Resumo da empresa

Informações Gerais e Regulamento

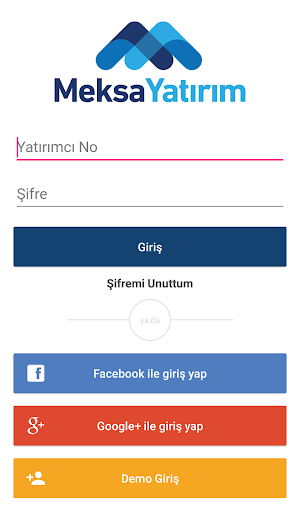

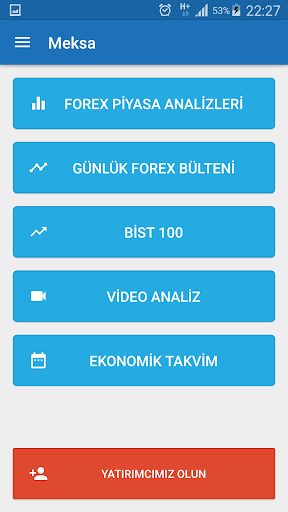

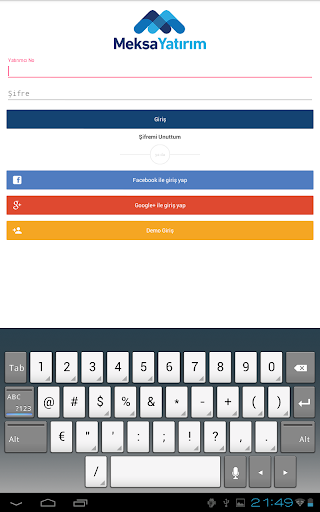

MEKSA, um nome comercial de Meksa Yatırım Menkul Değerler A.Ş , é supostamente uma corretora financeira estabelecida em 28 de junho de 1990 e registrada na turquia. a corretora informa que atua na bolsa de valores de borsa istambul com o certificado de autorização para intermediação de negociação obtido junto ao conselho do mercado de capitais, alegando fornecer a seus clientes pessoas físicas e jurídicas diversos serviços financeiros. aqui está a página inicial do site oficial deste corretor:

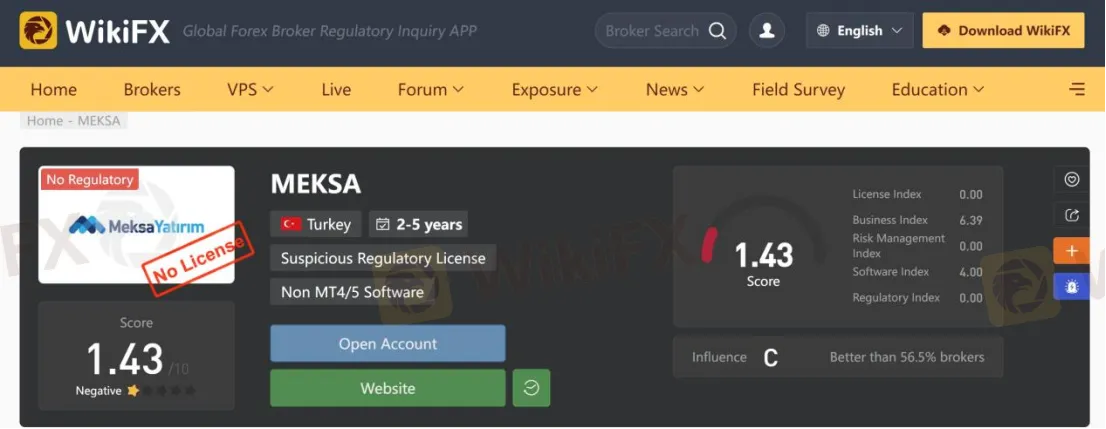

quanto à regulamentação, verificou-se que MEKSA não se enquadra em nenhum regulamento válido. é por isso que seu status regulatório no wikifx é listado como “sem licença” e recebe uma pontuação relativamente baixa de 1,43/10. por favor, esteja ciente do risco.

Avaliações negativas

um comerciante compartilhou sua terrível experiência comercial no MEKSA plataforma no wikifx. ele disse que MEKSA é um corretor fraudulento e não recebeu o depósito prometido de 50% quando chegou a data. é necessário que os comerciantes leiam as avaliações deixadas por alguns usuários antes de escolher os corretores forex, caso sejam enganados por golpes.

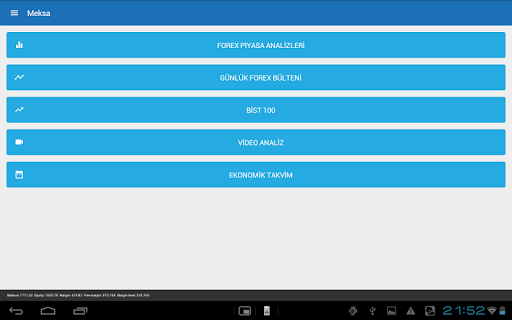

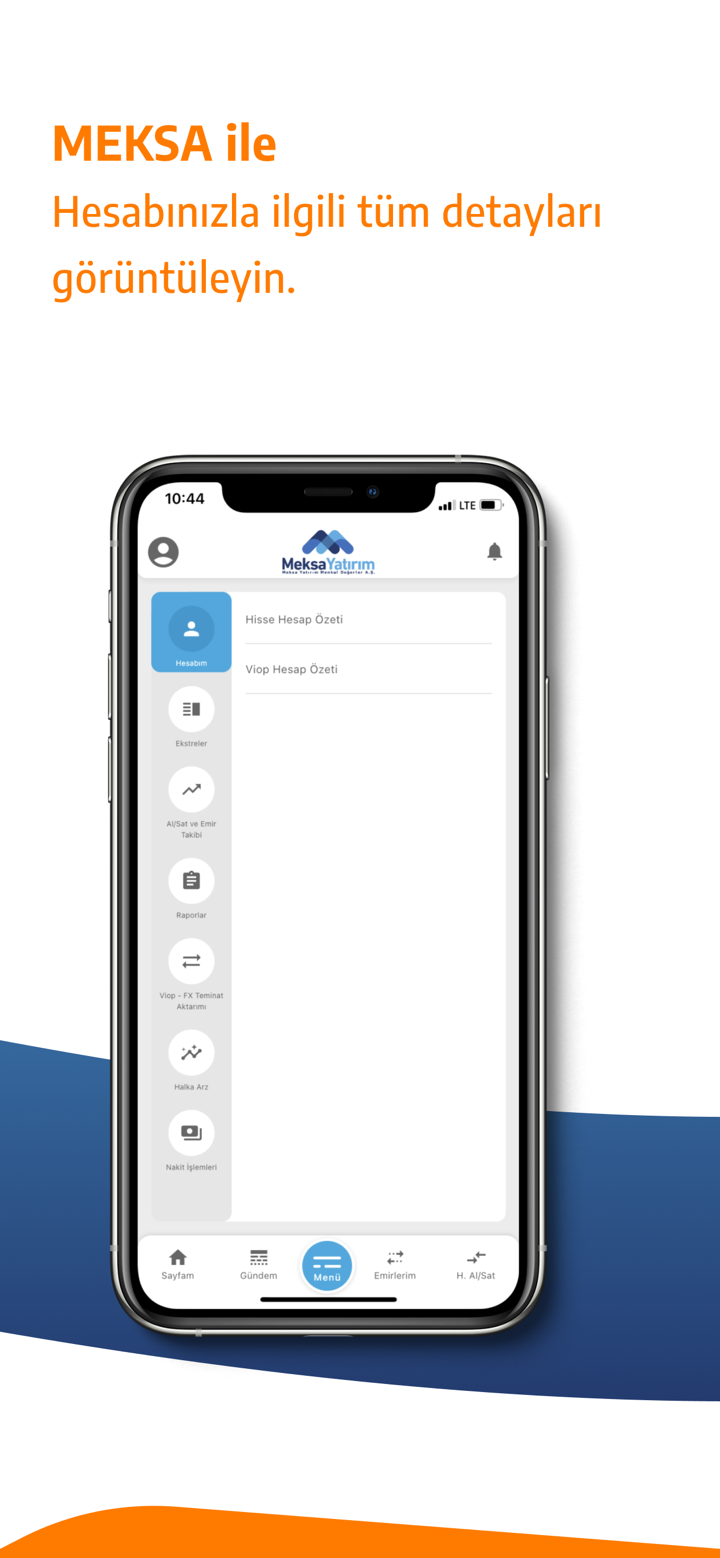

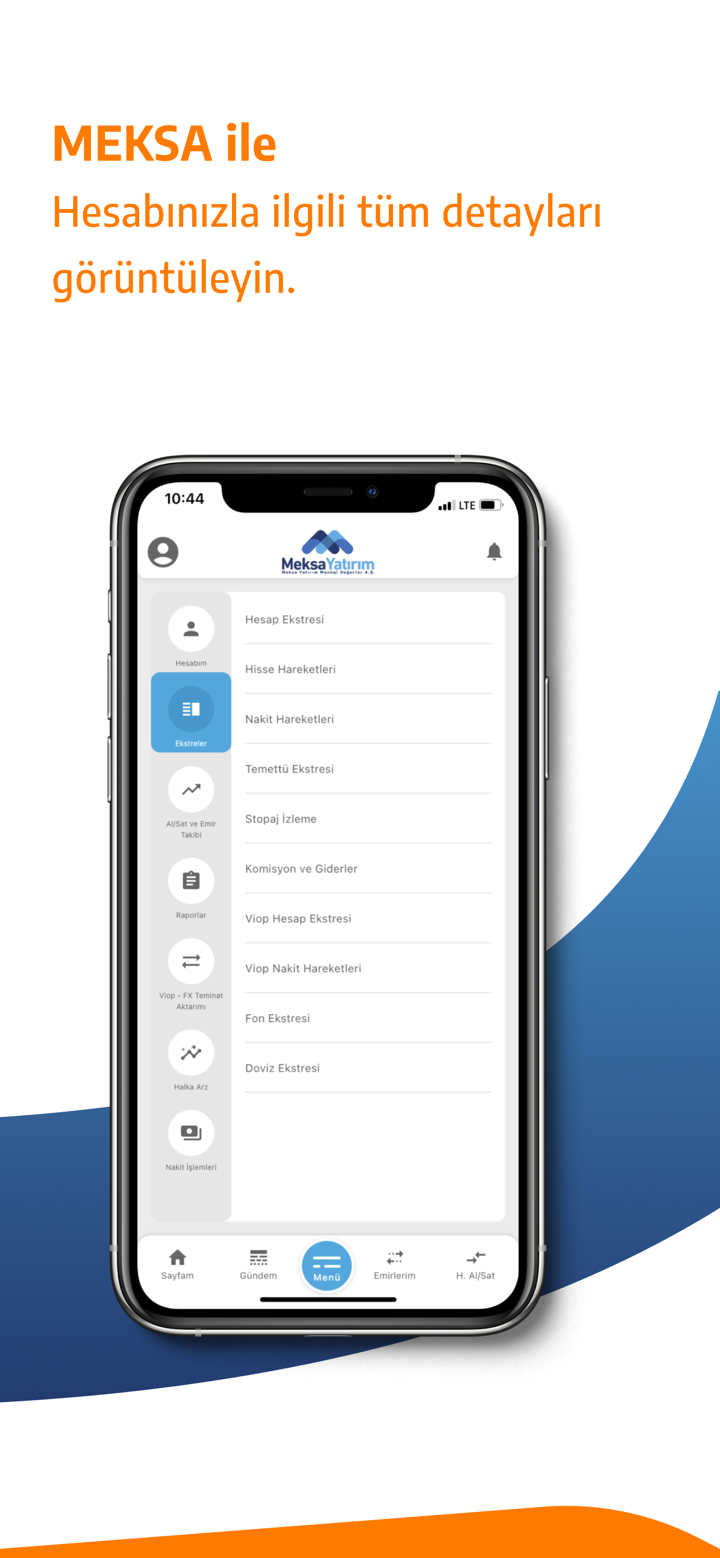

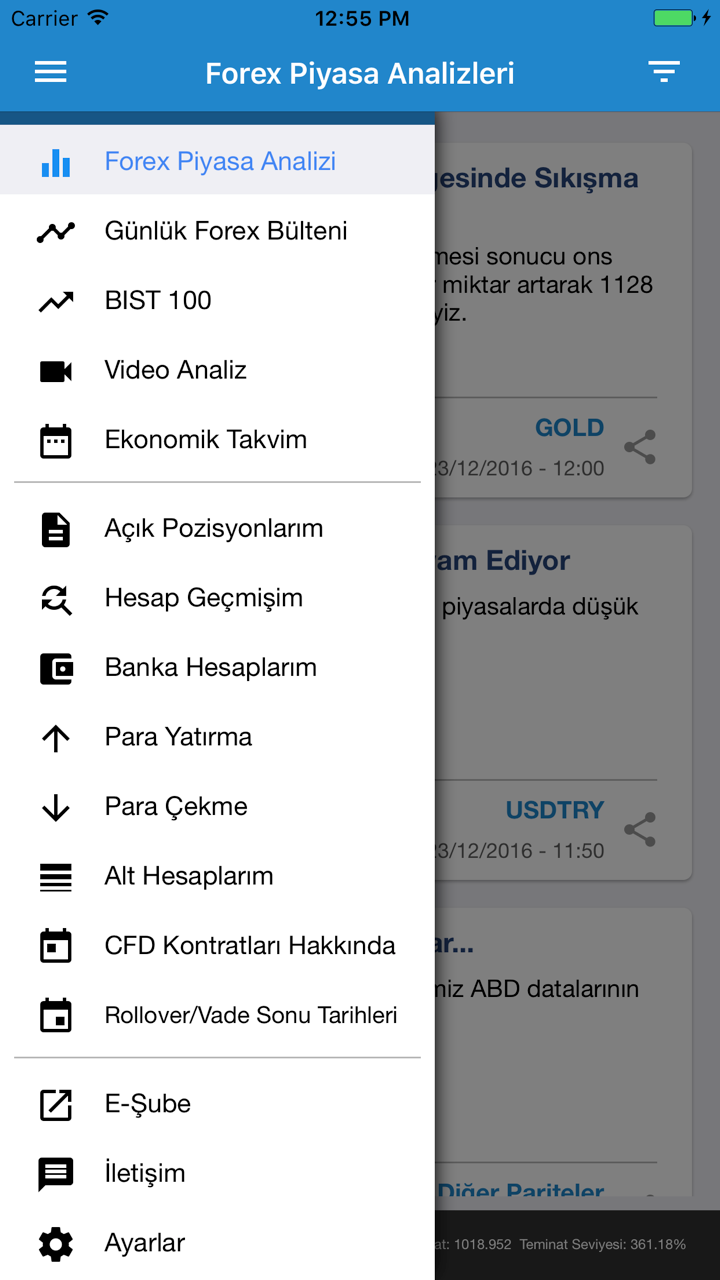

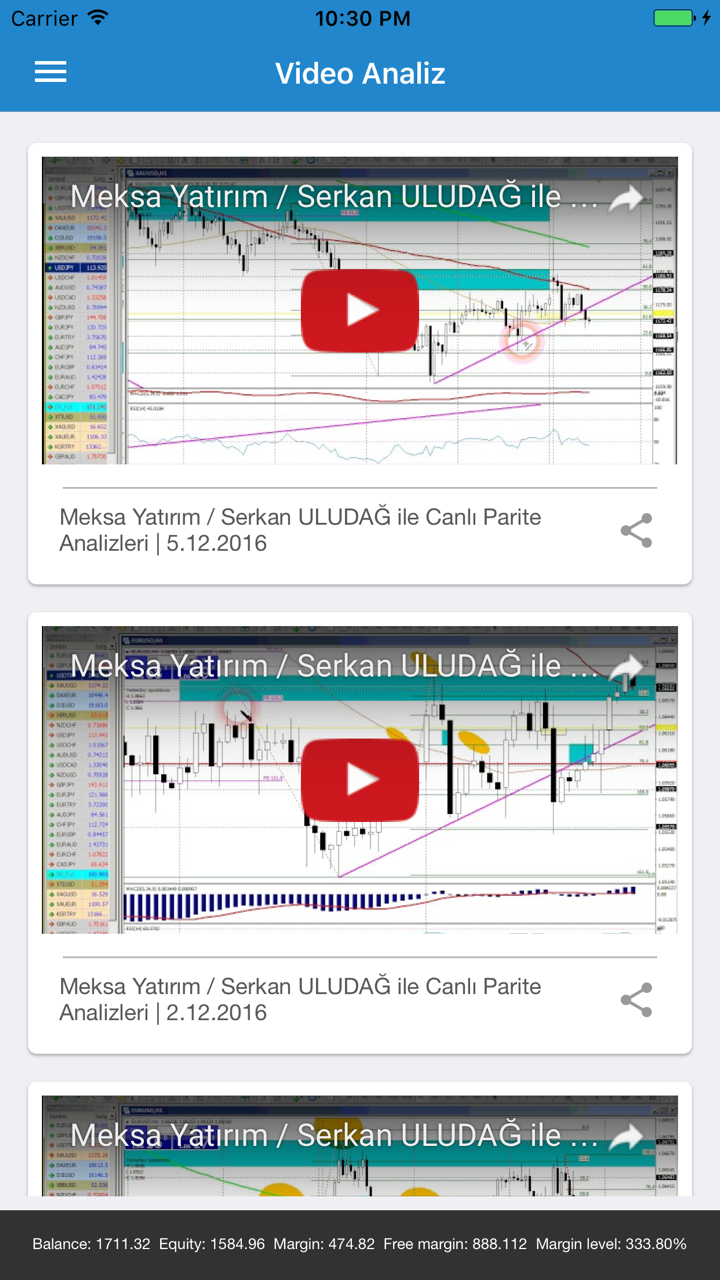

Serviços

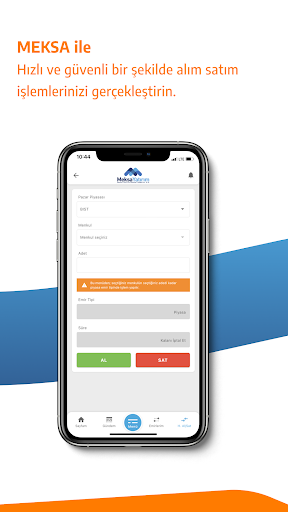

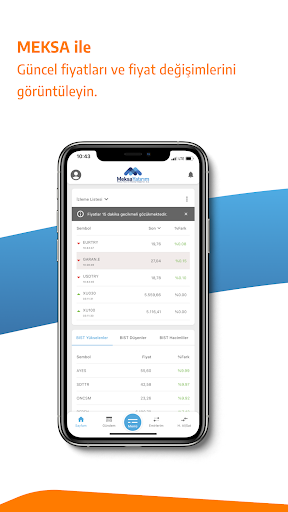

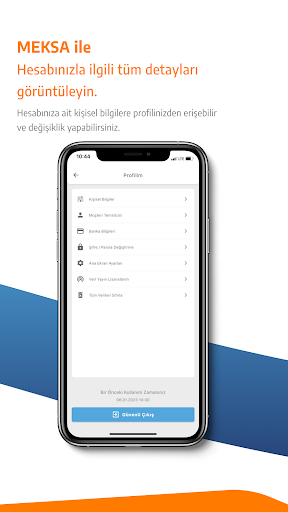

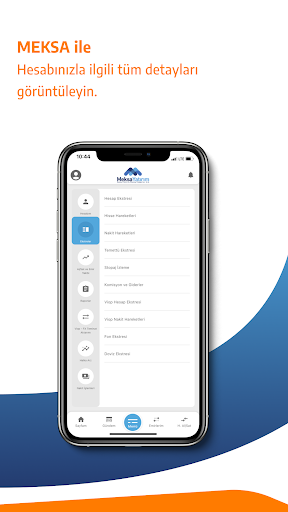

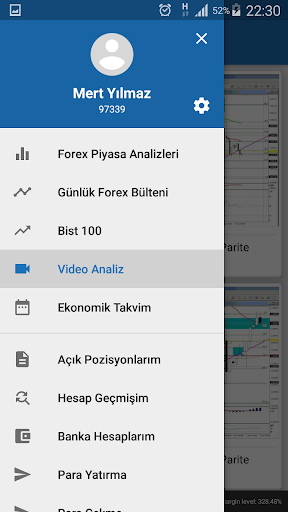

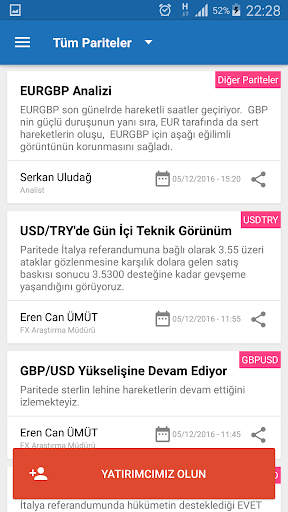

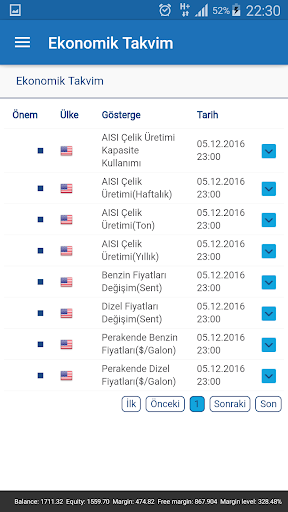

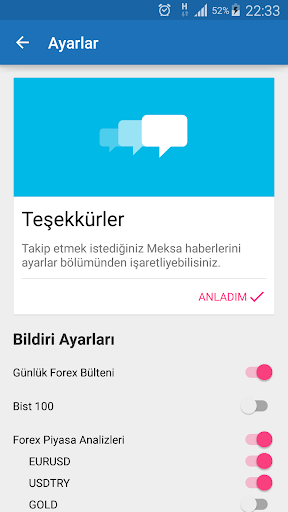

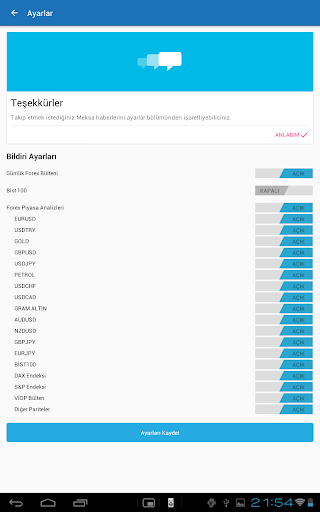

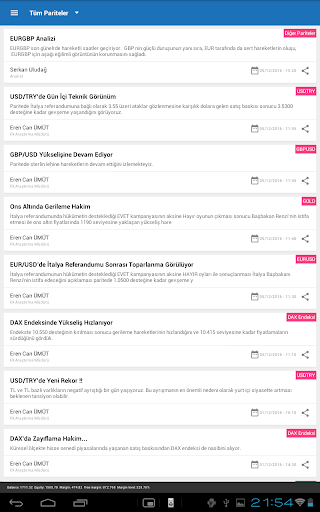

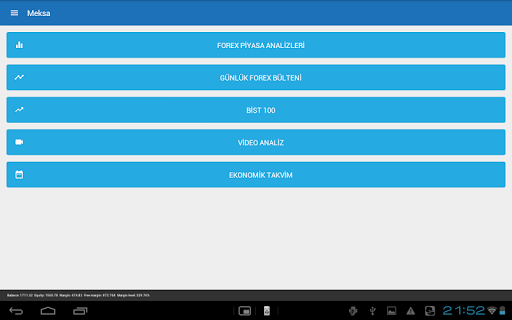

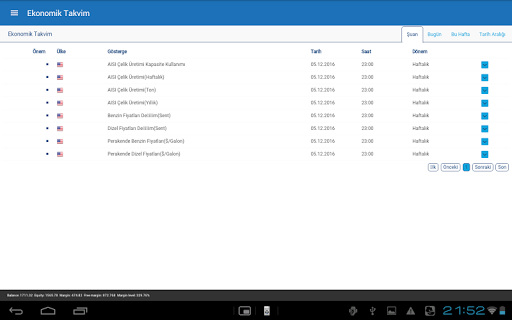

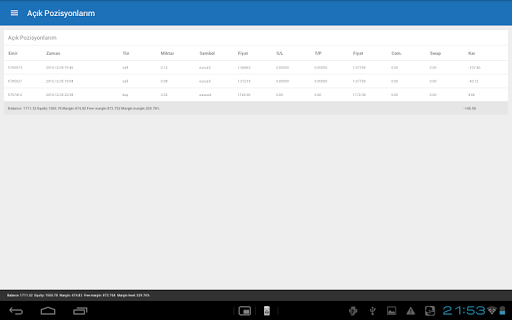

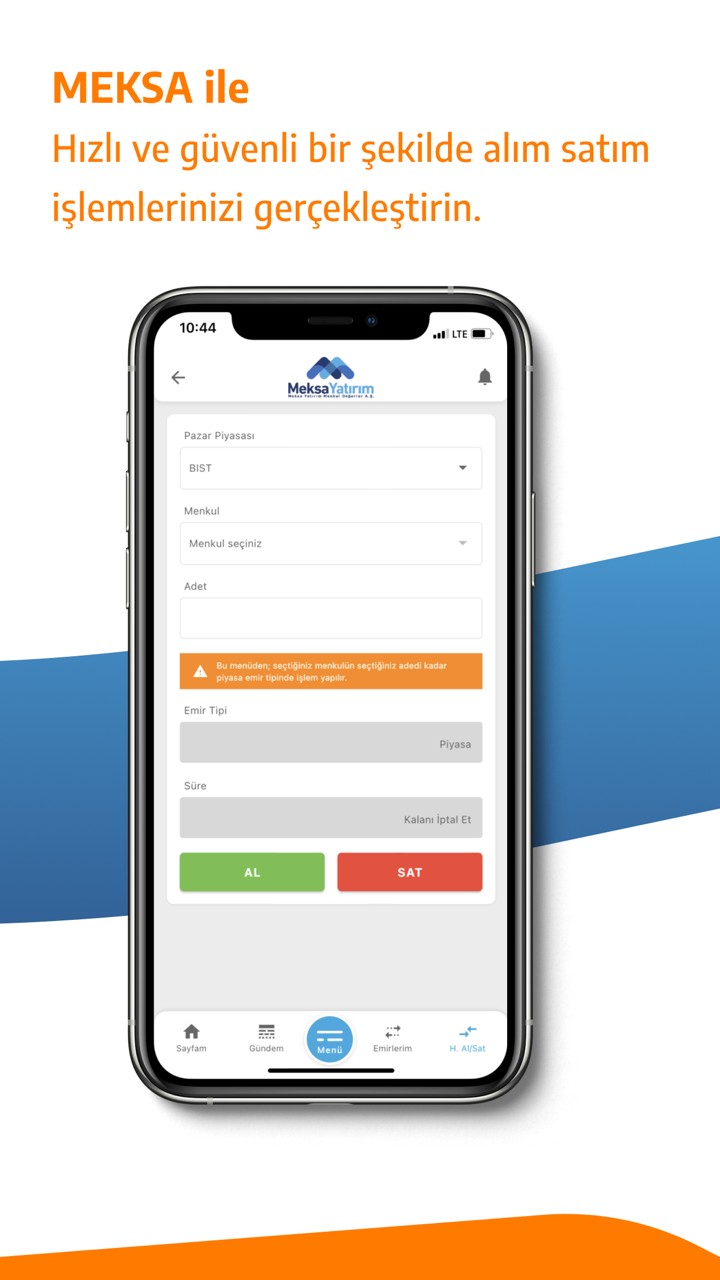

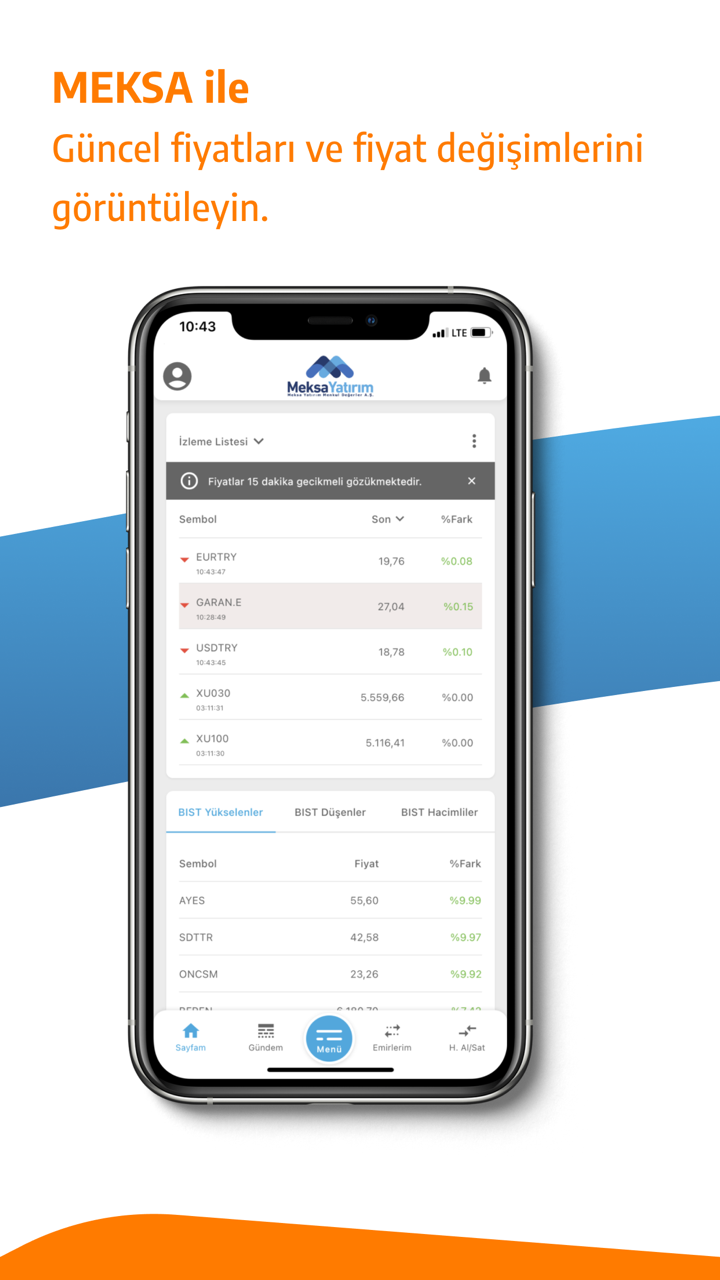

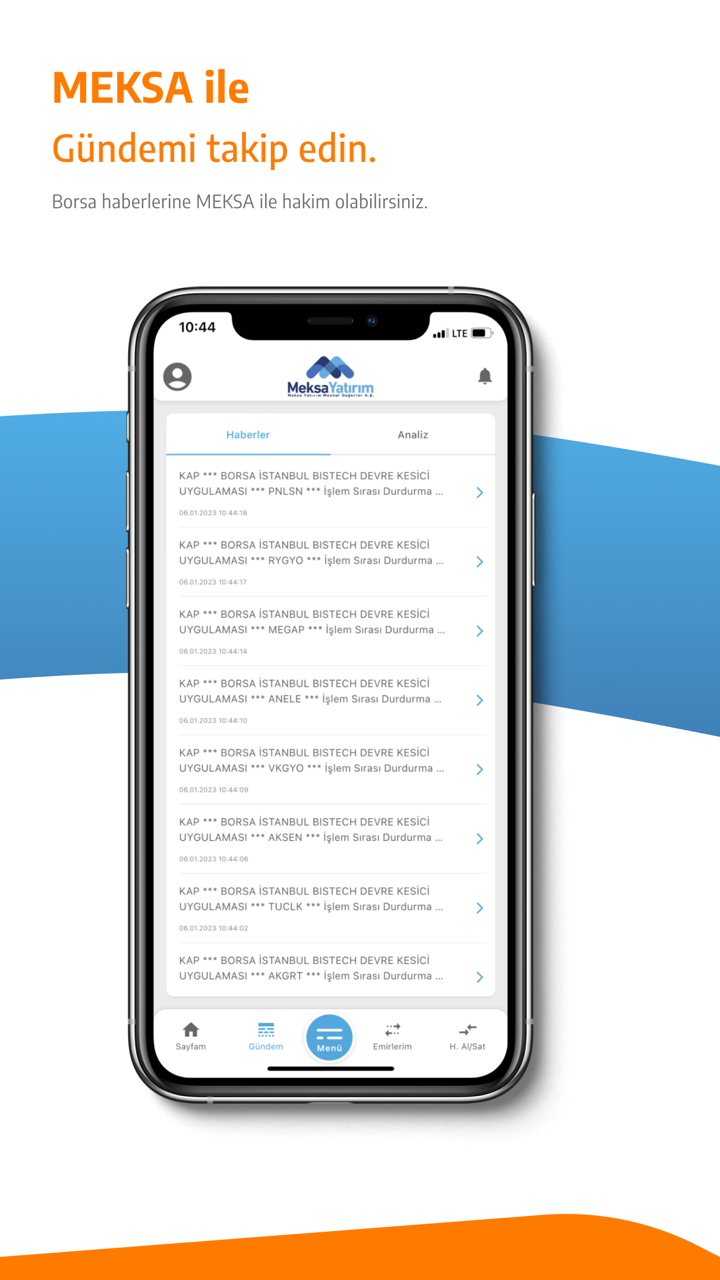

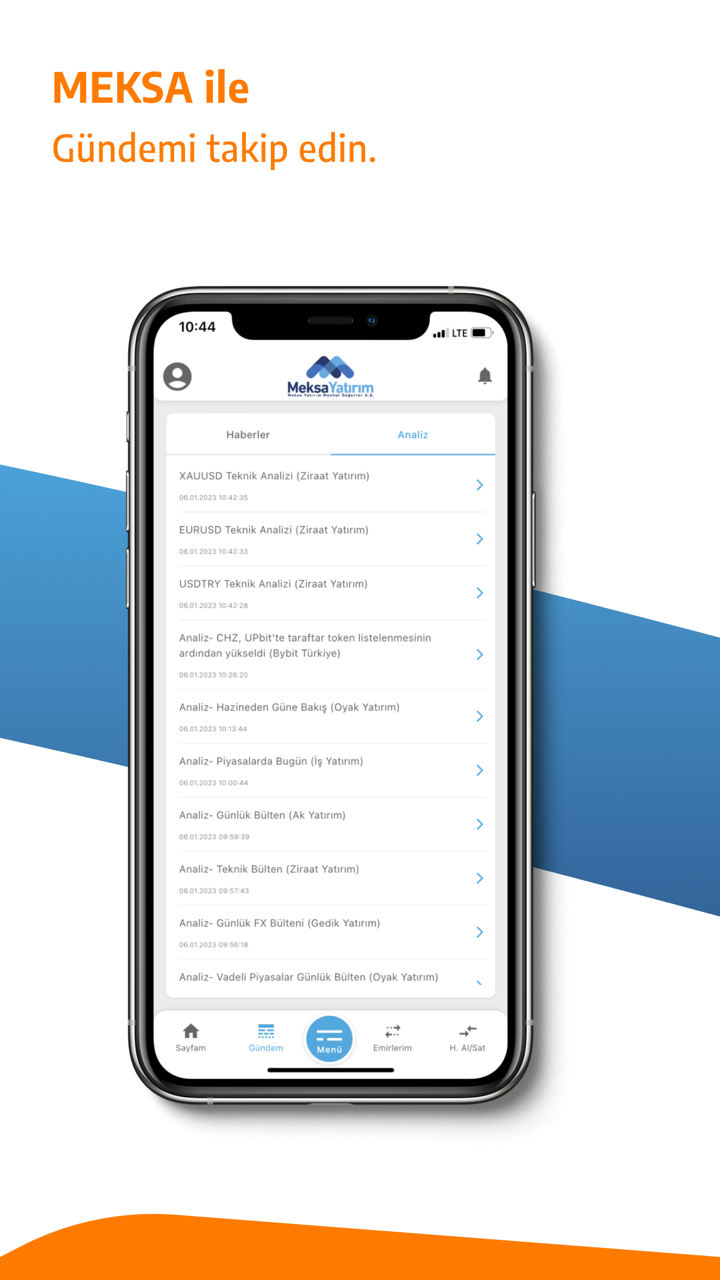

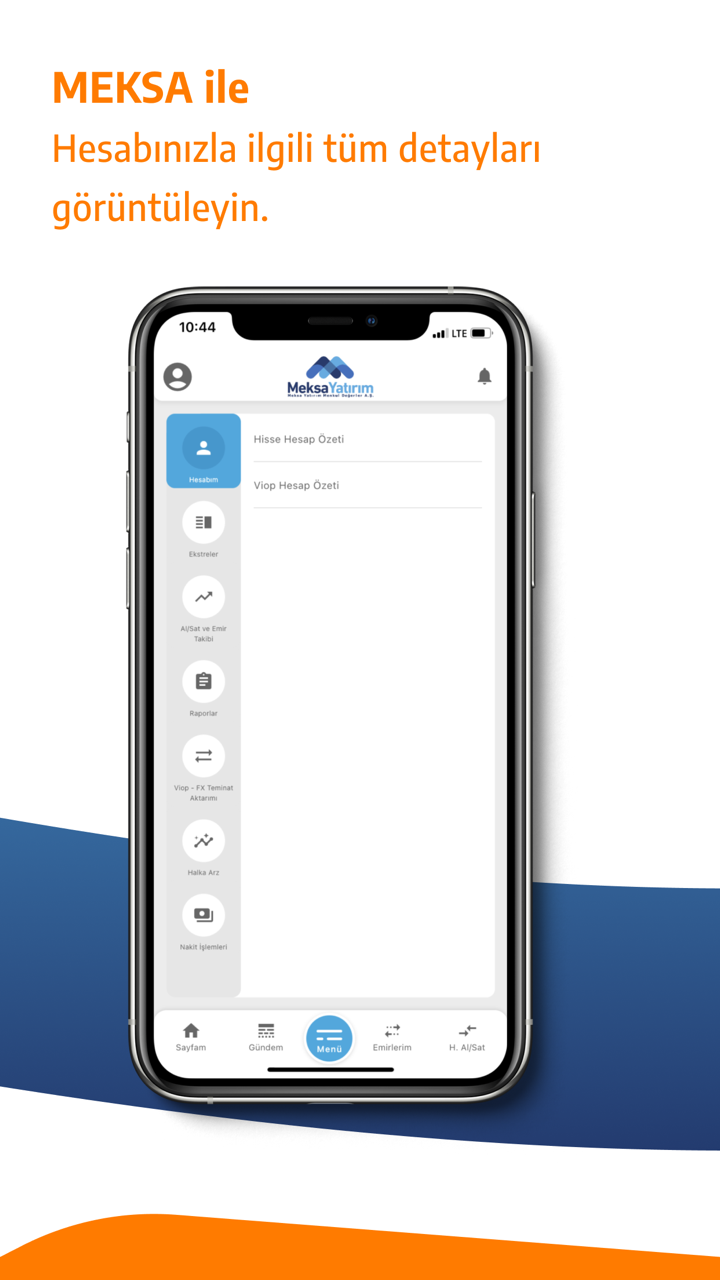

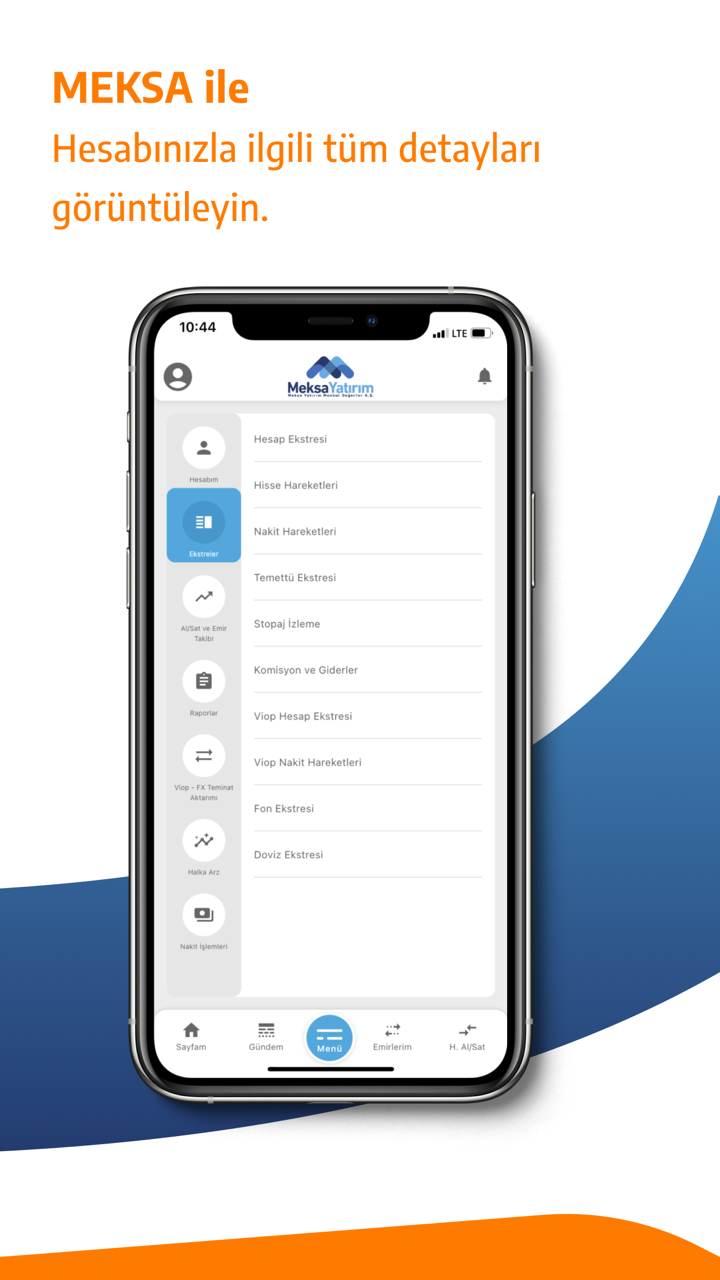

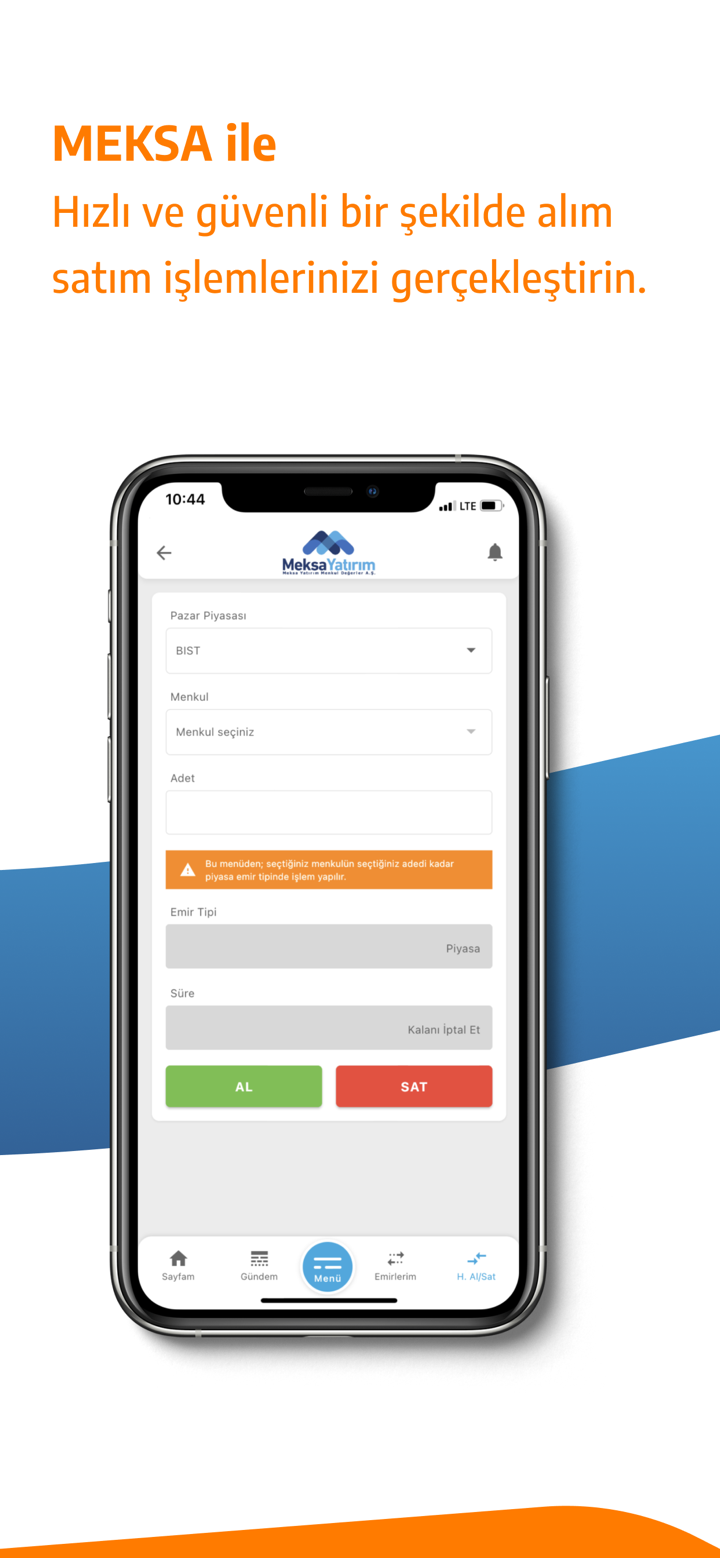

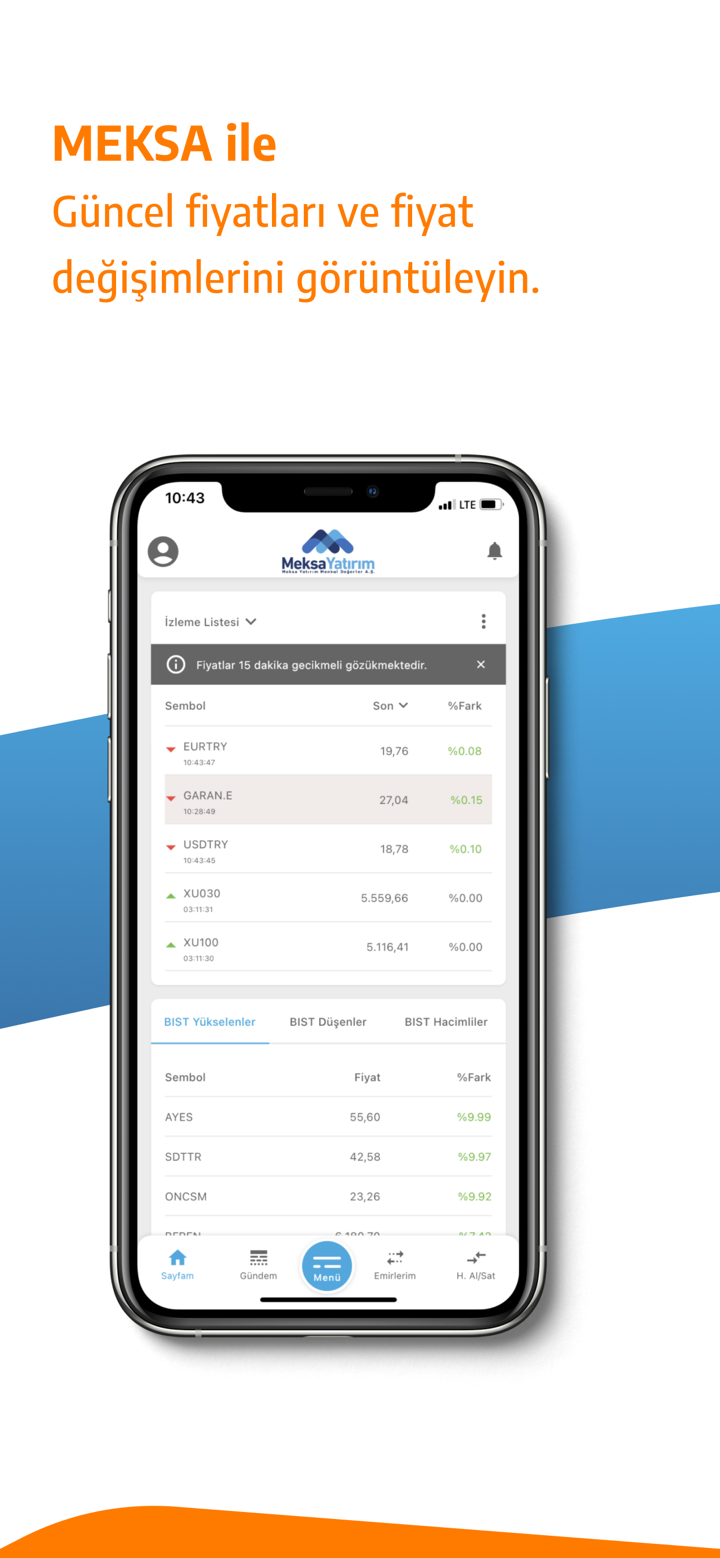

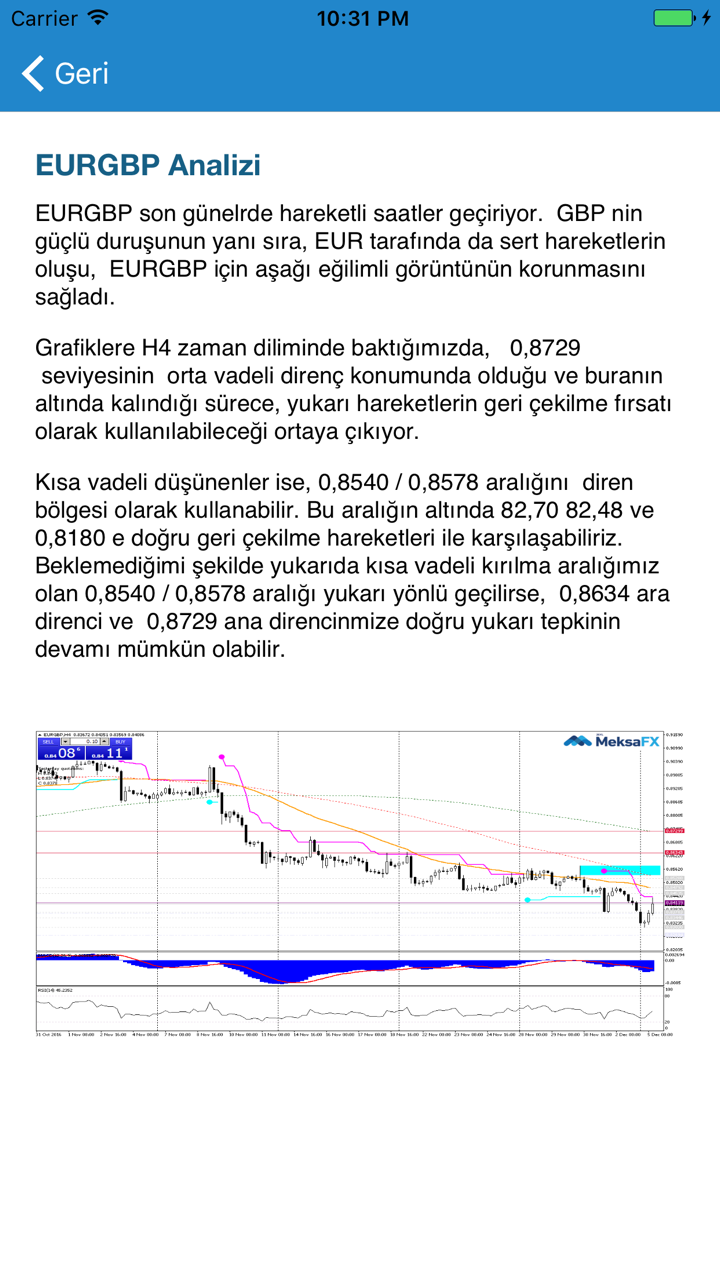

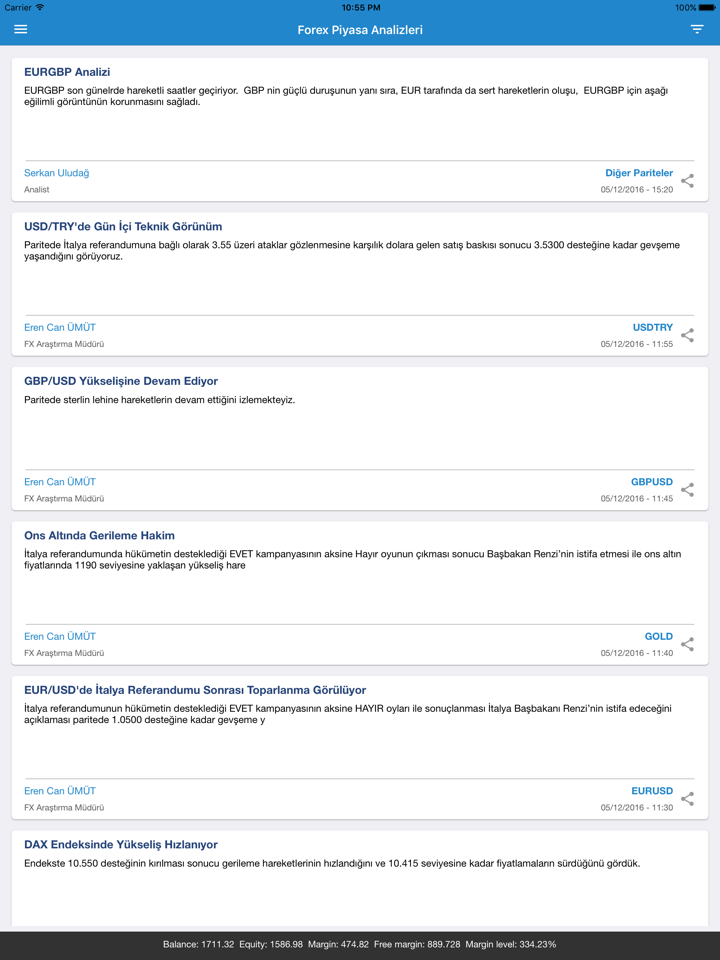

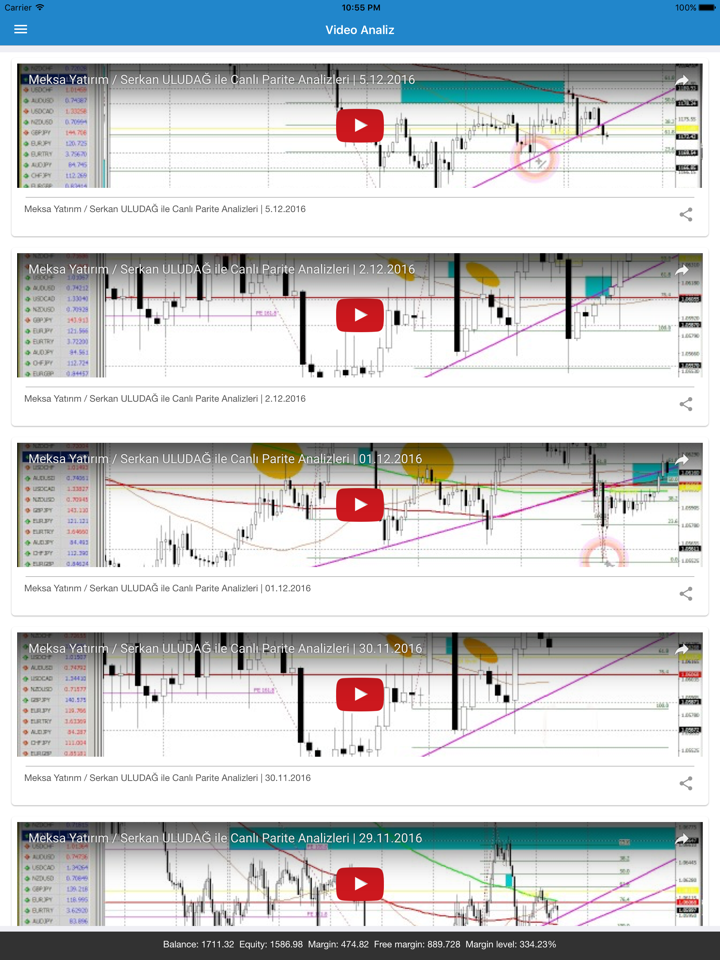

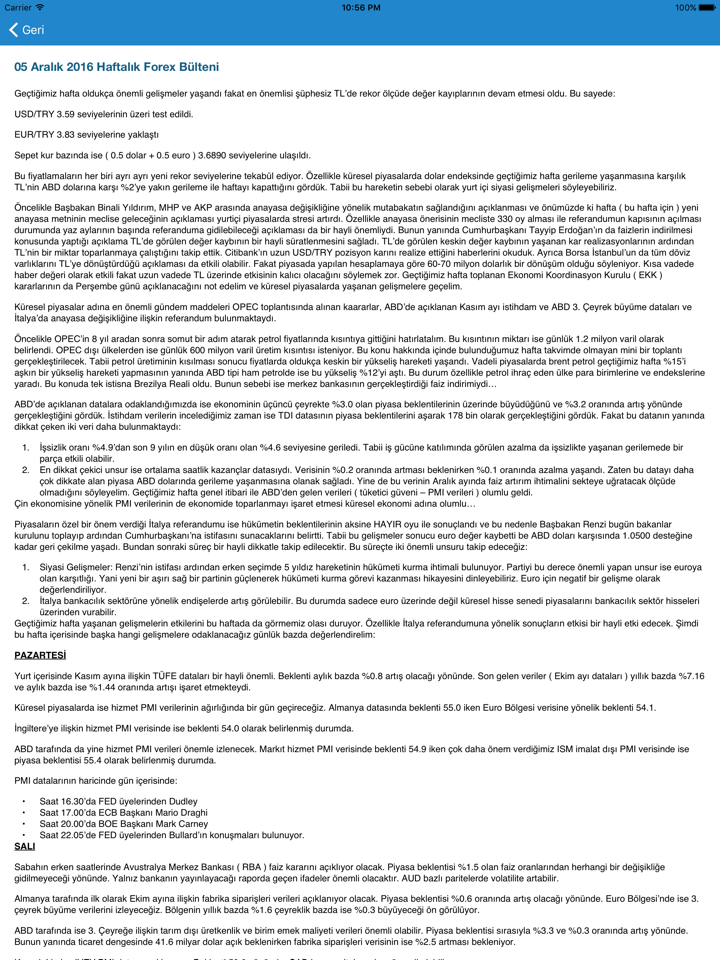

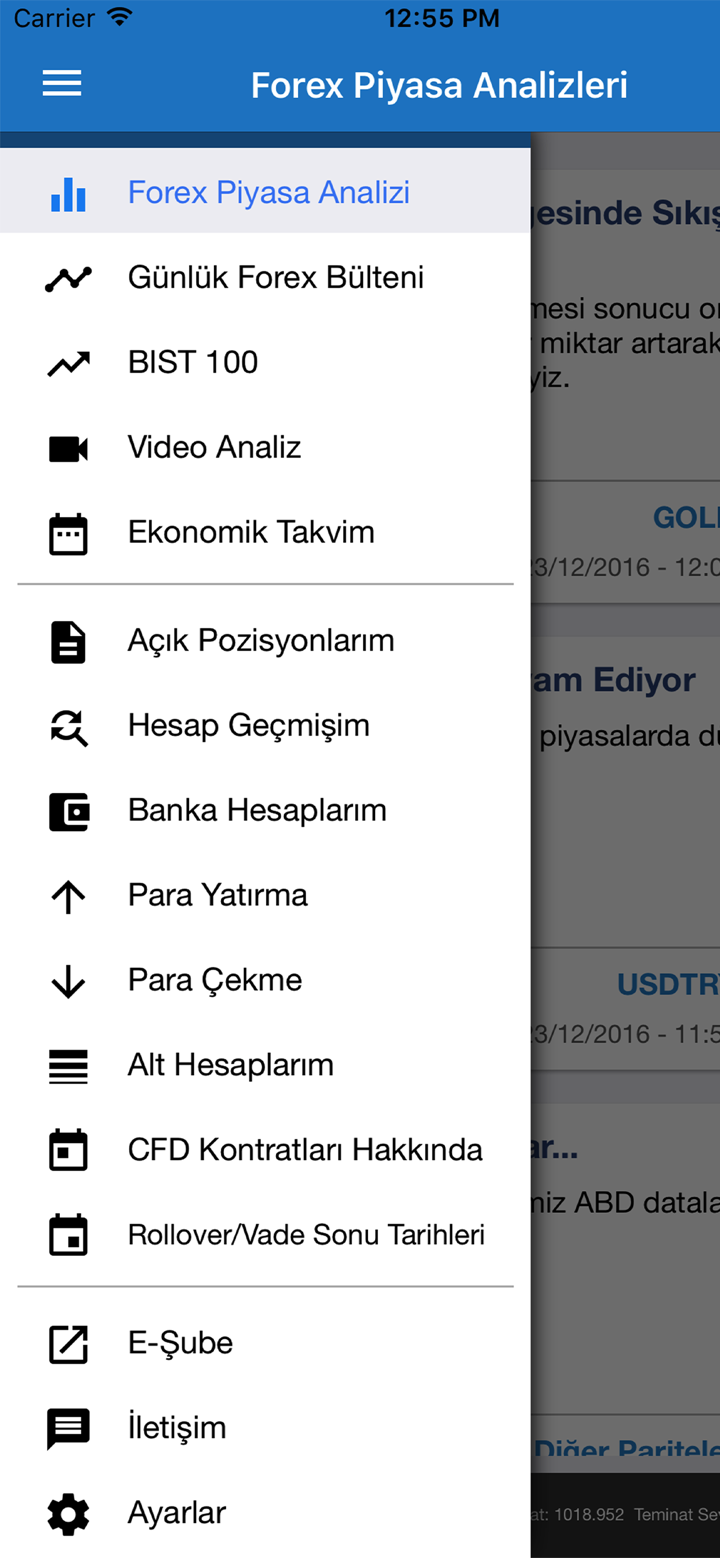

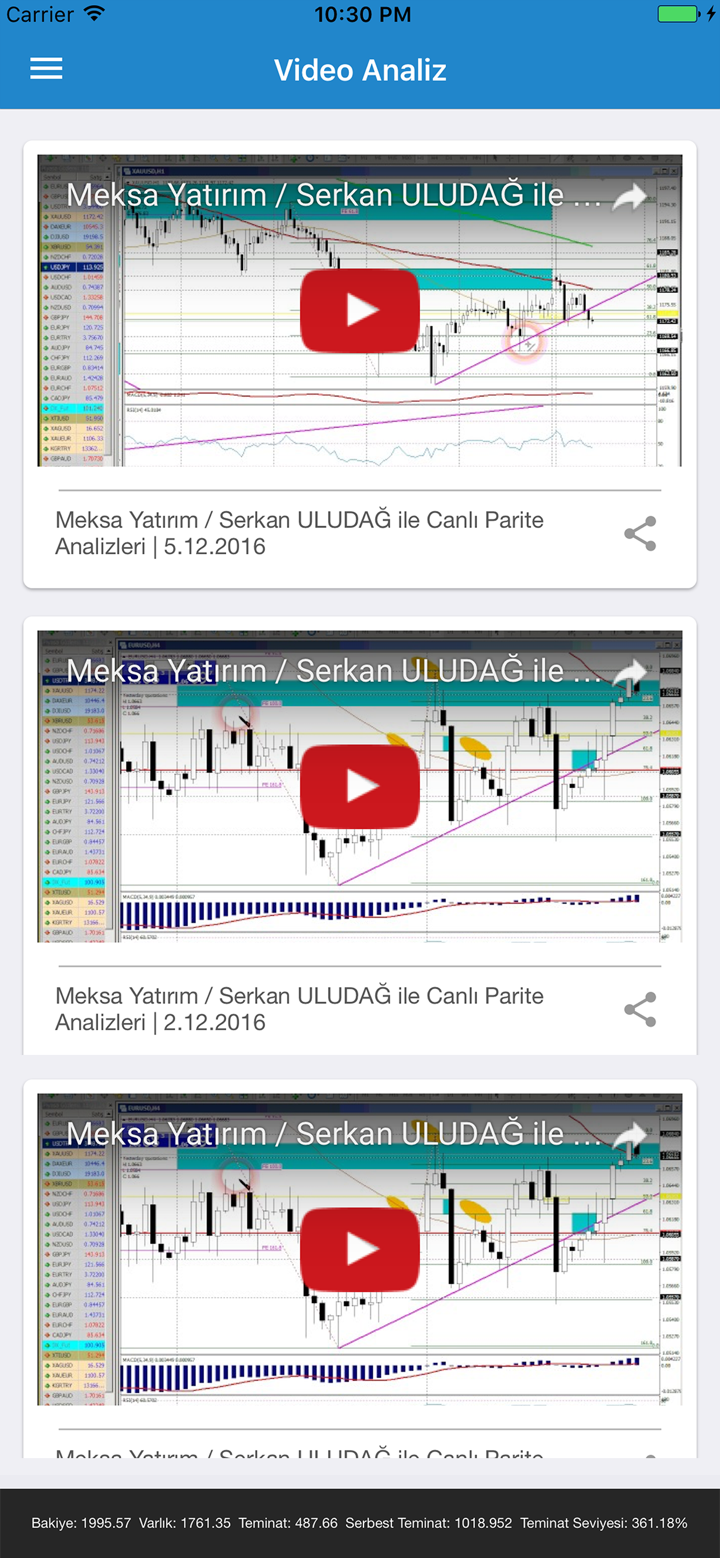

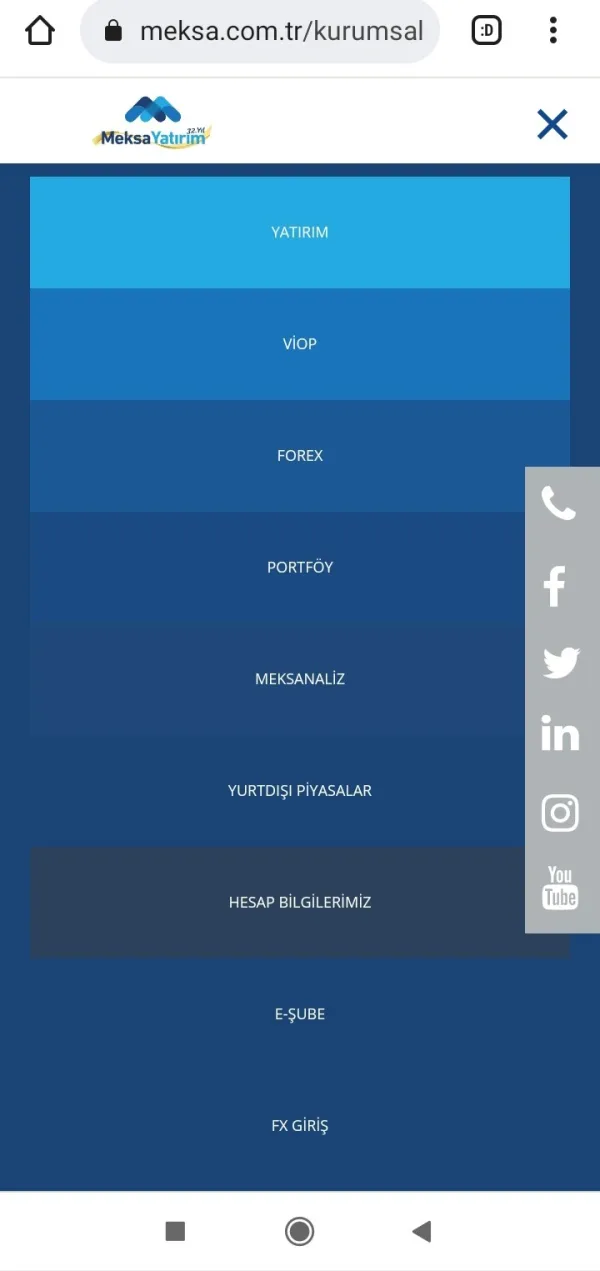

MEKSAanuncia que oferece uma gama diversificada de serviços, que incluem consultoria de investimento, serviços de corretagem, gestão de carteiras, instrumentos derivativos, serviços viop, gestão de fundos, pesquisa, mercados cambiais e finanças corporativas.

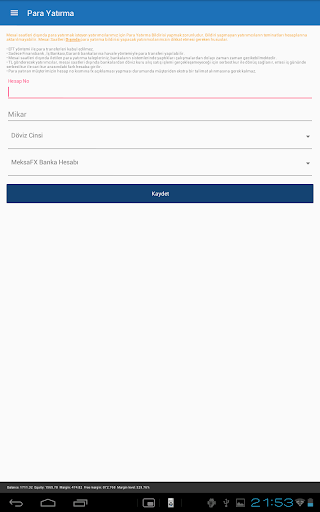

Depósito e Retirada

o valor mínimo do depósito para realizar os investimentos forex dentro MEKSA é dito ser 50.000 tl pelo cmb. no entanto, o corretor não revelou nenhuma informação sobre os métodos de depósito e retirada aceitáveis.

Suporte ao cliente

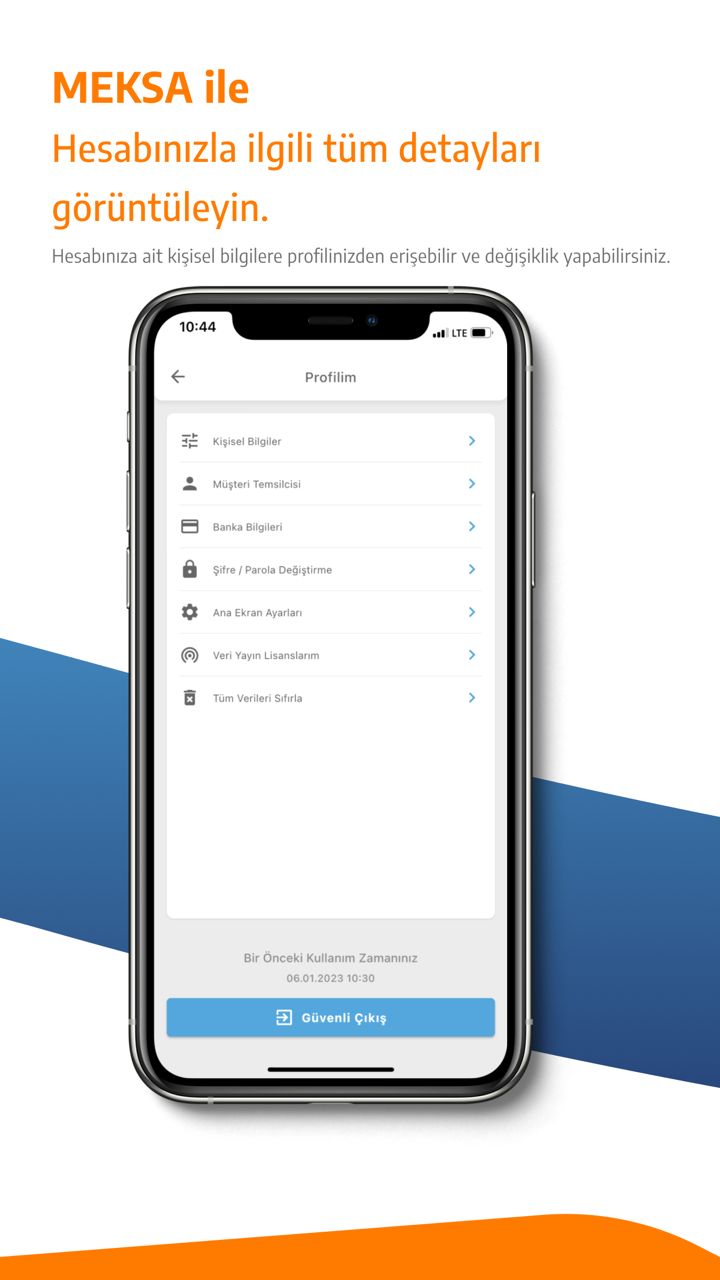

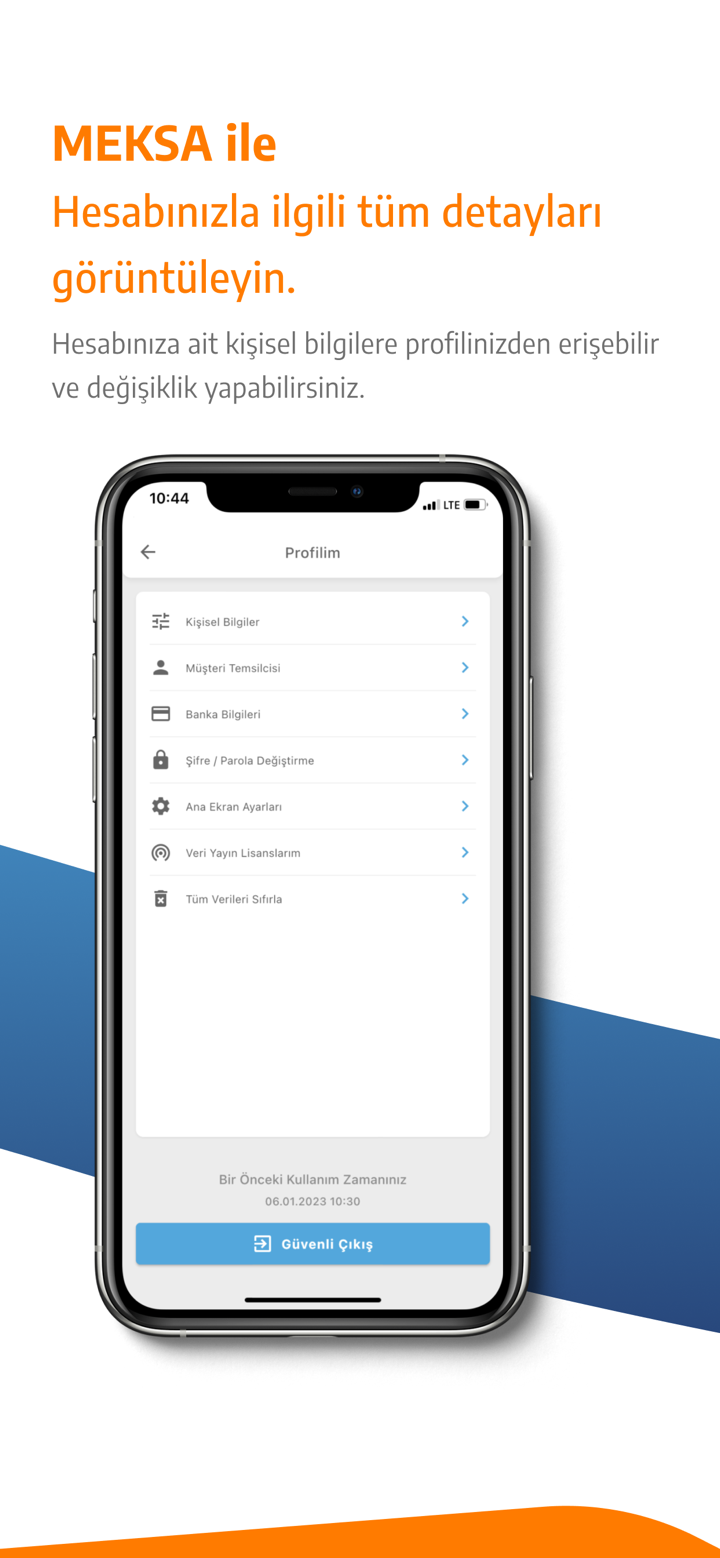

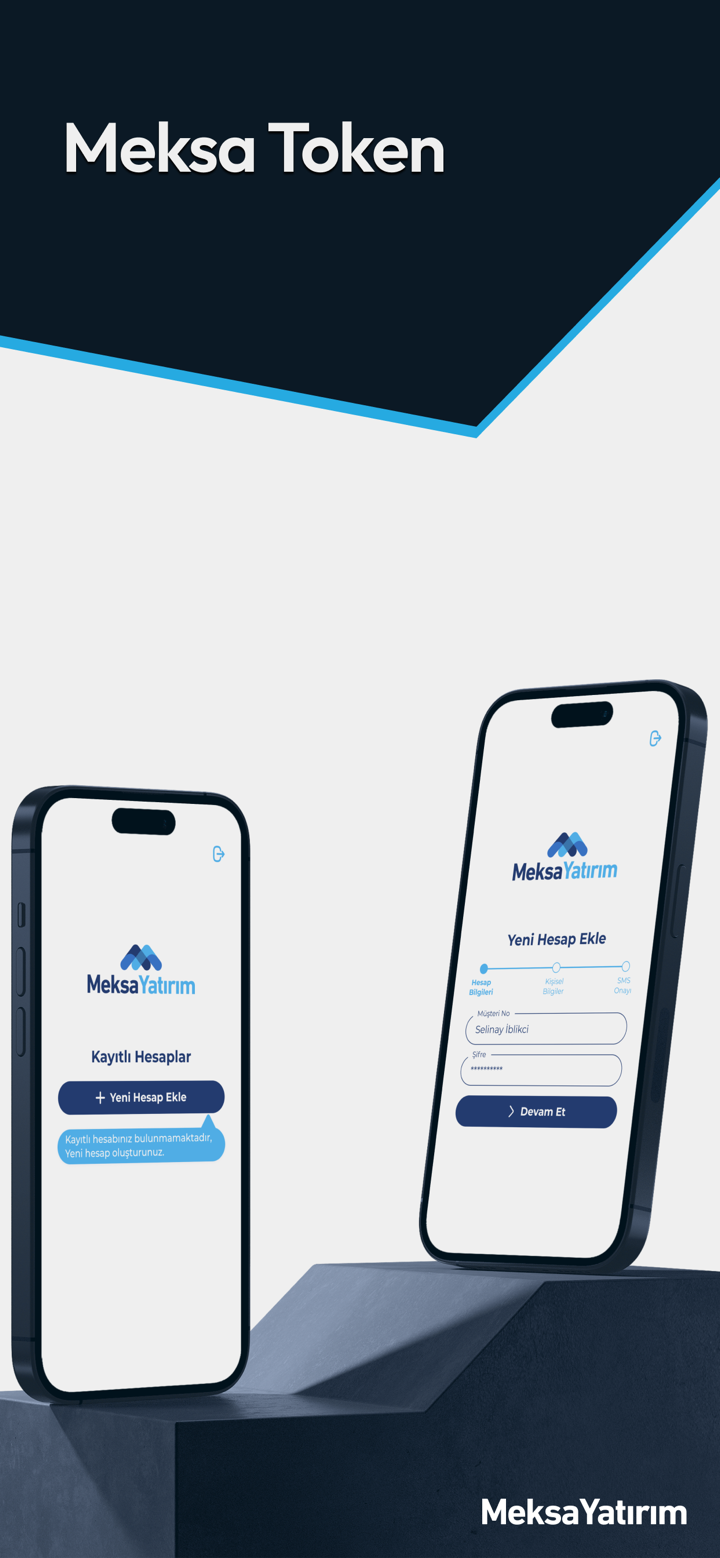

MEKSAs apoio ao cliente pode ser alcançado por telefone: 02166813400, fax: +90 (216) 6930570, +90 (216) 6930571, +90 (216) 6930572, email: destek@ MEKSA fx.com ou envie mensagens online para entrar em contato. você também pode seguir este corretor em plataformas de mídia social como twitter, facebook, instagram, youtube e linkedin. endereço da empresa: şehit teğmen ali yılmaz sok. güven sazak plaza a blok no:13 kat: 3-4 34810 kavacık - beykoz / istambul.

Aviso de risco

A negociação on-line envolve um nível significativo de risco e você pode perder todo o capital investido. Não é adequado para todos os comerciantes ou investidores. Certifique-se de entender os riscos envolvidos e observe que as informações contidas neste artigo são apenas para fins de informação geral.