Temel Bilgiler

Türkiye

Türkiye

Puan

Türkiye

|

5-10 yıl

|

Türkiye

|

5-10 yıl

| https://www.meksa.com.tr/yatirim

Web Sitesi

Derecelendirme Endeksi

Etkilemek

C

Etki endeksi NO.1

Avusturya 6.48

Avusturya 6.48 Lisans

LisansGeçerli düzenleyici bilgi yok, riskin farkında olun lütfen!

Türkiye

Türkiye meksa.com.tr

meksa.com.tr Türkiye

TürkiyeGenel Bilgiler ve Yönetmelik

MEKSA, ticari adı Meksa Yatırım Menkul Değerler A.Ş , iddiaya göre 28 Haziran 1990 tarihinde kurulmuş ve türkiye'de kayıtlı bir finansal aracı kurumdur. aracı kurum, sermaye piyasası kurulundan aldığı alım satıma aracılık yetki belgesi ile borsa istanbul borsasında faaliyet gösterdiğini belirterek, bireysel ve kurumsal müşterilerine çeşitli finansal hizmetler sunduğunu iddia etmektedir. İşte bu broker resmi sitesinin ana sayfası:

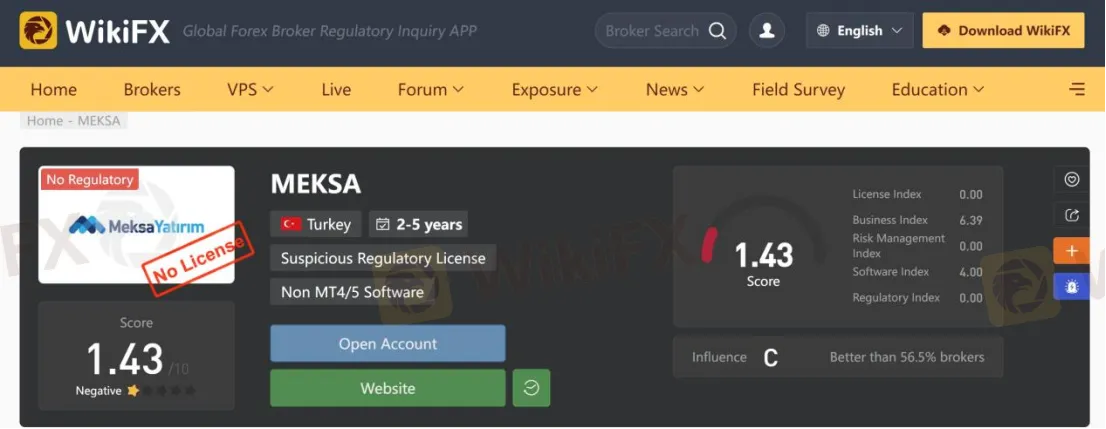

Yönetmeliğe gelince, doğrulandı MEKSA herhangi bir geçerli düzenleme kapsamına girmez. bu nedenle wikifx'teki düzenleyici statüsü "lisans yok" olarak listeleniyor ve 1.43/10 gibi nispeten düşük bir puan alıyor. lütfen riskin farkında olun.

Olumsuz Yorumlar

bir tüccar korkunç ticaret deneyimini paylaştı MEKSA wikifx platformu. dedi ki MEKSA bir dolandırıcılık komisyoncusu ve söz verilen %50 depozitoyu tarih geldiğinde alamadı. Dolandırıcılar tarafından dolandırılma ihtimaline karşı, tüccarların forex brokerlerini seçmeden önce bazı kullanıcılar tarafından bırakılan yorumları okumaları gerekir.

Hizmetler

MEKSAyatırım danışmanlığı, aracılık hizmetleri, portföy yönetimi, türev araçlar, viop hizmetleri, fon yönetimi, araştırma, forex piyasaları ve kurumsal finansman gibi geniş bir yelpazede hizmet sunduğunun reklamını yapmaktadır.

Para Yatırma ve Para Çekme

içerisinde forex yatırımlarını gerçekleştirmek için minimum para yatırma tutarı MEKSA SPK tarafından 50.000 TL olduğu söyleniyor. ancak komisyoncu, kabul edilebilir para yatırma ve çekme yöntemleri hakkında herhangi bir bilgi açıklamadı.

Müşteri desteği

MEKSAmüşteri desteğine telefonla ulaşılabilir: 02166813400, faks: +90 (216) 6930570, +90 (216) 6930571, +90 (216) 6930572, e-posta: destek@ MEKSA İletişime geçmek için fx.com veya çevrimiçi mesaj gönderin. bu komisyoncuyu twitter, facebook, instagram, youtube ve linkedin gibi sosyal medya platformlarında da takip edebilirsiniz. şirket adresi: şehit teğmen ali yılmaz sok. güven sazak plaza a blok no:13 kat:3-4 34810 kavacık - beykoz / istanbul.

Risk Uyarısı

Çevrimiçi ticaret önemli düzeyde risk içerir ve yatırdığınız sermayenin tamamını kaybedebilirsiniz. Tüm tüccarlar veya yatırımcılar için uygun değildir. Lütfen ilgili riskleri anladığınızdan emin olun ve bu makalede yer alan bilgilerin yalnızca genel bilgi amaçlı olduğunu unutmayın.

As an independent forex trader with years of experience navigating various brokerage platforms, I always prioritize safety and transparency when evaluating a broker’s deposit and withdrawal processes. With MEKSA, I found significant gaps in available information regarding both deposit and withdrawal methods. While the platform claims to require a minimum deposit of 50,000 TL for forex investments—a relatively high threshold—the precise payment channels for deposits or withdrawals are not disclosed on their official website or within publicly available documentation. This lack of transparency gives me pause. Fast or immediate withdrawals are a key criterion for my trading, and any credible broker should clearly specify supported payment options, withdrawal speeds, and associated fees. In MEKSA’s case, the absence of this information makes it impossible for me to confirm whether any instant withdrawal methods are available. Moreover, MEKSA is currently operating without a valid regulatory license, which elevates the risk profile and further weakens my confidence in their fund-handling practices. Given my background and the risks documented—including negative user experiences and regulatory concerns—I cannot confidently recommend relying on MEKSA for fast or reliable withdrawals. For any trader, especially with sizable deposits at stake, it is critical to work only with brokers that offer proven, transparent, and regulated payment systems. For me, the uncertainty present here is an unacceptable risk.

As an independent trader with many years of experience evaluating brokers, I am always cautious when dealing with firms that have limited transparency or carry regulatory uncertainties. In my research and careful examination of the available information about MEKSA, I found that there is a notable lack of publicly disclosed details regarding account fees—specifically, the presence or absence of inactivity fees. The broker does not make specifics about fee structures, including inactivity fees, easily accessible on its website or within reliable third-party reviews. In my own practice, I place great importance on clarity around such operational costs, as undisclosed or unexpected charges can materially affect trading outcomes. The absence of clear information on inactivity fees at MEKSA leaves a gap that could present unforeseen risks for both active and less frequent traders. In my experience, when a broker does not communicate its fee policies openly—especially in a context where regulatory protection is lacking—it warrants an extra degree of caution. Given MEKSA’s unregulated status and the limited fee transparency, I would be very careful when considering this broker. Anyone contemplating opening an account should contact customer service directly and request written, up-to-date documentation regarding all possible fees, including inactivity fees, before depositing any funds. This approach helps avoid unpleasant surprises and supports sound risk management, which is central to responsible trading.

Speaking from my experience as a trader who is vigilant about broker reliability and client fund safety, I could not find any evidence that MEKSA supports deposits via cryptocurrencies such as Bitcoin or USDT. The minimum deposit at MEKSA is specified as 50,000 TL, conforming to Turkish Capital Markets Board requirements, but there is no clear disclosure regarding their accepted funding methods. Personally, I’m cautious when a broker omits such critical information, as transparency about deposit and withdrawal processes is a basic standard of professionalism and trustworthiness. Moreover, MEKSA operates without any valid regulatory oversight, and its risk indicators are concerningly high—WikiFX notes both a lack of license and a very low trust score. In my view, this absence of transparency or regulatory protection substantially increases risk. In the absence of official or detailed documentation about funding options—especially for something as sensitive as cryptocurrency transfers—I would not assume such channels are available. For me, this lack of clarity makes MEKSA unsuitable for handling my funds, much less for something as irreversible and untraceable as crypto deposits. Ultimately, unless MEKSA formally announces support for cryptocurrencies through official channels, I would recommend proceeding with extreme caution.

In my experience as a forex trader, transparency around fees—especially for deposits and withdrawals—is crucial when considering any brokerage. With MEKSA, I have found the available information regarding their fee structure to be worryingly sparse. There is no published detail on their website or in their publicly available materials about specific deposit or withdrawal fees. This lack of disclosure immediately raises a red flag for me, as I have learned that reputable brokers are typically forthcoming about all potential charges to ensure client trust. Additionally, MEKSA's regulatory status further compounds my concerns. They do not hold a valid license from a recognized authority, and their risk management index on independent review sites is extremely low. In the forex trading world, unregulated brokers often fail to provide clear, accessible information about operational fees, which can sometimes lead to unexpected or hidden costs for traders. Given this absence of clear information and the broker’s high-risk profile, I am especially cautious. I would not feel comfortable depositing funds with MEKSA until I received written confirmation—ideally from their customer support—about all associated fees, including deposits and withdrawals. In my view, the combination of regulatory ambiguity and lack of fee transparency makes it difficult to rule out the possibility of hidden fees. As always, I advocate double-checking all cost structures in advance and only working with brokers who communicate openly and verify their regulatory standing.

Lütfen giriş yapın...

TOP

TOP

Chrome

Chrome uzantısı

Küresel Forex Broker Düzenleyici Sorgulama

Forex brokerlerinin web sitelerine göz atın ve hangilerinin güvenilir hangilerinin dolandırıcı olduğunu doğru bir şekilde belirleyin

Şimdi Yükle