회사 소개

| Metaverse Securities 리뷰 요약 | |

| 설립 연도 | 2021 |

| 등록 국가/지역 | 홍콩 |

| 규제 | SFC |

| 시장 상품 | 주식, 외환, 펀드, ETF, REITs |

| 거래 플랫폼 | MetaStock, Fuyuan Benben, 그리고 Yisheng Polestar Futures |

| 고객 지원 | 전화: 400-688-3187 (빠른 트랙) |

| 전화: (00852) 2523 8221 (전화 주문) | |

| 팩스: (00852) 2810 7978, (0755) 2665 8431 | |

| 주소: 홍콩 완차이 항구로 18번지 센트럴 플라자 48층 4806-07호 | |

Metaverse Securities 정보

Metaverse Securities은 주식, 외환, ETF 및 REITs와 같은 다양한 거래 상품을 제공하는 홍콩 기반의 중개업체입니다. 다양한 제품과 빠른 실행 속도에도 불구하고 규제 라이선스 (AAW177)가 만료되었으며 투자자는 주의해야 합니다. 플랫폼은 주로 초보자를 위한 것으로 MetaStock, Fuyuan Benben, 그리고 Yisheng Polestar Futures를 지원하지만 MT5와 같은 고급 거래 플랫폼은 제공하지 않습니다. 대부분의 기본 서비스는 무료이지만 비활성 계정에는 매월 HK$20의 수수료가 부과됩니다.

장단점

| 장점 | 단점 |

| SFC 규제 | 한정된 결제 수단 |

| 다양한 거래 종류 | |

| 당일 해석 빠름 |

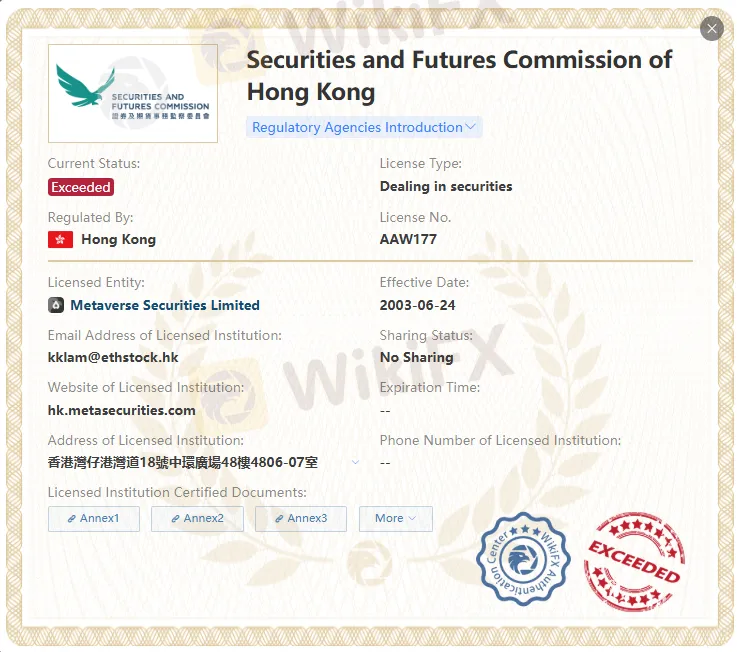

Metaverse Securities이 신뢰할 만한가요?

Metaverse Securities은 중국 홍콩 SFC가 규제하는 사업 범위를 초과합니다. Metaverse Securities은 두 규제기관에 의해 규제된다고 주장하지만 라이선스 번호 AAW177이 만료되었습니다. 리스크에 유의하시기 바랍니다!

| 규제 국가 | 규제 기관 | 규제 상태 | 규제 업체 | 라이선스 유형 | 라이선스 번호 |

| 홍콩 증권선물위원회 (SFC) | 규제됨 | Meta Futures Limited | 선물 계약 거래 | BSM300 |

| 홍콩 증권선물위원회 (SFC) | 초과됨 | Metaverse Securities Limited | 증권 거래 | AAW177 |

Metaverse Securities에서 무엇을 거래할 수 있나요?

Metaverse Securities은 30,000개 이상의 투자 및 레버리지 상품을 제공합니다. 거래 종류에는 외환, 주식, ETF, REIT, 펀드 등이 포함됩니다.

| 거래 자산 | 제공 여부 |

| 외환 | ✔ |

| 주식 | ✔ |

| 펀드 | ✔ |

| ETF | ✔ |

| REIT | ✔ |

| 상품 | ❌ |

| 지수 | ❌ |

| 암호화폐 | ❌ |

| 채권 | ❌ |

| 옵션 | ❌ |

수수료

대부분의 서비스(예: 자금 입금, 자금 인출, 주식 이체, 보관료 등)는 무료입니다.

특정 서비스에는 특정 수수료가 적용됩니다(예: 스탬프 이체 수수료, 등록 및 이체 수수료, 배당 처리 등).

비활성 계정에는 매월 HK$20의 수수료가 부과됩니다.

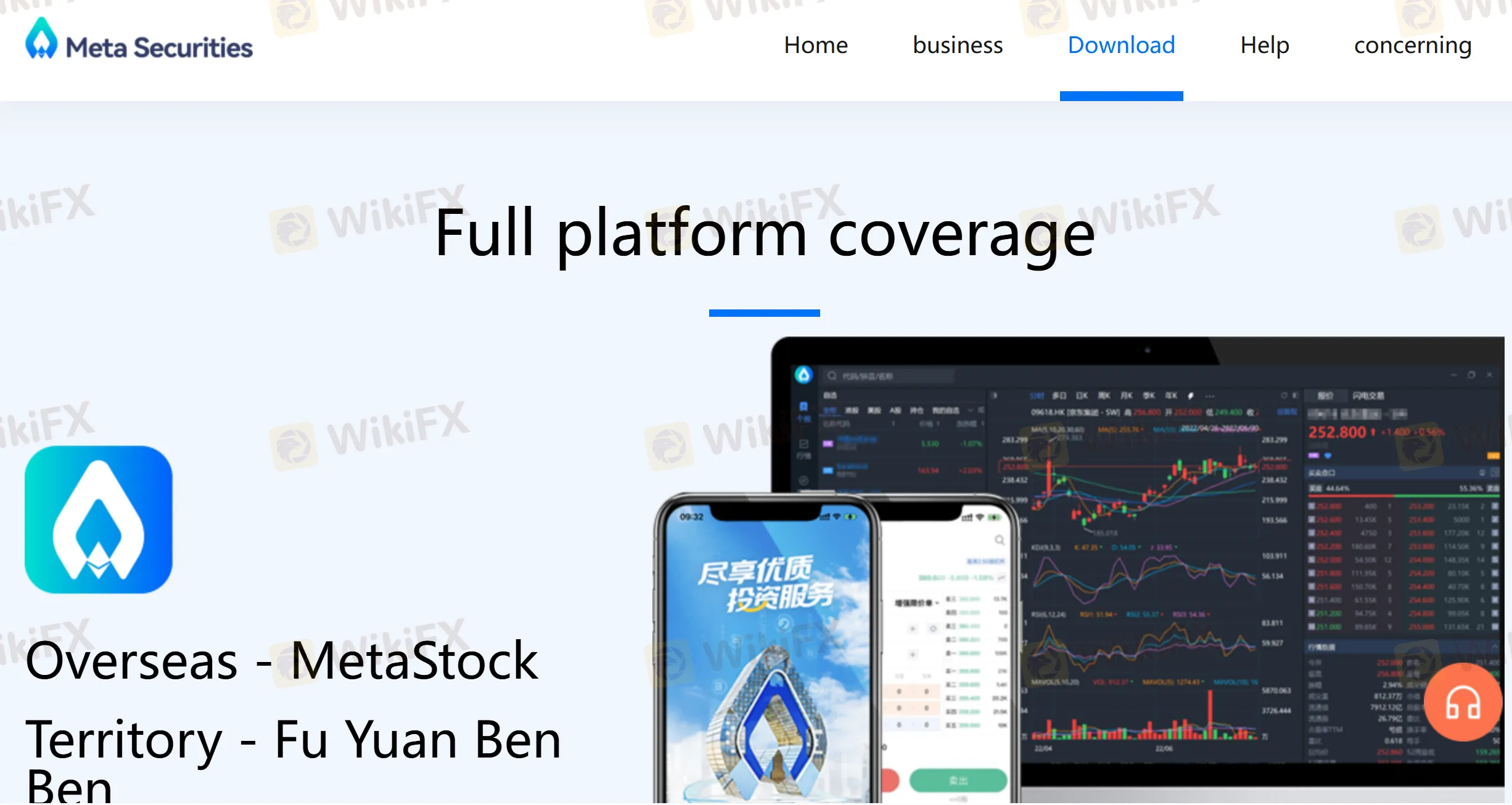

거래 플랫폼

| 거래 플랫폼 | 지원 여부 | 사용 가능한 장치 |

| MetaStock | ✔ | 데스크톱, 모바일, 웹 |

| Fuyuan Benben | ✔ | 모바일 |

| Yisheng Polestar Futures | ✔ | 데스크톱, 모바일 |

입출금

Metaverse Securities은 중국은행(홍콩), 통신은행(홍콩), CMB윙룽은행, 중국민생은행, 센트론은행, 난양상업은행, 동아은행, 홍콩상하이은행에서 결제를 받습니다.