Описание компании

| Metaverse Securities Обзор | |

| Основано | 2021 |

| Страна/Регион регистрации | Гонконг |

| Регулирование | SFC |

| Торговые инструменты | Акции, Форекс, Инвестиционные фонды, ETF, REIT |

| Торговая платформа | MetaStock, Fuyuan Benben и Yisheng Polestar Futures |

| Поддержка клиентов | Телефон: 400-688-3187 (Быстрый доступ) |

| Телефон: (00852) 2523 8221 (Телефонный заказ) | |

| Факс: (00852) 2810 7978, (0755) 2665 8431 | |

| Адрес: 4806-07, 48/F, Центральная плаза, 18 Harbour Road, Ван Чай, Гонконг | |

Информация о Metaverse Securities

Metaverse Securities - это брокерская компания с базой в Гонконге, предлагающая разнообразные торговые инструменты, такие как акции, Форекс, ETF и REIT. Несмотря на широкий спектр продуктов и быстрое исполнение, его лицензия (AAW177) истекла, и инвесторам следует быть осторожными. Платформа в основном предназначена для новичков, поддерживает MetaStock, Fuyuan Benben и Yisheng Polestar Futures, но не предоставляет продвинутые торговые платформы, такие как MT5. Большинство базовых услуг бесплатны, но за неактивные аккаунты взимается плата в размере 20 гонконгских долларов в месяц.

Плюсы и минусы

| Плюсы | Минусы |

| Регулируется SFC | Ограниченные методы оплаты |

| Многообразие торговых инструментов | |

| Быстрое интерпретирование в течение дня |

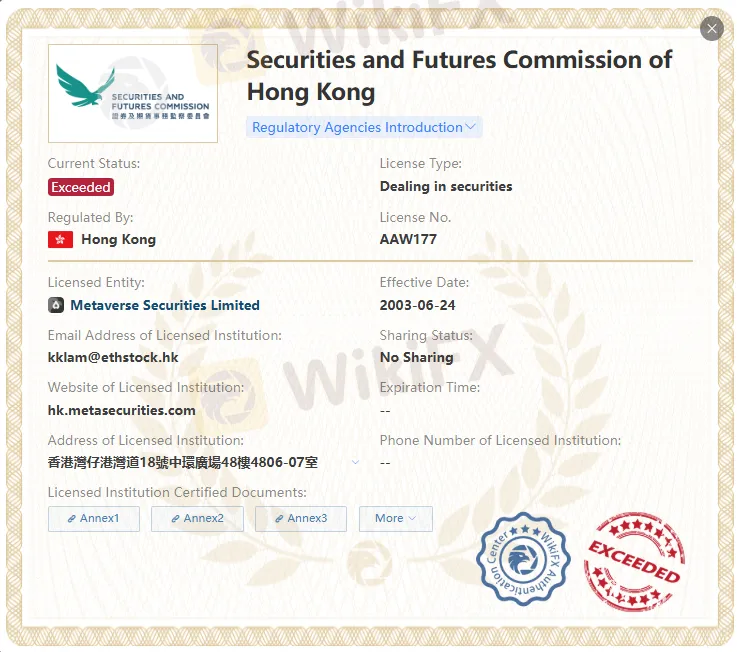

Metaverse Securities Легально?

Metaverse Securities выходит за рамки бизнеса, регулируемого Комиссией по ценным бумагам и фьючерсам Гонконга. Хотя Metaverse Securities утверждает, что регулируется двумя органами, регуляторный сертификат с номером лицензии AAW177 истек. Пожалуйста, будьте внимательны к риску!

| Регулируемая страна | Регулирующий орган | Статус регулирования | Регулируемая сущность | Тип лицензии | Номер лицензии |

| Комиссия по ценным бумагам и фьючерсам Гонконга (SFC) | Регулируется | Meta Futures Limited | Торговля фьючерсами | BSM300 |

| Комиссия по ценным бумагам и фьючерсам Гонконга (SFC) | Истекло | Metaverse Securities Limited | Торговля ценными бумагами | AAW177 |

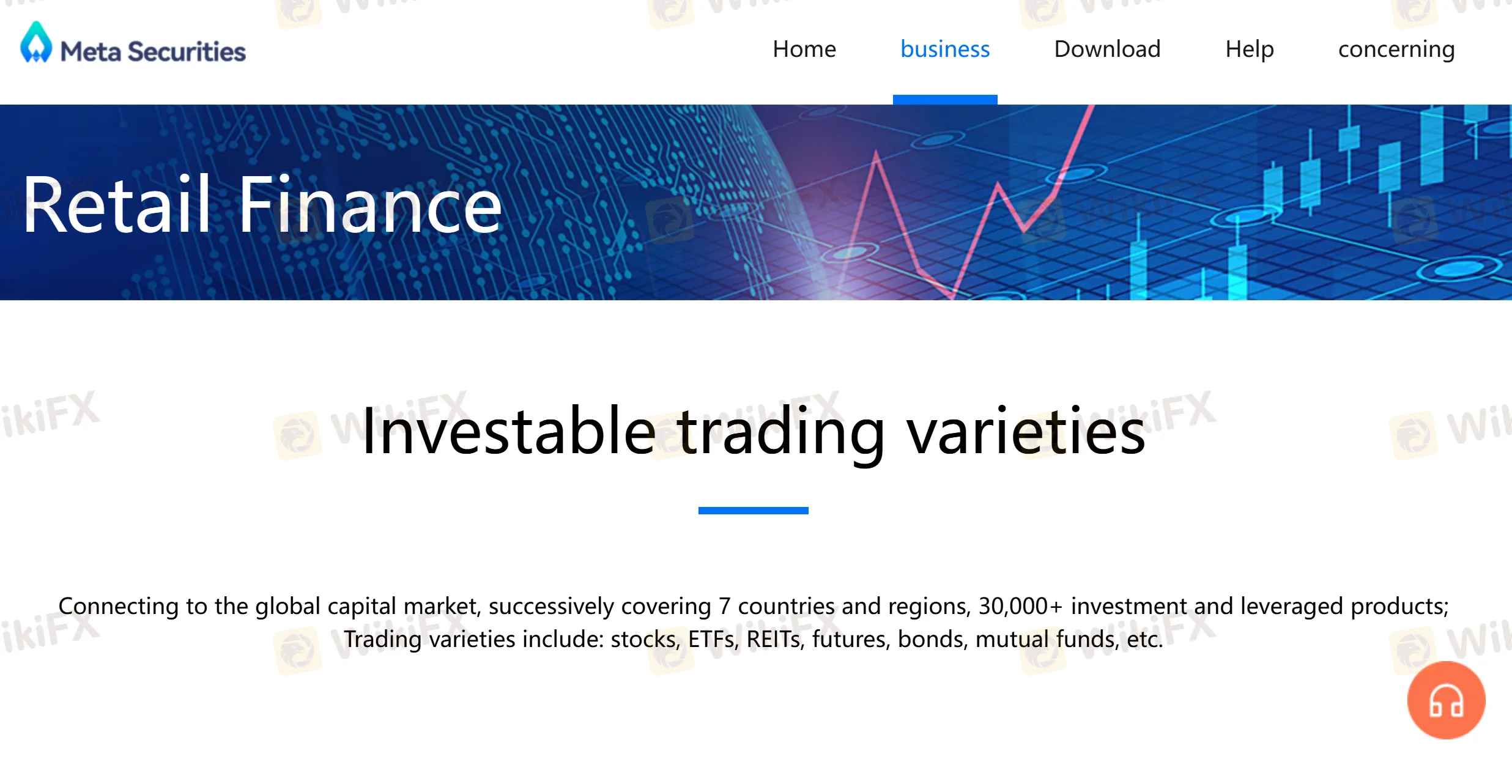

На что я могу торговать на Metaverse Securities?

Metaverse Securities предлагает более 30 000 инвестиционных и маржинальных продуктов. Торговые виды включают: форекс, акции, ETF, REIT, взаимные фонды и т. д.

| Торговые активы | Доступно |

| Форекс | ✔ |

| Акции | ✔ |

| Взаимные фонды | ✔ |

| ETF | ✔ |

| REIT | ✔ |

| Товары | ❌ |

| Индексы | ❌ |

| Криптовалюты | ❌ |

| Облигации | ❌ |

| Опционы | ❌ |

Сборы

Большинство услуг (такие как депозиты, вывод средств, передача акций, комиссии за хранение и т. д.) бесплатны.

Конкретные сборы применяются к конкретным услугам (например, сборы за перевод штампов, регистрацию и перевод, обработку дивидендов и т. д.).

Неактивные счета подлежат ежемесячной плате в размере HK$20.

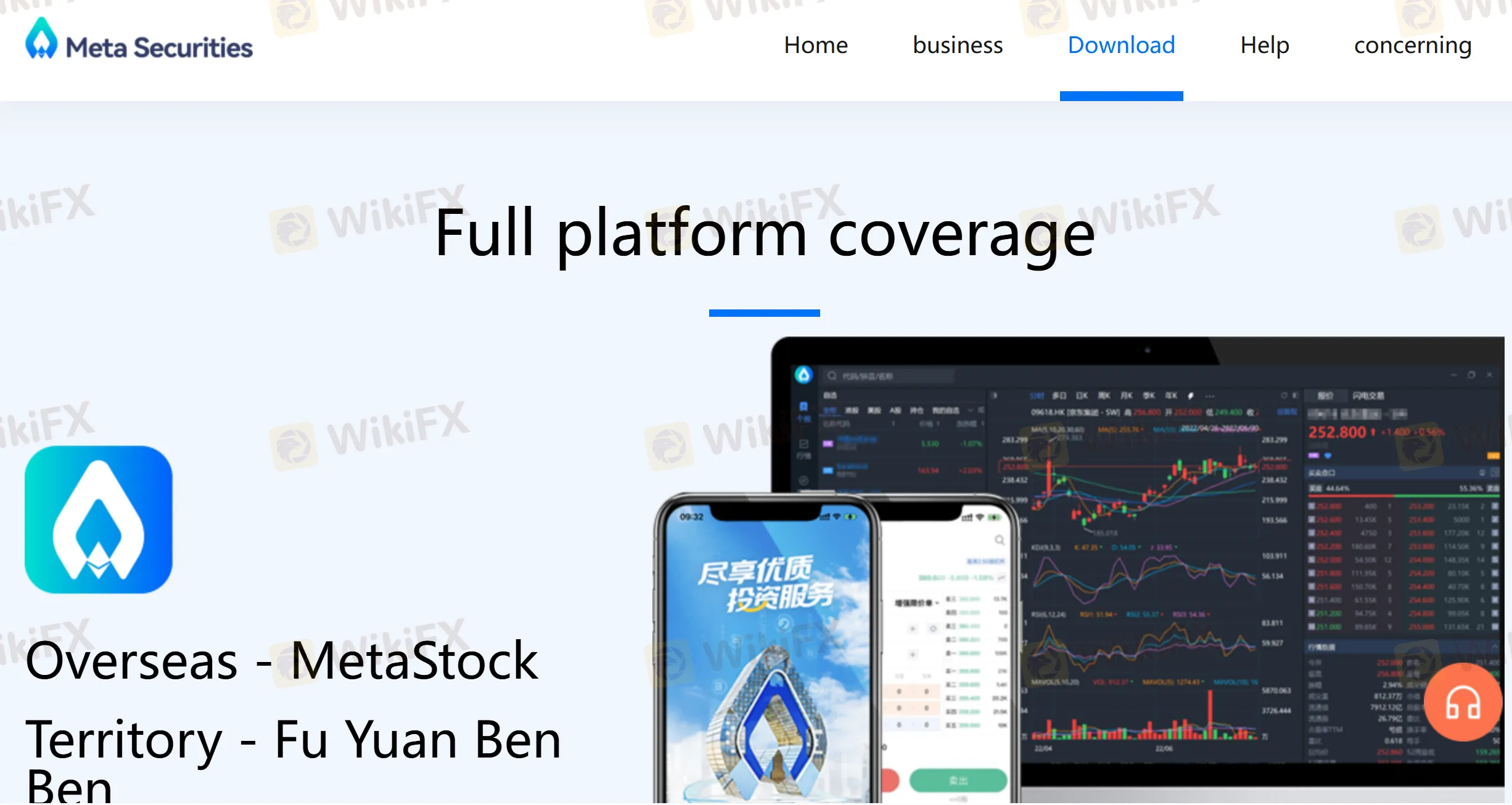

Торговая платформа

| Торговая платформа | Поддерживается | Доступные устройства |

| MetaStock | ✔ | Настольный, Мобильный, Веб |

| Fuyuan Benben | ✔ | Мобильный |

| Yisheng Polestar Futures | ✔ | Настольный, Мобильный |

Депозит и вывод средств

Metaverse Securities принимает платежи через следующие банки: Bank of China (Hong Kong), Bank of Communications (Hong Kong), CMB Wing Lung Bank, China Minsheng Bank, Centron Bank, Nanyang Commercial Bank, Bank of East Asia, the Hongkong and Shanghai Banking Corporation Limited.