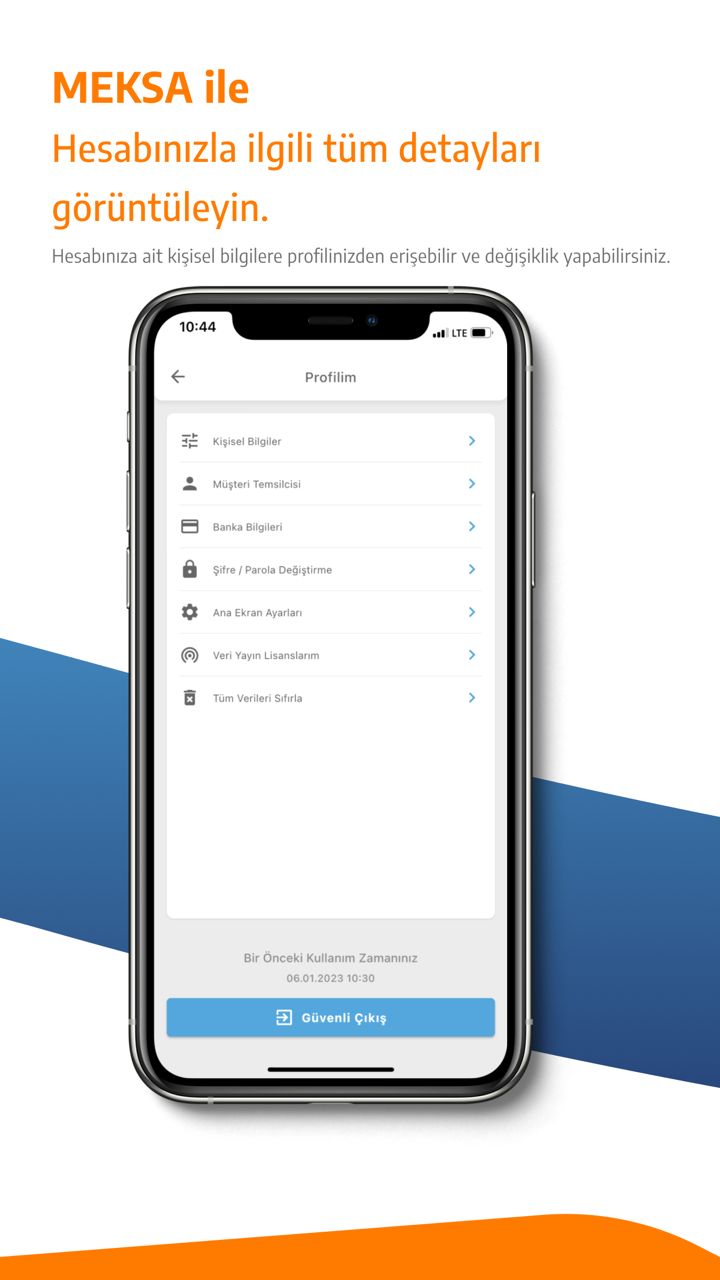

Kundendienst

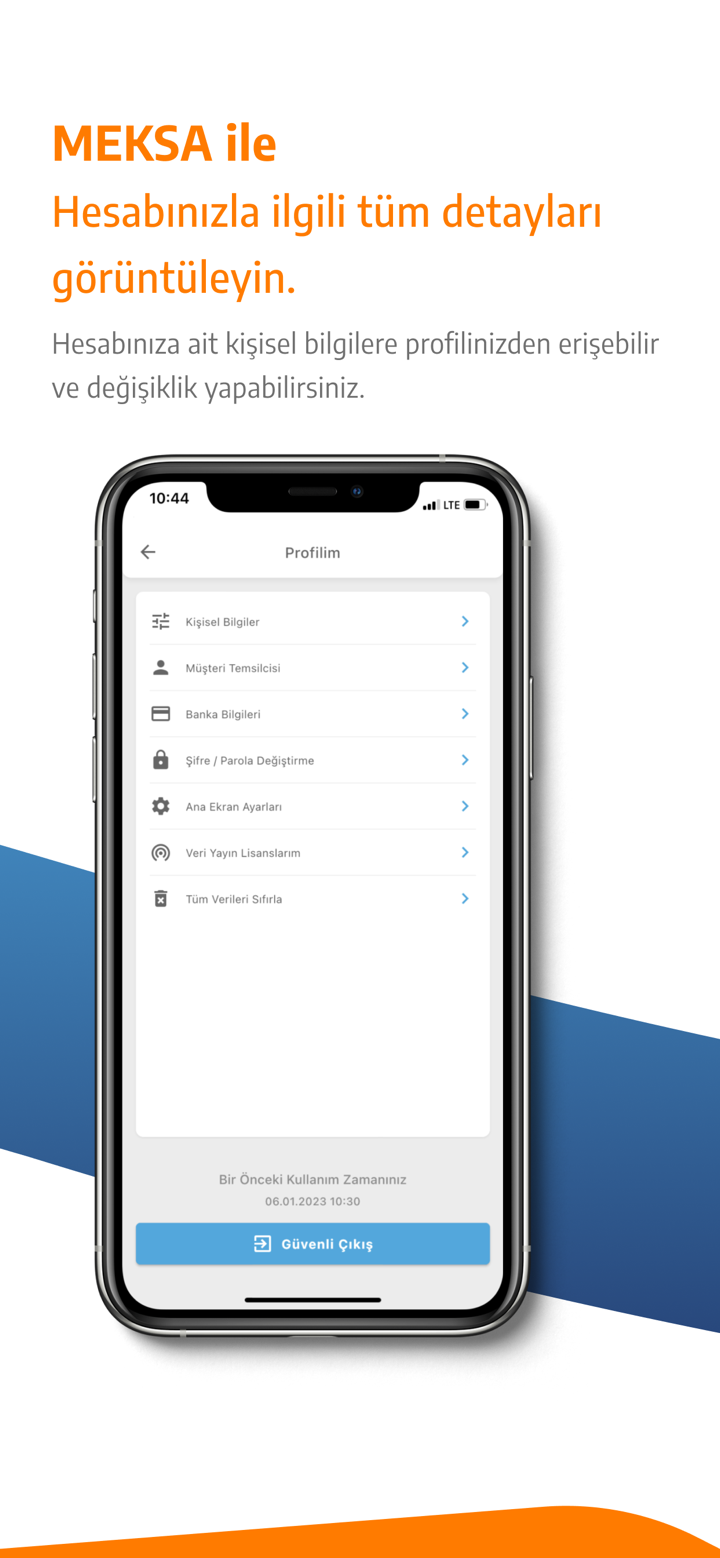

MEKSADer Kundensupport von s ist erreichbar unter: 02166813400, Fax: +90 (216) 6930570, +90 (216) 6930571, +90 (216) 6930572, E-Mail: destek@ MEKSA fx.com oder senden Sie Nachrichten online, um mit uns in Kontakt zu treten. Sie können diesem Broker auch auf Social-Media-Plattformen wie Twitter, Facebook, Instagram, YouTube und LinkedIn folgen. Firmenadresse: şehit teğmen ali yılmaz sok. güven sazak plaza a block no:13 kat: 3-4 34810 kavacık - beykoz / istanbul.

Risikowarnung

Der Online-Handel birgt ein erhebliches Risiko und Sie können Ihr gesamtes investiertes Kapital verlieren. Es ist nicht für alle Händler oder Investoren geeignet. Bitte stellen Sie sicher, dass Sie die damit verbundenen Risiken verstehen und beachten Sie, dass die in diesem Artikel enthaltenen Informationen nur allgemeinen Informationszwecken dienen.