Buod ng kumpanya

Pangkalahatang Impormasyon at Regulasyon

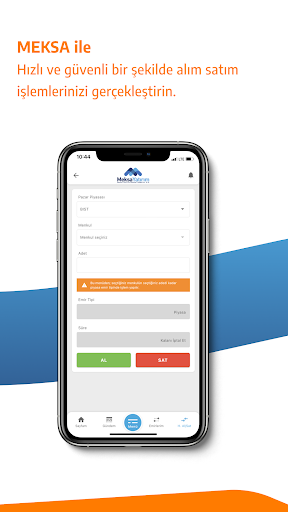

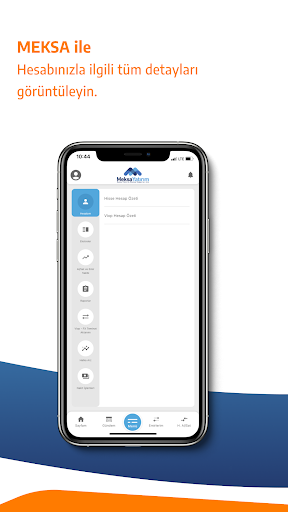

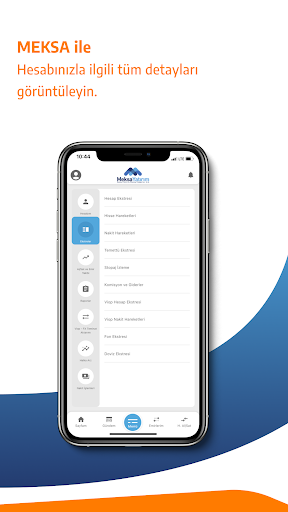

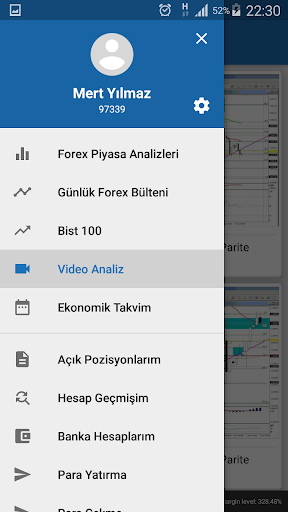

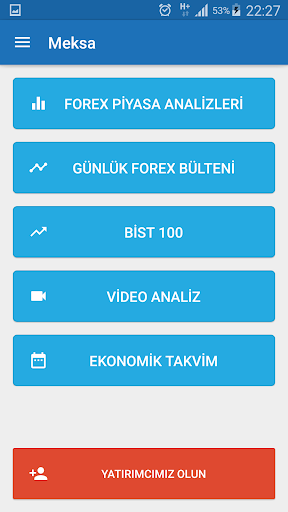

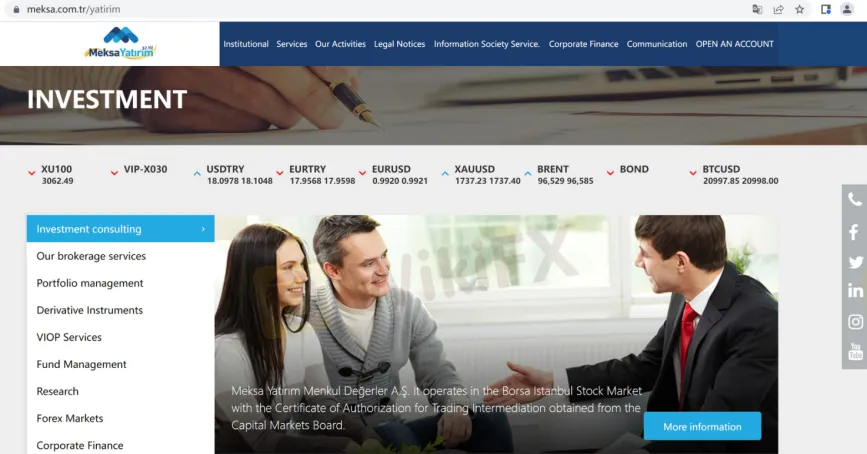

MEKSA, isang pangalan ng kalakalan ng Meksa Yatırım Menkul Değerler A.Ş , ay sinasabing isang financial brokerage company na itinatag noong Hunyo 28, 1990, at nakarehistro sa turkey. sinasabi ng broker na ito ay nagpapatakbo sa borsa istanbul stock market na may sertipiko ng awtorisasyon para sa pangangalakal na intermediation na nakuha mula sa capital markets board, na sinasabing nagbibigay sa mga indibidwal at corporate na customer nito ng iba't ibang serbisyong pinansyal. narito ang home page ng opisyal na site ng broker na ito:

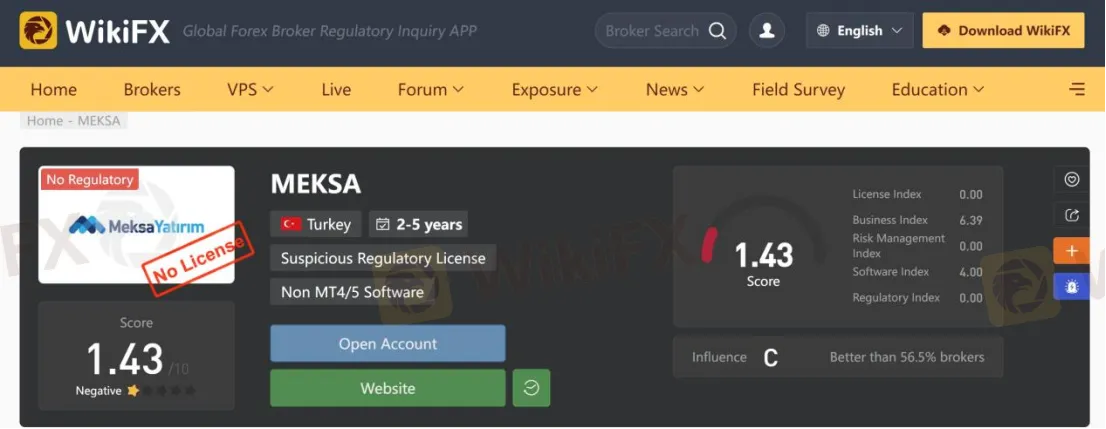

tungkol sa regulasyon, na-verify na MEKSA hindi napapailalim sa anumang wastong regulasyon. kaya naman nakalista ang regulatory status nito sa wikifx bilang "walang lisensya" at nakakatanggap ito ng medyo mababang marka na 1.43/10. mangyaring magkaroon ng kamalayan sa panganib.

Mga Negatibong Review

isang negosyante ang nagbahagi ng kanyang kakila-kilabot na karanasan sa pangangalakal sa MEKSA platform sa wikifx. sinabi niya yun MEKSA ay isang scam broker at hindi niya nakuha ang ipinangakong 50% na deposito nang dumating ang petsa. ito ay kinakailangan para sa mga mangangalakal na basahin ang mga review na iniwan ng ilang mga gumagamit bago pumili ng mga forex broker, kung sakaling sila ay dayain ng mga scam.

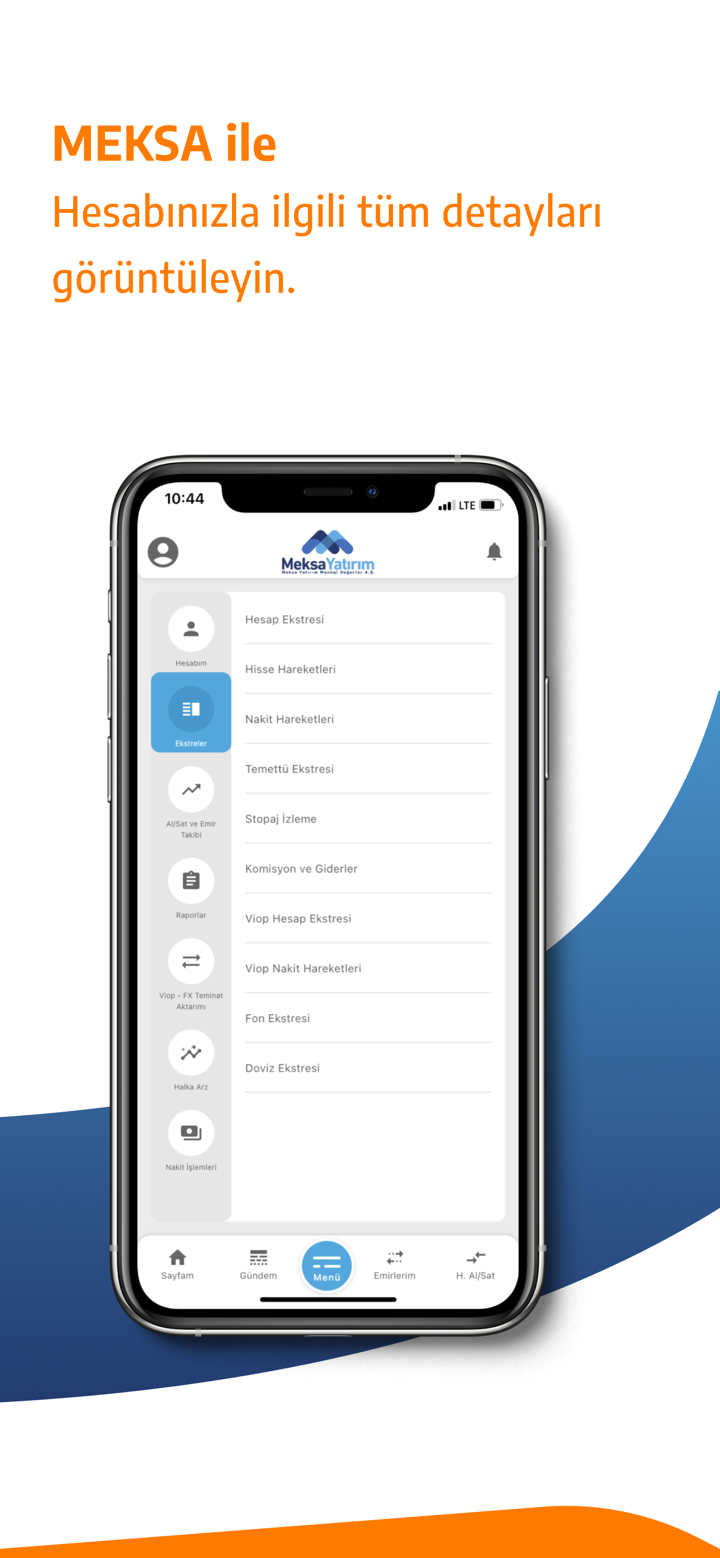

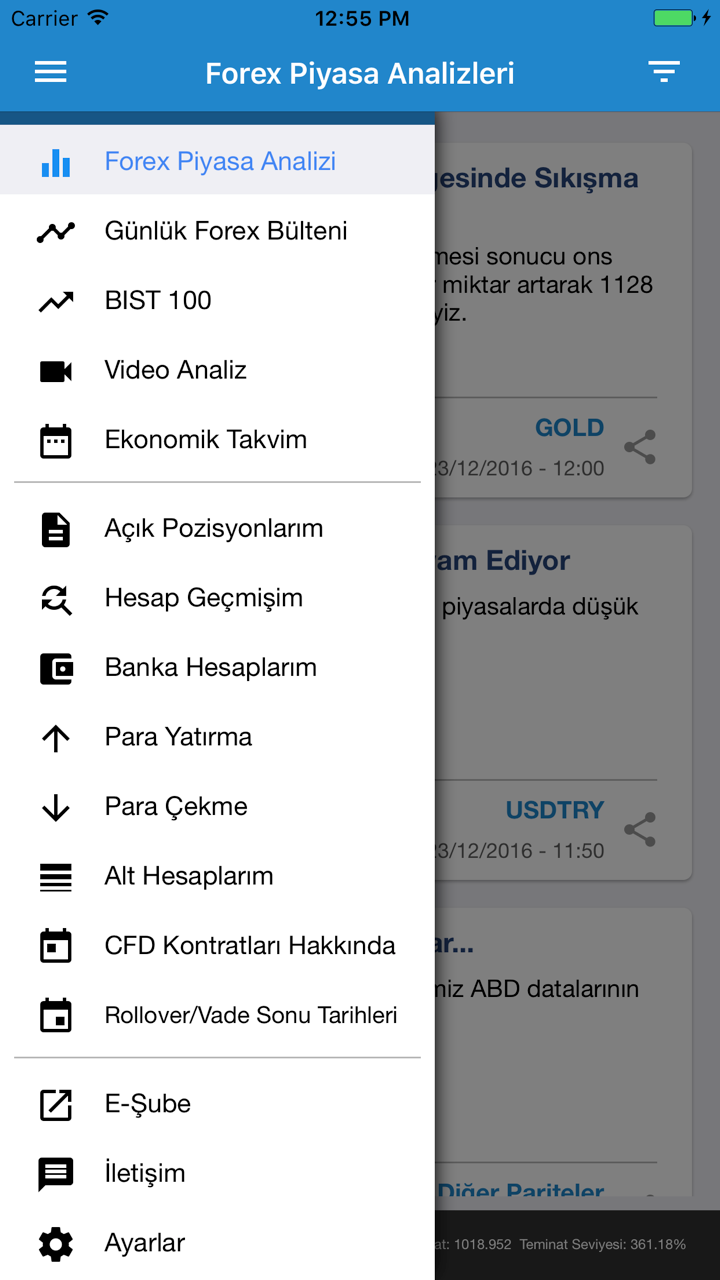

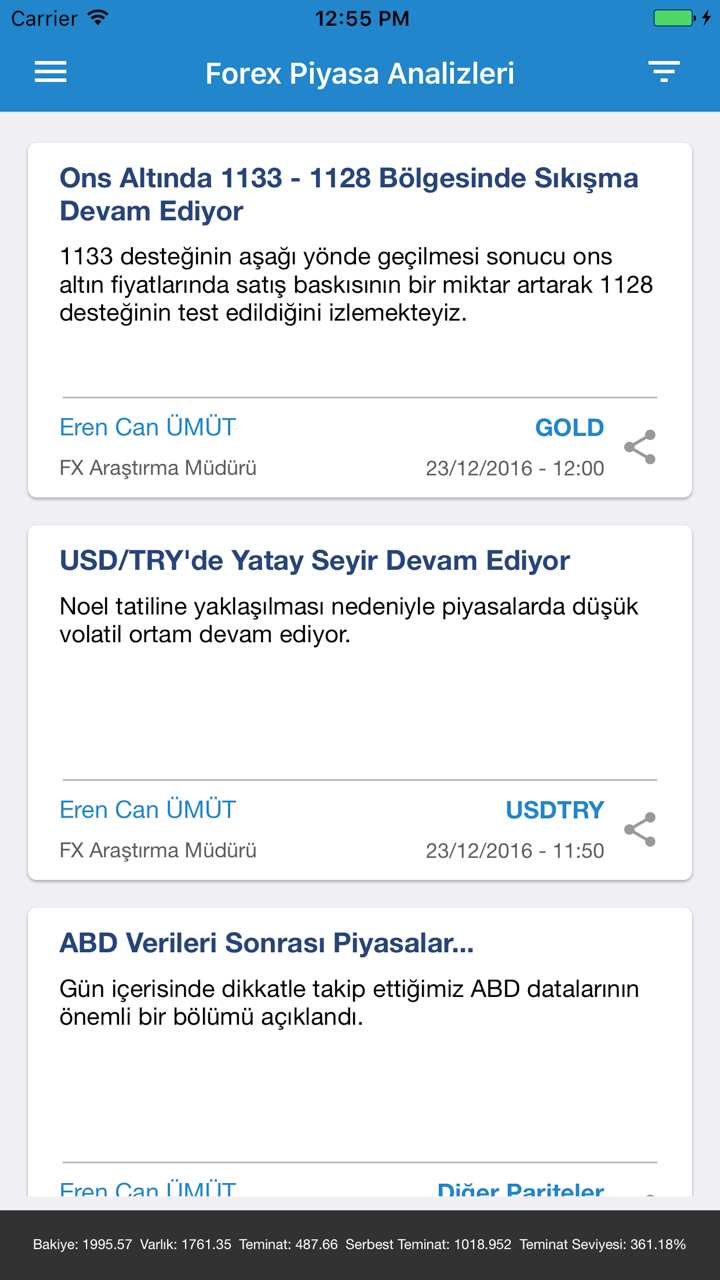

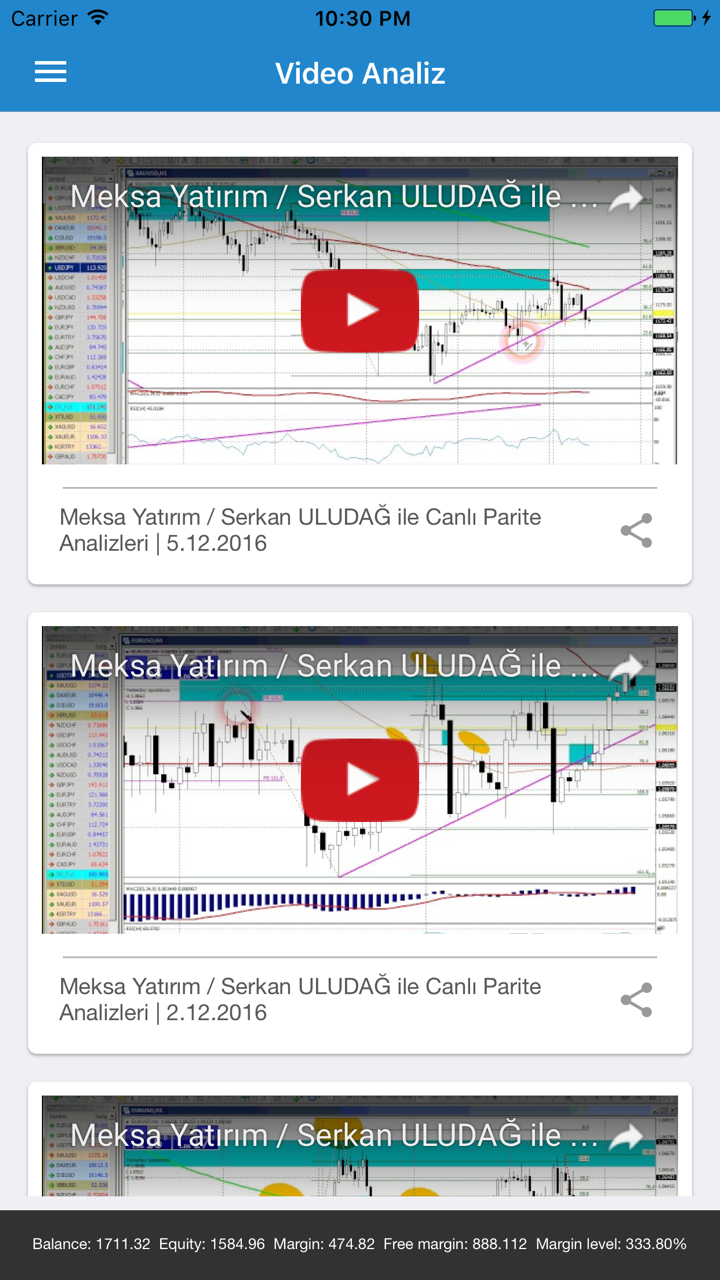

Mga serbisyo

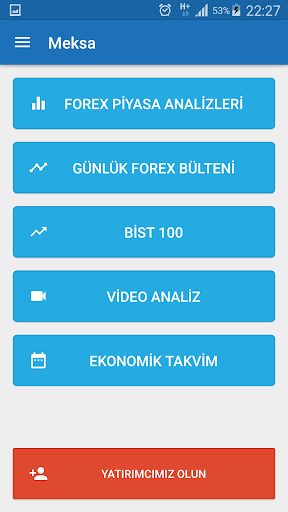

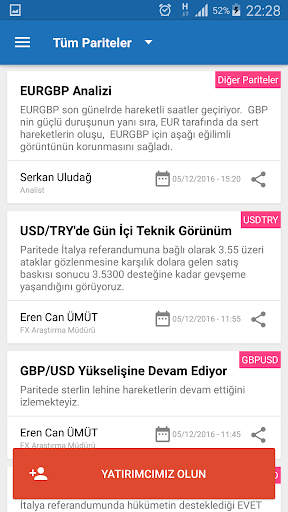

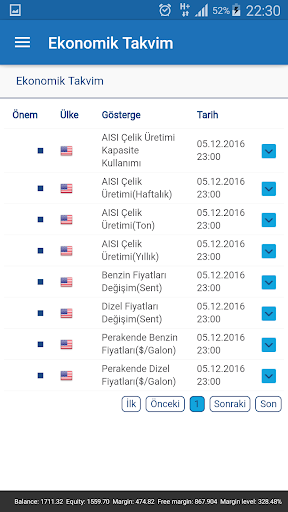

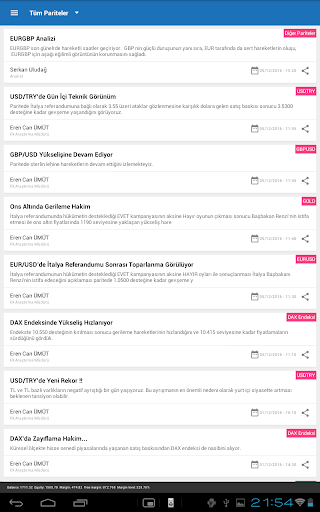

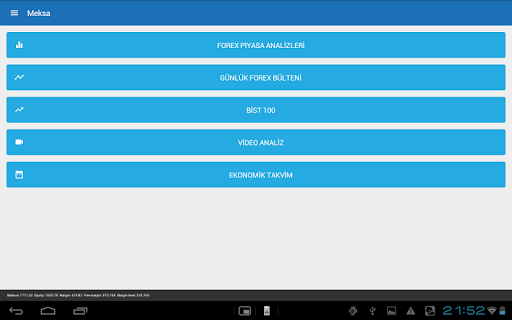

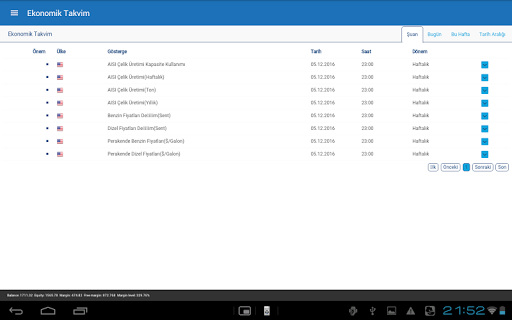

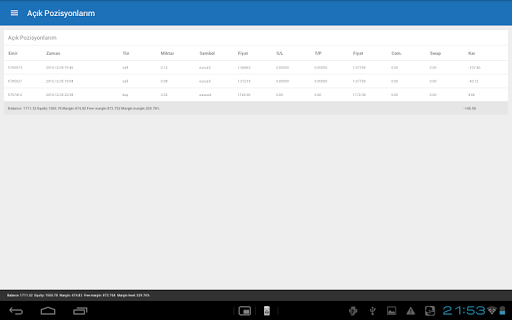

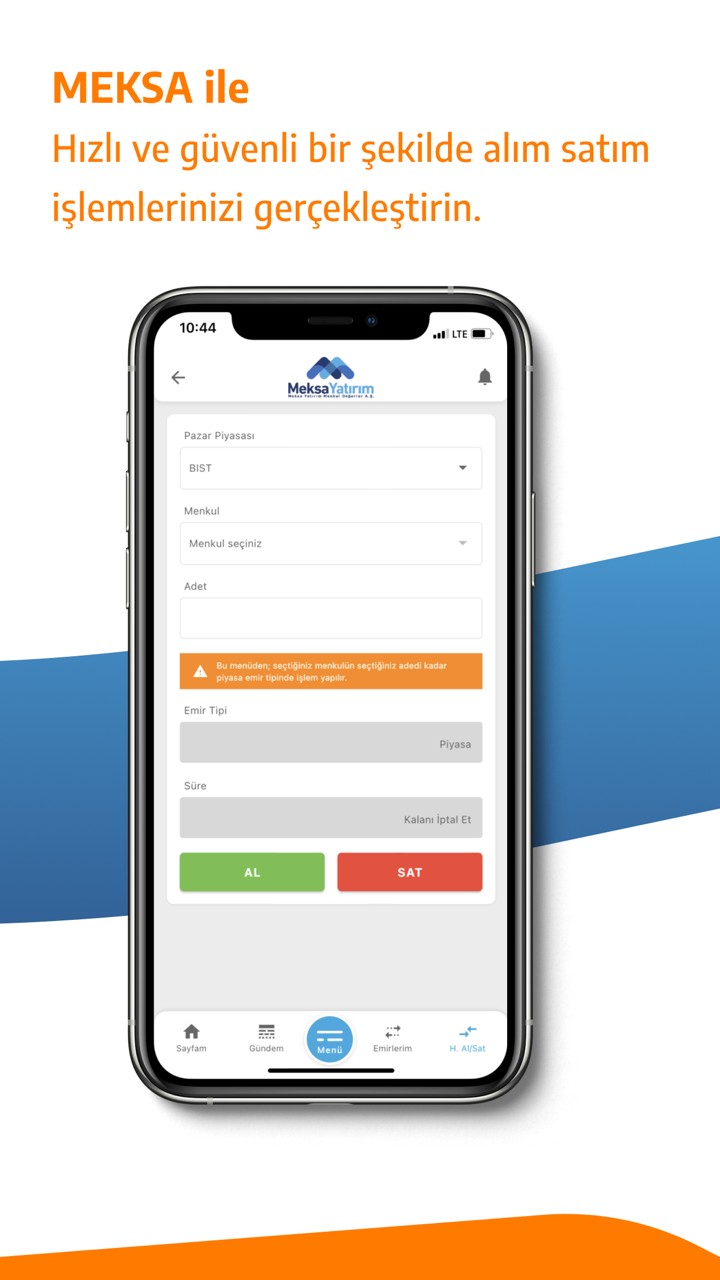

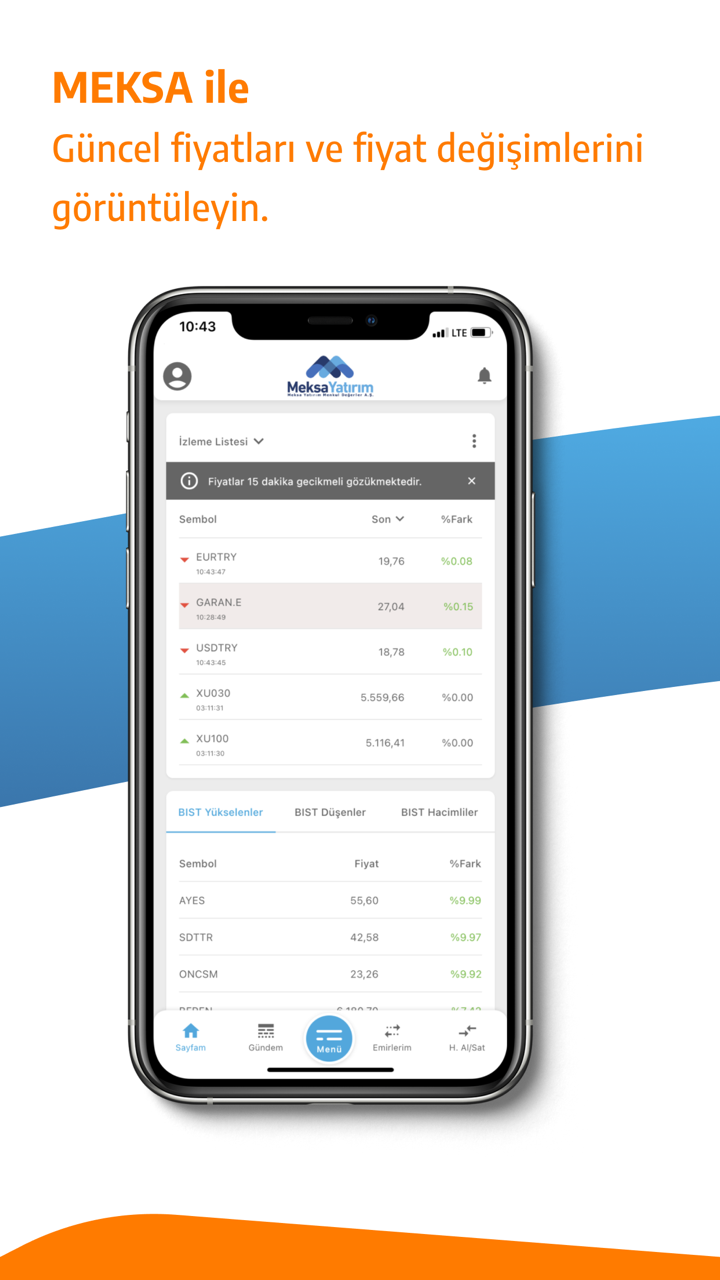

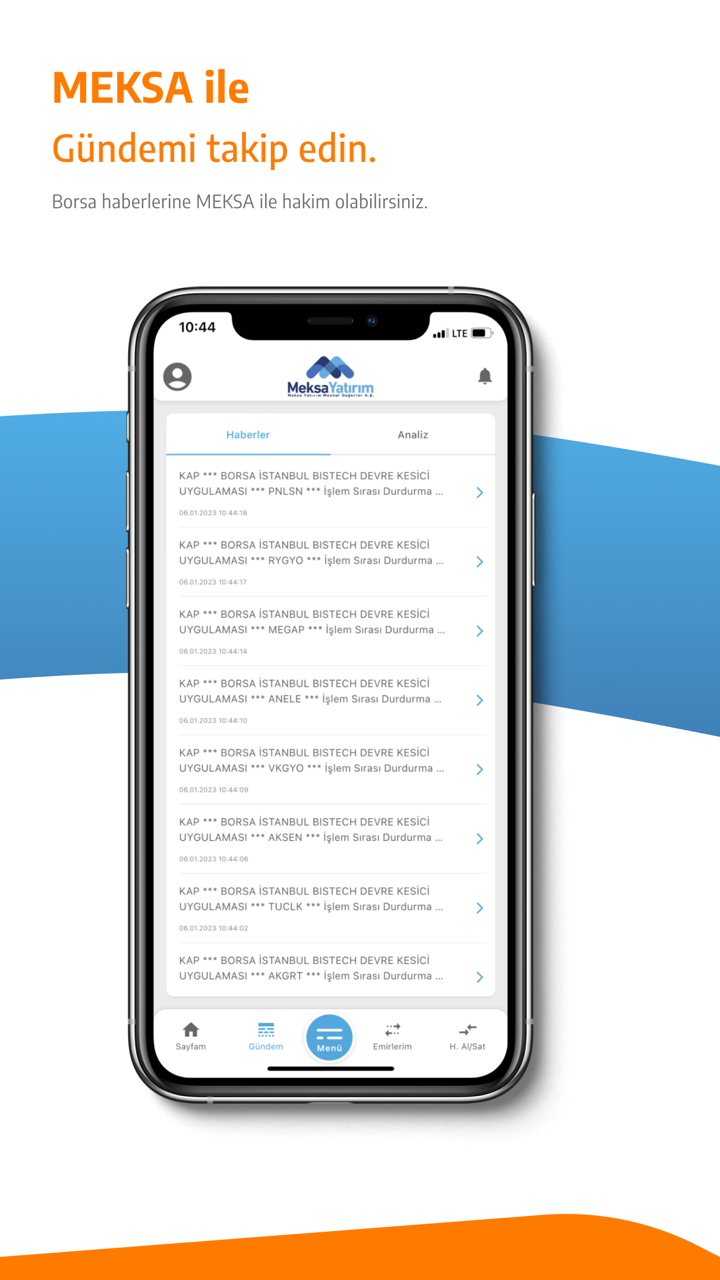

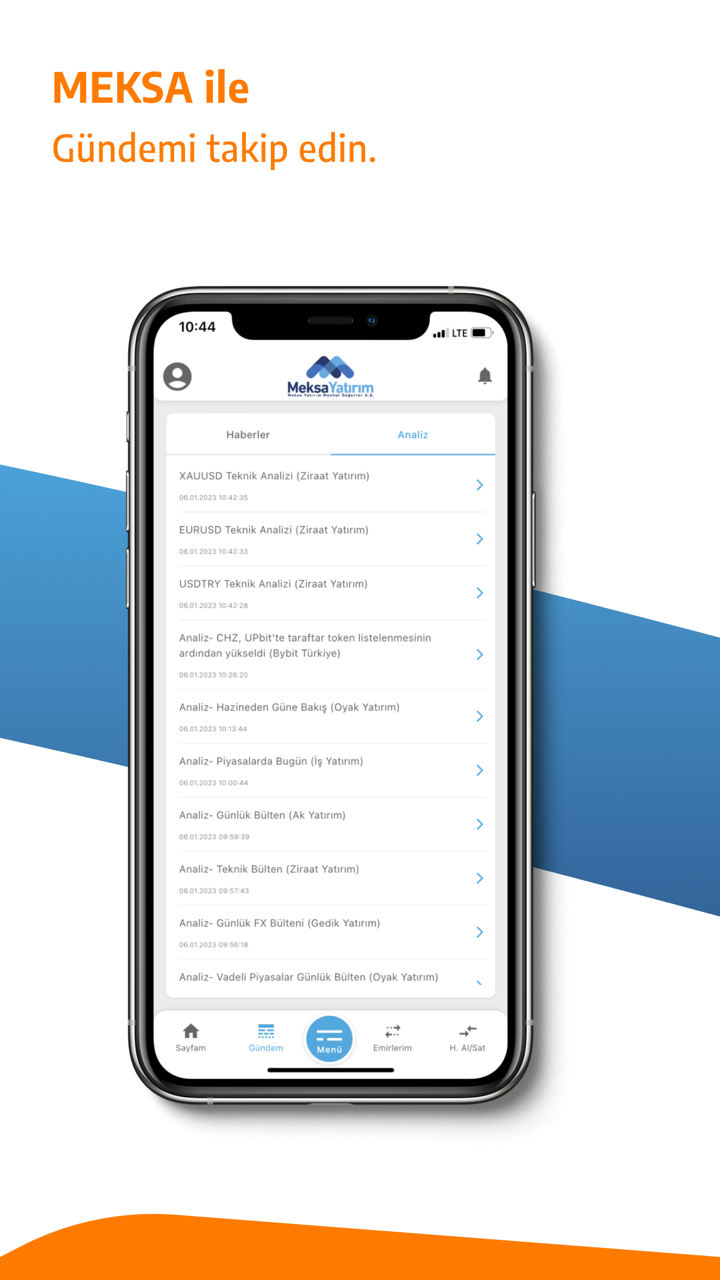

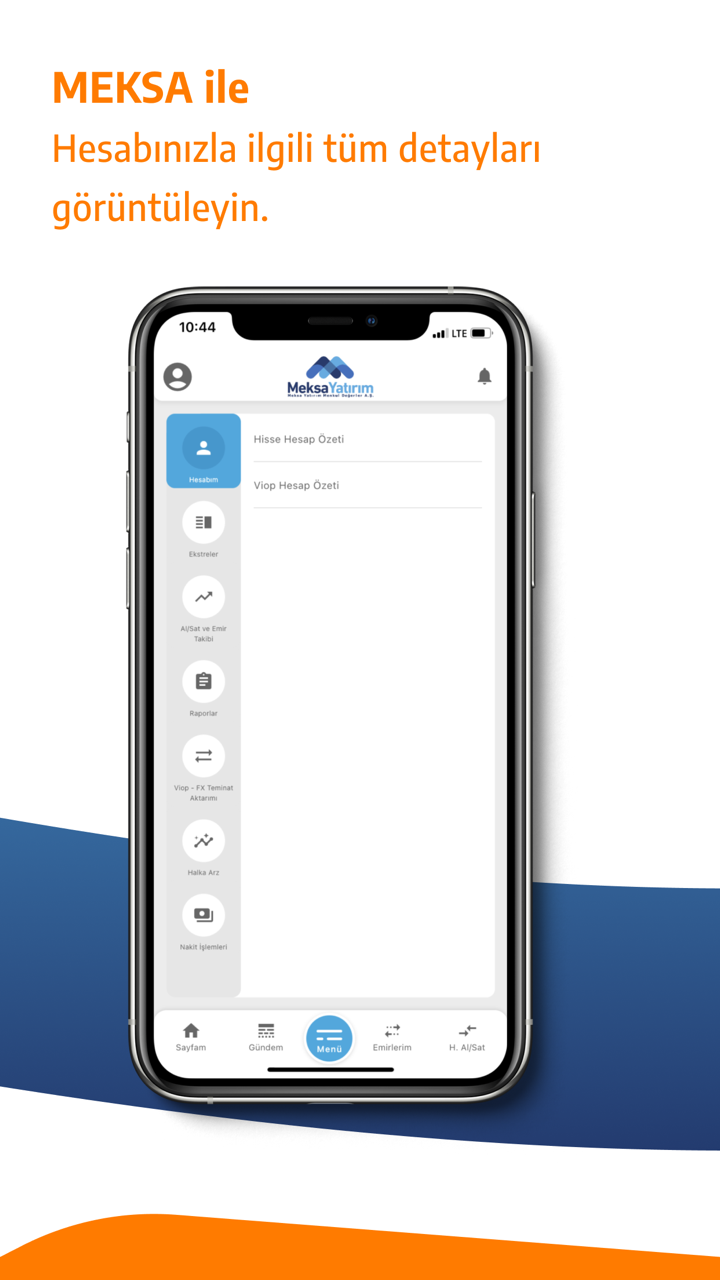

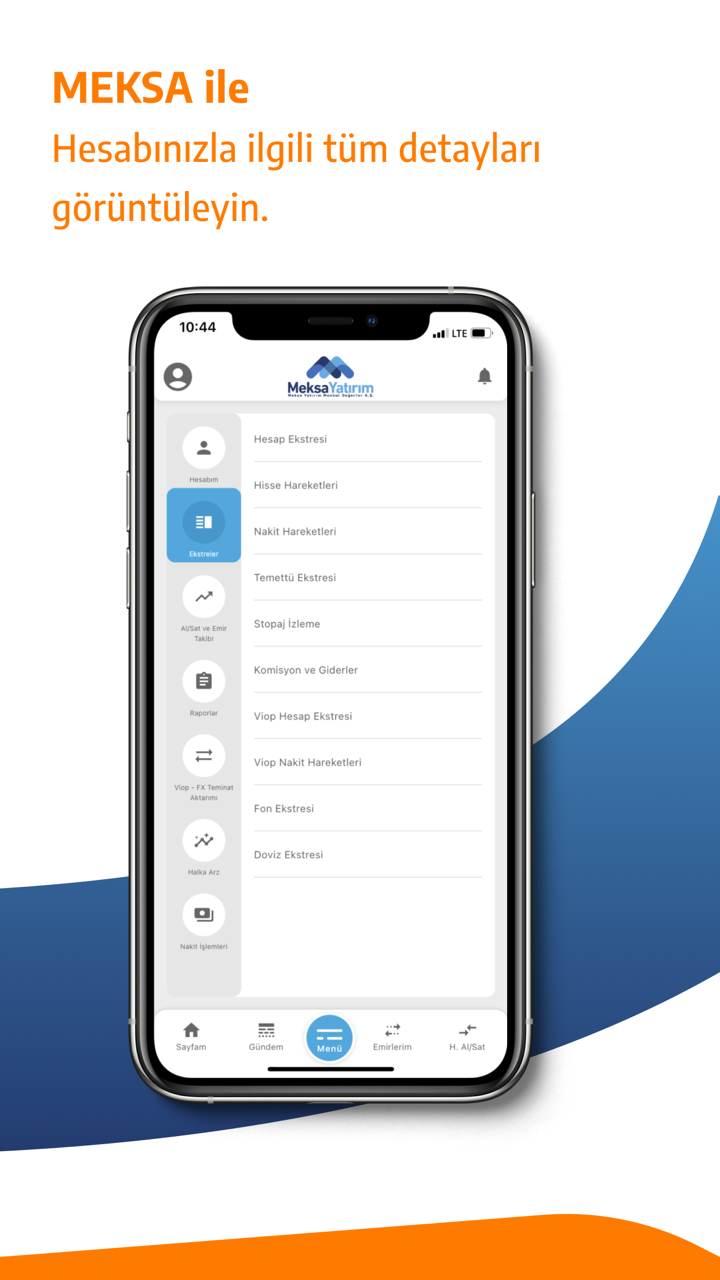

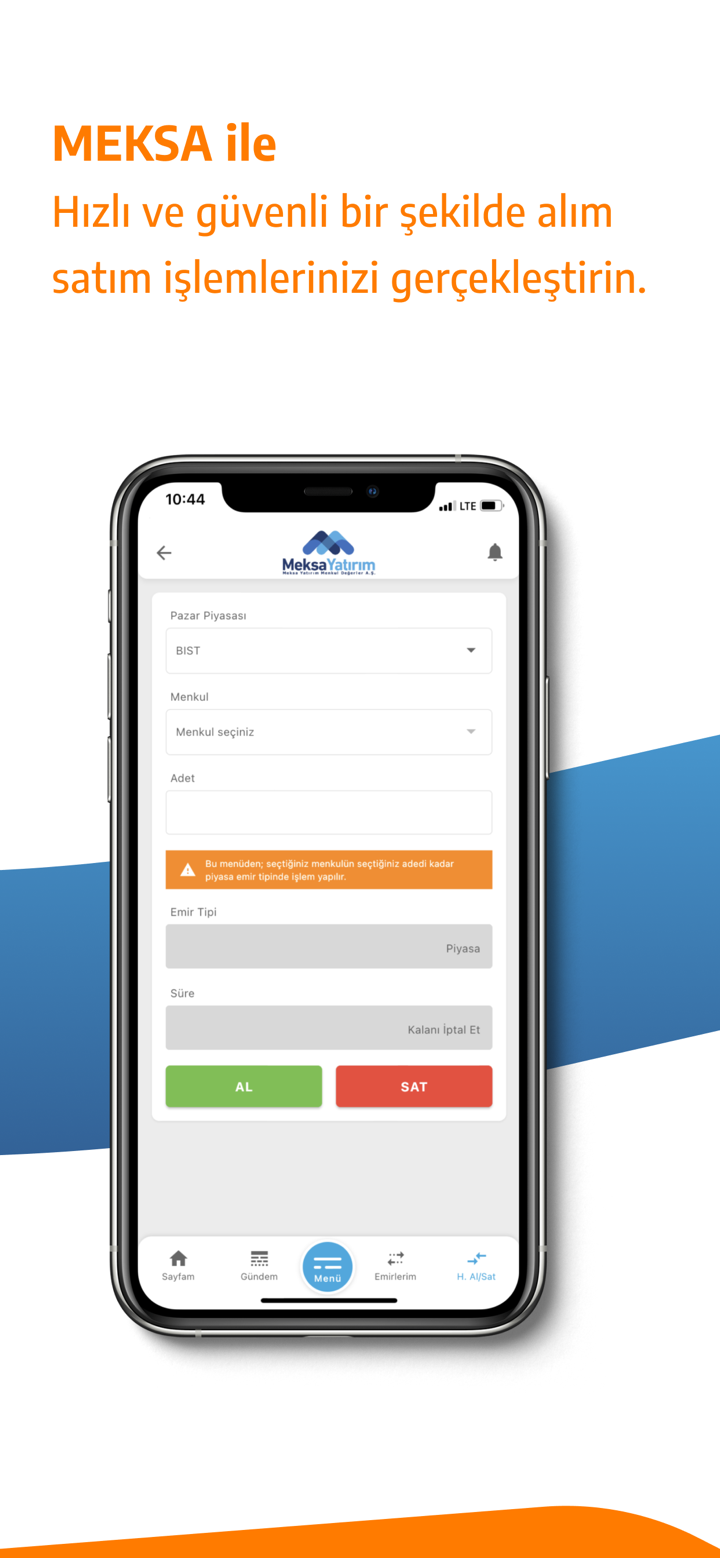

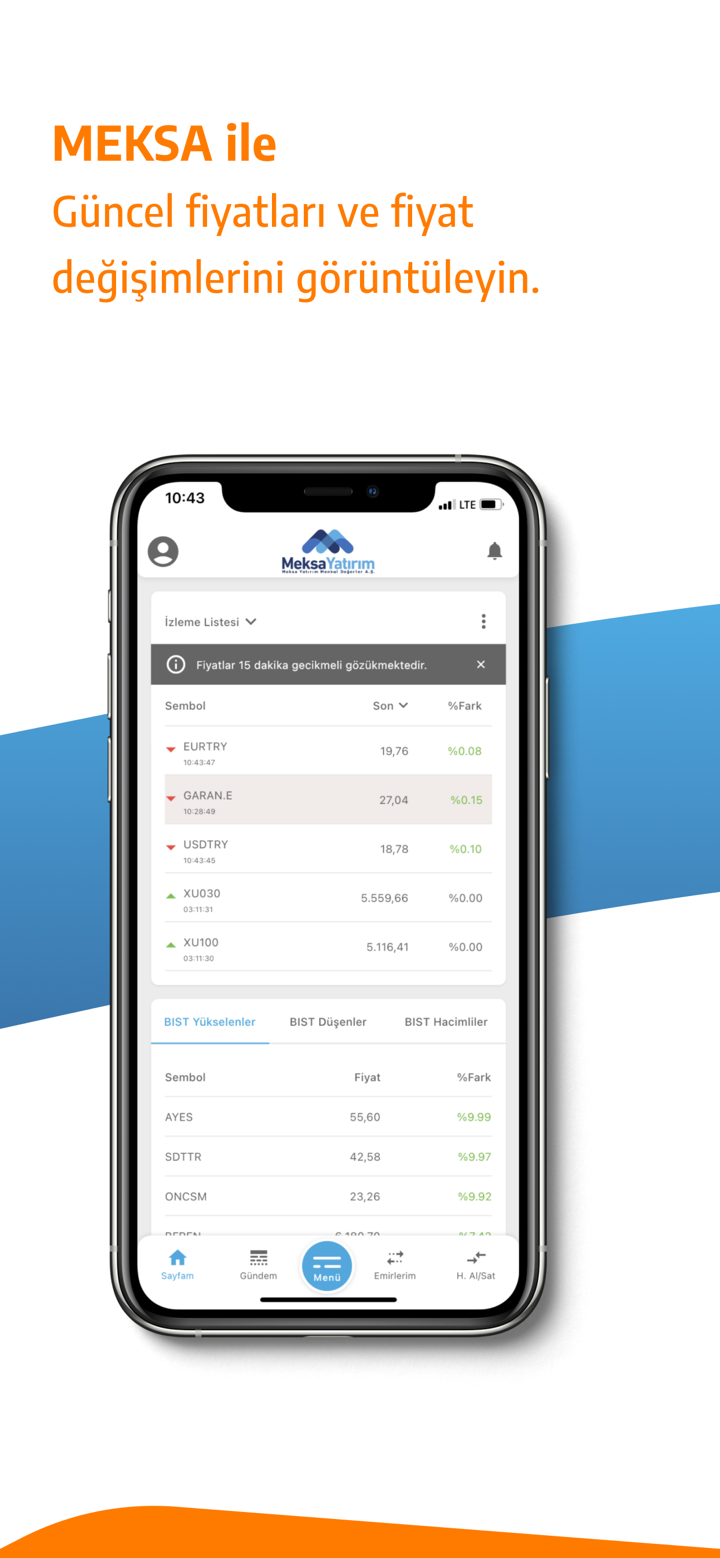

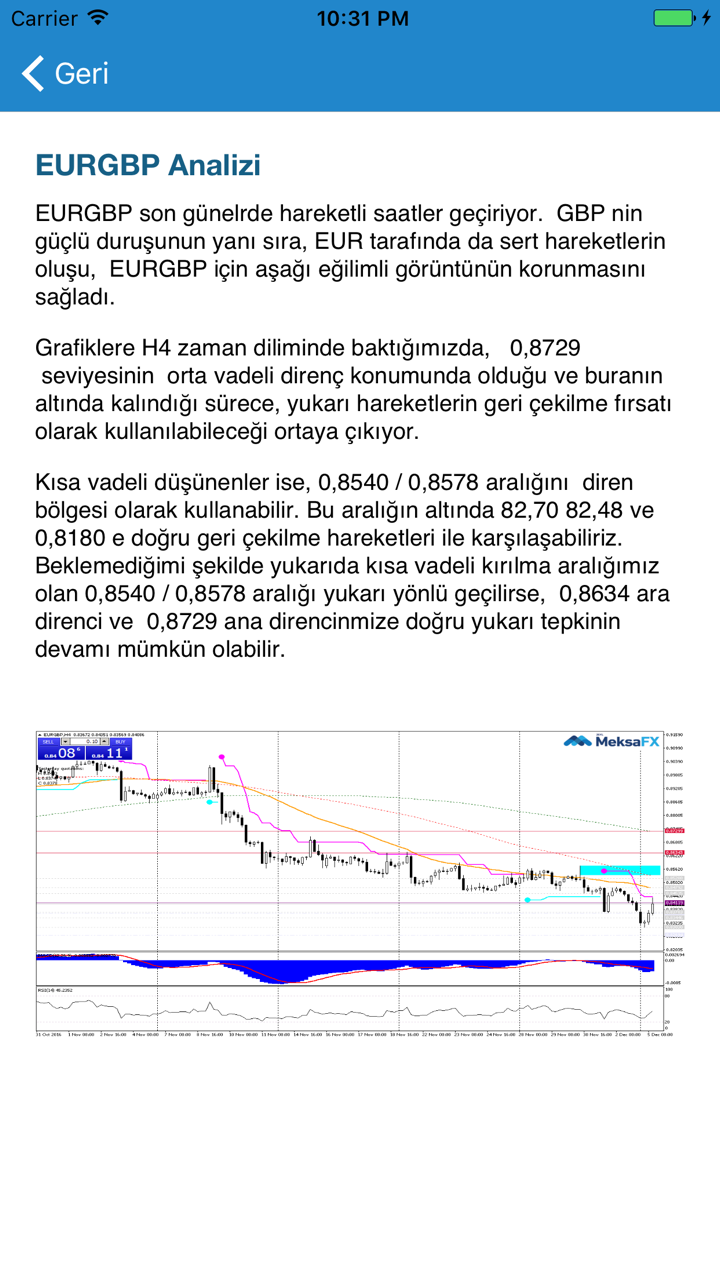

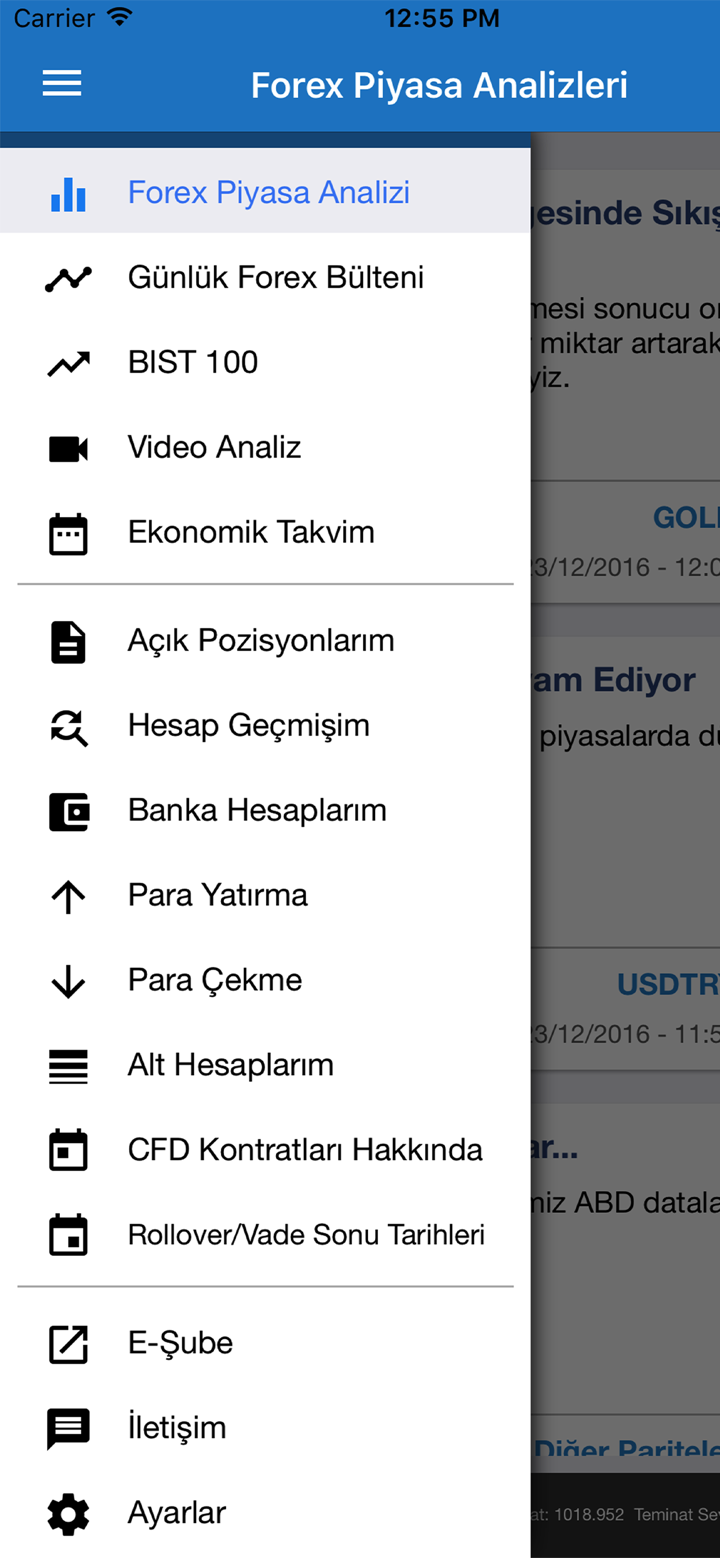

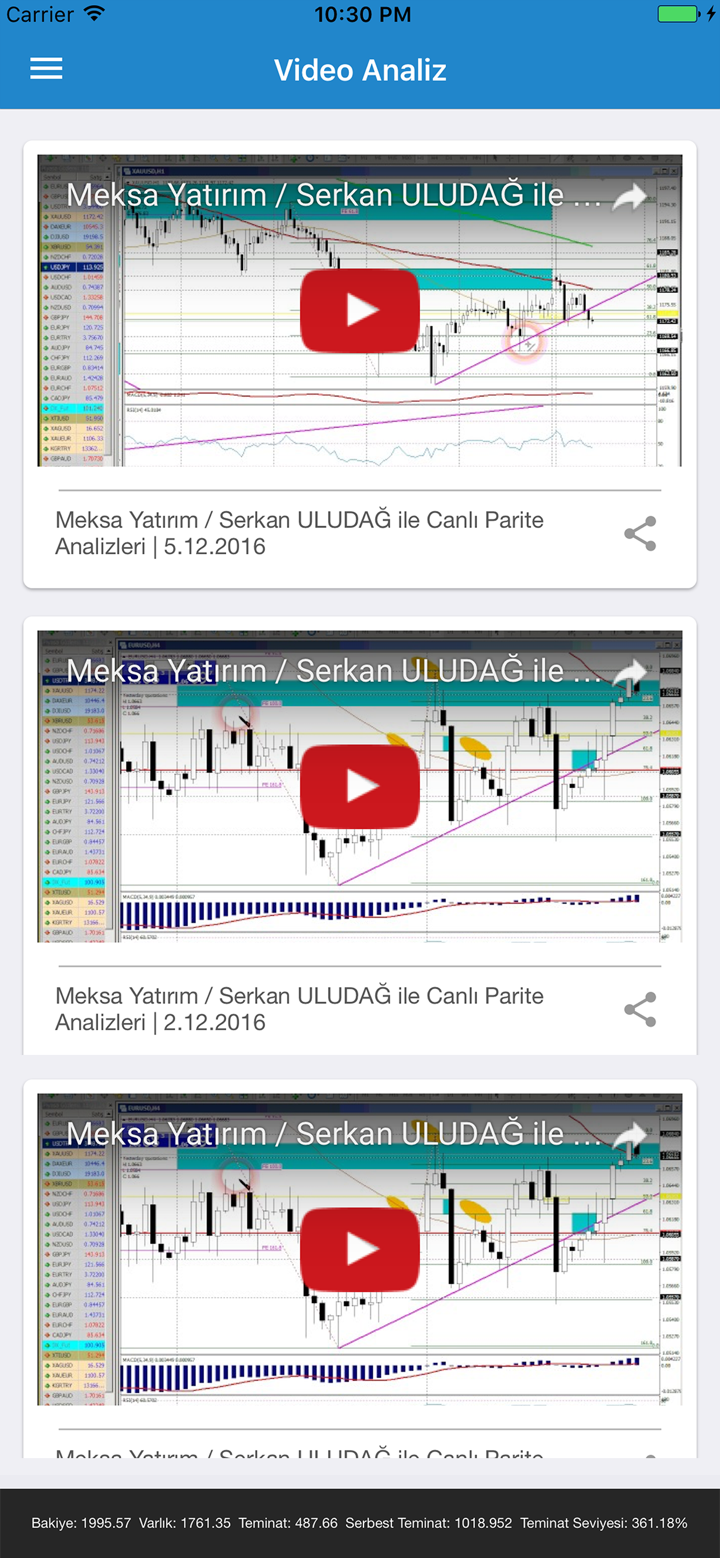

MEKSAnag-a-advertise na nag-aalok ito ng magkakaibang hanay ng mga serbisyo, na kinabibilangan ng investment consulting, brokerage services, portfolio management, derivative instruments, viop services, fund management, research, forex markets at corporate finance.

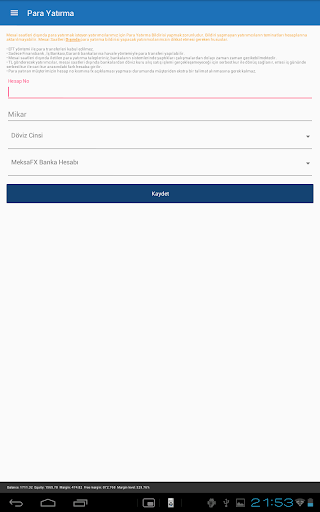

Pagdeposito at Pag-withdraw

ang pinakamababang halaga ng deposito upang mapagtanto ang mga pamumuhunan sa forex sa loob MEKSA ay sinasabing 50,000 tl ng cmb. gayunpaman, ang broker ay hindi nagpahayag ng anumang impormasyon tungkol sa katanggap-tanggap na deposito at mga paraan ng pag-withdraw.

Suporta sa Customer

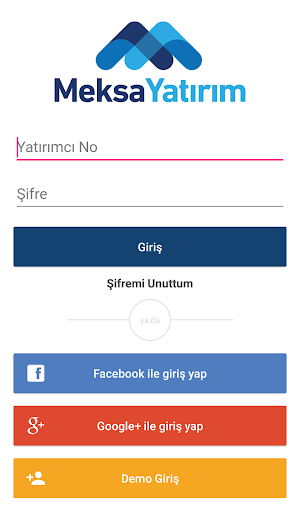

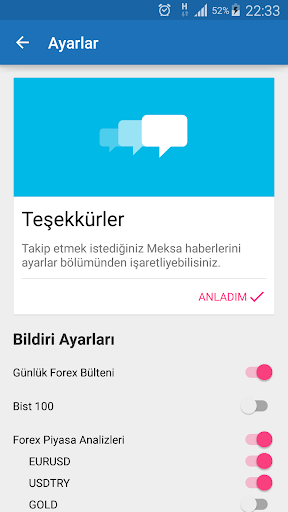

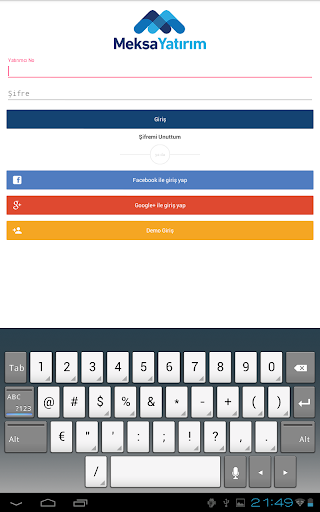

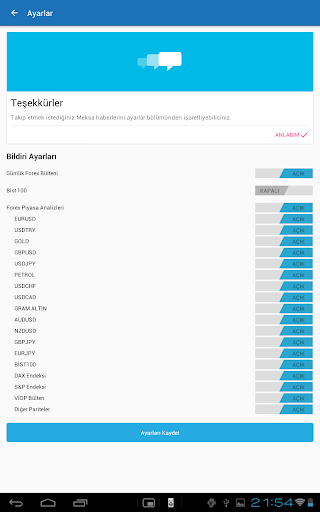

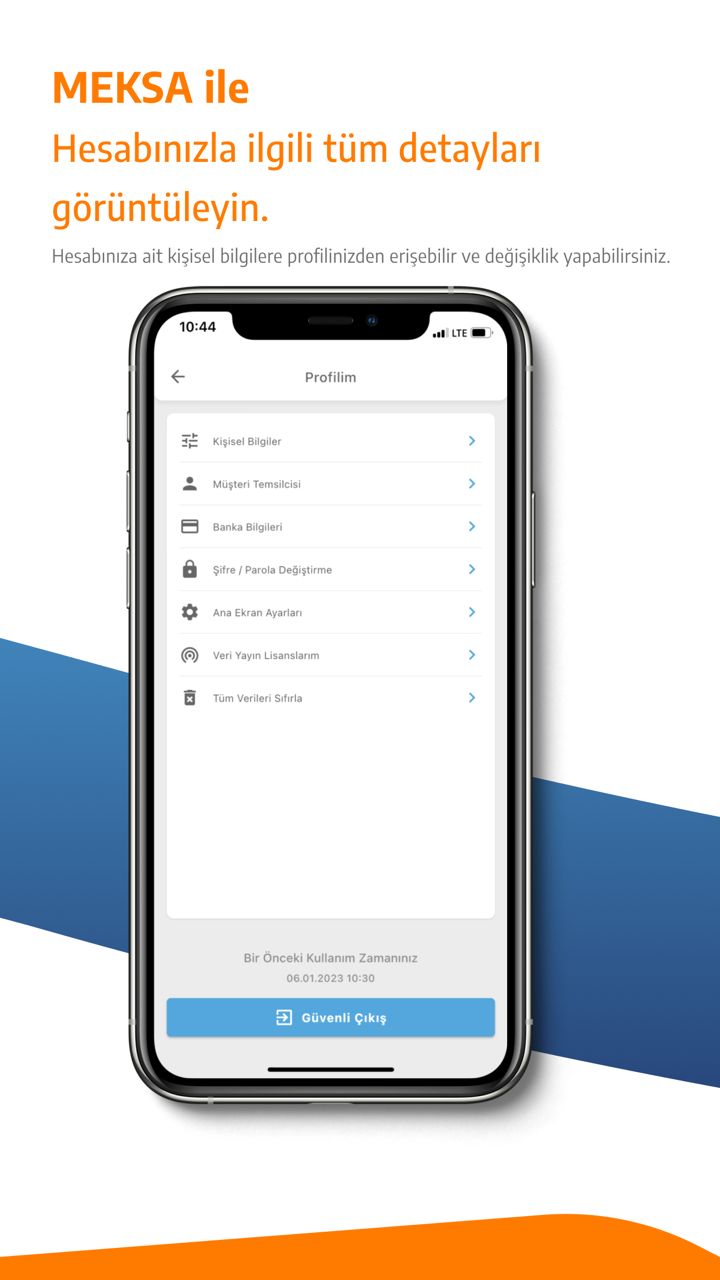

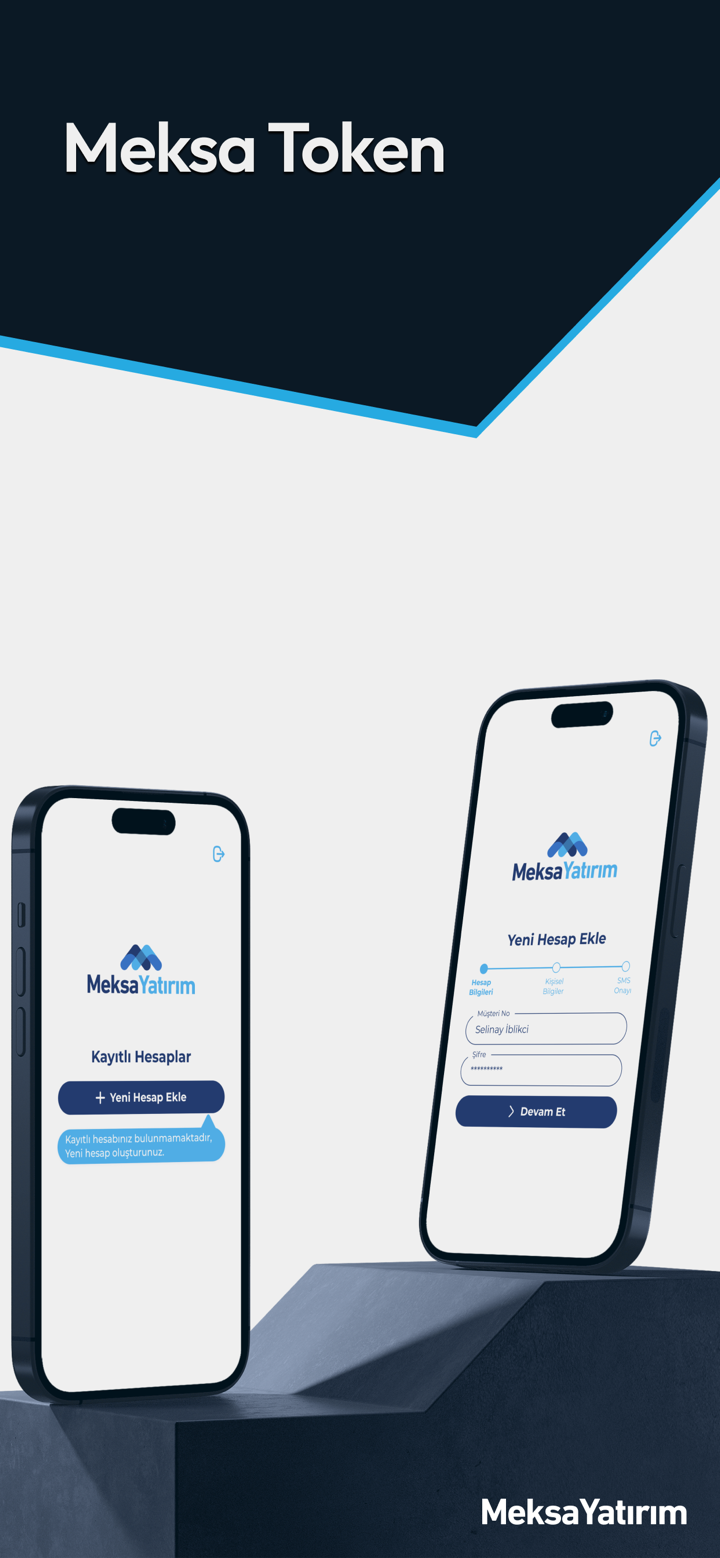

MEKSAs customer support ay maaaring maabot sa pamamagitan ng telepono: 02166813400, fax: +90 (216) 6930570, +90 (216) 6930571, +90 (216) 6930572, email: destek@ MEKSA fx.com o magpadala ng mga mensahe online para makipag-ugnayan. maaari mo ring i-follow ang broker na ito sa mga social media platform tulad ng twitter, facebook, instagram, youtube at linkedin. address ng kumpanya: şehit teğmen ali yılmaz sok. güven sazak plaza a blok no:13 kat: 3-4 34810 kavacık - beykoz / istanbul.

Babala sa Panganib

Ang online na kalakalan ay nagsasangkot ng isang malaking antas ng panganib at maaari mong mawala ang lahat ng iyong ipinuhunan na kapital. Ito ay hindi angkop para sa lahat ng mga mangangalakal o mamumuhunan. Pakitiyak na nauunawaan mo ang mga panganib na kasangkot at tandaan na ang impormasyong nilalaman sa artikulong ito ay para sa pangkalahatang layunin ng impormasyon lamang.