公司簡介

| 元宇證券 評論摘要 | |

| 成立年份 | 2021 |

| 註冊國家/地區 | 香港 |

| 監管 | SFC |

| 市場工具 | 股票、外匯、共同基金、ETF、REITs |

| 交易平台 | MetaStock、富源本本、以勝極星期貨 |

| 客戶支援 | 電話:400-688-3187(快速通道) |

| 電話:(00852) 2523 8221(電話訂單) | |

| 傳真:(00852) 2810 7978、(0755) 2665 8431 | |

| 地址:香港灣仔港灣道18號中環廣場48樓4806-07室 | |

元宇證券 資訊

元宇證券 是一家位於香港的券商,提供多種交易工具,如股票、外匯、ETF和REITs。儘管產品種類繁多且執行速度快,但其監管許可證(AAW177)已過期,投資者應謹慎。該平台主要面向新手,支援MetaStock、富源本本和以勝極星期貨,但不提供像MT5這樣的高級交易平台。大多數基本服務是免費的,但閒置帳戶每月收取HK$20的費用。

優點與缺點

| 優點 | 缺點 |

| 受SFC監管 | 付款方式有限 |

| 交易品種豐富 | |

| 即日解讀快速 |

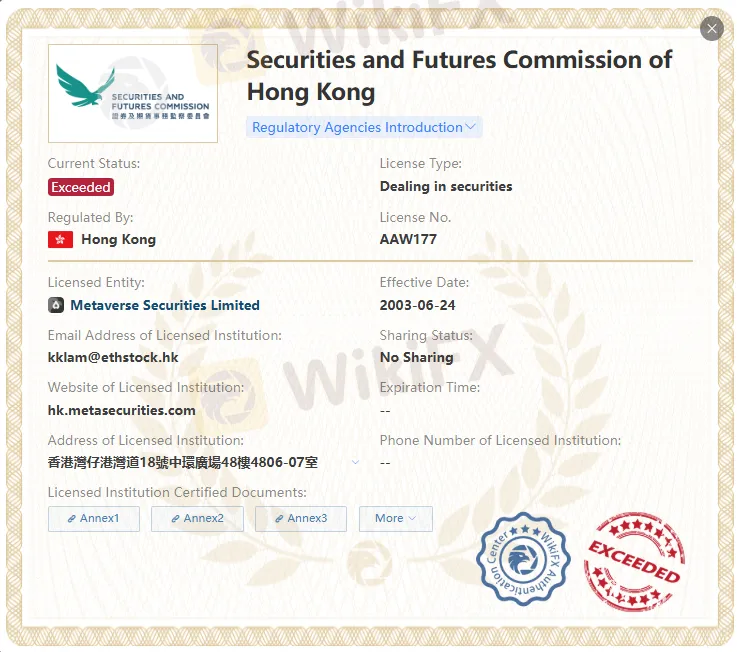

元宇證券 是否合法?

元宇證券 超出中國香港SFC監管的業務範圍。儘管 元宇證券 聲稱受到兩個監管機構的監管,但具有許可證編號AAW177的監管證書已過期。請注意風險!

| 監管國家 | 監管機構 | 監管狀態 | 受監管實體 | 許可證類型 | 許可證號碼 |

| 香港證監會(SFC) | 受監管 | Meta Futures Limited | 從事期貨合約交易 | BSM300 |

| 香港證監會(SFC) | 已過期 | 元宇證券 Limited | 從事證券交易 | AAW177 |

我可以在 元宇證券 上交易什麼?

元宇證券 提供了30,000多種投資和槓桿產品。交易品種包括:外匯、股票、ETF、REIT、共同基金等。

| 交易資產 | 可用 |

| 外匯 | ✔ |

| 股票 | ✔ |

| 共同 基金 | ✔ |

| ETF | ✔ |

| REIT | ✔ |

| 大宗商品 | ❌ |

| 指數 | ❌ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

費用

大部分服務(如存款、提款、股份轉移、保管費等)均免費。

特定服務需支付特定費用(例如印花稅轉移費、登記和轉移費、股息處理等)。

閒置帳戶將收取每月HK$20的費用。

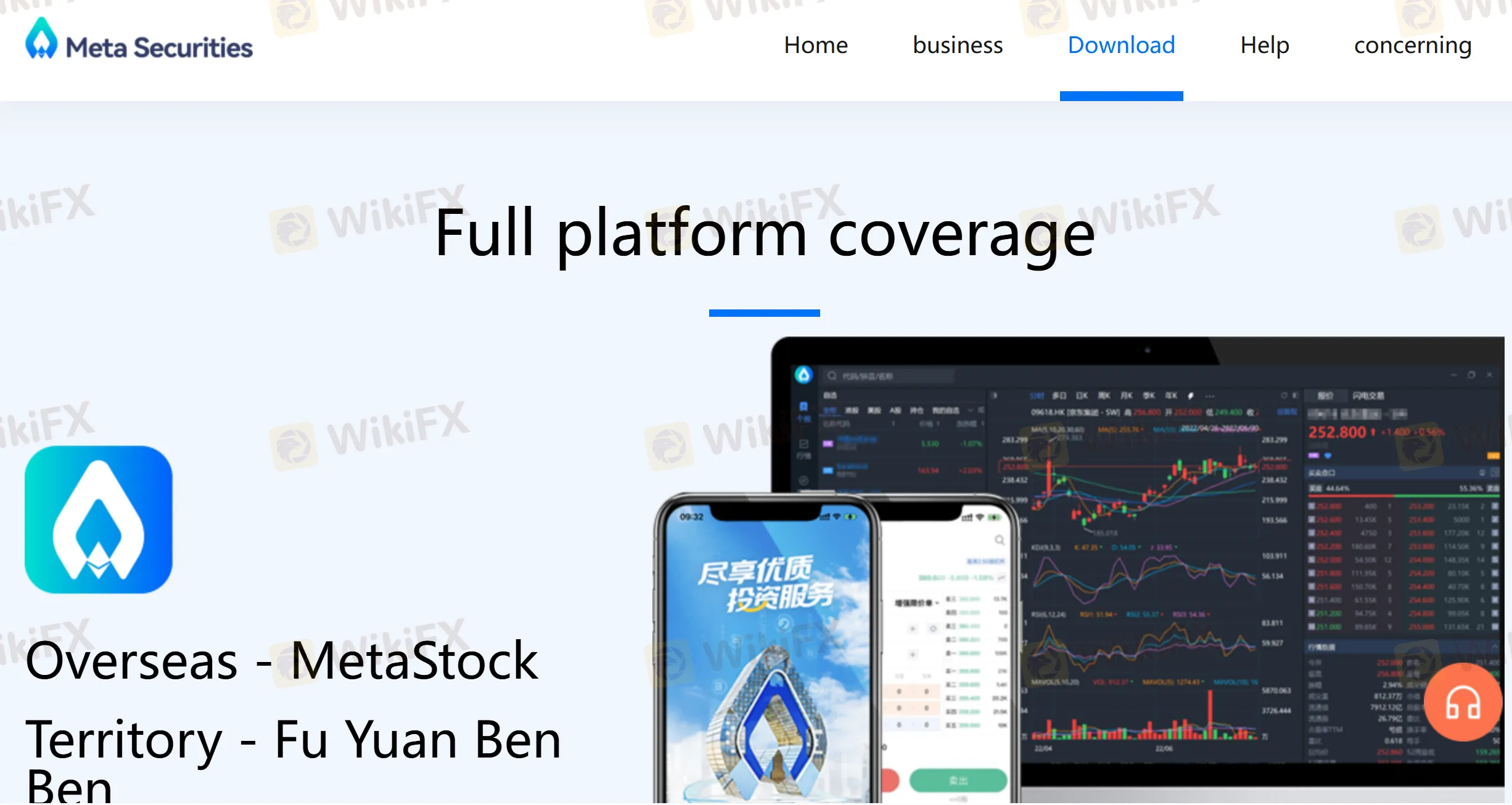

交易平台

| 交易平台 | 支援 | 可用設備 |

| MetaStock | ✔ | 桌面、手機、網頁 |

| Fuyuan Benben | ✔ | 手機 |

| Yisheng Polestar Futures | ✔ | 桌面、手機 |

存款和提款

元宇證券 接受以下銀行的付款:中國銀行(香港)、交通銀行(香港)、招商永隆銀行、中國民生銀行、中原銀行、南洋商業銀行、東亞銀行、香港上海滙豐銀行有限公司。