Basic Information

Hong Kong

Hong KongScore

Hong Kong

|

2-5 years

|

Hong Kong

|

2-5 years

| https://metasecurities.com

Website

Rating Index

Influence

D

Influence index NO.1

Singapore 2.49

Singapore 2.49Single Core

1G

40G

1M*ADSL

Hong Kong

Hong Kong metasecurities.com

metasecurities.com yuanyustock.com

yuanyustock.com

| Metaverse Securities Review Summary | |

| Founded | 2021 |

| Registered Country/Region | Hong Kong |

| Regulation | SFC |

| Market Instruments | Stocks, Forex, Mutual Funds, ETFs, REITs |

| Trading Platform | MetaStock, Fuyuan Benben, and Yisheng Polestar Futures |

| Customer Support | Phone: 400-688-3187 (Fast Track) |

| Phone: (00852) 2523 8221 (Telephone Order) | |

| Fax: (00852) 2810 7978, (0755) 2665 8431 | |

| Address: 4806-07, 48/F, Central Plaza, 18 Harbour Road, Wan Chai, Hong Kong | |

Metaverse Securities is a Hong Kong-based brokerage that offers a variety of trading instruments such as stocks, forex, ETFs, and REITs. Despite the wide range of products and fast execution, its regulatory license (AAW177) has expired, and investors should be cautious. The platform is mainly for novices, supporting MetaStock, Fuyuan Benben, and Yisheng Polestar Futures, but does not provide advanced trading platforms such as MT5. Most basic services are free, but inactive accounts are charged a fee of HK$20 per month.

| Pros | Cons |

| Regulated by SFC | Limited payment methods |

| Abundant trading varieties | |

| Intraday interpretation fast |

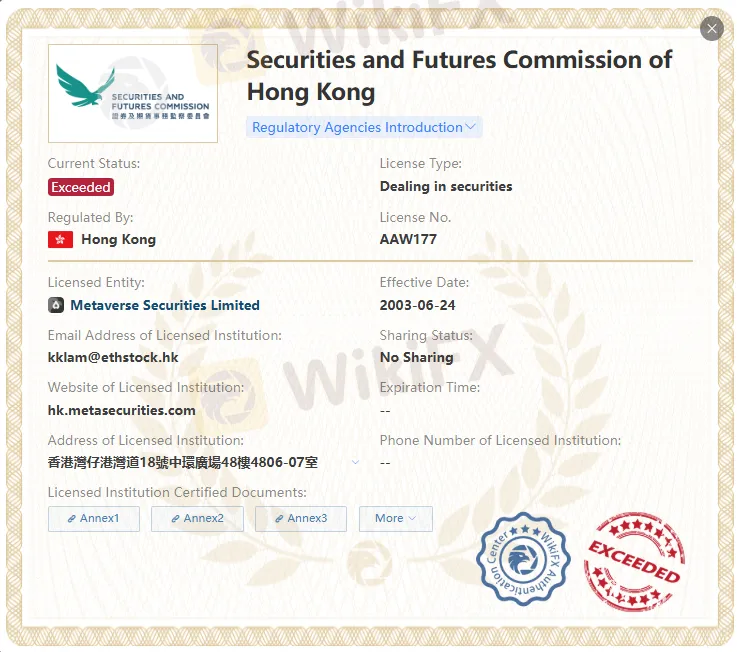

Metaverse Securities exceeds the business scope regulated by the China Hong Kong SFC. Although Metaverse Securities claims to be regulated by two regulators, the regulatory certificate with the license number AAW177 has exceeded. Please be aware of the risk!

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| Securities and Futures Commission of Hong Kong (SFC) | Regulated | Meta Futures Limited | Dealing in futures contracts | BSM300 |

| Securities and Futures Commission of Hong Kong (SFC) | Exceeded | Metaverse Securities Limited | Dealing in securities | AAW177 |

Metaverse Securities offers 30,000+ investment and leveraged products. Trading varieties include: forex, stocks, ETFs, REITs, mutual funds, etc.

| Trading Assets | Available |

| Forex | ✔ |

| Stocks | ✔ |

| Mutual Funds | ✔ |

| ETFs | ✔ |

| REITs | ✔ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

Most services (such as depositing funds, withdrawing funds, transferring shares, custody fees, etc.) are free.

Specific fees apply to specific services (e.g., stamp transfer fees, registration and transfer fees, dividend processing, etc.).

Inactive accounts are subject to a monthly fee of HK$20.

| Trading Platform | Supported | Available Devices |

| MetaStock | ✔ | Desktop, Mobile, Web |

| Fuyuan Benben | ✔ | Mobile |

| Yisheng Polestar Futures | ✔ | Desktop, Mobile |

Metaverse Securities accepts payments via the following banks: Bank of China(Hong Kong), Bank of Communications (Hong Kong), CMB Wing Lung Bank, China Minsheng Bank, Centron Bank, Nanyang Commercial Bank, Bank of East Asia, the Hongkong and Shanghai Banking Corporation Limited.

As someone who values robust automated trading tools in my strategies, I took a careful look at Metaverse Securities’ platform offerings before opening an account. Metaverse Securities mainly supports MetaStock, Fuyuan Benben, and Yisheng Polestar Futures, without offering the widely adopted MT4 or MT5 platforms. In my experience, the lack of MT4/MT5 means native support for the kinds of Expert Advisors (EAs) widely used in forex trading is absent. MetaStock does allow for some automation through system testing and scripting, but this is very different from the plug-and-play EA functionality found with MetaTrader. The other platforms mentioned focus more on manual, chart-based trading and don’t appear to have open environments for the typical FX EAs most algo traders rely on. For me, this was a clear limitation—one that could restrict traders who depend on flexible, third-party algorithmic trading solutions. Unless you are able to custom-script or adapt your automation to one of Metaverse Securities’ supported platforms (and accept the technical and practical hurdles involved), I don’t see it as a straightforward broker for running EAs in the way I’m accustomed to. For anyone prioritizing seamless EA integration, this would be a significant consideration before opening an account. Exercising caution and thorough platform research is essential for anyone with a strong interest in automated trading.

Based on my experience evaluating brokers, I found that Metaverse Securities does not clearly distinguish between multiple account types in the way many retail forex brokers do. Instead, the focus here seems to be on offering access to a broad array of products—such as stocks, forex, ETFs, REITs, and mutual funds—rather than segmenting clients by tiered account structures with varying features or minimum deposit requirements. For me, this approach might appeal to newer traders or those seeking simplicity, but it doesn't offer the fine-tuned customizability or perks (like advanced platforms, specialized support, or tailored fee schedules) that seasoned traders might expect from firms with distinct account types. I also noted that Metaverse Securities charges an inactivity fee for dormant accounts and provides most basic services free of charge. This means that, regardless of the size of your portfolio or your trading frequency, the experience will largely be standardized—something that may limit flexibility for active or institutional-level participants. Another important observation is the absence of mainstream advanced platforms like MT5 and the reliance on MetaStock, Fuyuan Benben, and Yisheng Polestar Futures, which could affect platform compatibility depending on a trader’s preferences or strategies. Overall, in my professional judgment, the lack of differentiated account options at Metaverse Securities warrants a cautious approach, especially for those with specific needs or higher expectations for bespoke brokerage services.

From my review of Metaverse Securities, I did not find clear information specifically outlining commissions per lot in the context of ECN or raw spread accounts. In my personal experience with various brokers, commission structures are usually prominently disclosed, especially for ECN models, as these tend to involve transparent per-lot fees. Instead, Metaverse Securities offers a variety of trading instruments—stocks, forex, ETFs, REITs—with most basic services such as depositing, withdrawing funds, and custody typically free. However, certain transactional services like stamp transfer fees and other processing charges may apply. What stands out to me is their focus on providing cost-effective basic trading, but the details around exact trading commissions, particularly per-lot charges on ECN or raw spread accounts, are not made explicit. Given this lack of detail and recognizing the cautious approach any prudent trader should take, I would personally be hesitant to make assumptions about hidden costs or the absence thereof. I also noticed that while Metaverse Securities is regulated in Hong Kong, their scope of business has reportedly exceeded the limits of one expired SFC license, which adds an additional layer of risk. For me, full transparency around fee structures and up-to-date licensing are key considerations before committing significant funds or trades. Therefore, I recommend contacting their customer support directly for a definitive answer regarding commission charges on specific accounts and ensuring you have all fee-related details in writing before trading.

Based on my thorough review of all the information available about Metaverse Securities, I have not found any indication that they offer a swap-free, or Islamic, account option for traders. In my experience, clarity on such account types is essential, especially for traders who are concerned with complying with Shariah financial principles. Reliable brokers tend to state up front if Islamic accounts are on offer, usually with clear outlines of how overnight charges are handled. For Metaverse Securities, I noticed that their range of supported platforms—such as MetaStock, Fuyuan Benben, and Yisheng Polestar Futures—seems more tailored to conventional trading rather than accommodating religious or ethical mandates that require swap-free conditions. Moreover, their platform details and fee structures make no mention of alternative arrangements for interest accrual on overnight positions, which are central to Islamic accounts. Given that regulatory information around Metaverse Securities is already somewhat ambiguous—particularly with the license AAW177 having expired and questions about the scope of their current activities—I would personally be very cautious if a swap-free account is a necessity for you. If this is a critical criterion for your trading, it's wise to contact Metaverse Securities directly for clarification or consider more transparent alternatives. Trust, clarity, and regulatory adherence are non-negotiable for me when choosing a broker for specific account needs.

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now